Global Gpon Market

Market Size in USD Billion

CAGR :

%

USD

7.73 Billion

USD

12.23 Billion

2024

2032

USD

7.73 Billion

USD

12.23 Billion

2024

2032

| 2025 –2032 | |

| USD 7.73 Billion | |

| USD 12.23 Billion | |

|

|

|

|

Gigabit Passive Optical Network (GPON) Market Size

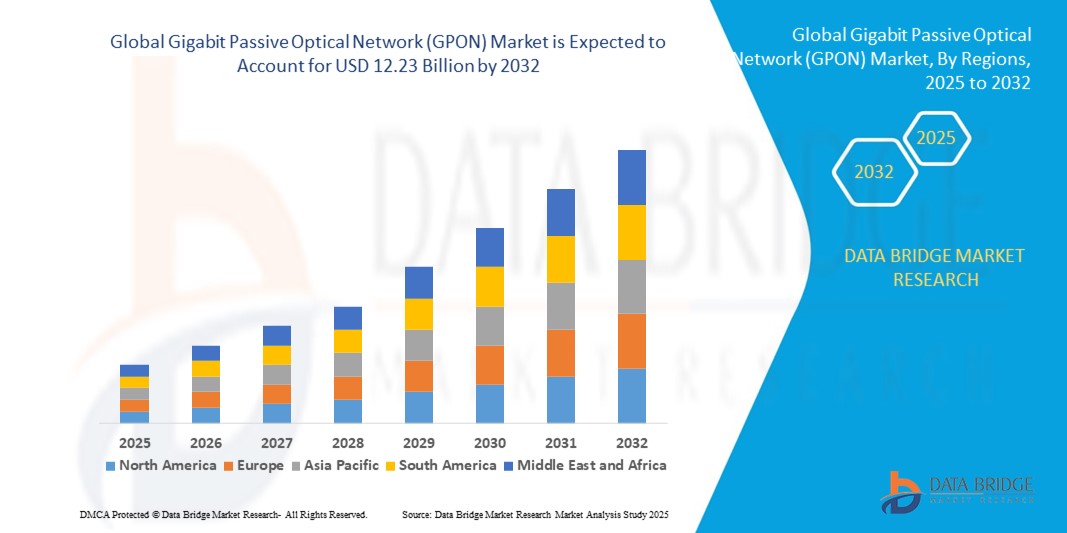

- The global gigabit passive optical network (GPON) market size was valued at USD 7.73 billion in 2024 and is expected to reach USD 12.23 billion by 2032, at a CAGR of 5.90% during the forecast period

- The market growth is primarily driven by the increasing demand for high-speed broadband connectivity, growing adoption of fiber-to-the-home (FTTH) solutions, and the rising need for efficient network infrastructure to support 5G and IoT applications

- Growing consumer and enterprise awareness regarding reliable, high-bandwidth connectivity for smart homes, businesses, and digital transformation initiatives is further propelling the demand for gigabit passive optical network solutions across both residential and commercial sectors

Gigabit Passive Optical Network (GPON) Market Analysis

- The gigabit passive optical network market is experiencing robust growth as global demand for high-speed internet and data-intensive applications continues to rise, driven by digitalization and smart city initiatives

- Increasing adoption across residential, commercial, and industrial segments is encouraging manufacturers to innovate with advanced gigabit passive optical network technologies, such as XGS-PON and NG-PON2, offering higher bandwidth and scalability

- North America dominated the gigabit passive optical network market with the largest revenue share of 31.2% in 2024, driven by a mature telecommunications industry, widespread FTTH deployments, and strong demand for high-speed internet solutions

- Asia-Pacific is expected to be the fastest-growing region in the GPON market during the forecast period, fueled by rapid urbanization, increasing internet penetration, and government initiatives for broadband expansion in countries such as China, India, and Southeast Asian nations

- The product segment dominated the largest market revenue share of 60% in 2024, driven by the widespread deployment of high-speed broadband infrastructure. Products such as OLTs and ONTs are critical for establishing reliable fiber-optic networks, particularly for Fiber to the Home (FTTH) applications

Report Scope and Gigabit Passive Optical Network (GPON) Market Segmentation

|

Attributes |

Gigabit Passive Optical Network (GPON) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Gigabit Passive Optical Network (GPON) Market Trends

Increasing Integration of AI and Big Data Analytics

- The Global Gigabit Passive Optical Network (GPON) market is experiencing a notable trend toward integrating Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced data processing and analysis, providing deeper insights into network performance, user behavior, and predictive maintenance needs

- AI-powered gigabit passive optical network solutions facilitate proactive issue resolution, identifying potential network failures or bottlenecks before they lead to service disruptions or costly downtime

- For instance, companies are developing AI-driven platforms that analyze network traffic patterns to optimize bandwidth allocation or enhance cybersecurity by detecting anomalies in real-time

- This trend is increasing the value of gigabit passive optical network systems, making them more appealing to telecom operators, enterprises, and smart city initiatives

- AI algorithms can process vast datasets, including network usage, latency, and signal quality, to improve service delivery and operational efficiency

Gigabit Passive Optical Network (GPON) Market Dynamics

Driver

Rising Demand for High-Speed Broadband and 5G Connectivity

- Growing consumer and business demand for high-speed broadband services, such as ultra-fast internet, 4K video streaming, and cloud-based applications, is a key driver for the GPON market

- Gigabit passive optical network systems enhance connectivity by providing high-bandwidth, low-latency solutions for applications such as Fiber to the Home (FTTH), Other FTTx, and Mobile Backhaul

- Government initiatives, particularly in regions such as Asia-Pacific, are promoting fiber-optic infrastructure to support digital transformation and smart city projects

- The expansion of 5G networks, which rely on gigabit passive optical network for efficient mobile backhaul, is further accelerating market growth, offering faster data transmission and enhanced network reliability

- Telecom operators are increasingly deploying factory-installed gigabit passive optical network systems to meet consumer expectations for seamless connectivity and to support emerging IoT applications

Restraint/Challenge

High Implementation Costs and Data Security Concerns

- The significant upfront costs for GPON hardware, such as Optical Line Terminals (OLTs) and Optical Network Terminals (ONTs), along with installation and integration, pose a barrier to adoption, particularly in emerging markets

- Deploying gigabit passive optical network infrastructure in existing networks can be complex and expensive, requiring specialized expertise and equipment

- Data security and privacy concerns are major challenges, as gigabit passive optical network systems collect and transmit sensitive user and network data, raising risks of breaches or misuse and necessitating compliance with stringent data protection regulations

- The fragmented regulatory landscape across countries regarding data collection, storage, and usage complicates operations for global service providers and equipment manufacturers

- These factors may deter adoption in cost-sensitive regions or areas with heightened data privacy awareness, potentially limiting market growth

Gigabit Passive Optical Network (GPON) market Scope

The market is segmented on the basis of component, technology, application, and end use.

- By Component

On the basis of component, the global gigabit passive optical network market is segmented into product and service. The product segment dominated the largest market revenue share of 60% in 2024, driven by the widespread deployment of high-speed broadband infrastructure. Products such as OLTs and ONTs are critical for establishing reliable fiber-optic networks, particularly for Fiber to the Home (FTTH) applications. Their scalability, compatibility with multiple gigabit passive optical network technologies, and ability to support high-bandwidth demands make them essential for telecom operators and ISPs expanding network coverage.

The service segment is expected to register the fastest growth rate from 2025 to 2032, fueled by the increasing complexity of GPON deployments and the demand for specialized services such as network management, troubleshooting, and maintenance. As operators transition to next-generation technologies such as XGS-PON and NG-PON2, the need for professional and managed services to ensure seamless upgrades, optimize performance, and reduce operational costs will drive significant growth in this segment.

- By Technology

On the basis of technology, the global gigabit passive optical network market is segmented into 2.5 GPON, XG-PON, XGS-PON, and NG-PON2. The 2.5 gigabit passive optical network segment held the largest revenue share of 50-55% in 2024, owing to its cost-effectiveness and widespread adoption in residential and small to medium-sized business deployments. Its ability to deliver sufficient bandwidth for most consumer applications, coupled with compatibility with existing infrastructure, has solidified its dominance in the market.

The NG-PON2 segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by its ability to deliver multi-gigabit speeds and enhanced flexibility through wavelength division multiplexing (WDM). NG-PON2’s capacity to support demanding applications such as 5G backhaul, enterprise networking, and smart city projects positions it as a future-ready solution for telecom operators aiming to meet escalating bandwidth demands.

- By Application

On the basis of application, the global gigabit passive optical network market is segmented into Fiber to the Home (FTTH), Other FTTX (Fiber to the Building, Curb, or Node), and Mobile Backhaul. The FTTH segment accounted for the largest revenue share of 46% in 2024, driven by the global surge in demand for high-speed internet in residential settings. FTTH delivers dedicated fiber-optic connections directly to homes, ensuring superior speed and reliability for data-intensive applications such as streaming, gaming, and smart home systems. Government initiatives promoting broadband access in underserved areas further bolster this segment’s growth.

The Mobile Backhaul segment is projected to grow at the fastest CAGR from 2025 to 2032, propelled by the rapid expansion of 5G networks worldwide. gigabit passive optical network high-capacity, low-latency architecture makes it ideal for supporting the data-intensive requirements of 5G infrastructure, particularly for connecting base stations to core networks. The scalability of gigabit passive optical network technologies such as XGS-PON and NG-PON2 further accelerates its adoption in this segment.

- By End Use

On the basis of end use, the global gigabit passive optical network market is segmented into Residential, Retail, IT & Telecom, BFSI, Healthcare, Government, and Others. The IT & Telecom segment held the largest revenue share in 2024, driven by the sector’s need for robust, high-speed connectivity to support data centers, cloud computing, and enterprise networking. Telecom operators and ISPs rely heavily on GPON infrastructure to deliver gigabit-speed broadband services, making this segment a cornerstone of market growth.

The Healthcare segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by the increasing adoption of digital health solutions and telemedicine. High-speed, secure gigabit passive optical network networks enable real-time data transfer for medical imaging, patient records, and telehealth applications, meeting the sector’s demand for reliable and low-latency connectivity. The push for smart hospitals and IoT-driven healthcare innovations further accelerates the adoption of gigabit passive optical network in this segment.

Gigabit Passive Optical Network (GPON) Market Regional Analysis

- North America dominated the gigabit passive optical network market with the largest revenue share of 31.2% in 2024, driven by a mature telecommunications industry, widespread FTTH deployments, and strong demand for high-speed internet solutions

- Consumers and businesses prioritize gigabit passive optical network solutions for their ability to deliver reliable, high-bandwidth services, supporting applications such as streaming, cloud computing, and IoT

- Growth is fueled by advancements in gigabit passive optical network technologies, including XGS-PON and NG-PON2, alongside widespread adoption in both residential and enterprise segments

U.S. Gigabit Passive Optical Network (GPON) Market Insight

The U.S. gigabit passive optical network (GPON) market captured the largest revenue share of 72.4% in 2024 within North America, fueled by strong demand for fiber-to-the-home (FTTH) deployments and increasing consumer awareness of high-speed broadband benefits. The trend towards smart homes and 5G network expansion further boosts market growth. Telecom operators’ investments in next-generation gigabit passive optical network (GPON) technologies, such as XGS-PON, complement both OEM and aftermarket deployments, creating a dynamic market ecosystem.

Europe Gigabit Passive Optical Network (GPON) Market Insight

The Europe gigabit passive optical network (GPON) market is expected to witness significant growth, supported by regulatory focus on high-speed broadband and digital transformation initiatives. Consumers and businesses seek gigabit passive optical network (GPON) technologies for enhanced connectivity, low latency, and support for data-intensive applications. Growth is prominent in FTTH and mobile backhaul applications, with countries such as Germany and France leading due to increasing urbanization and government-backed broadband expansion programs.

U.K. Gigabit Passive Optical Network (GPON) Market Insight

The U.K. market for gigabit passive optical network (GPON) is expected to experience rapid growth, driven by demand for high-speed internet and improved network reliability in urban and suburban areas. Rising awareness of GPON’s benefits, such as energy efficiency and scalability, encourages adoption. Evolving regulations promoting broadband accessibility and 5G infrastructure development influence consumer and operator choices, balancing performance with compliance.

Germany Gigabit Passive Optical Network (GPON) Market Insight

Germany is expected to witness rapid growth in the gigabit passive optical network (GPON) market, attributed to its advanced telecommunications sector and strong focus on digital infrastructure. German consumers and businesses prefer advanced gigabit passive optical network (GPON) technologies, such as NG-PON2, for their ability to support high-bandwidth applications and contribute to energy efficiency. Integration of gigabit passive optical network (GPON) in enterprise networks and aftermarket deployments supports sustained market expansion.

Asia-Pacific Gigabit Passive Optical Network (GPON) Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate in the global gigabit passive optical network (GPON) market, driven by rapid expansion of fiber-optic networks and rising internet penetration in countries such as China, India, and Japan. Increasing demand for high-speed broadband, fueled by urbanization and growing disposable incomes, boosts gigabit passive optical network (GPON) adoption. Government initiatives promoting digital connectivity and 5G backhaul solutions further accelerate the use of advanced GPON technologies.

Japan Gigabit Passive Optical Network (GPON) Market Insight

Japan’s gigabit passive optical network (GPON) market is expected to witness rapid growth due to strong consumer preference for high-quality, scalable gigabit passive optical network (GPON) solutions that enhance connectivity and support smart city initiatives. The presence of major telecom operators and the integration of gigabit passive optical network (GPON) in OEM deployments accelerate market penetration. Rising interest in aftermarket upgrades and 5G mobile backhaul applications also contributes to growth.

China GPON Market Insight

China holds the largest share of the Asia-Pacific gigabit passive optical network (GPON) market, propelled by rapid urbanization, increasing internet users, and strong demand for FTTH solutions. The country’s growing middle class and focus on smart mobility drive the adoption of advanced gigabit passive optical network (GPON) technologies such as XGS-PON and NG-PON2. Robust domestic manufacturing capabilities and competitive pricing enhance market accessibility, supporting widespread deployment.

Gigabit Passive Optical Network (GPON) Market Share

The gigabit passive optical network (GPON) industry is primarily led by well-established companies, including:

- Huawei (China)

- Cisco (U.S.)

- ZTE (China)

- DASAM Zhone Solutions (U.S.)

- Broadcom, Inc. (U.S.)

- Allied Telesis, Inc. (China)

- Iskratel (Slovenia)

- NXP Semiconductors N.V. (Netherlands)

- Verizon Communications, Inc.(U.S.)

- ADTRAN (U.S.)

- Ericsson (Sweden)

- NEC (Japan)

- Nokia (Finland)

- Calix (U.S.)

What are the Recent Developments in Global Gigabit Passive Optical Network (GPON) Market?

- In May 2025, the Broadband Forum hosted a major interoperability Plugfest at AT&T Labs in Plano, Texas, focused on 50G-PON and 25GS-PON technologies. This event marked the first-ever multi-vendor testing of 50G-PON and the second round for 25GS-PON, bringing together key industry players such as Nokia, Adtran, Calix, ZTE, Broadcom, and others. The Plugfest aimed to validate interoperability across diverse vendor equipment in emulated network environments, a critical step toward mass deployment of next-generation fiber networks. The initiative reflects the industry's commitment to collaboration, co-existence, and readiness for future broadband infrastructure

- In March 2025, Nokia introduced two new 25G PON fiber modems tailored for residential and mass-market broadband. These indoor modems deliver speeds up to 20 times faster than current gigabit solutions and are compatible with existing GPON and 10G PON networks. This backward compatibility allows operators to upgrade their infrastructure seamlessly and cost-effectively. With demand for multi-gigabit services rising—driven by applications such as cloud gaming, remote work, and Wi-Fi 7—Nokia’s modems offer a future-ready solution that supports scalable, high-speed connectivity for homes. The launch marks a major step in making 25G PON viable and affordable for large-scale deployment

- In October 2024, Broadcom Inc. announced the general availability of the BCM68660 and BCM55050—marking the industry's first merchant silicon 50G PON OLT-ONU devices. These cutting-edge components feature an embedded neural processing unit (NPU) to accelerate AI and machine learning at the network edge. Designed for seamless interoperability with existing GPON and 10G PON networks, they offer a cost-effective and power-efficient upgrade path. The 50G PON solution delivers up to 40x faster speeds and lower latency, enabling advanced applications such as 5G small cells, autonomous driving, and network slicing, while also enhancing security and operational efficiency through edge AI capabilities

- In October 2024, Ciena Corporation acquired TiBiT Communications Inc. for approximately USD 210 million, aiming to strengthen its fiber broadband access portfolio. TiBiT is known for its innovative pluggable Optical Line Terminal (OLT) technology, which integrates PON-specific hardware and software into a micro transceiver that can be inserted into standard Ethernet switches. This open, flexible approach enables scalable and cost-efficient GPON deployments, making it easier for service providers to modernize networks and support residential, enterprise, and mobility use cases. The acquisition positions Ciena to accelerate its time-to-market for next-gen PON solutions, including 10G XGS-PON and future 25G+ PON technologies

- In June 2024, Shenzhen Sopto Technology Co., Ltd. launched its new 1 PON Ports MINI GPON OLT, designed to meet the rising demand for modern broadband infrastructure. This compact and energy-efficient device supports up to 128 terminal connections with a 1:128 splitting ratio, and complies with ITU G.984.x and FSAN standards. It features 2 Gigabit Ethernet uplink ports and an optional XGPON/10G uplink port, making it ideal for small to medium-sized networks. With simplified installation, low power consumption, and robust performance, it offers a reliable and scalable solution for residential broadband and enterprise deployments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gpon Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gpon Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gpon Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.