Global Green Cell Foam Market

Market Size in USD Million

CAGR :

%

USD

581.26 Million

USD

1,705.23 Million

2024

2032

USD

581.26 Million

USD

1,705.23 Million

2024

2032

| 2025 –2032 | |

| USD 581.26 Million | |

| USD 1,705.23 Million | |

|

|

|

|

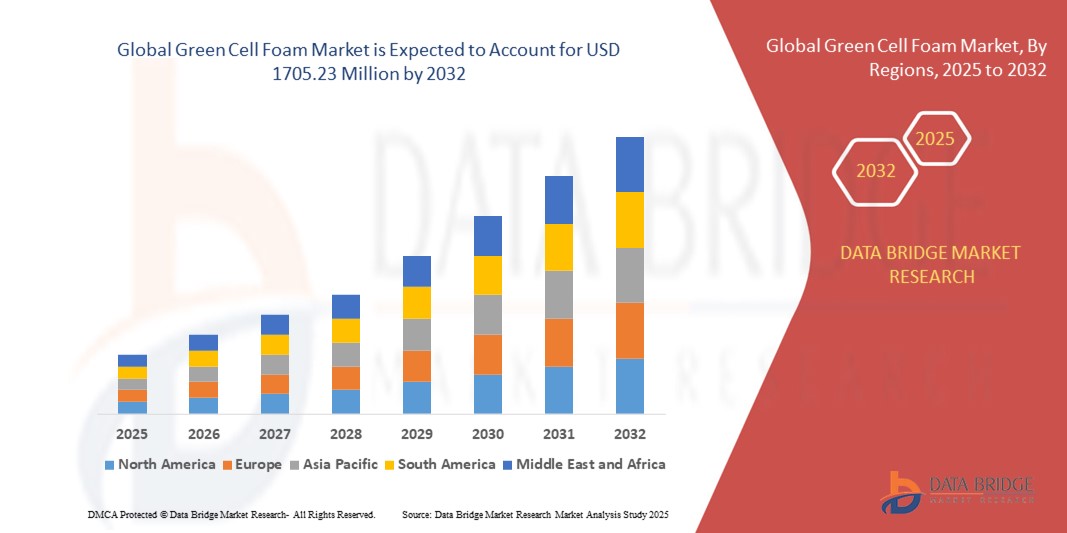

What is the Global Green Cell Foam Market Size and Growth Rate?

- The global green cell foam market size was valued at USD 581.26 million in 2024 and is expected to reach USD 1705.23 million by 2032, at a CAGR of 14.40% during the forecast period

- The global green cell foam market is witnessing significant growth driven by increasing consumer demand for eco-friendly packaging solutions. Companies across various industries are adopting green cell foam due to its biodegradable nature and its ability to provide effective cushioning and protection for products during shipping

- In addition, the expansion of end-use industries such as electronics, healthcare, and food and beverages is increasing the scope for market players to invest. Overall, the green cell foam market is poised for continued growth as sustainability becomes a top priority for businesses and consumers worldwide

What are the Major Takeaways of Green Cell Foam Market?

- Increasing awareness about environmental issues and stringent regulations aimed at reducing carbon footprints are significant drivers for the global green cell foam market. As governments worldwide impose restrictions on the use of traditional petroleum-based foams due to their harmful environmental impact, there is a growing demand for sustainable alternatives such as green cell foam, which is biodegradable and derived from renewable resources

- North America dominated the green cell foam market with the largest revenue share of 33.78% in 2024, driven by rising demand for eco-friendly packaging materials and the growing shift toward sustainable alternatives to plastics

- Asia-Pacific green cell foam market is projected to grow at the fastest CAGR of 6.74% from 2025 to 2032, supported by urbanization, expanding middle class, and sustainability awareness in countries such as China, Japan, and India

- The starch-based segment dominated the market with the largest revenue share of 41.3% in 2024, owing to its cost-effectiveness, wide availability, and biodegradability

Report Scope and Green Cell Foam Market Segmentation

|

Attributes |

Green Cell Foam Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Green Cell Foam Market?

Rising Demand for Sustainable and Eco-Friendly Packaging Solutions

- A major trend in the green cell foam market is the shift toward biodegradable and renewable packaging materials, driven by sustainability goals and increasing consumer preference for eco-friendly products

- Green Cell Foam, made from cornstarch and other plant-based resources, is gaining traction as a sustainable alternative to petroleum-based foams such as Styrofoam, aligning with global efforts to reduce plastic waste

- For instance, companies in food packaging and e-commerce sectors are adopting Green Cell Foam as a protective packaging material, offering both durability and compostability, thereby addressing environmental concerns

- The packaging bdiodegrades in composting environments and dissolves safely in water, further reinforcing its eco-friendly credentials

- This trend highlights how industries are integrating circular economy principles and replacing traditional plastic foams with bio-based options to meet ESG (Environmental, Social, Governance) targets

- As a result, green cell foam is becoming a preferred solution in food delivery, pharmaceuticals, and consumer goods packaging, reshaping sustainability practices across industries

What are the Key Drivers of Green Cell Foam Market?

- The global ban and restrictions on single-use plastics, along with stringent environmental regulations, are a primary driver pushing industries toward sustainable packaging alternatives such as green cell foam

- For instance, in June 2024, Stora Enso partnered with packaging suppliers to expand its portfolio of biodegradable foams, targeting industries shifting away from plastic packaging

- Rising consumer awareness of eco-friendly lifestyles and the growing demand for green alternatives in food delivery, cosmetics, and electronics packaging are fueling adoption

- The e-commerce boom has further accelerated the demand for lightweight yet protective packaging solutions, where Green Cell Foam offers both strength and biodegradability

- In addition, increasing investments by companies in biodegradable material R&D and the ability of green cell foam to serve as a direct substitute for petrochemical-based foams are propelling market growth globally

Which Factor is Challenging the Growth of the Green Cell Foam Market?

- A major challenge for the green cell foam market is the higher cost of production compared to conventional petroleum-based foams, limiting adoption among price-sensitive industries

- For instance, despite its eco-friendly benefits, green cell foam can cost nearly 30–40% more than traditional packaging, making large-scale adoption difficult for low-margin businesses

- Limited scalability of raw materials such as cornstarch and competition with food supply chains also raise concerns regarding long-term cost efficiency

- Another challenge lies in performance limitations under certain conditions, as Green Cell Foam is more sensitive to humidity and moisture, restricting its use in some industrial applications

- While ongoing innovations are improving durability, inconsistent global composting infrastructure can hinder proper disposal and recycling, reducing its practical environmental benefits in some regions

- Overcoming these challenges will require cost optimization, supply chain strengthening, and consumer education, making eco-friendly packaging both affordable and scalable

How is the Green Cell Foam Market Segmented?

The market is segmented on the basis of material, end use, foam type, and application.

- By Material

On the basis of material, the green cell foam market is segmented into starch-based, PLA-based, PHA-based, and cellulose-based. The starch-based segment dominated the market with the largest revenue share of 41.3% in 2024, owing to its cost-effectiveness, wide availability, and biodegradability. Starch-based foams are increasingly used in packaging applications due to their lightweight structure, cushioning properties, and compliance with environmental regulations. Their adaptability across various industries, particularly food and consumer goods, further enhances demand.

The PLA-based segment is expected to register the fastest CAGR from 2025 to 2032, driven by its durability, heat resistance, and suitability for applications requiring higher mechanical strength. Increasing demand from automotive interiors, electronics packaging, and construction materials is accelerating growth. With rising sustainability mandates worldwide, PLA-based foams are gaining traction as a long-term solution for industries seeking eco-friendly yet durable materials.

- By End Use

On the basis of end use, the green cell foam market is segmented into automotive, building and construction, household, and sports. The automotive segment dominated the market with the largest revenue share of 38.7% in 2024, supported by the rising demand for lightweight, eco-friendly foams in vehicle interiors, seat cushioning, and noise-dampening components. Automakers are increasingly turning to biodegradable foams to reduce their carbon footprint and align with global emission norms.

The building and construction segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by growing usage in insulation, panels, and structural applications. Green foams provide both thermal efficiency and environmental compliance, making them attractive for sustainable building projects. Increasing government incentives for green construction, coupled with rising consumer preference for energy-efficient homes, is expected to significantly boost adoption in the coming years.

- By Foam Type

On the basis of foam type, the green cell foam market is segmented into flexible, rigid, molded, extruded, and spray. The flexible foam segment accounted for the largest market revenue share of 44.6% in 2024, driven by its widespread application in furniture, mattresses, and automotive seating. Flexible foams provide superior comfort, shock absorption, and versatility, making them the preferred choice across industries. Their recyclability and compatibility with bio-based formulations further strengthen demand.

The rigid foam segment is forecasted to grow at the fastest CAGR from 2025 to 2032, primarily due to its superior structural strength and insulating properties. Applications in construction insulation, cold storage, and industrial packaging are fueling adoption. The shift toward energy-efficient infrastructure and the rising importance of thermal insulation in building projects are expected to accelerate growth in the rigid foam category.

- By Application

On the basis of application, the green cell foam market is segmented into furniture, footwear and recreational, seats, shipping, and packaging. The packaging segment dominated the market with the largest revenue share of 47.8% in 2024, supported by the surge in e-commerce, demand for protective shipping solutions, and sustainability-focused brand strategies. Green cell foams are widely used as a replacement for plastic-based packaging due to their biodegradability, lightweight properties, and cost-effectiveness.

The furniture segment is anticipated to record the fastest CAGR from 2025 to 2032, driven by increasing consumer preference for eco-friendly interiors and the growing adoption of bio-based foams in mattresses, sofas, and office chairs. Rising awareness of indoor environmental quality and green certifications in the furniture industry is expected to fuel long-term demand, positioning it as one of the most promising growth areas within the market.

Which Region Holds the Largest Share of the Green Cell Foam Market?

- North America dominated the green cell foam market with the largest revenue share of 33.78% in 2024, driven by rising demand for eco-friendly packaging materials and the growing shift toward sustainable alternatives to plastics

- Consumers in the region value biodegradability, recyclability, and premium protection offered by green cell foam, making it a preferred choice in food, electronics, and healthcare packaging sectors

- This widespread adoption is supported by stringent environmental regulations, high disposable incomes, and sustainability-focused consumer behavior, positioning green cell foam as a leading green packaging solution

U.S. Green Cell Foam Market Insight

U.S. green cell foam market captured the largest revenue share in 2024 within North America, fueled by strong demand for eco-friendly protective packaging in e-commerce, food delivery, and healthcare. Consumers increasingly prioritize biodegradable materials over traditional plastics. The country’s sustainability-driven brands and retailers, combined with regulatory push for plastic-free packaging, are accelerating adoption, making the U.S. the largest contributor to the regional market.

Europe Green Cell Foam Market Insight

Europe green cell foam market is projected to expand at a substantial CAGR, primarily driven by EU sustainability mandates, bans on single-use plastics, and corporate commitments to carbon reduction. Rapid urbanization and growing demand for green packaging solutions across industries are spurring adoption. Green Cell Foam is widely used in electronics, pharmaceuticals, and consumer goods packaging, with applications spreading across both new and existing distribution chains.

U.K. Green Cell Foam Market Insight

U.K. green cell foam market is anticipated to grow at a noteworthy CAGR, supported by consumer demand for eco-friendly delivery packaging and the retail sector’s focus on sustainable supply chains. Rising concerns about plastic pollution and government policies encouraging alternatives are boosting adoption. The country’s strong e-commerce infrastructure is expected to further propel growth in the green cell foam industry.

Germany Green Cell Foam Market Insight

Germany green cell foam market is expected to expand considerably, driven by the country’s leadership in sustainable innovation and packaging technologies. Demand is rising from automotive, industrial, and consumer goods sectors, where eco-conscious packaging is becoming standard. Germany’s robust manufacturing base and sustainability-focused policies are enabling faster adoption, positioning it as one of Europe’s strongest growth markets for green cell foam.

Which Region is the Fastest Growing Region in the Green Cell Foam Market?

Asia-Pacific green cell foam market is projected to grow at the fastest CAGR of 6.74% from 2025 to 2032, supported by urbanization, expanding middle class, and sustainability awareness in countries such as China, Japan, and India. Government initiatives promoting eco-packaging and local manufacturing of green cell foam products are boosting affordability and accessibility. This positions APAC as the most dynamic growth hub for the market.

Japan Green Cell Foam Market Insight

Japan green cell foam market is witnessing strong growth due to its tech-driven consumer base and emphasis on eco-friendly materials. Adoption is rising in electronics, retail, and healthcare packaging, where sustainable options are highly valued. Japan’s cultural preference for premium, safe, and environmentally conscious products is further stimulating demand for green cell foam.

China Green Cell Foam Market Insight

China green cell foam market accounted for the largest revenue share in APAC in 2024, supported by its rapid e-commerce expansion, rising disposable incomes, and government-backed sustainability policies. Green Cell Foam is being adopted across food delivery, electronics, and logistics packaging, with strong backing from local manufacturers. The country’s leadership in green packaging innovations makes it a key driver of regional growth.

Which are the Top Companies in Green Cell Foam Market?

The green cell foam industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Huntsman Corporation (U.S.)

- Cargill Incorporated (U.S.)

- Stora Enso (Finland)

- Braskem (Brazil)

- Sealed Air (U.S.)

- Evonik Industries (Germany)

- The Dow Chemical Company (U.S.)

- Toray Industries LLC (Japan)

- Kaneka Americas Holding (U.S.)

- Pregis LLC (U.S.)

What are the Recent Developments in Global Green Cell Foam Market?

- In April 2024, BASF introduced innovative concepts and advanced recycling methods for polyurethanes during the UTECH event in Maastricht, showcasing sustainable material solutions for multiple industries at booth E20. This marks BASF’s strong commitment to circularity and eco-friendly advancements in material science

- In April 2024, Arkema demonstrated a wide range of solutions and technologies at the American Coatings Show held in Indianapolis from April 30 to May 2, focusing on supporting decarbonization, enhanced circularity, and sustainability goals. This further strengthens Arkema’s positioning as a leader in sustainable innovation for the coatings sector

- In March 2024, Arkema received the USDA BioPreferred® product certification for its Oleris C7 and C11 oleochemicals, produced from renewable castor seeds and validated as biogenic carbon-based. This recognition highlights Arkema’s role in promoting renewable biomaterials and advancing green chemistry

- In November 2023, BASF launched BVERDE GP 790 L, a readily biodegradable anti-redeposition polymer designed to enhance laundry detergent applications while addressing the demand for sustainable solutions. This product underlines BASF’s focus on balancing high performance with environmental responsibility

- In September 2022, TemperPack, headquartered in Richmond, successfully acquired Michigan’s KTM Industries, the company recognized for its Green Cell Foam solutions. This acquisition strengthened TemperPack’s portfolio in sustainable packaging and broadened its leadership in eco-friendly materials

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Green Cell Foam Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Green Cell Foam Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Green Cell Foam Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.