Global Guar Complex Market

Market Size in USD Billion

CAGR :

%

USD

1.21 Billion

USD

1.56 Billion

2024

2032

USD

1.21 Billion

USD

1.56 Billion

2024

2032

| 2025 –2032 | |

| USD 1.21 Billion | |

| USD 1.56 Billion | |

|

|

|

|

Guar Complex Market Size

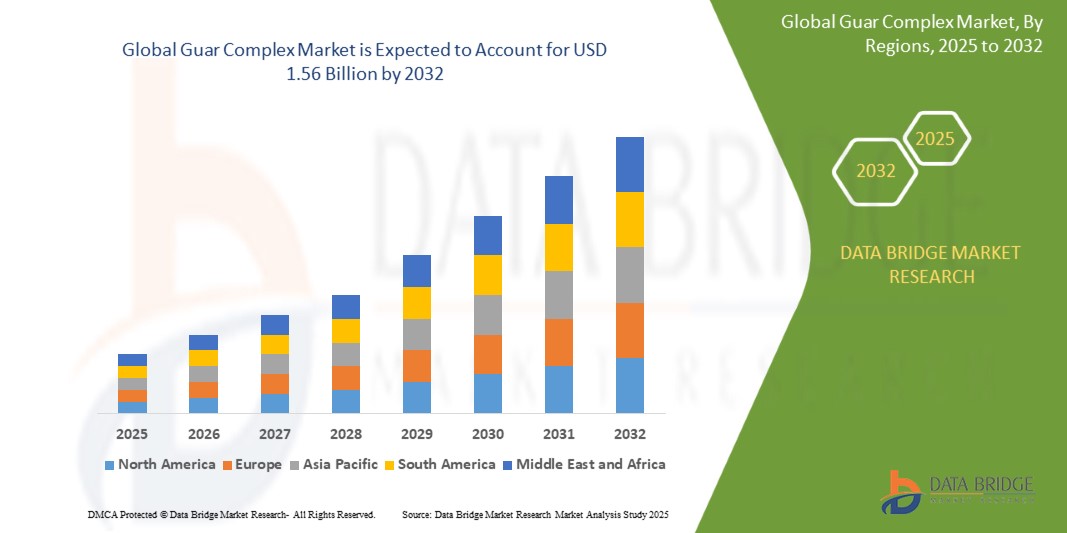

- The global guar complex market size was valued at USD 1.21 billion in 2024 and is expected to reach USD 1.56 billion by 2032, at a CAGR of 3.20% during the forecast period

- The market growth is largely fuelled by the rising demand for guar gum in the oil and gas industry for hydraulic fracturing, along with expanding applications in food, pharmaceuticals, and cosmetics

- The increasing preference for plant-based and clean-label ingredients is also contributing to the demand for guar products, especially in vegan and gluten-free formulations across food and beverage applications

Guar Complex Market Analysis

- Growing utilization of guar derivatives such as guar gum powder and guar splits in shale gas extraction and food processing sectors is significantly boosting market growth

- Demand for natural thickening, stabilizing, and emulsifying agents is driving the adoption of guar-based products across dairy, bakery, and personal care industries

- Asia-Pacific dominated the guar complex market with the largest revenue share of 53.72% in 2024, primarily driven by high production and export volumes from countries such as India and Pakistan

- North America region is expected to witness the highest growth rate in the global guar complex market, driven by surging demand for guar gum in oilfield applications, heightened awareness of natural food thickeners, and technological advancements in guar processing and formulation

- The guar gum segment held the largest market revenue share in 2024, owing to its extensive use across oil and gas, food and beverage, and pharmaceutical industries. Its superior thickening, emulsifying, and stabilizing properties make it an indispensable additive in fracking fluids, dairy products, baked goods, and cosmetic formulations

Report Scope and Guar Complex Market Segmentation

|

Attributes |

Guar Complex Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Guar Complex Market Trends

“Growing Preference For Natural Thickening And Binding Agents”

- Consumers are increasingly favoring natural and clean-label ingredients across food and cosmetic products, which is boosting the demand for guar gum as a safe and plant-derived alternative to synthetic additives in global markets

- Guar gum is being integrated into various applications such as gluten-free bakery items, dairy substitutes, and personal care emulsions due to its natural thickening, emulsifying, and stabilizing characteristics, making it highly versatile across industries

- For instance, various European vegan skincare brands have reformulated facial creams and hair gels using guar derivatives to comply with clean beauty trends and cater to ethical and eco-conscious consumer preferences

- Manufacturers are leveraging guar gum’s ability to replace allergens such as gluten and soy protein in specialized nutrition products, which aligns with the growing demand for hypoallergenic and allergen-free alternatives in food and pharmaceutical sectors

- The rising shift toward sustainable agriculture and plant-based ingredient sourcing has positioned guar as a key functional component in eco-friendly formulations, supported by both government initiatives and private sector R&D investments

Guar Complex Market Dynamics

Driver

“Rising Utilization of Guar Gum in Oil and Gas Industry”

- Guar gum is extensively used in the oil and gas industry as a key component of hydraulic fracturing fluids due to its superior thickening, gelling, and suspension properties, which help in proppant transport and pressure maintenance during fracking operations

- Energy companies favor guar-based formulations over synthetic chemicals due to their biodegradability, cost-effectiveness, and high performance in extreme temperature and pressure conditions, particularly in shale gas and tight oil drilling activities

- For instance, the U.S. shale gas sector accounted for nearly 70% of global guar gum imports in 2023, underlining its critical importance in boosting extraction efficiency and reducing operational costs for North American energy producers

- Guar derivatives improve the viscosity of fluids, enabling better control over underground fracture propagation, which enhances hydrocarbon recovery while minimizing environmental risks associated with chemical-based fracturing solutions

- The continuous expansion of oil and gas exploration in the U.S., Canada, and the Middle East is expected to maintain strong demand for guar gum, creating long-term growth opportunities for producers and exporters in India and Pakistan

Restraint/Challenge

“Price Volatility and Dependence on Monsoon-Driven Cultivation”

- The global guar market is highly dependent on cultivation in India and Pakistan, where monsoon variability can severely impact crop yields, leading to irregular supply chains and unpredictable pricing for buyers in key export markets

- Fluctuating weather conditions, such as droughts or excessive rainfall, often cause delayed harvests or reduced output, which in turn disrupts the availability of guar seed and its processed derivatives across food, industrial, and energy applications

- For instance, poor rainfall during the 2022 monsoon season in Rajasthan caused a significant drop in guar seed production, resulting in supply shortages and price hikes for importing countries such as the U.S. and China

- High market speculation and futures trading further intensify price instability, making it difficult for manufacturers to plan long-term procurement and affecting the stability of guar-based product pricing across end-use industries

- Unless investments are made in sustainable farming practices, irrigation systems, and regional diversification of guar cultivation, the market will continue to face constraints from weather-related uncertainties and supply shocks

Guar Complex Market Scope

The market is segmented on the basis of type, form, application, and distribution channel.

• By Type

On the basis of type, the guar complex market is segmented into brown fiber, white fiber, bristle coir, and buffering coir. The brown fiber segment dominated the market with the largest revenue share in 2024, primarily due to its robust utility in industrial applications including ropes, mats, and brushes. Its high lignin content offers greater durability and resistance, making it a preferred raw material across construction, packaging, and automotive industries. The availability of brown fiber in large quantities and its cost-effectiveness further support its market leadership.

The white fiber segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to its increased use in upholstery and mattress padding applications. Its softer texture and lighter shade make it ideal for high-end consumer products, especially in the furniture and interior décor sectors. Growing demand for sustainable, biodegradable alternatives in developed markets continues to drive its adoption in premium product categories.

• By Form

On the basis of form, the market is segmented into guar seed, guar gum, guar meal, and others. The guar gum segment held the largest market revenue share in 2024, owing to its extensive use across oil and gas, food and beverage, and pharmaceutical industries. Its superior thickening, emulsifying, and stabilizing properties make it an indispensable additive in fracking fluids, dairy products, baked goods, and cosmetic formulations.

Guar seed is expected to witness the fastest growth rate from 2025 to 2032 driven by rising global demand for processed guar products and increased cultivation activities in India and Pakistan. The seed serves as the core input for all value-added derivatives including gum and meal, thus experiencing stable procurement from processing units and exporters worldwide.

• By Application

On the basis of application, the guar complex market is segmented into food and beverages, direct consumption, fracking, textiles, pharmaceuticals, and others. The fracking segment accounted for the largest market revenue share in 2024, supported by robust demand in the oil and gas sector, particularly in North America. Guar gum's ability to increase viscosity and suspend solids in fracturing fluids makes it crucial for efficient hydrocarbon recovery during hydraulic fracturing processes.

The food and beverages segment is expected to witness the fastest growth rate from 2025 to 2032, bolstered by the increasing demand for natural, gluten-free, and plant-based ingredients. Guar gum is widely used as a stabilizer and thickener in bakery products, dairy alternatives, and ready-to-eat meals, aligning well with evolving consumer preferences and clean label trends.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into farmers, traders/wholesalers, retailers, and processors. The processors segment dominated the market in 2024 due to their central role in extracting and refining guar derivatives for multiple industrial applications. Processors manage large-scale operations, ensuring consistent quality, and form strategic partnerships with exporters and manufacturers across sectors.

Retailers is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising trend of direct-to-consumer (D2C) purchases and increased shelf presence of guar-based products. Expanding retail networks, both offline and online, especially in developing regions, are providing wider accessibility and creating new revenue streams for smaller-scale guar product sellers.

Guar Complex Market Regional Analysis

- Asia-Pacific dominated the guar complex market with the largest revenue share of 53.72% in 2024, primarily driven by high production and export volumes from countries such as India and Pakistan

- The region benefits from favorable agro-climatic conditions for guar cultivation, particularly in semi-arid zones, alongside established supply chain infrastructure supporting large-scale processing and distribution

- Growing global demand for guar-based products in oil & gas, food, and textile industries has encouraged investment in guar gum processing facilities, positioning Asia-Pacific as the key supplier to international markets

China Guar Complex Market Insight

The China guar complex market holds a significant share in Asia-Pacific, supported by demand from the food, textile, and oil drilling sectors. Guar gum is widely used in noodle production, sauces, and frozen foods for texture and consistency. In industrial applications, guar’s water-binding capacity is valued in textile printing and enhanced oil recovery. China heavily depends on imports from India, positioning itself as a key consumer rather than a producer. Government focus on food processing modernization is expected to boost demand further.

Japan Guar Complex Market Insight

Japan’s guar complex market is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand in food processing, cosmetics, and pharmaceuticals. Guar gum is favored for its natural origin and multifunctional uses, especially in dairy, bakery, and personal care products. Japan’s stringent quality standards encourage the import of high-grade guar gum from certified suppliers. Technological integration in processing and innovation in product development are key growth drivers. The aging population’s preference for functional foods also supports consistent guar demand.

North America Guar Complex Market Insight

The North America guar complex market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by rising demand from the oil and gas sector. The use of guar gum as a thickening and suspending agent in hydraulic fracturing fluids has made it indispensable in shale gas exploration. Furthermore, ongoing research into guar’s functional properties is creating new opportunities across food and pharmaceutical applications, encouraging greater imports and local innovation.

U.S. Guar Complex Market Insight

The U.S. guar complex market is expected to witness the fastest growth rate from 2025 to 2032, with consumption largely centered around oilfield operations. The growing domestic shale gas industry has driven steady demand for high-grade guar derivatives that improve well stimulation efficiency. In addition, U.S. manufacturers are increasingly exploring guar applications in gluten-free foods and natural cosmetics, contributing to diversification in product use and import volume.

Europe Guar Complex Market Insight

The Europe guar complex market is expected to witness the fastest growth rate from 2025 to 2032, supported by demand from the food and beverage industry, where guar gum is used as a stabilizer and emulsifier. Stringent food safety regulations and consumer preference for clean-label, plant-based ingredients are boosting the appeal of guar-based formulations. The pharmaceutical sector in countries such as Germany and France is also incorporating guar in tablet binding and controlled-release drug systems.

Germany Guar Complex Market Insight

Germany is expected to witness the fastest growth rate from 2025 to 2032, driven by growing interest in organic and functional foods. The country’s well-regulated pharmaceutical and cosmetic markets are also leveraging guar gum’s non-toxic and biodegradable nature. German companies are investing in R&D to optimize guar’s performance across new applications, contributing to the market’s growth and technological advancement.

U.K. Guar Complex Market Insight

The U.K. guar complex market is expected to witness the fastest growth rate from 2025 to 2032, driven by the clean-label movement and growing demand for gluten-free and vegan products. Guar gum is extensively used in bakery, dairy, sauces, and ready-to-eat meals to enhance texture and shelf life. The U.K. relies on imports, primarily from India, to meet industry demand for processed guar forms. Post-Brexit trade policies continue to allow stable guar imports with a focus on sustainability and transparency. Emerging applications in pet food and nutraceuticals are expected to support future growth.

Guar Complex Market Share

The Guar Complex industry is primarily led by well-established companies, including:

- VIKAS WSP LTD. (India)

- Shree Ram Industries. (India)

- LUCID COLLOIDS LTD. (India)

- Ashland (U.S.)

- Supreme Gums Pvt. Ltd. (India)

- India Glycols Limited (India)

- Lamberti S.p.A. (Italy)

- Best Agro Group (India)

- Avanscure Lifesciences Pvt. Ltd. (India)

- CHEMICAL ALLIANZ (India)

- Dabur (India)

- Ashapura Proteins Ltd (India)

- Amba Gums & Feeds Products (India)

- SIDDHARTH CHEMICALS (India)

- DWARKESH INDUSTRIES. (India)

- Oriental Gums & Biopolymers (India)

- Ashok Industries (India)

- Saboo Group (India)

Latest Developments in Global Guar Complex Market

- In May 2022, the Directorate General of Foreign Trade introduced a regulatory amendment requiring Indian exporters of guar gum to the European Union and United Kingdom to obtain official certification and analytical reports from Vimta Labs, Hyderabad, for testing PCP and ethylene oxide (ETO), while EIA Chennai was also designated for PCP testing. This move aims to ensure product compliance with international safety standards, improve traceability, and enhance the credibility of Indian guar gum in export markets

- In October 2021, Indian researchers announced the development of an eco-friendly polymer derived from guar gum and chitosan. Designed for use in packaging, the innovation offers excellent water stability and mechanical strength. This advancement, based on sustainable materials such as guar beans and shellfish, presents a promising alternative to conventional plastics, supporting environmental goals and expanding the industrial application of guar-based materials

- In March 2021, Nexira completed the acquisition of Unipektin Ingredients AG, significantly expanding its portfolio of plant-based and specialty ingredients. The addition includes hydrolyzed guar gum, tara gum, and beet fiber, strengthening Nexira’s capabilities in functional and nutritional ingredient solutions. This strategic move enhances its global competitiveness, opens new opportunities in the food and health sectors, and reinforces its commitment to natural product innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Guar Complex Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Guar Complex Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Guar Complex Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.