Global Graphite Coatings Market

Market Size in USD Million

CAGR :

%

USD

761.81 Million

USD

1,299.18 Million

2024

2032

USD

761.81 Million

USD

1,299.18 Million

2024

2032

| 2025 –2032 | |

| USD 761.81 Million | |

| USD 1,299.18 Million | |

|

|

|

|

Graphite Coatings Market Size

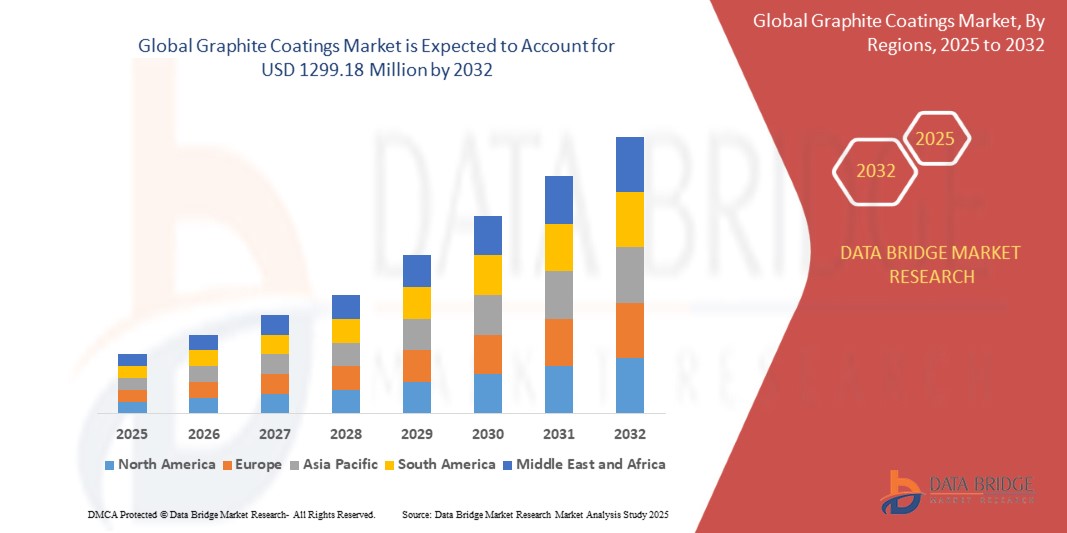

- The global graphite coatings market size was valued at USD 761.81 million in 2024 and is expected to reach USD 1299.18 million by 2032, at a CAGR of 6.90% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-performance lubricants and coatings in automotive and industrial applications

- Rising adoption of graphite coatings in electronics, aerospace, and metallurgical industries is further contributing to market expansion

Graphite Coatings Market Analysis

- The growing need for heat-resistant and corrosion-resistant coatings is expected to accelerate the demand for graphite-based formulations across multiple sectors

- Technological advancements in coating techniques and the introduction of environmentally friendly, water-based graphite coatings are creating new growth opportunities for market players

- Asia-Pacific dominated the graphite coatings market with the largest revenue share of 39.45% in 2024, driven by strong demand from the automotive, electronics, and renewable energy sectors

- Europe region is expected to witness the highest growth rate in the global graphite coatings market, driven by increasing demand from aerospace, automotive, and energy storage industries, as well as stringent environmental regulations encouraging the use of advanced, eco-friendly coating technologies

- The dry lubrication segment dominated the market with the largest market revenue share in 2024, driven by its effectiveness in reducing friction in extreme temperature and pressure conditions without the need for liquid lubricants. Industrial equipment manufacturers widely adopt dry graphite coatings for components such as gears, valves, and molds to enhance efficiency and durability. In addition, these coatings provide a clean, long-lasting lubrication solution, particularly valued in high-vacuum or cleanroom environments

Report Scope and Graphite Coatings Market Segmentation

|

Attributes |

Graphite Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Graphite Coatings Market Trends

“Rising Use of Graphite Coatings in Lithium-Ion Battery Manufacturing”

- The growing use of graphite-coated anodes in lithium-ion batteries is improving electron conductivity, mechanical stability, and overall battery longevity. These enhancements are particularly crucial for electric vehicles, where high-performance batteries are essential

- The global transition to renewable energy systems and grid storage solutions is driving strong demand for efficient battery materials. Graphite coatings have become integral to optimizing lithium-ion battery functionality and efficiency

- Research and development efforts are focusing on advanced coating formulations that minimize binder content, improve uniformity, and reduce resistance. These innovations are designed to boost battery efficiency and reduce production complexity

- Leading battery manufacturers are increasingly adopting sophisticated coating techniques to improve battery energy density, reduce internal heat generation, and extend product lifecycle in automotive and portable electronics sectors

- For instance, in 2023, Panasonic collaborated with graphite material suppliers to refine its anode coating process for Tesla batteries. The partnership led to improved battery performance, enhanced thermal stability, and extended driving range

Graphite Coatings Market Dynamics

Driver

“Growth in High-Temperature Industrial Applications”

- Graphite coatings are widely used in high-heat industrial processes such as steelmaking, glass molding, and non-ferrous casting due to their ability to withstand extreme temperatures exceeding 1000°C without degrading

- These coatings provide excellent lubricity and anti-stick properties, reducing surface wear, enhancing mold release, and extending the service life of critical equipment exposed to friction and high stress

- With industries prioritizing energy-efficient operations, graphite-coated components are increasingly used in heat exchangers, industrial furnaces, and kilns to improve thermal conductivity and reduce energy losses

- Emerging economies are witnessing robust investments in heavy industries and infrastructure, driving demand for reliable, thermally stable coatings that can endure demanding industrial environments

- For instance, in India, major steel manufacturers such as Tata Steel are deploying graphite coatings in blast furnaces. These coatings improve refractory lining durability, optimize heat resistance, and reduce maintenance downtime

Restraint/Challenge

“Fluctuating Raw Material Prices and Supply Chain Disruptions”

- Graphite is largely sourced from a few key regions such as China, Mozambique, and Madagascar, creating a high dependency on limited global suppliers. This concentration of supply makes the graphite market vulnerable to geopolitical tensions, trade disputes, and export restrictions, which can cause sudden disruptions in material availability for manufacturers worldwide

- Price fluctuations in graphite raw materials are a persistent challenge for manufacturers attempting to stabilize production costs. Volatile demand from sectors such as energy storage, metallurgy, and electronics—combined with speculative trading—makes it difficult to forecast expenses and plan sustainable long-term procurement strategies

- Environmental regulations in countries such as China have intensified, particularly targeting pollution control and land rehabilitation in graphite mining areas. These tighter controls have led to forced shutdowns of several operations, constraining global supply, elevating processing costs, and pushing international buyers to seek alternative but less-developed sources

- Ongoing supply chain disruptions—such as container shortages, reduced port capacity, and elevated freight rates—are significantly impacting the global graphite trade. Manufacturers face longer lead times and erratic delivery schedules, making it harder to meet production deadlines and maintain inventory consistency for downstream applications

- For instance, in 2022, SGL Carbon (Germany) and other major players experienced cost increases and shipment delays due to heightened environmental enforcement in China’s graphite sector. These supply issues disrupted manufacturing operations across Europe and North America, highlighting the fragility of the graphite value chain

Graphite Coatings Market Scope

The market is segmented on the basis of application and end user.

• By Application

On the basis of application, the graphite coatings market is segmented into dry lubrication, anti-seize agents, release agents, and others. The dry lubrication segment dominated the market with the largest market revenue share in 2024, driven by its effectiveness in reducing friction in extreme temperature and pressure conditions without the need for liquid lubricants. Industrial equipment manufacturers widely adopt dry graphite coatings for components such as gears, valves, and molds to enhance efficiency and durability. In addition, these coatings provide a clean, long-lasting lubrication solution, particularly valued in high-vacuum or cleanroom environments.

The release agents segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising use in die casting, plastic molding, and glass production processes. Graphite coatings serve as a reliable barrier between the mold and material, preventing adhesion and improving the quality of final products. The demand is further supported by ongoing innovation in water-based formulations and environmentally friendly alternatives, especially across the automotive and metal fabrication sectors.

• By End User

On the basis of end user, the graphite coatings market is segmented into advanced batteries and transistors, automotive, solar cells, displays, sensors, composites, metal coatings, and others. The automotive segment held the largest market share in 2024, driven by growing use of graphite coatings in engine components, brake systems, and exhaust parts for thermal protection and lubrication. The surge in electric vehicle production has also increased the use of graphite coatings in battery components and thermal management applications.

The advanced batteries and transistors segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing demand for energy-efficient and high-performance batteries in electric vehicles and grid storage systems. Graphite coatings play a key role in improving electrode conductivity and performance in lithium-ion batteries. Technological advancements and rising investments in battery technology are further propelling this segment’s rapid expansion across global markets.

Graphite Coatings Market Regional Analysis

- Asia-Pacific dominated the graphite coatings market with the largest revenue share of 39.45% in 2024, driven by strong demand from the automotive, electronics, and renewable energy sectors

- Manufacturers across the region are increasingly utilizing graphite coatings for heat management, dry lubrication, and corrosion resistance in advanced battery technologies and industrial equipment

- This regional growth is further bolstered by the growing presence of electric vehicle production hubs in countries such as China, Japan, and South Korea, coupled with favorable government initiatives promoting green energy and manufacturing innovation

China Graphite Coatings Market Insight

The China graphite coatings market accounted for the highest revenue share within Asia-Pacific in 2024, supported by the country’s leadership in electric vehicle manufacturing and lithium-ion battery production. China’s robust industrial infrastructure, combined with its investments in solar energy, composites, and sensor technologies, is fueling demand for thermal and conductive coating solutions. Domestic players are also enhancing their production capacities and technological expertise, making China a key driver of innovation and supply in the graphite coatings landscape.

Japan Graphite Coatings Market Insight

The Japan graphite coatings market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s advanced manufacturing sector and focus on high-performance electronic components. Japan’s strong presence in semiconductors, battery systems, and automotive technology creates consistent demand for thermally conductive and anti-corrosive coatings. The market is further supported by government-backed sustainability initiatives and the widespread integration of graphite coatings in solar panels, fuel cells, and precision machinery. Manufacturers are increasingly investing in research and development to enhance coating efficiency, durability, and environmental compatibility.

North America Graphite Coatings Market Insight

The North America graphite coatings market is expected to witness the fastest growth rate from 2025 to 2032, supported by the region’s advanced manufacturing base and strong presence of aerospace, automotive, and energy industries. Increased adoption of graphite coatings in metal protection, dry lubrication, and semiconductors is driving market expansion. Moreover, the growing focus on electric vehicle technologies and high-performance batteries is further stimulating demand for these coatings, particularly in the U.S. and Canada.

U.S. Graphite Coatings Market Insight

The U.S. graphite coatings market is expected to witness the fastest growth rate from 2025 to 2032, driven by technological innovation in automotive coatings, electronics, and renewable energy applications. Graphite coatings are widely used in battery components, heat sinks, and as anti-corrosive agents in industrial applications. The nation’s R&D investments and strategic collaborations among coating manufacturers and end-use sectors are contributing to sustained market growth. In addition, the focus on sustainability and lightweight materials in transportation fuels the demand for graphite-based solutions.

Europe Graphite Coatings Market Insight

The Europe graphite coatings market is expected to witness the fastest growth rate from 2025 to 2032, driven by increased applications in fuel cells, metal coatings, and sensor technology. Countries such as Germany, France, and the U.K. are witnessing growing investments in advanced materials and green technologies. The region’s emphasis on reducing carbon emissions and enhancing material durability is encouraging the use of graphite coatings across automotive and electronics manufacturing facilities.

Germany Graphite Coatings Market Insight

The Germany graphite coatings market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s leadership in engineering innovation and strong demand for high-performance materials in the automotive and industrial sectors. German manufacturers are adopting graphite coatings to improve thermal resistance and reduce mechanical wear in machinery and vehicle components. The integration of these coatings into solar cells and battery assemblies also supports the country’s transition toward sustainable energy and electric mobility solutions.

U.K. Graphite Coatings Market Insight

The U.K. graphite coatings market i is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing applications in aerospace, automotive, and renewable energy industries. The country's transition toward electric mobility and green energy solutions is driving the adoption of high-performance coatings for thermal and corrosion protection. In addition, ongoing investments in material innovation and clean technology are strengthening the market outlook. With a growing focus on industrial energy efficiency and performance enhancement, graphite coatings are emerging as a preferred solution across key end-use sectors in the U.K.

Graphite Coatings Market Share

The Graphite Coatings industry is primarily led by well-established companies, including:

- Final Advanced Materials Sàrl (Luxembourg)

- CONDAT (France)

- Elcora Advanced Materials Corp. (Canada)

- Mersen (France)

- Van Sickle Paint (U.S.)

- Whitford Worldwide (U.S.)

- Imerys (France)

- Asbury Carbons (U.S.)

- BECHEM (Germany)

- Triton Minerals Ltd (Australia)

- Hexagon Energy Materials Limited (Australia)

- Mason Graphite (Canada)

- Focus Graphite Inc. (Canada)

- NextSource Materials Inc. (Canada)

- SGL Carbon (Germany)

- MERSEN PROPERTY (France)

- GrafTech International (U.S.)

- Graphite India Limited (India)

- HEG Limited (India)

- Tokai Carbon Co., Ltd. (Japan)

- Toyo Tanso Co., Ltd. (Japan)

Latest Developments in Global Graphite Coatings Market

- In February 2023, Heubach Group revealed its plans to introduce a new array of products and tools at the European Coatings Show (ECS) in Nuremberg. Notably, the company announced the launch of Hostatint UV 100, a reformulated and innovative range of preparations designed primarily for radiation-cured coatings. This development underscores Heubach's commitment to advancing technologies in the coatings industry and meeting evolving market demands

- In August 2022, SGL Carbon announced a strategic expansion of its production capabilities for graphite products aimed at the semiconductor industry. This initiative, part of a comprehensive investment budget, will unfold in stages over the next two years, beginning at their Shanghai facility in China. Additional expansions are also being planned for various other locations, positioning SGL Carbon to better serve the growing needs of the semiconductor market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Graphite Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Graphite Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Graphite Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.