Global Grow Light For Poultry Farming Market

Market Size in USD Million

CAGR :

%

USD

582.29 Million

USD

749.16 Million

2025

2033

USD

582.29 Million

USD

749.16 Million

2025

2033

| 2026 –2033 | |

| USD 582.29 Million | |

| USD 749.16 Million | |

|

|

|

|

Grow Light for Poultry Farming Market Size

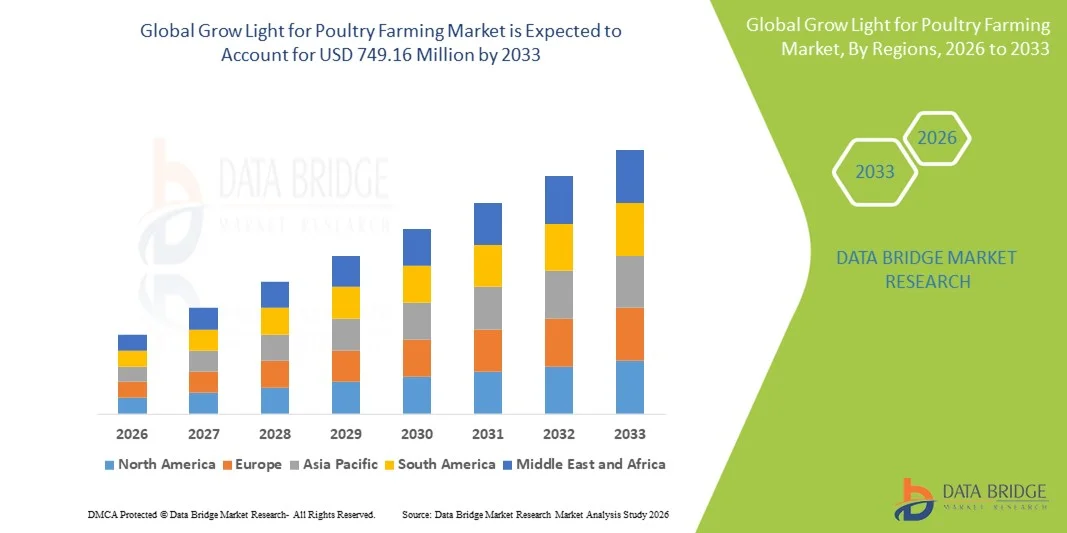

- The global grow light for poultry farming market size was valued at USD 582.29 million in 2025 and is expected to reach USD 749.16 million by 2033, at a CAGR of 3.20% during the forecast period

- The market growth is largely fuelled by increasing demand for enhanced poultry productivity, growing adoption of precision farming technologies, and the need for optimized lighting conditions to improve bird health and egg production

- Rising awareness about animal welfare and energy-efficient lighting solutions is also driving the adoption of grow lights in poultry farms

Grow Light for Poultry Farming Market Analysis

- The market is witnessing steady growth due to technological advancements in LED and automated lighting systems that allow precise control over light intensity, duration, and spectrum for different poultry species

- Increasing government support and initiatives promoting modern poultry farming practices, coupled with the expansion of commercial poultry farms in emerging regions, are further boosting market demand

- North America dominated the grow light for poultry farming market with the largest revenue share of 38.5% in 2025, driven by increasing adoption of energy-efficient LED lighting systems and the growing demand for enhanced poultry productivity and welfare

- Asia-Pacific region is expected to witness the highest growth rate in the global grow light for poultry farming market, driven by rapid urbanization, expansion of commercial poultry operations, growing disposable incomes, and government support for modern and energy-efficient farming technologies

- The LED segment held the largest market revenue share in 2025, driven by its energy efficiency, long lifespan, and ability to provide precise light spectrum control. LED grow lights allow poultry farmers to optimize growth, egg production, and overall flock health while reducing operational costs, making them the preferred choice for modern poultry farms

Report Scope and Grow Light for Poultry Farming Market Segmentation

|

Attributes |

Grow Light for Poultry Farming Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Grow Light for Poultry Farming Market Trends

Adoption Of Led And Smart Lighting Systems In Poultry Farms

- The growing use of LED and smart lighting systems is transforming poultry farming by providing precise control over light intensity, spectrum, and duration. These technologies improve bird growth, egg production, and overall flock health by mimicking natural lighting cycles and reducing stress. In addition, programmable lighting helps farmers standardize production cycles across multiple poultry houses, leading to consistent outputs and better resource management

- Increasing demand for automated and energy-efficient lighting solutions is accelerating adoption in commercial poultry farms. Smart systems allow remote monitoring and scheduling, optimizing energy consumption while maintaining ideal rearing conditions for poultry. Integration with IoT devices and farm management software enables real-time performance tracking, predictive maintenance, and reduced operational downtime

- The affordability, durability, and ease of installation of modern grow lights are encouraging their use across small, medium, and large-scale poultry operations. Frequent lighting adjustments can be implemented without high operational costs, enhancing productivity and animal welfare. The long lifespan of LED systems and low energy requirements also reduce total cost of ownership, making them a sustainable investment for farms of all sizes

- For instance, in 2024, several large poultry farms in the U.S. reported a 10-15% increase in egg yield after installing programmable LED grow lights, which helped regulate photoperiods and improve bird behavior. These improvements were coupled with better feed efficiency and reduced mortality rates, demonstrating a clear ROI for modern lighting systems. Adoption also encouraged innovation in flock management practices, including automated feeding and ventilation coordination

- While smart and LED grow lights are driving efficiency and sustainability, their full impact depends on proper system calibration, farmer training, and integration with existing poultry farm management practices. Continuous monitoring, periodic audits, and expert support ensure optimal lighting schedules and maximum productivity while minimizing stress and health issues in poultry flocks

Grow Light for Poultry Farming Market Dynamics

Driver

Increasing Focus On Poultry Productivity And Welfare

- Rising demand for higher egg and meat production is encouraging poultry farmers to adopt advanced lighting systems. Optimized light conditions help regulate feeding, growth, and reproductive cycles, resulting in improved productivity. Farmers are increasingly leveraging data from light sensors and automated systems to fine-tune production schedules, improve flock uniformity, and reduce wastage

- Poultry producers are increasingly aware of the benefits of controlled lighting on bird health, behavior, and stress reduction, motivating investments in LED and automated lighting systems. Healthier and less stressed birds show better immunity, reducing dependence on antibiotics and veterinary interventions, which aligns with sustainable and ethical farming practices. This awareness is also fostering adoption in both commercial and mid-scale operations

- Government programs and industry initiatives promoting modern poultry farming practices are supporting the adoption of grow lights, particularly in commercial operations. Subsidies, training workshops, and demonstration farms are helping farmers understand the benefits of controlled lighting, leading to faster adoption rates and improved operational standards. These programs also support research and development for energy-efficient solutions tailored to local farming conditions

- For instance, in 2023, poultry farms in Europe implementing LED lighting programs reported improved feed conversion ratios and reduced mortality rates, highlighting the efficiency gains from optimized lighting. The success stories prompted regional policy support and encouraged smaller farms to explore scalable lighting solutions, fostering wider market growth and adoption of modern technologies

- While productivity and welfare considerations are driving demand, widespread adoption requires continued education, cost-effective solutions, and integration with farm management technologies. Collaboration between lighting manufacturers, integrators, and poultry consultants is key to ensuring that farms can implement, maintain, and maximize the benefits of these systems

Restraint/Challenge

High Initial Investment And Limited Access In Small-Scale Farms

- The high upfront cost of advanced LED and smart lighting systems restricts adoption among smallholder and rural poultry farmers. These solutions are often more accessible to large commercial operations with higher capital. Limited financing options and lack of government incentives in some regions further slow adoption, leaving many smaller farms dependent on traditional and less efficient lighting methods

- In remote areas, lack of technical knowledge for installation, calibration, and maintenance limits effective utilization. Insufficient infrastructure and support services further hinder adoption. Farmers may face challenges troubleshooting lighting failures, and without proper training, suboptimal lighting schedules can negatively impact bird growth and productivity, undermining the benefits of the investment

- Supply chain constraints and limited availability of quality lighting products in certain regions can delay implementation, reducing the potential impact on productivity and bird welfare. Delays in procurement, inconsistent supply of replacement parts, and limited access to authorized service centers can result in prolonged downtime, affecting farm operations and profitability

- For instance, in 2024, surveys in Southeast Asia indicated that over 60% of small poultry farms had not adopted LED grow lights due to high costs and inadequate technical support. Many of these farms continued relying on incandescent or fluorescent lighting, which is less energy-efficient and less effective in supporting optimal growth and egg production cycles

- While lighting technology continues to advance, addressing affordability, accessibility, and training challenges is essential to unlock growth in small and medium-scale poultry operations. Innovative financing, local training programs, and mobile service solutions can help overcome barriers, ensuring that advanced lighting technologies benefit a broader spectrum of poultry farmers

Grow Light for Poultry Farming Market Scope

The market is segmented on the basis of type, installation type, and light color.

- By Type

On the basis of type, the grow light for poultry farming market is segmented into Light-Emitting Diode (LED), Fluorescent, Incandescent, and High-Intensity Discharge (HID). The LED segment held the largest market revenue share in 2025, driven by its energy efficiency, long lifespan, and ability to provide precise light spectrum control. LED grow lights allow poultry farmers to optimize growth, egg production, and overall flock health while reducing operational costs, making them the preferred choice for modern poultry farms.

The Fluorescent segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its low upfront cost, ease of installation, and widespread availability. Fluorescent lights are particularly suitable for small to medium-scale farms looking for cost-effective lighting solutions that still support bird growth and productivity.

- By Installation Type

On the basis of installation type, the market is segmented into retrofit and new installation. The new installation segment held the largest market share in 2025, driven by the construction of modern poultry farms and adoption of advanced lighting systems in newly built facilities. New installations allow farmers to integrate energy-efficient lighting with automated systems for optimized performance.

The retrofit segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the need to upgrade existing poultry houses with energy-efficient LED and smart lighting systems. Retrofit solutions help farms improve productivity and reduce electricity costs without requiring complete infrastructure overhaul.

- By Light Color

On the basis of light color, the market is segmented into Green, Red, Blue, and White. The White light segment held the largest revenue share in 2025, driven by its versatility in supporting general flock health and productivity across various poultry species. White light provides a balanced spectrum that helps regulate feeding and reproductive cycles, making it suitable for both egg-laying and broiler operations.

The Red light segment is expected to witness the fastest growth rate from 2026 to 2033, owing to its proven benefits in stimulating egg production and improving reproductive performance. Red lighting is increasingly adopted in commercial poultry farms to enhance productivity and optimize energy use while maintaining bird welfare.

Grow Light for Poultry Farming Market Regional Analysis

- North America dominated the grow light for poultry farming market with the largest revenue share of 38.5% in 2025, driven by increasing adoption of energy-efficient LED lighting systems and the growing demand for enhanced poultry productivity and welfare

- Poultry farmers in the region highly value the benefits of controlled lighting, including improved egg production, growth rates, and overall flock health. The integration of smart lighting systems with farm management solutions enables precise photoperiod control and operational efficiency

- This widespread adoption is further supported by high awareness of poultry welfare standards, advanced farm infrastructure, and government initiatives promoting modern poultry farming practices, establishing grow lights as a preferred solution for commercial and large-scale poultry farms

U.S. Grow Light For Poultry Farming Market Insight

The U.S. grow light for poultry farming market captured the largest revenue share in 2025 within North America, fueled by the increasing modernization of poultry operations and adoption of automated lighting systems. Poultry producers are focusing on optimizing egg production and bird growth through programmable LED and smart lighting solutions. The rising demand for energy-efficient and sustainable lighting, along with integration with IoT-based farm management platforms, is further propelling the market’s expansion.

Europe Grow Light For Poultry Farming Market Insight

The Europe grow light for poultry farming market is expected to witness the fastest growth rate from 2026 to 2033, driven by stringent animal welfare regulations and the increasing emphasis on poultry productivity. Growing urbanization and investment in commercial poultry farms are boosting the adoption of advanced lighting systems. European farmers are also attracted to the energy efficiency and long-term cost savings offered by LED and smart lighting technologies, with applications across both new and renovated poultry houses.

U.K. Grow Light For Poultry Farming Market Insight

The U.K. grow light for poultry farming market is expected to witness strong growth from 2026 to 2033, driven by the increasing adoption of energy-efficient lighting and the focus on improving poultry welfare. Concerns about productivity, bird health, and operational efficiency are motivating farmers to implement programmable lighting solutions. The country’s well-developed farm infrastructure and supportive policies for modern poultry practices are expected to continue stimulating market growth.

Germany Grow Light For Poultry Farming Market Insight

The Germany grow light for poultry farming market is expected to witness substantial growth from 2026 to 2033, fueled by rising awareness of poultry welfare, energy-efficient solutions, and precision farming practices. Germany’s advanced farm infrastructure and focus on sustainability encourage the adoption of LED and smart lighting systems in both commercial and research-focused poultry farms. Integration with automated feeding, ventilation, and monitoring systems is becoming increasingly prevalent.

Asia-Pacific Grow Light For Poultry Farming Market Insight

The Asia-Pacific grow light for poultry farming market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and modernization of poultry farms in countries such as China, Japan, and India. Government initiatives promoting sustainable and high-efficiency poultry farming are supporting the adoption of LED and smart lighting systems. The region’s role as a manufacturing hub for poultry lighting equipment also enhances accessibility and affordability, expanding adoption among commercial and small-scale farms.

Japan Grow Light For Poultry Farming Market Insight

The Japan grow light for poultry farming market is expected to witness strong growth from 2026 to 2033 due to the country’s high focus on technology, poultry welfare, and operational efficiency. Japanese farmers prioritize controlled lighting to improve egg production and bird growth while reducing stress and energy costs. Integration of smart lighting with IoT-based monitoring and farm automation systems is driving adoption in both commercial and medium-scale poultry farms.

China Grow Light For Poultry Farming Market Insight

The China grow light for poultry farming market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s large poultry industry, modernization of commercial farms, and increasing focus on energy-efficient lighting. Rapid urbanization, government initiatives promoting sustainable poultry production, and the availability of affordable LED and smart lighting solutions are key factors propelling market growth across residential, commercial, and industrial poultry operations.

Grow Light for Poultry Farming Market Share

The Grow Light for Poultry Farming industry is primarily led by well-established companies, including:

- OSRAM Opto Semiconductors GmbH (Germany)

- Signify Holding (Netherlands)

- DeLaval Inc. (Sweden)

- Big Dutchman (Germany)

- Uni-lightled LED (China)

- Once Inc. (U.S.)

- AGRILIGHT B.V. (Netherlands)

- Aruna Lighting (India)

- HATO Agricultural Lighting (Netherlands)

- Shenzhen Hontech-Wins Electronics Co., Ltd. (China)

- CBM Lighting Inc. (U.S.)

- Fienhage Poultry Solutions (Germany)

- SUNBIRD (China)

- Sinowell (China)

- G&G Industrial Lighting (U.K.)

- Excite LED Grow Lights (U.S.)

- TE Connectivity (U.S.)

- Cree, Inc. (U.S.)

- SAMSUNG (South Korea)

- Heliospectra AB (Sweden)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.