Global Graphics Processing Units Gpu Database Market

Market Size in USD Million

CAGR :

%

USD

603.75 Million

USD

2,444.29 Million

2025

2033

USD

603.75 Million

USD

2,444.29 Million

2025

2033

| 2026 –2033 | |

| USD 603.75 Million | |

| USD 2,444.29 Million | |

|

|

|

|

Graphics Processing Units (GPU) Database Market Size

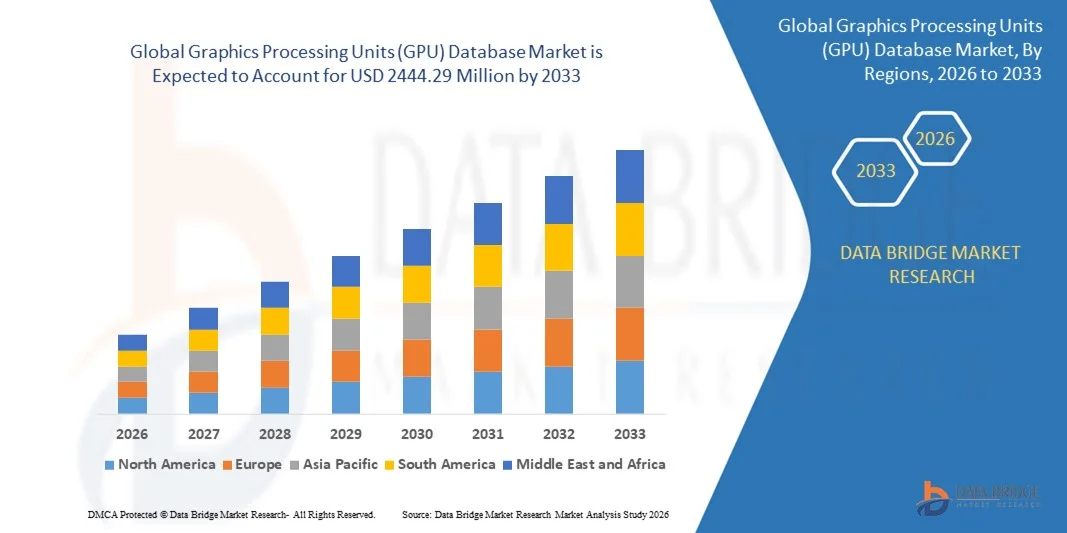

- The global Graphics Processing Units (GPU) Database market size was valued at USD 603.75 million in 2025 and is expected to reach USD 2444.29 million by 2033, at a CAGR of 19.10% during the forecast period

- The market growth is largely driven by the increasing adoption of artificial intelligence, machine learning, and real-time analytics, which require high-performance data processing capabilities supported by GPU-accelerated databases

- Furthermore, the rising volume of structured and unstructured data across enterprises, combined with the need for faster query execution and low-latency insights, is accelerating the adoption of GPU databases, thereby significantly boosting overall market growth

Graphics Processing Units (GPU) Database Market Analysis

- Graphics Processing Units (GPU) Database, designed to leverage parallel processing capabilities of GPUs for data storage and analytics, are becoming critical components of modern data architectures across cloud and on-premises environments due to their ability to handle large-scale, compute-intensive workloads efficiently

- The growing emphasis on real-time decision-making, advanced analytics, and AI-driven applications across BFSI, retail, healthcare, and IT sectors is a key factor driving sustained demand for GPU database solutions

- North America dominated the Graphics Processing Units (GPU) Database market with a share of 34.57% in 2025, due to early adoption of high-performance computing, strong presence of hyperscale cloud providers, and rapid deployment of AI- and data-intensive applications

- Asia-Pacific is expected to be the fastest growing region in the Graphics Processing Units (GPU) Database market during the forecast period due to rapid digitalization, expanding cloud infrastructure, and increasing adoption of AI technologies

- Tools segment dominated the market with a market share of 59.14% in 2025, due to the critical role of GPU-accelerated database engines, query optimizers, and analytics platforms in handling large-scale parallel data processing. Enterprises increasingly rely on GPU database tools to achieve faster query execution, real-time analytics, and improved performance for AI- and ML-driven workloads. The growing adoption of data-intensive applications in finance, retail, and scientific research further strengthens demand for advanced GPU database tools. Their ability to seamlessly integrate with existing data architectures and analytics frameworks supports widespread enterprise adoption

Report Scope and Graphics Processing Units (GPU) Database Market Segmentation

|

Attributes |

Graphics Processing Units (GPU) Database Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Graphics Processing Units (GPU) Database Market Trends

Rising Adoption of GPU Databases for Real-Time Analytics

- A major trend in the Graphics Processing Units (GPU) Database market is the increasing adoption of GPU-accelerated databases for real-time analytics, driven by the need to process massive data volumes with low latency across data-intensive industries. Organizations are shifting toward GPU databases to support faster query execution and parallel data processing, especially for AI-driven and analytical workloads

- For instance, companies such as Kinetica and SQream Technologies offer GPU-native databases that enable real-time analytics for telecommunications, financial services, and geospatial applications. These platforms allow enterprises to analyze streaming and historical data simultaneously, improving decision-making speed and operational efficiency

- The growing use of GPU databases in AI and machine learning pipelines is strengthening this trend, as GPUs significantly reduce model training and inference times when combined with high-performance databases. This capability is becoming essential for applications requiring instant insights from continuously generated data

- Cloud service providers are also integrating GPU database technologies into their platforms to meet enterprise demand for scalable real-time analytics. This integration is making GPU databases more accessible and accelerating adoption across mid-sized and large organizations

- Industries such as retail, BFSI, and healthcare are increasingly relying on GPU databases to support real-time personalization, fraud detection, and predictive analytics. These use cases highlight the expanding role of GPU databases as foundational components of modern data architectures

- Overall, the rising emphasis on speed, scalability, and real-time insight generation is reinforcing the position of GPU databases as a critical technology supporting next-generation analytics and AI-driven enterprise systems

Graphics Processing Units (GPU) Database Market Dynamics

Driver

Growing Demand for AI and Machine Learning Workloads

- The rapid expansion of artificial intelligence and machine learning applications is a primary driver for the GPU database market, as these workloads require high-throughput and parallel data processing capabilities. GPU databases enable faster handling of complex datasets, supporting advanced analytics and model development

- For instance, NVIDIA has advanced GPU database adoption through platforms such as RAPIDS and partnerships with cloud providers, enabling accelerated data processing for AI workloads. These solutions allow enterprises to run data preparation, analytics, and machine learning tasks more efficiently

- The increasing deployment of AI across sectors such as BFSI, retail, and healthcare is driving demand for databases capable of supporting real-time inference and large-scale model training. GPU databases address these requirements by significantly reducing processing times

- Enterprises are also adopting GPU databases to support recommendation engines, image and video analytics, and natural language processing applications. These workloads benefit from GPU acceleration due to their compute-intensive nature

- The growing integration of AI into core business operations continues to reinforce this driver. As organizations scale their AI initiatives, the reliance on GPU-accelerated database solutions is expected to strengthen further

Restraint/Challenge

High Cost and Deployment Complexity

- High cost and deployment complexity remain key challenges in the GPU database market, as organizations must invest in specialized GPU hardware and supporting infrastructure. These requirements increase upfront capital expenditure and limit adoption among cost-sensitive enterprises

- For instance, deploying enterprise-grade GPU database solutions from providers such as OmniSci or SQream Technologies often requires skilled professionals for configuration, optimization, and maintenance. The need for specialized expertise adds to operational complexity and costs

- GPU databases also demand careful workload optimization to achieve expected performance benefits, which can be challenging for organizations lacking in-house technical capabilities. Improper configuration may result in underutilized GPU resources

- Integration with existing data ecosystems and legacy systems further complicates deployment, increasing implementation timelines. This can slow adoption for organizations seeking rapid returns on investment

- These cost and complexity barriers continue to restrain market growth, particularly among small and mid-sized enterprises, despite the performance advantages offered by GPU database technologies

Graphics Processing Units (GPU) Database Market Scope

The market is segmented on the basis of component, deployment, application, and end user.

- By Component

On the basis of component, the Graphics Processing Units (GPU) Database market is segmented into tools and services. The tools segment dominated the market with the largest revenue share 59.14% in 2025, driven by the critical role of GPU-accelerated database engines, query optimizers, and analytics platforms in handling large-scale parallel data processing. Enterprises increasingly rely on GPU database tools to achieve faster query execution, real-time analytics, and improved performance for AI- and ML-driven workloads. The growing adoption of data-intensive applications in finance, retail, and scientific research further strengthens demand for advanced GPU database tools. Their ability to seamlessly integrate with existing data architectures and analytics frameworks supports widespread enterprise adoption.

The services segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for deployment, integration, and managed services tailored to GPU database environments. Organizations adopting GPU databases often require specialized expertise for workload optimization, migration, and performance tuning. Service providers play a key role in reducing deployment complexity and accelerating time to value. The increasing shift toward hybrid and multi-cloud strategies further amplifies the need for professional and managed services.

- By Deployment

On the basis of deployment, the GPU Database market is segmented into cloud and on-premises. The cloud segment accounted for the dominant market share in 2025, supported by the scalability, flexibility, and cost efficiency offered by cloud-based GPU infrastructure. Cloud deployment enables organizations to access high-performance GPU databases without heavy upfront hardware investments. It also supports elastic scaling for fluctuating data workloads and real-time analytics use cases. The availability of GPU instances from major cloud service providers has significantly lowered adoption barriers for enterprises of all sizes.

The on-premises segment is projected to grow at the fastest pace during the forecast period, driven by increasing data security, latency, and compliance requirements. Industries such as BFSI, government, and healthcare prefer on-premises GPU databases to maintain full control over sensitive data. On-premises deployment also allows organizations to optimize GPU resources for consistent, high-throughput workloads. The need for predictable performance in mission-critical applications supports continued growth of this segment.

- By Application

On the basis of application, the GPU Database market is segmented into governance, risk, and compliance; threat intelligence; customer experience management; fraud detection and prevention; supply chain management; and others. Fraud detection and prevention emerged as the leading application segment in 2025, driven by the need for real-time analysis of high-volume transactional data. GPU databases enable rapid pattern recognition and anomaly detection, which is essential for identifying fraudulent activities. The increasing adoption of digital payments and online banking further accelerates demand in this segment. High-speed analytics and low-latency processing make GPU databases a preferred choice for fraud prevention systems.

Customer experience management is anticipated to be the fastest-growing application segment from 2026 to 2033, supported by the growing use of real-time customer data analytics. Organizations leverage GPU databases to process large volumes of behavioral and interaction data to deliver personalized experiences. The rise of omnichannel engagement strategies increases the need for fast data processing and analytics. GPU-accelerated databases help businesses gain instant insights, improving customer satisfaction and retention.

- By End User

On the basis of end user, the GPU Database market is segmented into BFSI, retail and e-commerce, telecommunications and IT, transportation and logistics, healthcare and pharmaceuticals, government and defence, and others. The BFSI segment dominated the market in 2025 due to its heavy reliance on high-speed data analytics for risk assessment, fraud detection, and regulatory compliance. Financial institutions process massive volumes of structured and unstructured data, making GPU databases essential for performance optimization. The need for real-time decision-making and advanced analytics supports strong adoption in this sector.

Retail and e-commerce is expected to register the fastest growth rate over the forecast period, driven by increasing use of data-driven personalization and demand forecasting. GPU databases enable retailers to analyze customer behavior, pricing trends, and inventory data in real time. The rapid expansion of online shopping platforms and digital marketing further fuels demand. High-performance analytics capabilities help retailers enhance operational efficiency and customer engagement.

Graphics Processing Units (GPU) Database Market Regional Analysis

- North America dominated the Graphics Processing Units (GPU) Database market with the largest revenue share of 34.57% in 2025, driven by early adoption of high-performance computing, strong presence of hyperscale cloud providers, and rapid deployment of AI- and data-intensive applications

- Enterprises across the region prioritize Graphics Processing Units (GPU) databases for real-time analytics, machine learning workloads, and accelerated query performance across large datasets

- This dominance is further supported by advanced digital infrastructure, high enterprise IT spending, and widespread use of cloud and hybrid architectures, positioning Graphics Processing Units (GPU) databases as a core component across BFSI, technology, and government sectors

U.S. Graphics Processing Units (GPU) Database Market Insight

The U.S. Graphics Processing Units (GPU) database market captured the largest revenue share within North America in 2025, fueled by strong investments in artificial intelligence, big data analytics, and cloud computing. Enterprises increasingly deploy GPU databases to support real-time fraud detection, recommendation engines, and high-frequency analytics. The presence of leading cloud service providers and Graphics Processing Units (GPU) technology vendors accelerates adoption. In addition, rising demand for scalable and low-latency data processing across BFSI, retail, and IT sectors continues to drive market growth.

Europe Graphics Processing Units (GPU) Database Market Insight

The Europe Graphics Processing Units (GPU) database market is projected to expand at a steady CAGR during the forecast period, driven by growing adoption of advanced analytics and increasing focus on data governance and compliance. Organizations across the region are leveraging Graphics Processing Units (GPU) databases to process large volumes of structured and unstructured data efficiently. The rise of digital transformation initiatives across industries further supports market expansion. Adoption is also gaining momentum across research institutions and enterprises seeking high-performance data processing solutions.

U.K. Graphics Processing Units (GPU) Database Market Insight

The U.K. Graphics Processing Units (GPU) database market is anticipated to grow at a notable CAGR, supported by increasing use of data-driven decision-making across BFSI, retail, and media sectors. Organizations are adopting Graphics Processing Units (GPU) databases to enhance real-time analytics and improve customer experience management. Strong cloud adoption and emphasis on AI innovation further contribute to market growth. The expanding digital economy continues to create sustained demand for high-speed database solutions.

Germany Graphics Processing Units (GPU) Database Market Insight

The Germany Graphics Processing Units (GPU) database market is expected to expand at a considerable CAGR during the forecast period, driven by strong demand from manufacturing, automotive, and industrial analytics applications. German enterprises increasingly deploy Graphics Processing Units (GPU) databases to support predictive maintenance, supply chain optimization, and industrial AI workloads. The country’s focus on technological innovation and data security supports adoption across both cloud and on-premises environments. Graphics Processing Units (GPU) databases are becoming integral to Industry 4.0 initiatives.

Asia-Pacific Graphics Processing Units (GPU) Database Market Insight

The Asia-Pacific Graphics Processing Units (GPU) database market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid digitalization, expanding cloud infrastructure, and increasing adoption of AI technologies. Enterprises across the region are investing heavily in advanced analytics to support large-scale data processing. Government-led digital initiatives and growing startup ecosystems further accelerate adoption. The region’s strong focus on scalability and cost-efficient performance supports rapid market expansion.

Japan Graphics Processing Units (GPU) Database Market Insight

The Japan Graphics Processing Units (GPU) database market is gaining momentum due to strong adoption of AI, advanced analytics, and high-performance computing across enterprises. Organizations leverage Graphics Processing Units (GPU) databases to support real-time analytics in manufacturing, healthcare, and financial services. Japan’s emphasis on automation and precision-driven operations aligns well with Graphics Processing Units (GPU) -accelerated database capabilities. Growing integration with cloud platforms continues to support market growth.

China Graphics Processing Units (GPU) Database Market Insight

The China Graphics Processing Units (GPU) database market accounted for the largest revenue share in Asia-Pacific in 2025, driven by large-scale digital transformation initiatives and rapid expansion of cloud and AI infrastructure. Chinese enterprises increasingly adopt Graphics Processing Units (GPU) databases to manage massive data volumes generated by e-commerce, fintech, and smart city applications. Strong domestic technology ecosystems and government support for AI development further propel market growth. The demand for high-speed, scalable data processing solutions remains a key growth driver.

Graphics Processing Units (GPU) Database Market Share

The Graphics Processing Units (GPU) Database industry is primarily led by well-established companies, including:

- OmniSci, Inc. (U.S.)

- SQream Technologies (Israel)

- Kinetica DB Inc. (U.S.)

- Neo4j, Inc. (U.S.)

- NVIDIA Corporation (U.S.)

- Brytlyt (U.K.)

- Jedox Inc. (Germany)

- Blazegraph (U.S.)

- BlazingSQL, Inc. (U.S.)

- Zilliz (U.S.)

- HeteroDB (Japan)

- H2O.ai. (U.S.)

- FASTDATA (U.S.)

- Fuzzy Logix, Inc. (U.S.)

- Graphistry (U.S.)

- Anaconda Inc. (U.S.)

Latest Developments in Global Graphics Processing Units (GPU) Database Market

- In March 2024, NVIDIA partnered with Google Cloud to deliver GPU-accelerated databases and analytics on the Google Cloud Platform, significantly strengthening the performance of large-scale data processing and AI-driven workloads. This collaboration enables enterprises to run complex analytics and real-time data queries with lower latency and higher throughput. The integration enhances developer productivity and supports advanced AI model training and inference. As a result, the partnership reinforces both companies’ positions in the GPU database ecosystem by accelerating enterprise adoption of AI-ready data platforms

- In February 2024, NVIDIA expanded its collaboration with Oracle Cloud Infrastructure to scale GPU-accelerated databases and AI analytics for enterprise customers. The partnership allows organizations to leverage NVIDIA GPUs alongside Oracle’s database and cloud services for high-performance analytics and AI workloads. This development improves scalability and cost efficiency for data-intensive applications. It strengthens Oracle’s cloud competitiveness while expanding NVIDIA’s reach across enterprise database deployments

- In November 2023, NVIDIA deepened its collaboration with Amazon Web Services by expanding access to GPU-accelerated data analytics and database workloads through AWS cloud infrastructure. This development allows enterprises to process massive datasets efficiently while supporting AI and machine learning applications at scale. The availability of advanced GPU instances improves performance for real-time analytics and data-intensive operations. It further accelerates market adoption of GPU databases by making high-performance computing more accessible through the cloud

- In March 2023, NVIDIA partnered with Microsoft Azure to integrate GPU-accelerated databases and analytics within the Azure ecosystem, enabling faster processing of complex and large-scale data workloads. By combining NVIDIA AI Enterprise software with Azure Machine Learning, the collaboration enhances AI development, deployment, and management capabilities. This integration supports real-time analytics and advanced AI use cases across industries. The partnership solidifies both companies’ leadership in GPU-enabled cloud database solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.