Global Ground Penetrating Radar Market

Market Size in USD Million

CAGR :

%

USD

390.50 Million

USD

681.40 Million

2024

2032

USD

390.50 Million

USD

681.40 Million

2024

2032

| 2025 –2032 | |

| USD 390.50 Million | |

| USD 681.40 Million | |

|

|

|

|

Ground Penetrating Radar Market Size

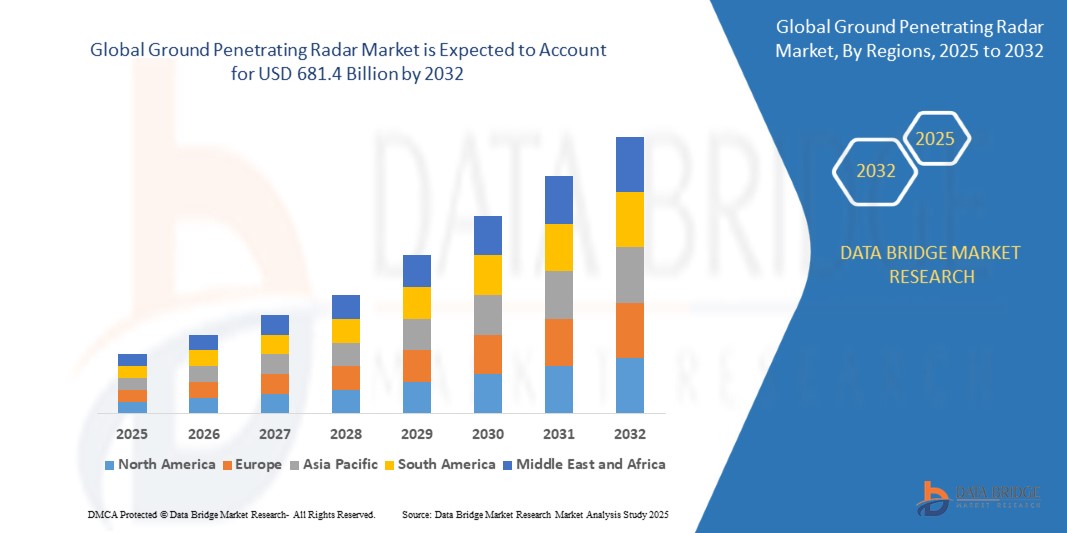

- The Global Ground Penetrating Radar Market size was valued at USD 390.5 Million in 2024 and is expected to reach USD 681.4 Billion by 2032, at a CAGR of 7.8% during the forecast period

- Growth in the GPR market is primarily driven by increasing demand for non-invasive and subsurface imaging technologies across applications such as utility detection, transportation infrastructure assessment, archaeology, and environmental studies. Rising investments in smart city initiatives and public safety further contribute to market expansion.

Ground Penetrating Radar Market Analysis

- Ground Penetrating Radar (GPR) is a geophysical method that uses radar pulses to image the subsurface. It is widely used in applications such as utility detection, concrete inspection, archaeology, geology, and infrastructure monitoring due to its non-destructive nature and high-resolution subsurface imaging capabilities.

- The market is driven by increasing demand for non-invasive subsurface investigations, infrastructure rehabilitation, and environmental assessment. GPR systems are increasingly used by construction companies, municipalities, and environmental agencies to locate pipes, cables, voids, and rebar before excavation or drilling.

- North America dominates the GPR market with the largest revenue share of 46.01% in 2025, owing to extensive infrastructure development, aging public utilities requiring assessment, and adoption of advanced technologies in construction and transportation sectors.

- Asia-Pacific is projected to grow at the fastest rate during the forecast period, supported by rapid urbanization, government-led smart city projects, increasing demand for underground utility mapping, and strong growth in civil engineering and transportation sectors.

- The vehicle-mounted GPR systems segment is expected to witness significant growth due to rising deployment in large-scale highway and bridge inspection projects. Additionally, advancements in real-time data processing, 3D imaging, and integration with GIS and AI platforms are expanding the capabilities and applications of modern GPR systems.

Report Scope and Ground Penetrating Radar Market Segmentation

|

Attributes |

Automotive Battery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ground Penetrating Radar Market Trends

AI-Driven Imaging, Drone Integration, and Infrastructure Mapping Fueling Market Growth

- A key and rapidly accelerating trend in the Ground Penetrating Radar (GPR) Market is the integration of AI and machine learning algorithms into subsurface imaging systems. These advancements are enabling real-time data interpretation, anomaly detection, and automated utility mapping, improving operational efficiency and decision-making across industries.

- The growing deployment of drone-mounted GPR systems is revolutionizing remote surveying, especially in hard-to-reach and hazardous areas. UAV-integrated GPR enhances mobility, reduces operational risks, and is increasingly being used for geological, archaeological, and environmental applications.

- Demand for high-resolution 3D visualization is driving innovation in GPR software and data processing tools. Enhanced imaging capabilities allow users to model underground structures and utilities with greater accuracy, supporting smarter infrastructure planning and reduced excavation risks.

- The shift toward smart cities and urban digital twins is accelerating the use of GPR in underground asset detection. Urban planners and utility managers are leveraging GPR to support sustainable development, reduce service disruptions, and comply with regulatory standards for underground safety.

- Technological miniaturization is leading to the development of portable, lightweight GPR systems. These handheld or cart-based units are gaining popularity in construction, road maintenance, and forensic applications due to ease of use, fast setup, and reliable surface penetration capabilities.

Ground Penetrating Radar Market Dynamics

Driver

Surge in Infrastructure Development, Utility Mapping, and Non-Destructive Testing

- The global increase in infrastructure modernization projects—such as highways, railways, airports, and smart cities—is driving demand for ground penetrating radar (GPR) systems. GPR helps detect underground utilities, voids, and structural weaknesses, minimizing the risk of costly delays and accidents during construction.

- Governments and municipal bodies are adopting GPR for non-destructive testing (NDT) of roads, bridges, and historical sites. The ability to map subsurface layers without excavation enables better decision-making in maintenance and asset management.

- The growing need for accurate utility detection and mapping in urban areas is propelling the adoption of GPR in civil engineering and telecommunications projects. It supports compliance with regulatory safety standards and helps prevent service disruptions.

- GPR is also gaining traction in military and defense sectors for landmine detection, tunnel mapping, and subsurface surveillance, enhancing national security operations in sensitive regions.

- Technological advancements in data processing, sensor design, and portability are making GPR systems more accessible to small and medium contractors, expanding their usage beyond specialized firms to general construction and surveying companies.

Restraint/Challenge

High Equipment Cost, Operational Limitations, and Technical Complexity

- Ground Penetrating Radar (GPR) systems, especially those equipped with advanced imaging and AI capabilities, involve high initial investment costs. This limits adoption among small contractors, archaeological teams, and institutions with limited budgets.

- GPR performance is influenced by soil type, moisture content, and material conductivity. In clay-rich or highly conductive soils, signal penetration is significantly reduced, affecting the accuracy and reliability of subsurface imaging.

- Interpreting GPR data requires specialized training and technical expertise. Many end users struggle with real-time analysis, increasing dependence on skilled geophysicists or third-party service providers, which can raise project costs and delay timelines.

- Regulatory barriers in certain regions restrict the use of radar-based equipment due to frequency and interference concerns, particularly in densely populated or sensitive military zones.

- Additionally, integrating GPR systems with drones, GPS, or other geospatial platforms presents compatibility challenges, especially for legacy systems, hindering smooth adoption in complex survey environments.

Ground Penetrating Radar Market Scope

The market is segmented on the offering, type and application.

Ground Penetrating Radar Market Scope

The market is segmented on the offering, type and application.

- By Offering

The market is segmented into Equipment and Services. Equipment dominates the segment in 2025 due to rising demand for advanced radar hardware across industries such as utilities, transportation, and military. These systems offer high-resolution imaging, deeper penetration, and improved portability. Services are growing rapidly as end users seek expertise in data interpretation, GPR system operation, and post-survey analysis, especially in archaeological digs and geotechnical investigations.

- By Type

GPR systems are segmented into Handheld Systems, Cart-based Systems, and Vehicle-mounted Systems. Cart-based Systems hold the largest market share in 2025, driven by their widespread use in road inspections, utility mapping, and concrete evaluation due to stability and depth range. Vehicle-mounted Systems are expected to witness the fastest growth, especially in large-scale infrastructure projects, thanks to their ability to cover wide areas efficiently. Handheld Systems are favored for indoor, confined, or small-scale surveys due to their portability.

- By Application

Applications include Utility Detection, Concrete Investigation, Transportation Infrastructure, Archaeology, Geology & Environment, Law Enforcement & Military, and Others. Utility Detection is the leading application in 2025, driven by increased urban development, renovation projects, and the need to avoid underground utility damage. Transportation Infrastructure is witnessing strong growth due to the rising need for bridge deck evaluation, pavement analysis, and structural integrity assessments. Archaeology and Geology & Environmental studies benefit from the non-destructive nature of GPR, allowing deep subsurface imaging without excavation. Law Enforcement & Military use GPR for forensic investigations, unexploded ordnance (UXO) detection, and tunnel mapping.

Ground Penetrating Radar Market Regional Analysis

- North America dominates the Ground Penetrating Radar Market with the largest revenue share of 45.01% in 2024. The North American GPR market is significantly driven by the expanding use of non-destructive testing (NDT) in construction, transportation, and utility detection. Government mandates for utility mapping and infrastructure modernization projects across the U.S. and Canada are accelerating GPR deployment.

- Additionally, substantial investments in smart city projects and public safety initiatives are supporting demand for ground imaging technologies. The integration of GPR with geospatial systems and increasing adoption in archaeology and law enforcement further enhance market growth across the region.

- The Europe Ground Penetrating Radar Market is projected to expand at a substantial CAGR throughout the forecast period. Growth is fueled by EU initiatives focused on non-invasive subsurface investigation methods for utility detection and transportation infrastructure maintenance. Public and private investments in heritage site preservation, along with advancements in GPR hardware and software, are enhancing adoption across the continent.

- The Asia-Pacific Ground Penetrating Radar Market is poised to grow at the fastest CAGR of over 25.1% in 2025, driven by infrastructure development across emerging economies, increasing utility mapping needs, and rising investment in smart urban planning. Countries such as China, India, and Japan are rapidly adopting GPR for transportation, environmental monitoring, and underground cable detection.

- The MEA Ground Penetrating Radar Market is expected to witness significant growth during the forecast period, driven by expanding urban infrastructure, oil & gas exploration activities, and rising defense investments in countries like Saudi Arabia and the UAE. The need for underground utility mapping and archaeological surveys is also increasing due to mega construction projects such as NEOM and smart city initiatives across the Gulf region.

- The South America Ground Penetrating Radar Market is experiencing steady growth, supported by growing demand for subsurface mapping in Brazil and Chile’s mining and construction sectors. Increased focus on environmental remediation and public infrastructure development is fueling GPR adoption, particularly for road inspection and utility detection. Government initiatives for digital infrastructure and urban planning further strengthen market potential.

U.S. Ground Penetrating Radar Market Insight

The U.S. Ground Penetrating Radar Market captured the largest revenue share of 71.2% within North America in 2025, driven by increasing infrastructure modernization, federal funding for public safety and utility mapping, and strong adoption in transportation and construction sectors. Expanding applications in archaeological studies and law enforcement, along with the integration of GPR into smart city projects, further support market growth.

Germany Ground Penetrating Radar Market Insight

The Germany Ground Penetrating Radar Market is expected to grow at a noteworthy CAGR during the forecast period, driven by its advanced civil engineering sector, commitment to digitized construction, and focus on subsurface utility engineering (SUE). Increasing deployment in transportation tunnel inspections, military applications, and environmental studies is accelerating market growth.

Saudi Arabia Ground Penetrating Radar Market Insight

Saudi Arabia is emerging as a key market for Ground Penetrating Radar (GPR) in the MEA region, fueled by massive infrastructure projects under the Vision 2030 initiative. The development of NEOM and other smart cities, along with expanding oil & gas exploration and heritage site preservation, is driving demand for GPR technology. Applications in utility detection, geotechnical surveys, and transportation planning are gaining momentum as urban expansion accelerates.

South Africa Ground Penetrating Radar Market Insight

South Africa is witnessing growing adoption of Ground Penetrating Radar (GPR) technology, primarily driven by the need for advanced subsurface imaging in mining, infrastructure development, and environmental studies. The country’s strong mining sector relies on GPR for mineral exploration and safety assessments, while urban development projects in cities like Johannesburg and Cape Town are increasing demand for utility mapping and geotechnical investigations. Additionally, efforts to modernize transportation networks are creating new opportunities for GPR applications across the region.

China Ground Penetrating Radar Market Insight

The China Ground Penetrating Radar Market accounted for the largest revenue share in Asia-Pacific in 2025. Market growth is fueled by rapid urbanization, national initiatives for underground utility mapping, and increasing government investment in transportation and smart city infrastructure. Domestic manufacturers are also innovating cost-effective GPR systems, enhancing accessibility and regional adoption.

Ground Penetrating Radar Market Share

The Ground Penetrating Radar Market is primarily led by well-established companies, including:

- IDS Georadar (Italy)

- Guideline GEO (Sweden)

- Sensors & Software Inc. (Canada)

- Chemring Group (UK)

- Geophysical Survey Systems, Inc. (GSSI) (US)

- Leica Geosystems AG (Switzerland)

- US Radar (US)

- Radiodetection (United Kingdom)

- Penetradar Corp. (US)

- Utsi Electronics Ltd. (UK)

- Geoscanners AB (Sweden)

- Groundradar Inc. (Canada)

- Pipehawk PLC (UK)

- Proceq AG (Switzerland)

- Impulseradar (Sweden)

- Transient Technologies LLC (Ukraine)

- Hilti (Liechtenstein)

- 3D Radar AS (Norway)

- T&A Survey BV (Netherlands)

- Maverick Inspection Ltd. (Canada)

Latest Developments in Ground Penetrating Radar Market

- In May 2025, Guideline Geo launched a new upgrade package for its MALÅ Ground Explorer and GeoDrone 80 antennas, enhancing performance with longer survey sessions, PPS positioning, and extended time window functionality, ideal for deep geological and glaciological surveys.

- In April 2025, IDS GeoRadar (Hexagon) introduced C-thrue XS, a compact, dual-polarization handheld GPR scanner designed for efficient concrete inspection in confined areas. The device enhances 3D imaging capabilities and is compatible with the company’s NDT Reveal software for CAD integration and reporting.

- In March 2025, Radiodetection (a brand of SPX Corporation) launched the GPR-SG GNSS-enabled system, offering centimeter-accurate positioning for GPR surveys. This innovation enhances subsurface utility mapping accuracy and supports integration with cloud-based geospatial platforms.

- In February 2025, ImpulseRadar released its Raptor-45 system, a new multi-channel GPR array designed for high-speed data acquisition in road and utility infrastructure surveys. The system features ultra-wide bandwidth and real-time synchronization with positioning systems for improved accuracy.

- In January 2025, Sensors & Software Inc. partnered with NovAtel to integrate WaveSense GPR with GNSS and inertial navigation systems, enabling precision localization in GPS-denied environments, such as tunnels and dense urban infrastructure.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.