Global Gnss Chip Market

Market Size in USD Billion

CAGR :

%

USD

2.50 Billion

USD

3.20 Billion

2024

2032

USD

2.50 Billion

USD

3.20 Billion

2024

2032

| 2025 –2032 | |

| USD 2.50 Billion | |

| USD 3.20 Billion | |

|

|

|

|

Navigation Satellite System (NSS) Chip Market Size

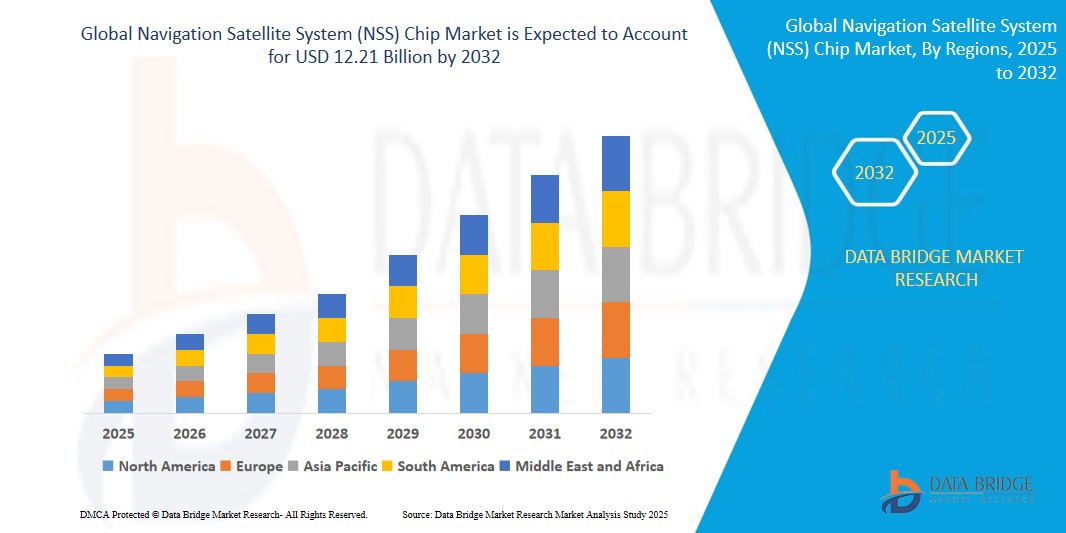

- The Global Navigation Satellite System (NSS) Chip Market size was valued at USD 7.87 billion in 2024 and is expected to reach USD 12.21 billion by 2032, at a CAGR of 6.5% during the forecast period

- This growth is driven by factors such as the rise in the need for the accurate real-time data and increase in the penetration of customer electronic devices

Navigation Satellite System (NSS) Chip Market Analysis

- Global Navigation Satellite System (GNSS) chips are essential components in modern positioning and timing systems used across various sectors, including transportation, agriculture, defense, and consumer electronics. These chips enable devices to receive signals from multiple satellite constellations such as GPS, GLONASS, Galileo, and BeiDou offering accurate location and timing data critical for navigation, automation, and IoT applications.

- Market growth is driven by the increasing integration of GNSS chips in smartphones, autonomous vehicles, drones, wearables, and precision agriculture tools. The rapid expansion of location based services and the growing demand for real-time tracking across industries are fueling widespread adoption.

- North America is expected to dominate the global GNSS chip market, supported by high demand for advanced navigation systems in automotive and military sectors, strong technological infrastructure, and growing adoption of connected and autonomous vehicles.

- Asia Pacific is anticipated to register the fastest growth due to the surge in smartphone penetration, rising demand for GNSS enabled applications in logistics and agriculture, and government backed initiatives for satellite navigation systems such as China’s BeiDou and India’s NavIC.

- The GPS segment holds the largest market share of 56.81% due to its widespread adoption across various commercial, industrial, and consumer applications.

Report Scope and Navigation Satellite System (NSS) Chip Market Segmentation

|

Attributes |

Navigation Satellite System (NSS) Chip Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Navigation Satellite System (NSS) Chip Market Trends

“Integration of Multi-Constellation GNSS and AI for Enhanced Precision”

- A major trend reshaping the GNSS chip market is the growing adoption of multi-constellation GNSS receivers that integrate signals from GPS, GLONASS, Galileo, BeiDou, and SBAS to deliver more accurate and reliable positioning, especially in urban canyons and high interference zones.

- Coupled with artificial intelligence and sensor fusion, these chips now enable high-precision applications in autonomous vehicles, robotics, and geospatial surveying.

- For Instance, in February 2025, u-blox launched its ZED-F9P-02B module that leverages signals from multiple GNSS systems and applies AI-assisted multipath rejection algorithms, delivering centimeter level accuracy for UAVs and precision agriculture.

- This trend is enhancing performance across industries that rely on seamless navigation, including automotive, agriculture, and construction, while supporting the evolution of smart cities and connected infrastructure.

Navigation Satellite System (NSS) Chip Market Dynamics

Driver

“Surge in Demand for Navigation and Tracking in Connected Vehicles and IoT Devices”

- The rising use of GNSS chips in connected and autonomous vehicles is a major driver for market growth. These chips enable precise real-time location tracking, route optimization, fleet management, and accident prevention systems.

- Additionally, IoT devices in logistics, asset tracking, and smart mobility applications are increasingly incorporating GNSS chips to enable continuous monitoring and geofencing.

- For Instance, In July 2024, major automotive OEMs in Europe began integrating dual band GNSS chips into their next gen EV models to support high accuracy driver assistance systems, boosting market demand.

- The widespread adoption of GNSS technology in mobile devices, wearables, and smart city infrastructure continues to support long-term growth of the market.

Opportunity

“Rising Adoption of GNSS in Precision Agriculture and Surveying Applications”

- The rising use of GNSS chips in connected and autonomous vehicles is a major driver for market growth. These chips enable precise real time location tracking, route optimization, fleet management, and accident prevention systems.

- Additionally, IoT devices in logistics, asset tracking, and smart mobility applications are increasingly incorporating GNSS chips to enable continuous monitoring and geofencing.

- For Instance, In July 2024, major automotive OEMs in Europe began integrating dual-band GNSS chips into their next-gen EV models to support high-accuracy driver assistance systems, boosting market demand.

- The widespread adoption of GNSS technology in mobile devices, wearables, and smart city infrastructure continues to support long-term growth of the market

Restraint/Challenge

“Signal Interference and Urban Canyon Challenges Limit GNSS Accuracy”

- One of the key restraints for GNSS chip adoption is the limited signal accuracy in dense urban environments, tunnels, and indoor areas, where satellite visibility is obstructed or reflected.

- Signal multipath errors, spoofing threats, and atmospheric delays can significantly reduce the reliability of GNSS solutions in critical applications.

- For instance, In December 2024, a major delivery drone operator in Tokyo reported delayed drop-offs due to inconsistent GNSS signals in skyscraper-filled districts, leading to service suspensions and prompting integration of alternative location tech like inertial navigation systems (INS).

- These challenges are driving the need for hybrid positioning systems, pushing developers to invest in complementary technologies, which may increase integration complexity and overall system cost.

Navigation Satellite System (NSS) Chip Market Scope

The market is segmented on the basis, product and industry.

|

Segmentation |

Sub-Segmentation |

|

By NSS Receiver |

|

|

By Device |

|

|

By Application |

|

|

By Vertical |

|

In 2025, Global Positioning System (GPS) are projected to dominate the market, holding the largest share within the NSS Receiver segment.

The GPS segment is anticipated to lead the GNSS chip market in 2025, owing to its widespread adoption across various commercial, industrial, and consumer applications. As the most established and globally accessible satellite navigation system, GPS continues to serve as the backbone for location-based services, automotive navigation, and mobile devices. Additionally, enhancements in GPS signal precision and availability are further reinforcing its dominance in the receiver segment.

The Smartphones is expected to account for the largest share in the device segment during the forecast period.

The growing penetration of smartphones globally and the increasing demand for real-time location-based services. With most modern smartphones integrating multi-constellation GNSS chips for improved accuracy in navigation, fitness tracking, and local search services, this segment continues to drive large-scale volume demand.

Navigation Satellite System (NSS) Chip Market Regional Analysis

“North America Holds the Largest Share in the Navigation Satellite System (NSS) Chip Market”

- North America currently dominates the global GNSS chip market due to its robust ecosystem of satellite infrastructure, widespread usage of consumer electronics, and early adoption of autonomous and connected technologies across sectors such as automotive, defense, and agriculture.

- The U.S. leads the region, driven by advanced R&D in GPS technologies, strong government support for precision navigation applications, and integration of GNSS chips into smartphones, wearables, and autonomous vehicles.

“Asia-Pacific is Projected to Register the Highest CAGR in the Navigation Satellite System (NSS) Chip Market”

- Asia-Pacific is expected to experience the fastest growth in the GNSS chip market during the forecast period, driven by surging smartphone adoption, rapid urbanization, and significant investments in satellite constellations such as China's BeiDou and India’s NavIC.

- China, in particular, has established a robust domestic satellite navigation ecosystem with BeiDou fully operational and integrated into a wide array of sectors, from consumer electronics to smart agriculture and military applications. India is also ramping up the use of NavIC chips in consumer devices and transportation infrastructure, further boosting regional growth.

Navigation Satellite System (NSS) Chip Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Qualcomm Technologies, Inc. (US)

- Broadcom (US)

- FURUNO ELECTRIC CO., LTD. (Japan)

- Belden Inc. (US)

- New Japan Radio Co., Ltd. (Japan)

- KATHREIN-SE (Germany)

- LAIRD (UK)

- MEDIATEK (Taiwan)

- NXP Semiconductors (Netherlands)

- PULSE ELECTRONICS (US)

- U-BLOX (Switzerland)

- STMicroelectronics (Switzerland)

- TE Connectivity (Switzerland)

- Blue Planet Geomatics (Canada)

- Eos Positioning Systems (Canada)

- Geo++ (Germany)

- NSS Solutions Ltd (Japan)

- General Dynamics Mission Systems, Inc. (US)

- Accord Software & Systems Private Limited (India)

- Intel Corporation (US)

- Skyworks Solutions, Inc. (US)

Latest Developments in Global Navigation Satellite System (NSS) Chip Market

- In April 2025, Qualcomm introduced the Snapdragon 8 Gen 4 mobile platform, featuring enhanced GNSS capabilities, including support for dual frequency GNSS and integration with multiple satellite constellations. This advancement aims to provide improved location accuracy and reliability for next generation smartphones and IoT devices, catering to the growing demand for precise positioning in various applications.

- In January 2025, Hexagon AB, a global leader in digital reality solutions, announced the acquisition of Septentrio N.V., a Belgian company specializing in high precision GNSS receivers. This acquisition aims to strengthen Hexagon's positioning and autonomy solutions by integrating Septentrio's advanced GNSS technology, thereby enhancing offerings in sectors such as surveying, agriculture, and autonomous vehicles.

- In March 2025, u-blox, a Swiss provider of positioning and wireless communication technologies, completed the acquisition of Sapcorda Services GmbH, a company known for its high precision GNSS services. This strategic move enables u-blox to offer enhanced GNSS solutions with improved accuracy and reliability, catering to applications in autonomous driving, industrial automation, and other precision dependent sectors.

- In March 2024, NextNav, a provider of next-generation GPS services, announced the acquisition of additional spectrum licenses in the lower 900 MHz band. This acquisition is intended to enhance NextNav's terrestrial positioning network, providing a robust complement to traditional satellite-based GNSS, and ensuring reliable location services in environments where satellite signals are obstructed.

- In June 2024, Renesas Electronics Corporation completed the acquisition of Transphorm, a company specializing in gallium nitride (GaN) semiconductor technology. This acquisition is expected to bolster Renesas's capabilities in developing high-performance GNSS chips with improved power efficiency and performance, addressing the growing needs of automotive and industrial applications.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gnss Chip Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gnss Chip Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gnss Chip Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.