Global Granulomatosis With Polyangiitis Treatment Market

Market Size in USD Billion

CAGR :

%

USD

2.72 Billion

USD

3.98 Billion

2024

2032

USD

2.72 Billion

USD

3.98 Billion

2024

2032

| 2025 –2032 | |

| USD 2.72 Billion | |

| USD 3.98 Billion | |

|

|

|

|

Granulomatosis with Polyangiitis Treatment Market Size

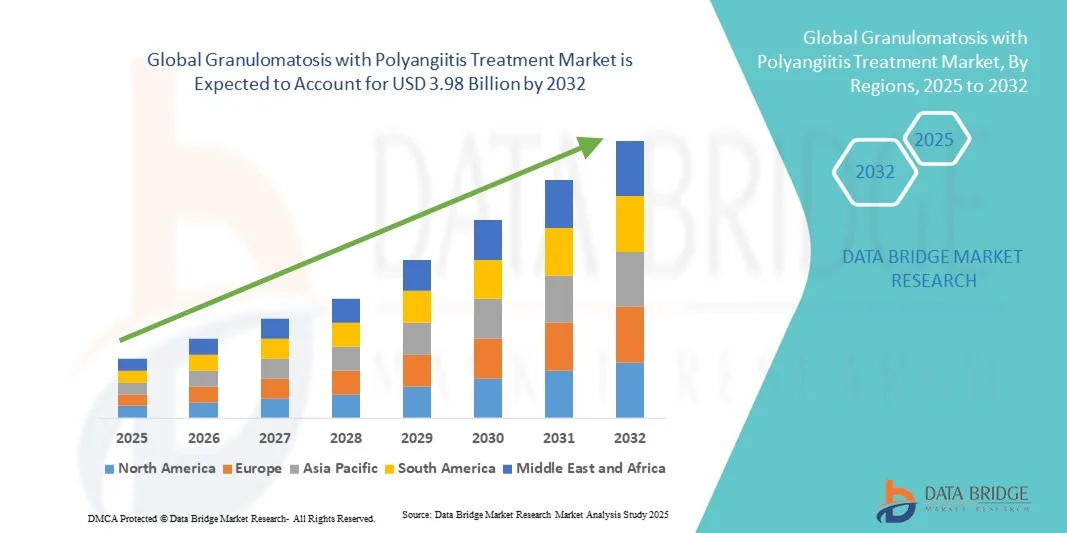

- The global granulomatosis with polyangiitis treatment market size was valued at USD 2.72 billion in 2024 and is expected to reach USD 3.98 billion by 2032, at a CAGR of 4.90% during the forecast period

- The market growth is primarily driven by the increasing prevalence of autoimmune and vasculitic disorders, alongside advancements in diagnostic technologies and biologic therapies that enhance disease management and patient outcomes

- Furthermore, rising awareness among healthcare professionals, growing access to immunosuppressive and targeted therapies, and expanding clinical research initiatives are collectively fostering the adoption of advanced treatment approaches for granulomatosis with polyangiitis, thereby propelling the market’s expansion globally

Granulomatosis with Polyangiitis Treatment Market Analysis

- Granulomatosis with polyangiitis (GPA), a rare autoimmune disorder that causes inflammation of blood vessels and affects organs such as the kidneys, lungs, and upper respiratory tract, is primarily managed through corticosteroids and immunosuppressive therapies aimed at inducing and maintaining remission

- The market growth is driven by the increasing prevalence of autoimmune conditions, improved diagnostic capabilities, and ongoing advancements in immunomodulatory and biologic drugs that enhance treatment outcomes and reduce relapse rates

- North America dominated the granulomatosis with polyangiitis treatment market with the largest revenue share of 43.2% in 2024, owing to the region’s strong healthcare infrastructure, availability of advanced biologics, and active research initiatives in autoimmune disease therapeutics, especially in the U.S.

- Asia-Pacific is anticipated to be the fastest-growing region in the granulomatosis with polyangiitis treatment market during the forecast period, supported by rising awareness of rare diseases, expanding healthcare coverage, and growing pharmaceutical investments

- The steroids segment dominated the granulomatosis with polyangiitis treatment market with a market share of 46.3% in 2024, due to their established role as the first-line therapy for inflammation control and induction of remission in GPA patients

Report Scope and Granulomatosis with Polyangiitis Treatment Market Segmentation

|

Attributes |

Granulomatosis with Polyangiitis Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Granulomatosis with Polyangiitis Treatment Market Trends

Shift Toward Targeted Biologic and Personalized Therapies

- A significant and accelerating trend in the global granulomatosis with polyangiitis (GPA) treatment market is the growing shift toward biologic and personalized therapies designed to precisely target immune pathways involved in vasculitis progression, improving patient outcomes and minimizing relapse rates

- For instance, rituximab, a B-cell–depleting monoclonal antibody, has become a cornerstone biologic therapy for GPA, offering enhanced remission rates compared to conventional immunosuppressants such as cyclophosphamide. Similarly, ongoing trials of avacopan (a C5a receptor inhibitor) demonstrate promising results in reducing corticosteroid dependence

- Biologic therapies enable physicians to tailor treatment strategies based on patients’ immunologic profiles and disease activity, enhancing safety and long-term disease control. For instance, advancements in biomarker-based diagnostics are helping clinicians monitor disease activity more effectively and adjust therapy accordingly, improving individualized care

- The integration of digital health tools and real-world data monitoring systems allows continuous tracking of treatment response, medication adherence, and relapse prediction, supporting precision-based disease management. Through these innovations, healthcare providers can optimize therapy selection and improve patient quality of life

- This trend toward precision medicine and biologic integration is fundamentally transforming GPA management by replacing broad immunosuppression with targeted immune modulation. Consequently, companies such as Roche and ChemoCentryx are advancing biologic and small-molecule therapies that address unmet needs in refractory or relapsing GPA cases

- The demand for biologic and personalized GPA treatments is expanding rapidly across hospitals and specialty clinics, as healthcare systems increasingly prioritize targeted, efficient, and patient-specific therapeutic approaches for autoimmune vasculitis

Granulomatosis with Polyangiitis Treatment Market Dynamics

Driver

Increasing Disease Awareness and Advancements in Biologic Therapies

- The rising global awareness of autoimmune vasculitis and the importance of early diagnosis are significant drivers fueling the demand for effective granulomatosis with polyangiitis (GPA) treatments

- For instance, in February 2024, ChemoCentryx (Amgen Inc.) expanded access to Tavneos (avacopan) across multiple countries, strengthening biologic availability and advancing precision immunotherapy for GPA patients

- As medical professionals gain greater understanding of GPA’s underlying mechanisms, biologics and immunosuppressants are increasingly used to manage the disease with fewer relapses and improved safety profiles

- Furthermore, growing government and non-profit initiatives to support rare disease awareness and patient registries are improving diagnostic timelines and access to advanced treatments

- The shift from conventional steroid-heavy regimens toward combination therapies integrating biologics and immunomodulators is a key factor enhancing treatment outcomes in both hospital and specialty clinic settings. The development of novel oral formulations and intravenous infusion centers further supports patient accessibility and adherence

- Technological advances in genomic sequencing and biomarker identification are enabling earlier and more precise detection of GPA, supporting the transition toward preventive and precision-based therapeutic strategies

Restraint/Challenge

High Treatment Costs and Limited Accessibility to Specialized Care

- The high cost of biologic and immunosuppressive therapies presents a major barrier to broader treatment accessibility, especially in low- and middle-income regions where reimbursement systems are limited

- For instance, biologics such as rituximab and avacopan require specialized administration and ongoing monitoring, resulting in substantial healthcare expenses for both patients and providers

- In addition, the rarity of GPA leads to delayed diagnosis and a shortage of specialists familiar with its complex clinical presentation, restricting timely intervention and optimized disease management. For instance, many healthcare systems in emerging markets face challenges in establishing specialized vasculitis centers capable of administering biologic therapies under expert supervision

- The need for lifelong management, regular laboratory monitoring, and potential side effects such as infection risk further complicate treatment adherence and cost management. Addressing these barriers through enhanced reimbursement programs, biosimilar development, and telehealth support will be crucial for global market expansion

- Limited awareness among primary care physicians regarding early symptoms of GPA often results in misdiagnosis, causing treatment delays that worsen patient outcomes and elevate healthcare costs

- For instance, inconsistent availability of approved drugs and slow regulatory approval timelines in certain regions hinder equitable access to modern biologic treatments, limiting the overall market penetration of advanced GPA therapies

Granulomatosis with Polyangiitis Treatment Market Scope

The market is segmented on the basis of drug class, route of administration, distribution channel, and end user.

- By Drug Class

On the basis of drug class, the granulomatosis with polyangiitis (GPA) treatment market is segmented into steroids and immunosuppressants. The steroids segment dominated the market with the largest revenue share of 46.3% in 2024, primarily due to their long-standing role as the first-line therapy for managing acute inflammation and inducing remission in GPA patients. Corticosteroids such as prednisone and methylprednisolone are widely prescribed owing to their rapid anti-inflammatory and immunosuppressive effects, which help stabilize patients during the initial phase of treatment. Their cost-effectiveness, global availability, and inclusion in nearly all clinical guidelines further reinforce their dominance. Despite emerging biologics, steroids remain a foundational therapy in both hospital and outpatient settings due to their predictable efficacy and well-documented safety profile when managed under proper medical supervision.

The immunosuppressant segment is anticipated to witness the fastest growth rate during the forecast period from 2025 to 2032, driven by advancements in drug formulations and rising adoption of combination regimens. Immunosuppressants such as cyclophosphamide, methotrexate, and azathioprine are increasingly used for maintenance therapy to prevent relapses while minimizing corticosteroid exposure. Growing research on targeted immunomodulatory drugs and the introduction of safer, more tolerable alternatives are propelling this segment forward. The transition toward precision-based treatment protocols and personalized therapy selection further enhances the segment’s growth outlook.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral and intravenous. The oral segment dominated the global GPA treatment market in 2024, driven by the convenience, cost-effectiveness, and patient preference for non-invasive treatment options. Oral corticosteroids and immunosuppressants, including prednisone and methotrexate, are extensively prescribed for outpatient care and long-term maintenance therapy. Their ease of administration, coupled with consistent therapeutic outcomes, makes them the preferred option for stable patients. Furthermore, the growing availability of oral formulations of advanced drugs and generics contributes to widespread adoption, especially in regions with limited access to infusion facilities.

The intravenous segment is expected to record the fastest growth during the forecast period due to the increasing use of biologics and infusion-based therapies such as rituximab and avacopan. Intravenous administration ensures higher bioavailability and rapid systemic action, making it particularly suitable for severe or relapsing cases of GPA. Hospitals and specialty clinics increasingly favor this route for controlled dosing and monitoring of patient responses. In addition, the development of dedicated infusion centers and reimbursement support for biologic treatments further drives growth in this segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment dominated the market in 2024, owing to the high dependency of GPA patients on specialized treatment and continuous monitoring in hospital-based care settings. Most biologic and intravenous drugs are administered and dispensed through hospital pharmacies to ensure appropriate dosage and patient safety. The presence of trained healthcare professionals, controlled drug distribution, and close physician-pharmacist collaboration further enhance patient outcomes. In addition, hospital pharmacies play a critical role in the initial management and induction phase of GPA therapy, where accurate dosing and emergency access to medications are essential.

The online pharmacies segment is projected to exhibit the fastest growth from 2025 to 2032, driven by expanding e-commerce penetration, increased digital health adoption, and convenience in medication refills for chronic diseases. GPA patients undergoing long-term therapy increasingly rely on online platforms for affordability, doorstep delivery, and access to hard-to-find specialty medications. The growing trust in verified online pharmacies and teleconsultation integration is supporting this channel’s expansion. Furthermore, initiatives promoting online prescription validation and secure drug handling are making digital platforms a vital part of GPA treatment distribution.

- By End User

On the basis of end user, the market is segmented into hospitals, homecare, specialty clinics, and others. The hospitals segment held the largest market revenue share in 2024, primarily due to the concentration of skilled specialists, advanced diagnostic facilities, and access to infusion-based biologic treatments. Hospitals serve as the primary centers for diagnosis, induction therapy, and management of severe GPA cases, where multidisciplinary care is essential. The growing number of patients requiring intravenous biologics and close clinical monitoring strengthens the segment’s dominance. Moreover, hospital-based treatment ensures adherence to global therapeutic guidelines and facilitates early intervention in case of relapses or drug-related complications.

The specialty clinics segment is anticipated to grow at the fastest rate during the forecast period, fueled by the increasing establishment of autoimmune and vasculitis-focused clinics offering personalized care. These centers provide continuous follow-up, patient education, and access to immunology experts, leading to better disease control and improved quality of life. For instance, the growing presence of rheumatology and immunology specialty centers in Asia-Pacific and Europe is enhancing outpatient biologic administration and monitoring capabilities. The shift toward specialized, patient-centric care models positions this segment as a key growth driver in the coming years.

Granulomatosis with Polyangiitis Treatment Market Regional Analysis

- North America dominated the granulomatosis with polyangiitis treatment market with the largest revenue share of 43.2% in 2024, owing to the region’s strong healthcare infrastructure, availability of advanced biologics, and active research initiatives in autoimmune disease therapeutics, especially in the U.S.

- Patients and healthcare providers in the region benefit from widespread access to specialized vasculitis centers, robust reimbursement systems, and ongoing clinical research programs aimed at improving long-term treatment outcomes

- This leadership is further reinforced by the presence of major pharmaceutical players, favorable regulatory frameworks for orphan drugs, and growing awareness of autoimmune and vasculitic diseases, positioning North America as a key hub for innovation and therapy adoption in the GPA treatment landscape

U.S. Granulomatosis with Polyangiitis Treatment Market Insight

The U.S. granulomatosis with polyangiitis (GPA) treatment market captured the largest revenue share of 82% in 2024 within North America, driven by the strong presence of advanced healthcare systems and early diagnosis capabilities. The widespread availability of biologic therapies such as rituximab and avacopan, coupled with extensive insurance coverage and patient assistance programs, supports treatment accessibility. Growing physician awareness, active clinical research, and the adoption of precision-based care models further strengthen the market. Moreover, initiatives from organizations such as the Vasculitis Foundation promote education and support networks, significantly contributing to improved patient outcomes and market expansion.

Europe Granulomatosis with Polyangiitis Treatment Market Insight

The Europe granulomatosis with polyangiitis treatment market is projected to grow at a substantial CAGR throughout the forecast period, driven by the increasing prevalence of autoimmune vasculitis and supportive healthcare infrastructure across major economies. The region’s strong regulatory environment for orphan drugs and the expansion of biologic treatment approvals are key growth drivers. Rising investment in rare disease research, coupled with patient-centric initiatives, is improving access to innovative therapies. European countries are also witnessing growing awareness campaigns and collaboration among medical associations, fostering timely diagnosis and treatment adoption across both hospital and specialty clinic settings.

U.K. Granulomatosis with Polyangiitis Treatment Market Insight

The U.K. granulomatosis with polyangiitis treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the country’s well-established National Health Service (NHS) framework and increasing access to biologic and immunosuppressive therapies. Heightened awareness among healthcare professionals and improved rare disease reporting systems are leading to earlier diagnoses and more effective treatment regimens. Moreover, growing participation in EU- and UK-based vasculitis registries is enhancing data-driven clinical decisions. Government-backed funding for autoimmune and rare disease research is also playing a key role in supporting the long-term expansion of the GPA treatment market.

Germany Granulomatosis with Polyangiitis Treatment Market Insight

The Germany granulomatosis with polyangiitis treatment market is expected to expand at a considerable CAGR during the forecast period, fueled by robust pharmaceutical innovation, advanced healthcare facilities, and strong clinical research participation. The country’s emphasis on precision medicine and biologic drug adoption supports improved disease management and reduced relapse rates. German hospitals and specialty clinics actively engage in multicenter clinical trials, accelerating new therapy introductions. Furthermore, an increasing focus on patient safety, cost-effective treatment options, and the availability of high-quality biosimilars continue to strengthen Germany’s role as a leading European market for GPA treatment.

Asia-Pacific Granulomatosis with Polyangiitis Treatment Market Insight

The Asia-Pacific granulomatosis with polyangiitis treatment market is poised to grow at the fastest CAGR of 23.5% during the forecast period (2025–2032), driven by improving healthcare infrastructure, growing awareness of autoimmune diseases, and rising adoption of biologic therapies. Countries such as China, Japan, and India are witnessing increased investments in rare disease research and diagnostic advancements. Government-backed healthcare expansion programs and favorable reimbursement initiatives are enhancing access to advanced treatments. Moreover, pharmaceutical collaborations and clinical trials in APAC are accelerating the introduction of novel immunosuppressive and biologic drugs, supporting widespread market growth across the region.

Japan Granulomatosis with Polyangiitis Treatment Market Insight

The Japan granulomatosis with polyangiitis treatment market is gaining momentum due to the country’s strong focus on medical innovation, an aging population, and a robust healthcare delivery system. The high rate of vasculitis diagnosis and adoption of biologic therapies such as rituximab and corticosteroid-sparing regimens are propelling growth. Japan’s emphasis on precision-based treatment approaches and participation in international clinical trials is further boosting therapeutic advancements. Moreover, the government’s initiatives supporting rare disease treatment accessibility and improved hospital infrastructure are fostering the market’s continuous expansion in both hospital and specialty clinic settings.

India Granulomatosis with Polyangiitis Treatment Market Insight

The India granulomatosis with polyangiitis treatment market accounted for the largest revenue share in the Asia-Pacific region in 2024, driven by the country’s improving diagnostic capabilities, expanding healthcare coverage, and growing specialist networks in immunology and rheumatology. Increased public awareness and the introduction of affordable biosimilars are improving access to effective therapies. Government initiatives promoting rare disease treatment under national health missions are also enhancing patient outcomes. In addition, collaborations between global pharmaceutical firms and domestic manufacturers are enabling local production and cost-effective distribution of key GPA treatments, fueling sustained market growth across India.

Granulomatosis with Polyangiitis Treatment Market Share

The Granulomatosis with Polyangiitis Treatment industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Amgen Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Novartis AG (Switzerland)

- CELLTRION INC. (South Korea)

- Takeda Pharmaceutical Company Limited (Japan)

- Biogen (U.S.)

- GSK plc (U.K.)

- AstraZeneca (U.K.)

- Sanofi (France)

- Bristol-Myers Squibb Company (U.S.)

- Samsung (South Korea)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Swedish Orphan Biovitrum AB (Sweden)

- Eli Lilly and Company (U.S.)

- Bayer AG (Germany)

- Sandoz International GmbH (Switzerland)

- UCB S.A. (Belgium)

- AbbVie Inc. (U.S.)

What are the Recent Developments in Global Granulomatosis with Polyangiitis Treatment Market?

- In December 2024, A multicentre European cohort study covering patients diagnosed between 1999 and 2022 (203 classified as GPA) revealed that although relapse rates remain high (~41% for GPA), treatment patterns shifted over time (use of cyclophosphamide for induction dropped, while rituximab use rose from ~5% to ~26%). The study highlights evolving therapy choices and persistent unmet needs in GPA management

- In September 2024, A new real-world retrospective study reported that treatment with Rituximab achieved remission in approximately 90% of patients with GPA within six months, compared to 68% with Cyclophosphamide, suggesting superior efficacy of rituximab for induction therapy in GPA. This may influence treatment algorithms toward rituximab-based induction

- In August 2024, A large real-world maintenance-therapy study of rituximab in ANCA-associated vasculitis (including GPA) documented a relapse rate of ~25% under rituximab-maintenance via retrospective cohort (median follow-up ~294 patient-years). Findings emphasize the need for optimized maintenance regimens and monitoring in GPA

- In November 2023, Evidence-based cross-discipline guidelines for the related condition Eosinophilic Granulomatosis with Polyangiitis (EGPA) were published, reflecting advances in vasculitis treatment and indirectly signalling trend momentum in the broader ANCA-vasculitis therapeutic space (including GPA). Though EGPA-specific, the guideline development underscores increasing recognition and specialization in vasculitis treatment protocols

- In October 2021, The Avacopan (brand Tavneos) was approved by the Food and Drug Administration (FDA) in the U.S. as an adjunctive treatment for adult patients with severe active ANCA-associated vasculitis (including GPA) in combination with standard therapy

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.