Global Green Chemicals Market

Market Size in USD Billion

CAGR :

%

USD

12.73 Billion

USD

22.53 Billion

2024

2032

USD

12.73 Billion

USD

22.53 Billion

2024

2032

| 2025 –2032 | |

| USD 12.73 Billion | |

| USD 22.53 Billion | |

|

|

|

|

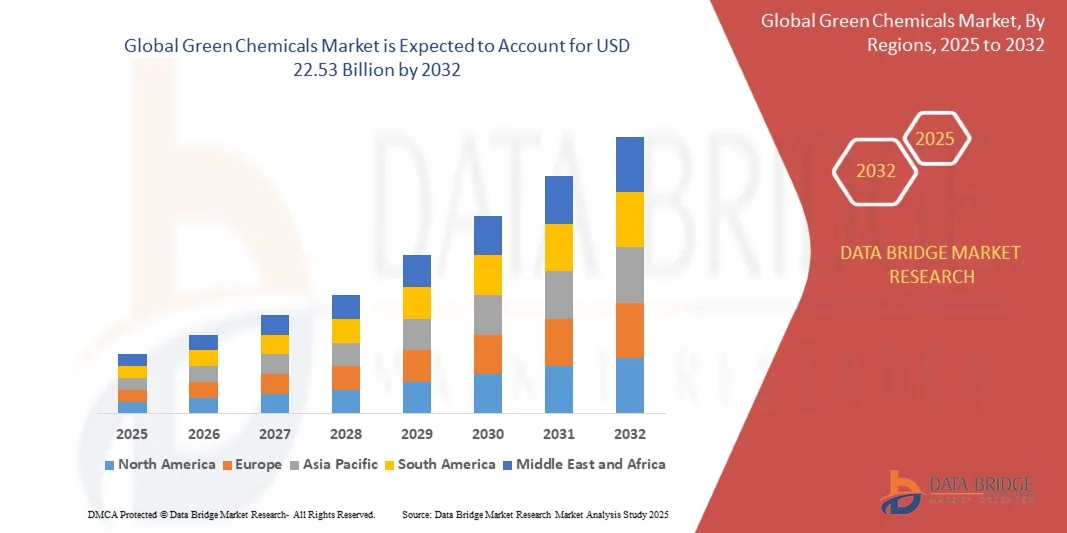

What is the Global Green Chemicals Market Size and Growth Rate?

- The global green chemicals market size was valued at USD 12.73 billion in 2024 and is expected to reach USD 22.53 billion by 2032, at a CAGR of 7.40% during the forecast period

- The market growth is primarily driven by increasing demand for environmentally friendly and sustainable chemical solutions across industries such as construction, automotive, personal care, and packaging

- Furthermore, stringent government regulations on carbon emissions, hazardous substances, and waste management are prompting manufacturers to adopt bio-based, biodegradable, and low-toxicity chemicals. These factors are accelerating the adoption of Green Chemicals globally, significantly enhancing market expansion

What are the Major Takeaways of Green Chemicals Market?

- Green Chemicals, including bio-based solvents, surfactants, and resins, are becoming essential for industries seeking sustainable alternatives to traditional petrochemical products, offering reduced environmental impact and improved safety

- The rising consumer and industrial preference for eco-friendly products, coupled with increasing regulatory compliance and sustainability initiatives, is driving the demand for green chemicals

- Companies are investing in R&D to develop innovative green formulations, which are fostering widespread adoption and establishing green chemicals as a critical component of modern industrial and consumer applications

- Asia-Pacific dominated the Green Chemicals market with a revenue share of 37.85% in 2024, driven by rapid industrialization, government incentives for sustainable manufacturing, and rising adoption of eco-friendly chemicals across agriculture, personal care, and industrial sectors

- Europe is projected to grow at the fastest CAGR of 11.25% during 2025–2032, driven by strict environmental regulations, government incentives, and high industrial adoption of eco-friendly chemicals

- The Bio Alcohols segment dominated the market with a revenue share of 52.4% in 2024, driven by its extensive applications in industrial solvents, biofuels, and cleaning agents

Report Scope and Green Chemicals Market Segmentation

|

Attributes |

Green Chemicals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Green Chemicals Market?

“Sustainability and Circular Economy Integration”

- A major and accelerating trend in the global green chemicals market is the shift toward eco-friendly, bio-based, and biodegradable chemical formulations across industries such as agriculture, personal care, and industrial applications

- Companies are increasingly investing in renewable raw materials, closed-loop production systems, and low-carbon footprint processes to meet rising environmental regulations and corporate sustainability goals

- Innovations in green solvents, bio-polymers, and enzymatic chemicals are enhancing performance, reducing toxicity, and minimizing environmental impact without compromising industrial efficacy

- Regulatory pressures in regions such as Europe and North America, along with consumer preference for sustainable products, are accelerating adoption of green alternatives

- The market trend also includes waste valorization and circular economy practices, enabling manufacturers to convert by-products and residues into high-value green chemicals

- This movement is reshaping the chemical industry, pushing companies to prioritize sustainability, innovation, and compliance with global environmental standards

What are the Key Drivers of the Green Chemicals Market?

- Growing environmental awareness and regulatory frameworks worldwide are compelling industries to switch to bio-based, low-VOC, and non-toxic chemicals

- Increasing consumer demand for sustainable products in cosmetics, packaging, cleaning agents, and agriculture is boosting the uptake of green chemicals

- Technological advancements in biocatalysis, fermentation, and enzymatic processes allow cost-effective production of high-performance green chemicals

- Corporate commitments toward carbon neutrality and ESG compliance are driving investments in sustainable raw materials and renewable production methods

- The rising integration of green chemicals in industrial applications, including coatings, adhesives, lubricants, and fertilizers, is supporting global market expansion

Which Factor is Challenging the Growth of the Green Chemicals Market?

- High production costs for bio-based and specialty green chemicals compared to conventional chemicals create pricing pressure

- Limited availability of renewable feedstocks and raw materials in certain regions constrains large-scale adoption

- Technological challenges in achieving the same performance, stability, and shelf-life as traditional chemicals hinder industry uptake in some applications

- Regulatory differences and certification requirements across regions complicate global market expansion

- Companies must continue investing in R&D, cost optimization, and supply chain development to overcome these barriers and achieve long-term sustainable growth.

How is the Green Chemicals Market Segmented?

The market is segmented on the basis of product type, source, form, and end use.

• By Product Type

On the basis of product type, the green chemicals market is segmented into Bio Alcohols and Bio Organic Acids. The Bio Alcohols segment dominated the market with a revenue share of 52.4% in 2024, driven by its extensive applications in industrial solvents, biofuels, and cleaning agents. Bio Alcohols are preferred for their eco-friendly profile, renewability, and compatibility with existing chemical processes, making them a reliable choice for large-scale industrial and commercial applications.

The Bio Organic Acids segment is anticipated to witness the fastest growth with a CAGR of 18.2% from 2025 to 2032, propelled by increasing use in food preservatives, personal care formulations, and pharmaceutical excipients. The rising consumer preference for natural ingredients and regulatory support for bio-based products further accelerates adoption of bio acids globally.

• By Source

On the basis of source, the market is segmented into Plant-Based and Algae-Based. The Plant-Based segment held the largest market revenue share of 61.3% in 2024 due to abundant availability, cost efficiency, and well-established supply chains for raw materials such as sugarcane, corn, and other biomass. Plant-derived green chemicals are extensively used across industrial, healthcare, and cosmetic applications owing to their safety and scalability.

The Algae-Based segment is projected to witness the fastest CAGR of 20.1% from 2025 to 2032, supported by advancements in biotechnology and sustainable cultivation practices. Algae-based chemicals are increasingly utilized for high-value applications such as bioactive compounds, nutraceuticals, and eco-friendly solvents, reflecting strong growth potential.

• By Form

On the basis of form, the market is segmented into Liquid and Solid. The Liquid segment dominated the Green Chemicals market with a revenue share of 57.6% in 2024, attributed to its versatility, ease of handling, and integration into various industrial and consumer processes. Liquids are preferred in chemical manufacturing, cleaning, and cosmetic formulations for consistent performance and process efficiency.

The Solid segment is expected to witness the fastest CAGR of 17.8% from 2025 to 2032, driven by demand for powdered, granular, or pelletized bio acids and alcohols used in pharmaceuticals, healthcare supplements, and construction additives. The solid form offers longer shelf life, simplified transportation, and targeted applications, boosting its adoption across niche markets.

• By End Use

On the basis of end use, the green chemicals market is segmented into Construction, Healthcare, and Cosmetics. The Construction segment held the largest market revenue share of 48.9% in 2024, fueled by the increasing demand for bio-based adhesives, coatings, sealants, and building materials that comply with green building regulations and sustainability certifications.

The Healthcare segment is expected to witness the fastest CAGR of 19.5% from 2025 to 2032, driven by rising use of bio alcohols and organic acids in pharmaceuticals, disinfectants, and medical-grade formulations. Growing consumer awareness of health and safety, coupled with regulatory mandates for environmentally friendly ingredients, is accelerating the adoption of green chemicals in healthcare applications.

Which Region Holds the Largest Share of the Green Chemicals Market?

- Asia-Pacific dominated the green chemicals market with a revenue share of 37.85% in 2024, driven by rapid industrialization, government incentives for sustainable manufacturing, and rising adoption of eco-friendly chemicals across agriculture, personal care, and industrial sectors

- Manufacturers are increasingly using bio-based solvents, biodegradable polymers, and renewable feedstocks to meet regulatory and consumer demands. Growing population, higher disposable incomes, and industrial expansion further support market growth

- This region is emerging as the global hub for green chemical production, supplying environmentally friendly solutions across multiple industries while aligning with sustainability goals

China Green Chemicals Market Insight

The China green chemicals market accounted for the largest share of Asia-Pacific in 2024 due to strong government policies promoting green manufacturing, urbanization, and industrial growth. Adoption of low-VOC, bio-based, and biodegradable chemicals is rising in agriculture, coatings, and personal care. Local manufacturers and multinational companies are investing in eco-friendly production technologies and renewable feedstocks to meet environmental standards. In addition, China’s push toward smart agriculture and sustainable industrial processes is driving demand for green chemicals, positioning the country as a key contributor to Asia-Pacific’s dominance in the global green chemicals market.

Japan Green Chemicals Market Insight

The Japan green chemicals market is witnessing steady growth driven by stringent environmental regulations, high technological capabilities, and rising demand for sustainable consumer and industrial products. Companies are focusing on biodegradable polymers, enzymatic chemicals, and renewable formulations to meet compliance and consumer preferences. Industrial sectors, particularly automotive, electronics, and personal care, are adopting eco-friendly chemicals to reduce environmental impact. In addition, Japan’s initiatives to promote green manufacturing, coupled with strong R&D in sustainable chemical processes, are boosting market expansion and ensuring widespread adoption of green chemicals across multiple applications, enhancing the country’s contribution to the regional market.

India Green Chemicals Market Insight

The India green chemicals market is expanding rapidly due to increasing awareness of eco-friendly products, government initiatives supporting sustainable manufacturing, and rising industrial adoption of bio-based chemicals. Sectors such as agriculture, textiles, and personal care are increasingly using biodegradable chemicals and renewable feedstocks to meet environmental standards. The growth of domestic manufacturers, combined with foreign investment in green chemical technologies, is fueling market expansion. Moreover, government policies promoting renewable energy and sustainability are accelerating adoption. India’s market is poised to become a major contributor to the Asia-Pacific green chemicals landscape, offering cost-effective and environmentally responsible solutions.

Which Region is the Fastest Growing Region in the Green Chemicals Market?

Europe is projected to grow at the fastest CAGR of 11.25% during 2025–2032, driven by strict environmental regulations, government incentives, and high industrial adoption of eco-friendly chemicals. Countries such as Germany, France, and the U.K. are witnessing increasing use of bio-based solvents, biodegradable polymers, and low-VOC chemicals in agriculture, coatings, personal care, and industrial applications. Technological advancements in green chemical production and the emphasis on sustainable manufacturing are opening new opportunities. In addition, consumer demand for eco-friendly products and corporate commitments to sustainability are further accelerating market growth, making Europe the fastest-growing region globally.

Germany Green Chemicals Market Insight

The Germany green chemicals market is expanding due to robust environmental policies, increasing industrial adoption of sustainable chemicals, and consumer preference for eco-friendly products. Companies are focusing on renewable feedstocks, biodegradable chemicals, and bio-based polymers to meet environmental compliance. Industrial sectors such as automotive, construction, and personal care are driving demand for green chemicals. Government initiatives supporting low-emission manufacturing and sustainable practices are further boosting growth. Germany’s emphasis on R&D in environmentally responsible chemicals is positioning it as a key player in Europe’s fastest-growing green chemicals market, contributing to technological innovation and export potential.

France Green Chemicals Market Insight

The France green chemicals market is witnessing strong growth, fueled by government incentives for sustainable manufacturing, rising consumer demand for eco-friendly products, and industrial adoption of bio-based chemicals. Biodegradable polymers, low-VOC solvents, and renewable feedstocks are increasingly used across personal care, agriculture, and industrial sectors. Investments in R&D for green chemical processes and renewable raw materials are boosting innovation. Growing awareness of sustainability and stricter environmental compliance are accelerating adoption. France is emerging as a strategic market in Europe, contributing significantly to the region’s rapid growth in green chemicals and supporting the continent’s transition toward eco-friendly industrial practices.

U.K. Green Chemicals Market Insight

The U.K. green chemicals market is growing steadily due to increasing industrial adoption of eco-friendly chemicals, government support for green manufacturing, and rising consumer preference for sustainable products. Adoption of bio-based solvents, biodegradable chemicals, and low-VOC polymers is driving growth in personal care, agriculture, and industrial applications. Technological advancements in green chemical production and regulatory compliance are further accelerating market expansion. The U.K.’s strong industrial base, coupled with sustainability-driven policies, ensures the market’s significant contribution to Europe’s overall growth. The country is becoming a hub for eco-friendly chemical innovation and sustainable industrial practices.

Which are the Top Companies in Green Chemicals Market?

The green chemicals industry is primarily led by well-established companies, including:

- Archer Daniels Midland Company (U.S.)

- Cargill, Incorporated (U.S.)

- BASF SE (Germany)

- Evonik Industries AG (Germany)

- Braskem SA (Brazil)

- Arkema Group (France)

- Vertec BioSolvents Inc. (Canada)

- Total Corbion PLA (Netherlands)

- DuPont de Nemours, Inc. (U.S.)

- SECOS Group Ltd (U.K.)

- Solugen (U.S.)

- DUDE CHEM (U.S.)

- Greenchemicals S.r.l. (Italy)

- Novozymes A/S (Denmark)

- Inkemia Green Chemicals (Spain)

- Versalis (Novamont Spa) (Italy)

- PCC Group (Germany)

- Stepan Company (U.S.)

- Croda International PLC (U.K.)

What are the Recent Developments in Global Green Chemicals Market?

- In June 2025, Syensqo launched Miracare Biopacify, a biodegradable and microplastic-free opacifier for liquid laundry detergents, aligning with upcoming European microplastics regulations. With a Renewable Carbon Index (RCI) above 90%, the product provides a sustainable alternative to styrene acrylates without compromising performance. This innovation enhances Syensqo’s green chemical portfolio and addresses the growing demand for eco-friendly home care solutions, reinforcing the company’s leadership in sustainable chemical innovation

- In April 2024, Merck introduced Cyrene, a bio-derived, greener substitute for traditional dipolar aprotic solvents such as Dimethylformamide (DMF) and N-Methyl-2-pyrrolidone (NMP), which face increasing EU REACH regulatory restrictions due to toxicity. Produced from renewable cellulose through a two-step process and adhering to the 12 Principles of Green Chemistry, Cyrene is safer for users and less harmful to the environment. Its superior performance in applications such as graphene production, Sonogashira cross-couplings, and amide bond formation positions it as a key solution in sustainable chemistry

- In February 2024, Arkema announced a 40% expansion of its global Pebax® elastomers manufacturing facility at Serquigny, France. This expansion is designed to better support clients in the consumer and sports goods market, enabling faster delivery and increased production capacity. The move strengthens Arkema’s presence in high-performance elastomers while meeting the rising demand for sustainable and innovative polymer solutions

- In January 2024, BASF, a leading catalyst technology provider, announced a collaboration with Envision Energy to advance green hydrogen and CO2 conversion into e-methanol using dynamic process design. This partnership aims to accelerate sustainable chemical production while reducing carbon emissions, reinforcing BASF’s commitment to innovative green chemistry solutions. The collaboration is a step toward achieving more energy-efficient and environmentally responsible chemical processes

- In July 2023, Mitsubishi Chemical Group and INPEX Corporation declared their agreement to conduct a combined feasibility study for a carbon reprocess and recycle chemicals project in Abu Dhabi, UAE. The project focuses on producing the first commercial-scale polypropylene generated from green hydrogen and CO2, aiming to establish a scalable, sustainable plastics solution. This initiative highlights the growing industrial adoption of green chemicals and the shift toward low-carbon circular economy solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Green Chemicals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Green Chemicals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Green Chemicals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.