Global Grow Light Market

Market Size in USD Billion

CAGR :

%

USD

1.75 Billion

USD

2.81 Billion

2024

2032

USD

1.75 Billion

USD

2.81 Billion

2024

2032

| 2025 –2032 | |

| USD 1.75 Billion | |

| USD 2.81 Billion | |

|

|

|

|

Grow Lights Market Size

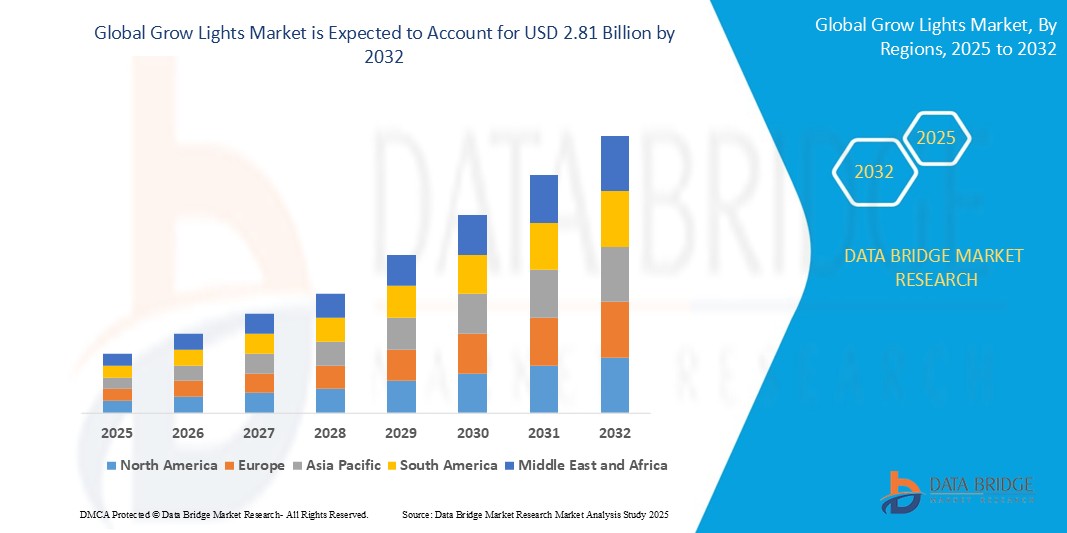

- The global grow lights market size was valued at USD 1.75 billion in 2024 and is expected to reach USD 2.81 billion by 2032, at a CAGR of 6.10 % during the forecast period

- This growth is driven by factors such as the increasing adoption of indoor farming and vertical agriculture, rising demand for food security, technological advancements in energy-efficient LED grow lights, and expanding legalization of cannabis cultivation in several countries

Grow Lights Market Analysis

- The global grow lights market is experiencing significant growth, driven by the increasing adoption of indoor and vertical farming practices, which utilize artificial lighting to promote plant growth in controlled environments

- Technological advancements in lighting solutions, such as the development of energy-efficient and customizable spectrum LED systems, are enhancing the efficiency and effectiveness of grow lights in various agricultural applications

- Asia-Pacific is expected to dominate the grow lights market due to rapid urbanization, government initiatives supporting sustainable farming, and the rising adoption of advanced agricultural technologies in countries such as China, Japan, and India.

- North America is expected to be the fastest-growing region in the grow lights market during the forecast period due to increasing demand for energy-efficient lighting solutions, the rise of urban farming, and significant technological advancements in grow light systems.

- The light emitting diode (LED) segment is expected to dominate the grow lights market with the largest share of 42.5% in 2025 due to its energy efficiency, long lifespan, and ability to offer precise light spectrum control, which is crucial for maximizing crop yields in controlled environments. In addition, the decreasing cost of LED technology and its growing adoption across various agricultural applications further drive this segment's market dominance.

Report Scope and Grow Lights Market Segmentation

|

Attributes |

Grow Lights Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Grow Lights Market Trends

“Integration of Smart Technologies in Grow Light”

- The integration of smart technologies into grow lights is transforming indoor agriculture by allowing precise and automated control over lighting parameters, helping growers meet plant-specific requirements effectively

- Smart grow lights use advanced features such as mobile connectivity, cloud-based monitoring, and programmable settings to optimize light exposure throughout different growth phases

- For instance,

- Philips GreenPower LED systems offer networked lighting controls that adapt light intensity and duration based on crop type and growth stage, significantly improving energy efficiency and yield

- The use of smart sensors in products by companies such as Black Dog LED, which monitor ambient conditions and adjust the lighting spectrum automatically to suit changing plant needs

- These innovations are part of the growing trend of precision agriculture, where data and automation improve crop outcomes while minimizing manual labor and energy consumption

Grow Lights Market Dynamics

Driver

“Government Support for Sustainable Agriculture”

- Governments around the world are taking active steps to promote sustainable agriculture by supporting the adoption of advanced technologies such as grow lights in controlled-environment farming

- Financial incentives such as subsidies, grants, and tax relief are being offered to help growers invest in energy-efficient lighting systems, making them more accessible and cost-effective

For instance,

- The U.S. Department of Energy funds research and provides financial aid to encourage the use of LED grow lights, which significantly reduce energy consumption in indoor farming

- The European Union’s Horizon program and China’s Five-Year Agricultural Plan include dedicated funding for sustainable agriculture technologies, including smart lighting solutions

- These initiatives not only ease the initial investment burden for growers but also support the broader global transition to environmentally responsible food production methods, boosting the overall market for grow lights

Opportunity

“Expansion of Urban Agriculture”

- The increasing urban population is fueling the growth of urban agriculture, creating a major opportunity for the grow lights market as cities seek innovative solutions for local food production

- Limited access to arable land in metropolitan areas is encouraging the adoption of indoor farming techniques such as vertical farming and hydroponics, both of which rely heavily on artificial lighting

- For instance, companies such as Plenty in the U.S. and Sky Greens in Singapore operate vertical farms within city environments using advanced grow light systems to produce fresh vegetables year-round

- Smart lighting technologies, including IoT-connected grow lights, allow urban farms to monitor and adjust light levels in real time, improving both yield and energy efficiency

- As urban agriculture becomes a vital component of food supply chains in cities, the demand for high-performance and adaptive grow light systems is expected to grow significantly

Restraint/Challenge

“High Initial Investment Costs”

- One of the main challenges facing the grow lights market is the high upfront cost of installation, which can discourage small-scale and first-time growers from adopting the technology

- Advanced lighting systems, particularly those using LED technology, require significant capital investment for equipment, setup, and supporting infrastructure

- For instance, small greenhouse operators often struggle to afford full-spectrum LED systems such as those offered by brands such as Gavita or Fluence, despite their efficiency and longevity

- Another barrier is the technical complexity of using grow lights effectively, as different plant types and growth stages require tailored light spectrums and timing, which demands specialized knowledge

- Without adequate training or access to expert guidance, many growers risk suboptimal crop performance, further increasing hesitation toward investing in grow light systems and slowing broader market adoption

Grow Lights Market Scope

The market is segmented on the basis of product, system, wattage, technology, installation type, spectrum, and application.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By System |

|

|

By Wattage |

|

|

By Technology |

|

|

By Installation Type |

|

|

By Spectrum |

|

|

By Application |

|

In 2025, the light emitting diode (LED) is projected to dominate the market with a largest share in technology segment

The light emitting diode (LED) segment is expected to dominate the grow lights market with the largest share of 42.5% in 2025 due to its energy efficiency, long lifespan, and ability to offer precise light spectrum control, which is crucial for maximizing crop yields in controlled environments. In addition, the decreasing cost of LED technology and its growing adoption across various agricultural applications further drive this segment's market dominance.

The commercial greenhouse is expected to account for the largest share during the forecast period in application market

In 2025, the commercial greenhouse segment is expected to dominate the market with the largest market share of 44.5% due to its ability to provide year-round production of crops, enhanced by artificial lighting systems that support plant growth in varying environmental conditions. The increasing demand for fresh produce and advancements in greenhouse technologies, including climate control systems, make this segment a key driver of the overall market growth.

Grow Lights Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Grow Lights Market”

- Asia-Pacific region is projected to dominate the grow lights market with an estimated market share of 40%

- Countries such as China, Japan, and India are investing heavily in indoor farming technologies, including advanced grow light systems, to enhance food security and meet the growing demand for fresh produce

- Government policies and subsidies in countries such as China and India are promoting sustainable farming practices, further boosting the adoption of grow lights

- The presence of key market players and technological advancements in the region contribute to its dominance in the global grow lights market

“North America is Projected to Register the Highest CAGR in the Grow Lights Market”

- North America is anticipated to experience the fastest growth in the grow lights market, fuelled by technological advancements and increasing demand for sustainable farming solutions.

- The U.S. and Canada are at the forefront of adopting LED grow lights, driven by the need for energy-efficient lighting solutions in indoor farming applications

- Government initiatives and funding programs in North America are supporting the development and adoption of advanced grow light technologies

- The growing popularity of urban farming and vertical agriculture in cities across North America is further accelerating the demand for grow lights

Grow Lights Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Signify Holding (Netherlands)

- OSRAM GmbH (Germany)

- Gavita International B.V (Netherlands)

- Valoya (Finland)

- California LightWorks (US)

- Helliospectra AB (Sweden)

- Black Dog Grow Technologies Inc. (U.S.)

- Bridgelux Inc. (U.S.)

- Cree LED (U.S.)

- EVERLIGHT ELECTRONICS CO. LTD. (Taiwan)

- Lumigrow (U.S.)

- Samsung (South Korea)

- Savant Systems Inc. (U.S.)

- AeroFarms (US)

- Hortilux Schréder (Netherlands)

- Koninklijke Philips N.V. (Netherlands)

- Alta LED Corporation (US)

- Epistar (Taiwan) General Electric (US)

- Illumitex Inc, (US)

- Shenzhen Juson Technology Co. Ltd. (China)

- Iwasaki Electric Co. Ltd (Japan)

Latest Developments in Global Grow Lights Market

- In November 2022, Signify launched two new portable smart lamps in India: the Philips Smart LED Squire and Philips Smart LED Hero. These lamps feature a round-shaped design with plug-and-play operation, making them easy to use and carry anywhere in the home. They offer a wide range of colors, from cool white to soft warm white, and preset modes such as Focus and Relax to create the best ambiance for various activities. Users can remotely operate these lamps using the Philips WiZ app or voice control, and they are compatible with all smart home systems that work via existing Wi-Fi networks. The introduction of these portable smart lamps aims to enhance the convenience and flexibility of smart lighting in Indian households, catering to the growing demand for smart and convenient lighting solutions

- In June 2022, ams OSRAM announced that Taiwan-based Ledtech had integrated its OSLON UV 3636 UV-C LEDs into Ledtech’s new BioLED intelligent air purifier. This collaboration combines UV-C LEDs with active carbon filters to effectively inactivate airborne viruses, bacteria, and fungi, achieving up to 99.99% inactivation at a dosing rate of 3.6 mJ/cm². The compact size and mercury-free design of the OSLON UV 3636 LEDs offer a sustainable and reliable alternative to traditional mercury lamps. This development is expected to enhance the adoption of UV-C LED technology in air purification systems, contributing to improved indoor air quality and public health safety. The market impact includes increased demand for advanced disinfection solutions in homes, offices, and public spaces

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Grow Light Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Grow Light Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Grow Light Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.