Global Guitar Pedals Market

Market Size in USD Billion

CAGR :

%

USD

5.62 Billion

USD

7.46 Billion

2024

2032

USD

5.62 Billion

USD

7.46 Billion

2024

2032

| 2025 –2032 | |

| USD 5.62 Billion | |

| USD 7.46 Billion | |

|

|

|

|

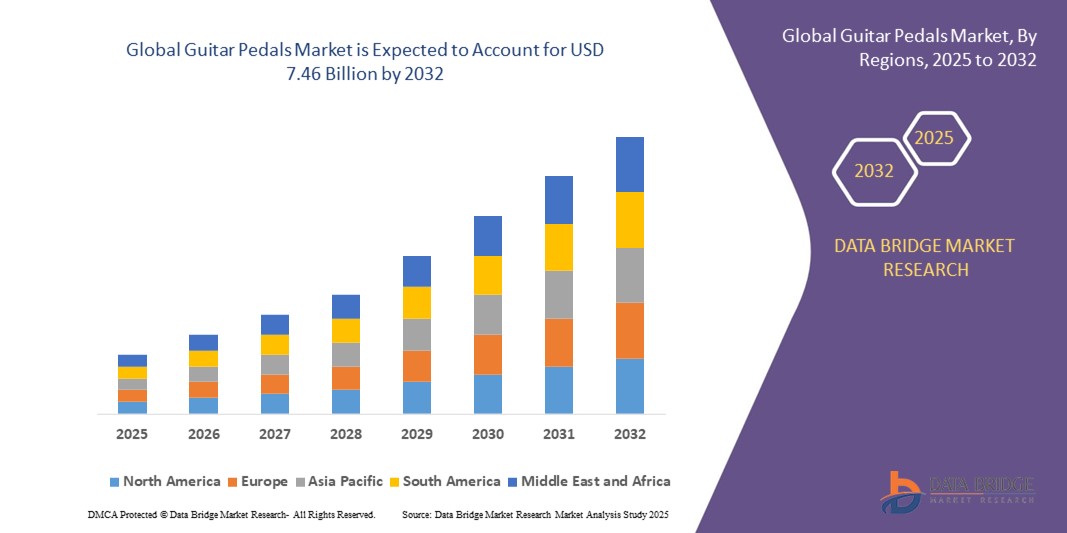

What is the Global Guitar Pedals Market Size and Growth Rate?

- The global guitar pedals market size was valued at USD 5.62 billion in 2024 and is expected to reach USD 7.46 billion by 2032, at a CAGR of 3.60% during the forecast period

- The global guitar pedals market is witnessing a surge in compact designs and multi-effect panels, catering to the demand for space-saving and versatile options. Manufacturers are introducing novel pedals such as modeling, eco-friendly, and smart pedals, expanding market opportunities

- The rise of amateur musicians producing professional-quality music further propels market growth. Notably, BOSS's recent SL-2 Slicer joins the trend of compact pedals, offering unique percussion patterns in a pedalboard-friendly format

What are the Major Takeaways of Guitar Pedals Market?

- With more people around the world taking up electric guitar playing, there is a corresponding increase in the demand for pedals. Electric guitarists often use pedals to modify their instrument's sound, adding effects such as distortion, delay, and reverb to create unique tones and textures. This trend is particularly evident in genres such as rock, blues, and metal, where guitar pedals are essential for achieving the desired sound. Manufacturers are responding to this demand by developing a wide range of pedals to cater to different musical styles and preferences, further driving the market growth

- North America dominated the guitar pedals market with the largest revenue share of 39.41% in 2024, driven by strong consumer demand for music accessories, an active live music culture, and high adoption among both amateur and professional musicians

- Asia-Pacific is expected to be the fastest growing region in the Guitar Pedals market during the forecast period due to increasing urbanization and rising disposable incomes

- The Gain Effects segment dominated the market with the largest market revenue share of 36.5% in 2024, owing to its critical role in shaping tone through distortion, overdrive, and fuzz

Report Scope and Guitar Pedals Market Segmentation

|

Attributes |

Guitar Pedals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Guitar Pedals Market?

Integration of Digital Technology and AI-Driven Features

- A significant trend in the global guitar pedals market is the adoption of AI algorithms, digital modeling, and software integration to create more versatile sound-shaping tools. Pedals are increasingly offering programmable presets, real-time sound customization, and compatibility with digital audio workstations (DAWs)

- For instance, companies such as Boss (Roland Corporation) and Line 6 have introduced pedals with AI-based tone shaping and cloud-based preset sharing, enabling musicians to access a wide range of sounds instantly

- AI-driven pedals are capable of learning a player’s style and automatically adjusting tones or suggesting optimized effects chains. This enhances creativity and reduces setup time for both studio and live performances

- The integration with voice assistants and mobile apps allows guitarists to control pedalboards hands-free, recall presets, or tweak sound parameters seamlessly during performances

- This convergence of AI, digital modeling, and smart control features is redefining user expectations by offering greater convenience, creative flexibility, and professional-grade tones in compact pedal formats

- As demand for intelligent, connected, and customizable pedals grows, companies are prioritizing R&D in software-driven sound design and seamless integration with existing gear

What are the Key Drivers of Guitar Pedals Market?

- The growing popularity of live music performances, home studios, and DIY musicianship is fueling demand for pedals that offer unique tones and creative flexibility

- For instance, in March 2024, Electro-Harmonix launched new multi-function pedals with enhanced modulation effects to meet the rising demand from independent musicians and touring artists

- The rise of digital recording and streaming platforms has pushed musicians to explore versatile pedals that can deliver professional-quality sounds without the need for large setups

- Increasing consumer preference for compact, multi-effect units is driving sales, as these pedals combine distortion, delay, reverb, and modulation in a single device

- The surge in online music education and content creation on platforms such as YouTube has also accelerated adoption, as aspiring guitarists seek pedals that enhance their learning and recording experience

- In addition, the trend toward affordable yet feature-rich pedals is expanding accessibility, attracting professionals and hobbyists and beginners to the market

Which Factor is Challenging the Growth of the Guitar Pedals Market?

- One of the key challenges facing the market is the high price of advanced digital pedals compared to traditional analog units. Musicians in emerging markets often find it difficult to invest in premium models with AI or smart features

- For instance, flagship pedals from Strymon and Eventide are highly popular among professionals but remain out of reach for many amateur players due to their premium cost

- Another concern is the complexity of advanced pedals, which can discourage beginners who prefer simple plug-and-play devices. Overly technical interfaces may limit adoption among casual guitarists

- The growing presence of low-cost counterfeit pedals also affects brand credibility and reduces profit margins for established players in the market

- Furthermore, as pedals increasingly integrate with apps and connectivity features, issues such as software bugs, firmware updates, and durability of digital components can raise reliability concerns among musicians who rely on consistent live performance gear

- Addressing these challenges by offering affordable, user-friendly, and durable pedal options, along with consumer education, will be crucial for expanding market reach and sustaining long-term growth

How is the Guitar Pedals Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Type

On the basis of type, the guitar pedals market is segmented into Gain Effects, Compressors, Pitch Effects, Volume Pedals, Filter Effects, Time-Based Effects, and Others. The Gain Effects segment dominated the market with the largest market revenue share of 36.5% in 2024, owing to its critical role in shaping tone through distortion, overdrive, and fuzz. These pedals are highly favored by rock, metal, and blues musicians for their ability to define guitar soundscapes.

The Time-Based Effects segment is anticipated to witness the fastest growth rate of 22.4% from 2025 to 2032, fueled by rising demand for delay and reverb pedals that enhance spatial sound quality. Increasing experimentation in modern genres such as ambient and indie rock, along with live performance needs, is accelerating adoption. Together, gain and time-based effects remain foundational to pedalboards, driving strong demand in both professional and amateur segments.

- By Pedal Component

On the basis of pedal component, the market is segmented into Stomp Box, Multi-Effects, and Rack Units. The Stomp Box segment accounted for the largest market revenue share of 47.1% in 2024, supported by its affordability, ease of use, and customization options for musicians building pedalboards. Stomp boxes are preferred by guitarists seeking specific tonal control through individual effect units.

The Multi-Effects segment is projected to grow at the fastest CAGR of 20.1% from 2025 to 2032, driven by technological advancements, compact portability, and cost-effectiveness of combining multiple effects in a single unit. Younger and amateur musicians especially favor multi-effects due to simplified usability and value-for-money. Rack units, though used in studio and professional touring setups, remain a niche category due to high cost and limited portability. This balance reflects the strong dominance of stomp boxes alongside the rising appeal of multi-effects solutions.

- By Effects

On the basis of effects, the market is segmented into Single-Effect Pedals and Multi-Effect Pedals. The Single-Effect Pedals segment dominated the market with a revenue share of 58.3% in 2024, as guitarists continue to prefer individual pedals for precise tonal customization and flexibility in building pedalboards. These pedals allow musicians to experiment with specific sounds and arrange effects chains to suit their unique style.

The Multi-Effect Pedals segment is expected to grow at the fastest CAGR of 23.2% during 2025–2032, largely due to increasing adoption among budget-conscious and entry-level players. Advances in modeling technology have improved sound quality, making multi-effects a viable choice for professionals as well. Furthermore, their compact design and integration with recording software appeal to home-studio musicians. While single pedals dominate due to tradition and tonal accuracy, multi-effects are increasingly reshaping the landscape of the market.

- By Technology

On the basis of technology, the market is segmented into Analog and Digital. The Analog segment held the largest market revenue share of 62.7% in 2024, owing to its warm, natural tone and preference among purist guitarists and vintage sound enthusiasts. Analog pedals are highly valued for their unique circuitry, often considered irreplaceable in delivering authentic overdrive, fuzz, and modulation.

The Digital segment, however, is projected to witness the fastest CAGR of 21.6% from 2025 to 2032, driven by advances in digital signal processing (DSP) that provide highly accurate effect modeling and versatility. Digital pedals also support presets, MIDI compatibility, and integration with recording software, catering to both live performers and home-studio musicians. While analog pedals maintain strong loyalty in traditional markets, digital pedals are expanding adoption due to affordability, flexibility, and innovative features.

- By Application

On the basis of application, the market is segmented into Professional Musicians and Amateurs. The Professional Musicians segment dominated the market with a 55.9% revenue share in 2024, driven by touring artists, recording musicians, and studio professionals who require high-performance pedals with premium sound quality. Professionals often invest heavily in diverse pedalboards and boutique brands to achieve distinct tones.

The Amateur segment is expected to register the fastest CAGR of 20.7% between 2025 and 2032, supported by the rise of bedroom producers, home-recording setups, and the growing popularity of online content creators using pedals in cover songs and experimental music. Affordable entry-level pedals, increasing availability of tutorials, and distribution through online platforms are fueling amateur adoption. This dual structure ensures sustained demand across the spectrum of users, balancing premium and entry-level markets.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Online and Offline. The Offline segment accounted for the largest revenue share of 64.8% in 2024, as music instrument stores, specialty retailers, and local distributors remain key sales channels. Musicians often prefer trying pedals in person before purchase, testing tonal quality, and receiving expert guidance. The shift toward online sales is reshaping buying behavior, although offline stores continue to hold strong relevance for professional-grade purchases.

The Online segment is forecasted to witness the fastest CAGR of 22.9% from 2025 to 2032, due to the convenience of e-commerce platforms, wider product availability, and competitive pricing. Direct-to-consumer strategies by brands and growth in second-hand marketplaces further accelerate online adoption. Online reviews, influencer marketing, and demo videos on YouTube also play a crucial role in shaping purchase decisions.

Which Region Holds the Largest Share of the Guitar Pedals Market?

- North America dominated the guitar pedals market with the largest revenue share of 39.41% in 2024, driven by strong consumer demand for music accessories, an active live music culture, and high adoption among both amateur and professional musicians

- The region benefits from the presence of leading pedal manufacturers, strong retail distribution networks, and the influence of global music trends originating in the U.S. and Canada

- Rising disposable incomes and the popularity of genres such as rock, metal, and indie further fuel demand, establishing North America as the key growth hub

U.S. Guitar Pedals Market Insight

The U.S. Guitar Pedals market captured 81% of North America’s share in 2024, supported by a thriving live performance industry, growing DIY music culture, and rapid adoption of boutique pedals. Increasing interest in digital effects, integration with recording software, and the demand for customizable tones are propelling the U.S. market forward.

Europe Guitar Pedals Market Insight

The Europe Guitar Pedals market is projected to grow steadily, driven by a strong heritage of music festivals, recording studios, and rising interest in experimental music. The demand for both analog and digital pedals is supported by growing online sales channels and active communities of musicians.

U.K. Guitar Pedals Market Insight

The U.K. market is expected to expand at a noteworthy CAGR, propelled by a vibrant rock and indie music culture, rising demand for boutique and handmade pedals, and strong adoption among touring musicians. Online platforms and direct-to-consumer brands are further boosting market penetration.

Germany Guitar Pedals Market Insight

The Germany market is experiencing consistent growth, supported by a large base of hobbyists, recording professionals, and electronic musicians. With a focus on precision engineering and eco-conscious manufacturing, Germany is increasingly adopting innovative pedal designs, particularly within the boutique segment.

Which Region is the Fastest Growing Region in the Guitar Pedals Market?

The Asia-Pacific Guitar Pedals market is projected to grow at the fastest CAGR of 24% from 2025 to 2032, driven by a surge in new musicians, urbanization, and rising disposable incomes in countries such as China, Japan, and India. Increasing local manufacturing and online distribution platforms are making pedals more affordable and accessible across the region.

Japan Guitar Pedals Market Insight

The Japan market is gaining momentum due to its tech-driven culture, strong music education ecosystem, and demand for compact, multifunction pedals. Integration of pedals with digital music systems and the popularity of genres such as J-Rock and J-Pop are fueling adoption.

China Guitar Pedals Market Insight

The China market accounted for the largest share in Asia-Pacific in 2024, supported by rapid urbanization, an expanding middle class, and government-led cultural initiatives promoting music education. With strong domestic pedal makers and rising demand for affordable options, China is emerging as one of the largest global hubs for Guitar Pedals.

Which are the Top Companies in Guitar Pedals Market?

The guitar pedals industry is primarily led by well-established companies, including:

- Boss (Roland Corporation) (Japan)

- Electro-Harmonix (U.S.)

- TC Electronic (Denmark)

- Digitech (U.S.)

- MXR (Jim Dunlop) (U.S.)

- Ibanez (Japan)

- Fulltone (U.S.)

- EarthQuaker Devices (U.S.)

- DOD (Digitech) (U.S.)

- Strymon (U.S.)

- Eventide (U.S.)

- Mooer Audio (China)

- Wampler Pedals (U.S.)

- JHS Pedals (U.S.)

- Xotic Effects (U.S.)

- ProCo Sound (U.S.)

- Keeley Electronics (U.S.)

- Catalinbread (U.S.)

- Voodoo Lab (U.S.)

- Dunlop Manufacturing, Inc. (U.S.)

What are the Recent Developments in Global Guitar Pedals Market?

- In June 2023, Warm Audio, a renowned manufacturer of audio equipment, made waves in the music industry with the launch of two new guitar pedals: the ODD Box V1 and the Mutation Phasor II. Both pedals reflect Warm Audio's commitment to quality and innovation, solidifying their reputation as a leading manufacturer of guitar pedals

- In March 2022, Robin Davies announced the public launch of PiPedal, an open-source guitar effects pedal designed for use with the Raspberry Pi 4. PiPedal offers an affordable alternative for guitarists, utilizing the Raspberry Pi 4 to create a versatile effects pedal. With a touch-friendly web interface accessible via a Wi-Fi hotspot, PiPedal allows for remote configuration and control of guitar effect chains using a connected phone or tablet

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.