Global Gut Free Snacks Market

Market Size in USD Billion

CAGR :

%

USD

1.70 Billion

USD

2.50 Billion

2024

2032

USD

1.70 Billion

USD

2.50 Billion

2024

2032

| 2025 –2032 | |

| USD 1.70 Billion | |

| USD 2.50 Billion | |

|

|

|

|

Gut-Free Snacks Market Size

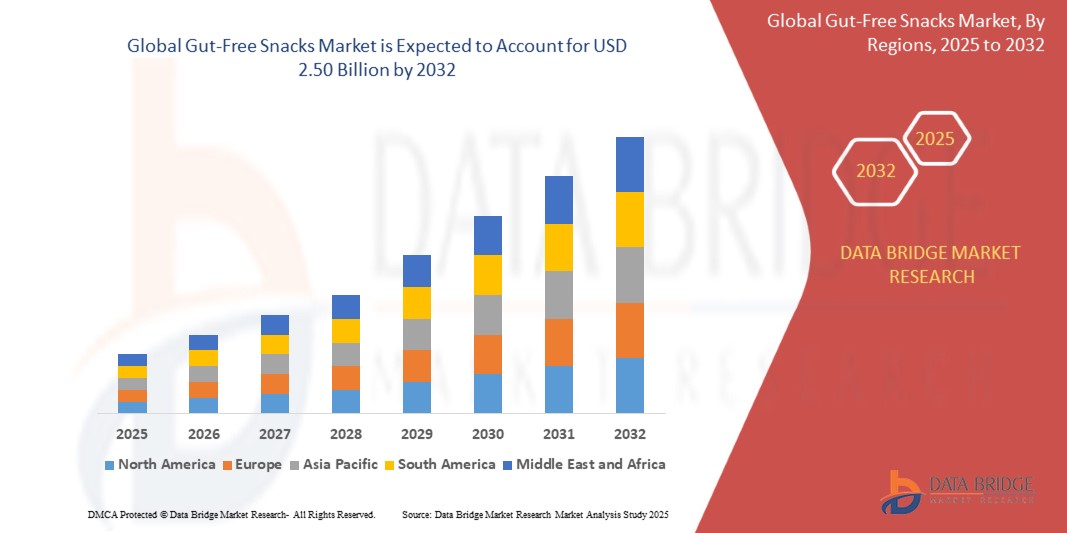

- The global gut-free snacks market size was valued at USD 1.70 billion in 2024 and is expected to reach USD 2.50 billion by 2032, at a CAGR of 4.4% during the forecast period

- The market growth is largely fueled by increasing health consciousness and rising consumer awareness about digestive wellness, leading to greater demand for functional and gut-friendly snack products in both residential and retail settings

- Furthermore, the growing preference for convenient, nutrient-rich, and protein- or fiber-fortified snacks is driving the adoption of gut-free products. These converging factors are accelerating the uptake of snacks that support gut health, thereby significantly boosting the market's expansion

Gut-Free Snacks Market Analysis

- Gut-free snacks are functional food products designed to promote digestive health, often enriched with probiotics, prebiotics, fiber, and natural ingredients. These snacks include dairy-based products, fermented foods, fruits and vegetables, nuts and seeds, and other nutrient-rich options, catering to a wide range of consumer needs

- The escalating demand for gut-free snacks is primarily fueled by rising awareness of digestive health, increasing incidence of food allergies and intolerances, and a growing trend toward clean-label, organic, and allergen-free products. Convenience, taste, and nutritional value are key factors influencing consumer adoption across retail, e-commerce, and specialty store channels

- North America dominated the gut-free snacks market with a share of 41.7% in 2024, due to rising health consciousness and increasing demand for functional foods that support digestive wellness

- Asia-Pacific is expected to be the fastest growing region in the gut-free snacks market during the forecast period due to increasing urbanization, rising disposable incomes, and growing awareness of digestive health in countries such as China, Japan, and India

- Probiotics and prebiotics segment dominated the market with a market share of 38.7% in 2024, due to their well-documented benefits in enhancing gut microbiota and promoting digestive wellness. Consumers increasingly recognize these ingredients as functional components that aid digestion and also strengthen immunity. The availability of a wide range of snack formats fortified with probiotics and prebiotics, such as bars, chips, and beverages, adds to market penetration

Report Scope and Gut-Free Snacks Market Segmentation

|

Attributes |

Gut-Free Snacks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Gut-Free Snacks Market Trends

Rising Prevalence of Digestive Health Issues

- The growing awareness of digestive health conditions and food sensitivities is driving the introduction of gut-free snacks that cater to consumers suffering from disorders such as irritable bowel syndrome (IBS), celiac disease, and gluten intolerance. The increasing prevalence of these issues is reshaping consumer preferences towards healthier, gut-friendly snack alternatives

- For instance, Fody Food Co. has successfully positioned itself as a leading player in this space with products specifically designed for those following a low-FODMAP diet plan. By offering foods such as protein bars and trail mixes that are free from high FODMAP ingredients, the brand addresses the growing population suffering from gut sensitivities and related digestive discomfort

- The integration of plant-based proteins and natural ingredients into gut-free snacks is creating a new wave of products that resonate with both health-conscious and environmentally conscious consumers. Brands are increasingly using formulations with chia seeds, quinoa, and pea protein to create appealing gut-friendly products that deliver nutrition without triggering irritation for sensitive digestive systems

- Product innovation targeting functional health benefits such as improved digestion, enhanced nutrient absorption, and reduced bloating is emerging as a strong trend. Gut-free snacks with clear ingredient labeling and free-from claims such as gluten-free, dairy-free, or soy-free are gaining widespread traction as informed consumers actively seek foods that reduce digestive stress

- Growing demand for portable snack formats and convenience products suited to individuals with restrictive diets is reshaping on-the-go consumption. This includes pocket-sized bars, ready-to-eat pouches, and travel-friendly packs that allow consumers with food sensitivities to maintain digestive comfort while keeping up with their active lifestyles

- The rising emphasis on clean-label ingredients and natural formulations is becoming central to consumer purchasing choices. Consumers are seeking gut-free snacks with non-GMO labels, organic certifications, and reduced artificial additives. Companies such as BelliWelli are reinforcing this trend by emphasizing transparency, ingredient simplicity, and products that align with the clean eating movement

Gut-Free Snacks Market Dynamics

Driver

Increasing Health Consciousness

- Consumers are becoming more mindful of their dietary choices in light of the rise in chronic lifestyle-related conditions, where digestive wellness plays a significant role. This shift is fueling the demand for gut-free snacks that are positioned as healthier alternatives to conventional packaged foods

- For instance, in 2024, Nestlé expanded its health-focused brand offerings with gut-friendly snack bars under its Garden of Life line, showcasing how major global food corporations are entering the space to respond to rising consumer demand for better-for-you products

- The trend towards personalized nutrition and functional foods is reinforcing the demand for snacks that support digestive comfort and overall wellness. Brands promoting gut-friendly snacks are increasingly marketing their products as part of a lifestyle choice instead of just dietary substitutes

- In addition, the surge in fitness culture and the preference for natural protein-rich snacks with digestive ease is proving to be a critical driver. Consumers pursuing fitness goals or mindful eating are actively seeking gut-free alternatives that align with healthy living objectives

- The synergy between gut-free snacks and other wellness movements such as gluten-free diets, vegan lifestyles, and allergen-free eating is further fueling market demand as consumers seek integrated dietary solutions addressing multiple health needs at once

Restraint/Challenge

Limited Awareness and Education

- One of the major hurdles inhibiting the adoption of gut-free snacks is the lack of adequate consumer awareness regarding digestive health-specific foods. Many consumers are still unaware of what the term "gut-free" really means and how it differentiates from gluten-free or lactose-free foods

- For instance, despite the presence of pioneering brands such as BelliWelli and Fody Food Co., surveys reveal that many consumers confuse gut-free claims with general organic snacks or are skeptical about their tangible digestive benefits

- Market penetration is further restricted by limited product availability across mainstream retail channels. Smaller brands in this segment often face challenges scaling distribution, resulting in restricted consumer access beyond niche health food stores or online platforms

- The relatively higher cost of gut-free snack options, driven by specialized formulations and premium ingredients, continues to be a challenge for broader adoption among price-sensitive consumers. This creates a barrier particularly in developing economies where affordability is a core decision factor

- The lack of clear standardization and regulations around "gut-free" claims further complicates consumer trust in this segment. Without consistent labeling or governing frameworks, skepticism persists, making it harder for the industry to build mass appeal and credibility

Gut-Free Snacks Market Scope

The market is segmented on the basis of product type, ingredient, and distribution channel.

- By Product Type

On the basis of product type, the gut-free snacks market is segmented into dairy-based snacks, fermented foods, fruits and vegetables, nuts and seeds, whole grains, and other snacks. The fermented foods segment dominated the largest market revenue share in 2024, driven by their established reputation for promoting gut health and digestion. Consumers increasingly prioritize fermented snacks due to their naturally occurring probiotics, which support healthy microbiota balance. The segment also benefits from growing awareness of functional foods and the versatility of fermented ingredients in both traditional and modern snack formats. Rising interest in plant-based diets and clean-label products further fuels demand, making fermented foods a preferred choice among health-conscious consumers.

The fruits and vegetables segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption among urban consumers seeking natural and fiber-rich snack options. These snacks are appreciated for their low-calorie content, high nutrient density, and ability to aid digestive health. Innovations in processing, such as freeze-drying and dehydration, preserve flavor and nutrients while offering convenience. The growing trend of on-the-go healthy snacking and incorporation of exotic and functional fruits further drives market expansion. Their versatility in blends with nuts, seeds, or other gut-friendly ingredients also contributes to rising popularity.

- By Ingredient

On the basis of ingredient, the gut-free snacks market is segmented into probiotics and prebiotics, natural ingredients, organic and non-GMO, and gluten-free and allergen-free. The probiotics and prebiotics segment dominated the largest market revenue share of 38.7% in 2024, owing to their well-documented benefits in enhancing gut microbiota and promoting digestive wellness. Consumers increasingly recognize these ingredients as functional components that aid digestion and also strengthen immunity. The availability of a wide range of snack formats fortified with probiotics and prebiotics, such as bars, chips, and beverages, adds to market penetration. Moreover, regulatory support and health-focused marketing campaigns have bolstered consumer trust in these ingredients, driving consistent demand.

The gluten-free and allergen-free segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by rising prevalence of gluten intolerance, celiac disease, and heightened awareness of food allergies. Consumers are actively seeking snacks that are safe, easily digestible, and free from common allergens, without compromising taste or convenience. Product innovations in gluten-free grains, nuts, seeds, and functional flours enhance both nutrition and texture, expanding consumer acceptance. The trend of clean-label and transparent ingredient sourcing further encourages adoption across age groups, particularly among health-conscious and fitness-oriented consumers.

- By Distribution Channel

On the basis of distribution channel, the gut-free snacks market is segmented into supermarkets and hypermarkets, convenience stores, specialty stores, drugstores and pharmacies, e-commerce, and others. The supermarkets and hypermarkets segment dominated the largest market revenue share in 2024, driven by wide product assortment, competitive pricing, and accessibility for mass consumers. Large retail chains offer dedicated health food sections and promotional campaigns for gut-friendly products, making them the primary choice for both urban and semi-urban shoppers. The convenience of bulk purchasing, combined with brand visibility and in-store sampling, further fuels market dominance.

The e-commerce segment is projected to witness the fastest growth rate from 2025 to 2032, driven by increasing online shopping trends and demand for doorstep delivery of specialty gut-free snacks. E-commerce platforms provide greater access to niche, premium, and imported products that may not be available in traditional retail. Personalized recommendations, subscription services, and competitive pricing strategies also attract health-conscious and tech-savvy consumers. The ability to read detailed ingredient labels, compare products, and access customer reviews enhances trust and accelerates adoption in this rapidly expanding channel.

Gut-Free Snacks Market Regional Analysis

- North America dominated the gut-free snacks market with the largest revenue share of 41.7% in 2024, driven by rising health consciousness and increasing demand for functional foods that support digestive wellness

- Consumers in the region highly value the convenience, nutrient-rich profiles, and digestive benefits offered by gut-friendly snacks

- This widespread adoption is further supported by high disposable incomes, well-established retail infrastructure, and a growing preference for clean-label, probiotic, and allergen-free products, establishing gut-free snacks as a favored choice across both urban and suburban households

U.S. Gut-Free Snacks Market Insight

The U.S. gut-free snacks market captured the largest revenue share in 2024 within North America, fueled by strong consumer awareness regarding digestive health and wellness. Rising adoption of probiotics, prebiotics, and fiber-rich snack options, combined with demand for convenient on-the-go formats, is significantly propelling market growth. The presence of major health-focused snack brands, extensive distribution networks, and a growing trend of online food retail further strengthens the market. In addition, consumer preference for functional snacks that combine taste, nutrition, and gut health benefits is accelerating expansion in the U.S. market.

Europe Gut-Free Snacks Market Insight

The Europe gut-free snacks market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing health awareness, regulatory support for functional foods, and the rising incidence of digestive health concerns. Consumers are increasingly seeking snacks fortified with probiotics, prebiotics, and natural ingredients. Urbanization, lifestyle changes, and demand for on-the-go healthy snacking are further fostering market adoption. The region is witnessing strong growth across retail, e-commerce, and specialty store channels, with consumers showing particular interest in organic, non-GMO, and allergen-free options.

U.K. Gut-Free Snacks Market Insight

The U.K. gut-free snacks market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by heightened focus on preventive health and functional nutrition. Concerns regarding digestive health, wellness, and balanced diets are encouraging consumers to choose gut-friendly snacks. In addition, the U.K.’s robust retail and e-commerce infrastructure, along with increasing availability of specialty and health-oriented products, continues to stimulate market growth. Consumers are actively seeking convenient, tasty, and nutrient-dense snacks that support gut health.

Germany Gut-Free Snacks Market Insight

The Germany gut-free snacks market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of digestive wellness and rising preference for clean-label and organic products. Germany’s well-developed retail and food manufacturing infrastructure, combined with consumer emphasis on health and sustainability, promotes the adoption of gut-friendly snacks. Functional ingredients such as probiotics, prebiotics, and fiber-enriched options are increasingly incorporated into snack products, particularly in urban areas, aligning with local demand for nutrition-focused innovations.

Asia-Pacific Gut-Free Snacks Market Insight

The Asia-Pacific gut-free snacks market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and growing awareness of digestive health in countries such as China, Japan, and India. The region's expanding middle class, coupled with a rising inclination towards healthy snacking, is boosting the adoption of gut-friendly products. Government initiatives promoting nutrition and functional foods, along with the availability of affordable and innovative snack options, are further accelerating market growth.

Japan Gut-Free Snacks Market Insight

The Japan gut-free snacks market is gaining momentum due to the country’s health-conscious population, aging demographics, and demand for convenient, functional snacks. Japanese consumers emphasize preventive health, nutrition, and wellness, which is driving the popularity of probiotic and prebiotic snacks. Integration of gut-friendly ingredients into traditional and modern snack formats, along with a preference for quality and taste, fuels growth in both retail and e-commerce channels.

China Gut-Free Snacks Market Insight

The China gut-free snacks market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s rapidly expanding urban population, rising disposable incomes, and increasing awareness of digestive health. Functional snacks fortified with probiotics, fiber, and natural ingredients are becoming highly popular in residential and commercial segments. The growth is further supported by government health initiatives, strong domestic snack manufacturers, and increasing availability of convenient gut-friendly snack formats across retail and e-commerce platforms.

Gut-Free Snacks Market Share

The gut-free snacks industry is primarily led by well-established companies, including:

- Danone (France)

- General Mills Inc. (U.S.)

- Nestlé (Switzerland)

- Pepsico (U.S.)

- The Hain Celestial Group, Inc. (U.S.)

- Unilever (U.S.)

- FERMENTED FOOD LAB (U.S.)

- Kite Hill (U.S.).

Latest Developments in Global Gut-Free Snacks Market

- In September 2023, Kellanova’s RXBAR brand partnered with podcaster Maria Menounos to launch a limited-edition RXBAR ManifX bars with customizable wrappers. Available in Chocolate Sea Salt flavor and containing 12g of protein, this launch strengthened RXBAR’s presence in the high-protein snack segment, appealing to consumers seeking personalization and functional nutrition. The collaboration enhanced brand visibility and engagement, particularly among younger, fitness-oriented audiences, reinforcing RXBAR’s competitive positioning in the U.S. protein snack market

- In September 2023, Danone UK&I introduced a new high-protein dairy snack lineup under the GetPRO brand, targeting fitness-focused consumers aiming to optimize workout nutrition. With 15–25g of protein per serving and options that are low-fat, 0% fat, or sugar-free, this launch positioned Danone strongly in the functional dairy snacks segment. The GetPRO range addresses growing consumer demand for convenient, protein-rich, and health-conscious snacking solutions, expanding Danone’s market share in the U.K. and Ireland

- In June 2023, Unilever completed the acquisition of Yasso Holdings, Inc., a U.S.-based premium frozen Greek yogurt brand. This strategic move supports Unilever’s premiumization strategy in its Ice Cream Business Group, enhancing its portfolio with a health-oriented indulgent product line. By adding Yasso, Unilever is tapping into the growing North American demand for convenient, better-for-you frozen snacks, strengthening its foothold in the premium frozen desserts market while complementing established brands such as Ben & Jerry’s and Magnum

- In May 2020, Kellogg Company launched Jumbo Snax, a new cereal-based snack range featuring Fruit Loops, Apple Jacks, Corn Pops, and Tiger Paws. This initiative expanded Kellogg’s presence in the ready-to-eat snack market, leveraging its iconic cereal brands to attract children and family-oriented consumers. The launch supported brand diversification, encouraged repeat purchases, and contributed to maintaining Kellogg’s competitive edge in the U.S. snack food market by merging familiar flavors with convenient snacking formats

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gut Free Snacks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gut Free Snacks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gut Free Snacks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.