Global Glycerin Market

Market Size in USD Million

CAGR :

%

USD

3.21 Million

USD

5.68 Million

2024

2032

USD

3.21 Million

USD

5.68 Million

2024

2032

| 2025 –2032 | |

| USD 3.21 Million | |

| USD 5.68 Million | |

|

|

|

|

Glycerinee Market Size

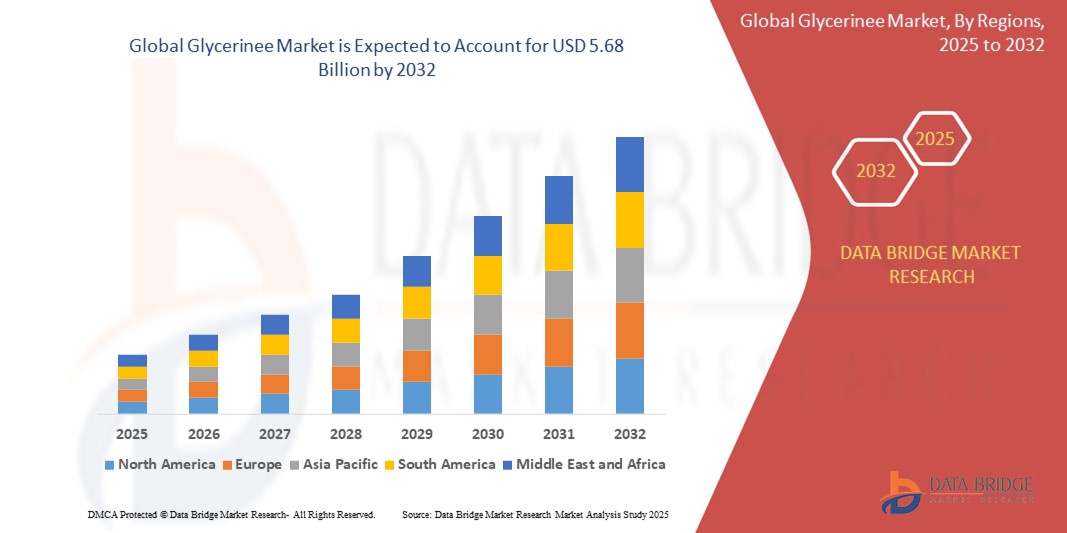

- The global Glycerine market size was valued at USD 3.21 billion in 2024 and is expected to reach USD 5.68 billion by 2032, growing at a CAGR of 7.20% during the forecast period.

- This growth is attributed to the rising demand from personal care & cosmetics, pharmaceuticals, and processed food industries, along with the increasing utilization of biodiesel, which enhances the availability of Glycerine as a by-product.

Glycerinee Market Analysis

- Glycerine, also known as glycerol, is a polyol compound widely used for its humectant, solvent, and sweetening properties. It plays a critical role in manufacturing processes across a range of industries including healthcare, cosmetics, food & beverages, and chemicals.

- The market is witnessing strong growth due to rising health and hygiene consciousness, growing demand for plant-based ingredients, and increasing use in bio-based chemical manufacturing.

- The refined Glycerine segment is expected to dominate the market, accounting for over 62.75% of the market share, driven by its high purity and widespread application in pharmaceutical and personal care formulations.

- Vegetable oil-based Glycerine is projected to lead the market by source, owing to the rising trend of natural and sustainable ingredients in food, cosmetics, and healthcare sectors.

- The personal care & cosmetics application segment is anticipated to maintain its dominance with over 33.40% market share due to its moisturizing, emulsifying, and skin-conditioning properties, widely used in creams, lotions, and oral care products.

- Asia-Pacific is expected to dominate the Glycerine market with a share of 38.91%, supported by abundant availability of raw materials, growing population, and robust demand across personal care, food, and pharmaceutical sectors.

- North America is projected to be the fastest-growing region during the forecast period, driven by rising demand for natural ingredients, expanding pharmaceutical and food manufacturing, and favorable regulatory standards encouraging bio-based chemical adoption.

Report Scope and Glycerinee Market Segmentation

|

Attributes |

Glycerinee Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Glycerinee Market Trends

“Surging Demand for Bio-Based and Pharmaceutical-Grade Glycerine””

- One of the key trends in the global Glycerine market is the increasing demand for bio-based and pharmaceutical-grade Glycerine. This trend is primarily driven by the rising preference for natural and renewable raw materials across industries such as pharmaceuticals, personal care, and food & beverage.

- For instance, companies such as Cargill Incorporated and Wilmar International are expanding their bio-based Glycerine portfolios to cater to rising demand from cosmetics and pharmaceutical manufacturers seeking safer and more sustainable ingredients.

- The demand for refined, high-purity Glycerine is also increasing due to its growing application in oral care products, cough syrups, and intravenous drugs. As regulatory standards become more stringent regarding ingredient safety and sustainability, manufacturers are focusing on developing USP- and EP-grade Glycerine to meet quality benchmarks.

- Moreover, the biofuel industry's growth is also generating a surplus of crude Glycerine, which is being refined and repurposed for high-value applications, reinforcing a circular economy approach. With industries adopting cleaner and renewable inputs, the demand for bio-based Glycerine is anticipated to strengthen further over the forecast period.

Glycerinee Market Dynamics

Driver

“Rising Application in Pharmaceutical and Personal Care Industries”

- The growing use of Glycerine in pharmaceutical and personal care applications is a major driver of market growth. Glycerine’s non-toxic, moisturizing, and solvent properties make it highly valuable in products such as toothpaste, skin creams, cough syrups, and wound care formulations.

- This trend is particularly prominent in the pharmaceutical industry, where Glycerine is used as a humectant and excipient in drug formulations due to its compatibility with active pharmaceutical ingredients and its ability to enhance shelf-life and efficacy.

- In the personal care segment, consumers’ increasing demand for clean-label and plant-based products is accelerating the use of Glycerine in skincare and hygiene products.

- For instance, Godrej Industries and Croda International have developed Glycerine-based ingredients tailored for sensitive-skin personal care products, catering to evolving consumer preferences.

- As global awareness about ingredient safety, product efficacy, and sustainability grows, pharmaceutical and personal care manufacturers are increasingly incorporating high-purity Glycerine into their formulations, fueling strong demand across developed and emerging markets alike.

Restraint/Challenge

“Fluctuations in Raw Material Supply and Glycerine Prices”

- Volatility in the supply of raw materials used in biodiesel and oleochemical production presents a significant challenge for the Glycerine market. Since Glycerine is largely derived as a byproduct from biodiesel and fatty acid production, any disruption in these upstream sectors can directly impact Glycerine availability and pricing.

- The market is also influenced by inconsistent crude Glycerine quality from biodiesel plants, which adds to purification costs and affects downstream applications requiring high-purity grades.

- For instance, during periods of lower biodiesel production due to feedstock shortages or policy changes, Glycerine supply tightens, leading to price spikes and limiting availability for industries such as food, personal care, and pharmaceuticals.

- Additionally, the rising cost of refining technology required to convert crude Glycerine into pharmaceutical or food-grade Glycerine poses challenges for smaller manufacturers and cost-sensitive regions.

- These fluctuations in supply and pricing create uncertainty and may hinder long-term planning and procurement strategies, especially for manufacturers dependent on stable input costs and consistent quality.

Glycerinee Market Scope

The Glycerine market is segmented on the basis of grade, source, application, and end-use industry.

- By Type

On the basis of grade, the Glycerine market is segmented into Refined and Crude. The refined Glycerine segment is expected to dominate the market with the largest revenue share of 64.7% in 2025. This dominance is due to its widespread use in high-value applications such as pharmaceuticals, personal care products, and food & beverages, where high-purity standards and compliance with pharmacopeial regulations are essential. Refined Glycerine offers superior quality, low toxicity, and excellent compatibility with other formulation ingredients, making it indispensable in sensitive applications.

However, the crude Glycerine segment is projected to grow with the highest CAGR of 6.91% during the forecast period of 2025–2032. This growth is driven by its increasing use in industrial applications such as animal feed, biogas production, and chemical intermediates, especially in cost-sensitive markets where purity requirements are less stringent and operational efficiency is a key focus.

- By Source

Based on source, the market is segmented into Vegetable Oils, Biodiesel, Animal Fat, and Synthetic. The vegetable oils segment is expected to hold the largest market share of 48.3% in 2025, attributed to its clean-label appeal and alignment with consumer preferences for natural and sustainable inputs. Vegetable-oil-derived Glycerine is widely used in pharmaceutical and personal care applications due to its renewable origin, high purity, and low allergenicity.

On the other hand, the biodiesel segment is anticipated to witness the highest CAGR of 7.15% during the forecast period. This growth is supported by the expanding biodiesel production across major economies, particularly in Europe, Southeast Asia, and North America, resulting in increased availability of crude Glycerine as a byproduct. With advancements in refining technologies, more of this byproduct is being upgraded to pharmaceutical and industrial-grade Glycerine, creating a cost-effective supply stream for various downstream applications.

- By Application

On the basis of application, the Glycerine market is segmented into Pharmaceuticals, Personal Care & Cosmetics, Food & Beverages, and Industrial. The personal care & cosmetics segment is expected to lead the market in 2025 with a share of 29.4%, driven by its intensive use as a humectant, moisturizer, and emulsifier in skincare, oral care, and hair care products. The rise in demand for clean-label, plant-based, and skin-friendly cosmetic formulations is further boosting the segment.

Meanwhile, the pharmaceuticals segment is forecasted to record the highest CAGR of 7.23% during 2025–2032. This is due to growing consumption of Glycerine in cough syrups, capsule formulations, and wound care solutions, coupled with regulatory support for the use of non-toxic excipients and increased investment in health infrastructure globally.

- By End-Use Industry

The end-use industry segmentation includes Healthcare, Chemical, Personal Care, and Automotive. In 2025, the personal care industry is anticipated to dominate the market, accounting for the largest revenue share of 33.6%. Glycerine’s wide functionality, biocompatibility, and regulatory acceptance have made it a key ingredient in a range of personal hygiene and cosmetic products, including lotions, shaving creams, and deodorants.

However, the healthcare segment is expected to witness the fastest growth over the forecast period, with a projected CAGR of 7.35%. This growth is driven by the increasing use of Glycerine in medical formulations, topical treatments, and nutraceuticals, especially amid rising health awareness and pharmaceutical production in emerging economies.

Global Glycerinee Market Regional Analysis

- North America Glycerinee Market Insight

North America accounts for a significant share of the global Glycerine market, contributing 28.4% of the total revenue in 2025, driven by mature demand across pharmaceuticals, personal care, and food & beverage industries. The region’s strict quality regulations and preference for high-purity, sustainable ingredients support widespread use of refined Glycerine in both consumer and industrial products.

Increasing demand for bio-based products and advancements in chemical manufacturing technologies further bolster the growth of Glycerine in this region.

- U.S. Glycerinee Market Insight

The U.S. leads the North American Glycerine market, accounting for the majority share in 2025, supported by its dominant pharmaceutical and personal care sectors. The rise in health-conscious consumer trends, coupled with the demand for natural and non-toxic ingredients, is boosting Glycerine usage in cough syrups, skincare products, and functional foods. Additionally, the U.S. is a major producer of biodiesel, providing an abundant supply of crude Glycerine for industrial upgrading.

- Canada Glycerinee Market Insight

Canada’s Glycerine market is growing steadily, driven by the expansion of the personal care and food processing sectors. Increasing demand for clean-label and sustainable products has encouraged the adoption of vegetable-based Glycerine in cosmetics, moisturizers, and dietary supplements. Regulatory alignment with the U.S. and ongoing innovation in specialty chemicals support the country’s role in North America’s Glycerine value chain.

Europe Glycerinee Market Insight

The Europe Glycerine market is expected to grow at a CAGR of 6.78% during the forecast period of 2025–2032, supported by strong demand in pharmaceutical formulations, eco-friendly personal care products, and food-grade applications. The region’s robust regulatory framework and circular economy initiatives are accelerating the shift toward bio-based and sustainable ingredients. Europe’s extensive biodiesel production also ensures a stable supply of crude Glycerine for refining.

- Germany Glycerinee Market Insight

Germany remains a key market for Glycerine in Europe due to its advanced pharmaceutical and cosmetics industries. The country’s strong emphasis on R&D, sustainability, and product safety has increased the use of high-purity Glycerine in topical treatments, oral care, and food applications. Additionally, Germany’s leadership in green chemistry and industrial biotechnology supports innovation in Glycerine-based derivatives.

- France Glycerinee Market Insight

France is witnessing steady growth in the Glycerine market, driven by increasing consumption in organic cosmetics, nutraceuticals, and wellness-focused products. Government support for bioeconomy development and consumer demand for natural ingredients are fueling interest in vegetable oil–derived Glycerine. The expanding pharmaceutical sector and the rise of ethical beauty brands also contribute to market momentum.

Asia-Pacific Glycerinee Market Insight

Asia-Pacific dominates the global Glycerine market with the largest revenue share of 39.6% in 2025 and is projected to register the highest CAGR of 8.45% during 2025–2032. Rapid industrialization, urbanization, and population growth in emerging economies are driving demand for Glycerine in food & beverages, personal care, and industrial applications. Favorable production economics, a growing middle class, and increasing consumer awareness of product quality are contributing to the region’s dynamic expansion.

- China Glycerinee Market Insight

China holds the largest share in the Asia-Pacific Glycerine market, supported by its expansive pharmaceutical manufacturing, cosmetics, and food processing sectors. Domestic availability of biodiesel-based crude Glycerine and strong export-oriented production capacity are key advantages. Government-backed initiatives to improve healthcare access and promote green chemicals further support the adoption of Glycerine-based formulations.

- India Glycerinee Market Insight

India’s Glycerine market is poised for substantial growth, fueled by increasing demand across personal care, food, and pharmaceutical sectors. The shift toward natural and sustainable ingredients in Ayurvedic and wellness products is encouraging greater use of refined Glycerine. In addition, the country's expanding biodiesel output and foreign investment in specialty chemical manufacturing are creating new opportunities for Glycerine supply and downstream integration.

Glycerinee Market Players

The Glycerinee industry is primarily led by well-established companies, including:

- P&G Chemicals (U.S.)

- KLK OLEO (Malaysia)

- Emery Oleochemicals (Malaysia)

- Cargill Incorporated (U.S.)

- Godrej Industries (India)

- IOI Oleochemicals (Malaysia)

- Wilmar International (Singapore)

- Aemetis Inc. (U.S.)

- Repsol S.A. (Spain)

- Avril Group (France)

- Vance Group Ltd. (Singapore)

- Musim Mas Holdings (Singapore)

- Croda International Plc (UK)

- Vantage Specialty Chemicals Inc. (U.S.)

- Sakamoto Yakuhin Kogyo Co. Ltd. (Japan)

Latest Developments in Global Glycerinee Market

- In February 2025, Emery Oleochemicals announced the expansion of its technical-grade Glycerine production at its Cincinnati, Ohio facility to meet rising demand from industrial and chemical applications. The expansion aims to enhance Emery’s supply reliability in North America and strengthen its market position in downstream segments such as resins, antifreeze, and lubricants, where Glycerine is widely used as a humectant and solvent.

- In October 2024, KLK OLEO introduced a new line of pharmaceutical- and food-grade Glycerine derived from sustainable vegetable oils under its “Olebased PureGlyc” brand. This innovation aligns with increasing regulatory and consumer preference for traceable, non-GMO, and RSPO-certified inputs in health and nutrition products, solidifying KLK’s commitment to ethical sourcing and high-purity standards in the Glycerine market.

- In May 2024, Godrej Industries expanded its Glycerine production capacity in India, targeting domestic and Southeast Asian markets with refined Glycerine for use in personal care, oral hygiene, and food applications. The expansion is aimed at capturing growing regional demand for bio-based and halal-certified ingredients, reinforcing Godrej’s strategic growth in Asia’s value-added oleochemical sector.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Glycerin Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Glycerin Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Glycerin Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.