Global Green Concrete Market

Market Size in USD Billion

CAGR :

%

USD

22.05 Billion

USD

44.95 Billion

2024

2032

USD

22.05 Billion

USD

44.95 Billion

2024

2032

| 2025 –2032 | |

| USD 22.05 Billion | |

| USD 44.95 Billion | |

|

|

|

|

Green Concrete Market Size

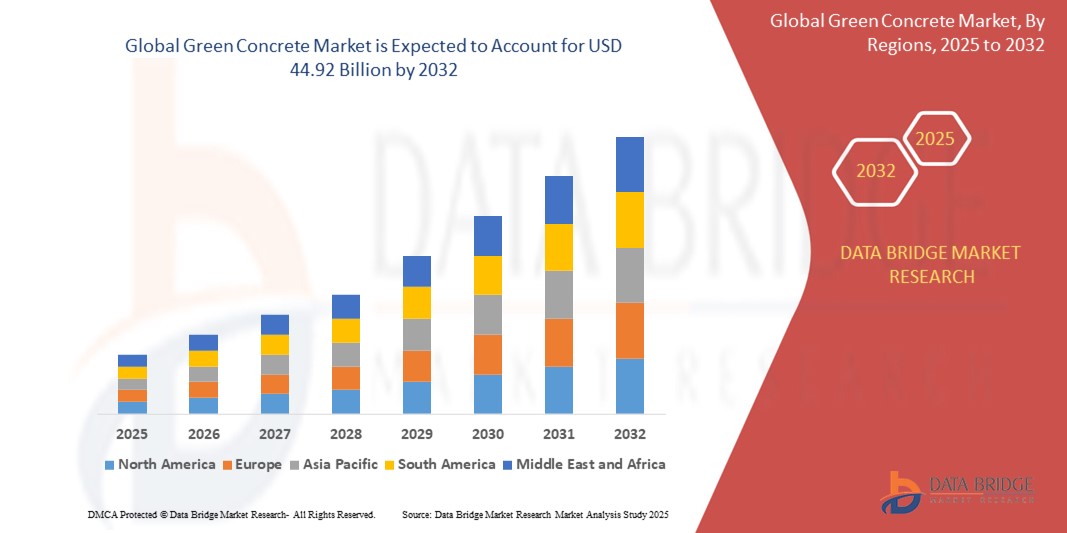

- The global green concrete market size was valued at USD 22.05 billion in 2024 and is expected to reach USD 44.92 billion by 2032, at a CAGR of 9.30% during the forecast period

- The market growth is largely fueled by increasing environmental regulations and a growing emphasis on sustainable construction practices worldwide

- With growing awareness of climate change and environmental degradation, the construction industry is increasingly adopting green concrete to reduce carbon footprints. Green concrete utilizes recycled materials and industrial by-products, minimizing natural resource depletion and lowering greenhouse gas emissions

- Many governments across the globe are implementing stringent regulations and offering incentives to promote sustainable construction. Subsidies, tax benefits, and mandatory green building certifications are encouraging developers and contractors to incorporate green concrete in their projects

Green Concrete Market Analysis

- Green Concretes, offering electronic or digital access control for doors and gates, are increasingly vital components of modern home security and automation systems in both residential and commercial settings due to their enhanced convenience, remote access capabilities, and seamless integration with smart home ecosystems

- The escalating demand for Green Concretes is primarily fueled by the widespread adoption of smart home technologies, growing security concerns among consumers, and a rising preference for the convenience of keyless entry

- North America dominated the green concrete market with the largest revenue share of 36.11% in 2024, driven by increasing government regulations focused on reducing carbon emissions in construction and promoting sustainable building practices.

- Asia-Pacific is expected to be the fastest growing region in the green concrete market during the forecast period growing at a CAGR of 13.68% from 2025 to 202. Rapid urbanization, increasing infrastructure development, and government initiatives promoting sustainable construction are driving the market.

- The cement segment dominated global green concrete market with the largest market revenue share in 2024, driven by its widespread availability and established use in construction projects aiming for sustainability.

Report Scope and Green Concrete Market Segmentation

|

Attributes |

Green Concrete Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Green Concrete Market Trends

“Rising Use of Recycled Materials in Concrete”

- Companies are increasingly using recycled aggregates from construction and demolition waste to produce green concrete

- Cement manufacturers are exploring ways to integrate industrial byproducts like fly ash and slag as eco-friendly alternatives

- The trend includes recycling glass, plastics, and metal particles into concrete mixes to enhance sustainability

- Green concrete products with high recycled content are being used in major infrastructure and commercial projects

- Collaborations between tech startups and construction firms are accelerating the development of recyclable concrete formulations

- For instance, a recent innovation involves transforming rice husk ash into a supplementary material for cement, significantly reducing carbon emissions

- In conclusion, the consistent rise in the use of recycled materials marks a defining shift in the green concrete market, aligning construction methods with sustainable development goals without compromising quality or performance

Green Concrete Market Dynamics

Driver

“Growing Demand for Sustainable Construction Solutions”

- Governments worldwide are enforcing stricter regulations to reduce carbon emissions in construction, encouraging the use of green concrete as a sustainable building material

- Major construction companies and cement manufacturers, such as Holcim and Heidelberg Materials, are investing in low-carbon cement innovations to meet sustainability goals

- The global green cement market is projected to reach USD 89.7 billion by 2032, driven by the increasing emphasis on environmental sustainability and the need to curb carbon emissions

- Innovations like fly ash-based green cement, which offers environmental benefits and cost-effectiveness, are gaining traction, accounting for an estimated 42.3% market share in 2024

- Companies like Cemex are collaborating with carbon capture technology firms to develop cost-effective solutions for producing net-zero CO2 concrete products by 2050

- In conclusion, the pursuit of sustainable construction practices is significantly boosting the green concrete market, with demand expected to grow steadily as climate-conscious policies become more mainstream and green infrastructure becomes the standard

Restraint/Challenge

“High Initial Cost and Limited Availability”

- Green concrete often involves the use of alternative binders and industrial byproducts that are not readily available in all locations, creating sourcing and supply issues

- The production of green concrete requires advanced technologies and specialized equipment, increasing upfront investment especially for small and medium-sized enterprises

- For instance, companies using carbon capture in cement production, like CarbonCure or Solidia, face higher operating costs compared to traditional producers

- Limited access to skilled labor and region-specific infrastructure for processing green materials adds to the difficulty of large-scale adoption

- Many construction firms, especially in budget-constrained markets, prioritize lower upfront costs over long-term sustainability gains, which slows market growth

- In conclusion, the high initial cost and material availability challenges continue to be major roadblocks for green concrete adoption despite its long-term environmental advantages

Green Concrete Market Scope

The market is segmented on the basis of product type, design, and end use.

• By Product Type

On the basis of product type, the global green concrete market is segmented into cement and lime. The cement segment dominated global green concrete market with the largest market revenue share in 2024, driven by its widespread availability and established use in construction projects aiming for sustainability. Cement-based green concrete, especially incorporating supplementary materials like fly ash and slag, offers enhanced durability and reduced carbon emissions.

The lime segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption in restoration and heritage construction projects. Lime-based green concrete offers benefits such as improved workability and lower energy consumption during production, making it an attractive option for sustainable building practices.

• By Design

On the basis of design, the green concrete market is segmented into plain cement, pre-stressed, and reinforced. The reinforced segment accounted for the largest market revenue share in 2024, driven by its enhanced structural performance and widespread use in infrastructure projects. Reinforced green concrete combines sustainability with strength, making it suitable for high-load-bearing applications.

The pre-stressed segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its efficiency in reducing material usage and improving load distribution in structures. Pre-stressed green concrete is increasingly utilized in bridge construction and large-span structures, where performance and sustainability are critical.

• By End Use

On the basis of end use, the green concrete market is segmented into residential, commercial, industrial, and infrastructure. The residential segment held the largest market revenue share in 2024, driven by the growing demand for sustainable housing and government incentives promoting green building practices. Homeowners and developers are increasingly adopting green concrete for its environmental benefits and potential cost savings over the building lifecycle.

The infrastructure segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by large-scale public projects and urban development initiatives. Governments and municipalities are incorporating green concrete into transportation, water management, and energy infrastructure to meet sustainability goals and reduce environmental impact.

Green Concrete Market Regional Analysis

- North America dominated the green concrete market with the largest revenue share of 36.11% in 2024, driven by increasing government regulations focused on reducing carbon emissions in construction and promoting sustainable building practices

- The region benefits from strong investments by major construction and cement companies in green technologies, including the development of low-carbon cement and recycled material usage, which boosts market growth

- In addition, rising awareness among consumers and developers about environmental impact is encouraging the adoption of green concrete in commercial and infrastructure projects across North America

U.S. Green Concrete Market Insight

The U.S. Green Concrete market held a significant revenue share of USD 11.53 billion in 2024, driven by the rapid adoption of sustainable construction practices and stringent environmental regulations. The Infrastructure Investment and Jobs Act has further propelled the demand for eco-friendly building materials, including green concrete, in large-scale infrastructure projects. Additionally, the increasing awareness among consumers and builders about the environmental impact of traditional concrete has led to a surge in the use of green alternatives.

Europe Green Concrete Market Insight

The Europe Green Concrete market reached a valuation of USD 10.2 billion in 2024 and is projected to grow at a CAGR of 9.2% from 2025 to 2033. This growth is attributed to the European Union's ambitious goals to reduce carbon emissions and promote sustainable construction practices. Countries like Germany and the UK are leading the charge, with significant investments in green infrastructure and the adoption of environmentally friendly building materials.

U.K. Green Concrete Market Insight

The U.K. Green Concrete market was valued at USD 1.84 billion in 2024 and is expected to grow at a CAGR of 9.0% during the forecast period. The growth is driven by the government's commitment to achieving net-zero carbon emissions by 2050, leading to increased adoption of green building materials. The construction industry's focus on sustainability and the rising demand for eco-friendly residential and commercial buildings are further propelling the market.

Germany Green Concrete Market Insight

Germany led the European Green Concrete market with a 25.5% share in 2024, reflecting its strong commitment to environmental sustainability. The country's stringent regulations on carbon emissions and the promotion of green building standards have accelerated the adoption of green concrete. Innovations in low-carbon cement and the integration of recycled materials in construction are key factors contributing to market growth.

Asia-Pacific Green Concrete Market Insight

The Asia-Pacific Green Concrete market was valued at USD 8.74 billion in 2024 and is anticipated to reach USD 29.35 billion by 2033, growing at a CAGR of 13.68% from 2025 to 2033. Rapid urbanization, increasing infrastructure development, and government initiatives promoting sustainable construction are driving the market. Countries like China, Japan, and India are witnessing significant investments in green building projects, boosting the demand for green concrete.

Japan Green Concrete Market Insight

The Japan Green Concrete market reached USD 1.9 billion in 2024 and is projected to grow and country's focus on reducing environmental impact and promoting sustainable construction practices has led to increased adoption of green concrete. Government policies and incentives supporting eco-friendly building materials are further contributing to market growth.

China Green Concrete Market Insight

China's Green Concrete market was valued at USD 3.8 billion in 2024 and is expected to grow at a CAGR of 9.0% during the forecast period. The government's emphasis on sustainable urban development and the implementation of strict environmental regulations are key drivers of market growth. The integration of green concrete in large-scale infrastructure projects and the promotion of green building standards are accelerating the adoption of eco-friendly construction materials.

Green Concrete Market Share

The green concrete industry is primarily led by well-established companies, including:

- HOLCIM (Switzerland)

- CEMEX (Mexico)

- HeidelbergCement AG (Germany)

- CRH (Ireland)

- UltraTech Cement Ltd (India)

- Sika AG (Switzerland)

- Buzzi S.p.A. (Italy)

- Vicat SA (France)

- TAIHEIYO CEMENT CORPORATION (Japan)

- Ecocem (Ireland)

- BASF SE (Germany)

- Cement Australia Holdings Pty Limited (Australia)

- Tarmac (U.K.)

- St. Marys Cement Inc. (Canada)

- CarbonCure Technologies Inc. (Canada)

- SOLIDIA TECHNOLOGIES (U.S.)

- Giatec Scientific Inc. (Canada)

- Aggregate Industries (U.K.)

Latest Developments in Global Green Concrete Market

- In January 2023, ACC Limited, a part of the Adani Group, launches 'ACC ECOMaxX' in Mumbai, aiming to transform the building materials industry with sustainable green concrete solutions, fostering environmentally conscious construction practices

- In October 2022, JSW Cement announces a substantial investment of over INR 3,200 crore (USD 390 million) to establish green cement manufacturing facilities in Madhya Pradesh and Uttar Pradesh, with a combined capacity of 5 MTPA, furthering India's commitment to sustainable infrastructure development

- In July 2022, Hallett Group announced a USD 125 million green cement project across strategic locations in South Australia, aimed at slashing carbon dioxide emissions by 300,000 tonnes per annum initially, with projections to reach one million tonnes annually, displaying a significant stride towards carbon-neutral cement production

- In July 2020, LafargeHolcim launches its "green concrete" in the U.S., with plans for expansion into Latin America, Canada, and the U.K. This eco-friendly concrete, already available in Europe, marks a significant step towards reducing carbon emissions in the construction sector globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Green Concrete Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Green Concrete Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Green Concrete Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.