Global Guitar Market

Market Size in USD Billion

CAGR :

%

USD

19.70 Billion

USD

29.29 Billion

2024

2032

USD

19.70 Billion

USD

29.29 Billion

2024

2032

| 2025 –2032 | |

| USD 19.70 Billion | |

| USD 29.29 Billion | |

|

|

|

|

Guitar Market Size

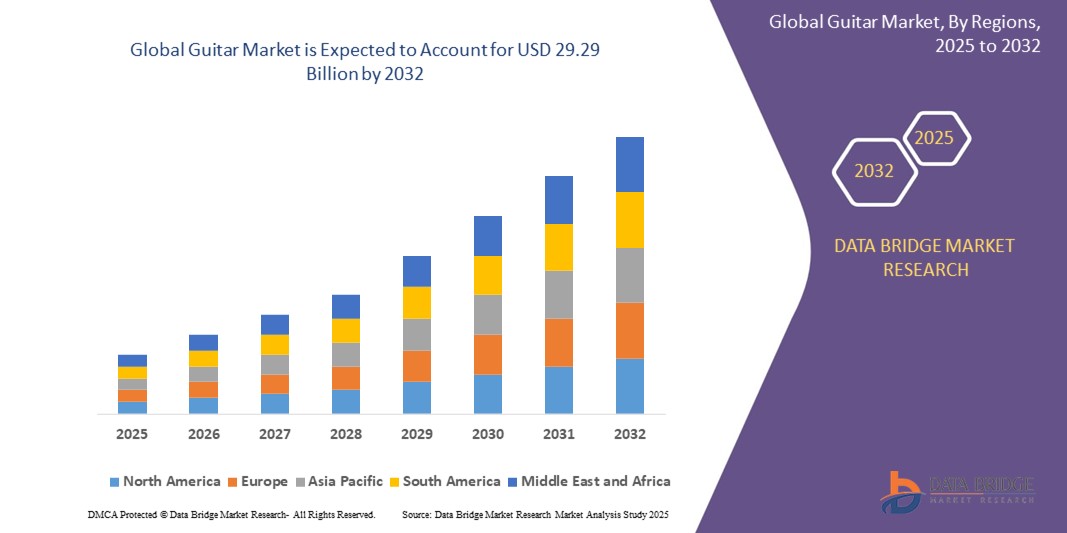

- The global guitar market size was valued at USD 19.70 billion in 2024 and is expected to reach USD 29.29 billion by 2032, at a CAGR of 5.08% during the forecast period

- The market growth is primarily driven by the increasing popularity of music education, rising interest in live music performances, and the growing influence of digital platforms promoting music creation and learning

- In addition, consumer demand for high-quality, customizable, and aesthetically appealing guitars, coupled with advancements in manufacturing technologies, is solidifying guitars as a preferred instrument across professional and amateur segments, significantly boosting industry growth

Guitar Market Analysis

- Guitars, as stringed musical instruments, are essential in various music genres, offering versatility, portability, and accessibility for both professional musicians and hobbyists in settings ranging from live performances to home practice

- The rising demand for guitars is fueled by the global surge in music streaming, social media platforms showcasing musical talent, and growing interest in music as a recreational and professional pursuit

- North America dominated the guitar market with the largest revenue share of 38.5% in 2024, driven by a strong music culture, high disposable incomes, and the presence of leading guitar manufacturers

- Europe is expected to be the fastest-growing region during the forecast period due to increasing music festivals, a rich tradition of classical and contemporary music, and rising disposable incomes

- The electric guitar segment dominated the largest market revenue share of 38.5% in 2024, driven by its widespread use in popular music genres such as rock, metal, and pop, coupled with advancements in amplifier technology and effects pedals that enhance versatility and appeal

Report Scope and Guitar Market Segmentation

|

Attributes |

Guitar Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Guitar Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global guitar market is experiencing a notable trend toward the integration of Artificial Intelligence (AI) and Big Data analytics to enhance product offerings and customer experience

- These technologies enable manufacturers to analyze consumer preferences, purchasing patterns, and playing behaviors, providing insights for product development and marketing strategies

- AI-powered platforms are being developed to offer personalized learning experiences, such as smart guitars with built-in sensors that provide real-time feedback on playing techniques through connected apps

- For instances, companies such as Samsung have introduced smart electric guitars, such as the ZamString, which integrates with apps to simplify the learning process and enhance user engagement

- Big Data analytics helps retailers and manufacturers understand market trends, optimize inventory, and tailor promotional campaigns to specific demographics, boosting sales and customer loyalty

- This trend is making guitars more appealing to tech-savvy consumers, particularly younger musicians, by combining traditional craftsmanship with modern technological advancements

Guitar Market Dynamics

Driver

“Rising Demand for Music-Related Leisure Activities and Online Education”

- The growing popularity of music as a leisure activity, driven by increasing participation in music festivals, live concerts, and social media platforms, is a key driver for the global guitar market

- Online music education platforms, utilizing video conferencing, digital sheet music, and interactive apps, have made learning the guitar more accessible, boosting demand among beginners and hobbyist

- Government and school initiatives promoting music education in curricula, particularly in developed regions, are encouraging younger demographics to take up guitar playing as an extracurricular activity

- The rise of social media and platforms such as YouTube provides a global stage for aspiring musicians to showcase their skills, further fueling interest in guitar ownership and usage

- Manufacturers are responding by offering affordable, versatile guitars suitable for beginners, as well as premium models for professional musicians, catering to a broad consumer base

Restraint/Challenge

“High Cost of Premium Guitars and Data Security Concerns”

- The high cost of premium, wood-based, or technologically advanced guitars, such as those with IoT-enabled features, can be a significant barrier to adoption, particularly for budget-conscious consumers in emerging markets

- Integrating smart technologies, such as sensors or connectivity features, into guitars increases production costs, making these instruments less accessible to some demographics

- Data security and privacy concerns are emerging as challenges with the rise of connected guitars that collect user data, such as playing patterns, raising risks of data breaches or misuse

- The lack of standardized regulations across countries for data collection and usage in smart musical instruments complicates compliance for manufacturers and app developer

- These factors may deter potential buyers, particularly in regions with high cost sensitivity or growing awareness of data privacy issues, potentially limiting market growth

Guitar market Scope

The market is segmented on the basis of type, wood material, covers, tailpiece, neck shape, number of strings, string material, music type, color, distribution channel, and application.

- By Type

On the basis of type, the global guitar market is segmented into acoustic guitar, electric guitar, electric-acoustic guitar, classical guitar, bass guitar, resonator, extended range electric guitar, lap steel guitar, double neck guitar, and others. The electric guitar segment held the largest market revenue share of 38.5% in 2024, driven by its widespread use in popular music genres such as rock, metal, and pop, coupled with advancements in amplifier technology and effects pedals that enhance versatility and appeal.

The electric-acoustic guitar segment is expected to witness the fastest growth rate of 8.9% from 2025 to 2032, fueled by increasing demand for hybrid instruments that combine acoustic resonance with amplified performance, appealing to both live performers and studio musicians.

- By Wood Material

On the basis of wood material, the global guitar market is segmented into solid and laminate. The solid wood segment is expected to hold the largest market revenue share of 62.5% in 2024, owing to its superior tonal quality, durability, and aesthetic appeal, which are highly valued by professional musicians and enthusiasts.

The laminate wood segment is anticipated to experience significant growth from 2025 to 2032, driven by its affordability and suitability for entry-level and mid-range guitars, making it popular among beginners and budget-conscious consumers.

- By Covers

On the basis of covers, the global guitar market is segmented into solid body, semi-hollow body, hollow body, and others. The solid body segment dominated the market with a revenue share of 55.5% in 2024, primarily due to its prevalence in electric guitars, offering durability, sustain, and resistance to feedback, making it ideal for high-energy performances.

The semi-hollow body segment is projected to witness the fastest growth rate of 9.2% from 2025 to 2032, driven by its versatility in producing warm, resonant tones suitable for jazz, blues, and indie music, attracting a diverse range of musicians.

- By Tailpiece

On the basis of tailpiece, the global guitar market is segmented into vibrato arms, floating tailpiece, hard tail, and string-through body. The hard tail segment held the largest market revenue share of 48.5% in 2024, attributed to its stability, tuning reliability, and widespread use in solid-body electric guitars.

The vibrato arms segment is expected to grow rapidly from 2025 to 2032, driven by increasing demand for expressive playing techniques in rock and metal genres, where tremolo systems enhance pitch modulation and performance dynamics.

- By Neck Shape

On the basis of neck shape, the global guitar market is segmented into C necks, U necks, V necks, and others. The C necks segment accounted for the largest market revenue share of 60.5% in 2024, due to its ergonomic design, which provides comfort and ease of play for a wide range of hand sizes and playing styles.

The V necks segment is anticipated to witness robust growth from 2025 to 2032, as its vintage-inspired design appeals to players of blues, rock, and traditional music seeking a classic feel and aesthetic.

- By Number of Strings

On the basis of number of strings, the global guitar market is segmented into six strings, eight strings, twelve strings, and more than twelve strings. The six strings segment dominated with a market revenue share of 70.5% in 2024, driven by its standard configuration across most guitar types, making it the most accessible and widely used option.

The eight strings segment is expected to grow significantly from 2025 to 2032, fueled by increasing popularity in progressive metal and djent genres, where extended-range guitars offer lower tunings and expanded creative possibilities.

- By String Material

On the basis of string material, the global guitar market is segmented into steel, nylon, and others. The steel strings segment held the largest market revenue share of 65.5% in 2024, owing to their bright tone and durability, which are preferred for electric and acoustic guitars in modern music.

The nylon strings segment is projected to witness strong growth from 2025 to 2032, driven by their use in classical and flamenco guitars, appealing to traditional musicians and educational institutions.

- By Music Type

On the basis of music type, the global guitar market is segmented into rock, blues, pop, metal, jazz, electronica, traditional, and others. The rock segment accounted for the largest market revenue share of 40.5% in 2024, driven by the genre’s global popularity and reliance on electric and acoustic guitars as core instruments.

The jazz segment is expected to experience rapid growth of 8.7% from 2025 to 2032, fueled by increasing interest in semi-hollow and hollow-body guitars, which deliver the warm, clean tones favored by jazz musicians.

- By Color

On the basis of color, the global guitar market is segmented into black, brown, red, light tan, light yellow, amber, and others. The black color segment held the largest market revenue share of 35.5% in 2024, due to its timeless appeal and versatility across various music genres and performance settings.

The red color segment is anticipated to witness significant growth from 2025 to 2032, driven by its bold aesthetic, which resonates with younger musicians and performers seeking a striking stage presence.

- By Distribution Channel

On the basis of distribution channel, the global guitar market is segmented into specialty stores/music stores, e-commerce, supermarkets/hypermarkets, and others. The specialty stores/music stores segment dominated with a market revenue share of 50.5% in 2024, as these outlets offer expert guidance, hands-on testing, and a wide range of premium instruments.

The e-commerce segment is projected to witness the fastest growth rate of 10.5% from 2025 to 2032, driven by the convenience of online shopping, competitive pricing, and increasing availability of high-quality guitars on digital platforms.

- By Application

On the basis of application, the global guitar market is segmented into professional performance, learning and training, and individual amateurs. The individual amateurs segment held the largest market revenue share of 45.5% in 2024, driven by the growing number of hobbyists and casual players, supported by accessible online tutorials and affordable instruments.

The professional performance segment is expected to grow rapidly from 2025 to 2032, fueled by rising demand for high-quality guitars among touring musicians and studio professionals, driven by live music events and content creation.

Guitar Market Regional Analysis

- North America dominated the guitar market with the largest revenue share of 38.5% in 2024, driven by a strong music culture, high disposable incomes, and the presence of leading guitar manufacturers

- Consumers prioritize guitars for their sound quality, aesthetic appeal, and durability, particularly in regions with a strong music culture

- Growth is supported by advancements in guitar manufacturing technologies, such as improved tonewoods and electronic components, alongside rising adoption in both professional and amateur segments

U.S. Guitar Market Insight

The U.S. guitar market captured the largest revenue share of 91.4% in 2024 within North America, fueled by strong demand from musicians, hobbyists, and collectors, as well as growing interest in music education. The trend toward customization, including bespoke designs and premium materials, further boosts market expansion. Major guitar manufacturers’ incorporation of innovative features, such as built-in electronics, complements a robust aftermarket, creating a diverse product ecosystem.

Europe Guitar Market Insight

The Europe guitar market is expected to witness the fastest growth rate, supported by a thriving music scene and increasing consumer interest in high-quality instruments. Musicians seek guitars that offer superior sound clarity and playability, catering to both live performances and studio recordings. The growth is prominent in both new instrument sales and second-hand markets, with countries such as Germany and the U.K. showing significant uptake due to rising cultural emphasis on music and live events.

U.K. Guitar Market Insight

The U.K. market for guitars is expected to witness rapid growth, driven by demand for instruments that enhance musical expression and aesthetic appeal in urban and suburban settings. Increased interest in music genres such as rock, folk, and indie, along with rising awareness of sustainable materials in guitar manufacturing, encourages adoption. Evolving consumer preferences for eco-friendly and locally crafted guitars influence purchasing decisions, balancing quality with environmental consciousness.

Germany Guitar Market Insight

Germany is expected to witness the fastest growth rate in the European guitar market, attributed to its advanced manufacturing sector and high consumer focus on precision-crafted instruments. German consumers prefer technologically advanced guitars, such as those with enhanced electronics and sustainable materials, contributing to improved sound quality and durability. The integration of these guitars in professional music settings and aftermarket customization supports sustained market growth.

Asia-Pacific Guitar Market Insight

The Asia-Pacific region is expected to witness significant growth, driven by expanding music education programs and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of guitar craftsmanship, sound quality, and aesthetic appeal is boosting demand. Government initiatives promoting cultural arts and music education further encourage the adoption of high-quality guitars.

Japan Guitar Market Insight

Japan’s guitar market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced guitars that enhance musical performance and durability. The presence of major guitar manufacturers and the integration of innovative designs in both acoustic and electric models accelerate market penetration. Rising interest in aftermarket modifications and custom builds also contributes to growth.

China Guitar Market Insight

China holds the largest share of the Asia-Pacific guitar market, propelled by rapid urbanization, rising interest in Western music, and increasing demand for affordable yet high-quality instruments. The country’s growing middle class and focus on music as a recreational activity support the adoption of advanced guitars. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Guitar Market Share

The guitar industry is primarily led by well-established companies, including:

- Fender Musical Instruments Corporation (U.S.)

- Gibson Inc.(U.S.)

- PRS Guitars (U.S.)

- B.C. Rich Guitars.(U.S.)

- C.F. Martin & Co. Inc. (U.S.)

- The ESP Guitar Company (U.S.)

- Godin Guitars (Canada)

- Ibanez guitars (Japan)

- Samick® Guitars (South Korea)

- Schecter Guitar Research (U.S.)

- TAYLOR-LISTUG, INC. (U.S.)

- Michael Kelly Guitar Co. (U.S.)

- Yamaha Corporation (U.S.)

What are the Recent Developments in Global Guitar Market?

- In April 2025, Taylor Guitars introduced the Gold Label Collection, a lineup of radically different guitars designed to deliver a stunning old-heritage sound unlike any previous Taylor models. This collection features a new body design, a long-tenon neck joint, and fanned V-Class bracing, enhancing resonance, sustain, and tonal depth. Inspired by classic 1930s and ’40s flat-top acoustic guitars, the Gold Label models blend vintage warmth with modern playability. Available in Honduran rosewood and Hawaiian koa, these guitars showcase exclusive aesthetic elements, including a redesigned headstock, logo, and pickguard

- In January 2025, E Ink partnered with Cream Guitars to unveil the world’s first color-changing guitar, integrating E Ink Prism 3 ePaper technology. This innovation transforms the Cream Voltage DaVinci model, allowing musicians to switch between seven colors for personalized visual expression. The Prism 3 technology offers low power consumption, durability, and dynamic color-changing capabilities, redefining instrument customization. Cream Guitars showcased the latest models at NAMM 2025, highlighting their commitment to pushing creative boundaries

- In January 2025, Jackson Guitars revived the Surfcaster, a hardtail offset electric guitar designed for modern metal players. Originally introduced in the early ’90s, the Surfcaster was reimagined with dual high-output humbuckers, a 12”-16” compound radius bound fingerboard, and a robust hardtail bridge, ensuring stable tuning and powerful sustain. The JS Series Surfcaster starts at $249, while the X Series Surfcaster is priced, with a seven-string version available. This launch reinforces Jackson’s commitment to shred-oriented instruments, blending vintage aesthetics with high-performance features

- In October 2024, Fender Musical Instruments Corporation (FMIC) launched The Highway Series, a lineup of ergonomic and lightweight acoustic guitars designed for stage-ready performance. This series features fully integrated Fishman Fluence® acoustic pickups, ensuring consistent sound quality with minimal feedback. The thin silhouette enhances comfort and playability, while the hyper-playable mahogany neck allows for greater speed and reduced hand fatigue. Fender’s innovative bracing structure delivers rich resonance, blending modern technology with classic acoustic aesthetics

- In February 2023, Yamaha Guitar Group acquired Cordoba Music Group, expanding its presence in the classical and nylon-stringed guitar niche while complementing its electric and steel-string acoustic offerings. This acquisition brought Cordoba Guitars, Guild Guitars, DeArmond Pickups, and HumiCase under Yamaha’s umbrella, strengthening its portfolio of premium acoustic and electric instruments. Yamaha emphasized its commitment to preserving and evolving these iconic brands, integrating Cordoba’s expertise in traditional Spanish guitar craftsmanship into its lineup

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 INTERNAL COMPETITION

4.2 PRICE INDEX

4.2.1 BREAKDOWN OF GUITAR PRICES

4.2.1.1 ELECTRIC GUITARS

4.2.1.2 ACOUSTIC GUITARS

4.2.1.3 USED GUITAR PRICES

4.2.2 FACTORS AFFECTING GUITAR PRICES

4.3 BRAND ANALYSIS

4.4 CONSUMER BUYING BEHAVIOR

4.4.1 DECISION-MAKING PROCESS IN GUITAR PURCHASES

4.4.1.1 PROBLEM RECOGNITION

4.4.1.2 INFORMATION SEARCH

4.4.1.3 EVALUATION OF ALTERNATIVES

4.4.1.4 PURCHASE DECISION

4.4.1.5 POST-PURCHASE BEHAVIOR

4.4.2 FACTORS INFLUENCING CONSUMER BUYING BEHAVIOR

4.4.2.1 BRAND INFLUENCE AND REPUTATION

4.4.2.2 PRODUCT QUALITY AND PERFORMANCE

4.4.2.3 PRICE SENSITIVITY AND AFFORDABILITY

4.4.2.4 CULTURAL AND MUSIC TRENDS

4.4.2.5 TECHNOLOGICAL INNOVATIONS

4.4.3 CONSUMER SEGMENTATION AND BUYING PREFERENCES

4.4.3.1 BEGINNERS AND STUDENTS

4.4.3.2 HOBBYISTS

4.4.3.3 PROFESSIONAL MUSICIANS

4.4.4 COLLECTORS

4.4.5 CONCLUSION

4.5 IMPACT OF ECONOMIC SLOWDOWN

4.5.1 IMPACT ON PRICES

4.5.2 IMPACT ON SUPPLY CHAIN

4.5.3 IMPACT ON SHIPMENT

4.5.4 IMPACT ON DEMAND

4.5.5 IMPACT ON STRATEGIC DECISIONS

4.6 OVERVIEW OF GUITAR SALES EXPANSION FORECAST

4.6.1 KEY DRIVERS OF GROWTH

4.6.2 MARKET CHALLENGES

4.6.3 REGIONAL INSIGHTS

4.6.4 CONCLUSION

4.7 PRODUCT ADOPTION SCENARIO

4.7.1 STAGES OF PRODUCT ADOPTION IN THE GUITAR MARKET

4.7.1.1 INNOVATORS

4.7.1.2 EARLY ADOPTERS

4.7.1.3 EARLY MAJORITY

4.7.1.4 LATE MAJORITY

4.7.1.5 LAGGARDS

4.7.2 FACTORS INFLUENCING PRODUCT ADOPTION

4.7.2.1 TECHNOLOGICAL ADVANCEMENTS

4.7.2.2 PRICE SENSITIVITY

4.7.2.3 CULTURAL AND REGIONAL INFLUENCES

4.7.2.4 PRODUCT CUSTOMIZATION AND PERSONALIZATION

4.7.2.5 ENVIRONMENTAL CONCERNS

4.7.3 REGIONAL MARKET DYNAMICS AND ADOPTION PATTERNS

4.7.4 CONCLUSION

4.8 RAW MATERIAL SOURCING ANALYSIS

4.8.1 WOOD SELECTION AND SUSTAINABILITY TRENDS

4.8.2 METAL COMPONENTS AND SUPPLY CHAIN VOLATILITY

4.8.3 SYNTHETIC MATERIALS AND COST OPTIMIZATION

4.8.4 ADHESIVES AND FINISHES: ENVIRONMENTAL COMPLIANCE

4.8.5 CONCLUSION

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5 REGULATION COVERAGE

5.1 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING POPULARITY OF MUSIC AND WESTERN CULTURE

6.1.2 GROWING AWARENESS AND INTEREST IN MUSIC EDUCATION

6.1.3 INCREASE IN DISPOSABLE INCOME ENABLE PEOPLE TO INVEST IN MUSICAL INSTRUMENTS

6.2 RESTRAINTS

6.2.1 HIGH COST OF PREMIUM GUITARS

6.2.2 INTENSE COMPETITION FROM NUMEROUS PLAYERS IN THE MARKET

6.3 OPPORTUNITIES

6.3.1 INCREASING CONSUMER DEMAND FOR ECO-FRIENDLY GUITAR PRODUCTS

6.3.2 COLLABORATIONS WITH FAMOUS MUSICIANS, INFLUENCERS, AND SOCIAL MEDIA CAMPAIGNS

6.4 CHALLENGES

6.4.1 SHORTAGE OF RAW MATERIALS USED FOR GUITAR PRODUCTION

6.4.2 PROLIFERATION OF COUNTERFEIT AND LOW-QUALITY GUITARS

7 GLOBAL GUITAR MARKET, BY TYPE

7.1 OVERVIEW

7.2 ACOUSTIC GUITAR

7.2.1 ACOUSTIC GUITAR, BY TYPE

7.3 ELECTRIC GUITAR

7.3.1 ELECTRIC GUITAR, BY TYPE

7.4 ELECTRIC-ACOUSTIC GUITAR

7.5 CLASSICAL GUITAR

7.6 BASS GUITAR

7.7 RESONATOR

7.8 EXTENDED RANGE ELECTRIC GUITAR

7.9 LAP STEEL GUITAR

7.1 DOUBLE NECK GUITAR

7.11 OTHERS

8 GLOBAL GUITAR MARKET, BY WOOD MATERIAL

8.1 OVERVIEW

8.2 SOLID

8.2.1 SOLID, BY TYPE

8.3 LAMINATE

9 GLOBAL GUITAR MARKET, BY COVERS

9.1 OVERVIEW

9.2 SOLID BODY

9.3 SEMI-HOLLOW BODY

9.4 HOLLOW BODY

9.5 OTHERS

10 GLOBAL GUITAR MARKET, BY TAILPIECE

10.1 OVERVIEW

10.2 VIBRATO ARMS

10.3 FLOATING TAILPIECE

10.4 HARD TAIL

10.5 STRING-THROUGH BODY

11 GLOBAL GUITAR MARKET, BY NECK SHAPE

11.1 OVERVIEW

11.2 C NECK

11.3 U NECK

11.4 V NECK

11.5 OTHERS

12 GLOBAL GUITAR MARKET, BY NUMBER OF STRINGS

12.1 OVERVIEW

12.2 SIX STRINGS

12.3 EIGHT STRINGS

12.4 TWELVE STRINGS

12.5 MORE THAN TWELVE STRINGS

13 GLOBAL GUITAR MARKET, BY STRING MATERIAL

13.1 OVERVIEW

13.2 STEEL

13.3 NYLON

13.4 OTHERS

14 GLOBAL GUITAR MARKET, BY MUSIC TYPE

14.1 OVERVIEW

14.2 ROCK

14.3 BLUES

14.4 POP

14.5 METAL

14.6 JAZZ

14.7 ELECTRONICA

14.8 TRADITIONAL

14.9 OTHERS

15 GLOBAL GUITAR MARKET, BY COLOR

15.1 OVERVIEW

15.2 BLACK

15.3 BROWN

15.4 RED

15.5 LIGHT TAN

15.6 LIGHT YELLOW

15.7 AMBER

15.8 OTHERS

16 GLOBAL GUITAR MARKET, BY APPLICATION

16.1 OVERVIEW

16.2 PROFESSIONAL PERFORMANCE

16.2.1 PROFESSIONAL PERFORMANCE, BY TYPE

16.3 LEARNING AND TRAINING

16.3.1 LEARNING AND TRAINING, BY TYPE

16.4 INDIVIDUAL AMATEURS

16.4.1 INDIVIDUAL AMATEURS, BY TYPE

16.5 OTHERS

16.5.1 OTHERS, BY TYPE

17 GLOBAL GUITAR MARKET, BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 SPECIALTY STORES/MUSIC STORES

17.3 E-COMMERCE

17.4 SUPERMARKETS/HYPERMARKETS

17.5 OTHERS

18 GLOBAL GUITAR MARKET, BY REGION

18.1 OVERVIEW

18.2 NORTH AMERICA

18.2.1 U.S.

18.2.2 CANADA

18.2.3 MEXICO

18.3 EUROPE

18.3.1 GERMANY

18.3.2 U.K.

18.3.3 FRANCE

18.3.4 ITALY

18.3.5 SPAIN

18.3.6 RUSSIA

18.3.7 TURKEY

18.3.8 NETHERLANDS

18.3.9 BELGIUM

18.3.10 SWITZERLAND

18.3.11 REST OF EUROPE

18.4 ASIA-PACIFIC

18.4.1 CHINA

18.4.2 JAPAN

18.4.3 INDIA

18.4.4 SOUTH KOREA

18.4.5 INDONESIA

18.4.6 AUSTRALIA AND NEW ZEALAND

18.4.7 THAILAND

18.4.8 PHILIPPINES

18.4.9 SINGAPORE

18.4.10 MALAYSIA

18.4.11 REST OF ASIA-PACIFIC

18.5 SOUTH AMERICA

18.5.1 BRAZIL

18.5.2 ARGENTINA

18.5.3 REST OF SOUTH AMERICA

18.6 MIDDLE EAST AND AFRICA

18.6.1 U.A.E.

18.6.2 SOUTH AFRICA

18.6.3 SAUDI ARABIA

18.6.4 ISRAEL

18.6.5 EGYPT

18.6.6 REST OF MIDDLE EAST AND AFRICA

19 GLOBAL GUITAR MARKET: COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: GLOBAL

19.2 COMPANY SHARE ANALYSIS: EUROPE

19.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

19.4 COMPANY SHARE ANALYSIS: NORTH AMERICA

20 SWOT ANALYSIS

21 COMPANY PROFILES

21.1 GIBSON INC.

21.1.1 COMPANY SNAPSHOT

21.1.2 COMPANY SHARE ANALYSIS

21.1.3 PRODUCT PORTFOLIO

21.1.4 RECENT DEVELOPMENTS

21.2 FENDER MUSICAL INSTRUMENTS CORPORATION

21.2.1 COMPANY SNAPSHOT

21.2.2 COMPANY SHARE ANALYSIS

21.2.3 PRODUCT PORTFOLIO

21.2.4 RECENT DEVELOPMENTS

21.3 IBANEZ GUITARS

21.3.1 COMPANY SNAPSHOT

21.3.2 COMPANY SHARE ANALYSIS

21.3.3 PRODUCT PORTFOLIO

21.3.4 RECENT DEVELOPMENT

21.4 YAMAHA CORPORATION

21.4.1 COMPANY SNAPSHOT

21.4.2 REVENUE ANALYSIS

21.4.3 COMPANY SHARE ANALYSIS

21.4.4 PRODUCT PORTFOLIO

21.4.5 RECENT DEVELOPMENTS

21.5 TAYLOR-LISTUG, INC.

21.5.1 COMPANY SNAPSHOT

21.5.2 COMPANY SHARE ANALYSIS

21.5.3 PRODUCT PORTFOLIO

21.5.4 RECENT DEVELOPMENT

21.6 B.C. RICH GUITARS

21.6.1 COMPANY SNAPSHOT

21.6.2 PRODUCT PORTFOLIO

21.6.3 RECENT DEVELOPMENT

21.7 C.F. MARTIN & CO. INC.

21.7.1 COMPANY SNAPSHOT

21.7.2 PRODUCT PORTFOLIO

21.7.3 RECENT DEVELOPMENTS

21.8 GODIN GUITARS

21.8.1 COMPANY SNAPSHOT

21.8.2 PRODUCT PORTFOLIO

21.8.3 RECENT DEVELOPMENT

21.9 MICHAEL KELLY GUITAR CO.

21.9.1 COMPANY SNAPSHOT

21.9.2 PRODUCT PORTFOLIO

21.9.3 RECENT DEVELOPMENT

21.1 PRS GUITARS

21.10.1 COMPANY SNAPSHOT

21.10.2 PRODUCT PORTFOLIO

21.10.3 RECENT DEVELOPMENT

21.11 SAMICK-GUITARS.COM

21.11.1 COMPANY SNAPSHOT

21.11.2 PRODUCT PORTFOLIO

21.11.3 RECENT DEVELOPMENT

21.12 SCHECTER GUITAR RESEARCH

21.12.1 COMPANY SNAPSHOT

21.12.2 PRODUCT PORTFOLIO

21.12.3 RECENT DEVELOPMENT

21.13 THE ESP GUITAR COMPANY

21.13.1 COMPANY SNAPSHOT

21.13.2 PRODUCT PORTFOLIO

21.13.3 RECENT DEVELOPMENT

22 QUESTIONNAIRE

23 RELATED REPORTS

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.