Global Graph Database Market

Market Size in USD Billion

CAGR :

%

USD

2.70 Billion

USD

10.28 Billion

2024

2032

USD

2.70 Billion

USD

10.28 Billion

2024

2032

| 2025 –2032 | |

| USD 2.70 Billion | |

| USD 10.28 Billion | |

|

|

|

|

Graph Database Market Size

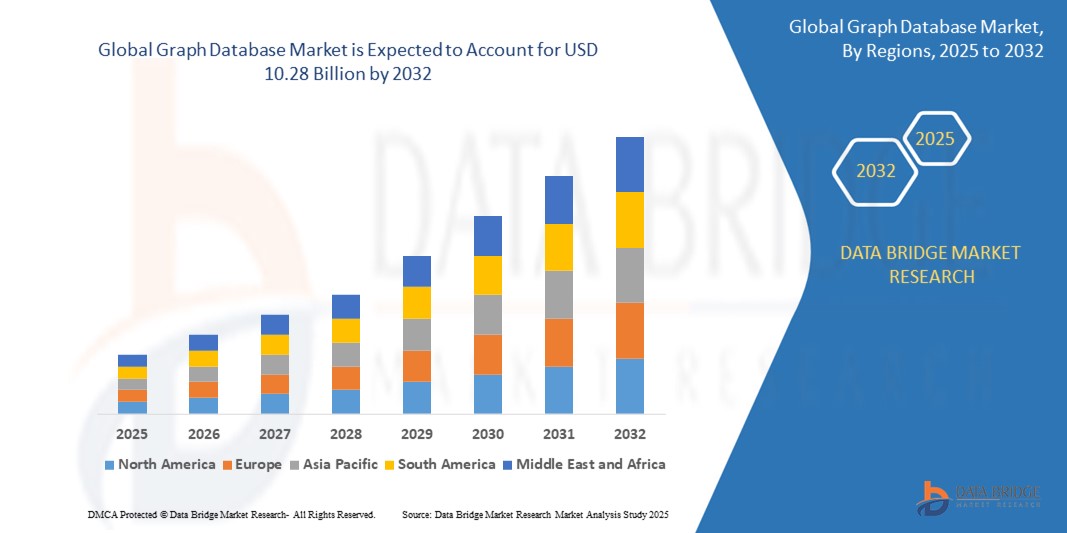

- The global graph database market size was valued at USD 2.70 billion in 2024 and is expected to reach USD 10.28 billion by 2032, at a CAGR of 18.20% during the forecast period

- The market growth is largely fueled by the increasing adoption of graph databases for real-time data analytics, fraud detection, and recommendation engines across sectors such as BFSI, telecom, and e-commerce

- Furthermore, the rising complexity of enterprise data and growing demand for scalable, high-performance solutions that uncover hidden relationships are positioning graph databases as a critical tool for modern data infrastructure, thereby significantly accelerating market expansion

Graph Database Market Analysis

- Graph databases, designed to store, manage, and query data based on relationships, are becoming essential for enterprises aiming to derive insights from highly connected and complex datasets across various applications such as fraud detection, recommendation systems, and network analysis

- The escalating demand for graph databases is primarily driven by the growing need for real-time analytics, increasing adoption of AI and machine learning, and the rising volume of unstructured and semi-structured data generated across industries

- North America dominated the graph database market with a share of 42.5% in 2024, due to early adoption of advanced analytics tools, strong investments in AI and machine learning, and the rising need for real-time data processing in industries such as BFSI, healthcare, and IT

- Asia-Pacific is expected to be the fastest growing region in the graph database market during the forecast period due to increasing enterprise digitalization, government-backed smart city initiatives, and rapid cloud adoption in economies such as China, India, Japan, and South Korea

- Cloud segment dominated the market in 2024, due to growing preference for scalable, cost-effective, and maintenance-free deployment options. Cloud-based graph databases offer on-demand performance, simplified integration with other cloud services, and global accessibility, making them ideal for distributed teams and modern application development

Report Scope and Graph Database Market Segmentation

|

Attributes |

Graph Database Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Graph Database Market Trends

“Increasing Adoption of Cloud-Based Graph Databases”

- A significant and accelerating trend in the global graph database market is the increasing adoption of cloud-based deployment models, enabling enhanced scalability, flexibility, and real-time collaboration across distributed data environments

- For instance, Amazon Neptune, a fully managed graph database service on AWS, supports both RDF and Property Graph models and is widely used for knowledge graphs and fraud detection. Similarly, Microsoft’s Azure Cosmos DB provides native support for Gremlin API, enabling scalable graph database solutions in the cloud

- Cloud-based graph databases allow organizations to manage massive volumes of connected data with minimal infrastructure overhead, enabling faster deployment and easier integration with existing cloud-native services. Google Cloud’s integration with Neo4j AuraDB allows users to build advanced analytics and recommendation engines without managing backend systems

- These platforms support use cases such as identity access management, real-time fraud analysis, and personalized content delivery by leveraging relationship-centric data modeling in a cost-effective, on-demand environment

- This shift toward cloud-native graph solutions is fundamentally reshaping how businesses derive insights from complex data. Companies such as Neo4j and TigerGraph are actively expanding their cloud offerings to meet rising demand from sectors including BFSI, telecom, and retail

- The demand for cloud-based graph databases is accelerating rapidly as enterprises seek to modernize data infrastructure, improve time-to-insight, and achieve seamless integration with AI and machine learning workflows

Graph Database Market Dynamics

Driver

“Rising Need for Real-Time Data Analytics”

- The rising need for real-time data analytics across industries is a significant driver for the growing demand for graph databases

- For instance, in March 2024, Neo4j announced major updates to its graph data science platform, enhancing its real-time recommendation and fraud detection capabilities, which are being rapidly adopted by fintech firms and e-commerce platforms. Such developments by key players are expected to propel the graph database market in the coming years

- As enterprises face increasing volumes of highly connected data, graph databases enable instant analysis of relationships and patterns that traditional databases cannot handle efficiently. This is critical in use cases such as detecting fraudulent transactions, identifying supply chain disruptions, and powering personalized content engines

- Furthermore, the growing demand for instant insights in sectors such as banking, telecom, and retail is driving organizations to shift from batch processing models to real-time analytics solutions powered by graph technologies

- Cloud-based solutions from companies such as TigerGraph, Amazon Neptune, and Microsoft Azure Cosmos DB are further expanding access to real-time graph analytics, allowing enterprises to deploy these capabilities quickly and cost-effectively across diverse operational environments

Restraint/Challenge

“Limited Workforce Expertise”

- Limited workforce expertise in graph database technologies presents a significant challenge to broader market adoption and deployment. As graph databases require specialized knowledge in graph theory, query languages such as Cypher or Gremlin, and schema design, many organizations struggle to find qualified professionals capable of implementing and managing these systems effectively

- For instance, despite Neo4j’s widespread adoption, many enterprises face a steep learning curve in onboarding developers familiar with its architecture and graph query language. This lack of expertise can lead to slower deployment timelines, misconfigured implementations, and underutilization of graph database capabilities

- Addressing this challenge through targeted training programs, certification courses, and user-friendly development tools is critical for market expansion. Companies such as TigerGraph and Neo4j have launched educational initiatives and community support platforms to build a skilled user base, yet the talent gap remains a bottleneck for scaling advanced graph-based solutions

- In addition, the rapid pace of innovation in graph technology can overwhelm traditional IT teams, further widening the expertise gap. This issue is particularly pronounced among small and medium enterprises that may lack the resources to invest in specialized training

- Bridging this talent shortage through strategic partnerships, academic collaborations, and simplified tooling will be essential to ensure that organizations can fully harness the potential of graph databases for real-time analytics, fraud detection, and knowledge graph applications

Graph Database Market Scope

The market is segmented on the basis of type, application, database, deployment model, analysis type, size, component, and end-user.

• By Type

On the basis of type, the graph database market is segmented into Resource Description Framework (RDF) and Labeled Property Graph (LPG). The Labeled Property Graph (LPG) segment dominated the largest market revenue share in 2024, driven by its flexibility in representing complex relationships with nodes, edges, and key-value properties. LPG's intuitive data modeling structure supports use cases such as knowledge graphs, recommendation engines, and real-time fraud detection with high performance, making it suitable for both transactional and analytical workloads.

The RDF segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by its standardized semantic web framework and strong compatibility with linked data and ontology-based reasoning. RDF finds increasing adoption in government and academic sectors for data integration and compliance with W3C standards, especially in projects that demand strong interoperability across heterogeneous data sources.

• By Application

On the basis of application, the graph database market is segmented into Fraud Detection, Prevention, and Recommendation Engine. Fraud Detection and Prevention held the largest revenue share in 2024, owing to its growing deployment in banking and e-commerce sectors to uncover hidden patterns and detect anomalies in real-time. Graph databases excel at identifying suspicious behavior through connected data insights, offering businesses advanced tools to combat increasingly sophisticated fraud schemes.

The recommendation engine segment is expected to record the fastest growth rate from 2025 to 2032, driven by the demand for hyper-personalized user experiences in sectors such as retail, streaming, and social platforms. Graph-based recommendations leverage multi-dimensional relationships to deliver accurate content and product suggestions, significantly improving customer engagement and satisfaction.

• By Database

On the basis of database type, the graph database market is segmented into Relational (SQL) and Non-relational (NoSQL). The Non-relational (NoSQL) segment held the largest market share in 2024, attributed to its high scalability, schema flexibility, and ability to handle unstructured and semi-structured data. NoSQL graph databases support agile application development and real-time analytics, making them widely adopted across dynamic environments such as social networks, cybersecurity, and knowledge management.

The Relational (SQL) segment is projected to grow at the fastest CAGR from 2025 to 2032 as enterprises integrate graph capabilities into traditional SQL environments. This hybrid approach allows organizations to leverage existing relational infrastructure while gaining advanced relationship-querying features, minimizing operational disruptions and training needs.

• By Deployment Model

On the basis of deployment model, the graph database market is segmented into On-premise and Cloud. The cloud segment dominated the largest revenue share in 2024, driven by growing preference for scalable, cost-effective, and maintenance-free deployment options. Cloud-based graph databases offer on-demand performance, simplified integration with other cloud services, and global accessibility, making them ideal for distributed teams and modern application development.

The on-premise segment is anticipated to witness the fastest growth from 2025 to 2032, particularly among enterprises in highly regulated sectors such as finance, healthcare, and defense. These organizations prefer on-premise setups for greater data control, compliance with strict privacy policies, and security against external threats.

• By Analysis Type

On the basis of analysis type, the graph database market is segmented into Path Analysis, Connectivity Analysis, Community Analysis, and Centrality Analysis. Path analysis held the largest market share in 2024, owing to its critical role in optimizing logistics, detecting fraud chains, and mapping customer journeys. It allows businesses to understand sequences, dependencies, and causal relationships in transactional and operational data.

Community analysis is expected to witness the fastest CAGR from 2025 to 2032, propelled by its applications in marketing, social network analysis, and cybersecurity. It helps identify clusters, influencer groups, and behavior patterns, enabling more targeted interventions and deeper insights into ecosystem dynamics.

• By Size

On the basis of organization size, the market is segmented into Large Enterprises and Small and Medium Enterprises (SMEs). Large enterprises accounted for the largest revenue share in 2024, driven by their extensive need to manage massive and complex datasets across departments and regions. These organizations leverage graph databases for enterprise knowledge graphs, fraud analytics, and supply chain optimization.

The SME segment is expected to grow at the fastest rate from 2025 to 2032 due to increasing digital transformation initiatives and growing access to cloud-based graph solutions. SMEs benefit from improved customer insights and streamlined decision-making without heavy investments in traditional infrastructure.

• By Component

On the basis of component, the graph database market is segmented into Software and Services. The software segment held the largest market share in 2024, attributed to the rising adoption of graph engines and database management platforms for data querying, visualization, and integration. Continuous product innovations and growing open-source availability further strengthen this segment.

The services segment is projected to grow at the highest CAGR from 2025 to 2032, supported by rising demand for consulting, training, integration, and support services. As more organizations explore graph technology, expert services are vital to ensure smooth adoption, performance tuning, and strategic alignment with business goals.

• By End User

On the basis of end user, the graph database market is segmented into Banking, Financial Services and Insurance (BFSI), Telecom and IT, Healthcare and Lifesciences, Transportation and Logistics, Retail and E-commerce, Energy and Utilities, Government and Public, Manufacturing, and Others. The BFSI segment held the largest market share in 2024, driven by the need for robust fraud detection, risk management, and regulatory compliance. Graph databases provide BFSI players with the ability to map complex transactional relationships and track financial crime networks.

The healthcare and lifesciences segment is expected to record the fastest CAGR from 2025 to 2032 due to growing applications in genomics, drug discovery, and patient data integration. Graph technology enables researchers and clinicians to analyze biological networks and medical records in a connected context, accelerating innovation and personalized care.

Graph Database Market Regional Analysis

- North America dominated the graph database market with the largest revenue share of 42.5% in 2024, driven by early adoption of advanced analytics tools, strong investments in AI and machine learning, and the rising need for real-time data processing in industries such as BFSI, healthcare, and IT

- Organizations in the region leverage graph databases for fraud detection, recommendation engines, and complex network analysis across structured and unstructured datasets

- The market's expansion is supported by the presence of leading vendors, growing cloud adoption, and enterprise demand for scalable, high-performance data management solutions

U.S. Graph Database Market Insight

The U.S. graph database market captured the largest revenue share in 2024 within North America, driven by widespread enterprise digitization and integration of graph-based analytics into data platforms. The country's advanced cloud infrastructure and data-centric regulatory environment encourage adoption in finance, healthcare, and retail sectors. U.S. firms are increasingly deploying graph databases for customer experience enhancement, cybersecurity, and relationship intelligence, supported by a robust ecosystem of solution providers and cloud platforms.

Europe Graph Database Market Insight

The Europe graph database market is projected to expand at a strong CAGR throughout the forecast period, primarily due to strict data governance standards such as GDPR and the region's growing focus on data lineage, transparency, and interoperability. The increasing demand for AI-powered insights in telecom, BFSI, and public services fuels growth. Enterprises are adopting graph technologies to enhance fraud detection, improve supply chain visibility, and drive personalization strategies across digital channels.

U.K. Graph Database Market Insight

The U.K. graph database market is expected to grow at a robust CAGR during the forecast period, fueled by rising investments in digital transformation and the growing importance of network analytics in government and finance sectors. The U.K.'s expanding fintech landscape and cybersecurity focus are driving demand for graph-based fraud detection and customer journey mapping solutions. Adoption is also increasing in research institutions and enterprises focused on semantic knowledge graph construction.

Germany Graph Database Market Insight

The Germany graph database market is set to expand steadily during the forecast period, supported by the country's emphasis on Industry 4.0, data automation, and intelligent decision-making. German enterprises are leveraging graph databases for optimizing production networks, predictive maintenance, and IT operations. The integration of graph analytics into legacy systems and ERP platforms is gaining traction, particularly within the automotive, manufacturing, and public sector domains.

Asia-Pacific Graph Database Market Insight

The Asia-Pacific graph database market is poised to grow at the fastest CAGR from 2025 to 2032, fueled by increasing enterprise digitalization, government-backed smart city initiatives, and rapid cloud adoption in economies such as China, India, Japan, and South Korea. Organizations are turning to graph databases to power fraud detection, personalized services, and complex data integration across distributed environments.

Japan Graph Database Market Insight

The Japan graph database market is growing steadily, driven by the country's strong technological infrastructure and rising demand for AI-enhanced data solutions. Enterprises and government agencies are using graph databases to improve semantic search, optimize logistics, and detect patterns in cybersecurity threats. The market is also supported by the integration of graph analytics into IoT and smart manufacturing systems aligned with Japan’s Society 5.0 goals.

China Graph Database Market Insight

The China graph database market held the largest revenue share in Asia Pacific in 2024, attributed to the government's push for data innovation and strong demand from the tech, finance, and logistics sectors. China's fast-growing digital ecosystem is leveraging graph databases to support recommendation systems, fraud detection, and supply chain intelligence. Domestic vendors are actively innovating in the graph space, supported by a large talent pool and favorable policy frameworks.

Graph Database Market Share

The graph database industry is primarily led by well-established companies, including:

- Hewlett Packard Enterprise Development LP (U.S.)

- IBM (U.S.)

- Microsoft (U.S.)

- Siemens (Germany)

- ANSYS, Inc. (U.S.)

- SAP SE (Germany)

- Oracle (U.S.)

- Robert Bosch GmbH (Germany)

- Atos SE (France)

- ABB (Switzerland)

- Kellton (India)

- AVEVA Group Limited (U.K.)

- DXC Technology Company (U.S.)

- Altair Engineering, Inc. (U.S.)

- Hexaware Technologies Limited. (India)

- Tata Consultancy Services Limited (India)

- Infosys Limited (India)

- NTT DATA Group Corporation (Japan)

- Cloud Software Group, Inc. U.S.)

- Redis Ltd (U.S.)

Latest Developments in Global Graph Database Market

- In May 2023, AWS partnered with Neo4j, a key player in defining the graph database landscape and setting open-source standards. As an AWS Marketplace seller, Neo4j has established itself as a leader in the graph database space. In addition, the company has earned the AWS Data and Analytics Competency, highlighting its expertise in delivering advanced data solutions on the AWS platform

- In May 2023, SAP and Google Cloud announced an enhanced partnership, featuring the launch of a comprehensive open data offering aimed at streamlining data landscapes and maximizing the potential of business data. This new initiative combines SAP's and Google Cloud's data and analytics technologies to enhance the accessibility and utility of enterprise data. Furthermore, it aims to propel advancements in enterprise artificial intelligence development, facilitating greater innovation and insights for businesses

- In April 2023, Neo4j partnered with Imperium Solutions to address the rising demand for graph technology in Singapore. Through this collaboration, Imperium Solutions will help customers unlock the full potential of Neo4j, the leading graph database provider known for solving complex, enterprise-level challenges. This partnership aims to enhance the ability to efficiently identify relationships and patterns within vast datasets, driving greater value for businesses in the region

- In February 2023, IBM announced its acquisition of StepZen Inc., the creator of a GraphQL server with an innovative architecture that enables developers to build GraphQL APIs rapidly and with minimal coding. StepZen is designed for high flexibility, seamlessly integrating with various API approaches. In addition, it is offered as a Software as a Service (SaaS) solution, while also supporting deployments in private clouds and on-premises data centers, catering to diverse business needs

- In December 2022, LSEG and Microsoft entered into a 10-year strategic partnership aimed at developing next-generation data and analytics solutions, alongside cloud infrastructure enhancements. As part of this collaboration, Microsoft will make an equity investment in LSEG through a share acquisition. The partnership will leverage Microsoft Azure, artificial intelligence, and Microsoft Teams to design LSEG's data infrastructure and create innovative productivity, data analytics, and modeling solutions for users

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL GRAPH DATABASE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL GRAPH DATABASE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 MULTIVARIATE MODELLING

2.2.5 TOP TO BOTTOM ANALYSIS

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 VENDOR SHARE ANALYSIS

2.2.8 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.9 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL GRAPH DATABASE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTER’S FIVE FORCES ANALYSIS

5.2 REGULATORY STANDARDS

5.3 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

5.4 PENETRATION AND GROWTH POSPECT MAPPING

5.5 NEW BUSINESS AND EMERGING BUSINESS'S REVENUE OPPORTUNITIES

5.6 TECHNOLOGY ANALYSIS

5.6.1 KEY TECHNOLOGIES

5.6.2 COMPLEMENTARY TECHNOLOGIES

5.6.3 ADJACENT TECHNOLOGIES

FIGURE 1 TECHNOLOGY MATRIX

Company Product/Service offered

5.7 COMPANY COMPETITIVE ANALYSIS

5.7.1 STRATEGIC DEVELOPMENT

5.7.2 TECHNOLOGY IMPLEMENTATION PROCESS

5.7.2.1. CHALLENGES

5.7.2.2. INHOUSE IMPLEMENTATION/OUTSOURCED (THIRD PARTY) IMPLEMENTATION

5.7.3 CUSTOMER BASE

5.7.4 SERVICE POSITIONING

5.7.5 CUSTOMER FEEDBACK/RATING (B2B OR B2C)

5.7.6 APPLICATION REACH

5.7.7 SERVICE PLATFORM MATRIX

FIGURE 2 COMPANY COMPARATIVE ANALYSIS

Parameters Company A

Market Share

Growth (%)

Target Audience

Price Structure

Market Strategies

Customer Feedback

Service Positioning

Customer Feedback/Rating

Strategic Development

Application Reach

6 COMPANY SERVICE PLATFORM MATRIX

6.1 USED CASES & ITS ANALYSIS

7 FIG 4. USED CASE ANALYSIS

Company Product/Service offered

8 GLOBAL GRAPH DATABASE MARKET, BY MODEL TYPE

8.1 OVERVIEW

8.2 RESOURCE DESCRIPTION FRAMEWORK (RDF)

8.3 LABELED PROPERTY GRAPH (LPG)

8.4 HYPERGRAPHS

8.5 OTHERS

9 GLOBAL GRAPH DATABASE MARKET, BY SET OF OBJECTS

9.1 OVERVIEW

9.2 NODES

9.3 EDGES

9.4 OTHERS

10 GLOBAL GRAPH DATABASE MARKET, BY OFFERING

10.1 OVERVIEW

10.2 SOLUTION

10.2.1 BY DEPLOYMENT TYPE

10.2.1.1. ON-PREMISE

10.2.1.2. CLOUD

10.3 SERVICES

10.3.1 PROFESSIONAL SERVICES

10.3.2 MANAGED SERVICES

11 GLOBAL GRAPH DATABASE MARKET, BY ANALYSIS TYPE

11.1 OVERVIEW

11.2 PATH ANALYSIS

11.3 CONNECTIVITY ANALYSIS

11.4 COMMUNITY ANALYSIS

11.5 CENTRALITY ANALYSIS

12 GLOBAL GRAPH DATABASE MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FRAUD DETECTION

12.3 REAL-TIME RECOMMENDATION ENGINES

12.4 MASTER DATA MANAGEMENT (MDM)

12.5 NETWORK AND IT OPERATIONS

12.6 IDENTITY AND ACCESS MANAGEMENT (IAM)

13 GLOBAL GRAPH DATABASE MARKET, BY ORGANISATION TYPE

13.1 OVERVIEW

13.2 LARGE ENTERPRISES

13.3 SMALL & MEDIUM ENTERPRISES

14 GLOBAL GRAPH DATABASE MARKET, BY DEPLOYMENT MODE

14.1 OVERVIEW

14.2 ON-PREMISE

14.3 CLOUD

15 GLOBAL GRAPH DATABASE MARKET, BY END USER

15.1 OVERVIEW

15.2 MANUFACTURING & AUTOMOTIVE

15.2.1 BY OFFERING

15.2.1.1. SOLUTION

15.2.1.1.1. BY DEPLOYMENT TYPE

15.2.1.1.1.1 ON-PREMISE

15.2.1.1.1.2 CLOUD

15.2.1.1.1.3 SERVICES

15.2.1.1.1.4 PROFESSIONAL SERVICES

15.2.1.1.1.5 MANAGED SERVICES

15.3 RETAIL AND E-COMMERCE

15.3.1 SOLUTION

15.3.1.1. BY DEPLOYMENT TYPE

15.3.1.1.1. ON-PREMISE

15.3.1.1.2. CLOUD

15.3.1.2. SERVICES

15.3.1.2.1. PROFESSIONAL SERVICES

15.3.1.2.2. MANAGED SERVICES

15.4 HEALTHCARE AND PHARMACEUTICALS

15.4.1 SOLUTION

15.4.1.1. BY DEPLOYMENT TYPE

15.4.1.1.1. ON-PREMISE

15.4.1.1.2. CLOUD

15.4.1.2. SERVICES

15.4.1.2.1. PROFESSIONAL SERVICES

15.4.1.2.2. MANAGED SERVICES

15.5 BANKING, FINANCIAL SERVICES & INSURANCE

15.5.1 SOLUTION

15.5.1.1. BY DEPLOYMENT TYPE

15.5.1.1.1. ON-PREMISE

15.5.1.1.2. CLOUD

15.5.1.2. SERVICES

15.5.1.2.1. PROFESSIONAL SERVICES

15.5.1.2.2. MANAGED SERVICES

15.6 ENERGY & UTILITIES

15.6.1 SOLUTION

15.6.1.1. BY DEPLOYMENT TYPE

15.6.1.1.1. ON-PREMISE

15.6.1.1.2. CLOUD

15.6.1.2. SERVICES

15.6.1.2.1. PROFESSIONAL SERVICES

15.6.1.2.2. MANAGED SERVICES

15.7 GOVERNMENT & PUBLIC

15.7.1 SOLUTION

15.7.1.1. BY DEPLOYMENT TYPE

15.7.1.1.1. ON-PREMISE

15.7.1.1.2. CLOUD

15.7.1.2. SERVICES

15.7.1.2.1. PROFESSIONAL SERVICES

15.7.1.2.2. MANAGED SERVICES

15.8 TELECOM & IT

15.8.1 SOLUTION

15.8.1.1. BY DEPLOYMENT TYPE

15.8.1.1.1. ON-PREMISE

15.8.1.1.2. CLOUD

15.8.1.2. SERVICES

15.8.1.2.1. PROFESSIONAL SERVICES

15.8.1.2.2. MANAGED SERVICES

15.9 TRANSPORTATION & LOGISTICS

15.9.1 SOLUTION

15.9.1.1. BY DEPLOYMENT TYPE

15.9.1.1.1. ON-PREMISE

15.9.1.1.2. CLOUD

15.9.1.2. SERVICES

15.9.1.2.1. PROFESSIONAL SERVICES

15.9.1.2.2. MANAGED SERVICES

15.1 OTHERS

16 GLOBAL GRAPH DATABASE MARKET, BY REGION

16.1 GLOBAL GRAPH DATABASE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

16.1.1 NORTH AMERICA

16.1.1.1. U.S.

16.1.1.2. CANADA

16.1.1.3. MEXICO

16.1.2 EUROPE

16.1.2.1. GERMANY

16.1.2.2. FRANCE

16.1.2.3. U.K.

16.1.2.4. ITALY

16.1.2.5. SPAIN

16.1.2.6. RUSSIA

16.1.2.7. TURKEY

16.1.2.8. BELGIUM

16.1.2.9. NETHERLANDS

16.1.2.10. SWITZERLAND

16.1.2.11. SWEDEN

16.1.2.12. DENMARK

16.1.2.13. POLAND

16.1.2.14. REST OF EUROPE

16.1.3 ASIA PACIFIC

16.1.3.1. JAPAN

16.1.3.2. CHINA

16.1.3.3. SOUTH KOREA

16.1.3.4. INDIA

16.1.3.5. AUSTRALIA AND NEW ZEALAND

16.1.3.6. SINGAPORE

16.1.3.7. THAILAND

16.1.3.8. MALAYSIA

16.1.3.9. INDONESIA

16.1.3.10. PHILIPPINES

16.1.3.11. TAIWAN

16.1.3.12. VIETNAM

16.1.3.13. REST OF ASIA PACIFIC

16.1.4 SOUTH AMERICA

16.1.4.1. BRAZIL

16.1.4.2. ARGENTINA

16.1.4.3. REST OF SOUTH AMERICA

16.1.5 MIDDLE EAST AND AFRICA

16.1.5.1. SOUTH AFRICA

16.1.5.2. EGYPT

16.1.5.3. SAUDI ARABIA

16.1.5.4. U.A.E

16.1.5.5. ISRAEL

16.1.5.6. KUWAIT

16.1.5.7. QATAR

16.1.5.8. REST OF MIDDLE EAST AND AFRICA

16.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

17 GLOBAL GRAPH DATABASE MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT & APPROVALS

17.7 EXPANSIONS

17.8 REGULATORY CHANGES

17.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

18 GLOBAL GRAPH DATABASE MARKET, SWOT ANALYSIS

19 GLOBAL GRAPH DATABASE MARKET, COMPANY PROFILE

19.1 MICROSOFT CORPORATION

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 PRODUCT PORTFOLIO

19.1.4 RECENT DEVELOPMENTS

19.2 IBM CORPORATION

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 PRODUCT PORTFOLIO

19.2.4 RECENT DEVELOPMENTS

19.3 NEO4J INC.

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 PRODUCT PORTFOLIO

19.3.4 RECENT DEVELOPMENTS

19.4 ORACLE CORPORATION

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 PRODUCT PORTFOLIO

19.4.4 RECENT DEVELOPMENTS

19.5 DATASTAX INC.

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 PRODUCT PORTFOLIO

19.5.4 RECENT DEVELOPMENTS

19.6 ARANGOGRAPH DB

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENTS

19.7 TIGERGRAPH

19.7.1 COMPANY SNAPSHOT

19.7.2 REVENUE ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT DEVELOPMENTS

19.8 AMAZON WEB SERVICES INC.

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUE ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENTS

19.9 ONTOTEXT INC.

19.9.1 COMPANY SNAPSHOT

19.9.2 REVENUE ANALYSIS

19.9.3 PRODUCT PORTFOLIO

19.9.4 RECENT DEVELOPMENTS

19.1 STARDOG UNION

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 PRODUCT PORTFOLIO

19.10.4 RECENT DEVELOPMENTS

19.11 SAP SE

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENTS

19.12 MARKLOGIC CORPORATION

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT DEVELOPMENTS

19.13 TIBCO SOFTWARE INC. (CLOUD SOFTWARE GROUP)

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUE ANALYSIS

19.13.3 PRODUCT PORTFOLIO

19.13.4 RECENT DEVELOPMENTS

19.14 FRANZ INC.

19.14.1 COMPANY SNAPSHOT

19.14.2 REVENUE ANALYSIS

19.14.3 PRODUCT PORTFOLIO

19.14.4 RECENT DEVELOPMENTS

19.15 OPENLINK SOFTWARE

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT DEVELOPMENTS

19.16 BITNINE CO. LTD.

19.16.1 COMPANY SNAPSHOT

19.16.2 REVENUE ANALYSIS

19.16.3 PRODUCT PORTFOLIO

19.16.4 RECENT DEVELOPMENTS

19.17 FLUREE

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUE ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT DEVELOPMENTS

19.18 DGRAPH

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 PRODUCT PORTFOLIO

19.18.4 RECENT DEVELOPMENTS

19.19 REDIS LABS

19.19.1 COMPANY SNAPSHOT

19.19.2 REVENUE ANALYSIS

19.19.3 PRODUCT PORTFOLIO

19.19.4 RECENT DEVELOPMENTS

19.2 ALTAIR ENGINEERING INC.

19.20.1 COMPANY SNAPSHOT

19.20.2 REVENUE ANALYSIS

19.20.3 PRODUCT PORTFOLIO

19.20.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

20 RELATED REPORTS

21 QUESTIONNAIRE

22 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.