Global Grain Fumigants Market

Market Size in USD Million

CAGR :

%

USD

312.15 Million

USD

482.70 Million

2024

2032

USD

312.15 Million

USD

482.70 Million

2024

2032

| 2025 –2032 | |

| USD 312.15 Million | |

| USD 482.70 Million | |

|

|

|

|

Grain Fumigants Market Size

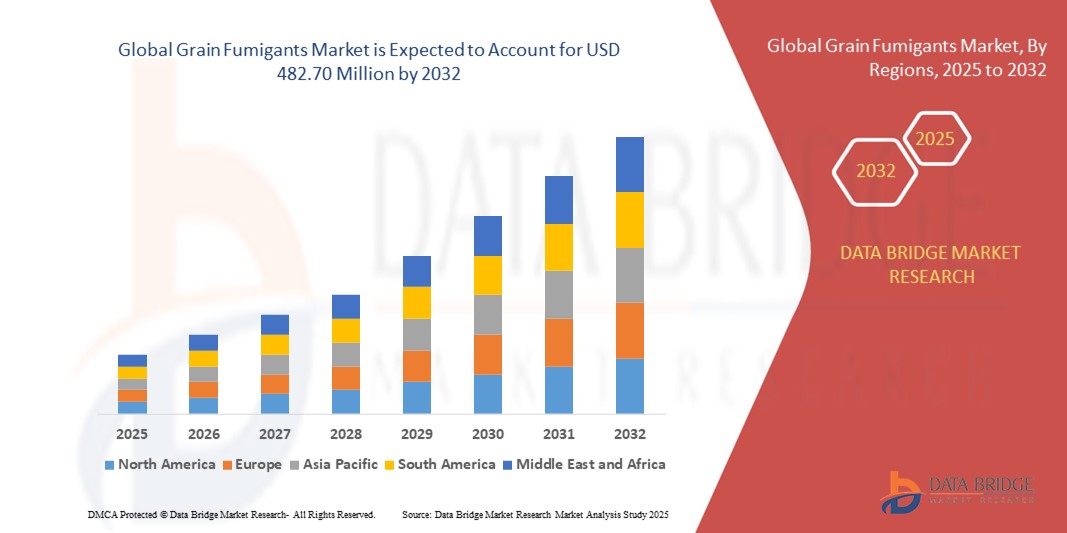

- The global grain fumigants market size was valued at USD 312.15 million in 2024 and is expected to reach USD 482.70 million by 2032, at a CAGR of 5.6% during the forecast period

- The market growth is largely fueled by the increasing demand for effective post-harvest pest management solutions and the adoption of advanced storage and fumigation technologies in both commercial and industrial settings

- Furthermore, rising awareness among farmers, storage operators, and exporters regarding post-harvest losses, grain quality preservation, and regulatory compliance is driving the uptake of grain fumigants. These converging factors are accelerating the adoption of fumigation solutions, thereby significantly boosting the market’s growth

Grain Fumigants Market Analysis

- Grain fumigants are chemical agents used to control insects, pests, and rodents in stored grains, oilseeds, pulses, and other agricultural commodities. They are available in gas, solid, and liquid forms and are applied in silos, warehouses, and storage facilities to prevent infestation and maintain quality

- The escalating demand for grain fumigants is primarily fueled by growing global grain production, increasing need for food security, stringent storage regulations, and rising adoption of modern storage infrastructure and automated fumigation methods

- North America dominated the grain fumigants market with a share of 31.7% in 2024, due to the presence of large-scale grain storage facilities, advanced agricultural practices, and stringent pest control regulations

- Asia-Pacific is expected to be the fastest growing region in the grain fumigants market during the forecast period due to increasing grain production, urbanization, and rising demand for high-quality storage solutions in countries such as China, India, and Japan

- Cereals & grains segment dominated the market with a market share of 48.5% in 2024, due to the global significance of grain storage and the need to protect staple crops from post-harvest losses. Fumigants are critical in preserving the quality and safety of cereals such as wheat, rice, and maize, which form the backbone of global food supply chains. The large-scale storage of cereals in silos and warehouses amplifies demand for reliable fumigation solutions. In addition, the integration of fumigation with monitoring systems ensures minimal wastage and optimized pest management

Report Scope and Grain Fumigants Market Segmentation

|

Attributes |

Grain Fumigants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Grain Fumigants Market Trends

Rising Adoption of Environmentally Friendly Fumigants

- Increasing regulatory pressure and consumer demand for safer agricultural practices are driving the adoption of environmentally friendly grain fumigants that offer reduced toxicity, biodegradability, and lower environmental impact during storage and transportation

- For instance, companies such as Nichino America and ADAMA are investing in research and development of bio-based fumigants and safer chemical alternatives such as phosphine replacements, aligning with sustainability goals and tightening residue limits

- Growth in organic and sustainable farming practices supports demand for grain fumigants that comply with organic certification standards and minimize chemical residues

- Expansion of integrated pest management (IPM) programs encourages the use of fumigants that work synergistically with biological control agents, reducing reliance on harmful pesticides

- Technological advancements in fumigant delivery systems and formulations improve application efficiency, safety, and residue control, facilitating wider adoption of eco-friendly options

- Increasing awareness about worker safety and community health fosters regulatory incentives and corporate initiatives favoring green fumigant technologies

Grain Fumigants Market Dynamics

Driver

Growing Demand for Effective Pest Control Solutions

- Rising grain production and storage volumes worldwide amplify the need for effective and reliable pest control solutions to prevent post-harvest losses and maintain product quality during distribution and storage

- For instance, grain storage operators and agribusinesses rely on phosphine-based fumigants and emerging bio-fumigants from providers such as BASF and FMC Corporation to manage resistant insect populations and safeguard commodity value

- Export-driven markets demand stringent pest control measures complying with international phytosanitary standards, boosting demand for robust fumigant solutions with proven efficacy

- Seasonal pest outbreaks and climate variability increase the unpredictability of pest pressures, necessitating adaptable fumigant options for diverse grain types and storage conditions

- Increasing investments in post-harvest infrastructure and grain handling facilities in emerging economies create opportunities for growth in fumigant consumption and application diversity

Restraint/Challenge

Limited Availability of Raw Materials

- Restricted access to essential raw materials and active ingredients for fumigant formulations poses significant challenges, impacting production capacity, pricing, and market availability of grain fumigants

- For instance, supply chain disruptions affecting key chemicals such as aluminum phosphide and methyl bromide derivatives limit manufacturers’ ability to meet growing market demands efficiently

- Regulatory bans or phase-outs of certain potent fumigants in major markets reduce material choices and force reformulation efforts that can delay product launches

- Dependence on limited geographic sources for specialty chemicals exposes manufacturers to geopolitical risks, trade restrictions, and export controls that constrain supply

- Increased raw material costs elevate production expenses, leading to higher end-product prices and potential market resistance, especially in price-sensitive agricultural sectors. Sourcing challenges impede innovation pace, regulatory compliance, and scalability of eco-friendly fumigant alternatives, slowing transition to sustainable grain protection solutions

Grain Fumigants Market Scope

The market is segmented on the basis of form, product type, and crop type.

- By Form

On the basis of form, the grain fumigants market is segmented into gas, solid, and liquid. The gas segment dominated the largest market revenue share in 2024, owing to its rapid penetration into stored grains and its effectiveness in eliminating a wide spectrum of pests. Gas fumigants provide uniform treatment across storage facilities, reducing the risk of infestations and ensuring the preservation of grain quality. Their ability to penetrate deep into bulk storage makes them highly preferred by large-scale storage operators. Moreover, gas fumigants are compatible with automated monitoring systems, which enhances safety and operational efficiency in storage warehouses. Regulatory approvals and established safety protocols also support the dominance of this segment in the market.

The solid segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising adoption among small-scale farmers and warehouse operators who prefer easy-to-handle formulations. Solid fumigants offer controlled release of active ingredients, minimizing direct exposure risks for operators and reducing environmental impact. Their versatility in treating various storage conditions and compatibility with integrated pest management practices make them increasingly popular in emerging markets. The cost-effectiveness and longer shelf-life of solid fumigants further contribute to their growing uptake.

- By Product Type

On the basis of product type, the grain fumigants market is segmented into sulfuryl fluoride, phosphine, methyl bromide, and others. The phosphine segment held the largest market revenue share in 2024, driven by its high efficacy against a broad range of stored grain pests and its suitability for large-scale storage applications. Phosphine fumigants are valued for their low residue properties, making them compliant with stringent food safety standards. Their ability to penetrate deeply into grains and storage facilities ensures thorough pest control, while established handling and application protocols promote widespread adoption. In addition, phosphine’s flexibility for use in both silo and warehouse storage enhances its market presence.

The sulfuryl fluoride segment is projected to register the fastest CAGR from 2025 to 2032, owing to increasing demand in industrial grain storage and export-oriented facilities. Sulfuryl fluoride is preferred for its rapid action and ability to maintain grain quality during fumigation. The growing focus on sustainable pest management practices and regulatory acceptance of sulfuryl fluoride in key markets also drive its expansion. Furthermore, advancements in fumigation technology, such as automated monitoring and controlled dosing, support the faster adoption of sulfuryl fluoride-based products.

- By Crop Type

On the basis of crop type, the grain fumigants market is segmented into oilseeds & pulses, cereals & grains, fruits & vegetables, and others. The cereals & grains segment dominated the largest market revenue share of 48.5% in 2024, reflecting the global significance of grain storage and the need to protect staple crops from post-harvest losses. Fumigants are critical in preserving the quality and safety of cereals such as wheat, rice, and maize, which form the backbone of global food supply chains. The large-scale storage of cereals in silos and warehouses amplifies demand for reliable fumigation solutions. In addition, the integration of fumigation with monitoring systems ensures minimal wastage and optimized pest management.

The oilseeds & pulses segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing cultivation and storage of high-value crops such as soybeans, lentils, and chickpeas. These crops are highly susceptible to insect infestations during storage, creating a strong need for effective fumigants. Rising awareness among farmers about post-harvest losses and the benefits of fumigation, coupled with government support programs in emerging economies, further drives the adoption. The segment’s growth is also supported by innovations in fumigation methods that minimize chemical residues while maintaining crop quality.

Grain Fumigants Market Regional Analysis

- North America dominated the grain fumigants market with the largest revenue share of 31.7% in 2024, driven by the presence of large-scale grain storage facilities, advanced agricultural practices, and stringent pest control regulations

- Consumers and storage operators in the region highly prioritize effective post-harvest pest management solutions to minimize grain losses and maintain quality

- This widespread adoption is further supported by technologically advanced fumigation methods, well-established supply chains, and high awareness regarding food safety, positioning grain fumigants as a critical solution for both commercial and industrial storage facilities

U.S. Grain Fumigants Market Insight

The U.S. grain fumigants market captured the largest revenue share in North America in 2024, fueled by large-scale cereal and pulse production and increasing investments in grain storage infrastructure. The demand for reliable, residue-compliant fumigants is rising, driven by strict USDA and FDA regulations. Integration of automated monitoring systems, combined with growing awareness about post-harvest losses and pest control best practices, is further propelling market growth. Moreover, increasing adoption of sustainable fumigation methods is encouraging operators to upgrade to advanced fumigant solutions.

Europe Grain Fumigants Market Insight

The Europe grain fumigants market is projected to expand at a substantial CAGR during the forecast period, primarily driven by strict regulatory standards for food safety and pest control. Increasing urbanization, modern storage infrastructure, and demand for high-quality grain exports are fostering the adoption of fumigants. European operators are focusing on residue-compliant and eco-friendly fumigants to meet environmental and consumer safety requirements. The market is experiencing significant growth across cereals, oilseeds, and pulses storage applications, with advanced fumigation techniques being incorporated in both new and renovated storage facilities.

U.K. Grain Fumigants Market Insight

The U.K. grain fumigants market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by stringent pest control regulations and the need to maintain crop quality during storage. In addition, concerns regarding post-harvest losses are encouraging farmers and storage operators to adopt modern fumigants. The U.K.’s advanced agricultural infrastructure, combined with increasing awareness of food safety standards, is expected to continue to stimulate market growth.

Germany Grain Fumigants Market Insight

The Germany grain fumigants market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing demand for technologically advanced and environmentally safe fumigants. Germany’s strong agricultural sector, focus on sustainability, and well-developed storage infrastructure promote the adoption of innovative fumigation solutions. Integration with automated monitoring and storage management systems is also gaining traction, with a preference for solutions that ensure both effective pest control and compliance with local regulations.

Asia-Pacific Grain Fumigants Market Insight

The Asia-Pacific grain fumigants market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing grain production, urbanization, and rising demand for high-quality storage solutions in countries such as China, India, and Japan. Government initiatives supporting post-harvest management and digitalized storage monitoring systems are accelerating adoption. As APAC emerges as a major hub for grain production and exports, the affordability and accessibility of advanced fumigants are expanding to a wider base of farmers and storage operators.

Japan Grain Fumigants Market Insight

The Japan grain fumigants market is gaining momentum due to the country’s focus on advanced agricultural practices and precision storage management. The adoption of fumigants is driven by the need to prevent post-harvest losses and maintain the quality of grains for both domestic consumption and export. Integration with modern storage systems and the emphasis on environmentally safe fumigation practices are fueling growth.

China Grain Fumigants Market Insight

The China grain fumigants market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s massive grain production, rapid urbanization, and rising awareness of post-harvest pest management. China is one of the largest markets for grain fumigants, with adoption expanding across commercial silos, warehouses, and export-oriented storage facilities. Government support, availability of cost-effective fumigants, and the push for smart storage management systems are key factors propelling the market in China.

Grain Fumigants Market Share

The grain fumigants industry is primarily led by well-established companies, including:

- UPL Limited (India)

- Solvay (Belgium)

- Corteva Agriscience (U.S.)

- BASF SE (Germany)

- Detia Degesch GmbH (Germany)

- Douglas Products (U.S.)

- ECOTEC Fumigation (Argentina)

- Noble Crop Science (India)

- Rollins, Inc. (U.S.)

- Royal Group (India)

Latest Developments in Global Grain Fumigants Market

- In April 2023, Rollins Inc. acquired Fox Pest Control Company, a firm providing residential pest management services across 13 U.S. states. This strategic acquisition strengthens Rollins’ footprint in new geographic markets and opens avenues for growth by integrating Fox’s established customer base and operational expertise. By expanding into additional U.S. locations, Rollins can leverage cross-brand synergies, enhance service offerings, and consolidate its position as a leading pest management provider across multiple regions

- In January 2022, UPL Limited entered into a partnership with Bunge, whereby Bunge acquired a 33% stake from Sinagro to advance its grain-focused strategy in Brazil. Sinagro’s deep expertise in supporting agri-producers and end-consumers in the Cerrado Savanna regions enhances UPL and Bunge’s operational capabilities. This collaboration enables both companies to strengthen their market presence in Brazil, optimize supply chains, and generate mutual profits, while positioning themselves as key players in the regional grain and post-harvest management sector

- In May 2021, Detia Degesch Group acquired Universal Fumigation Services Ltd., expanding its market presence in North America. The acquisition allowed Detia Degesch to strengthen its operations in the U.S. and Canada, increasing access to key storage and grain fumigation markets. This move reinforces the company’s leadership in fumigation solutions by combining Universal Fumigation’s regional expertise with Detia Degesch’s global capabilities, driving growth through an enhanced service portfolio and broader geographic reach

- In November 2020, MustGrow secured an exclusive patent license from the University of Idaho for the fumigation of stored vegetables and grains. This patent protection provides MustGrow with a competitive edge, enabling it to exclusively commercialize innovative fumigation solutions while preventing competitors from copying or selling similar products. The move enhances the company’s market position, strengthens intellectual property assets, and creates opportunities for premium product offerings in the grain and vegetable storage sectors

- In July 2020, Rollins Inc. acquired Adams Pest Control Pty Ltd., Australia’s largest independent pest control provider. This acquisition solidified Rollins’ presence in the Australian market and integrated Adams Pest Control into a portfolio of prominent brands, including Murray Pest Control, Scientific Pest Management, Allpest, and Statewide Pest Control. The consolidation expanded Rollins’ geographic reach, improved operational scale, and enhanced service capabilities, positioning the company as a dominant player in Australia’s residential and commercial pest management sector.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Grain Fumigants Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Grain Fumigants Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Grain Fumigants Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.