Global Greenhouse Drip Irrigation System Market

Market Size in USD Billion

CAGR :

%

USD

1.68 Billion

USD

3.89 Billion

2024

2032

USD

1.68 Billion

USD

3.89 Billion

2024

2032

| 2025 –2032 | |

| USD 1.68 Billion | |

| USD 3.89 Billion | |

|

|

|

|

Greenhouse Drip Irrigation Systems Market Size

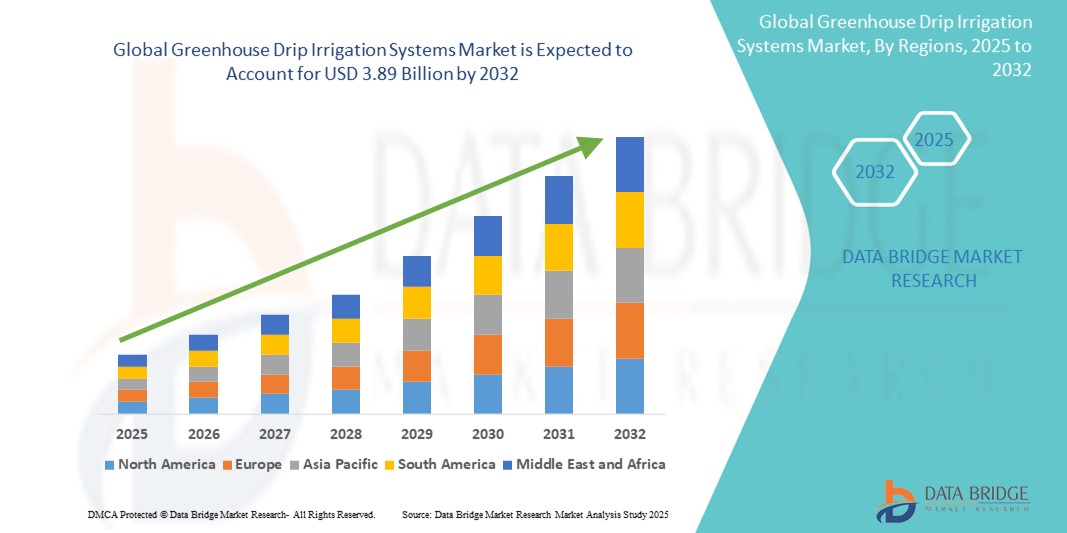

- The global greenhouse drip irrigation systems market size was valued at USD 1.68 billion in 2024 and is expected to reach USD 3.89 billion by 2032, at a CAGR of 11.10% during the forecast period

- The market growth is primarily driven by the increasing adoption of precision agriculture, rising demand for water-efficient irrigation systems, and the expansion of greenhouse farming to meet global food security needs

- Growing awareness of sustainable farming practices and the need for optimized water usage in agriculture are further propelling the demand for greenhouse drip irrigation systems, making them a preferred choice for modern farming

Greenhouse Drip Irrigation Systems Market Analysis

- Greenhouse drip irrigation systems, designed to deliver water and nutrients directly to plant roots, are critical for enhancing crop yield and resource efficiency in controlled agricultural environments

- The rising demand for these systems is fueled by global water scarcity concerns, the need for higher agricultural productivity, and the adoption of advanced irrigation technologies in greenhouse farming

- Asia-Pacific dominated the greenhouse drip irrigation systems market with the largest revenue share of 42.5% in 2024, driven by extensive greenhouse farming, government support for sustainable agriculture, and high adoption rates in countries such as China and India

- North America is expected to be the fastest-growing region during the forecast period, attributed to technological advancements in irrigation systems, increasing investment in precision agriculture, and growing awareness of water conservation practices

- The large farms segment dominated the largest market revenue share of 45% in 2024, driven by the widespread adoption of drip irrigation systems in large-scale greenhouse operations for efficient water management, higher crop yields, and reduced labor costs

Report Scope and Greenhouse Drip Irrigation Systems Market Segmentation

|

Attributes |

Greenhouse Drip Irrigation Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Greenhouse Drip Irrigation Systems Market Trends

“Increasing Integration of Smart Technologies and IoT”

- The Global Greenhouse Drip Irrigation Systems Market is experiencing a significant trend toward integrating Internet of Things (IoT) and smart technologies

- These technologies enable real-time monitoring and precise control of irrigation schedules, optimizing water and nutrient delivery based on crop needs and environmental conditions

- IoT-powered drip irrigation systems allow for proactive management, such as automated adjustments to water flow based on soil moisture levels, weather forecasts, or crop growth stages

- For instance, companies are developing smart platforms that integrate sensors and data analytics to provide farmers with actionable insights, improving irrigation efficiency and crop yields

- This trend enhances the appeal of drip irrigation systems for small, medium, and large farms, making them more efficient and sustainable for diverse crop types such as vegetables, flowers and ornamentals, fruit plants, and nursery crops

- Smart systems can analyze data from various sources, including soil sensors, weather stations, and crop health monitors, to optimize irrigation for specific crops, reducing waste and improving productivity

Greenhouse Drip Irrigation Systems Market Dynamics

Driver

“Rising Demand for Water-Efficient and Sustainable Agriculture”

- Increasing global concerns over water scarcity and the need for sustainable farming practices are major drivers for the Global Greenhouse Drip Irrigation Systems Market

- Drip irrigation systems deliver water and nutrients directly to plant roots, significantly reducing water wastage compared to traditional irrigation methods, making them ideal for water-scarce regions

- Government initiatives, particularly in the Asia-Pacific region, which dominates the market, are promoting water-efficient technologies through subsidies and grants, encouraging adoption across small, medium, and large farms

- The proliferation of IoT and advancements in renewable power sources, such as solar-powered pumps, are enabling more efficient and eco-friendly drip irrigation systems, supporting applications for vegetables, flowers, fruit plants, and nursery crops

- Farmers are increasingly adopting greenhouse drip irrigation systems to meet consumer demand for high-value crops and comply with environmental regulations, enhancing system value and market growth

Restraint/Challenge

“High Initial Costs and Maintenance Complexities”

- The high upfront investment required for components such as spinners and sprays, micro sprinklers/emitters, regulators, drip tape and drip lines, hoses, valves, pumps, and control heads can be a significant barrier, particularly for small farms in emerging markets

- Installing and integrating these systems, especially advanced technologies such as IoT-enabled drip tubes and poly fittings, can be complex and costly, requiring technical expertise

- In addition, maintenance challenges, such as clogging of emitters due to sediments or algae, necessitate frequent cleaning and monitoring, increasing operational costs for farmers

- Data security and system reliability concerns arise with smart irrigation systems, as they collect and transmit sensitive farm data, raising issues about potential breaches and compliance with regional regulations, particularly in North America, the fastest-growing region

- These factors can deter adoption, especially in regions with limited financial resources or technical know-how, potentially slowing market expansion despite long-term benefits

Greenhouse Drip Irrigation Systems market Scope

The market is segmented on the basis of farm size, product part, power source, technology, and crop type.

- By Farm Size

On the basis of farm size, the global greenhouse drip irrigation systems market is segmented into small farms, medium farms, and large farms. The large farms segment dominated the largest market revenue share of 45% in 2024, driven by the widespread adoption of drip irrigation systems in large-scale greenhouse operations for efficient water management, higher crop yields, and reduced labor costs. These systems are critical for optimizing resource utilization in extensive agricultural setups.

The small farms segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of cost-effective drip irrigation solutions tailored for small-scale greenhouse farming. Government subsidies and technological advancements in affordable, easy-to-install systems further accelerate adoption among small farmers, particularly in developing regions.

- By Product Part

On the basis of product part, the global greenhouse drip irrigation systems market is segmented into spinners and sprays, micro sprinklers/emitters, regulators, drip tape and drip lines, hoses, valves, and other parts. The drip tape and drip lines segment is expected to hold the largest market revenue share of 38% in 2024, primarily due to their critical role in delivering precise water and nutrient delivery directly to plant roots, ensuring high efficiency and minimal water wastage.

The micro sprinklers/emitters segment is anticipated to experience the fastest growth rate of 12.5% from 2025 to 2032, driven by advancements in emitter technology that enhance water distribution uniformity and reduce clogging. The increasing demand for high-value crops requiring precise irrigation further boosts this segment’s growth.

- By Power Source

On the basis of power source, the global greenhouse drip irrigation systems market is segmented into renewable and non-renewable. The non-renewable power source segment is expected to hold the largest market revenue share of 62% in 2024, owing to its widespread availability and reliability in powering pumps and control systems in greenhouse drip irrigation setups, particularly in regions with limited renewable infrastructure.

The renewable power source segment is expected to witness significant growth from 2025 to 2032, driven by the increasing adoption of solar-powered drip irrigation systems. These systems are gaining traction in regions with abundant sunlight and supportive government policies promoting sustainable agriculture, reducing operational costs and environmental impact.

- By Technology

On the basis of technology, the global greenhouse drip irrigation systems market is segmented into drip tube, poly fittings and accessories, emitters, pumps, control head, filters and valves, and others. The emitters segment is expected to hold the largest market revenue share of 40% in 2024, driven by their essential role in controlling water flow and ensuring precise delivery to plant roots, which enhances crop yield and water efficiency.

The control head segment is anticipated to witness robust growth from 2025 to 2032, fueled by the integration of smart sensors, automation, and IoT-based technologies. These advancements enable real-time monitoring and precise control of irrigation schedules, improving efficiency and reducing resource wastage.

- By Crop Type

On the basis of crop type, the global greenhouse drip irrigation systems market is segmented into vegetables, flowers and ornamentals, fruit plants, nursery crops, and others. The vegetables segment dominated the market revenue share of 48% in 2024, owing to the high demand for greenhouse-grown vegetables such as tomatoes, cucumbers, and peppers, which benefit from precise water and nutrient delivery to optimize yield and quality.

The fruit plants segment is anticipated to witness rapid growth of 13.8% from 2025 to 2032, driven by the increasing cultivation of high-value fruit crops such as strawberries and melons in greenhouses. Drip irrigation systems enhance fruit quality and early maturation while conserving water, making them ideal for fruit plant cultivation.

Greenhouse Drip Irrigation Systems Market Regional Analysis

- Asia-Pacific dominated the greenhouse drip irrigation systems market with the largest revenue share of 42.5% in 2024, driven by extensive greenhouse farming, government support for sustainable agriculture, and high adoption rates in countries such as China and India

- Consumers prioritize drip irrigation systems for precise water delivery, reducing water wastage, enhancing crop yields, and promoting sustainable farming practices, particularly in water-scarce regions

- Growth is supported by advancements in irrigation technology, such as automated drip systems and smart sensors, alongside rising adoption in both commercial and small-scale greenhouse farming

U.S. Greenhouse Drip Irrigation Systems Market Insight

The U.S. greenhouse drip irrigation systems market is expected to witness significant growth, fueled by strong demand for precision agriculture and increasing awareness of water conservation benefits. The trend towards sustainable farming and supportive government subsidies for efficient irrigation systems further boost market expansion. The integration of advanced drip irrigation systems in both new greenhouse setups and retrofitting projects creates a robust market ecosystem.

Europe Greenhouse Drip Irrigation Systems Market Insight

The Europe greenhouse drip irrigation systems market is expected to witness significant growth, supported by regulatory emphasis on sustainable agriculture and water efficiency. Consumers seek systems that optimize water usage while maintaining high crop productivity. The growth is prominent in both large-scale commercial greenhouses and smaller operations, with countries such as Germany and the Netherlands showing significant uptake due to advanced agricultural practices and environmental concerns.

U.K. Greenhouse Drip Irrigation Systems Market Insight

The U.K. market for greenhouse drip irrigation systems is expected to witness rapid growth, driven by demand for efficient water management and improved crop yields in controlled environments. Increased awareness of water scarcity and the benefits of precision irrigation encourages adoption. Evolving regulations promoting sustainable farming practices influence consumer choices, balancing system efficiency with compliance.

Germany Greenhouse Drip Irrigation Systems Market Insight

Germany is expected to witness rapid growth in greenhouse drip irrigation systems, attributed to its advanced agricultural sector and high consumer focus on water efficiency and crop productivity. German farmers prefer technologically advanced systems, such as automated drip irrigation with smart sensors, to reduce water usage and enhance sustainability. The integration of these systems in commercial greenhouses and aftermarket solutions supports sustained market growth.

Asia-Pacific Greenhouse Drip Irrigation Systems Market Insight

The Asia-Pacific region dominates the global greenhouse drip irrigation systems market, driven by expanding greenhouse farming and rising food demand in countries such as China, India, and Japan. Increasing awareness of water conservation, coupled with government initiatives promoting precision agriculture, boosts demand. The adoption of advanced drip irrigation technologies, including renewable-powered systems, further enhances market growth.

Japan Greenhouse Drip Irrigation Systems Market Insight

Japan’s greenhouse drip irrigation systems market is expected to witness rapid growth due to strong consumer preference for high-efficiency, technologically advanced irrigation systems that enhance crop quality and sustainability. The presence of major agricultural technology providers and the integration of drip systems in both OEM and aftermarket applications accelerate market penetration. Rising interest in precision farming also contributes to growth.

China Greenhouse Drip Irrigation Systems Market Insight

China holds the largest share of the Asia-Pacific greenhouse drip irrigation systems market, propelled by rapid urbanization, increasing greenhouse adoption, and growing demand for water-efficient irrigation solutions. The country’s expanding agricultural sector and focus on food security support the adoption of advanced drip systems. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Greenhouse Drip Irrigation Systems Market Share

The greenhouse drip irrigation systems industry is primarily led by well-established companies, including:

- Argus Control Systems Limited (Canada)

- Heliospectra (Sweden)

- Rough Brothers, Inc (U.S.)

- LOGIQS BV (Netherlands)

- Hort Americas (U.S.)

- NETAFIM (Israel)

- Priva (Netherlands)

- Richel Group (U.S.)

- Ridder Holding Harderwijk BV (Netherlands)

- Top Greenhouses (Canada)

- DripWorks, Inc. (U.S.)

- Metzer Group (Israel)

- EPC Industries Limited (India)

- Sistema Azud (Spain)

- Nelson Irrigation Corporation (U.S.)

What are the Recent Developments in Global Greenhouse Drip Irrigation Systems Market?

- In April 2024, Rivulis Pte. Ltd., a leading Israeli micro-irrigation company, completed the acquisition of Jain Irrigation’s International Irrigation Business. This strategic move marked a significant milestone in the global irrigation industry, positioning Rivulis as one of the top players worldwide. The merger enhances Rivulis’ ability to deliver advanced irrigation and climate-smart solutions, supporting sustainable agriculture and addressing critical global challenges such as food security and water scarcity. With a broader geographic footprint and expanded technological capabilities, the combined entity is poised to accelerate the adoption of modern farming practices across diverse markets

- In July 2023, IRIGREEN, a U.S.-based innovator in sprinkler and irrigation technologies, entered into a strategic partnership with BIC Farms, a Nigerian agricultural enterprise. This collaboration focuses on deploying subsurface irrigation systems across Nigeria, aiming to enhance water efficiency and support year-round farming. IRIGREEN’s patented microporous hose technology—designed to resist clogging and operate at low pressure—was adopted by BIC Farms for use in large-scale hydroponic greenhouses. The partnership is expected to significantly boost crop yields, reduce energy consumption, and promote sustainable agriculture throughout the region

- In September 2023, Rivulis and Dragon-Line entered into an exclusive partnership covering the United States, Mexico, and Canada. As part of this collaboration, Dragon-Line introduced a new Mobile Drip Irrigation (MDI) System that incorporates a specially developed Rivulis drip line. This innovative system enables the conversion of traditional center pivot sprinklers into efficient mobile drip systems, helping farmers reduce water usage, lower input costs, and improve crop yields. The partnership also strengthens Rivulis’ in-field presence and boosts its production capabilities, allowing the company to respond more swiftly to evolving market needs with cutting-edge irrigation solutions

- In February 2023, The Toro Company introduced the 900 Series Valve, a high-performance irrigation control solution designed to meet the evolving needs of modern agriculture. Anchored by a patent-pending valve seat design, this innovation minimizes pressure loss and enhances water flow efficiency. The valve’s hydrodynamic profile and durable diaphragm reduce vibration and wear, extending the system’s lifespan. Available in sizes ranging from 1.5” to 6” with threaded, grooved, and flanged connections, it supports various configurations including on/off, pressure-reducing, and pressure-sustaining modes—making it a versatile choice for diverse irrigation setups

- In March 2023, Jain International Trading B.V. (JITBV), a wholly owned subsidiary of Jain Irrigation, successfully merged with Rivulis to form a new global entity branded as "Rivulis in alliance with Jain International." This strategic merger created one of the world’s largest irrigation and climate solution providers, with a combined revenue of approximately USD 750 million. The alliance enhances global reach, operational scale, and innovation capacity, enabling the company to lead the adoption of modern irrigation technologies and digital farming practices. Jain (Israel) B.V. now holds a strategic minority stake of around 18.7% in Rivulis, reinforcing long-term collaboration and shared growth goals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.