Global Gluten Removed Products Market

Market Size in USD Billion

CAGR :

%

USD

8.29 Billion

USD

14.96 Billion

2025

2033

USD

8.29 Billion

USD

14.96 Billion

2025

2033

| 2026 –2033 | |

| USD 8.29 Billion | |

| USD 14.96 Billion | |

|

|

|

|

What is the Global Gluten-Removed Products Market Size and Growth Rate?

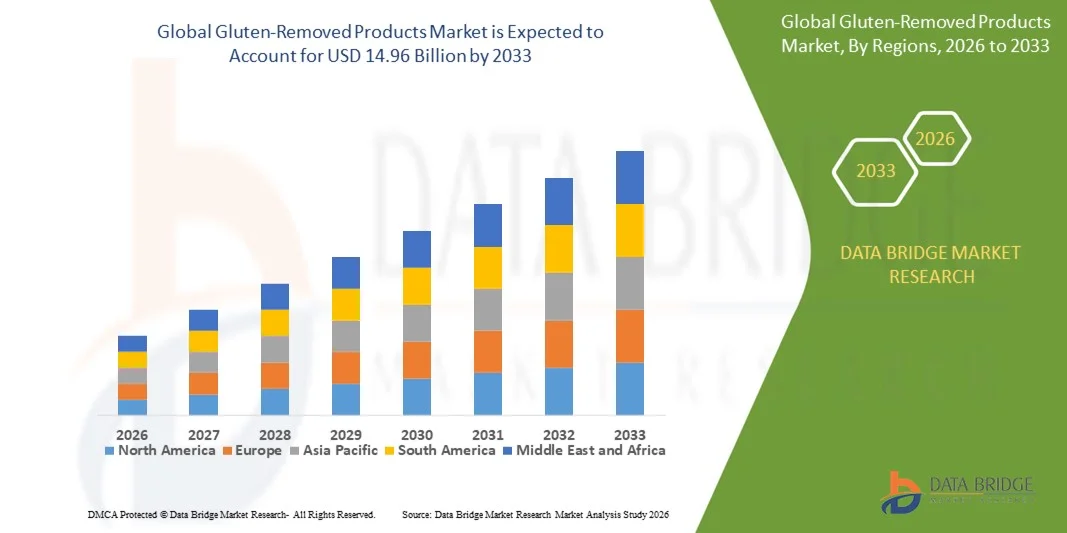

- The global gluten-removed products market size was valued at USD 8.29 billion in 2025 and is expected to reach USD 14.96 billion by 2033, at a CAGR of 7.65% during the forecast period

- The rise in the number of celiac disease patients across the globe acts as one of the major factors driving the growth of gluten-removed products market

- The increased awareness regarding healthy diets, and prevention of health disorders, such as diabetes, obesity, metabolic syndrome, heart diseases, stroke, and chronic pulmonary disease, and rise in prevalence of irritable bowel syndrome (IBS) accelerate the market growth

What are the Major Takeaways of Gluten-Removed Products Market?

- The surge in availability of gluten-free products in organized retail stores leading to increased sales, and health benefits and adoption of special dietary lifestyles and free-from foods further influence the market

- In addition, high use in range of food, surge in food spending, rise in health consciousness among consumers, media influence on consumer awareness and growth in awareness regarding adopting healthy lifestyles positively affect the gluten-removed products market

- Furthermore, adoption of microencapsulation technology to improve the shelf-life of gluten-free products and product innovations to make gluten-free products more convenient and affordable extends profitable opportunities to the market players

- North America dominated the Gluten-Removed Products market with a 41.8% revenue share in 2025, driven by high consumer awareness of celiac disease and gluten sensitivity, widespread adoption of healthy and functional diets, and strong retail and e-commerce distribution channels across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 11.2% from 2026 to 2033, driven by rising awareness of gluten intolerance, increasing adoption of Western dietary habits, and rapid urbanization in China, India, Japan, South Korea, and Southeast Asia

- The Bakery Products segment dominated the market with a 38.5% share in 2025, driven by strong consumer preference for gluten-free breads, cookies, cakes, and pastries

Report Scope and Gluten-Removed Products Market Segmentation

|

Attributes |

Gluten-Removed Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Gluten-Removed Products Market?

Increasing Shift Toward Convenient, Ready-to-Eat, and Health-Oriented Gluten-Removed Products

- The gluten-removed products market is witnessing strong adoption of ready-to-eat, packaged, and shelf-stable products that cater to growing consumer demand for convenience and clean-label foods

- Manufacturers are introducing highly versatile product lines, including gluten-free breads, snacks, cereals, pasta, and baked goods, with improved taste, texture, and shelf life

- Growing consumer preference for organic, natural, and allergen-free ingredients is driving the launch of products that combine nutritional value with high sensory appeal

- For instance, companies such as Bob’s Red Mill, Enjoy Life Foods, Dr. Schär, Barilla, and Amy’s Kitchen have expanded their gluten-free product portfolios with innovative flours, cereals, bakery mixes, and snack options that meet dietary restrictions

- Increasing awareness of celiac disease, gluten sensitivity, and wellness trends is accelerating the shift toward gluten-removed and functional foods

- As global demand for healthy and convenient food solutions grows, Gluten-Removed Products will remain vital for consumers seeking safe, high-quality, and easily accessible gluten-free options

What are the Key Drivers of Gluten-Removed Products Market?

- Rising consumer awareness regarding celiac disease, gluten intolerance, and overall digestive health is driving demand for gluten-removed products

- For instance, in 2025, leading companies such as Bob’s Red Mill, Dr. Schär, Enjoy Life Foods, Barilla, and Amy’s Kitchen launched new flours, ready-to-eat snacks, and bakery items designed to improve taste, texture, and nutritional profile

- Growing adoption of health-conscious diets, veganism, and plant-based nutrition is boosting demand for gluten-removed alternatives across the U.S., Europe, and Asia-Pacific

- Advancements in food processing technologies, natural binding agents, and clean-label formulations have enhanced product quality, texture, and shelf life

- Increasing use of functional ingredients such as whole grains, quinoa, and pulses is creating opportunities for nutrient-rich gluten-removed products

- Supported by steady investments in R&D, health-oriented product development, and expanding retail and e-commerce channels, the Gluten-Removed Products market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Gluten-Removed Products Market?

- Higher costs associated with premium, certified gluten-free ingredients limit adoption among price-sensitive consumers and small retailers

- For instance, during 2024–2025, fluctuations in grain and specialty flour prices, along with supply-chain disruptions, increased production costs for global gluten-free brands

- Complexity in maintaining taste, texture, and nutritional balance in gluten-removed products increases product development challenges

- Limited awareness in emerging markets about gluten intolerance, labeling standards, and gluten-free benefits slows adoption

- Competition from non-certified gluten-free products, traditional bakery goods, and private-label offerings creates pricing pressure and reduces differentiation

- To address these challenges, companies are focusing on cost-effective formulations, consumer education, innovative packaging, and digital marketing to increase global adoption of gluten-removed products

How is the Gluten-Removed Products Market Segmented?

The market is segmented on the basis of type, form, and source.

- By Type

On the basis of type, the gluten-removed products market is segmented into Bakery Products, Snacks & RTE Products, Condiments & Dressings, Pizzas & Pastas, and Other Types. The Bakery Products segment dominated the market with a 38.5% share in 2025, driven by strong consumer preference for gluten-free breads, cookies, cakes, and pastries. Enhanced taste, texture, and nutritional value, combined with increasing bakery consumption in households and restaurants, are fueling demand. Bakery products remain the most visible and widely adopted gluten-removed category, benefiting from innovations in clean-label flours, fortification, and pre-mixed baking solutions.

The Snacks & RTE Products segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand for convenient, portable, and ready-to-eat gluten-free foods. Growing awareness of healthy snacking habits, on-the-go lifestyles, and the expansion of retail and e-commerce distribution channels are driving strong adoption of gluten-removed snack bars, chips, and pre-packaged meals globally.

- By Form

On the basis of form, the gluten-removed products market is segmented into Solid and Liquid products. The Solid form segment dominated the market with a 64.2% share in 2025, reflecting higher adoption of gluten-free bakery items, snacks, cereals, and pasta products. Solid gluten-removed products are widely preferred due to their convenience, portability, and long shelf life, making them suitable for retail, foodservice, and household consumption.

The Liquid form segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increased consumer interest in gluten-free sauces, dressings, beverages, and soups. Rising health consciousness, flavor innovation, and incorporation of plant-based or functional ingredients are encouraging manufacturers to develop liquid gluten-removed products that cater to both dietary needs and lifestyle convenience.

- By Source

On the basis of source, the gluten-removed products market is segmented into Plant and Animal sources. The Plant-based segment dominated the market with a 57.6% share in 2025, fueled by growing veganism, health-conscious diets, and rising use of gluten-free grains, pulses, seeds, and nuts in bakery, snacks, and meal products. Plant-based gluten-removed products are perceived as healthier, sustainable, and allergen-friendly, driving strong adoption across North America, Europe, and Asia-Pacific.

The Animal-based segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing demand for gluten-free dairy, eggs, and specialty meat products in functional and ready-to-eat formulations. Product innovations, fortified ingredients, and expanding foodservice applications are contributing to rapid growth in this segment globally.

- By Distribution Channel

On the basis of distribution channel, the gluten-removed products market is segmented into Conventional Stores, Specialty Stores, and Drugstores & Pharmacies. The Conventional Stores segment dominated the market with a 52.4% share in 2025, driven by widespread retail penetration, consumer familiarity, and availability of gluten-free products in supermarkets, hypermarkets, and grocery chains. Conventional stores remain the primary choice for bulk purchases of bakery products, snacks, and staple foods.

The Specialty Stores segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising consumer preference for curated gluten-free selections, premium ingredients, and expert guidance on dietary needs. Expansion of dedicated health food stores, organic outlets, and gluten-free boutique shops is accelerating adoption, particularly in urban and high-income regions.

Which Region Holds the Largest Share of the Gluten-Removed Products Market?

- North America dominated the Gluten-Removed Products market with a 41.8% revenue share in 2025, driven by high consumer awareness of celiac disease and gluten sensitivity, widespread adoption of healthy and functional diets, and strong retail and e-commerce distribution channels across the U.S. and Canada. Leading manufacturers are continuously introducing innovative gluten-free bakery, snacks, and ready-to-eat products that meet taste, texture, and nutritional expectations, reinforcing the region’s market leadership

- North American companies are leveraging premium ingredients, fortification technologies, and convenient packaging formats to strengthen brand loyalty and cater to both urban and health-conscious consumers. Investment in marketing campaigns, dietary education, and product innovation further enhances adoption rates

- Strong consumer preference for organic, plant-based, and clean-label products, combined with established retail infrastructure, continues to sustain North America’s dominance in the global gluten-removed products market

U.S. Gluten-Removed Products Market Insight

The U.S. is the largest contributor in North America, supported by high consumer awareness, rising disposable income, and expanding retail penetration of gluten-removed products. Demand is particularly strong for bakery items, snacks, cereals, and ready-to-eat meals, driven by health-conscious millennials and urban professionals. The presence of leading gluten-free brands, extensive product variety, and growing e-commerce channels further drive market growth.

Canada Gluten-Removed Products Market Insight

Canada contributes significantly to regional growth, supported by increasing demand for gluten-free alternatives in urban and suburban markets. Consumers are actively seeking healthy, allergen-free, and convenient food options, prompting manufacturers to expand product portfolios with breads, pastas, and plant-based snacks. Government dietary guidelines, wellness trends, and retail promotions strengthen adoption across both conventional and specialty stores.

Asia-Pacific Gluten-Removed Products Market

Asia-Pacific is projected to register the fastest CAGR of 11.2% from 2026 to 2033, driven by rising awareness of gluten intolerance, increasing adoption of Western dietary habits, and rapid urbanization in China, India, Japan, South Korea, and Southeast Asia. Expanding middle-class populations, growing health-consciousness, and the proliferation of supermarkets and e-commerce platforms are fueling demand for gluten-removed bakery, snacks, and ready-to-eat products. Rapid growth in functional foods, plant-based alternatives, and fortified formulations supports increasing consumer adoption. Market expansion is further accelerated by international brands entering APAC, local gluten-free product development, and rising export opportunities.

China Gluten-Removed Products Market Insight

China is the largest contributor in Asia-Pacific due to growing health awareness, increasing disposable income, and strong retail expansion. Rising demand for gluten-free bakery, snacks, and pasta products, along with the entry of global and domestic brands, drives rapid market growth. Urban consumers increasingly prefer functional and convenient gluten-removed foods, further boosting adoption.

Japan Gluten-Removed Products Market Insight

Japan shows steady growth supported by established retail infrastructure, high consumer health awareness, and demand for premium and specialty gluten-free products. Manufacturers focus on high-quality bakery items, snacks, and fortified ready-to-eat meals. Innovation in taste, texture, and packaging supports continued market expansion.

India Gluten-Removed Products Market Insight

India is emerging as a key growth hub, driven by increasing awareness of gluten intolerance, rising urbanization, and higher disposable incomes. Expansion of supermarkets, e-commerce platforms, and health-focused foodservice outlets is supporting adoption of gluten-removed products, particularly bakery and ready-to-eat snacks.

South Korea Gluten-Removed Products Market Insight

South Korea contributes significantly due to growing health-consciousness, rising demand for functional foods, and increasing adoption of gluten-free snacks and bakery items. The expansion of specialty stores and online platforms, combined with rising interest in Western diets, supports rapid growth in gluten-removed product consumption.

Which are the Top Companies in Gluten-Removed Products Market?

The gluten-removed products industry is primarily led by well-established companies, including:

- Bob’s Red Mill Natural Foods (U.S.)

- Seitz glutenfrei (Germany)

- Silly Yaks- For Real Taste (U.K.)

- Warburtons (U.K.)

- Dun & Bradstreet, Inc. (U.S.)

- Big OZ (Australia)

- Farmo S.P.A. (Italy)

- Enjoy Life Foods (U.S.)

- Dr. Schär AG / SPA (Italy)

- Raisio Plc (Finland)

- Ecotone (France)

- FREEDOM FOODS GROUP LIMITED (Australia)

- Quinoa Corporation (U.S.)

- Barilla G. e R. (Italy)

- Fratelli S.p.A (Italy)

- Hero AG (Switzerland)

- Conagra Brands, Inc. (U.S.)

- Kellogg Co. (U.S.)

- The Kraft Heinz Company (U.S.)

- Amy’s Kitchen, Inc (U.S.)

- Kelkin Ltd (Ireland)

What are the Recent Developments in Global Gluten-Removed Products Market?

- In March 2025, Quiznos, the renowned sandwich chain known for its freshly sliced meats and cheeses and expertly toasted sandwiches, launched new gluten-smart options across its U.S. locations, including a limited-time Buffalo Chicken Club featuring spicy mayonnaise with Frank’s RedHot sauce, bacon, provolone, tomatoes, and lettuce. The gluten-free bread option is available for all sandwiches in regular and large sizes with location-based pricing. This launch reinforces Quiznos’ commitment to providing inclusive and high-quality dining experiences for gluten-conscious consumers

- In December 2024, Revyve and Lallemand Bio-Ingredients Savory announced a strategic partnership in North America, designating Lallemand as Revyve's exclusive distributor in the U.S., Canada, and Mexico, while Revyve sourced a key raw material from Lallemand. This collaboration aims to set new standards for sustainable, gluten-free, animal-free, GMO-free, and natural food innovations, strengthening their position in the market

- In October 2024, Dr. Schär launched three new gluten-free snacks, including Peanut Butter Blondie Bites with creamy-crunchy textures, Chocolate Brownie Bites with a rich chocolate and crispy wafer center, and Mini Honeygrams, bite-sized graham-style cookies lightly sweetened with honey. These snacks provide consumers with tasty and convenient gluten-free snacking options, enhancing Dr. Schär’s portfolio and market presence

- In July 2024, The Kraft Heinz Company’s brands Ore-Ida and GoodPop introduced Fudge n' Vanilla French Fry Pops, made with vanilla oat milk, a chocolate fudge shell, and crispy potato bits, strategically positioned in the gluten-free category. This innovation is expected to capture growing consumer interest in unique and allergen-friendly frozen snacks, strengthening the brands’ competitive edge

- In March 2024, Garden Veggie, a brand of The Hain Celestial Group, launched Flavor Burst Tortilla Chips, featuring gluten-free vegetable-infused flavors such as Nacho Cheese and Zesty Ranch. This product line is designed to offer healthy and nutritious gluten-free snacking alternatives, supporting the brand’s growth in the market

- In February 2024, General Mills Inc.'s Yoplait brand introduced Yoplait Original with Chocolate Shavings in Cherry, Raspberry, and Strawberry flavors, offering a creamy, gluten-free treat made with real chocolate. These innovations enhance Yoplait’s gluten-free portfolio, catering to consumer demand for indulgent yet health-conscious snack options

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gluten Removed Products Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gluten Removed Products Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gluten Removed Products Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.