Global Graphic Film Market

Market Size in USD Billion

CAGR :

%

USD

31.16 Billion

USD

73.50 Billion

2024

2032

USD

31.16 Billion

USD

73.50 Billion

2024

2032

| 2025 –2032 | |

| USD 31.16 Billion | |

| USD 73.50 Billion | |

|

|

|

|

What is the Global Graphic Film Market Size and Growth Rate?

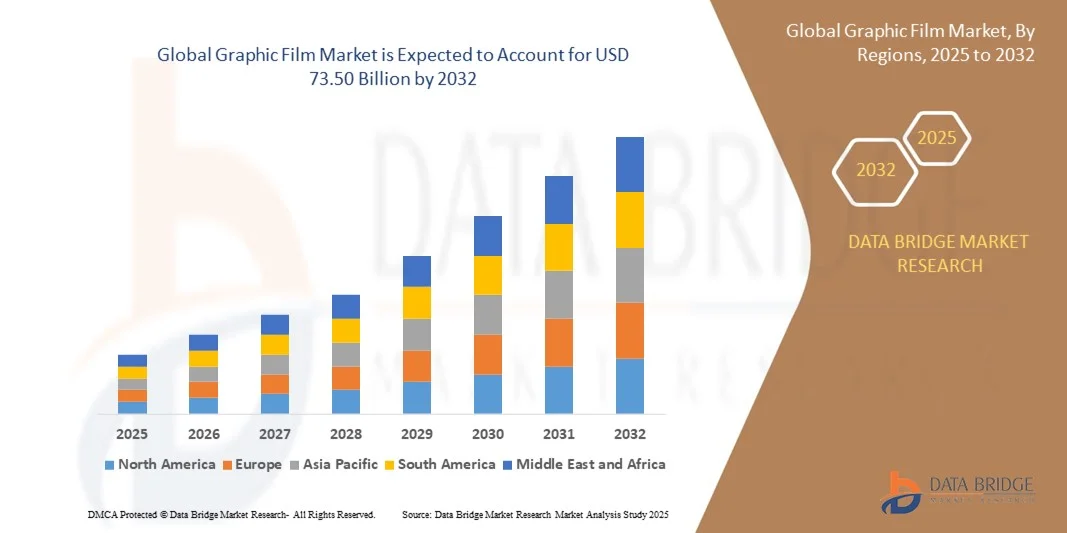

- The global graphic film market size was valued at USD 31.16 billion in 2024 and is expected to reach USD 73.50 billion by 2032, at a CAGR of 11.32% during the forecast period

- The graphic film Market has witnessed huge growth owing to the development of the infrastructure, rapidly increasing urbanization leads to an increase in the activities in the construction industry. The growing advancement in the film industry, expansion of novel manufacturing techniques, and inflation in purchasing ability have added fuel to the growth of this market

What are the Major Takeaways of Graphic Film Market?

- Lightweights, recyclability, cost-effectiveness, high durability, and excellent print-ability are some of the basic characteristics of the material that has fostered the demand for graphic films. The growing use of graphic film for making promotional and advertising banners and vehicle wraps in the automotive and advertising industries is another major factor expected to drive the growth of the graphic film market over the forecast period.

- Asia-Pacific dominated the graphic film market with the largest revenue share of 42.3% in 2024, supported by rapid urbanization, increasing disposable incomes, and the strong expansion of advertising and promotional activities

- The North America graphic film market is anticipated to grow at the fastest CAGR of 12.8% from 2025 to 2032, supported by surging demand in promotional advertising, fleet graphics, and industrial applications

- The PVC segment dominated the market with the largest revenue share of 48.6% in 2024, owing to its versatility, durability, and cost-effectiveness

Report Scope and Graphic Film Market Segmentation

|

Attributes |

Graphic Film Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Graphic Film Market?

Sustainability and Eco-Friendly Materials Driving Market Growth

- A major trend shaping the global graphic film market is the increasing demand for sustainable and eco-friendly films made from recyclable and biodegradable materials. Growing consumer awareness of environmental impact, along with stricter government regulations on single-use plastics, is compelling manufacturers to innovate with green alternatives

- For instance, Avery Dennison has been investing in recyclable label and film solutions, aiming to reduce plastic waste and improve circularity across packaging. Similarly, Innovia Films introduced propyl-based films that are recyclable and designed to replace traditional PVC films

- Eco-friendly graphic films are being adopted by industries such as advertising, automotive wraps, and packaging, where companies want to reduce their carbon footprint while still ensuring durability, performance, and aesthetics. These films often feature reduced VOC emissions, energy-efficient production, and compatibility with sustainable inks

- The push for green printing technologies further complements this trend, as water-based and UV inks combine with sustainable films to create environmentally responsible solutions for branding and promotions

- This shift towards sustainability is not just a compliance requirement but also a market differentiator, as end-users increasingly prefer brands with visible commitments to eco-conscious practices. Consequently, leading players such as 3M, Avery Dennison, and HEXIS S.A. are aligning their R&D pipelines with the development of low-impact, recyclable, and bio-based graphic films

- The growing adoption of sustainable graphic films highlights a long-term market transformation, ensuring that environmentally responsible products become central to growth in both developed and emerging markets

What are the Key Drivers of Graphic Film Market?

- The expanding advertising and branding industry, particularly outdoor advertising, vehicle wraps, and promotional displays, is one of the strongest drivers of the Graphic Film market. Graphic films provide durability, weather resistance, and high-quality visuals, making them a preferred choice for advertisers

- For instance, in March 2024, 3M expanded its Envision Print Film Series, which is non-PVC and designed for sustainability without compromising performance, showing how innovation aligns with rising demand

- The growing automotive sector is also boosting demand, as graphic films are increasingly used in vehicle wrapping for both commercial branding and personalization. The versatility and cost-effectiveness of films compared to traditional paint jobs enhance their appeal

- In addition, the shift towards eco-friendly solutions and rising regulations on plastic waste are pushing companies and consumers to adopt recyclable and sustainable film options. Industries such as packaging, retail, and signage are leading this adoption

- The surge of e-commerce and digital printing has also fueled demand, as more small businesses and brands are opting for custom films to create cost-effective, flexible, and visually appealing promotional materials

- Together, these factors highlight that the Graphic Film market is being propelled by a combination of branding needs, automotive innovation, and sustainable packaging adoption across multiple industries

Which Factor is Challenging the Growth of the Graphic Film Market?

- One of the biggest challenges facing the graphic film market is the environmental concern around plastic waste and recycling limitations. Traditional films, often made from PVC and other non-recyclable plastics, contribute to landfill waste and face growing scrutiny

- For instance, the EU’s tightening regulations on single-use plastics have directly impacted the use of non-sustainable films, forcing companies to transition toward greener alternatives

- Another challenge is the high cost of advanced sustainable films compared to conventional options. While eco-friendly graphic films provide environmental benefits, their higher price point can limit adoption, particularly in price-sensitive regions

- Fluctuations in raw material prices, such as resins and polymers, also create supply chain pressures, impacting manufacturers’ profit margins and pricing strategies

- In addition, competition from digital signage solutions is posing a threat, as more businesses switch from printed films to digital displays for dynamic advertising. This substitution risk could slow growth in certain segments such as outdoor promotions

- Overcoming these challenges will require greater investment in recycling technologies, cost reduction in sustainable films, and product diversification to compete effectively with digital alternatives. Manufacturers focusing on innovation and circular economy practices are expected to strengthen long-term resilience in the market

How is the Graphic Film Market Segmented?

The market is segmented on the basis of polymer, film type, printing technology, and end-use.

- By Polymer

On the basis of polymer, the Graphic Film market is segmented into PVC, PP, and PE. The PVC segment dominated the market with the largest revenue share of 48.6% in 2024, owing to its versatility, durability, and cost-effectiveness. PVC-based graphic films are widely used for outdoor advertising, vehicle wraps, and signage applications due to their superior printability and resistance to weathering. The material’s compatibility with various adhesives and finishes further strengthens its preference among manufacturers and advertisers.

The PP segment is expected to witness the fastest growth rate of 20.9% from 2025 to 2032, driven by its eco-friendliness, recyclability, and growing use in sustainable packaging and labeling solutions. PP films are lightweight, moisture-resistant, and increasingly favored by brands aiming to reduce environmental impact while maintaining print quality. As sustainability gains prominence, demand for PP-based films is projected to expand significantly across industries.

- By Film Type

On the basis of film type, the Graphic Film market is segmented into Opaque, Reflective, Transparent, and Translucent. The Opaque segment held the largest revenue share of 41.7% in 2024, supported by its extensive use in billboards, hoardings, and large-scale promotional campaigns where vibrant visuals and complete light blocking are critical. These films provide excellent color reproduction and durability, making them a preferred choice for outdoor applications that require long-lasting visibility.

The Reflective segment is projected to register the fastest CAGR of 21.3% during 2025 to 2032, fueled by rising adoption in safety, automotive signage, and transportation sectors. Reflective graphic films enhance nighttime visibility, ensuring compliance with road safety regulations and boosting branding opportunities for fleet graphics. Increasing demand from infrastructure and automotive industries is expected to accelerate the uptake of reflective films in the coming years.

- By End Use

On the basis of end use, the Graphic Film market is segmented into Promotional & Advertisement, Industrial, and Automotive. The Promotional & Advertisement segment dominated the market with the largest revenue share of 52.4% in 2024, driven by high demand for retail branding, outdoor advertising, point-of-sale displays, and exhibition graphics. The growing emphasis on visual marketing and the ability of graphic films to deliver eye-catching and customizable designs underpin this segment’s dominance.

The Automotive segment is forecasted to witness the fastest CAGR of 22.5% from 2025 to 2032, supported by rising adoption of vehicle wraps, fleet graphics, and paint protection films. Automakers and aftermarket service providers are increasingly using graphic films to enhance aesthetics, brand visibility, and protective coatings. With consumer preference shifting toward personalization and durability, automotive applications are expected to become a major growth driver in the market.

- By Printing Technology

On the basis of printing technology, the Graphic Film market is segmented into Digital and Rotogravure. The Digital segment accounted for the largest market revenue share of 57.1% in 2024, propelled by the increasing demand for short-run, customizable, and on-demand printing solutions. Digital printing offers high-quality graphics, faster turnaround times, and cost efficiency for small batches, making it the preferred technology for promotional graphics, retail displays, and personalized advertising campaigns.

The Rotogravure segment is anticipated to witness the fastest CAGR of 19.4% from 2025 to 2032, owing to its suitability for large-scale, high-volume production with consistent print quality. Rotogravure printing is extensively used in packaging, labels, and industrial applications, where durability and precision are critical. As industries expand their branding efforts with mass-scale graphic films, demand for rotogravure-printed solutions is projected to rise steadily.

Which Region Holds the Largest Share of the Graphic Film Market?

- Asia-Pacific dominated the graphic film market with the largest revenue share of 42.3% in 2024, supported by rapid urbanization, increasing disposable incomes, and the strong expansion of advertising and promotional activities. The region’s thriving automotive and packaging industries are also major contributors, driving large-scale demand for vehicle wraps, billboards, and industrial labeling solutions

- Consumers in Asia-Pacific highly value the affordability, durability, and versatility of Graphic Films, which are increasingly being integrated into marketing campaigns and automotive personalization

- The presence of large-scale manufacturing hubs in China, India, and Japan enhances production efficiency and affordability, further boosting adoption across residential, commercial, and industrial sectors

China Graphic Film Market Insight

The China graphic film market captured the largest revenue share within Asia-Pacific in 2024, attributed to the country’s vast advertising industry, rapid infrastructure growth, and technological innovation. China’s expanding middle class and increasing demand for automotive customization have further fueled adoption. Domestic manufacturers play a vital role in offering cost-effective, high-quality solutions, while the government’s focus on digitalization and smart cities is creating new opportunities for graphic film applications.

Japan Graphic Film Market Insight

The Japan graphic film market is gaining significant traction, driven by the nation’s tech-savvy culture, innovation-driven industries, and rising need for eco-friendly solutions. Japanese consumers prioritize premium-quality, sustainable, and technologically advanced films, particularly for automotive, promotional, and architectural applications. In addition, Japan’s aging population is fostering demand for clear, durable, and easy-to-maintain films, aligning with preferences for high safety and energy-efficient solutions.

Europe Graphic Film Market Insight

The Europe graphic film market is projected to expand at a healthy CAGR over the forecast period, backed by stringent sustainability regulations and the rising demand for advanced printing technologies. Growth is particularly strong in sectors such as automotive wraps, packaging, and large-format retail promotions. European consumers also value eco-friendly films with recyclability and energy efficiency features. The adoption of Graphic Films is accelerating across both renovation projects and new constructions, supported by strict compliance with environmental and safety standards.

U.K. Graphic Film Market Insight

The U.K. graphic film market is expected to grow at a notable CAGR, propelled by strong adoption in advertising, retail, and transport sectors. High demand for customizable, digitally printed films in retail spaces and vehicle branding is driving market growth. In addition, U.K. businesses are investing heavily in sustainable and recyclable films to align with environmental goals, further supporting expansion.

Germany Graphic Film Market Insight

The Germany graphic film market is witnessing substantial growth, fueled by increasing adoption in automotive and industrial sectors. German manufacturers emphasize high-quality, eco-conscious solutions, integrating recyclable polymers and innovative film types. The demand for digitally printed graphic films for advertising and architectural purposes continues to expand, while the country’s strong automotive aftermarket supports rising vehicle wrap applications.

Which Region is the Fastest Growing Region in the Graphic Film Market?

The North America graphic film market is anticipated to grow at the fastest CAGR of 12.8% from 2025 to 2032, supported by surging demand in promotional advertising, fleet graphics, and industrial applications. The region’s highly developed retail infrastructure and the strong presence of leading brands drive large-scale adoption of graphic films for marketing and display purposes. Rising interest in automotive wraps and the increasing use of eco-friendly and recyclable films are further boosting the industry.

U.S. Graphic Film Market Insight

The U.S. graphic film market accounted for the largest revenue share within North America in 2024, driven by high spending on marketing campaigns, automotive customization, and packaging innovations. The strong presence of multinational brands and advertising agencies, combined with growing consumer demand for sustainability, is encouraging the use of digitally printed and recyclable films. The U.S. also leads in technological innovation, promoting advanced digital printing methods that support vibrant, customizable designs.

Which are the Top Companies in Graphic Film Market?

The graphic film industry is primarily led by well-established companies, including:

- DuPont de Nemours, Inc. (U.S.)

- 3M (U.S.)

- Innovia Films (U.K.)

- Avery Dennison Corporation (U.S.)

- HEXIS S.A. (France)

- KPMF Limited (U.K.)

- DUNMORE (U.S.)

- Achilles USA (U.S.)

- CONSTANTIA (Austria)

- Drytac Corporation (U.K.)

- THE GRIFF NETWORK (U.S.)

- Arlon Graphics, LLC (U.S.)

- FDC Films (U.S.)

- Nekoosa Inc. (U.S.)

- Charter NEX (U.S.)

- Aura Graphics Limited (U.K.)

What are the Recent Developments in Global Graphic Film Market?

- In October 2023, Avery Dennison Corporation (U.S.) partnered with Siser North America, announcing the retail launch of EasyPSV Starling, a pressure-sensitive vinyl film product, designed for enhanced durability and ease of application. This launch highlights Avery Dennison’s continued innovation in the graphic film sector

- In October 2023, DuPont de Nemours, Inc. (U.S.) collaborated with United States Steel Corporation to introduce COASTALUME, a product that merges the durability of U.S. Steel’s GALVALUME material with DuPont Tedlar Polyvinyl Fluoride (PVF) film. This collaboration reflects the companies’ commitment to high-performance and long-lasting material solutions

- In October 2023, Drytac launched Polar Blockout UV, an opaque printable block-out film tailored for two-sided window graphics and other block-out requirements. This product strengthens Drytac’s position as a provider of versatile and practical printing solutions

- In September 2023, Drytac introduced its new ReTac Clear PET film in the North American market, offering a flexible and easy-to-remove solution for graphics applications. This expansion underlines Drytac’s focus on eco-friendly and customer-centric innovations

- In July 2023, Innovia, a subsidiary of CCL Industries (U.S.), invested in a new coating line at its Wigton, Great Britain site, aimed at developing a new series of PVC-free films for the graphics sector. This investment highlights Innovia’s sustainability-driven approach to the evolving film industry

- In March 2023, ORAFOL Europe GmbH (Germany) launched the Oracle 651 Matte PVC film, suitable for both indoor and outdoor applications, available in 18 matte color variations. This launch reinforces ORAFOL’s reputation for offering stylish and durable film solutions

- In March 2023, HEXIS S.A.S (France) announced the acquisition of Stickittome, a supplier of vinyl films for the printing and cutting process, strengthening HEXIS’s global supply and distribution capabilities. This acquisition showcases HEXIS’s expansion strategy in the graphics market

- In March 2023, Avery Dennison Corporation expanded its product portfolio by adding DOL 1060 Max and DOL 1360 Max, designed for extended durability and performance. This expansion reflects the company’s efforts to address diverse customer needs in the graphics segment

- In November 2022, CCL Industries launched a new generation of high-gloss polypropylene films, printable by both HP Latex and UV Inkjet systems. This launch emphasizes CCL’s focus on innovation and adaptability in printing technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Graphic Film Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Graphic Film Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Graphic Film Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.