Global Graphene Infused Packaging Market

Market Size in USD Billion

CAGR :

%

USD

3.64 Billion

USD

8.60 Billion

2024

2032

USD

3.64 Billion

USD

8.60 Billion

2024

2032

| 2025 –2032 | |

| USD 3.64 Billion | |

| USD 8.60 Billion | |

|

|

|

|

Graphene Infused Packaging Market Size

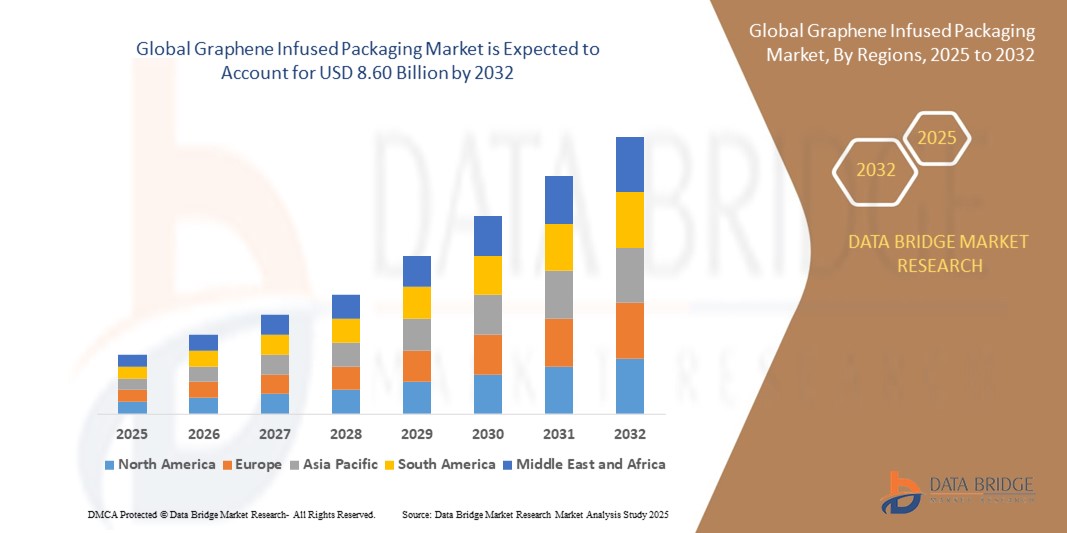

- The global graphene infused packaging market size was valued at USD 3.64 billion in 2024 and is expected to reach USD 8.60 billion by 2032, at a CAGR of 11.35% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced nanomaterials and the rising demand for high-performance packaging across industries such as pharmaceuticals, electronics, and food, where enhanced barrier protection, durability, and thermal stability are essential

- Furthermore, the global shift toward sustainable, lightweight, and recyclable packaging solutions is accelerating the uptake of graphene-infused materials, which offer improved mechanical properties and longer shelf life without compromising environmental goals. These combined factors are significantly boosting the growth trajectory of the graphene infused packaging market

Graphene Infused Packaging Market Analysis

- Graphene infused packaging involves the integration of graphene nanoplatelets or other graphene derivatives into conventional packaging materials such as polyethylene or polypropylene to enhance their mechanical strength, barrier performance, thermal conductivity, and anti-static properties

- The growing appeal of graphene-infused packaging is driven by the need for lightweight, multifunctional, and sustainable solutions, especially in sectors handling sensitive products, where protection against moisture, oxygen, or physical stress is critical. The market is also benefitting from advancements in graphene production techniques and increased investment in scalable commercial applications

- North America dominated the graphene infused packaging market with a share of 35.5% in 2024, due to increasing investments in advanced materials, strong demand from the pharmaceutical and electronics industries, and a well-established packaging infrastructure

- Asia-Pacific is expected to be the fastest growing region in the graphene infused packaging market during the forecast period due to rapid industrialization, growing electronics exports, and government initiatives promoting smart materials in countries such as China, Japan, and South Korea

- Multiple layer segment dominated the market with a market share of 57.9% in 2024, due to its enhanced protective properties and suitability for high-performance packaging applications. Multilayered structures allow for the integration of graphene between layers, significantly improving barrier performance, mechanical strength, and longevity of packaging solutions. This format is particularly valued in sectors where protection against environmental degradation, moisture ingress, and physical stress is crucial

Report Scope and Graphene Infused Packaging Market Segmentation

|

Attributes |

Graphene Infused Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Graphene Infused Packaging Market Trends

“Rising Demand for Sustainable Packaging Solutions”

- Graphene-infused packaging is gaining traction as industries across food, pharmaceuticals, and electronics seek sustainable alternatives to conventional plastic packaging

- For instance, companies such as Gerdau Graphene and Packseven have developed commercial stretch films with graphene that use less virgin plastic while delivering over 120% more durability, supporting both cost efficiency and environmental goals

- Graphene’s ability to act as a powerful oxygen, moisture, and UV barrier makes it ideal for packaging fresh food and temperature-sensitive medical products, where product integrity and extended shelf life are critical

- Consumer demand for eco-conscious packaging is pressuring brands and governments to phase out single-use plastics, encouraging the shift to high-performance materials such as graphene-enhanced polymer composites

- Graphene’s compatibility with biodegradable substrates (such as starch-based films and coated paper) is opening new avenues for fully compostable and high-strength packaging solutions

- The growth of smart packaging is also fueled by graphene’s conductive properties, enabling embedded sensors, freshness indicators, and tamper-detection features in next-gen packaging formats

Graphene Infused Packaging Market Dynamics

Driver

“Increased Strength and Durability”

- Graphene significantly enhances the mechanical properties of packaging materials—offering resistance to punctures, tears, pressure, and extreme handling—while allowing reduced material thickness

- For instance, graphene-polymer composites developed by Gerdau Graphene are being used in industrial stretch films that stabilize heavy loads, prevent packaging failure, and reduce plastic consumption across cold chains and logistics

- These superior strength attributes make graphene a suitable additive in packaging for e-commerce, perishables, and high-value goods where shipment integrity is essential

- Graphene’s enhancement of polymer chains also leads to higher tensile strength and flexibility, allowing multi-layer packaging systems to be optimized for both protection and convenience

- With applications ranging from simple wrapping films to rigid trays and protective cases, graphene is helping manufacturers reduce overall package weight without compromising safety or durability

Restraint/Challenge

“High Production Costs”

- The mass production of high-quality graphene remains expensive due to labor-intensive processes such as chemical vapor deposition (CVD), liquid-phase exfoliation, and purification that drive up per-unit costs

- For instance, even with improved manufacturing efficiencies, suppliers in North America and Europe report average costs of $200–$500 per kilogram for high-purity graphene—making it difficult to integrate into high-volume packaging lines

- The lack of standardized graphene grades and performance benchmarks complicates integration across packaging formats, requiring custom blends and costly formulation testing

- Entry-level packaging applications primarily operate under thin profit margins, making widespread graphene adoption unviable without government incentives or dramatic cost reductions

- Regulatory hurdles, especially around food-safe packaging and contact materials, require extensive testing and certifications, which delays commercialization and increases go-to-market expenditures

Graphene Infused Packaging Market Scope

The market is segmented on the basis of end-user industries and application.

- By End-User Industries

On the basis of end-user industries, the graphene infused packaging market is segmented into pharmaceuticals, electronics and semiconductor, food, and others. The pharmaceuticals segment accounted for the largest market revenue share in 2024, owing to growing concerns over product stability, contamination prevention, and the rising need for advanced barrier solutions in drug packaging. Graphene’s exceptional antimicrobial properties and moisture resistance make it highly suitable for preserving drug efficacy during storage and transit. In addition, regulatory emphasis on extending shelf life and reducing material waste is reinforcing the preference for graphene-based packaging in this sector.

The electronics and semiconductor segment is projected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for static-dissipative, thermally conductive, and EMI-shielding packaging materials. As devices and components become smaller and more sensitive, graphene's ability to shield against electromagnetic interference while offering superior thermal management is attracting significant investment. The growing use of flexible and miniaturized electronics is further boosting adoption across global supply chains in this vertical.

- By Application

On the basis of application, the graphene infused packaging market is segmented into single layer and multiple layer. The multiple layer segment dominated the largest market revenue share of 57.9% in 2024, largely due to its enhanced protective properties and suitability for high-performance packaging applications. Multilayered structures allow for the integration of graphene between layers, significantly improving barrier performance, mechanical strength, and longevity of packaging solutions. This format is particularly valued in sectors where protection against environmental degradation, moisture ingress, and physical stress is crucial.

The single layer segment is anticipated to record the fastest CAGR from 2025 to 2032, driven by cost-effectiveness, ease of manufacturing, and increasing use in lightweight packaging formats. As packaging producers seek to reduce material complexity without compromising performance, single-layer graphene coatings and films are emerging as a scalable alternative. The rise of sustainable packaging initiatives and circular economy practices is also encouraging investment in simpler, recyclable solutions where single-layer applications offer a balance of performance and environmental compliance.

Graphene Infused Packaging Market Regional Analysis

- North America dominated the graphene infused packaging market with the largest revenue share of 35.5% in 2024, driven by increasing investments in advanced materials, strong demand from the pharmaceutical and electronics industries, and a well-established packaging infrastructure

- Regional manufacturers are actively adopting graphene-enhanced materials to improve packaging performance, particularly in high-value sectors requiring moisture resistance, thermal stability, and extended shelf life

- The region’s focus on sustainable and high-performance packaging, along with robust R&D capabilities and regulatory support for novel materials, continues to position graphene-infused solutions at the forefront of innovation

U.S. Graphene Infused Packaging Market Insight

The U.S. graphene infused packaging market captured the largest revenue share in 2024 within North America, driven by the early commercialization of graphene technologies and growing adoption in pharmaceutical and semiconductor packaging. U.S.-based firms are actively investing in scalable production methods and forming strategic partnerships to integrate graphene into mainstream packaging solutions. The increasing shift toward eco-friendly, recyclable packaging with superior barrier properties is further fueling demand.

Europe Graphene Infused Packaging Market Insight

The Europe graphene infused packaging market is projected to expand at a significant CAGR over the forecast period, supported by stringent environmental regulations and the push for sustainable packaging across the EU. The region’s strong base in electronics, pharmaceuticals, and food industries is fostering the adoption of graphene-infused materials. Government funding for advanced materials research and increasing preference for lightweight, high-strength packaging further contribute to regional market growth.

U.K. Graphene Infused Packaging Market Insight

The U.K. market is anticipated to witness notable growth, supported by strong academic and industrial collaborations focused on graphene innovation. The country’s packaging industry is emphasizing smart, functional, and environmentally friendly materials, which aligns well with the properties offered by graphene. Rising demand for longer shelf life in food and pharmaceutical packaging and the growing trend toward digitalized logistics are expected to drive the adoption of graphene-based solutions.

Germany Graphene Infused Packaging Market Insight

Germany’s graphene infused packaging market is expected to grow at a healthy pace, bolstered by the country’s leadership in both materials science and high-end manufacturing. German firms are leveraging graphene to enhance packaging durability and performance, particularly in sectors demanding strict quality control such as automotive electronics and life sciences. A strong focus on industrial automation and sustainability supports ongoing investment in graphene-enabled packaging technologies.

Asia-Pacific Graphene Infused Packaging Market Insight

The Asia-Pacific market is projected to register the fastest CAGR from 2025 to 2032, driven by rapid industrialization, growing electronics exports, and government initiatives promoting smart materials in countries such as China, Japan, and South Korea. The region’s large-scale manufacturing capacity, cost-efficient production, and expanding pharmaceutical and semiconductor sectors are fueling the demand for advanced graphene-based packaging solutions.

Japan Graphene Infused Packaging Market Insight

Japan is witnessing steady growth in the graphene infused packaging market due to its innovation-driven economy and early adoption of nanomaterials. The packaging needs of Japan’s high-end electronics and aging population, particularly in pharmaceuticals and health care, are aligning with graphene’s properties. Strong R&D and government funding into graphene commercialization are supporting domestic market expansion.

China Graphene Infused Packaging Market Insight

China accounted for the largest revenue share in the Asia-Pacific graphene infused packaging market in 2024, driven by a booming electronics industry, a growing pharmaceutical sector, and supportive government policies. China leads in graphene production and is rapidly commercializing its application in industrial packaging. The country's expansive e-commerce and logistics sectors are also driving demand for high-strength, lightweight, and protective packaging formats infused with graphene.

Graphene Infused Packaging Market Share

The graphene infused packaging industry is primarily led by well-established companies, including:

- Abalonyx AS (Norway)

- Advanced Graphene Products (Italy)

- Metalgrass LTD (U.K.)

- Haydale Graphene Industries plc (U.K.)

- Applied Graphene Materials (U.K.)

- Global Graphene Group (U.S.)

- Graphene NanoChem (Malaysia)

- First Graphene (Australia)

- Elcora Advanced Materials (Canada)

- Graphene One (U.S.)

- Graphite Central (U.K.)

- Versarien plc (U.K.)

- Graphenest, S.A. (Spain)

- Swinburne (Australia)

- 2D Materials (U.K.)

- Directa Plus S.p.A (Italy)

- Graphene Square Inc. (South Korea)

- NANOGRAFEN (Turkey)

- NANOSPAN (U.S.)

Latest Developments in Global Graphene Infused Packaging Market

- In November 2024, Gerdau Graphene was named a platinum award winner at the 35th Packaging Innovation Awards (PIA) for its graphene-enhanced packaging solution, Poly-G. This recognition underscores the product's disruptive potential in the packaging industry, as Poly-G merges sustainability with advanced performance features. Its suitability for extrusion-based applications such as films, profiles, and sheets is expected to accelerate the adoption of graphene-infused materials across industrial packaging formats

- In July 2024, Black Swan Graphene Inc. introduced the Graphene Enhanced Masterbatch (GEM) S27M under its GraphCore-01 product line. This high-density polyethylene (HDPE) masterbatch, infused with 10% graphene nanoplatelets (GNPs), is poised to significantly elevate the functionality of plastic packaging by enhancing durability, strength, and performance. This innovation reinforces the growing commercial viability of graphene-based additives in the polymer and packaging markets

- In 2020, Graphenea SA introduced the S11 and S12 graphene-based sensors under their GEFT product line. These advanced sensors are anticipated to significantly boost the graphene-based sensors segment, enhancing the company's position in the market. The expansion of this product line reflects Graphenea’s commitment to leveraging cutting-edge graphene technology to meet growing demand and innovate within the sensor industry

- In 2020, NanoXplore Inc. acquired Continental Structural Plastics through its subsidiary RMC Advanced Technologies Inc. This strategic acquisition is expected to broaden NanoXplore’s operational presence in the US, providing a substantial growth opportunity. The move is designed to strengthen NanoXplore's market position and expand its capabilities in advanced materials and composites, facilitating further business development and market expansion

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Graphene Infused Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Graphene Infused Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Graphene Infused Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.