Global Gummy Vitamin Market

Market Size in USD Billion

CAGR :

%

USD

9.28 Billion

USD

22.50 Billion

2025

2033

USD

9.28 Billion

USD

22.50 Billion

2025

2033

| 2026 –2033 | |

| USD 9.28 Billion | |

| USD 22.50 Billion | |

|

|

|

|

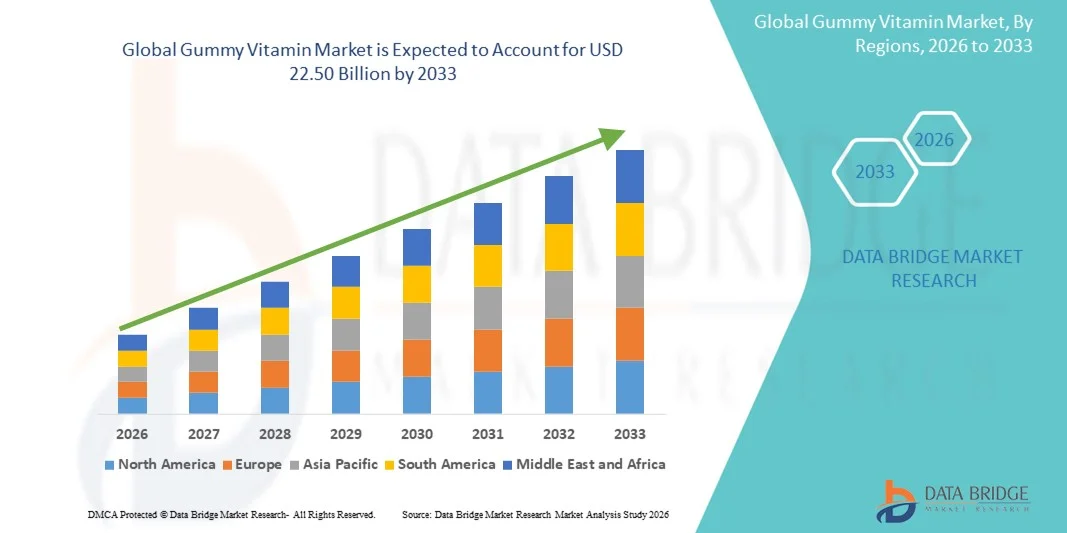

What is the Global Gummy Vitamin Market Size and Growth Rate?

- The global gummy vitamin market size was valued at USD 9.28 billion in 2025 and is expected to reach USD 22.50 billion by 2033, at a CAGR of 11.70% during the forecast period

- Gummy vitamins offer a convenient and enjoyable alternative to traditional pill-based supplements. Many people, including children and adults, find it easier and more pleasant to consume gummy vitamins, as they resemble candies and come in a variety of flavors and shapes

- The appeal of gummy vitamins as a fun and tasty way to incorporate essential nutrients into daily routines has significantly driven their market growth

What are the Major Takeaways of Gummy Vitamin Market?

- Increasing awareness about the importance of maintaining a healthy lifestyle has resulted in a growing interest in nutritional supplements

- Consumers are actively seeking products that support their overall health and well-being. Gummy vitamins provide a convenient and accessible option for individuals looking to supplement their diets with essential vitamins and minerals

- North America dominated the gummy vitamin market with a 36.8% revenue share in 2025, supported by widespread adoption of vitamin-, protein-, and plant-based gummy supplements across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 7.98% from 2026 to 2033, driven by rising disposable incomes, urbanization, and increasing health-conscious behavior in China, India, Japan, and Southeast Asia

- The Multivitamin segment dominated the market with a revenue share of 54.3% in 2025, driven by growing consumer demand for comprehensive nutrition in a convenient, chewable format

Report Scope and Gummy Vitamin Market Segmentation

|

Attributes |

Gummy Vitamin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Gummy Vitamin Market?

Rising Demand for Nutrient-Enriched and Plant-Based Gummy Vitamins

- The Gummy Vitamin market is witnessing a significant trend toward the incorporation of plant-based ingredients, nutrient fortification, and functional additives such as vitamins, minerals, adaptogens, and herbal extracts. This trend is driven by health-conscious consumers seeking convenient, clean-label, and customizable nutrition solutions for adults and children

- For instance, brands such as SmartyPants, Olly, and Nature’s Bounty have expanded their product lines to include gummy vitamins enriched with probiotics, antioxidants, and plant extracts to support immunity, digestion, and energy levels

- Rising consumer awareness of lifestyle-related health concerns such as fatigue, low immunity, stress, and poor nutrition is driving demand for functional gummy supplements

- Manufacturers are integrating advanced extrusion, dosing, and coating technologies to produce nutrient-dense, consistent, and shelf-stable gummies with enhanced bioavailability

- Increased R&D in natural flavor integration, vegan formulations, and nutrient stability is accelerating innovation across Gummy Vitamin platforms

- As consumers continue shifting toward plant-based, low-sugar, and functional supplements, Gummy Vitamin Makers are expected to remain central to the global nutritional supplement industry

What are the Key Drivers of Gummy Vitamin Market?

- Rising consumer preference for convenience, personalization, and health benefits of gummy vitamins—including precise nutrient dosing, chewable delivery, and multi-vitamin combinations—is driving adoption globally

- For instance, in 2025, companies such as Nestlé and Olly enhanced their production of plant-based and probiotic-enriched gummy vitamins targeting wellness-conscious consumers

- Growing demand for clean-label, vegan, low-sugar, and specialty gummy supplements across North America, Europe, and Asia-Pacific is fueling market expansion

- Technological advancements in gummy manufacturing, nutrient encapsulation, flavor masking, and sugar alternatives are improving product quality and shelf life

- Increasing integration of gummy vitamins into daily health routines, workplace wellness programs, and family nutrition practices strengthens global market growth

- With ongoing investment in R&D, functional ingredient innovation, and sustainability-focused manufacturing, the Gummy Vitamin market is expected to maintain strong growth in the coming years

Which Factor is Challenging the Growth of the Gummy Vitamin Market?

- High production costs associated with plant-based ingredients, premium nutrient blends, advanced dosing systems, and coating technologies limit affordability in price-sensitive regions

- For instance, during 2024–2025, supply fluctuations in natural botanicals, probiotics, and vitamins impacted gummy vitamin production for leading brands

- Regulatory requirements related to food safety, labeling, allergen management, and fortification standards increase compliance complexity and cost

- Limited consumer awareness in emerging markets about the health benefits of gummy supplements and proper dosage restricts large-scale adoption

- Competition from tablets, capsules, functional beverages, and fortified foods creates price pressure and affects market penetration

- To overcome these challenges, companies are focusing on cost-efficient ingredient sourcing, automated production systems, modular manufacturing, and consumer education initiatives to offer high-quality, affordable, and convenient gummy vitamin solutions

How is the Gummy Vitamin Market Segmented?

The market is segmented on the basis of product type, source, packaging type, distribution channel, and end-users.

- By Product Type

On the basis of product type, the gummy vitamin market is segmented into Single Vitamin and Multivitamin. The Multivitamin segment dominated the market with a revenue share of 54.3% in 2025, driven by growing consumer demand for comprehensive nutrition in a convenient, chewable format. Multivitamin gummies provide a balanced blend of essential vitamins and minerals, supporting immunity, energy, and overall wellness for adults and children asuch as. Continuous innovation in natural flavorings, plant-based formulations, and bioavailability enhancement is further boosting adoption globally.

The Single Vitamin segment is projected to grow at the fastest CAGR between 2026 and 2033, fueled by rising preference for targeted supplementation, including vitamin D, C, B-complex, and specialized wellness-focused nutrients, catering to personalized health requirements. Manufacturers are developing single vitamin gummies in convenient, portable packaging to support modern, health-conscious lifestyles.

- By Source

Based on source, the market is segmented into Plant and Animal. The Plant-based segment dominated the market with a revenue share of 57.1% in 2025, supported by increasing consumer preference for vegan, clean-label, and sustainable supplements. Plant-sourced gummy vitamins utilize natural ingredients such as algae, soy, and fruit extracts, appealing to health-conscious, environmentally aware, and ethical consumers.

The Animal-based segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by the rising demand for nutrient-rich gelatin-based gummies that offer enhanced texture, chewability, and nutrient encapsulation. Continuous improvements in sourcing, quality control, and flavor masking are enhancing adoption in global markets. Companies are also exploring hybrid formulations combining plant and animal sources to meet diverse consumer preferences.

- By Packaging Type

On the basis of packaging type, the market is segmented into Bottles & Jars and Pouches. The Bottles & Jars segment dominated the market with a revenue share of 61.2% in 2025, owing to its ability to maintain product freshness, provide reusability, and offer convenient storage for daily consumption. This packaging type is popular across retail chains, pharmacies, and health stores, enhancing brand visibility and customer trust.

The Pouches segment is expected to register the fastest CAGR between 2026 and 2033, driven by growing demand for on-the-go consumption, portability, and eco-friendly packaging solutions. Pouch packaging is increasingly adopted by direct-to-consumer brands and e-commerce channels, supporting subscription models and impulse purchases. Innovation in resealable, biodegradable, and customizable pouches is anticipated to accelerate adoption globally.

- By Distribution Channel

On the basis of distribution channel, the Gummy Vitamin market is segmented into Store-Based and Online. The Store-Based segment dominated the market with a revenue share of 58.6% in 2025, supported by supermarkets, pharmacies, specialty health stores, and retail chains, which offer in-person product evaluation, convenience, and instant purchase.

The Online segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising e-commerce penetration, digital marketing, and subscription-based delivery models. Online platforms provide access to a wider variety of products, targeted health bundles, and convenient doorstep delivery, appealing particularly to urban, tech-savvy consumers. Growth in direct-to-consumer models and strategic partnerships with e-retailers is expected to strengthen online adoption further.

- By End-Users

On the basis of end-users, the market is segmented into Adult and Children. The Adult segment dominated the market with a revenue share of 62.5% in 2025, driven by rising health awareness, preventive healthcare trends, and the increasing adoption of daily multivitamin routines to support immunity, energy, and wellness.

The Children segment is projected to grow at the fastest CAGR between 2026 and 2033, fueled by the popularity of chewable gummy vitamins among parents seeking convenient, palatable, and nutrient-rich options for their kids. Manufacturers are developing age-specific formulations, fun shapes, natural flavors, and sugar-controlled variants to increase adoption in households, schools, and pediatric health programs globally.

Which Region Holds the Largest Share of the Gummy Vitamin Market?

- North America dominated the gummy vitamin market with a 36.8% revenue share in 2025, supported by widespread adoption of vitamin-, protein-, and plant-based gummy supplements across the U.S. and Canada. High health consciousness, well-established retail networks, and awareness of functional and clean-label supplements contribute to regional leadership.

- Leading players are leveraging innovative formulations, eco-friendly packaging, and digital subscription models to meet growing consumer demand. Government initiatives supporting nutrition labeling, wellness programs, and preventive healthcare further strengthen market dominance

- Urbanization, higher disposable incomes, and active lifestyle trends are boosting adoption of Gummy Vitamin Makers in North American households and specialty retail outlets

U.S. Gummy Vitamin Maker Market Insight

The U.S. is the largest contributor to North America’s market, driven by high adoption of multivitamin and targeted single-vitamin gummies. Consumers increasingly prefer nutrient-enriched, plant-based, and functional supplements to support immunity, energy, and wellness. Manufacturers are investing in innovative gummy formulations, subscription-based delivery, and digital marketing strategies, while expanding distribution through supermarkets, specialty stores, and e-commerce platforms. Preventive health trends, clean-label demand, and tech-savvy urban populations underpin strong growth in the U.S.

Canada Gummy Vitamin Maker Market Insight

Canada contributes steadily, supported by rising awareness of plant-based and nutrient-enriched gummies. Adoption is supported by specialty retail chains, pharmacies, e-commerce, and workplace wellness programs. Collaborations between nutraceutical brands and functional food companies are expanding offerings, including vitamin and mineral-enriched gummies. Consumer preference for sustainable, convenient, and clean-label supplements continues to drive market growth.

Asia-Pacific Gummy Vitamin Maker Market Insight

Asia-Pacific is projected to register the fastest CAGR of 7.98% from 2026 to 2033, driven by rising disposable incomes, urbanization, and increasing health-conscious behavior in China, India, Japan, and Southeast Asia. Expanding retail networks, growing e-commerce adoption, and preventive healthcare trends are accelerating market growth. Gummy Vitamin Makers enriched with vitamins, minerals, and plant-based extracts are gaining popularity, supported by product innovation and awareness campaigns.

China Gummy Vitamin Maker Market Insight

China leads the Asia-Pacific market, supported by urbanization, rising fitness awareness, and increasing demand for fortified dietary supplements. Consumers are adopting Gummy Vitamin Makers enriched with vitamins, minerals, and plant-based nutrients. Strong distribution across supermarkets, specialty stores, and e-commerce channels ensures broad accessibility. R&D investment, innovative formulations, and promotional campaigns continue to drive consumption.

India Gummy Vitamin Maker Market Insight

India is emerging as a key contributor, fueled by increasing health awareness, government nutrition programs, and expanding retail and online channels. Affordable Gummy Vitamin Makers enriched with vitamins, minerals, and plant-based ingredients are gaining traction for immunity, wellness, and convenience. Companies are innovating with clean-label, eco-friendly, and easy-to-consume packaging solutions. Rising urbanization, disposable incomes, and preventive healthcare trends are expected to sustain long-term growth.

Europe Gummy Vitamin Maker Market Insight

Europe holds a significant share, led by demand for fortified and functional gummy supplements in Germany, the U.K., France, and the Netherlands. Consumers increasingly prefer multivitamin and plant-based gummy products for wellness and immunity. Growth is supported by clean-label trends, sustainability initiatives, and health-focused marketing. Innovation in functional ingredients and premium gummy formulations strengthens adoption.

Germany Gummy Vitamin Maker Market Insight

Germany leads Europe, driven by high consumer demand for plant-based and fortified gummy supplements. Urban populations increasingly adopt gummies for immunity, wellness, and preventive health. Companies invest in R&D, innovative formulations, and premium product designs. Supermarkets, specialty stores, and online sales enhance accessibility, while sustainability and clean-label trends continue to boost growth.

U.K. Gummy Vitamin Maker Market Insight

The U.K. market is expanding steadily, supported by growing awareness of fortified and plant-based gummy supplements. Adoption is facilitated through specialty stores and e-commerce platforms, offering convenient, clean-label, and eco-friendly products. Rising urbanization, active lifestyles, and government wellness initiatives continue to drive market growth.

Which are the Top Companies in Gummy Vitamin Market?

The gummy vitamin industry is primarily led by well-established companies, including:

- Life Science Nutritionals (Canada)

- Bettera Brands (U.S.)

- Softigel (Colombia)

- Nature’s Way Products, LLC (U.S.)

- OLLY Public Benefit Corporation (U.S.)

- Herbaland (Canada)

- Hero Nutritionals (U.S.)

- SmartyPants Vitamins (U.S.)

- The Nature’s Bounty Co. (U.S.)

- Nutra Solutions USA (U.S.)

- Makers Nutrition, LLC (U.S.)

- Vitakem Nutraceutical Inc. (U.S.)

What are the Recent Developments in Global Gummy Vitamin Market?

- In October 2023, Clasado Biosciences, a U.K.-based biotechnology research company, partnered with Stratum Nutrition, an ingredient distributor in Tunisia, to launch its latest prebiotic-postbiotic gummy supplements, containing Clasado Bimuno galactooligosaccharide and lactobacillus probiotic strains, targeting improved gut health and digestive functions, marking a significant innovation in functional gummy formulations

- In July 2023, Power Gummies, an Indian D2C nutraceutical company, invested approximately USD 2 million to establish a new manufacturing facility in Manesar, Gurugram, and introduced their latest product, Power Gummies Junior, entering the children’s segment, reflecting strategic expansion into kid-focused gummy vitamins

- In June 2023, P&G, an American multinational company, expanded its gummy product portfolio under the VOOST brand, offering essential benefits in a convenient format tailored for millennials and on-the-go consumers, reinforcing its commitment to innovative, functional gummy solutions

- In March 2023, Goli Nutrition Inc. launched a 3-in-1 probiotic gummy combining prebiotics, probiotics, and postbiotics to maintain a healthy gut microbiome and support immune health, strengthening its presence in the functional wellness gummy segment

- In July 2022, Mankind Pharma, an Indian pharmaceutical company, introduced "Health OK," a new line of vitamin gummies for children aged seven to seventeen, aimed at supporting immune development and promoting normal growth, marking a notable entry into the pediatric gummy vitamins market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.