Global Golf Trolley Market

Market Size in USD Billion

CAGR :

%

USD

18.99 Billion

USD

29.14 Billion

2025

2033

USD

18.99 Billion

USD

29.14 Billion

2025

2033

| 2026 –2033 | |

| USD 18.99 Billion | |

| USD 29.14 Billion | |

|

|

|

|

Golf Trolley Market Size

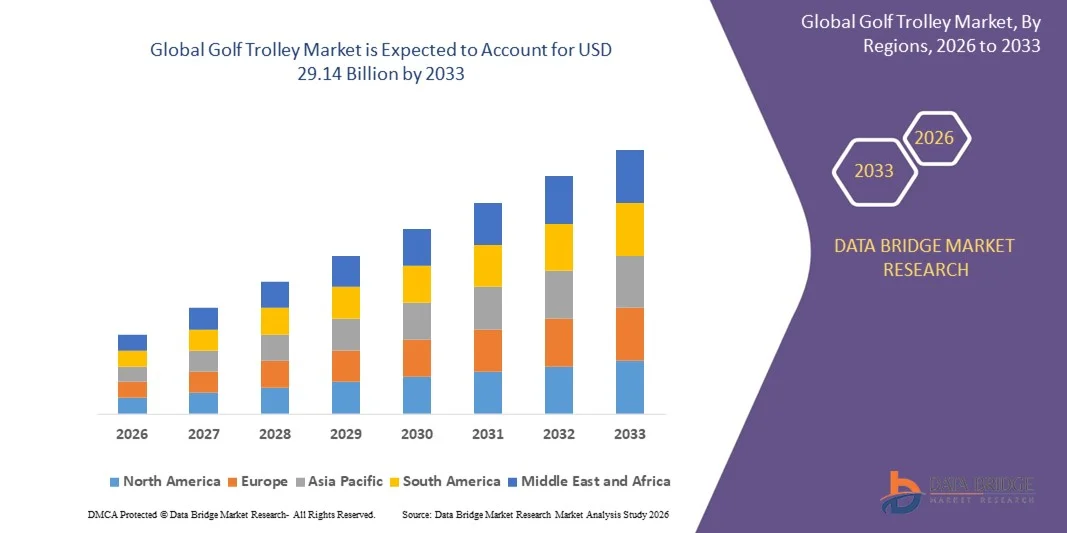

- The global golf trolley market size was valued at USD 18.99 billion in 2025 and is expected to reach USD 29.14 billion by 2033, at a CAGR of 5.5% during the forecast period

- The market growth is largely fueled by the rising popularity of golf as a recreational sport, increasing golf course development, and the growing adoption of electric and manual golf trolleys for convenience and reduced physical effort on the course

- Furthermore, increasing consumer preference for technologically advanced, ergonomic, and battery-efficient trolleys is establishing electric golf trolleys as the preferred choice among both recreational and professional golfers. These converging factors are accelerating the adoption of innovative golf trolleys, thereby significantly driving the overall market growth

Golf Trolley Market Analysis

- Golf trolleys, offering convenient transportation of golf bags and equipment across courses, are becoming essential for enhancing player comfort, reducing physical strain, and improving overall on-course experience in both commercial and recreational settings

- The escalating demand for golf trolleys is primarily fueled by the increasing number of golf enthusiasts, rising investments in golf infrastructure, and the growing adoption of electric trolleys with advanced features such as remote control, AI navigation, and terrain responsiveness

- North America dominated golf trolley market with a share of 54% in 2025, due to increasing participation in golf, rising popularity of golf tourism, and growing investments in golf courses and resorts

- Asia-Pacific is expected to be the fastest growing region in the golf trolley market during the forecast period due to rising disposable incomes, increasing golf course development, and growing interest in recreational sports in countries such as China, Japan, and India

- Electric segment dominated the market with a market share of 69.9% in 2025, due to its convenience, reduced physical effort, and enhanced performance on varied terrains. Golfers increasingly prefer electric trolleys as they allow easy transportation of golf bags and equipment without fatigue, improving the overall playing experience. The segment’s popularity is also supported by technological features such as remote control operation, automated navigation, and integrated battery management systems

Report Scope and Golf Trolley Market Segmentation

|

Attributes |

Golf Trolley Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Golf Trolley Market Trends

Rising Adoption of Electric and Smart Golf Trolleys

- A notable trend in the golf trolley market is the increasing adoption of electric and smart trolleys, driven by the rising preference for automated and effortless mobility solutions among golfers. These trolleys enhance the overall playing experience by reducing physical exertion and offering advanced features such as GPS integration, speed control, and automated navigation

- For instance, Motocaddy and Stewart Golf offer a range of electric and smart golf trolleys equipped with GPS-enabled displays and Bluetooth connectivity, enabling users to track performance and navigate courses efficiently. Such offerings are strengthening consumer interest and driving wider adoption of technologically enhanced golf mobility solutions

- The integration of lithium-ion batteries is enabling lighter, longer-lasting trolleys that can cover entire golf courses on a single charge, which is enhancing convenience for players and encouraging consistent usage. This trend is positioning electric trolleys as the preferred choice over traditional push or pull trolleys

- Golf courses are increasingly supporting the use of smart trolleys by providing infrastructure such as charging stations and dedicated trolley lanes. This development is facilitating the broader adoption of advanced trolleys and shaping course design considerations for modern golf facilities

- Retailers and e-commerce platforms are expanding their offerings of electric and smart golf trolleys, providing buyers with detailed product comparisons, reviews, and customizable options. This is boosting market accessibility and creating greater consumer engagement in selecting technologically advanced trolleys

- The market is witnessing rising collaborations between golf equipment manufacturers and technology companies to integrate innovative features such as automated ball tracking and smartphone app connectivity. These partnerships are accelerating product development and reinforcing the transition toward smarter, more connected golf experiences

Golf Trolley Market Dynamics

Driver

Growing Golf Participation and Course Development

- The increasing global participation in golf, combined with the expansion of golf courses, is driving demand for golf trolleys that enhance convenience and user experience. This growth is creating opportunities for manufacturers to offer electric and smart trolleys that cater to both recreational and professional players

- For instance, the R&A and the PGA of America report a rising number of registered golfers and new course developments, which has led companies such as PowaKaddy to expand their electric trolley portfolio. Such trends are increasing sales potential and stimulating investment in innovative trolley designs

- Golf tourism and leisure-oriented golf resorts are adopting premium trolleys to enhance guest experiences, which is further contributing to market growth. These establishments prioritize advanced trolley features that improve mobility and reduce physical strain during gameplay

- The rising inclination toward health-conscious and active lifestyles is encouraging casual players to use electric trolleys, providing a balance between exercise and convenience. This is supporting demand across diverse demographic segments and course types

- Technological advancements and product diversification are enabling manufacturers to address a wider range of player preferences, supporting market expansion. This driver continues to sustain growth by aligning product features with evolving consumer expectations

Restraint/Challenge

High Cost of Premium and Technologically Advanced Trolleys

- The golf trolley market faces constraints due to the high pricing of premium and technologically advanced models, which limits accessibility for casual and budget-conscious players. Advanced features, superior battery systems, and smart integrations contribute significantly to higher retail prices

- For instance, Motocaddy’s latest electric GPS trolley models are priced significantly higher than standard push trolleys, which may deter first-time buyers. Such pricing pressures affect adoption rates in emerging markets and restrict the potential consumer base

- Manufacturing smart trolleys involves sourcing advanced electronics and high-capacity batteries, which elevates production costs and affects pricing strategies. These complexities make it challenging for manufacturers to balance innovation with affordability

- The high cost of maintenance and replacement parts for electric trolleys further impacts long-term ownership expenses. Consumers may be discouraged by ongoing investment requirements, limiting repeat purchases and upgrades

- Price sensitivity across various regions continues to constrain growth despite rising demand for advanced features. Manufacturers must strategize to offer cost-effective models or financing options to mitigate this challenge and sustain market expansion

Golf Trolley Market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the golf trolley market is segmented into manual and electric trolleys. The electric golf trolley segment dominated the market with the largest market revenue share of 69.9% in 2025, driven by its convenience, reduced physical effort, and enhanced performance on varied terrains. Golfers increasingly prefer electric trolleys as they allow easy transportation of golf bags and equipment without fatigue, improving the overall playing experience. The segment’s popularity is also supported by technological features such as remote control operation, automated navigation, and integrated battery management systems. In addition, electric trolleys are compatible with both amateur and professional golf settings, making them a preferred choice in clubs and resorts. The ease of maintenance, availability of lightweight models, and growing interest in premium golf accessories further strengthen the dominance of electric trolleys in the market.

The manual golf trolley segment is anticipated to witness the fastest growth rate of 14.8% from 2026 to 2033, fueled by its affordability and simplicity. For instance, brands such as Clicgear continue to attract price-sensitive and casual golfers who prefer compact, foldable, and easy-to-carry trolleys. Manual trolleys require no battery or charging infrastructure, making them ideal for non-powered golf courses and regions with limited access to electricity. The rising trend of outdoor fitness and walking-based golfing experiences also contributes to the segment’s growth, as players seek to combine exercise with sport. Lightweight and ergonomically designed models are further enhancing the appeal of manual trolleys. The segment benefits from growing awareness about sustainability and low-maintenance equipment among golf enthusiasts, driving its steady adoption in both commercial and recreational settings.

- By Application

On the basis of application, the golf trolley market is segmented into commercial and non-commercial applications. The commercial application segment dominated the market with the largest market revenue share in 2025, driven by extensive adoption in golf clubs, resorts, and sports facilities. Commercial operators often prefer advanced electric trolleys for their durability, ease of fleet management, and enhanced golfer satisfaction. These trolleys are integrated with GPS and smart tracking systems, allowing clubs to optimize usage and maintenance schedules. For instance, Topgolf and large golf resorts utilize electric trolleys to provide premium experiences to members and visitors. The ability to handle high-frequency usage and rough terrains makes electric trolleys indispensable in commercial settings. Rising tourism and increased investments in golf infrastructure further reinforce the dominance of commercial applications in the market.

The non-commercial application segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing popularity of recreational and home golf setups. For instance, casual golfers and hobbyists often prefer compact manual trolleys that are easy to transport and store. Growth is supported by the rising number of private golf courses, residential golfing communities, and the trend of personal wellness activities incorporating golfing. Lightweight and foldable trolleys appeal to non-commercial users seeking convenience and affordability. The segment is further boosted by growing awareness of walking-based golfing experiences that combine fitness with sport. Increasing online availability of affordable trolleys and accessories also contributes to the steady adoption of non-commercial golf trolleys.

Golf Trolley Market Regional Analysis

- North America dominated the golf trolley market with the largest revenue share of 54% in 2025, driven by increasing participation in golf, rising popularity of golf tourism, and growing investments in golf courses and resorts

- Consumers in the region value convenience, ease of use, and advanced features offered by electric golf trolleys, enhancing the overall golfing experience

- This widespread adoption is further supported by high disposable incomes, technologically inclined golfers, and the growing preference for battery-powered, low-effort equipment, establishing electric golf trolleys as a favored solution for both commercial and recreational users

U.S. Golf Trolley Market Insight

The U.S. golf trolley market captured the largest revenue share in 2025 within North America, fueled by rising golf club memberships, growing recreational interest, and strong demand for lightweight, foldable, and battery-efficient electric trolleys. Consumers are increasingly prioritizing convenience and reduced physical effort during play, and the availability of technologically advanced models from leading brands further propels the market. Moreover, the growing trend of golf tourism and the adoption of premium and mid-range trolleys are significantly contributing to the market’s expansion.

Europe Golf Trolley Market Insight

The Europe golf trolley market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing golf participation, urbanization, and the demand for technologically advanced and ergonomic equipment. Golfers in the region are attracted to electric trolleys for their battery efficiency, ease of use, and convenience on large or hilly courses. The increase in golf tourism, residential clubs, and commercial courses is fostering adoption, and trolleys are increasingly being incorporated into both new developments and renovation projects.

U.K. Golf Trolley Market Insight

The U.K. golf trolley market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising trend of recreational golf and the desire for ease of use and convenience. Concerns regarding physical effort and accessibility are encouraging golfers to choose electric trolleys, while robust e-commerce and retail infrastructure in the country is further stimulating adoption.

Germany Golf Trolley Market Insight

The Germany golf trolley market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of ergonomic designs, durability, and battery-powered solutions. Golf clubs and resorts prefer low-maintenance, technologically advanced trolleys for an enhanced user experience. Integration with tracking devices and the focus on premium quality models align with local consumer expectations and drive market growth.

Asia-Pacific Golf Trolley Market Insight

The Asia-Pacific golf trolley market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising disposable incomes, increasing golf course development, and growing interest in recreational sports in countries such as China, Japan, and India. The region’s emerging golf culture, supported by government and private investments in sports infrastructure, is driving adoption of both manual and electric trolleys.

Japan Golf Trolley Market Insight

The Japan golf trolley market is gaining momentum due to the country’s high-tech culture, aging population, and focus on convenience. Electric trolleys are preferred for ease of use, reduced physical effort, and integration with smart features, enhancing the golfing experience for all age groups. The adoption of lightweight, battery-efficient models and integration with course navigation systems are fueling growth in both recreational and commercial sectors.

China Golf Trolley Market Insight

The China golf trolley market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, increasing golf participation, and rising disposable incomes. Electric trolleys are becoming increasingly popular in golf clubs, resorts, and private courses due to convenience, battery efficiency, and ergonomic design. Government and private investments in sports infrastructure, coupled with domestic manufacturers providing affordable and technologically advanced models, are key factors propelling market growth.

Golf Trolley Market Share

The golf trolley industry is primarily led by well-established companies, including:

- A.T. CADDY (U.S.)

- Motocaddy (U.K.)

- GOLF TECH GOLFARTIKELVERTRIEBS GMBH (Germany)

- Adept Golf (U.S.)

- THE PROACTIVE SPORTS GROUP (U.S.)

- Sun Mountain Sports (U.S.)

- SPITZER Products Corp (U.S.)

- Cart Tek Golf Carts (U.S.)

- Axglo Inc. (U.S.)

- The Bag Boy Company (U.S.)

- Motocaddy (U.K.)

Latest Developments in Global Golf Trolley Market

- In November 2024, Stewart Golf launched its new V10 Remote electric golf trolley, featuring an advanced Active Terrain Control system that automatically adjusts speed and power based on ground conditions, enhancing performance and user control on diverse terrains. This development highlights the market’s shift toward smart, adaptive trolley technologies that improve golfer experience and broaden appeal across both individual and commercial users, strengthening Stewart Golf’s position as an innovator in high‑tech electric trolleys

- In October 2024, Futurewave, in collaboration with Botronics, introduced the iXi, an AI‑enabled self‑driving golf trolley designed to autonomously follow players while providing real‑time performance analysis. This milestone reflects the market’s movement toward artificial intelligence and autonomy, offering golfers hands‑free convenience and gameplay insights, and positioning golf trolleys as intelligent assistants rather than simple equipment carriers

- In August 2024, MGI launched its latest series of electric golf trolleys, emphasizing enhanced style, ergonomics, and functionality to improve player comfort and on‑course performance. This initiative demonstrates the market trend of product diversification, where manufacturers introduce user-centric improvements to attract both tech‑savvy golfers and traditional players seeking convenience and reliability

- In December 2023, GT Goldf Supplies acquired The ProActive Sports to expand its dominance as the largest golf accessories distributor in the U.S. This strategic acquisition strengthens GT Goldf’s distribution network and market reach, allowing faster access to both commercial and recreational golfers and enhancing its competitive positioning in the U.S. golf trolley and accessories market

- In December 2022, Saera Electric Auto introduced an exclusive electric golf cart in India featuring bucket seats, a monocoque frame, cabin lights, and a zero-maintenance AC drive. This launch highlights the growing adoption of premium, technologically advanced golf vehicles in emerging markets, improving comfort, convenience, and overall user experience while expanding market demand for electric golf solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.