Global Grain Processing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

6.07 Billion

USD

9.45 Billion

2024

2032

USD

6.07 Billion

USD

9.45 Billion

2024

2032

| 2025 –2032 | |

| USD 6.07 Billion | |

| USD 9.45 Billion | |

|

|

|

|

Grain Processing Equipment Market Size

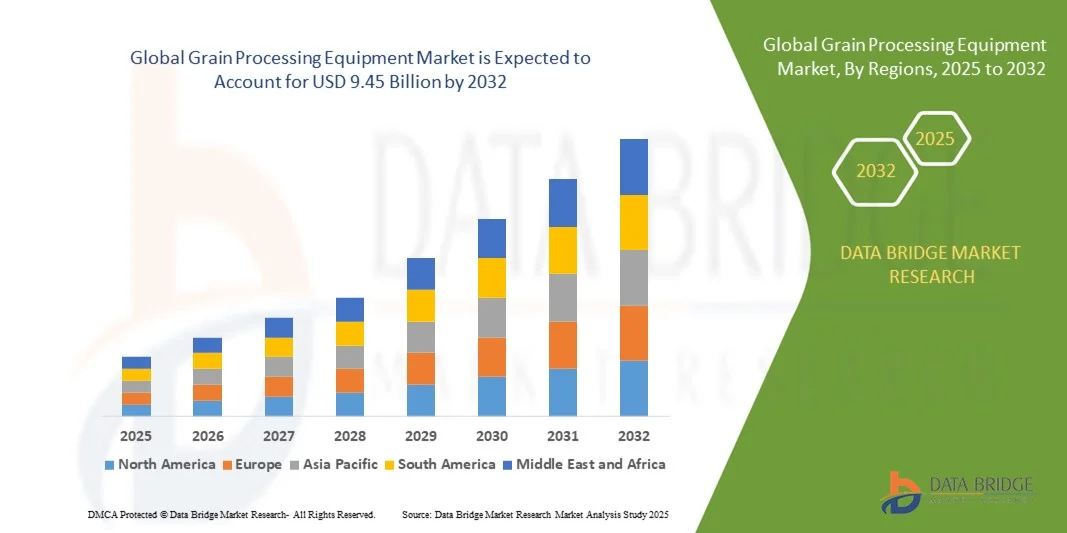

- The global grain processing equipment market size was valued at USD 6.07 billion in 2024 and is expected to reach USD 9.45 billion by 2032, at a CAGR of 5.70% during the forecast period

- The market growth is largely fuelled by the increasing demand for processed grains and cereals, rising adoption of advanced processing technologies, and growing need for food safety and quality assurance

- Rising urbanization and changing consumer lifestyles are boosting the demand for convenient, ready-to-eat, and processed grain-based products

Grain Processing Equipment Market Analysis

- The market is witnessing significant technological advancements, including automation, energy-efficient machinery, and AI-enabled monitoring systems, which enhance operational efficiency

- Increasing investments in the food and beverage industry and expansion of grain-based product lines are driving equipment demand

- North America dominated the grain processing equipment market with the largest revenue share of 38.50% in 2024, driven by increasing demand for processed grains, adoption of automation technologies, and the presence of well-established food and beverage industries

- Asia-Pacific region is expected to witness the highest growth rate in the global grain processing equipment market, driven by growing agricultural output, rising population, increasing demand for processed foods, and expanding industrial grain processing facilities

- The Cleaners segment held the largest market revenue share in 2024, driven by the critical role of cleaning in removing impurities and ensuring food safety. High demand for hygienic and quality-compliant grains in food manufacturing and milling units is fueling the adoption of advanced cleaning equipment. Cleaners equipped with automation and sensor-based monitoring systems are increasingly preferred for consistent performance and reduced labor requirements

Report Scope and Grain Processing Equipment Market Segmentation

|

Attributes |

Grain Processing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Grain Processing Equipment Market Trends

Adoption of Automation and Smart Processing Technologies

- The rising integration of automation and smart technologies is reshaping the grain processing equipment sector by enabling more precise, efficient, and consistent operations. Advanced sensors, AI-driven monitoring systems, and automated sorting and milling solutions allow processors to reduce wastage, improve quality, and enhance overall throughput. These technologies also enable real-time data collection, which supports informed decision-making and predictive analysis across production lines. Manufacturers are increasingly investing in connected systems to maintain a competitive edge and improve operational sustainability

- The demand for real-time monitoring and predictive maintenance solutions is driving the adoption of IoT-enabled equipment. These systems help operators anticipate mechanical failures, optimize energy usage, and ensure continuous production, particularly in large-scale grain processing plants. IoT integration also provides remote monitoring capabilities, reducing the need for constant on-site supervision. This enhances operational efficiency, lowers downtime, and supports proactive maintenance strategies

- Compact and modular grain processing systems are gaining traction due to their ease of installation and flexibility in small- to mid-sized operations. These solutions support scalable operations and rapid adaptation to changing production requirements without significant downtime. Their modular design allows processors to add or upgrade components as needed, reducing capital expenditure and improving adaptability to market demands. In addition, modular systems simplify cleaning, maintenance, and compliance with food safety regulations

- For instance, in 2023, several grain milling companies in Southeast Asia implemented AI-enabled sorting and cleaning equipment, resulting in reduced contamination, higher milling yields, and lower operational costs. These installations also facilitated continuous monitoring of grain quality, enabling rapid response to defects or impurities. The adoption of these solutions demonstrates the tangible benefits of integrating AI and automation in improving efficiency and profitability in grain processing

- While automation and smart systems are transforming production efficiency, successful adoption depends on investment capability, workforce training, and integration with existing plant infrastructure. Equipment manufacturers must focus on cost-effective and user-friendly solutions to fully leverage this trend. Furthermore, fostering partnerships with technology providers and offering training programs ensures seamless adoption and maximizes the return on investment for operators

Grain Processing Equipment Market Dynamics

Driver

Increasing Demand for Processed Grains and Cereal Products

- Growing consumer preference for ready-to-eat, packaged, and fortified grain-based products is driving the demand for advanced processing equipment. This trend is particularly strong in urban populations, where convenience and food safety are highly valued. Changing dietary habits, such as the rising demand for high-protein cereals and gluten-free alternatives, are also contributing to the increased need for specialized processing equipment. Manufacturers are responding by introducing customized machinery to meet evolving consumer preferences

- Food and beverage manufacturers are investing in modern machinery to improve production efficiency, reduce losses, and meet stringent regulatory standards for quality and hygiene. Advanced cleaning, sorting, and milling equipment reduces contamination risks and ensures compliance with international food safety standards. Investment in energy-efficient machinery further allows companies to optimize operational costs while meeting environmental and sustainability goals

- Expansion of the processed foods industry in emerging economies is fueling equipment demand. Rising disposable incomes and changing dietary habits are encouraging investment in scalable and automated processing solutions. Urbanization, coupled with increasing demand for packaged and fortified foods, is creating opportunities for both small-scale and large-scale processing units. Government initiatives promoting food security and industrial growth are also supporting the market expansion

- For instance, in 2022, several large cereal manufacturers in India upgraded their grain cleaning and milling lines, leading to higher product consistency and reduced processing time. These upgrades also facilitated higher throughput, reduced labor requirements, and improved overall operational efficiency. The success of these projects highlights the critical role of modern equipment in meeting growing consumer demand and ensuring competitive advantage

- While rising consumption and industrial expansion are driving market growth, equipment affordability, maintenance support, and energy efficiency remain key considerations for sustained adoption. Companies are exploring financing solutions, leasing models, and government subsidies to overcome high capital requirements. In addition, continuous training for operators ensures optimal utilization and longevity of installed equipment

Restraint/Challenge

High Capital Investment and Skilled Workforce Requirements

- The substantial cost of installing and maintaining advanced grain processing equipment is a significant barrier for small- and medium-scale processors. High upfront investment limits adoption, particularly in developing regions. Equipment procurement, installation, and integration with existing systems require significant financial resources, which can restrict market growth in price-sensitive markets. Access to affordable financing and leasing options is often necessary to overcome these challenges

- Many operators lack trained personnel capable of running sophisticated machinery and interpreting data from automated systems. This skill gap can lead to operational inefficiencies and underutilization of installed equipment. Training programs, technical support, and partnerships with equipment manufacturers are critical to developing skilled workforces. Without proper knowledge and guidance, the benefits of automation and smart technologies may not be fully realized, impacting productivity and profitability

- Supply chain and infrastructure limitations in remote areas also restrict equipment accessibility and timely maintenance. Inconsistent power supply, limited availability of spare parts, and logistical challenges can hamper production continuity. The absence of local service centers or certified technicians further exacerbates downtime issues, reducing operational efficiency and increasing operational costs for processors. Establishing localized support networks is essential to overcome these constraints

- For instance, in 2023, several small-scale flour mills in Sub-Saharan Africa reported delays in equipment installation and downtime due to unavailability of trained technicians and spare parts. These challenges directly impacted production schedules, product quality, and revenue generation. The situation underscores the need for better supply chain management, workforce development, and infrastructure investment to support sustainable market growth

- While technological advancements continue, addressing high investment costs and workforce skill gaps is crucial. Market participants must focus on affordable solutions, training programs, and localized support services to enhance equipment adoption and maximize operational efficiency. In addition, strategic collaborations with technology providers and government agencies can facilitate easier access to modern processing solutions in underserved regions

Grain Processing Equipment Market Scope

The market is segmented on the basis of process, operation, machine, and distribution channel

- By Process

On the basis of process, the grain processing equipment market is segmented into Cleaners, Dryers, Coaters, Graders, Separators, Polishers, and Others. The Cleaners segment held the largest market revenue share in 2024, driven by the critical role of cleaning in removing impurities and ensuring food safety. High demand for hygienic and quality-compliant grains in food manufacturing and milling units is fueling the adoption of advanced cleaning equipment. Cleaners equipped with automation and sensor-based monitoring systems are increasingly preferred for consistent performance and reduced labor requirements.

The Dryers segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for moisture-controlled grain storage and reduced post-harvest losses. Modern drying systems offer energy-efficient operation, precise temperature control, and compatibility with multiple grain types, making them ideal for both large-scale and small-scale processing units. Increasing awareness of grain quality preservation and extended shelf life is further boosting the adoption of dryer equipment.

- By Operation

On the basis of operation, the market is segmented into Semi-Automatic and Automatic. The Automatic segment held the largest market revenue share in 2024 due to its ability to enhance efficiency, reduce human error, and enable continuous production in large-scale milling and grain processing plants. Automatic systems are also integrated with smart monitoring solutions for real-time process optimization and predictive maintenance.

The Semi-Automatic segment is expected to witness significant growth during 2025–2032, driven by its cost-effectiveness and suitability for small- and medium-sized processing units. These systems offer a balance between manual control and automated functions, making them attractive for operators seeking reliable performance without high capital investment.

- By Machine

On the basis of machine, the market is segmented into Pre-Processing and Processing. The Processing segment held the largest market revenue share in 2024, driven by the need for consistent milling, polishing, and coating of grains to meet industry standards. Processing machines enhance product quality, reduce wastage, and support large-volume production, making them essential for commercial grain processing operations.

The Pre-Processing segment is expected to register the highest growth rate from 2025 to 2032, driven by increasing demand for efficient cleaning, grading, and sorting before the main processing stage. Pre-processing machines improve overall workflow efficiency, maintain grain quality, and reduce operational losses, particularly in regions with high agricultural output.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Online Channel and Offline Channel. The Offline Channel held the largest market revenue share in 2024, driven by established dealer networks, after-sales support, and ease of installation and servicing. Offline sales remain preferred by large processing units that require on-site demonstrations and technical assistance.

The Online Channel is expected to witness the fastest growth during 2025–2032, fueled by increasing digitalization, e-commerce adoption, and availability of product information and reviews. Online platforms also offer convenient ordering, competitive pricing, and access to a wider range of equipment, making them increasingly attractive to small and mid-sized operators.

Grain Processing Equipment Market Regional Analysis

- North America dominated the grain processing equipment market with the largest revenue share of 38.50% in 2024, driven by increasing demand for processed grains, adoption of automation technologies, and the presence of well-established food and beverage industries

- Grain processors in the region prioritize efficiency, quality, and compliance with food safety standards, leading to high adoption of advanced cleaning, grading, and milling machinery

- The widespread adoption is further supported by high technological awareness, availability of skilled labor, and strong industrial infrastructure, establishing North America as a key market for both large-scale and mid-sized processing facilities.

U.S. Grain Processing Equipment Market Insight

The U.S. grain processing equipment market captured the largest revenue share in 2024 within North America, fueled by the modernization of milling and cereal processing plants. Food manufacturers are increasingly investing in automated and smart processing machinery to improve operational efficiency, reduce waste, and meet stringent quality regulations. Rising demand for ready-to-eat and fortified grain products, combined with advancements in IoT-enabled monitoring and predictive maintenance systems, is further propelling market growth. Moreover, supportive government initiatives for food security and industrial automation are contributing to market expansion.

Europe Grain Processing Equipment Market Insight

The Europe grain processing equipment market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by modernization of food processing units and increasing demand for high-quality processed grains. The expansion of urban population and the need for advanced, energy-efficient equipment are fostering market adoption. European processors are investing in environmentally friendly and automated solutions, enhancing productivity and reducing operational costs. The region is experiencing significant growth across commercial milling and packaged food industries, with equipment upgrades being implemented in both new and existing facilities.

U.K. Grain Processing Equipment Market Insight

The U.K. grain processing equipment market is expected to witness strong growth from 2025 to 2032, driven by rising demand for processed and fortified grains, coupled with increasing focus on food safety and hygiene. Small- and medium-sized food processors are upgrading to semi-automatic and automatic machines to improve efficiency and meet regulatory requirements. The growth is further supported by the country’s advanced industrial infrastructure, availability of skilled workforce, and rising adoption of IoT-enabled monitoring solutions in food processing plants.

Germany Grain Processing Equipment Market Insight

The Germany grain processing equipment market is expected to witness significant growth from 2025 to 2032, fueled by the adoption of high-tech, energy-efficient processing machinery and the increasing emphasis on quality and sustainability. Germany’s well-established food processing industry, combined with strong industrial standards and technological innovation, supports the uptake of advanced equipment. Integration of automated sorting, grading, and polishing solutions in both commercial and industrial operations is becoming increasingly prevalent, meeting local and export quality standards.

Asia-Pacific Grain Processing Equipment Market Insight

The Asia-Pacific grain processing equipment market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and growing demand for processed grains in countries such as China, India, and Japan. Government initiatives supporting industrial modernization, food safety, and agricultural processing infrastructure are promoting adoption. Furthermore, APAC is emerging as a manufacturing hub for grain processing machinery, improving affordability and accessibility of advanced equipment for small- and large-scale processors.

Japan Grain Processing Equipment Market Insight

The Japan grain processing equipment market is expected to witness strong growth from 2025 to 2032, due to the country’s focus on automation, precision processing, and quality enhancement in grain products. Processors are investing in semi-automatic and automatic systems for improved efficiency, product consistency, and energy savings. The integration of IoT-enabled monitoring and smart pre-processing and processing machinery is fueling growth, while rising demand for ready-to-eat and fortified grain products supports continuous market expansion.

China Grain Processing Equipment Market Insight

The China grain processing equipment market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid industrialization, urbanization, and increasing consumer demand for processed grains. China is one of the largest markets for modern milling, drying, and grading machinery, with strong domestic manufacturing capabilities supporting equipment availability. Government initiatives promoting food safety, smart factories, and agricultural modernization are key factors propelling market growth in both residential and commercial grain processing sectors.

Grain Processing Equipment Market Share

The Grain Processing Equipment industry is primarily led by well-established companies, including:

- Agro Asian Industries (India)

- Sigur Group (China)

- Carl Zeiss AG (Germany)

- Lewis M. Carter Manufacturing, LLC (U.S.)

- Shri Vishvakarma (Emery Stones) Industries Pvt. Ltd. (India)

- Forsberg Agritech (India) Pvt. Ltd. (India)

- Satake USA (U.S.)

- PETKUS Technologie GmbH (Germany)

- Osaw Agro Industries Private Limited (India)

- Alvan Blanch Development Company Limited (U.K.)

- GRAIN MACHINERY MANUFACTURING CORPORATION (U.S.)

- Ang Enterprise (India)

- AGCO Grain and Protein (U.S.)

- Avity Agrotech Private Limited (India)

- Buschhoff (Germany)

- Millgrain Machinery Industries (India)

- SATAKE CORPORATION (Japan)

- ADEPTA (France)

- Ricetec Machinery Private Limited (India)

- Roshan Agro Industries (India)

Latest Developments in Global Grain Processing Equipment Market

- In October 2024, Bühler Group launched its Grain Innovation Center, a cutting-edge facility focused on advancing grain processing equipment and technologies. The center is designed to develop sustainable solutions for the grain industry, aiming to improve efficiency and productivity in grain handling and processing. By fostering collaboration with industry partners, the initiative strengthens Bühler’s innovation capabilities, enhances global food production, and supports more resilient supply chains, positively impacting the grain processing market

- In March 2023, Mathews Company introduced a new line of grain handling products aimed at boosting operational efficiency in grain processing equipment. The innovative product line addresses evolving industry needs by providing advanced solutions for grain handling and processing. These offerings are expected to improve productivity for processors and operators across multiple sectors, supporting market growth and enhancing competitiveness in the grain processing equipment industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Grain Processing Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Grain Processing Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Grain Processing Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.