Global Green Roof Market

Market Size in USD Billion

CAGR :

%

USD

1.93 Billion

USD

5.91 Billion

2024

2032

USD

1.93 Billion

USD

5.91 Billion

2024

2032

| 2025 –2032 | |

| USD 1.93 Billion | |

| USD 5.91 Billion | |

|

|

|

|

Green Roof Market Size

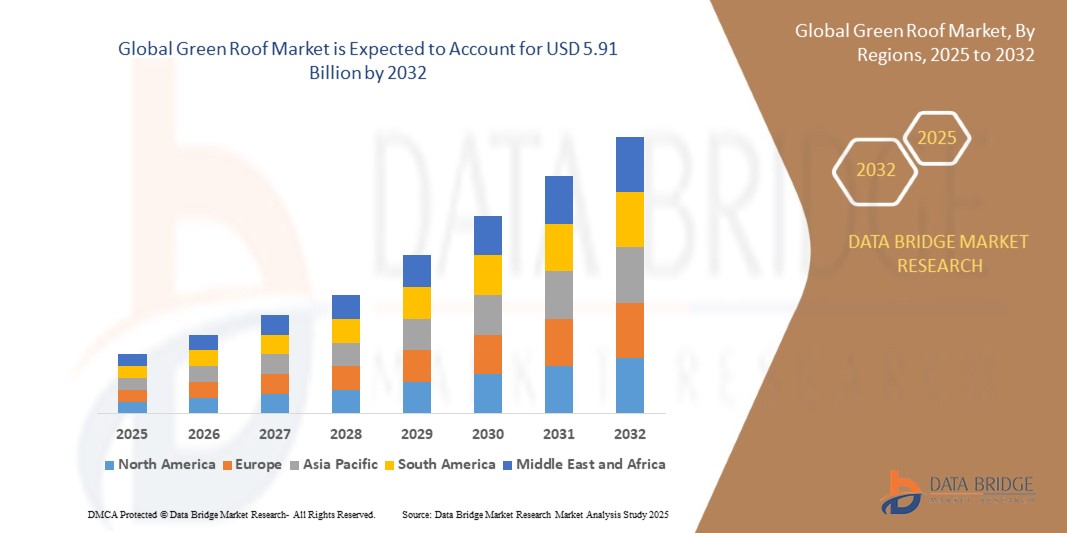

- The global green roof market size was valued at USD 1.93 billion in 2024 and is expected to reach USD 5.91 billion by 2032, at a CAGR of 15.00% during the forecast period

- The market growth is largely fuelled by the increasing emphasis on sustainable urban development, rising concerns over climate change, and government incentives for energy-efficient infrastructure

- Growing adoption of green building codes, along with rising awareness of the environmental and economic benefits of green roofs, such as improved insulation, reduced urban heat island effect, and enhanced stormwater management, is further supporting market expansion

Green Roof Market Analysis

- The market is experiencing notable growth across developed economies in Europe and North America, driven by stringent environmental regulations and urban sustainability goals

- In addition, rapid urbanization in Asia-Pacific is fostering increased green roof installations, especially in commercial and public infrastructure projects

- Europe dominated the global green roof market with the largest revenue share of 42.8% in 2024, driven by strict environmental regulations, growing urban sustainability initiatives, and strong government incentives for eco-friendly construction practices

- The Asia-Pacific region is expected to witness the highest growth rate in the global green roof market, driven by rapid urbanization, rising environmental awareness, and increasing government initiatives promoting sustainable building practices across countries such as China, India, and Japan

- The extensive segment dominated the market with the largest market revenue share in 2024, driven by its low maintenance requirements, lighter structural load, and cost-effectiveness. Extensive green roofs are widely adopted for retrofitting existing buildings due to their thinner soil layers and lower installation costs. They are ideal for urban environments where structural limitations exist, providing insulation and stormwater management benefits with minimal upkeep

Report Scope and Green Roof Market Segmentation

|

Attributes |

Green Roof Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Green Roof Market Trends

“Surging Adoption Of Smart Green Roof Systems In Urban Construction”

- Smart green roof systems are increasingly integrated with technologies such as automated irrigation and environmental sensors to optimize building performance

- These systems offer benefits such as reduced energy consumption, enhanced stormwater management, and real-time monitoring of moisture and temperature levels

- Urban developers are adopting smart green roofs to meet sustainability goals and green building certifications such as LEED

- Cities are leveraging these roofs to address urban heat island effects and improve the ecological footprint of buildings

- For instance, In Singapore, smart green roofs are being implemented under the “Skyrise Greenery” incentive scheme to enhance biodiversity and regulate rooftop temperatures

Green Roof Market Dynamics

Driver

“Government Initiatives and Regulations Supporting Sustainable Construction”

- Governments across North America, Europe, and Asia are implementing policies to promote or mandate green roof installations on new and existing buildings

- Financial incentives such as subsidies, tax rebates, and grants are boosting adoption rates among builders and property owners

- Regulations in cities such as Chicago and Stuttgart require green roofs on large flat-roof buildings for environmental compliance

- These initiatives support urban resilience against flooding, reduce air pollution, and contribute to carbon emission reductions

- For instance, Stuttgart (Germany) mandates green roofs on new flat-roof buildings larger than 60 m² to combat stormwater runoff and rising urban temperatures

Restraint/Challenge

“High Installation Costs and Structural Limitations”

- The initial cost of green roof installation is significantly higher than traditional roofs due to additional materials and engineering requirements

- Retrofitting older buildings requires structural reinforcement, increasing complexity and deterring property owners

- The lack of skilled labor and green infrastructure policies in some developing regions further hinders adoption

- Long return on investment discourages cost-conscious developers despite long-term energy savings and ecological benefits

- For instance, In Indonesia, limited funding and insufficient technical expertise make it challenging for developers to adopt green roofs in public infrastructure projects

Green Roof Market Scope

The market is segmented on the basis of type, application, distribution channel, and vegetation type.

• By Type

On the basis of type, the green roof market is segmented into extensive, semi-intensive, and intensive. The extensive segment dominated the market with the largest market revenue share in 2024, driven by its low maintenance requirements, lighter structural load, and cost-effectiveness. Extensive green roofs are widely adopted for retrofitting existing buildings due to their thinner soil layers and lower installation costs. They are ideal for urban environments where structural limitations exist, providing insulation and stormwater management benefits with minimal upkeep.

The intensive segment is expected to witness the fastest growth rate from 2025 to 2032, owing to rising demand for high-performance green spaces that can support a wider range of plant types, including shrubs and trees. These roofs offer recreational and aesthetic advantages, making them popular in commercial complexes and institutional buildings. Their adaptability to design, combined with environmental and social benefits, contributes to their growing preference among developers and architects.

• By Application

On the basis of application, the green roof market is segmented into residential, commercial, and industrial. The commercial segment held the largest market revenue share in 2024 due to increased implementation of sustainable practices across office buildings, shopping malls, and hospitality infrastructure. Businesses are embracing green roofs to meet green building certifications and improve energy efficiency.

The residential segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by increasing awareness among homeowners regarding the benefits of improved insulation, reduced heat absorption, and enhanced property value. The rise in sustainable housing projects across urban centers further supports segment growth.

• By Distribution Channel

On the basis of distribution channel, the green roof market is segmented into retail and wholesale. The wholesale segment dominated the market in 2024, as bulk procurement by construction companies, landscaping contractors, and green building developers remains the most common purchasing approach. Partnerships with large-scale distributors and government-supported building projects also contribute to wholesale dominance.

The retail segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand from individual homeowners and small-scale developers. Availability of modular green roofing kits and improved accessibility through e-commerce and gardening stores are accelerating retail sales globally.

• By Vegetation Type

On the basis of vegetation type, the green roof market is segmented into sedum and succulents, native grasses and wildflowers, and vegetable and herb gardens. The sedum and succulents segment held the largest market revenue share in 2024 due to their drought-resistant properties, low maintenance, and strong adaptability to varying climatic conditions.

The vegetable and herb gardens segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising trend of urban farming and increasing interest in self-sustained food sources. Consumers, particularly in metropolitan areas, are utilizing rooftop spaces to grow fresh produce, aligning with health-conscious and eco-friendly living preferences.

Green Roof Market Regional Analysis

• Europe dominated the global green roof market with the largest revenue share of 42.8% in 2024, driven by strict environmental regulations, growing urban sustainability initiatives, and strong government incentives for eco-friendly construction practices

• Consumers and developers across the region are increasingly adopting green roofs due to their benefits in stormwater management, thermal insulation, and urban biodiversity enhancement

• The widespread implementation of green building standards, along with active participation by municipalities in promoting vegetative roofing through subsidies and policy frameworks, continues to support market expansion across both new developments and retrofit projects

Germany Green Roof Market Insight

The Germany green roof market captured the largest revenue share of 68% in 2024 within Europe, fueled by progressive environmental policies and widespread municipal mandates promoting green infrastructure. Cities such as Berlin and Stuttgart have integrated green roof requirements into urban planning codes, accelerating adoption across residential and commercial buildings. The country’s leadership in sustainable construction, coupled with public awareness and funding support, continues to strengthen the market.

U.K. Green Roof Market Insight

The U.K. green roof market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing urban development, stricter planning policies, and the push for sustainable architecture. Initiatives such as the London Plan promote green infrastructure, encouraging developers to include green roofs in building designs. The country’s emphasis on reducing carbon emissions and improving urban air quality is expected to drive further market expansion.

North America Green Roof Market Insight

The North America green roof market is expected to witness the fastest growth rate from 2025 to 2032, driven by growing concerns over urban heat islands, increasing focus on stormwater control, and expanding green building certifications such as LEED. Cities across the U.S. and Canada are introducing tax rebates and incentive programs to encourage green roof implementation, especially in densely populated metro areas. The integration of green roofing into sustainable urban planning frameworks is further enhancing its uptake.

U.S. Green Roof Market Insight

The U.S. green roof market is expected to hold a dominant share within North America, supported by growing environmental awareness, expanding urban development, and the rising cost of traditional cooling methods. Green roofs are being increasingly adopted in schools, commercial buildings, and government facilities, with cities such as New York, Chicago, and Washington D.C. mandating or incentivizing their installation. Public-private partnerships and the availability of federal grants are also bolstering the market

Asia-Pacific Green Roof Market Insight

The Asia-Pacific green roof market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, environmental concerns, and rising demand for energy-efficient building solutions. Countries such as Japan, China, and South Korea are investing heavily in smart city initiatives and sustainable infrastructure. In addition, increasing government incentives and awareness campaigns are supporting the adoption of green roofs in urban planning.

Japan Green Roof Market Insight

The Japan green roof market is expected to witness the fastest growth rate from 2025 to 2032, as the country prioritizes sustainable urban development and climate-resilient infrastructure. With limited space for traditional green areas, green roofs are being widely implemented in commercial, public, and residential buildings to combat the urban heat island effect. Japan’s focus on combining green technology with innovation and aesthetics continues to support demand for advanced green roofing solutions.

China Green Roof Market Insight

The China captured the largest market revenue share in Asia Pacific in 2024, supported by extensive government-led initiatives targeting green building development. The push towards carbon neutrality and sustainable urban expansion has led to an increase in green roof installations across major cities. Public buildings, schools, and commercial developments are increasingly incorporating green roofs, driven by environmental policies, air quality concerns, and the need to manage stormwater runoff effectively.

Green Roof Market Share

The Green Roof industry is primarily led by well-established companies, including:

- Optigrün International AG (Germany)

- Green Roof Blocks (U.K.)

- Axter Limited (U.K.)

- Sempergreen (Netherlands)

- Bauder Ltd (U.K.)

- ZinCo GmbH (Germany)

- SOPREMA (France)

- XeroFlor (Germany)

- Bender (Germany)

- Jörg Breuning (Germany)

- American Hydrotech, Inc. (U.S.)

- Barrett Company (U.S.)

- Columbia Green Technologies (U.S.)

- ArchiGreen (U.S.)

- Pashek+MTR (U.S.)

- Berkeley Group (U.K.)

- Coca-Cola System (U.S.)

- Gambit Nash Limited (U.K.)

- HARROWDEN TURF (U.K.)

- GreenBlue Urban Limited (U.S.)

Latest Developments in Global Green Roof Market

- In 2022, Barrett Company was acquired by Keene Family. This strategic acquisition expanded Keene Family's portfolio into new markets and enhanced their operational capabilities. The deal provided Barrett Company with additional resources and a broader network, facilitating growth and innovation. The acquisition aimed to leverage synergies between the two entities for long-term success

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Green Roof Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Green Roof Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Green Roof Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.