Global Grain Storage And Silos Storage Systems Market

Market Size in USD Billion

CAGR :

%

USD

1.90 Billion

USD

3.07 Billion

2025

2033

USD

1.90 Billion

USD

3.07 Billion

2025

2033

| 2026 –2033 | |

| USD 1.90 Billion | |

| USD 3.07 Billion | |

|

|

|

|

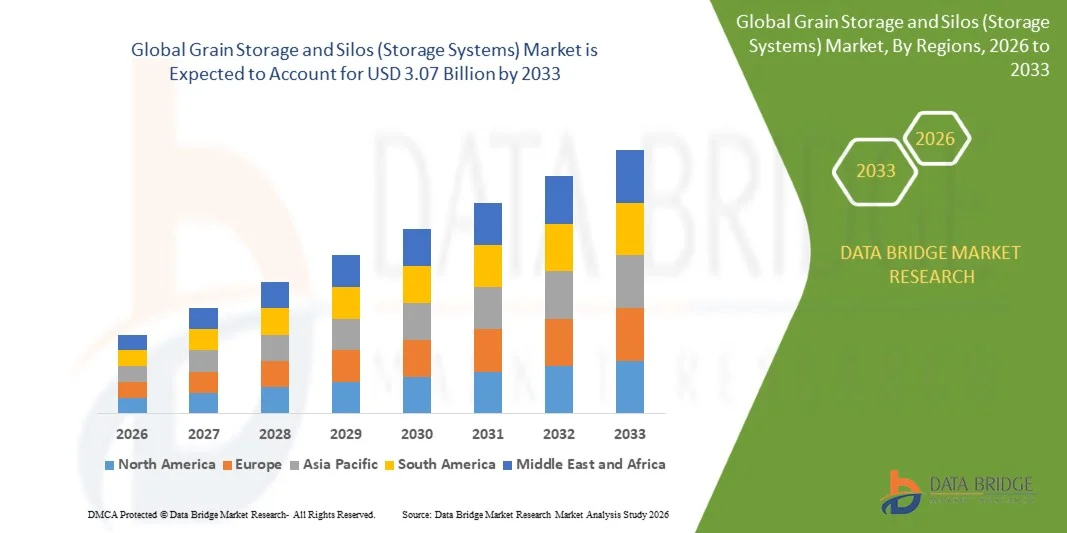

What is the Global Grain Storage and Silos (Storage Systems) Market Size and Growth Rate?

- The global grain storage & silos (storage systems) market size was valued at USD 1.90 billion in 2025 and is expected to reach USD 3.07 billion by 2033, at a CAGR of6.20% during the forecast period

- Market growth is driven by the rising need for secure, long-term grain preservation, increasing adoption of mechanized and modern storage systems, and expanding demand for bulk storage solutions across farming, milling, and food processing industries

- Rapid growth in global grain trade, rising post-harvest losses, expansion of commercial agriculture, and investments in automated storage infrastructure further strengthen market expansion

- Increasing focus on food security, efficiency in grain handling, and reduction of spoilage continues to push governments and private players toward advanced silo-based storage solutions

What are the Major Takeaways of Grain Storage & Silos (Storage Systems) Market?

- Rising adoption of flat bottom and hopper silos, supported by increasing farm mechanization and growing need for high-capacity grain storage across developing economies, is creating significant market opportunities

- Expanding investments in food processing, feed mills, and bulk grain terminals, combined with the shift toward automated and smart monitoring systems, continues to accelerate long-term market demand

- Asia-Pacific dominated the Grain Storage & Silos (Storage Systems) market with the largest revenue share of 35.57% in 2025, driven by extensive agricultural output, rising grain export activities, rapid expansion of bulk storage infrastructure, and large-scale modernization of grain handling systems across China, India, Australia, and Southeast Asia

- North America is projected to register the fastest CAGR of 10.45% from 2026 to 2033, driven by rapid adoption of automated grain handling systems, increasing modernization of on-farm storage, and rising investments in large-capacity steel silos across the U.S. and Canada

- The Flat Bottom Silos segment dominated the market with a 41.3% share in 2025, driven by high adoption across large farms, commercial grain handlers, and export terminals due to their high-volume capacity, cost efficiency, and suitability for long-term storage of cereals, pulses, and oilseeds

Report Scope and Grain Storage & Silos (Storage Systems) Market Segmentation

|

Attributes |

Grain Storage & Silos (Storage Systems) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Grain Storage & Silos (Storage Systems) Market?

“Increasing Shift Toward Automated, High-Capacity, and Smart Grain Storage Solutions”

- The grain storage & silos (storage systems) market is witnessing strong adoption of automated, high-capacity, and IoT-enabled silos designed to enhance grain quality, reduce post-harvest losses, and optimize storage efficiency for farms, grain processors, and commercial grain handlers

- Manufacturers are introducing smart monitoring systems, remote-controlled aeration, temperature-humidity tracking, and advanced material designs such as galvanized steel and reinforced aluminum to improve durability and operational safety

- Growing emphasis on cost-efficient, high-volume, and long-lifespan silos is increasing deployment across farms, port terminals, grain trading hubs, and large food-processing facilities

- For instance, leading players such as AGI, Sukup, Brock Grain Systems, and Silos Córdoba have upgraded their silo systems with real-time grain condition monitoring, automated grain flow control, and integrated grain management software

- Rising demand for peak-load handling, faster grain transfer, and contamination-free storage is accelerating the shift toward advanced, high-performance silo systems

- As global grain production expands and food security needs increase, smart grain storage & silo systems will remain vital for scalable, safe, and energy-efficient grain preservation

What are the Key Drivers of Grain Storage & Silos (Storage Systems) Market?

- Rising demand for efficient post-harvest grain management, driven by increasing production of wheat, corn, soybeans, and rice, is accelerating the adoption of modern silos across farming and commercial grain handling sectors

- For instance, in 2025, leading companies such as AGI, Sioux Steel, and Symaga upgraded their silo portfolios with larger storage capacities, improved material strength, and digital monitoring technologies to meet global grain storage demands

- Growing adoption of mechanized farming, food security programs, and large-scale grain procurement systems across the U.S., Europe, Asia-Pacific, and emerging markets is boosting silo installation rates

- Advancements in aeration systems, automation, corrosion-resistant materials, and airtight sealing technologies have significantly improved storage performance and reduced grain spoilage

- Rising focus on reducing post-harvest losses, improving grain quality, and supporting export-oriented grain handling is generating strong demand for high-capacity storage solutions

- Supported by increasing agricultural investments, government warehouse modernization programs, and private-sector grain trading expansion, the Grain Storage & Silos (Storage Systems) market is expected to experience strong long-term growth

Which Factor is Challenging the Growth of the Grain Storage & Silos (Storage Systems) Market?

- High costs associated with large-capacity metal silos, advanced automation systems, and digital monitoring technologies limit adoption among small and medium-scale farmers in developing economies

- For instance, during 2024–2025, fluctuations in steel and aluminum prices, supply chain disruptions, and higher installation expenses increased the overall cost of silo construction and procurement for many grain storage companies

- Complexity in managing large-scale grain inventories, maintaining ventilation systems, and preventing moisture-induced spoilage increases the need for skilled operators and periodic technical training

- Limited awareness in rural regions regarding modern storage systems, grain quality monitoring benefits, and long-term cost efficiency slows the transition from traditional storage methods to advanced silos

- Competition from traditional warehouses, temporary grain bags, and low-cost storage structures puts pricing pressure on silo manufacturers and reduces market penetration in low-income agricultural regions

- To address these challenges, companies are focusing on cost-optimized designs, modular silo structures, training programs, and affordable smart monitoring solutions to increase the global adoption of Grain Storage & Silos (Storage Systems)

How is the Grain Storage & Silos (Storage Systems) Market Segmented?

The market is segmented on the basis of type, storage capacity, material, end use, and operation type.

• By Type

The grain storage & silos (storage systems) market is segmented into Flat Bottom Silos, Hopper Silos, Grain Bins, and Others. The Flat Bottom Silos segment dominated the market with a 41.3% share in 2025, driven by high adoption across large farms, commercial grain handlers, and export terminals due to their high-volume capacity, cost efficiency, and suitability for long-term storage of cereals, pulses, and oilseeds. Their adaptability for automated cleaning, aeration, and fumigation further strengthens usage among large-capacity storage operators.

The Hopper Silos segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing demand for short-term storage, faster grain discharge, and easy grain flow control. Rising deployment across feed mills, grain processing units, and small-to-medium farm clusters fuels rapid uptake. As global grain handling requirements grow, both segments are expected to witness strong long-term adoption.

• By Storage Capacity

The market is segmented into Up to 1,000 tons, 1,000 to 5,000 tons, and Above 5,000 tons. The 1,000 to 5,000 tons segment dominated the market with a 46.7% share in 2025, as mid-range capacity silos are widely preferred by commercial grain handlers, cooperatives, processing mills, and medium-to-large farms. They offer optimal storage flexibility, support bulk commodity management, and are compatible with automated aeration, blending, and grain flow systems.

The Above 5,000 tons segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing expansion of port terminals, bulk grain exporters, large processing plants, and government-led food reserve programs. Growing grain trade volumes, rising export competitiveness, and increasing dependence on large silo complexes for long-term preservation are accelerating this segment’s adoption.

• By Material

The grain storage & silos (storage systems) market is segmented into Steel, Aluminum, Wood, and Others. The Steel segment dominated the market with a 58.4% share in 2025, owing to its superior strength, long lifespan, corrosion resistance, and suitability for both high-capacity and automated storage structures. Steel silos provide structural stability for aeration systems, temperature sensors, and grain flow equipment, making them the leading choice across commercial storage environments.

The Aluminum segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing interest in lightweight, rust-resistant, and energy-efficient silo structures, especially in humid climates. Aluminum silos minimize maintenance costs, enhance operational safety, and are gaining traction among food processors and coastal grain hubs. Rising demand for durable and sustainable storage materials is further boosting segment growth.

• By End Use

The market is segmented into Farming/Primary Producers (on-farm), Feed Mills & Animal Feed, Grain Processing Mills, Port & Bulk Terminals, and Food & Beverage Processors. The Farming/Primary Producers segment dominated the market with a 39.1% share in 2025, as farms increasingly adopt storage silos to reduce dependence on external warehouses, minimize post-harvest losses, and maintain grain quality during seasonal price fluctuations. Technology adoption, increasing farm mechanization, and expansion of on-farm grain handling systems reinforce segment leadership.

The Port & Bulk Terminals segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising grain export volumes, growing global demand for cereal shipments, and the need for high-capacity, automated silo complexes. Investments in port infrastructure modernization and digital grain management systems further accelerate segment expansion.

• By Operation Type

The grain storage & silos (storage systems) market is segmented into Manual, Semi-Automatic, and Automatic. The Semi-Automatic segment dominated the market with a 44.6% share in 2025, as it offers the ideal balance between operational control, cost efficiency, and productivity. Semi-automated silos are widely preferred by medium and large grain handling facilities due to their compatibility with conveyor systems, aeration fans, and temperature monitoring modules.

The Automatic segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing demand for fully digitized grain storage systems, IoT-based monitoring, remote control, automated grain flow management, and AI-enabled quality assessment. Rising labor shortages, the need for 24/7 grain monitoring, and the expansion of large silo complexes are accelerating adoption of fully automated storage systems globally.

Which Region Holds the Largest Share of the Grain Storage & Silos (Storage Systems) Market?

- Asia-Pacific dominated the Grain Storage & Silos (Storage Systems) market with the largest revenue share of 35.57% in 2025, driven by extensive agricultural output, rising grain export activities, rapid expansion of bulk storage infrastructure, and large-scale modernization of grain handling systems across China, India, Australia, and Southeast Asia. Strong government-led investments in food security, increasing demand for high-capacity steel silos, and accelerated adoption of mechanized grain handling solutions are key factors supporting market leadership. Expanding warehousing networks, rising commercial grain trading volumes, and growing focus on reducing post-harvest losses further strengthen regional dominance

- Leading countries in Asia-Pacific continue to expand steel silo installations, automation systems, real-time grain monitoring technologies, and large-scale storage facilities, enhancing operational efficiency and strengthening regional capacity

- The region’s high agricultural output, strategic export position, and government-backed grain infrastructure upgrades reinforce its long-term market leadership

China Grain Storage & Silos (Storage Systems) Market Insight

China is the largest contributor to Asia-Pacific, supported by significant grain reserve programs, rapid modernization of rural storage infrastructure, and continuous investments in steel silos, automated loading systems, and high-capacity grain terminals. Strong government initiatives aimed at minimizing post-harvest losses and maintaining national food reserves continue to boost market demand. Expansion of commercial grain trading and processing facilities further strengthens growth.

Japan Grain Storage & Silos (Storage Systems) Market Insight

Japan shows steady growth due to its focus on high-quality grain handling systems, technologically advanced silo automation solutions, and modernization of storage facilities across food processing plants and port terminals. Rising adoption of corrosion-resistant silos, temperature-control systems, and advanced monitoring technologies supports long-term market expansion. Increasing demand for premium grains and enhanced supply chain efficiency boosts system upgrades across the country.

India Grain Storage & Silos (Storage Systems) Market Insight

India is emerging as a high-growth market driven by government-led grain storage expansion programs, rising procurement of cereals, and large-scale modernization of aging storage warehouses. Rapid adoption of steel silos backed by the Food Corporation of India (FCI), private players, and agri-tech startups continues to expand market penetration. Increasing grain exports, rising need for scientific storage, and growing farm mechanization further enhance demand nationwide.

South Korea Grain Storage & Silos (Storage Systems) Market Insight

South Korea contributes steadily due to rising demand for automated grain storage, modernization of feed mills, and increasing need for high-efficiency silos supporting livestock production. Growing import volumes of grain, expansion of port-based storage capacity, and adoption of smart inventory monitoring systems drive market growth. Technological innovation and strong food processing activity continue to support sustained demand across the region.

North America Grain Storage & Silos (Storage Systems) Market – Fastest Growing Region

North America is projected to register the fastest CAGR of 10.45% from 2026 to 2033, driven by rapid adoption of automated grain handling systems, increasing modernization of on-farm storage, and rising investments in large-capacity steel silos across the U.S. and Canada. Expansion of commercial grain elevators, strong demand for temperature- and moisture-controlled grain storage, and increasing replacement of aging infrastructure support rapid market growth. Advanced technologies such as IoT-based grain monitoring, remote-controlled aeration, robotic unloading systems, and smart silo management platforms continue to accelerate adoption across small and large-scale producers.

U.S. Grain Storage & Silos (Storage Systems) Market Insight

The U.S. is the largest contributor in North America, driven by high agricultural output, extensive grain export volumes, and rapid transition toward modern, corrosion-resistant, and high-capacity silo systems. Increasing installation of flat-bottom silos, hopper silos, and automated grain management systems across farming cooperatives, commercial storage operators, feed mills, and port terminals is boosting demand. Strong investments in post-harvest infrastructure, advanced moisture-control technologies, and smart inventory monitoring tools further support market expansion.

Canada Grain Storage & Silos (Storage Systems) Market Insight

Canada contributes significantly due to expanding grain production, rising exports of wheat, canola, and pulses, and growing focus on reducing post-harvest losses in colder climates. Grain handling companies and commercial terminals continue to deploy advanced steel silos, conveyor systems, and automated aeration technologies. Government-backed initiatives for enhancing agricultural competitiveness, increasing farm consolidation, and rising demand for high-efficiency grain storage facilities strengthen adoption across the country.

Which are the Top Companies in Grain Storage & Silos (Storage Systems) Market?

The grain storage & silos (storage systems) industry is primarily led by well-established companies, including:

- Sukup Manufacturing Co. (U.S.)

- Ag Growth International Inc (AGI) (Canada)

- CST Industries (U.S.)

- Sioux Steel Company (U.S.)

- Brock Grain Systems (U.S.)

- Ecosphere India Pvt. Ltd (India)

- Silos Córdoba (Spain)

- PRADO SILOS (Spain)

- Hoffmann, Inc. (U.S.)

- Symaga S.A.U. (Spain)

- Silos Metálicos Zaragoza S.L.U. (SIMEZA) (Spain)

- Bentall Rowlands Silo Storage Ltd (U.K.)

- Mysilo (Turkey)

- Chief Agri/Industrial Group (U.S.)

- Grain & Protein Technologies (U.S.)

What are the Recent Developments in Global Grain Storage & Silos (Storage Systems) Market?

- In September 2025, Chief Agri, a division of Chief Industries, Inc., launched three newly designed grain-storage silos that emphasize smarter, stronger, and more user-friendly features to enhance efficiency, durability, and operational ease for farmers managing grain storage. This development is expected to significantly improve modern grain-handling workflows

- In September 2025, AGI collaborated with Live to Farm and RIPCO Systems to feature real-world farming conditions in a televised program, where the team constructed a new AGI grain bin equipped with AGI BinManager technology, showcasing advanced, tech-driven grain storage solutions. This initiative is anticipated to boost awareness and adoption of intelligent grain-management systems

- In March 2025, India expanded its cooperative grain storage initiative after successful pilot trials, selecting 500 additional local societies for large-scale storage capacity implementation, strengthening rural storage infrastructure. This expansion is poised to enhance grassroots grain-handling efficiency across the country

- In November 2024, the USDA introduced the USD 140 million Commodity Storage Assistance Program, providing financial support to producers for rebuilding storage bins damaged by hurricanes, thereby improving resilience in agricultural storage systems. This program is expected to accelerate restoration of critical grain storage facilities

- In January 2024, the Port of New Orleans secured a USD 226.2 million federal grant for the USD 1.8 billion Louisiana International Terminal, which includes the development of major grain silo infrastructure to support growing export and logistics demand. This investment is set to strengthen the region’s long-term grain storage and shipping capacity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.