Global Golf Shoes Market

Market Size in USD Billion

CAGR :

%

USD

9.23 Billion

USD

11.79 Billion

2024

2032

USD

9.23 Billion

USD

11.79 Billion

2024

2032

| 2025 –2032 | |

| USD 9.23 Billion | |

| USD 11.79 Billion | |

|

|

|

|

Golf Shoes Market Size

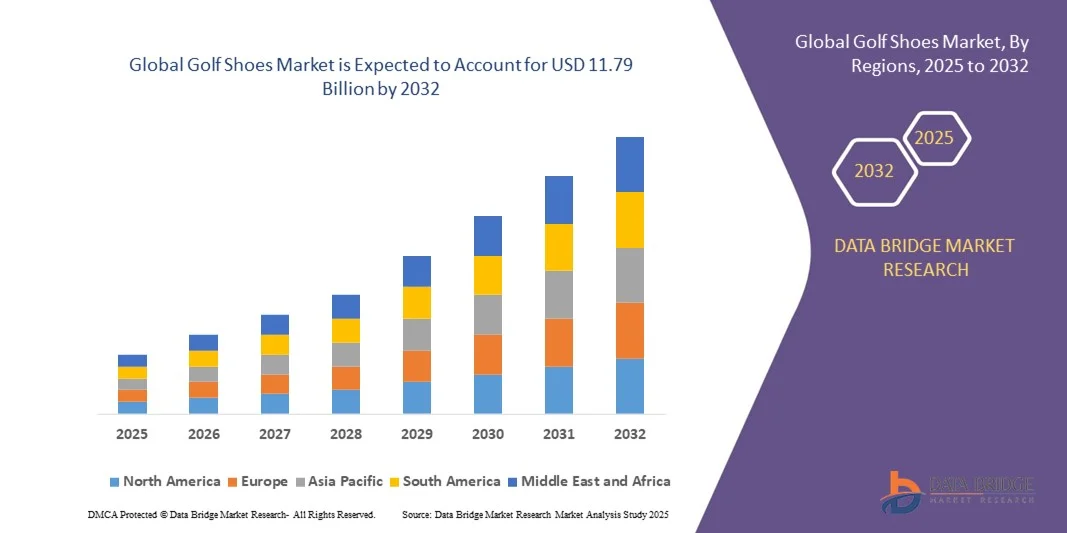

- The global golf shoes market size was valued at USD 9.23 billion in 2024 and is expected to reach USD 11.79 billion by 2032, at a CAGR of 3.10% during the forecast period

- The market growth is largely fuelled by the increasing popularity of golf worldwide, rising disposable incomes, and growing participation in professional and recreational golf activities

- In addition, technological innovations in golf shoe design, including lightweight materials, enhanced comfort, and improved traction, are driving demand among both amateur and professional golfers

Golf Shoes Market Analysis

- The global golf shoes market is experiencing steady growth due to the rising popularity of golf as both a recreational and professional sport, along with increasing disposable incomes among players

- Technological advancements in golf shoe design, such as lightweight materials, enhanced comfort, and improved traction, are driving adoption and encouraging repeat purchases

- North America dominated the golf shoes market with the largest revenue share in 2024, driven by the growing popularity of golf as a recreational and professional sport, as well as increased demand for performance-oriented and technologically advanced footwear

- Asia-Pacific region is expected to witness the highest growth rate in the global golf shoes market, driven by rapid urbanization, rising participation in golf across countries such as China, Japan, and Australia, and the increasing availability of affordable, high-performance golf shoes

- The Spiked or Cleated Golf Shoes segment held the largest market revenue share in 2024, driven by enhanced traction and stability offered during play. These shoes remain the preferred choice for professional and serious amateur golfers who prioritize performance on the course

Report Scope and Golf Shoes Market Segmentation

|

Attributes |

Golf Shoes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Golf Shoes Market Trends

Rise of Performance-Oriented and Technologically Advanced Golf Shoes

- The growing focus on performance-oriented golf shoes is transforming the market by offering players enhanced stability, comfort, and traction. Advanced designs reduce fatigue during long play sessions and help prevent injuries, improving overall performance on the course. Manufacturers are increasingly integrating cushioning, arch support, and ergonomic soles to meet diverse player needs

- Increasing demand for lightweight, breathable, and waterproof golf shoes is driving the adoption of innovative materials such as EVA foam, mesh textiles, and synthetic leathers. These materials improve foot ventilation, moisture management, and flexibility, appealing to both professional and recreational golfers seeking durability and comfort

- The popularity of spikeless and hybrid golf shoes is rising due to their versatility on and off the course. Players can wear these shoes casually without compromising traction or performance, which broadens the target audience beyond traditional golfers. Retailers are promoting these designs as multi-purpose lifestyle footwear

- For instance, in 2023, several major golf clubs in North America and Europe reported higher customer satisfaction and repeat purchases after introducing technologically advanced shoe lines. Features such as improved grip, water resistance, and anti-fatigue cushioning contributed to increased player confidence and enhanced gameplay experience

- While technological innovation and comfort are fueling growth, the market’s expansion depends on continued material advancements, design innovation, and affordability. Manufacturers must balance performance, style, and cost to capture both amateur and professional consumer segments

Golf Shoes Market Dynamics

Driver

Increasing Popularity of Golf and Rising Participation Across Age Groups

- The growing global popularity of golf as a recreational and professional sport is driving demand for specialized footwear. Increasing participation across men, women, and juniors is boosting the need for high-performance, comfortable, and durable golf shoes. Sports organizations are investing in awareness campaigns to attract new players

- Golfers are becoming increasingly aware of the importance of proper footwear for stability, comfort, and injury prevention, prompting frequent purchases of premium and technologically advanced shoes. Retailers are responding by offering personalized fittings and custom designs to cater to diverse foot anatomies and playing styles

- Sports clubs, academies, and professional tournaments actively promote branded and technologically advanced shoes, further stimulating market growth. Sponsorships, endorsements, and equipment partnerships are helping manufacturers showcase the performance benefits of advanced golf footwear

- For instance, in 2022, several European golf associations reported a surge in membership and tournament participation, which coincided with higher adoption of premium golf shoes. This trend highlights the link between organized sports growth and increased consumer willingness to invest in performance footwear

- While rising interest and awareness are driving the market, affordable high-performance shoes and greater distribution in emerging markets are still needed. Companies that focus on localized marketing and cost-effective product lines are likely to achieve long-term adoption and revenue growth

Restraint/Challenge

High Cost Of Premium Golf Shoes And Limited Accessibility In Emerging Market

- Premium and technologically advanced golf shoes are often priced high, limiting adoption among amateur players and in cost-sensitive regions. High costs prevent many new or casual golfers from purchasing performance footwear, constraining overall market penetration

- In many emerging markets, limited retail availability and lack of access to branded footwear restrict consumer choice. Players often rely on generic or low-cost alternatives, which lack performance features and durability, reducing brand loyalty and repeat purchases

- Market penetration is affected by the seasonal nature of golf and fluctuating demand in regions with shorter playing seasons. Sales volumes often dip in off-seasons, making inventory management and revenue predictability challenging for manufacturers and retailers

- For instance, in 2023, several golf retailers in South Asia reported that over 60% of potential consumers preferred lower-cost alternatives due to budget constraints and limited local availability. This highlights the need for affordable product lines and wider distribution networks

- While product innovation continues, addressing pricing and accessibility challenges is essential. Companies must explore scalable, cost-effective, and regionally tailored solutions, such as modular shoe designs and entry-level performance lines, to expand global reach and unlock long-term market potential

Golf Shoes Market Scope

The global golf shoes market is segmented on the basis of product type, price, demographics, application, and distribution channel.

- By Product Type

On the basis of product type, the golf shoes market is segmented into Spiked or Cleated Golf Shoes, Spikeless Golf Shoes, Golf Boots, and Golf Sandals. The Spiked or Cleated Golf Shoes segment held the largest market revenue share in 2024, driven by enhanced traction and stability offered during play. These shoes remain the preferred choice for professional and serious amateur golfers who prioritize performance on the course.

The Spikeless Golf Shoes segment is expected to witness the fastest growth rate from 2025 to 2032, driven by their versatility, comfort, and suitability for both on- and off-course use. Spikeless shoes are particularly popular among recreational golfers and casual users due to ease of wear and lightweight design, making them an increasingly preferred choice.

- By Price

On the basis of price, the market is segmented into Economy, Mid, Premium, and Super-Premium. The Premium segment held the largest revenue share in 2024, driven by advanced materials, ergonomic design, and superior performance features. Golfers are increasingly willing to invest in high-quality shoes that enhance comfort, stability, and durability during play.

The Super-Premium segment is expected to witness the fastest growth from 2025 to 2032, driven by luxury designs, branded collaborations, and technologically advanced features. These shoes cater to elite players and enthusiasts who prioritize performance, style, and exclusivity.

- By Demographics

On the basis of demographics, the market is segmented into Women, Men, and Kids. Men’s golf shoes held the largest share in 2024, driven by higher participation rates in professional and recreational golf. Men’s shoes are available in diverse styles and performance features to suit competitive and leisure players.

The Women’s segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing female participation and targeted designs for comfort, fit, and aesthetics. Female golfers are seeking specialized shoes that combine style, performance, and lightweight construction.

- By Application

On the basis of application, the market is segmented into Personal Use, Club, Business, Race, and Golf Course. Personal use dominated in 2024, driven by recreational golfers purchasing shoes for practice, training, and leisure play. These shoes emphasize comfort, versatility, and moderate performance features.

The Golf Club segment is expected to witness the fastest growth from 2025 to 2032, driven by membership programs, tournaments, and professional training academies. Clubs are increasingly providing specialized footwear for members and events to improve performance and player satisfaction.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Modern Trade, Departmental Stores, Specialty Stores, Online Retail, Sport Stores, and Others. Modern Trade dominated in 2024 due to accessibility, wide product range, and in-store purchase convenience. Retailers provide options for fitting, style selection, and performance testing.

The Online Retail segment is expected to witness the fastest growth from 2025 to 2032, driven by convenience, e-commerce penetration, and availability of multiple brands and models. Online channels offer competitive pricing, reviews, and doorstep delivery, appealing to tech-savvy and global consumers.

Golf Shoes Market Regional Analysis

- North America dominated the golf shoes market with the largest revenue share in 2024, driven by the growing popularity of golf as a recreational and professional sport, as well as increased demand for performance-oriented and technologically advanced footwear

- Consumers in the region highly value the comfort, stability, traction, and innovative features offered by modern golf shoes, which enhance performance on the course

- This widespread adoption is further supported by rising disposable incomes, a large base of recreational and professional golfers, and well-developed sports infrastructure, establishing golf shoes as an essential component of the game across both casual and competitive players

U.S. Golf Shoes Market Insight

The U.S. golf shoes market captured the largest revenue share within North America in 2024, fueled by increasing participation in golf tournaments, academies, and club memberships. Consumers are prioritizing footwear that combines stability, comfort, and advanced material technology for long play sessions. The growing preference for premium and performance-oriented shoes, along with the influence of professional endorsements and online retail availability, further drives market growth.

Europe Golf Shoes Market Insight

The Europe golf shoes market is expected to witness the fastest growth from 2025 to 2032, primarily driven by increasing interest in golf across urban and suburban regions, and a rising focus on fitness and recreational sports. Advanced designs, lightweight materials, and specialized features are encouraging adoption among both amateur and professional golfers. The region is witnessing significant growth across personal use, club, and competitive applications, with modern and technologically advanced shoes being preferred in both new and renovated club facilities.

U.K. Golf Shoes Market Insight

The U.K. golf shoes market is expected to witness the fastest growth from 2025 to 2032, driven by a surge in golf club memberships and the rising trend of recreational and professional golf participation. In addition, concerns about injury prevention and the desire for performance enhancement are encouraging players to invest in high-quality footwear. The U.K.’s robust e-commerce infrastructure and active sports community continue to support market expansion.

Germany Golf Shoes Market Insight

The Germany golf shoes market is expected to witness the fastest growth from 2025 to 2032, fueled by growing awareness of the benefits of performance-oriented and technologically advanced footwear. Germany’s well-developed sports facilities and focus on innovation and quality promote the adoption of high-performance shoes, particularly for professional, club, and tournament play. Enhanced materials, ergonomic designs, and eco-conscious manufacturing are becoming increasingly popular among German golfers.

Asia-Pacific Golf Shoes Market Insight

The Asia-Pacific golf shoes market is expected to witness the fastest growth from 2025 to 2032, driven by rising urbanization, increasing disposable incomes, and growing interest in golf in countries such as China, Japan, and India. The region’s expanding base of recreational and professional golfers, along with government and private initiatives promoting sports, is fueling demand for performance-oriented footwear. In addition, APAC’s emergence as a manufacturing hub for golf shoes is making technologically advanced and affordable options increasingly accessible to a wider consumer base.

Japan Golf Shoes Market Insight

The Japan golf shoes market is expected to witness the fastest growth from 2025 to 2032 due to high awareness of sports technology, a strong golf culture, and increasing participation among all age groups. Japanese golfers prefer shoes that combine performance, comfort, and style for long practice sessions and competitive play. The integration of lightweight materials and ergonomic designs is further encouraging adoption in both residential and club settings, while an aging population is increasing demand for supportive and easy-to-wear footwear.

China Golf Shoes Market Insight

The China golf shoes market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, rising disposable incomes, and the growing popularity of golf as a leisure and professional sport. Golf shoes are increasingly adopted for club, personal, and competitive use. The expansion of golf courses, rising participation in tournaments, and availability of both premium and affordable footwear options are key factors propelling market growth.

Golf Shoes Market Share

The Golf Shoes industry is primarily led by well-established companies, including:

- Callaway Golf Company (U.S.)

- Nike, Inc. (U.S.)

- HONMA GOLF CO., LTD. (Japan)

- adidas America Inc. (U.S.)

- YONEX Co., Ltd. (Japan)

- DUCA DEL COSMA (Italy)

- ASICS Oceania Pty Ltd (Australia)

- New Balance (U.S.)

- SKECHERS USA, Inc. (U.S.)

- PUMA SE (Germany)

- Under Armour, Inc. (U.S.)

- Peter Millar (U.S.)

- ECCO (Denmark)

- Golf Galaxy (U.S.)

- Etonic Golf (U.S.)

- Oregon Mudders (U.S.)

- TRUE linkswear (U.S.)

- Cleveland Golf Company, Inc. (U.S.)

- Amer Sports (Finland)

- Wilson Sporting Goods (U.S.)

Latest Developments in Global Golf Shoes Market

- In June 2024, Nike launched special edition golf shoes for major tournaments, including the Masters and PGA Championship. The releases included the Nike Air Zoom Victory Tour 3 NRG, Nike Air Zoom Infinity Tour Next% 2, and Nike Air Pegasus 89 G NRG golf shoes, each featuring unique designs tailored for professional performance. These launches aim to enhance player stability, comfort, and traction during competitive play, while boosting brand visibility and driving demand among golf enthusiasts globally

- In April 2024, FootJoy unveiled a new television advertisement titled "Joy Ride" featuring PGA Tour star Max Homa showcasing the brand’s innovative Pro/SLX and Pro/SLX Carbon golf shoes. Designed with high-quality ChromoSkin leather, these models provide superior comfort, durability, and performance on the course. The campaign highlights product innovation and style, strengthening FootJoy’s market presence and encouraging adoption among both professional and recreational golfers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.