Global Government Cyber Warfare Market

Market Size in USD Billion

CAGR :

%

USD

38.52 Billion

USD

138.07 Billion

2025

2033

USD

38.52 Billion

USD

138.07 Billion

2025

2033

| 2026 –2033 | |

| USD 38.52 Billion | |

| USD 138.07 Billion | |

|

|

|

|

What is the Global Government Cyber Warfare Market Size and Growth Rate?

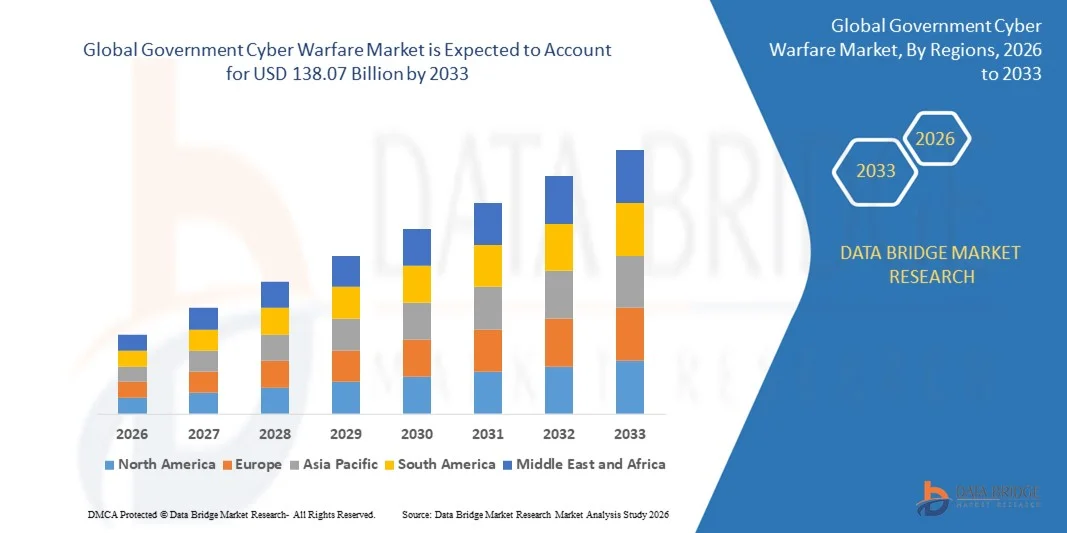

- The global Government Cyber Warfare market size was valued at USD 38.52 billion in 2025 and is expected to reach USD 138.07 billion by 2033, at a CAGR of17.30% during the forecast period

- Increasing penetration of cloud-based security solutions, growing government and compliance regulations, surging levels of investment in the defence sector across the globe along with rising concern regarding national security, rising adoption of e-commerce platform and advent of disruptive technologies are some of the major as well as vital factors which will such asly to augment the growth of the government cyber warfare market

What are the Major Takeaways of Government Cyber Warfare Market?

- Increasing adoption of cloud based services in IT securities along with integration of technologies such as internet of things, machine learning and big data in threat and security technique upgradation which will further contribute by generating massive opportunities that will lead to the growth of the government cyber warfare market in the above mentioned projected timeframe

- Lack of skilled workforce to tackle emerging threats along with lack of shared real-time information on constantly evolving threats which will likely to act as market restraints factor for the growth of the government cyber warfare in the above mentioned projected timeframe. High cost of innovations and budget constraint which will become the biggest and foremost challenge for the growth of the market

- North America dominated the government cyber warfare market with a 43.69% revenue share in 2025, driven by strong national cybersecurity initiatives, high defense budgets, and rising deployment of advanced cyber defense systems across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.69% from 2026 to 2033, driven by escalating geopolitical tensions, rising cyber espionage incidents, and rapid digital transformation across China, Japan, India, Singapore, and South Korea

- The Power Grids segment dominated the market with a 32.4% revenue share in 2025, driven by rising cyberattacks targeting national electricity networks, smart grid infrastructures, and distributed energy systems

Report Scope and Government Cyber Warfare Market Segmentation

|

Attributes |

Government Cyber Warfare Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Government Cyber Warfare Market?

Growing Adoption of AI-Driven, Automated, and Intelligence-Integrated Cyber Defense Systems

- The government cyber warfare market is witnessing rapid adoption of AI-driven, automated, and intelligence-integrated cyber defense platforms to counter advanced nation-state attacks, zero-day exploits, and evolving digital warfare strategies

- Governments are deploying systems capable of real-time threat hunting, automated incident response, behavioral analytics, and predictive threat modelling to secure national infrastructure

- Rising use of big-data analytics, threat intelligence feeds, and ML-based anomaly detection is strengthening proactive defense capabilities across military and intelligence networks

- For instance, Microsoft, IBM, Cisco, Lockheed Martin, and Raytheon have expanded their AI-enabled cybersecurity platforms, integrating faster detection engines, advanced deception technologies, and cross-border cyber-intelligence sharing

- Growing need for military-grade cyber resilience, strategic threat anticipation, and autonomous defense operations is accelerating the adoption of intelligent cyber warfare systems

- As global cyber conflicts evolve, AI-augmented, automated, and intelligence-driven solutions are expected to remain central to national security modernization and advanced warfare preparedness

What are the Key Drivers of Government Cyber Warfare Market?

- Rising demand for national cybersecurity strengthening, driven by increasing state-sponsored attacks, cyber espionage activities, and cross-border digital warfare operations

- For instance, in 2025, Lockheed Martin, Northrop Grumman, and Microsoft enhanced their cyber defense ecosystems to support federal agencies with extended threat visibility and AI-enabled security operations

- Growing global expansion of defense digitalization, military cloud adoption, cyber command units, and intelligence-sharing alliances across the U.S., Europe, and Asia-Pacific

- Advancements in encryption systems, digital forensics, next-gen firewalls, threat intelligence platforms, and secure network architectures have strengthened national defense posture

- Rising adoption of AI, IoT, 5G military networks, satellite-linked communication, and battlefield digitalization has accelerated demand for secure cyber warfare systems

- With ongoing investments in defense modernization, cybersecurity R&D, international cyber collaborations, and sovereign security programs, the Government Cyber Warfare market is expected to continue strong upward growth

Which Factor is Challenging the Growth of the Government Cyber Warfare Market?

- High deployment costs associated with advanced cyber defense platforms, AI-enabled systems, and military-grade threat intelligence solutions limit adoption in low-budget nations

- For instance, during 2024–2025, rising cybersecurity tool pricing, talent shortages, and global supply chain issues increased operational costs for several defense organizations

- Strict national security compliance, classified network protection rules, and multi-layered integration requirements increase complexity for governments and vendors

- Limited cybersecurity workforce, low awareness of AI-based threat mitigation, and inadequate digital infrastructure in developing nations restrict widescale adoption

- Strong competition from legacy defense systems, conventional firewalls, and region-specific cybersecurity tools creates challenges in modernization and global standardization

- To overcome these challenges, governments are focusing on capacity building, cost-optimized cybersecurity procurement, skill development programs, and strategic technology partnerships to strengthen national cyber warfare readiness

How is the Government Cyber Warfare Market Segmented?

The market is segmented on the basis of product type, application, and component.

- By Application

On the basis of application, the government cyber warfare market is segmented into Transportation Systems, Banking Systems, Power Grids, Water Supplies, Dams, Hospitals, and Critical Manufacturing. The Power Grids segment dominated the market with a 32.4% revenue share in 2025, driven by rising cyberattacks targeting national electricity networks, smart grid infrastructures, and distributed energy systems. Nation-states are increasingly investing in advanced cyber defense platforms, real-time threat monitoring, and incident containment tools to safeguard critical electrical infrastructure.

The Banking Systems segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rapid digitalization, fintech expansion, high-value cybercrime threats, and increased cross-border cyber espionage. Financial institutions are deploying AI-enabled fraud detection, encrypted communication frameworks, and cyber threat intelligence systems to strengthen resilience. Growing digitization of critical sectors continues to expand the need for sophisticated cyber warfare defense capabilities across all applications.

- By Component

On the basis of component, the market is segmented into Solution and Services. The Solution segment dominated the government cyber warfare market with a 67.1% share in 2025, driven by rising national investments in AI-enabled security tools, advanced threat intelligence systems, encryption technologies, and cyber defense command platforms. Governments rely heavily on integrated cyber solutions to detect complex attacks, secure classified networks, prevent espionage, and enhance digital warfare readiness.

The Services segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing demand for managed security operations, cybersecurity consulting, forensic analysis, and system integration across defense agencies. Growing sophistication of cyber threats has strengthened reliance on continuous monitoring, compliance management, and specialized cybersecurity workforce support. As cyber warfare evolves toward intelligence-driven, real-time response ecosystems, both segments remain integral to strengthening national cybersecurity resilience.

- By Product Type

On the basis of product type, the government cyber warfare market is segmented into Cyberattacks, Espionage, and Sabotage. The Cyberattacks segment dominated the market with a 49.6% revenue share in 2025, primarily due to increasing incidents of ransomware, DDoS attacks, malware intrusions, and coordinated offensive operations targeting defense networks, military assets, and national infrastructure. Governments are enhancing cyber offense and defense capabilities to counter sophisticated adversaries employing zero-day exploits and AI-driven attack vectors.

The Espionage segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by expanding geopolitical tensions, intelligence warfare, and cross-border digital surveillance. State-sponsored actors increasingly focus on stealing classified military data, diplomatic communication, and technological IP. Rising dependence on digital intelligence systems, satellite communication, and secure military networks continues to elevate global demand for cyber warfare solutions designed to counter espionage and digital infiltration threats.

Which Region Holds the Largest Share of the Government Cyber Warfare Market?

- North America dominated the government cyber warfare market with a 43.69% revenue share in 2025, driven by strong national cybersecurity initiatives, high defense budgets, and rising deployment of advanced cyber defense systems across the U.S. and Canada. Growing cyber threats, state-sponsored attacks, and digital warfare risks have accelerated adoption of AI-enabled threat detection tools, encrypted networks, and cyber intelligence platforms across government and defense agencies

- Leading cybersecurity players in the region continue to upgrade platforms with improved threat analytics, zero-trust architectures, secure cloud frameworks, and high-performance defense-grade solutions. Increased focus on cyber resilience, critical infrastructure protection, and digital sovereignty strengthens regional dominance

- High defense spending, robust digital infrastructure, and widespread modernization of government networks continue to support long-term growth

U.S. Government Cyber Warfare Market Insight

The U.S. is the largest contributor to the North American market, supported by extensive federal investment in cyber command capabilities, intelligence systems, and mission-critical cyber defense. Increasing cyber espionage incidents, attacks on critical infrastructure, and military modernization are driving demand for advanced cyber warfare tools. Growth in cloud-native defense systems, AI-powered threat hunting, digital surveillance, and secure communication frameworks further accelerates adoption. Strong collaboration between defense agencies, cybersecurity firms, and intelligence organizations enhances national cyber preparedness.

Canada Government Cyber Warfare Market Insight

Canada contributes significantly to regional growth due to rising cyber defense funding, federal security modernization programs, and increasing focus on protecting national infrastructure. Government agencies are adopting advanced threat monitoring solutions, secure network architecture, and cyber intelligence tools to counter multi-vector attacks. Expansion of cybersecurity training, national digital resilience initiatives, and public-private partnerships strengthens overall adoption. Growing reliance on cloud systems and critical data platforms further drives investment in cyber warfare defense capabilities.

Asia-Pacific Government Cyber Warfare Market

Asia-Pacific is projected to register the fastest CAGR of 8.69% from 2026 to 2033, driven by escalating geopolitical tensions, rising cyber espionage incidents, and rapid digital transformation across China, Japan, India, Singapore, and South Korea. Governments are heavily investing in cyber defense commands, AI-driven surveillance systems, and large-scale cyber threat intelligence programs to counter advanced attacks. Expansion of critical infrastructure, fintech growth, 5G networks, and cloud ecosystems significantly accelerates regional cybersecurity spending. The region’s growing emphasis on national security and digital sovereignty positions it as the fastest-growing market globally.

China Government Cyber Warfare Market Insight

China is the largest contributor to Asia-Pacific, supported by rapid expansion of cyber defense capabilities, AI-enabled surveillance systems, and state-driven digital security initiatives. Rising deployment of national cyber command centres, offensive cyber units, and intelligence platforms strengthens market demand. Massive investments in domestic cybersecurity technologies and large-scale digital infrastructure projects further boost adoption.

Japan Government Cyber Warfare Market Insight

Japan shows steady growth driven by increasing cyber threats targeting critical infrastructure, financial systems, and government institutions. Strong emphasis on secure communication, data protection, and modernization of defense IT networks supports adoption of advanced cybersecurity tools. Growth in 5G networks and cloud-based government systems enhances the need for resilient cyber warfare solutions.

India Government Cyber Warfare Market Insight

India is emerging as a high-growth market, supported by national cybersecurity missions, expansion of defense cyber units, and rising attacks on government networks. Growing digital transformation, fintech adoption, online citizen services, and cloud-based governance drives investment in cyber defense platforms. Increasing collaboration with global cybersecurity firms further accelerates adoption.

South Korea Government Cyber Warfare Market Insight

South Korea contributes significantly due to high digitalization, strong defense investments, and increasing cyberattacks linked to regional geopolitical conflicts. Advanced telecom infrastructure, widespread use of 5G, and expansion of AI-driven digital ecosystems strengthen demand for next-generation cyber defense tools. Government initiatives to secure critical sectors further support market growth.

Which are the Top Companies in Government Cyber Warfare Market?

The Government Cyber Warfare industry is primarily led by well-established companies, including:

- Airbus (Netherlands)

- BAE Systems (U.K.)

- Booz Allen Hamilton Inc. (U.S.)

- DXC Technology Company (U.S.)

- General Dynamics Mission Systems, Inc. (U.S.)

- Intel Corporation (U.S.)

- IBM Corporation (U.S.)

- Leonardo S.p.A. (Italy)

- Lockheed Martin Corporation (U.S.)

- Northrop Grumman Corporation (U.S.)

- Raytheon Company (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Boeing (U.S.)

- FireEye, Inc. (U.S.)

- Cisco (U.S.)

- Fortinet, Inc. (U.S.)

- Proofpoint, Inc. (U.S.)

- Microsoft (U.S.)

- Broadcom (U.S.)

- Forcepoint (U.S.)

- F5, Inc. (U.S.)

- Juniper Networks, Inc. (U.S.)

- McAfee, LLC (U.S.)

- Micro Focus (U.K.)

What are the Recent Developments in Global Government Cyber Warfare Market?

- In May 2023, Mosaic, an agricultural firm, partnered with U.S.-based Safe Security, a cybersecurity platform provider, to introduce a new cyber coverage model by integrating real-time cyber-risk intelligence into Mosaic’s underwriting workflow, enabling deeper internal security assessments and rewarding organizations with premium benefits for strengthening cybersecurity investments, ultimately improving risk transparency and insurer confidence

- In August 2022, SynSaber, a cybersecurity and asset-monitoring company, raised USD 13 million in a Series A funding round, supporting the continued enhancement of its industrial asset and network monitoring platform, strengthening global expansion, and accelerating sales, marketing, and product development efforts, ultimately boosting its industry presence and technological capabilities

- In February 2022, IBM invested multi-million dollars into expanding its cybersecurity footprint across the Asia-Pacific region, including the establishment of a new Security Operations Center (SOC) to enhance organizational cyber resilience and support regional customers with advanced threat management, ultimately reinforcing IBM’s leadership in cybersecurity services

- In July 2021, Leonardo, an aerospace and defense company, collaborated with Italy-based utility provider A2A to test and integrate advanced cybersecurity technologies into A2A’s plants and networks, aiming to support secure digital transformation and develop new solutions to protect critical energy infrastructures, ultimately strengthening the cybersecurity posture of essential utilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.