Global Green Hydrogen Market

Market Size in USD Billion

CAGR :

%

USD

9.24 Billion

USD

156.45 Billion

2024

2032

USD

9.24 Billion

USD

156.45 Billion

2024

2032

| 2025 –2032 | |

| USD 9.24 Billion | |

| USD 156.45 Billion | |

|

|

|

|

What is the Global Green Hydrogen Market Size and Growth Rate?

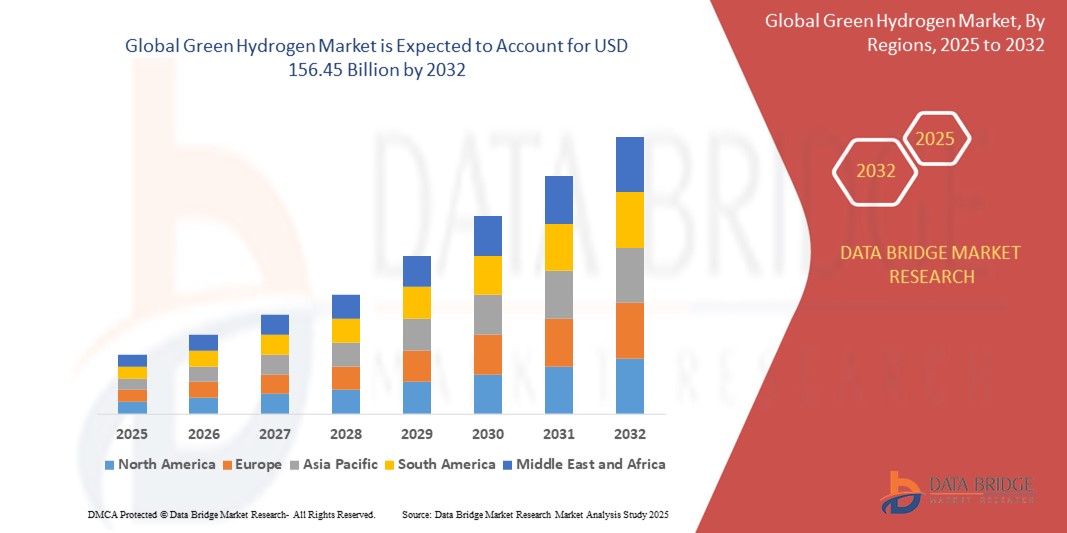

- The global green hydrogen market size was valued at USD 9.24 billion in 2024 and is expected to reach USD 156.45 billion by 2032, at a CAGR of 42.42% during the forecast period

- In the expanding green hydrogen market, alkaline (ALK) electrolyzers such as those by Nel hydrogen are favored for large-scale industrial projects such as power-to-gas plants

- Proton exchange membrane (PEM) electrolyzers, exemplified by products from companies such as ITM Power, excel in smaller, decentralized applications such as hydrogen refueling stations. Solid oxide electrolyzers, such as those by sun fire, are preferred for high-temperature industrial processes such as steel production

What are the Major Takeaways of Green Hydrogen Market?

- Innovations such as improved catalysts, membrane materials, and system designs enhance electrolysis processes, reducing energy consumption and costs. Higher efficiency translates to greater hydrogen production with less input energy, making green hydrogen increasingly competitive with conventional hydrogen production methods

- This efficiency boost lowers the overall cost of hydrogen production and accelerates the adoption of green hydrogen across various sectors, driving the market forward

- Europe dominated the green hydrogen market with the largest revenue share of 46.8% in 2024, driven by strong policy support for decarbonization, aggressive climate targets, and growing investments in clean hydrogen infrastructure across major economies including Germany, France, the U.K., and the Netherlands

- Asia-Pacific is projected to grow at the fastest CAGR of 14.6% from 2025 to 2032, fueled by rising energy demand, massive investments in renewable energy, and government initiatives supporting clean hydrogen development in countries such as China, Japan, India, South Korea, and Australia

- The Polymer Electrolyte Membrane (PEM) Electrolyzer segment dominated the green hydrogen market with the largest revenue share of 64.3% in 2024, owing to its high efficiency, compact design, and rapid response to fluctuating power inputs

Report Scope and Green Hydrogen Market Segmentation

|

Attributes |

Green Hydrogen Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Green Hydrogen Market?

- A major and rapidly advancing trend in the global green hydrogen market is the surge in technological innovation focused on electrolyzers and large-scale hydrogen infrastructure, aimed at reducing production costs and increasing efficiency

- Companies are heavily investing in next-generation PEM, alkaline, and solid oxide electrolyzers that enhance hydrogen yield and enable decentralized, renewable-powered hydrogen production

- Breakthroughs in modular electrolyzer systems and integration with solar and wind energy are making green hydrogen more scalable and cost-competitive with grey and blue hydrogen

- Governments and energy giants are accelerating infrastructure investments, including hydrogen refueling stations, pipelines, and storage facilities, to support clean mobility and decarbonize industrial sectors

- Major players such as Siemens Energy, Plug Power, and Nel ASA are actively partnering with utilities and governments to launch green hydrogen hubs, industrial projects, and pilot programs

- This trend is fundamentally transforming the global energy landscape, positioning green hydrogen as a key pillar in the transition toward net-zero emissions and a circular hydrogen economy

What are the Key Drivers of Green Hydrogen Market?

- The global push toward decarbonization, combined with ambitious net-zero targets, is a primary driver fueling the growth of the green hydrogen market across energy, mobility, and industrial applications

- For instance, in June 2024, Plug Power Inc. announced the opening of the largest U.S.-based green hydrogen plant in Georgia, capable of producing 15 tons of liquid hydrogen daily from renewable sources

- Rising investments in renewable energy integration, especially solar and wind, are accelerating electrolyzer deployment and reducing the carbon intensity of hydrogen production.

- Supportive government policies such as the EU Green Deal, Inflation Reduction Act (U.S.), and National Hydrogen Missions (India, Australia) are driving funding, subsidies, and R&D for green hydrogen

- Increasing demand for clean fuels in transportation, heavy industry, power generation, and fertilizer production is also expanding the market’s end-use footprint

- The convergence of policy, innovation, and infrastructure is creating a strong foundation for sustained growth in the global green hydrogen economy

Which Factor is challenging the Growth of the Green Hydrogen Market?

- The high cost of production and energy-intensive nature of electrolytic hydrogen remains a significant challenge, especially in comparison to fossil-based hydrogen alternatives such as grey and blue hydrogen

- For instance, producing green hydrogen currently costs 2 to 5 times more than grey hydrogen due to expensive electrolyzer systems and the need for abundant, low-cost renewable electricity

- The lack of hydrogen infrastructure including pipelines, storage solutions, and refueling stations—hinders seamless supply chain integration and slows adoption across key sectors.

- In addition, technical challenges such as intermittent renewable power supply, low electrolyzer utilization rates, and water availability in arid regions pose operational constraints

- There are also regulatory and standardization gaps, with different countries at varying stages of green hydrogen strategy implementation, limiting international trade and investment momentum

- Overcoming these hurdles will require public-private collaboration, innovation in electrolyzer efficiency, long-term policy clarity, and strategic global investments to make green hydrogen scalable, affordable, and universally deployable

How is the Green Hydrogen Market Segmented?

The market is segmented on the basis of type, technology, renewable source, application, distribution channel, and end-use industry.

• By Type

On the basis of type, the green hydrogen market is segmented into Polymer Electrolyte Membrane (PEM) Electrolyzers and Solid Oxide Electrolyzers. The Polymer Electrolyte Membrane (PEM) Electrolyzer segment dominated the Green Hydrogen market with the largest revenue share of 64.3% in 2024, owing to its high efficiency, compact design, and rapid response to fluctuating power inputs. PEM electrolyzers are widely used for grid balancing, renewable integration, and mobile hydrogen generation due to their flexibility and fast start-up capabilities.

The Solid Oxide Electrolyzer segment is projected to witness the fastest CAGR from 2025 to 2032, driven by its ability to operate at high temperatures and deliver higher hydrogen output per unit of energy. These electrolyzers are gaining traction in industrial sectors and large-scale hydrogen projects aimed at maximizing efficiency and reducing long-term operational costs.

• By Technology

On the basis of technology, the green hydrogen market is segmented into Alkaline (ALK) Electrolyzer, Proton Exchange Membrane (PEM) Electrolyzer, and Solid Oxide Electrolyzer. The Alkaline Electrolyzer segment held the largest market revenue share in 2024, driven by its well-established technology, lower capital cost, and suitability for large-scale hydrogen production. ALK electrolyzers are primarily adopted in chemical processing, refineries, and industrial hydrogen supply.

The PEM Electrolyzer segment is expected to register the fastest CAGR during the forecast period, supported by increasing applications in transportation, mobility, and renewable-powered hydrogen generation due to its compact size, high purity output, and superior efficiency.

• By Renewable Source

On the basis of renewable source, the green hydrogen market is segmented into Wind, Solar, and Other. The Solar segment dominated the market with the highest revenue share in 2024, supported by the declining cost of solar photovoltaics and increasing deployment of solar-powered electrolyzer systems in arid and sun-rich regions.

The Wind segment is anticipated to witness the fastest growth rate from 2025 to 2032, as offshore and onshore wind farms are increasingly paired with electrolyzers to generate green hydrogen at scale, especially in Europe and coastal Asia-Pacific regions.

• By Application

On the basis of application, the green hydrogen market is segmented into Power Generation, Heating, and Transport. The Transport segment accounted for the largest revenue share of 45.1% in 2024, owing to the growing shift toward clean mobility solutions such as fuel cell electric vehicles (FCEVs), hydrogen-powered trains, and commercial fleets.

The Power Generation segment is projected to expand at the fastest CAGR from 2025 to 2032, fueled by the use of green hydrogen in gas turbines, peaker plants, and as a storage medium to balance intermittent renewable electricity.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Pipeline and Cargo. The Pipeline segment dominated the market in 2024, driven by its efficiency in transporting large volumes of hydrogen over short to medium distances, especially in industrial zones and integrated hydrogen valleys.

The Cargo segment is expected to grow at the fastest rate during the forecast period, driven by rising international hydrogen trade, advancements in cryogenic storage, and increasing global demand for hydrogen exports via tankers and containers.

• By End-Use Industry

On the basis of end-use industry, the green hydrogen market is segmented into Mobility, Power Chemical, Industrial, Grid Injection, Transportation, Chemical, Steel, Domestic, Food and Beverages, Medical, Petrochemicals, Electronics, Glass, Mining, and Others. The Industrial segment held the largest market share of 38.5% in 2024, led by the strong demand for clean hydrogen in refining, ammonia production, and high-temperature processing applications.

The Mobility segment is poised to register the fastest CAGR from 2025 to 2032, supported by government incentives for hydrogen-fueled vehicles, growing investments in hydrogen refueling infrastructure, and the rapid expansion of zero-emission public transport fleets worldwide.

Which Region Holds the Largest Share of the Green Hydrogen Market?

- Europe dominated the green hydrogen market with the largest revenue share of 46.8% in 2024, driven by strong policy support for decarbonization, aggressive climate targets, and growing investments in clean hydrogen infrastructure across major economies including Germany, France, the U.K., and the Netherlands

- The European Union’s Green Deal and Hydrogen Strategy are accelerating regional production and utilization of green hydrogen in power, mobility, and industrial sectors, establishing Europe as a global leader in the transition to hydrogen-based energy

- The region benefits from well-developed renewable energy capacity, government-funded electrolyzer projects, and public-private partnerships aimed at building a hydrogen ecosystem, reinforcing its dominant position in the global market

Germany Green Hydrogen Market Insight

Germany green hydrogen market held the largest revenue share within Europe in 2024, propelled by the country’s leadership in renewable energy deployment, industrial decarbonization, and hydrogen R&D initiatives. Germany's National Hydrogen Strategy and growing demand for zero-emission fuels in steel, chemicals, and transport sectors are significantly contributing to the country's green hydrogen adoption and market expansion.

U.K. Green Hydrogen Market Insight

The U.K. green hydrogen market is growing rapidly, supported by government funding for green hydrogen hubs and a national hydrogen roadmap focused on clean energy transition. With the rise in offshore wind installations and emphasis on hydrogen-powered transport, the U.K. is driving market demand across industrial and mobility applications.

France Green Hydrogen Market Insight

The France green hydrogen market is experiencing steady growth, fueled by the government’s €7 billion investment plan in hydrogen as part of its broader climate agenda. Increasing deployment of electrolyzers and collaborations between public bodies and energy giants are enhancing hydrogen production and end-use penetration in transport and industry.

Which Region is the Fastest Growing Region in the Green Hydrogen Market?

Asia-Pacific is projected to grow at the fastest CAGR of 14.6% from 2025 to 2032, fueled by rising energy demand, massive investments in renewable energy, and government initiatives supporting clean hydrogen development in countries such as China, Japan, India, South Korea, and Australia. The region's ambition to decarbonize hard-to-abate sectors, combined with growing interest in hydrogen exports and industrial-scale electrolyzer manufacturing, is significantly boosting green hydrogen adoption. Advancements in solar and wind infrastructure, along with a maturing hydrogen supply chain, are enabling cost-effective production, making Asia-Pacific a strategic hub for global green hydrogen expansion.

China Green Hydrogen Market Insight

The China green hydrogen market led the Asia-Pacific region in revenue share in 2024, supported by large-scale renewable energy deployment, carbon neutrality goals for 2060, and investments in hydrogen-powered transport and industrial decarbonization. Major pilot zones and public-private ventures are strengthening China’s position in global hydrogen leadership.

Japan Green Hydrogen Market Insight

The Japan green hydrogen market is gaining momentum due to its national hydrogen strategy, which emphasizes clean fuel adoption across transport, power generation, and industrial heating. Japan’s collaboration with international partners and its technological prowess in fuel cells and storage solutions are supporting continued market growth.

India Green Hydrogen Market Insight

The India green hydrogen market is poised for strong growth, driven by favorable government policies such as the National Green Hydrogen Mission, increasing renewable energy capacity, and rising industrial demand. Strategic initiatives to reduce import dependency and decarbonize fertilizer and refinery sectors are propelling market expansion.

Which are the Top Companies in Green Hydrogen Market?

The green hydrogen industry is primarily led by well-established companies, including:

- Siemens Energy (Germany)

- Nel ASA (Norway)

- Plug Power Inc. (U.S.)

- ITM Power PLC (U.K.)

- McPhy Energy S.A (France)

- Ballard Power Systems (Canada)

- Cummins Inc. (U.S.)

- Linde plc (U.K.)

- ENGIE SA (France)

- Kawasaki Heavy Industries, Ltd. (Japan)

- PowerCell Sweden AB (Sweden)

- Green Hydrogen Systems (Denmark)

- BayoTech (U.S.)

- Enapter S.r.l. (Germany)

- Areva H2Gen (France)

- HydrogenPro (Norway)

- Topsoe A/S (Denmark)

What are the Recent Developments in Global Green Hydrogen Market?

- In September 2024, Thermax entered into a strategic partnership with Ceres Power to locally manufacture Solid Oxide Electrolysis Cells (SOEC) aimed at green hydrogen production using industrial waste heat. The initiative focuses on supplying energy-efficient solutions for sectors such as steel and oil refineries, with Thermax planning to set up a domestic production facility and localize SOEC components. This move represents a significant milestone in advancing India’s industrial decarbonization through green hydrogen technology

- In September 2024, Jindal Steel (JSPL) and Jindal Renewables (JRPL) announced a joint initiative to decarbonize steel manufacturing using green hydrogen. Under the collaboration, JSPL will integrate green hydrogen into its Direct Reduced Iron (DRI) process at the Angul facility in Odisha, aligning with its commitment to clean energy and low-carbon steel production. This step reinforces the steel industry’s transition towards sustainability and clean energy leadership in India

- In April 2023, Sinopec unveiled its plan to build a 400 km green hydrogen pipeline connecting Inner Mongolia to Beijing, marking China’s first large-scale hydrogen transport network. Designed to carry up to 100,000 tonnes of green hydrogen annually, the pipeline supports the nation’s clean energy shift by enabling efficient transmission of renewable hydrogen. This development strengthens China’s infrastructure for green hydrogen and accelerates its national decarbonization goals

- In April 2020, Siemens Gas and Power and Uniper SE, both headquartered in Germany, signed a partnership to jointly develop renewable hydrogen generation and application projects. Their collaboration aims to establish the commercial viability of green hydrogen by replacing fossil fuels in industrial energy systems. This alliance marked an early push in Europe’s hydrogen economy, emphasizing long-term sustainability and innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL GREEN HYDROGEN MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL GREEN HYDROGEN MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBAL GREEN HYDROGEN MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 PORTER’S FIVE FORCES

5.4 VENDOR SELECTION CRITERIA

5.5 PESTEL ANALYSIS

5.6 REGULATION COVERAGE

5.6.1.1. PRODUCT CODES

5.6.1.2. CERTIFIED STANDARDS

5.6.1.3. SAFETY STANDARDS

5.6.1.4. MATERIAL HANDLING & STORAGE

5.6.1.5. TRANSPORT & PRECAUTIONS

5.6.1.6. HARAD IDENTIFICATION

6 PRICING ANALYSIS

7 PRODUCTION CAPACITY OVERVIEW

8 SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9 CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

10 OVERVIEW ON HYDROGEN EPC PROJECT OPPORTUNITY IN SOUTH EAST ASIA

11 GLOBAL GREEN HYDROGEN MARKET, BY TECHNOLOGY, 2022-2031, (USD MILLION) (VOLUME)

11.1 OVERVIEW

11.2 ALKALINE ELECTROLYZER

11.3 PROTON EXCHANGE MEMBRANE (PEM) ELECTROLYZER

11.4 SOLID OXIDE ELECTROLYZER

11.5 SOLAR HYDROGEN PROUCTION

11.5.1.1. PHOTOELECTROCHEMICAL WATER SPLITTING (PEC)

11.5.1.2. PHOTOCATALYTIC WATER SPLITTING

11.6 WIND HYDROGEN PRODUCTION

11.7 MICROBIAL ELECTROLYSIS

12 GLOBAL GREEN HYDROGEN MARKET, BY RENEWABLE SOURCE, 2022-2031, (USD MILLION)

12.1 OVERVIEW

12.2 SOLAR

12.3 WIND

12.4 OTHERS

12.4.1.1. HYDROPOWER

12.4.1.2. GEOTHERMAL

12.4.1.3. OTHERS

13 GLOBAL GREEN HYDROGEN MARKET, BY APPLICATION, 2022-2031, (USD MILLION)

13.1 OVERVIEW

13.2 HEATING

13.3 ELECTRIC VEHICLES

13.4 STEEL MANUFACTURING

13.5 POWER GENERATION

13.6 CHEMICALS

13.6.1.1. METHANOL

13.6.1.2. AMMONIA

13.6.1.3. OTHERS

13.7 INDUSTRIAL

13.7.1.1. REFINING

13.7.1.2. PETROCHEMICALS

13.7.1.3. STEEL PRODUCTION

13.7.1.4. OTHERS

13.8 AGRICULTURE

13.9 OTHERS

14 GLOBAL GREEN HYDROGEN MARKET, BY REGION, (2022-2031), (USD MILLION) (VOLUME)

14.1 GLOBAL GREEN HYDROGEN MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.2 NORTH AMERICA

14.2.1.1. U.S.

14.2.1.2. CANADA

14.2.1.3. MEXICO

14.3 EUROPE

14.3.1.1. GERMANY

14.3.1.2. U.K.

14.3.1.3. ITALY

14.3.1.4. FRANCE

14.3.1.5. SPAIN

14.3.1.6. RUSSIA

14.3.1.7. SWITZERLAND

14.3.1.8. TURKEY

14.3.1.9. BELGIUM

14.3.1.10. NETHERLANDS

14.3.1.11. REST OF EUROPE

14.4 ASIA-PACIFIC

14.4.1.1. JAPAN

14.4.1.2. CHINA

14.4.1.3. SOUTH KOREA

14.4.1.4. INDIA

14.4.1.5. SINGAPORE

14.4.1.6. THAILAND

14.4.1.7. INDONESIA

14.4.1.8. MALAYSIA

14.4.1.9. PHILIPPINES

14.4.1.10. AUSTRALIA

14.4.1.11. NEW ZEALAND

14.4.1.12. REST OF ASIA-PACIFIC

14.5 SOUTH AMERICA

14.5.1.1. BRAZIL

14.5.1.2. ARGENTINA

14.5.1.3. REST OF SOUTH AMERICA

14.6 MIDDLE EAST AND AFRICA

14.6.1.1. SOUTH AFRICA

14.6.1.2. EGYPT

14.6.1.3. SAUDI ARABIA

14.6.1.4. UNITED ARAB EMIRATES

14.6.1.5. ISRAEL

14.6.1.6. REST OF MIDDLE EAST AND AFRICA

15 GLOBAL GREEN HYDROGEN MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS AND ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

15.7 EXPANSIONS

15.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 GLOBAL GREEN HYDROGEN MARKET - COMPANY PROFILES

16.1 LINDE PLC

16.1.1.1. COMPANY SNAPSHOT

16.1.1.2. PRODUCT PORTFOLIO

16.1.1.3. REVENUE ANALYSIS

16.1.1.4. RECENT UPDATES

16.2 AIR LIQUIDE

16.2.1.1. COMPANY SNAPSHOT

16.2.1.2. PRODUCT PORTFOLIO

16.2.1.3. REVENUE ANALYSIS

16.2.1.4. RECENT UPDATES

16.3 SIEMENS ENERGY + AIR PRODUCTS AND CHEMICALS, INC.

16.3.1.1. COMPANY SNAPSHOT

16.3.1.2. PRODUCT PORTFOLIO

16.3.1.3. REVENUE ANALYSIS

16.3.1.4. RECENT UPDATES

16.4 ENGIE

16.4.1.1. COMPANY SNAPSHOT

16.4.1.2. PRODUCT PORTFOLIO

16.4.1.3. REVENUE ANALYSIS

16.4.1.4. RECENT UPDATES

16.5 UNIPER SE

16.5.1.1. COMPANY SNAPSHOT

16.5.1.2. PRODUCT PORTFOLIO

16.5.1.3. REVENUE ANALYSIS

16.5.1.4. RECENT UPDATES

16.6 SIEMENS ENERGY

16.6.1.1. COMPANY SNAPSHOT

16.6.1.2. PRODUCT PORTFOLIO

16.6.1.3. REVENUE ANALYSIS

16.6.1.4. RECENT UPDATES

16.7 CUMMINS INC

16.7.1.1. COMPANY SNAPSHOT

16.7.1.2. PRODUCT PORTFOLIO

16.7.1.3. REVENUE ANALYSIS

16.7.1.4. RECENT UPDATES

16.8 FUELCELL ENERGY, INC.

16.8.1.1. COMPANY SNAPSHOT

16.8.1.2. PRODUCT PORTFOLIO

16.8.1.3. REVENUE ANALYSIS

16.8.1.4. RECENT UPDATES

16.9 NEL ASA

16.9.1.1. COMPANY SNAPSHOT

16.9.1.2. PRODUCT PORTFOLIO

16.9.1.3. REVENUE ANALYSIS

16.9.1.4. RECENT UPDATES

16.1 CWP RENEWABLES

16.10.1.1. COMPANY SNAPSHOT

16.10.1.2. PRODUCT PORTFOLIO

16.10.1.3. REVENUE ANALYSIS

16.10.1.4. RECENT UPDATES

16.11 IBERDROLA, S.A.

16.11.1.1. COMPANY SNAPSHOT

16.11.1.2. PRODUCT PORTFOLIO

16.11.1.3. REVENUE ANALYSIS

16.11.1.4. RECENT UPDATES

16.12 ØRSTED A/S

16.12.1.1. COMPANY SNAPSHOT

16.12.1.2. PRODUCT PORTFOLIO

16.12.1.3. REVENUE ANALYSIS

16.12.1.4. RECENT UPDATES

16.13 ACWA POWER

16.13.1.1. COMPANY SNAPSHOT

16.13.1.2. PRODUCT PORTFOLIO

16.13.1.3. REVENUE ANALYSIS

16.13.1.4. RECENT UPDATES

16.14 ITM POWER PLC

16.14.1.1. COMPANY SNAPSHOT

16.14.1.2. PRODUCT PORTFOLIO

16.14.1.3. REVENUE ANALYSIS

16.14.1.4. RECENT UPDATES

16.15 HY2GEN AG

16.15.1.1. COMPANY SNAPSHOT

16.15.1.2. PRODUCT PORTFOLIO

16.15.1.3. REVENUE ANALYSIS

16.15.1.4. RECENT UPDATES

16.16 NEXT HYDROGEN

16.16.1.1. COMPANY SNAPSHOT

16.16.1.2. PRODUCT PORTFOLIO

16.16.1.3. REVENUE ANALYSIS

16.16.1.4. RECENT UPDATES

16.17 SHELL GLOBAL

16.17.1.1. COMPANY SNAPSHOT

16.17.1.2. PRODUCT PORTFOLIO

16.17.1.3. REVENUE ANALYSIS

16.17.1.4. RECENT UPDATES

16.18 PLUG POWER INC.

16.18.1.1. COMPANY SNAPSHOT

16.18.1.2. PRODUCT PORTFOLIO

16.18.1.3. REVENUE ANALYSIS

16.18.1.4. RECENT UPDATES

16.19 ENVISION GROUP

16.19.1.1. COMPANY SNAPSHOT

16.19.1.2. PRODUCT PORTFOLIO

16.19.1.3. REVENUE ANALYSIS

16.19.1.4. RECENT UPDATES

16.2 STATKRAFT

16.20.1.1. COMPANY SNAPSHOT

16.20.1.2. PRODUCT PORTFOLIO

16.20.1.3. REVENUE ANALYSIS

16.20.1.4. RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

17 RELATED REPORTS

18 QUESTIONNAIRE

19 CONCLUSION

20 ABOUT DATA BRIDGE MARKET RESEARCH

Global Green Hydrogen Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Green Hydrogen Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Green Hydrogen Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.