Global Grease Cartridges Market

Market Size in USD Million

CAGR :

%

USD

652.50 Million

USD

1,001.38 Million

2024

2032

USD

652.50 Million

USD

1,001.38 Million

2024

2032

| 2025 –2032 | |

| USD 652.50 Million | |

| USD 1,001.38 Million | |

|

|

|

|

Grease Cartridges Market Size

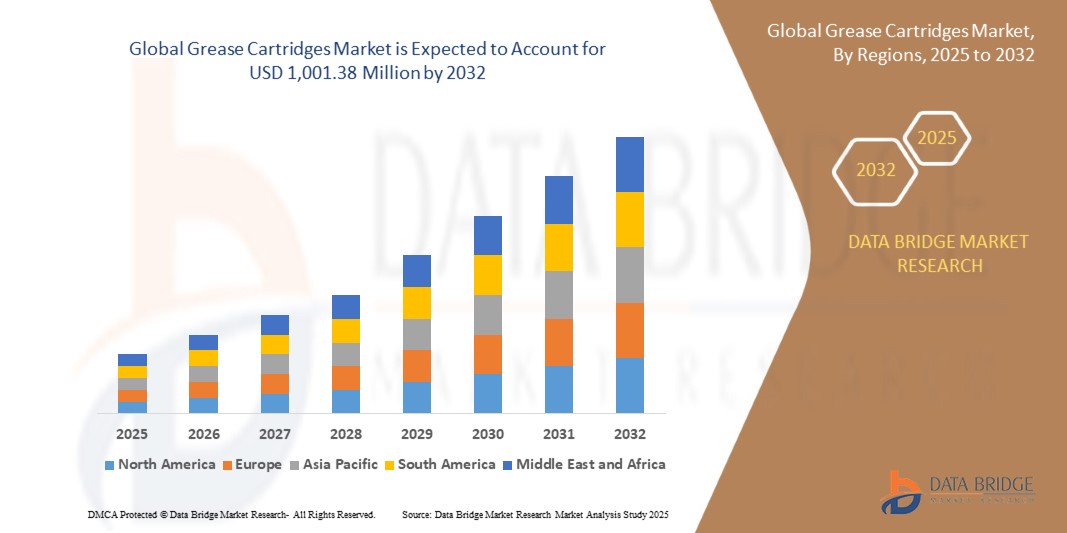

- The global grease cartridges market size was valued at USD 652.5 million in 2024 and is expected to reach USD 1,001.38 million by 2032, at a CAGR of 5.5% during the forecast period

- The market growth is largely fuelled by the rising demand for efficient lubrication systems in automotive and industrial machinery, increasing maintenance activities across heavy equipment sectors, and the growing preference for convenient, mess-free lubricant packaging formats

- The expansion of manufacturing industries in emerging economies, coupled with rising investments in machinery maintenance and industrial automation, is expected to significantly contribute to market growth over the forecast period

Grease Cartridges Market Analysis

- The grease cartridges market is witnessing steady expansion due to the advantages these products offer, such as ease of handling, reduced contamination risk, and precise application

- The shift toward automatic lubrication systems in manufacturing plants, combined with the growing automotive aftermarket, is expected to further support demand

- Asia-Pacific dominated the grease cartridges market with the largest revenue share of 39.12% in 2024, driven by expanding industrialization, increasing demand for machinery maintenance solutions, and the strong presence of manufacturing facilities across the region

- North America region is expected to witness the highest growth rate in the global grease cartridges market, driven by the widespread adoption of high-performance lubricants, rising demand in the aerospace and energy sectors, and the presence of major market players focused on innovation and sustainability

- The 14oz segment accounted for the largest market revenue share in 2024 due to its widespread usage in industrial, automotive, and agricultural lubrication applications. Its compatibility with most standard grease guns and machinery types makes it a preferred choice among end-users, ensuring consistent performance and reduced operational disruptions. The availability of 14oz cartridges in various grease formulations and its cost-efficiency further reinforce its dominance in the global market

Report Scope and Grease Cartridges Market Segmentation

|

Attributes |

Grease Cartridges Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Grease Cartridges Market Trends

Shift Toward Automated and Centralized Lubrication Systems

- The growing integration of centralized and automated lubrication systems across manufacturing and heavy-duty industrial sectors is reshaping demand for grease cartridges. These systems rely heavily on standardized, easy-to-install cartridge units to ensure precise, contamination-free lubrication, enhancing equipment performance and reducing downtime

- Increasing adoption of Industry 4.0 technologies and predictive maintenance practices has amplified the role of grease cartridges in ensuring machine health. As sensors and software monitor wear and tear in real-time, timely cartridge replacement enables proactive upkeep, especially in mining, construction, and food processing sectors

- Environmental regulations encouraging clean and safe lubricant handling are accelerating the shift toward sealed grease cartridges. These cartridges reduce spillage, improve workplace hygiene, and ensure consistent grease application, making them preferred over bulk containers in hygiene-sensitive sectors

- For instance, in 2023, several European food processing companies transitioned from bulk greasing systems to cartridge-based solutions to comply with new sanitation protocols and reduce the risk of lubricant contamination in critical operations

- As automation becomes more pervasive, the role of grease cartridges is evolving from a consumable product to a strategic component in predictive maintenance ecosystems. Manufacturers must innovate in cartridge design, capacity, and compatibility to address the growing need for smart lubrication solutions

Grease Cartridges Market Dynamics

Driver

Growing Demand for Maintenance Efficiency and Reduced Downtime

- The increasing need for operational efficiency and equipment reliability across industrial sectors is a primary factor boosting the demand for grease cartridges. These cartridges enable fast, clean, and precise lubrication during scheduled maintenance, minimizing unplanned shutdowns and production losses

- Manufacturing and processing facilities, especially in automotive, steel, and packaging industries, are under pressure to reduce machine downtime and labor hours. The use of pre-filled, standardized cartridges helps ensure consistent lubrication practices, supporting predictive maintenance efforts and increasing machinery lifespan

- Rising labor costs and a shortage of skilled maintenance personnel have further elevated the value of user-friendly cartridge-based lubrication. Operators prefer simple, tool-free greasing systems that reduce errors and increase operational safety

- For instance, in 2024, several North American automotive suppliers integrated quick-change grease cartridge systems into their maintenance protocols, resulting in over 20% reduction in lubrication-related equipment failures

- While maintenance efficiency is a key driver, continuous innovation in grease formulations and cartridge technology will be critical to meeting the evolving lubrication requirements of next-generation machinery

Restraint/Challenge

Limited Standardization and Compatibility Issues Across Equipment

- One of the key challenges in the grease cartridges market is the lack of universal standards for cartridge sizes and thread designs, which limits interchangeability across different machinery brands and lubrication systems. This often leads to procurement complexities and stocking inefficiencies for industrial users

- End-users operating mixed fleets or legacy equipment often face compatibility concerns, requiring them to stock multiple cartridge types and adapters. This reduces the convenience and efficiency that cartridge-based systems are meant to offer, and increases operational costs

- In sectors with diverse equipment portfolios, such as construction, logistics, and marine, the need for cartridge compatibility poses hurdles for uniform maintenance procedures and limits automation opportunities

- For instance, in 2023, maintenance managers in Southeast Asia reported delays in routine servicing due to mismatched cartridge specifications across imported equipment, especially in mining operations with multi-brand machinery

- To overcome these challenges, cartridge manufacturers and equipment OEMs must collaborate on standardization, while offering adaptable cartridge systems and retrofit kits that cater to a wide range of machinery needs

Grease Cartridges Market Scope

The market is segmented on the basis of capacity, material type, and closure type.

• By Capacity

On the basis of capacity, the grease cartridges market is segmented into 3oz, 14oz, 14.1oz, and 14.5oz. The 14oz segment accounted for the largest market revenue share in 2024 due to its widespread usage in industrial, automotive, and agricultural lubrication applications. Its compatibility with most standard grease guns and machinery types makes it a preferred choice among end-users, ensuring consistent performance and reduced operational disruptions. The availability of 14oz cartridges in various grease formulations and its cost-efficiency further reinforce its dominance in the global market.

The 14.1oz segment is expected to witness the fastest growth rate from 2025 to 2032, supported by growing preferences for slightly higher volume cartridges in heavy-duty applications. This size offers extended service intervals and reduced frequency of cartridge replacement, especially in high-load environments such as mining and construction. As maintenance efficiency becomes a growing focus across sectors, the demand for 14.1oz grease cartridges is expected to rise steadily.

• By Material Type

On the basis of material type, the grease cartridges market is categorized into plastic, fiberboard, and high-density polyethylene (HDPE). The plastic segment led the market with the highest revenue share in 2024, attributed to its cost-effectiveness, lightweight nature, and high compatibility with automated grease dispensing systems. Plastic cartridges also offer superior protection against moisture and contamination, making them ideal for extended storage and varied climatic conditions.

The HDPE segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising environmental concerns and demand for recyclable materials. HDPE cartridges are increasingly favored for their durability, resistance to chemicals, and eco-friendly profile. Industries focused on sustainability initiatives are expected to adopt HDPE-based cartridges to align with green operational standards.

• By Closure Type

On the basis of closure type, the market is segmented into piston cap, spouted cap, flat cap, and pull-off cap. The piston cap segment held the largest market share in 2024 due to its secure sealing mechanism, which minimizes grease leakage and ensures controlled dispensing. Its use is particularly high in industries where precise grease application and cleanliness are critical, such as automotive and aerospace.

The spouted cap segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its convenience in targeted application and user-friendly design. Spouted caps enable direct grease application into hard-to-reach components without requiring additional tools, increasing their utility in maintenance-heavy sectors. As machinery design becomes more compact and complex, the need for flexible dispensing solutions like spouted caps is expected to rise significantly.

Grease Cartridges Market Regional Analysis

- Asia-Pacific dominated the grease cartridges market with the largest revenue share of 39.12% in 2024, driven by expanding industrialization, increasing demand for machinery maintenance solutions, and the strong presence of manufacturing facilities across the region

- The region’s growth is further supported by a rising need for high-performance lubricants in automotive and construction equipment, especially in rapidly developing countries such as China, India, and Southeast Asian nations

- In addition, the presence of key grease cartridge manufacturers and growing investments in industrial automation are contributing to the continued expansion of the grease cartridges market in the region

China Grease Cartridges Market Insight

The China grease cartridges market accounted for the largest market revenue share in Asia-Pacific in 2024, propelled by the country's massive industrial base, expanding automotive sector, and consistent investments in heavy machinery and infrastructure projects. The growing need for efficient lubrication solutions, especially in high-speed production environments, is driving adoption. Moreover, China's strong domestic production capabilities and cost-effective manufacturing are reinforcing its dominant position in the regional market.

Japan Grease Cartridges Market Insight

The Japan grease cartridges market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country's robust automotive and industrial machinery sectors. Japanese manufacturers emphasize precision and cleanliness in lubrication processes, promoting the adoption of sealed and easy-to-handle cartridge systems. Moreover, the rising demand for environmentally friendly and recyclable packaging solutions aligns with the growing preference for high-density polyethylene (HDPE) grease cartridges. The continued focus on automation and maintenance efficiency in manufacturing is further expected to support market expansion in Japan.

North America Grease Cartridges Market Insight

The North America grease cartridges market is expected to witness the fastest growth rate from 2025 to 2032, owing to the high demand for reliable lubrication systems in the automotive, construction, and mining sectors. The region benefits from advanced technological capabilities and strict maintenance protocols in industrial operations. Furthermore, the trend of equipment automation and the preference for environmentally friendly and refillable lubrication cartridges are contributing to the market’s progression.

U.S. Grease Cartridges Market Insight

The U.S. grease cartridges market is expected to witness the fastest growth rate from 2025 to 2032, supported by a mature industrial base, large-scale manufacturing operations, and widespread adoption of preventive maintenance practices. The demand for high-efficiency lubrication solutions is rising due to the increased focus on minimizing downtime and maximizing machinery performance. In addition, the presence of major lubricant and grease cartridge producers reinforces the country’s market position.

Europe Grease Cartridges Market Insight

The Europe grease cartridges market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising concerns around equipment durability, machinery efficiency, and stringent environmental regulations. The demand for biodegradable and recyclable grease cartridges is increasing in countries such as Germany, France, and Italy. The region also benefits from advanced mechanical engineering sectors and a strong emphasis on sustainability and product innovation, encouraging further adoption across industrial applications.

Germany Grease Cartridges Market Insight

The Germany grease cartridges market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country's highly developed industrial landscape and demand for premium lubrication systems. The automotive and heavy machinery sectors are significant contributors, with a focus on ensuring long-term operational efficiency and compliance with environmental standards. Germany's leadership in engineering and technology development continues to support market innovation and adoption.

U.K. Grease Cartridges Market Insight

The United Kingdom grease cartridges market is expected to witness the fastest growth rate from 2025 to 2032, supported by the increasing need for efficient lubrication solutions across automotive, marine, and industrial maintenance sectors. The shift towards user-friendly and waste-reducing cartridge systems is gaining traction among end-users. In addition, stringent environmental and workplace safety regulations are encouraging the use of standardized grease cartridges over traditional bulk grease methods. The rising number of service garages and workshops in the U.K. is also positively influencing the demand for compact and disposable cartridge-based lubrication systems.

Grease Cartridges Market Share

The Grease Cartridges industry is primarily led by well-established companies, including:

- Shell plc (U.K.)

- Exxon Mobil Corporation (U.S.)

- Chevron Corporation (U.S.)

- Fuchs Petrolub SE (Germany)

- TotalEnergies SE (France)

- BP plc (U.K.)

- Petroliam Nasional Berhad – PETRONAS (Malaysia)

- Idemitsu Kosan Co., Ltd. (Japan)

- Valvoline Inc. (U.S.)

- Sinopec Lubricant Company (China)

- Phillips 66 Company (U.S.)

- ENEOS Corporation (Japan)

- Klüber Lubrication München SE & Co. KG (Germany)

- AMSOIL Inc. (U.S.)

- Indian Oil Corporation Limited (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Grease Cartridges Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Grease Cartridges Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Grease Cartridges Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.