Global Glycine Supplement Market

Market Size in USD Billion

CAGR :

%

USD

623.71 Billion

USD

975.49 Billion

2025

2033

USD

623.71 Billion

USD

975.49 Billion

2025

2033

| 2026 –2033 | |

| USD 623.71 Billion | |

| USD 975.49 Billion | |

|

|

|

|

Glycine Supplement Market Size

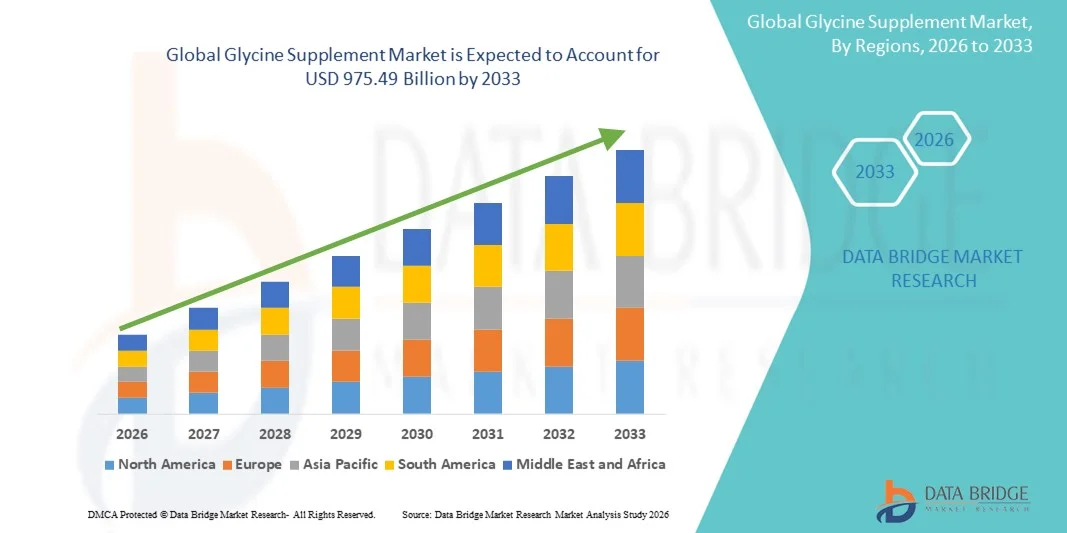

- The global glycine supplement market size was valued at USD 623.71 billion in 2025 and is expected to reach USD 975.49 billion by 2033, at a CAGR of 5.75% during the forecast period

- The market growth is largely driven by increasing consumer awareness regarding preventive healthcare and wellness, along with the rising adoption of dietary supplements as part of daily nutrition routines. Growing emphasis on fitness, stress management, sleep quality, and metabolic health is encouraging consumers across both developed and emerging economies to incorporate glycine supplements into their diets. In addition, advancements in nutraceutical formulations and the expansion of e-commerce platforms are enhancing product accessibility and market penetration

- Furthermore, rising demand for clean-label, science-backed, and multifunctional supplements is positioning glycine as a preferred ingredient due to its proven benefits in sleep improvement, muscle recovery, cognitive support, and metabolic regulation. The shift toward natural amino acid–based supplements, coupled with increasing recommendations from healthcare and sports nutrition professionals, is accelerating the uptake of glycine supplements, thereby significantly boosting the overall growth of the Glycine Supplement market

Glycine Supplement Market Analysis

- Glycine supplements, formulated as powders, capsules, or functional nutrition ingredients, are increasingly recognized as essential components of modern preventive healthcare and wellness routines due to their scientifically supported benefits in improving sleep quality, muscle recovery, metabolic health, and cognitive function. Their growing use spans both individual consumers and clinical nutrition applications, supported by increasing awareness of amino acid–based supplementation

- The escalating demand for glycine supplements is primarily driven by rising health consciousness, increased adoption of sports nutrition and lifestyle supplements, and a growing preference for natural, clean-label, and evidence-backed ingredients. In addition, the expanding aging population and higher incidence of sleep disorders and metabolic conditions are further reinforcing market demand

- North America dominated the glycine supplement market with the largest revenue share of approximately 38.5% in 2025, supported by high dietary supplement consumption, strong consumer awareness, and a well-established nutraceutical industry. The U.S. accounted for the majority of regional demand, driven by widespread use of glycine in sleep aids, sports nutrition products, and functional beverages, alongside strong distribution through e-commerce and specialty health stores

- Asia-Pacific is expected to be the fastest-growing region in the glycine supplement market during the forecast period, driven by increasing urbanization, rising disposable incomes, expanding middle-class populations, and growing awareness of preventive healthcare in countries such as China, India, and Japan. Rapid growth of the sports nutrition and functional food sectors is further accelerating regional market expansion

- The solid dosage form segment accounted for the largest market revenue share of 61.4% in 2025, driven by its widespread availability, longer shelf life, and ease of transportation and storage

Report Scope and Glycine Supplement Market Segmentation

|

Attributes |

Glycine Supplement Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Ajinomoto Co., Inc. (Japan) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Glycine Supplement Market Trends

Rising Focus on Health, Sleep Quality, and Preventive Nutrition

- A prominent and accelerating trend in the global glycine supplement market is the growing consumer focus on preventive healthcare, sleep optimization, and overall metabolic wellness. Glycine is increasingly recognized for its role in improving sleep quality, supporting muscle recovery, enhancing cognitive function, and promoting gut and joint health

- For instance, several nutraceutical brands have introduced glycine-based sleep support formulations marketed as natural alternatives to melatonin, highlighting glycine’s clinically supported role in improving sleep onset and sleep quality

- Consumers are becoming more proactive in managing stress, fatigue, and lifestyle-related disorders, driving demand for amino acid–based supplements such as glycine that offer multifunctional health benefits with minimal side effects

- The expanding popularity of fitness culture, sports nutrition, and recovery-focused supplementation is further reinforcing this trend. Glycine is widely used by athletes and active individuals due to its involvement in protein synthesis and muscle repair

- In addition, the rising adoption of clean-label and scientifically backed supplements is supporting glycine demand, as it is a naturally occurring amino acid with strong clinical support and a favorable safety profile

- Manufacturers are increasingly offering glycine in various formats, including capsules, powders, and functional blends, improving consumer accessibility and convenience. This trend toward targeted, condition-specific supplementation is reshaping consumer expectations within the nutritional supplements landscape

- As awareness around sleep disorders, metabolic health, and aging-related concerns continues to grow, glycine supplements are gaining traction across both developed and emerging markets

Glycine Supplement Market Dynamics

Driver

Growing Demand Driven by Sleep Disorders, Fitness Trends, and Preventive Healthcare

- The rising prevalence of sleep disorders, stress-related health issues, and lifestyle-induced metabolic conditions is a key driver fueling demand for glycine supplements globally. Glycine’s ability to improve sleep quality, support nervous system function, and regulate blood sugar levels makes it increasingly attractive to health-conscious consumers

- For instance, clinical research highlighting glycine’s effectiveness in improving sleep efficiency and reducing daytime fatigue has strengthened its recommendation by healthcare professionals and nutritionists, positively influencing consumer adoption

- The global shift toward preventive healthcare and self-care is encouraging consumers to adopt dietary supplements as part of their daily wellness routines, significantly boosting glycine consumption

- Furthermore, the rapid expansion of the sports nutrition and fitness industry is accelerating glycine supplement uptake, as athletes and fitness enthusiasts seek effective solutions for muscle recovery, endurance, and overall performance

- Increased awareness of amino acid supplementation among aging populations is also contributing to market growth, as glycine supports joint health, collagen synthesis, and cognitive well-being

- The widespread availability of glycine supplements through online platforms, pharmacies, and health stores, along with increasing endorsements by healthcare professionals, continues to strengthen market demand across residential and clinical consumer segments

Restraint/Challenge

Limited Consumer Awareness and Regulatory Variability

- Despite its proven health benefits, limited awareness about glycine supplementation among general consumers remains a key challenge to market expansion, particularly in developing regions. Many consumers are more familiar with popular supplements such as protein powders, vitamins, or omega fatty acids, while amino acids like glycine receive comparatively less attention

- For instance, in several emerging markets, glycine is often marketed only as a minor ingredient within blended supplements rather than as a standalone product, limiting consumer understanding of its specific benefits

- Inconsistent regulatory frameworks governing dietary supplements across different countries pose another restraint. Variations in labeling requirements, dosage approvals, and health claims can create compliance challenges for manufacturers and limit market entry in certain regions

- In addition, the presence of alternative supplements targeting similar benefits—such as melatonin for sleep or collagen for joint health—can reduce consumer preference for standalone glycine products

- Price sensitivity in emerging economies may also hinder adoption, especially for premium or branded glycine supplements, as consumers may opt for lower-cost alternatives or multi-ingredient formulations

- Addressing these challenges through improved consumer education, clinical validation, transparent labeling, and affordable product offerings will be critical for sustained long-term growth in the global Glycine Supplement market

Glycine Supplement Market Scope

The market is segmented on the basis of dosage form, application, and distribution channel.

- By Dosage Form

On the basis of dosage form, the Glycine Supplement market is segmented into solid and liquid forms. The solid dosage form segment accounted for the largest market revenue share of 61.4% in 2025, driven by its widespread availability, longer shelf life, and ease of transportation and storage. Solid forms, including capsules, tablets, and powders, are highly preferred by consumers due to precise dosing, convenience, and compatibility with daily supplement routines. Powdered glycine, in particular, is popular among fitness enthusiasts and individuals managing sleep or joint health, as it allows flexible dosage adjustment. Manufacturers favor solid formats due to cost-effective production and packaging efficiencies. In addition, the dominance of solid dosage forms is reinforced by strong retail penetration and consumer familiarity, especially in North America and Europe, where dietary supplement consumption is well established.

The liquid dosage form segment is expected to witness the fastest CAGR of 9.8% from 2026 to 2033, driven by increasing demand for faster absorption and ease of consumption. Liquid glycine supplements are particularly appealing to elderly consumers, children, and individuals with swallowing difficulties. The rising popularity of functional beverages and liquid nutritional supplements is further accelerating adoption. Improved flavor masking technologies and innovative formulations have enhanced consumer acceptance of liquid glycine products. Moreover, liquid forms are gaining traction in clinical nutrition and hospital settings, where rapid bioavailability is critical. Growing health awareness and premium supplement trends are expected to sustain strong growth in this segment.

- By Application

On the basis of application, the Glycine Supplement market is segmented into sleep problems, joint and bone health, cardiovascular diseases, and others. The sleep problems segment dominated the market with a revenue share of 38.6% in 2025, driven by growing prevalence of sleep disorders, stress, and irregular lifestyles across urban populations. Glycine is widely recognized for its role in improving sleep quality by lowering core body temperature and promoting relaxation, making it a preferred natural sleep aid. Consumers increasingly favor glycine supplements as a non-habit-forming alternative to pharmaceutical sleep medications. The segment benefits from rising awareness about mental wellness and the importance of quality sleep. Increased marketing of glycine-based sleep supplements through digital platforms and health practitioners has further strengthened its dominance globally.

The joint and bone health segment is projected to register the fastest CAGR of 10.6% from 2026 to 2033, supported by an aging global population and increasing incidence of arthritis and musculoskeletal disorders. Glycine plays a vital role in collagen synthesis, which is essential for maintaining joint flexibility and bone strength. Rising adoption of preventive healthcare and nutritional supplementation among middle-aged and elderly consumers is accelerating growth. The segment also benefits from increasing participation in fitness and sports activities, where joint recovery and mobility are key concerns. Expanding use of glycine in combination formulations for bone and joint health is expected to further drive demand.

- By Distribution Channel

On the basis of distribution channel, the Glycine Supplement market is segmented into retail stores, online stores, and others. The retail store segment held the largest market revenue share of 54.2% in 2025, driven by strong consumer preference for in-store purchases of dietary supplements. Pharmacies, health food stores, and supermarkets provide consumers with immediate product availability, professional guidance, and brand trust. Many consumers prefer physical stores to verify product authenticity and compare formulations before purchase. Retail dominance is particularly strong in developing regions, where online penetration is still evolving. Promotional activities, discounts, and pharmacist recommendations further support sustained demand through retail channels.

The online store segment is expected to witness the fastest CAGR of 12.4% from 2026 to 2033, fueled by rapid growth in e-commerce and increasing digital health awareness. Online platforms offer wider product selection, competitive pricing, and convenient home delivery, making them highly attractive to modern consumers. Subscription-based supplement models and personalized nutrition recommendations are gaining popularity online. The segment is also driven by the influence of social media, fitness influencers, and direct-to-consumer brands. Improved logistics infrastructure and growing smartphone penetration in emerging economies are expected to further accelerate online sales growth globally.

Glycine Supplement Market Regional Analysis

- North America dominated the glycine supplement market with the largest revenue share of approximately 38.5% in 2025, supported by high dietary supplement consumption, strong consumer awareness, and a well-established nutraceutical industry across the region

- Consumers in North America increasingly value glycine supplements for their benefits in improving sleep quality, supporting muscle recovery, enhancing metabolic health, and promoting cognitive wellness

- This widespread adoption is further reinforced by high disposable incomes, a proactive approach toward preventive healthcare, and strong penetration of e-commerce and specialty health stores, positioning glycine supplements as a preferred choice across sports nutrition, functional foods, and wellness applications

U.S. Glycine Supplement Market Insight

The U.S. glycine supplement market captured the majority share of regional demand in 2025, driven by the widespread use of glycine in sleep aids, sports nutrition formulations, and functional beverages. Growing awareness regarding amino acid supplementation for muscle recovery, stress reduction, and metabolic support continues to fuel demand. In addition, strong distribution networks, including online platforms, pharmacies, and specialty nutrition stores, combined with the rising popularity of clean-label and scientifically backed supplements, are significantly propelling market growth in the U.S.

Europe Glycine Supplement Market Insight

The Europe glycine supplement market is projected to expand at a steady CAGR throughout the forecast period, supported by increasing health consciousness and a strong emphasis on preventive nutrition. Consumers across Europe are showing growing interest in amino acid supplementation for improved sleep, joint health, and overall wellness. The presence of established nutraceutical manufacturers, along with regulatory support for high-quality dietary supplements, is fostering market growth across functional foods, beverages, and pharmaceutical-grade applications.

U.K. Glycine Supplement Market Insight

The U.K. glycine supplement market is anticipated to grow at a notable CAGR during the forecast period, driven by rising awareness of mental well-being, sleep health, and sports nutrition. Increasing adoption of glycine-based supplements among fitness enthusiasts and aging populations is supporting demand. The country’s strong retail and e-commerce infrastructure, along with a growing preference for plant-based and clean-label supplements, is expected to further stimulate market expansion.

Germany Glycine Supplement Market Insight

The Germany glycine supplement market is expected to expand at a considerable CAGR, fueled by high consumer awareness of nutritional science and preventive healthcare. Germany’s strong pharmaceutical and nutraceutical manufacturing base, combined with demand for premium, evidence-based supplements, is driving adoption. Glycine supplements are increasingly used in functional foods, dietary supplements, and clinical nutrition, aligning well with the country’s emphasis on quality, safety, and sustainability.

Asia-Pacific Glycine Supplement Market Insight

The Asia-Pacific glycine supplement market is expected to be the fastest-growing region during the forecast period, driven by rapid urbanization, rising disposable incomes, and expanding middle-class populations. Growing awareness of preventive healthcare, along with increasing adoption of dietary supplements for fitness, immunity, and sleep health, is accelerating demand. The rapid growth of the sports nutrition and functional food sectors is further strengthening the regional market outlook.

Japan Glycine Supplement Market Insight

The Japan glycine supplement market is gaining strong momentum due to the country’s aging population, high health awareness, and preference for scientifically validated nutritional products. Glycine is widely used in sleep-enhancing supplements, functional beverages, and clinical nutrition products. The focus on longevity, stress management, and cognitive health continues to drive steady demand across both consumer and healthcare channels.

China Glycine Supplement Market Insight

The China glycine supplement market accounted for the largest revenue share in the Asia-Pacific region in 2025, driven by rapid urbanization, a growing middle class, and increasing adoption of dietary supplements. Rising interest in sports nutrition, functional foods, and traditional wellness practices incorporating amino acids is supporting market growth. Strong domestic manufacturing capabilities and expanding online retail platforms are making glycine supplements more accessible, further propelling market expansion in China.

Glycine Supplement Market Share

The Glycine Supplement industry is primarily led by well-established companies, including:

• Ajinomoto Co., Inc. (Japan)

• Evonik Industries AG (Germany)

• Archer Daniels Midland Company (U.S.)

• Prinova Group LLC (U.S.)

• Kyowa Hakko Bio Co., Ltd. (Japan)

• Novus International, Inc. (U.S.)

• GEO Specialty Chemicals, Inc. (U.S.)

• Hubei Xingfa Chemicals Group Co., Ltd. (China)

• Yuki Gosei Kogyo Co., Ltd. (Japan)

• Cargill, Incorporated (U.S.)

• Shijiazhuang Donghua Jinlong Chemical Co., Ltd. (China)

• Henan HDF Chemical Co., Ltd. (China)

• Showa Denko K.K. (Japan)

• Daesang Corporation (South Korea)

• Fufeng Group Limited (China)

Latest Developments in Global Glycine Supplement Market

- In June 2023, Jarrow Formulas, a well-known supplement manufacturer, announced a strategic partnership with a leading health and wellness influencer to promote its glycine products through targeted social media campaigns. This collaboration marked a shift in marketing strategy for glycine supplements, as brands increasingly leveraged influencer engagement to raise product visibility and reach younger, health-aware consumers across digital platforms

- In June 2023, Solgar, a global dietary supplement brand, expanded its distribution channels to improve accessibility of its glycine supplement offerings in the Indian market, reflecting a broader trend of international brands penetrating high-growth regions to capture rising demand for amino acid-based health products in Asia

- In August 2023, several glycine manufacturers reported enhanced raw material offerings for research and development applications in biopharmaceutical production, showcased at industry events such as the BioProcess International Conference in the U.S. This signaled increased cross-industry interest in glycine as a key component for biologics and advanced formulations

- In June 2024, NOW Foods, a leading U.S. supplement producer, achieved organic certification for its plant-based glycine supplement line, aligning with the growing consumer preference for clean-label and sustainably sourced products in premium supplement segments

- In July 2024, Bulk Supplements, a major raw ingredient and formulation supplier, completed construction of a new 150,000 square foot manufacturing facility in Nevada, USA, increasing glycine production capacity by approximately 40% to meet rising global demand. The expansion included advanced quality control systems to ensure high-purity raw materials for dietary supplement and nutrition applications

- In September 2024, NOW Foods also entered into a strategic distribution partnership with leading sports nutrition retailers in North America, specifically to promote glycine-based powder products tailored for athletes and recovery-focused consumers, thereby broadening its market reach and positioning glycine as a performance supplement

- In January 2025, Ajinomoto Co., Inc., a major amino acid producer, announced a strategic partnership with Evonik Industries AG to secure a stable supply of food-grade glycine and jointly develop high-purity glycine applications for flavor, nutrition, and supplement markets. This collaboration emphasized industry efforts to strengthen supply chains and innovate high-quality glycine derivatives

- In April 2025, Exactitude Consultancy released a comprehensive U.S. Glycine Supplement Market report, highlighting new market insights, import trends, competitive dynamics, and future opportunities. This research provided an authoritative benchmark for industry growth and helped supplement companies refine strategies for expanding in the U.S. market

- In September 2025, Swanson Health Products (US) announced the launch of a new organic glycine supplement line designed for athletes and fitness enthusiasts, reflecting consumers’ growing preference for targeted performance and recovery solutions within the broader supplement category

- In October 2025, GNC Holdings (US) entered into a strategic partnership with a major e-commerce platform to enhance its online distribution and digital presence for glycine supplements. This move aimed to tap into the accelerating trend of online supplement sales and improve customer engagement through enhanced digital reach and marketing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.