Global Grignard Reagents Market

Market Size in USD Billion

CAGR :

%

USD

5.29 Billion

USD

8.49 Billion

2024

2032

USD

5.29 Billion

USD

8.49 Billion

2024

2032

| 2025 –2032 | |

| USD 5.29 Billion | |

| USD 8.49 Billion | |

|

|

|

|

Grignard Reagents Market Size

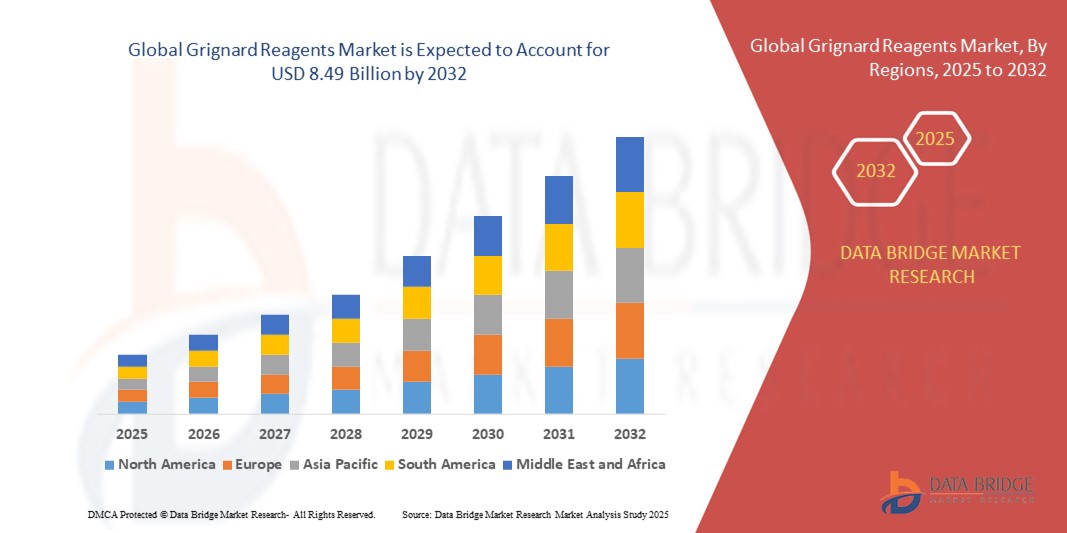

- The global grignard reagents market size was valued at USD 5.29 billion in 2024 and is expected to reach USD 8.49 billion by 2032, at a CAGR of 6.1% during the forecast period

- The market growth is largely fueled by increasing demand for Grignard reagents in pharmaceutical synthesis and specialty chemical production, supported by advancements in organic synthesis techniques and expanding API manufacturing across emerging economies

- Furthermore, the growing use of Grignard reagents in agrochemicals and polymer functionalization, coupled with the adoption of continuous flow technologies to enhance process safety and scalability, is driving widespread adoption across chemical industries, significantly accelerating market expansion

Grignard Reagents Market Analysis

- Grignard reagents are organomagnesium compounds widely used in chemical synthesis to form carbon–carbon bonds, making them essential intermediates in the production of pharmaceuticals, agrochemicals, and specialty polymers

- The increasing demand for complex molecules in drug discovery, growing focus on fine chemical manufacturing, and technological innovations such as continuous flow systems are collectively propelling the growth of the Grignard reagents market across global industrial and research applications

- Asia-Pacific dominated the grignard reagents market with a share of 39.5% in 2024, due to the rapid expansion of pharmaceutical and agrochemical manufacturing and growing demand for organometallic intermediates

- North America is expected to be the fastest growing region in the grignard reagents market during the forecast period due to strong pharmaceutical R&D, increasing use of Grignard reagents in polymer and agrochemical development, and growing demand for high-purity synthesis reagents

- APIs & drugs segment dominated the market with a market share of 53.2% in 2024, due to the vital role Grignard reagents play in pharmaceutical synthesis. These reagents facilitate the construction of essential molecular frameworks found in various drug candidates and final formulations. Their use in forming bonds at key molecular sites enhances their value in medicinal chemistry, and the ongoing demand for innovative therapeutics sustains their dominance in pharmaceutical applications

Report Scope and Grignard Reagents Market Segmentation

|

Attributes |

Grignard Reagents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Grignard Reagents Market Trends

Rising Adoption of Continuous Flow Technology

- The Grignard reagents market is evolving as continuous flow technology gains traction, offering safer, more efficient, and scalable production methods that address the traditional challenges of batch synthesis involving highly reactive organomagnesium compounds

- For instance, companies such as Lonza and ThalesNano have developed continuous flow reactors that enable precise control over reaction parameters, improve yield and purity, and reduce the risks associated with the exothermic nature of Grignard reagent synthesis

- Continuous flow systems facilitate rapid reaction times and seamless integration with downstream processing, enabling on-demand manufacturing of Grignard intermediates suitable for pharmaceutical and fine chemical industries

- Adoption of automated and modular flow platforms is supporting smaller batch sizes and faster scale-up, accelerating R&D workflows and commercial production of complex molecules using Grignard reagents

- Regulatory and safety considerations, especially for handling air- and moisture-sensitive reagents, are driving companies toward flow chemistry applications that enhance operator safety and reduce solvent usage

- Integration of real-time monitoring and AI-driven process optimization in continuous flow technology further improves reproducibility and quality compliance for Grignard reagent production

Grignard Reagents Market Dynamics

Driver

Growing Demand for Grignard Reagents in Pharmaceutical Synthesis

- The pharmaceutical industry's persistent demand for innovative and efficient synthetic routes for APIs fuels robust growth in Grignard reagent consumption, given their versatility in forming carbon-carbon bonds essential for complex drug molecules

- For instance, suppliers such as Sigma-Aldrich (Merck), TCI Chemicals, and Tokyo Chemical Industry provide standardized Grignard reagents used extensively in creating intermediates for anti-cancer, antiviral, and anti-inflammatory drug synthesis

- Increasing pharmaceutical R&D investments, particularly in personalized medicine and biologics, require precise and reliable organomagnesium reagents, driving market expansion and diversification of product portfolios

- Growth in contract manufacturing and custom synthesis organizations leveraging Grignard chemistry to accelerate drug candidate development further boosts demand for high-purity reagents

- Emerging biopharmaceutical and agrochemical sectors also contribute to expanding applications of Grignard reagents in the synthesis of novel compounds with improved efficacy and safety profiles

Restraint/Challenge

High Reactivity and Sensitivity to Moisture and Air

- The intrinsic high reactivity and extreme sensitivity of Grignard reagents to moisture and atmospheric oxygen present significant handling and storage challenges, limiting their shelf life and complicating manufacturing and logistics

- For instance, laboratories and manufacturers must maintain rigorously dry, inert environments supported by specialized equipment and trained personnel, resulting in elevated operational costs and safety concerns

- Exposure to moisture can cause reagent decomposition or side reactions, affecting yield, product purity, and reproducibility in downstream processes, necessitating stringent quality control protocols

- Transport and packaging require robust containment solutions and cold-chain logistics to preserve reagent integrity, restricting broader adoption in remote or less-equipped locations

- Regulatory compliance regarding hazardous chemical management and worker safety adds layers of complexity and cost to production and distribution, creating barriers especially for smaller manufacturers and emerging markets

Grignard Reagents Market Scope

The market is segmented on the basis of product type, application, and end-use industry.

- By Product Type

On the basis of product type, the Grignard reagents market is segmented into Alkyl Grignard Reagents, Vinyl Grignard Reagents, and Aryl Grignard Reagents. The alkyl Grignard reagents segment accounted for the largest market share in 2024, owing to their widespread use in forming carbon–carbon bonds and their broad applicability in pharmaceuticals and fine chemicals. These reagents are particularly favored in organic synthesis due to their high reactivity and ability to generate diverse intermediate structures, making them indispensable in drug discovery and active pharmaceutical ingredient (API) production. Their compatibility with a wide range of electrophiles further strengthens their industrial utility across chemical synthesis applications.

The vinyl Grignard reagents segment is expected to witness the fastest growth rate from 2025 to 2032. This rapid expansion is driven by increasing demand for functionalized olefins in polymer and material science applications. Vinyl Grignard reagents enable the formation of complex unsaturated structures, which are increasingly being used in the production of performance polymers, advanced materials, and specialty chemicals. Their enhanced selectivity and the possibility of fine-tuned reaction conditions make them a promising choice in high-precision chemical synthesis, contributing to their accelerating market traction.

- By Application

On the basis of application, the Grignard reagents market is categorized into APIs & Drugs, Agrochemicals, and Polymer Synthesis & Functionalization. The APIs & Drugs segment led the market with a share of 53.2% in 2024, primarily due to the vital role Grignard reagents play in pharmaceutical synthesis. These reagents facilitate the construction of essential molecular frameworks found in various drug candidates and final formulations. Their use in forming bonds at key molecular sites enhances their value in medicinal chemistry, and the ongoing demand for innovative therapeutics sustains their dominance in pharmaceutical applications.

The polymer synthesis & functionalization segment is projected to register the highest growth during the forecast period. This growth is supported by the increasing pursuit of functionalized polymers in specialty coatings, packaging, and biomedical materials. Grignard reagents allow precise control over polymer architecture and end-group functionality, which is crucial for tailoring properties such as biodegradability, thermal resistance, and mechanical strength. These factors are driving their use in high-performance and custom-designed polymer materials.

- By End-use Industry

On the basis of end-use industry, the market is segmented into Pharmaceutical & Biotechnology, Agriculture, Chemical, Flavors & Fragrances, and Research. The pharmaceutical & biotechnology segment captured the largest revenue share in 2024, owing to the continuous reliance on Grignard reagents for the synthesis of complex organic molecules. These reagents are essential in both early-stage R&D and commercial drug manufacturing, enabling selective bond formations that are difficult to achieve through other means. Their utility in synthesizing intermediates and APIs makes them foundational to pharmaceutical innovation and production pipelines.

The flavors & fragrances segment is projected to grow at the fastest pace from 2025 to 2032. This growth is fueled by the increasing demand for synthetic aroma chemicals and fine fragrance ingredients where Grignard reagents are used to construct key aromatic and aliphatic structures. Their application enables manufacturers to reproduce rare or expensive natural scents synthetically with high purity and reproducibility, making them a preferred choice in the evolving landscape of modern perfumery and flavoring solutions.

Grignard Reagents Market Regional Analysis

- Asia-Pacific dominated the grignard reagents market with the largest revenue share of 39.5% in 2024, driven by the rapid expansion of pharmaceutical and agrochemical manufacturing and growing demand for organometallic intermediates

- The region benefits from low production costs, increasing R&D investments, and the presence of globally competitive chemical production clusters

- Accelerating industrialization, favorable trade policies, and the growing need for specialty chemicals are fueling consumption of Grignard reagents across multiple end-use sectors

China Grignard Reagents Market Insight

China held the largest share in the Asia-Pacific Grignard reagents market in 2024, supported by its dominant position in active pharmaceutical ingredient (API) manufacturing and strong capabilities in fine chemical production. The country's strategic investments in expanding chemical plants, combined with favorable government policies and export incentives, are propelling demand. Its robust infrastructure for organic synthesis and growing internal consumption of advanced intermediates also contribute to sustained market growth.

India Grignard Reagents Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, driven by rising pharmaceutical exports, growing domestic production of agrochemicals, and government-led initiatives such as “Make in India.” Increased focus on backward integration of raw materials and development of chemical industrial parks are boosting Grignard reagent consumption. Moreover, expanding research activities and process innovation in chemical synthesis are strengthening India's market position.

Europe Grignard Reagents Market Insight

The Europe Grignard reagents market continues to grow steadily, supported by strict regulatory standards, high demand for pure and customized reagents, and the strong presence of specialty chemical and life sciences industries. European manufacturers emphasize green chemistry, quality control, and scalable synthetic pathways, making the region a hub for research-intensive and environmentally compliant Grignard reagent applications.

Germany Grignard Reagents Market Insight

Germany leads the European market with its well-established pharmaceutical and chemical sectors. The country’s reputation for precision synthesis, advanced research capabilities, and a strong export-driven model supports the continued use of Grignard reagents in APIs and specialty chemicals. Collaboration between academia and industry further drives innovation in complex reagent formulations and sustainable process development.

U.K. Grignard Reagents Market Insight

The U.K. market is supported by its advanced life sciences ecosystem and increasing emphasis on domestic chemical production post-Brexit. Strong academic R&D, a focus on synthetic innovation, and rising demand for specialty reagents in drug discovery and material science are contributing to market growth. The country also benefits from its agile approach to custom synthesis and laboratory-scale reagent manufacturing.

North America Grignard Reagents Market Insight

North America is projected to register the fastest CAGR from 2025 to 2032, driven by strong pharmaceutical R&D, increasing use of Grignard reagents in polymer and agrochemical development, and growing demand for high-purity synthesis reagents. The trend toward reshoring chemical manufacturing and integration of advanced synthetic methods in drug development further support market expansion.

U.S. Grignard Reagents Market Insight

The U.S. accounted for the largest share in the North America market in 2024, due to its leading position in pharmaceutical innovation, chemical process development, and academic research. The country’s focus on high-value reagents for complex molecule synthesis, along with the presence of major specialty chemical manufacturers, supports continued growth. Regulatory compliance, strong distribution networks, and a robust innovation pipeline reinforce the U.S.’s dominance in the region.

Grignard Reagents Market Share

The grignard reagents industry is primarily led by well-established companies, including:

- Merck KGaA (Germany)

- Albemarle Corporation (U.S.)

- WeylChem International GmbH (Germany)

- HOKKO CHEMICAL INDUSTRY CO., LTD. (Japan)

- CHEMIUM srl (Belgium)

- FAR Chemical (U.S.)

- PMC Group, Inc (U.S.)

- Boulder Scientific Group (U.S.)

- Neogen Chemicals Ltd (India)

- Tokyo Chemical Industry (India) Pvt. Ltd. (India)

- Optima Chem (U.S.)

- Shaoxing Shangyu Hualun Chemical Co., Ltd. (China)

- Nanjing Freehoo Chemical Technology Co., Ltd. (China)

- Chemische Fabrik Karl Bucher GmbH (Germany)

- Jiangsu Changjili New Energy Technology Co., Ltd. (China)

Latest Developments in Global Grignard Reagents Market

- In November 2023, Chemium srl signed a Manufacturing Services Agreement with Swiss fine chemical company Valsynthese SA to host its proprietary MgFlow Grignard reagent production units. This partnership significantly strengthens the Grignard reagents market by expanding access to continuous flow production technology in Europe. The MgFlow system offers improved process safety, precise temperature control, and efficient mixing, which reduces reaction volume and eliminates the risks associated with batch synthesis. As demand rises for high-purity reagents in pharmaceuticals and specialty chemicals, this development positions Chemium as a key enabler of scalable and reliable Grignard reagent manufacturing

- In 2023, Albemarle Corporation entered into a formal supply agreement with Ford Motor Company to deliver battery-grade lithium hydroxide. While not directly tied to the Grignard market, this strategic deal bolsters Albemarle's leadership in the specialty chemical space and reinforces the company’s position in the global transition to electric vehicles (EVs). By aligning with a major automaker’s supply chain, Albemarle expands its influence in advanced chemical manufacturing and strengthens its reputation for high-purity, performance-critical materials. The move reflects growing cross-sector integration between chemical producers and end-user industries such as automotive and energy storage

- In September 2022, Chemium srl launched its MgFlow Technology for industrial-scale Grignard reagent production. This innovation marks a major advancement in organometallic synthesis, as MgFlow applies flow chemistry principles and advanced process simulation to enable continuous, controlled manufacturing. The technology enhances overall safety, reduces waste, and ensures reproducibility—factors that are increasingly critical for pharmaceutical and specialty chemical companies. Its introduction reinforces Chemium’s commitment to process innovation and positions it as a leader in modern reagent production techniques

- In 2022, FMC Corporation made substantial investments in new synthetic technologies and cutting-edge biological solutions such as pheromones and peptides to support sustainable agriculture. This strategic move enhances FMC’s position in the agrochemical market by expanding its portfolio of environmentally friendly crop protection solutions. As demand for sustainable farming inputs increases globally, these innovations allow FMC to cater to evolving regulatory standards and consumer preferences for safer, eco-conscious agricultural practices

- In 2022, FMC Corporation also launched a youth-focused initiative in Kenya aimed at preparing the next generation for careers in agriculture. This socially impactful program improves agricultural knowledge and skill-building in the region while simultaneously fostering future demand for agrochemicals and farming technologies. By contributing to local development and economic empowerment, FMC strengthens its brand presence and creates long-term market opportunities in emerging economies throughout Africa

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Grignard Reagents Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Grignard Reagents Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Grignard Reagents Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.