Global Gold Mining Chemicals Market

Market Size in USD Billion

CAGR :

%

USD

12.03 Billion

USD

18.05 Billion

2024

2032

USD

12.03 Billion

USD

18.05 Billion

2024

2032

| 2025 –2032 | |

| USD 12.03 Billion | |

| USD 18.05 Billion | |

|

|

|

|

Gold Mining Chemicals Market Size

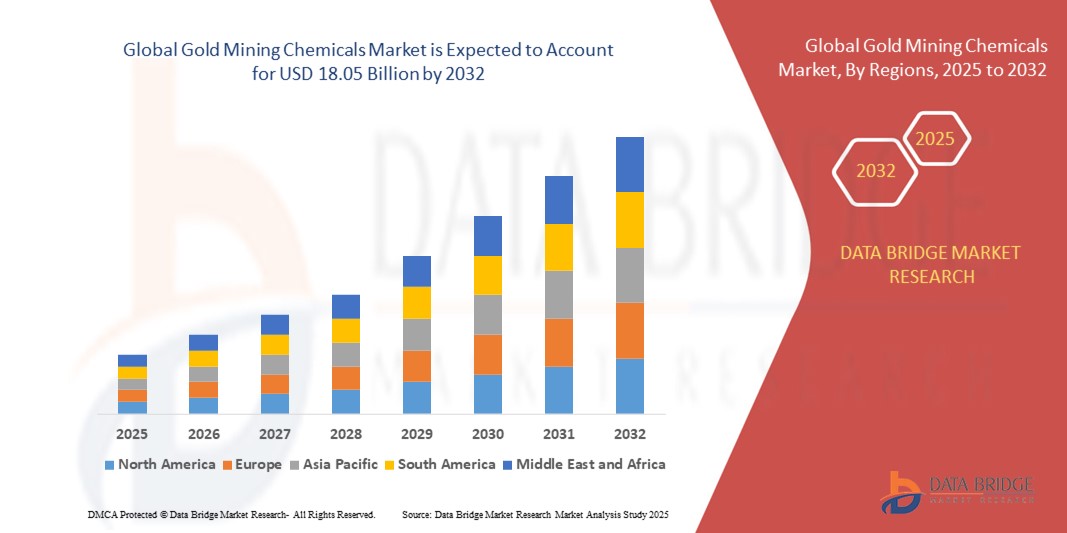

- The global gold mining chemicals market size was valued at USD 12.03 billion in 2024 and is expected to reach USD 18.05 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fuelled by the rising demand for gold in jewelry, electronics, and investment applications, coupled with advancements in chemical formulations that enhance extraction efficiency and reduce environmental impact

- Increasing investments in large-scale mining projects and the expansion of gold mining operations in emerging economies are further contributing to the market’s growth trajectory

Gold Mining Chemicals Market Analysis

- The gold mining chemicals market is witnessing steady growth, driven by increasing gold exploration and mining activities worldwide, particularly in emerging economies with untapped reserves

- The industry is also benefiting from the adoption of eco-friendly and cyanide-free alternatives, as environmental regulations become more stringent

- North America dominated the gold mining chemicals market with the largest revenue share in 2024, driven by the region’s extensive mining activities, advanced extraction technologies, and strong demand for precious metals in both industrial and investment applications

- Asia-Pacific region is expected to witness the highest growth rate in the global gold mining chemicals market, driven by expanding mining operations in countries such as China, Australia, and Indonesia, along with growing demand for advanced chemical solutions to enhance gold yield

- The flotation reagents segment dominated the market with the largest market revenue share in 2024, driven by their crucial role in enhancing gold recovery rates from low-grade ores. Their adaptability to varying ore compositions and compatibility with other processing chemicals has made them an essential component in modern gold extraction processes

Report Scope and Gold Mining Chemicals Market Segmentation

|

Attributes |

Gold Mining Chemicals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion of Eco-Friendly Gold Extraction Chemicals |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Gold Mining Chemicals Market Trends

Shift Towards Environmentally Sustainable Gold Extraction Methods

- The global gold mining industry is witnessing a steady transition towards eco-friendly chemicals, driven by stricter environmental regulations and growing awareness of sustainable mining practices. Innovations in cyanide-free leaching agents, such as thiosulfate and glycine, are enabling efficient gold recovery while minimizing environmental hazards

- The demand for non-toxic and biodegradable chemicals is particularly strong in countries with stringent mining legislation, where environmental compliance is a prerequisite for operational licensing. This is encouraging mining companies to adopt green chemistry solutions that align with ESG (Environmental, Social, and Governance) goals

- In emerging markets, government-backed initiatives are promoting the adoption of sustainable extraction methods through incentives and technology transfer programs. These efforts are helping small- and mid-scale miners modernize operations and reduce ecological impact

- For instance, in 2023, a leading Australian mining firm successfully implemented a glycine-based leaching process across multiple sites, reducing cyanide usage by over 85% while maintaining high recovery yields. This innovation improved the company’s environmental profile and set a benchmark for industry peers

- While eco-friendly gold mining chemicals present a significant opportunity, their widespread adoption will depend on continuous R&D, competitive pricing, and industry-wide education to overcome resistance to change among traditional operators

Gold Mining Chemicals Market Dynamics

Driver

Rising Gold Production and Increasing Demand for Efficient Recovery Solutions

• The steady rise in global gold production is fueling demand for advanced chemicals that enhance extraction efficiency and reduce operational costs. As ore grades decline, mining companies are increasingly reliant on specialized reagents to optimize recovery from complex and low-grade deposits

• Growing investment in gold mining projects, particularly in Africa, Latin America, and Central Asia, is expanding the addressable market for mining chemicals. These regions are emerging as key production hubs, supported by favorable geology and foreign direct investment

• Mining firms are prioritizing process optimization to remain competitive, leading to greater adoption of tailored chemical formulations that improve leaching rates, reduce processing time, and lower waste generation

• For instance, in 2022, several mines in West Africa integrated customized flotation reagents that significantly boosted recovery rates from sulfide ores, improving profitability and reducing energy consumption

• While rising production and innovation are driving market growth, the need for continuous technical support and training remains essential to maximize the benefits of these advanced solutions

Restraint/Challenge

Stringent Environmental Regulations and Volatile Raw Material Prices

• Environmental restrictions on cyanide usage and tailings management are posing significant challenges for gold mining chemical manufacturers. Compliance with international standards such as the International Cyanide Management Code requires continuous investment in safer alternatives and waste treatment solutions

• Volatility in raw material prices, including key inputs such as sodium cyanide, lime, and flotation collectors, directly impacts production costs and profitability. Supply chain disruptions can further exacerbate these fluctuations, creating operational uncertainties for mining companies

• Small-scale and artisanal miners, who form a large portion of the market in certain regions, often lack the financial and technical capacity to adopt compliant, high-performance chemicals. This limits the penetration of advanced products in developing markets

• For instance, in 2023, rising sodium cyanide prices by over 20% in Asia-Pacific forced several mid-tier miners to temporarily scale back operations, highlighting the vulnerability of the sector to cost pressures

• Addressing these challenges will require a balance between regulatory compliance, cost efficiency, and innovation in chemical formulations that meet both performance and sustainability requirements

Gold Mining Chemicals Market Scope

The market is segmented on the basis of product type, ore type, mining type, application, and end-user.

- By Product Type

On the basis of product type, the gold mining chemicals market is segmented into flotation reagents, solvent extractants, grinding aids, and cyanide-based chemicals. The flotation reagents segment dominated the market with the largest market revenue share in 2024, driven by their crucial role in enhancing gold recovery rates from low-grade ores. Their adaptability to varying ore compositions and compatibility with other processing chemicals has made them an essential component in modern gold extraction processes.

The cyanide-based chemicals segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by their unmatched efficiency in dissolving and separating gold from ores in both heap leaching and carbon-in-pulp processes. Although subject to environmental scrutiny, ongoing innovations in cyanide management and detoxification are sustaining demand in large-scale mining projects.

- By Ore Type

On the basis of ore type, the market is segmented into powder gold, iron, and copper. The powder gold segment accounted for the largest revenue share in 2024, attributed to its direct association with high-purity gold recovery and reduced processing requirements compared to complex ores. Its prevalence in both primary and secondary gold deposits further reinforces its dominance.

The copper ore segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing trend of extracting gold as a by-product from copper mining operations. Advancements in metallurgical techniques that allow simultaneous recovery of both metals are boosting the economic viability of copper-gold projects.

- By Mining Type

On the basis of mining type, the market is segmented into open-pit mining and underground mining. The open-pit mining segment led the market in 2024, owing to its cost-effectiveness, high production capacity, and ability to process large volumes of ore efficiently. The segment benefits from easier access to deposits and lower operational complexity compared to underground methods.

The underground mining segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising exploration of deeper ore bodies and the depletion of near-surface reserves. Technological advancements in underground equipment and safety measures are further enhancing its adoption in gold mining projects.

- By Application

On the basis of application, the market is segmented into heap leaching, carbon-in-pulp (CIP) process, carbon-in-leach (CIL) process, and flotation. The heap leaching segment captured the largest revenue share in 2024, supported by its suitability for low-grade ores and cost-effective large-scale operations. The method’s minimal infrastructure requirements and ability to operate in remote locations have further reinforced its market position.

The carbon-in-leach (CIL) process segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its efficiency in combining leaching and adsorption steps, which shortens processing time and improves gold recovery rates, making it attractive for high-volume mining operations.

- By End-User

On the basis of end-user, the market is segmented into large-scale mining companies, small-scale mining operations, and artisanal miners. The large-scale mining companies segment dominated the market in 2024, benefiting from substantial capital investment, advanced extraction technologies, and high-volume production capabilities that ensure consistent demand for mining chemicals.

The small-scale mining operations segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by supportive government policies, rising gold prices, and increasing access to affordable chemical solutions that improve recovery efficiency for smaller operators.

Gold Mining Chemicals Market Regional Analysis

• North America dominated the gold mining chemicals market with the largest revenue share in 2024, driven by the region’s extensive mining activities, advanced extraction technologies, and strong demand for precious metals in both industrial and investment applications

• The presence of established mining companies, coupled with significant investments in environmentally friendly mining practices, is fostering the adoption of advanced chemical solutions to improve yield and reduce environmental impact

• High regulatory standards, along with a focus on sustainable mining operations, are further accelerating the demand for specialized chemicals in the region

U.S. Gold Mining Chemicals Market Insight

The U.S. gold mining chemicals market captured the largest revenue share within North America in 2024, fueled by large-scale mining projects, robust infrastructure, and the continuous adoption of innovative mineral processing techniques. The country’s well-developed supply chain for mining chemicals, coupled with strict quality and safety standards, supports strong market growth. In addition, rising demand for high-purity gold in electronics and jewelry manufacturing is driving increased use of advanced extraction reagents and eco-friendly chemical solutions.

Europe Gold Mining Chemicals Market Insight

The Europe gold mining chemicals market is projected to expand at a steady CAGR during the forecast period, primarily driven by the region’s emphasis on sustainable mining practices and compliance with stringent environmental regulations. Demand for cyanide-free and low-toxicity chemicals is increasing, especially in countries with active gold extraction projects. The region also benefits from technological advancements in mineral processing, boosting efficiency and lowering operational costs in gold mining.

U.K. Gold Mining Chemicals Market Insight

The U.K. gold mining chemicals market is expected to witness the fastest growth rate from 2025 to 2032, supported by ongoing investments in precious metals recovery and urban mining initiatives. With a focus on sustainability and efficiency, mining operators are increasingly adopting advanced flotation reagents and eco-friendly leaching agents. The country’s robust research and development ecosystem further enhances innovation in gold extraction methods.

Germany Gold Mining Chemicals Market Insight

The Germany gold mining chemicals market is expected to witness the fastest growth rate from 2025 to 2032, driven by the nation’s strong engineering expertise and demand for high-performance processing chemicals. Germany’s mining sector is investing in advanced, low-impact chemical technologies that align with its strict environmental policies. In addition, its focus on recycling and secondary gold recovery supports the adoption of specialized reagents in material reprocessing facilities.

Asia-Pacific Gold Mining Chemicals Market Insight

The Asia-Pacific gold mining chemicals market is expected to witness the fastest growth rate from 2025 to 2032, driven by expanding mining activities in countries such as China, Australia, and Indonesia. Rapid industrialization, rising gold demand, and supportive government policies for mining projects are fueling the adoption of advanced chemicals for higher efficiency and recovery rates. Furthermore, APAC’s role as a manufacturing hub for mining reagents is enhancing availability and affordability across the region.

Japan Gold Mining Chemicals Market Insight

The Japan gold mining chemicals market is expected to witness the fastest growth rate from 2025 to 2032, due to the country’s growing focus on resource recovery and recycling. While Japan’s domestic gold mining is limited, its advanced technology sector is driving demand for high-purity gold used in electronics, which in turn supports the adoption of innovative and eco-friendly chemical extraction methods.

China Gold Mining Chemicals Market Insight

The China gold mining chemicals market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by its position as the world’s leading gold producer. The country’s large-scale mining operations, coupled with heavy investments in modern mineral processing plants, are boosting demand for flotation reagents, solvent extractants, and cyanide-based chemicals. Government initiatives to improve environmental compliance are also pushing adoption of safer, high-efficiency chemical solutions.

Gold Mining Chemicals Market Share

The Gold Mining Chemicals industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Solvay S.A. (Belgium)

- CLARIANT (Switzerland)

- Kemcore (Singapore)

- SNF Floerger (France)

- Orica Limited (Australia)

- Cheminova (Denmark)

- Nalco Water (U.S.), Dow (U.S.)

- Huntsman Corporation (U.S.)

- AkzoNobel N.V. (Netherlands)

- Ashland Global Holdings Inc. (U.S.)

- DuPont de Nemours, Inc. (U.S.)

- Cognis Corporation (Germany)

- Chevron Phillips Chemical Company (U.S.)

- AECI Limited (South Africa)

- Cytec Industries Inc. (U.S.)

- Sasol Limited (South Africa)

- ArrMaz (U.S.)

Latest Developments in Global Gold Mining Chemicals Market

- In October 2023, BASF introduced two new brands such as Luprofroth for frothers and Luproset for flotation modifiers. This expansion signifies BASF's commitment to innovation and establishing itself as a comprehensive solution provider for the mining industry. Luprofroth features a sulfidic frother portfolio with enhanced environmental, health, and safety (EHS) profiles. Luproset includes innovative technologies to improve mineral recovery and reduce reagent consumption. BASF's integrated chemical value chain and global scale operations contribute to resource efficiency. The launch addresses industry challenges, emphasizing sustainable solutions and aligning with the evolving needs of large-scale mining companies and other stakeholders

- In March 2023, Barrick Gold Corporation has entered a strategic partnership with Draslovka, a leading specialty chemicals company, to implement Draslovka's cutting-edge glycine leaching technology, GlyCatTM, across multiple mines worldwide. GlyCat offers a sustainable alternative to cyanide in gold ore processing, reducing environmental impact while potentially increasing gold recovery rates. Draslovka aims to quadruple its earnings over five years through licensing GlyCat and providing services, leveraging its industry-leading position. This partnership signals a significant shift towards sustainability in the gold mining industry, setting a new standard for best practices and offering a scalable solution to address environmental concerns and improve operational efficiency

- In May 2022, Czech multinational Draslovka through Mining and Process Solutions (MPS) acquired a cleaner extraction technology by Australia's Curtin University, which employs amino acids such as glycine for gold, copper, cobalt, and nickel extraction. Utilizing a combination of potassium permanganate and glycine, it reduces cyanide use, offering a safer and more environmentally-friendly alternative. Curtin University's researchers optimized the process, enabling efficient extraction of precious and base metals. This advancement addresses concerns over cyanide toxicity and transportation risks, potentially reshaping extraction practices in the gold mining industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gold Mining Chemicals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gold Mining Chemicals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gold Mining Chemicals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.