Global Haemophilia Market

Market Size in USD Billion

CAGR :

%

USD

13.08 Billion

USD

23.50 Billion

2024

2032

USD

13.08 Billion

USD

23.50 Billion

2024

2032

| 2025 –2032 | |

| USD 13.08 Billion | |

| USD 23.50 Billion | |

|

|

|

|

Haemophilia Market Size

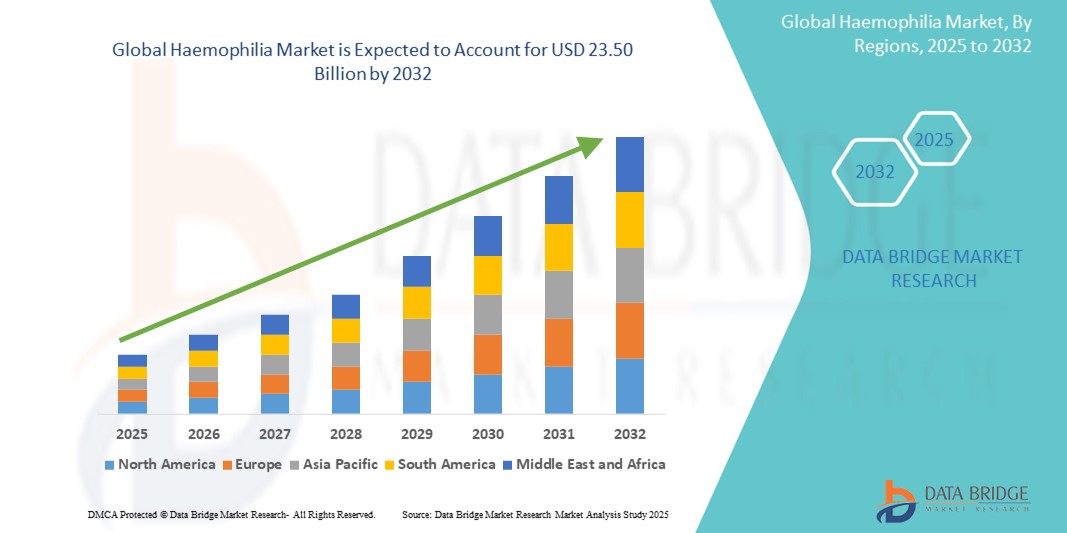

- The global haemophilia market size was valued at USD 13.08 billion in 2024 and is expected to reach USD 23.50 billion by 2032, at a CAGR of 7.60% during the forecast period

- The market growth is largely fueled by increasing diagnosis rates, a growing focus on prophylactic treatments, and ongoing innovation in recombinant and gene therapies for hemophilia A and B, transforming the treatment landscape for patients globally

- Furthermore, rising healthcare expenditure, greater access to specialized therapies, and strategic collaborations among pharmaceutical firms are enhancing the availability and efficacy of hemophilia treatments. These converging factors are accelerating the adoption of advanced therapies, thereby significantly boosting the industry's growth

Haemophilia Market Analysis

- Hemophilia, a rare genetic bleeding disorder characterized by a deficiency in clotting factors, continues to be a critical focus area within the global rare disease and specialty therapeutics sectors due to its lifelong management needs and evolving treatment landscape

- The escalating demand for hemophilia treatments is primarily fueled by improved disease awareness, enhanced diagnostic capabilities, and the increasing adoption of long-acting recombinant factors and emerging gene therapies aimed at reducing bleeding episodes and treatment burden

- North America dominated the hemophilia market with the largest revenue share of 46.3% in 2024, driven by advanced healthcare infrastructure, early access to novel therapies, and supportive reimbursement policies, with the U.S. leading in clinical trials and the adoption of cutting-edge gene therapies and extended half-life products

- Asia-Pacific is expected to be the fastest growing region in the hemophilia market during the forecast period due to increasing healthcare investments, rising diagnosis rates, and expanding access to specialty care

- Hemophilia A segment dominated the global hemophilia market with a market share of 60.9% in 2024, attributed to its higher prevalence compared to other types and the availability of a broad range of treatment options including FVIII concentrates and prophylactic regimens

Report Scope and Haemophilia Market Segmentation

|

Attributes |

Haemophilia Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Haemophilia Market Trends

“Rising Adoption of Gene Therapy and Extended Half-Life Products”

- A significant and accelerating trend in the global hemophilia market is the increasing adoption of gene therapies and extended half-life (EHL) factor replacement therapies, which aim to reduce treatment frequency and improve quality of life for patients. These advanced therapies are transforming the standard of care, offering sustained benefits with fewer infusions

- For instance, in November 2022, CSL Behring’s Hemgenix received FDA approval as the first gene therapy for hemophilia B, delivering a one-time treatment that significantly reduces annual bleeding rates. Similarly, BioMarin’s Roctavian gene therapy for hemophilia A gained EU approval, with U.S. approval following in 2023

- EHL products such as Elocta (Sobi), Adynovate (Takeda), and Alprolix (Sobi) are designed to maintain clotting factor levels longer, minimizing the frequency of infusions required. These therapies offer more consistent protection from bleeding and are increasingly favored by patients and physicians

- The shift towards gene therapies is also driven by their potential to offer long-term or even curative outcomes, which could significantly reduce the lifetime cost and burden of traditional prophylaxis. However, due to their novelty and high cost, uptake is currently concentrated in developed markets with advanced reimbursement frameworks

- This trend towards innovative, long-acting, and potentially curative treatments is reshaping patient management and fueling R&D investments. Consequently, companies such as Pfizer, Spark Therapeutics, and Sangamo Therapeutics are actively developing next-generation gene therapies targeting both hemophilia A and B

- The demand for safer, more convenient, and longer-lasting therapies is growing rapidly across the global hemophilia community, with healthcare systems gradually adapting to support these advancements in clinical practice and reimbursement

Haemophilia Market Dynamics

Driver

“Improved Diagnosis, Access to Therapies, and Supportive Health Policies”

- The global rise in hemophilia diagnosis rates, coupled with expanded access to advanced treatments and government support for rare disease management, is a key driver of market growth

- For instance, the World Federation of Hemophilia’s global outreach programs and national hemophilia registries have significantly improved disease awareness and access to factor concentrates in lower-income regions. In addition, the rollout of prophylactic regimens in countries such as China and India is rapidly increasing treatment volumes

- As more patients gain access to modern therapies, there is a growing emphasis on preventive care and early intervention to avoid long-term complications such as joint damage

- Furthermore, public-private partnerships and orphan drug incentives have spurred innovation and made high-cost therapies more accessible. For instance, Takeda and Roche have implemented patient-assistance programs to expand treatment coverage in underserved markets

- With ongoing support from healthcare providers, governments, and advocacy groups, the hemophilia market is poised for sustained expansion, especially in emerging economies where access is rapidly improving

Restraint/Challenge

“High Cost of Treatment and Unequal Global Access”

- Despite significant medical advances, the high cost of hemophilia treatment—especially gene therapies and EHL factor products—remains a major barrier, particularly in low- and middle-income countries

- For instance, Hemlibra (Roche), a bispecific antibody for hemophilia A, offers exceptional prophylaxis but comes at a substantial cost, limiting its use to high-income regions. Similarly, newly approved gene therapies such as Hemgenix are priced at over USD 3 million per dose, raising concerns about affordability and reimbursement

- Moreover, while developed nations have well-established treatment protocols, many developing countries still lack adequate screening programs, diagnostic infrastructure, and reliable access to factor concentrates. This disparity results in underdiagnosis and high mortality or morbidity rates in certain regions

- Addressing these challenges requires global collaboration to lower costs, scale up manufacturing, and improve distribution. Initiatives such as tiered pricing, non-profit factor distribution (e.g., WFH Humanitarian Aid Program), and expanded local production are essential to ensuring equitable care

Haemophilia Market Scope

The market is segmented on the basis of treatment, route of administration, diagnosis, patient type, hemophilia type, end users, and distribution channel.

- By Treatment

On the basis of treatment, the hemophilia market is segmented into medication, desmopressin, emicizumab, anti-fibrinolytics, factor replacement therapy, monoclonal antibodies, ITI therapy, gene therapy, fibrin sealants, and others. The factor replacement therapy segment dominated the market with the largest revenue share in 2024, owing to its long-standing effectiveness in managing bleeding episodes and widespread use in both prophylactic and on-demand treatments. It remains the cornerstone therapy, especially for hemophilia A and B.

The gene therapy segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the emergence of novel therapies such as Hemgenix and Roctavian, which offer the potential for one-time treatment and long-term efficacy. The segment is further boosted by growing regulatory approvals and increasing patient awareness.

- By Route Of Administration

On the basis of route of administration, the hemophilia market is segmented into oral, injectable, and others. The injectable segment dominated the market in 2024 due to the prevalence of intravenous and subcutaneous delivery across standard treatments such as factor concentrates and emicizumab. Most approved therapies require routine injections to maintain effective clotting levels.

The oral segment is expected to experience moderate growth through 2032, supported by ongoing R&D in non-replacement therapies and innovations in drug delivery that aim to reduce the treatment burden for patients.

- By Diagnosis

On the basis of diagnosis, the hemophilia market is segmented into blood test, genetic tests, and others. The blood test segment held the largest market share in 2024, driven by its critical role in initial diagnosis, classification of severity, and ongoing monitoring of clotting factor levels in patients.

The genetic tests segment is projected to grow at the fastest pace from 2025 to 2032 due to its expanding use in prenatal screening, carrier detection, and eligibility assessment for advanced gene-based therapies.

- By Patient Type

On the basis of patient type, the hemophilia market is segmented into pediatric and adult. The pediatric segment accounted for the largest market share in 2024, owing to early diagnosis and initiation of preventive therapies to avoid long-term joint damage and bleeding complications. Pediatric patients are also primary candidates for long-acting treatment regimens.

The adult segment is expected to grow steadily over the forecast period due to increasing treatment access, improved life expectancy, and rising prevalence of comorbidities requiring continuous care in adult hemophilia patients.

- By Type

On the basis of type, the hemophilia market is segmented into hemophilia A, hemophilia B, hemophilia C, and others. The hemophilia A segment dominated the market with market share of 60.9% in 2024, representing over 60% of global cases. Its dominance is supported by a broad array of treatment options, including standard and extended half-life factor VIII products, and the widespread adoption of emicizumab.

The hemophilia B segment is anticipated to witness significant growth through 2032, propelled by innovations in factor IX replacement and the recent approval of gene therapies specifically for hemophilia B.

- By End User

On the basis of end-users, the hemophilia market is segmented into hospitals, specialty clinics, homecare, and others. The hospitals segment held the largest revenue share in 2024, as hospitals are the primary settings for emergency management of bleeding episodes, comprehensive diagnostics, and administration of advanced therapies.

The homecare segment is expected to grow at the fastest rate from 2025 to 2032, supported by the increasing availability of self-administered infusions, long-acting products, and patient-centric care models that enhance quality of life and treatment adherence.

- By Distribution Channel

On the basis of distribution channel, the hemophilia market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. The hospital pharmacy segment led the market in 2024 due to the concentration of specialized therapies and acute care services within hospital systems. Most factor replacement therapies are distributed through institutional channels.

The online pharmacy segment is projected to expand rapidly through 2032, driven by rising digital health adoption, convenience in medication delivery, and the increasing integration of specialty drug logistics with e-commerce platforms.

Haemophilia Market Regional Analysis

- North America dominated the hemophilia market with the largest revenue share of 46.3% in 2024, driven by advanced healthcare infrastructure, early access to novel therapies, and supportive reimbursement policies, with the U.S. leading in clinical trials and the adoption of cutting-edge gene therapies and extended half-life products

- Patients in the region benefit from early diagnosis, established hemophilia treatment centers, and access to cutting-edge therapies including long-acting factors and novel non-factor products such as emicizumab

- This market leadership is further supported by favorable reimbursement policies, high awareness levels, and a proactive regulatory environment, making North America a key hub for innovation and clinical trials in hemophilia treatment

U.S. Haemophilia Market Insight

The U.S. hemophilia market captured the largest revenue share of 83% in 2024 within North America, driven by early disease diagnosis, advanced healthcare infrastructure, and strong reimbursement systems. The widespread adoption of recombinant factor products, gene therapies, and non-factor treatments such as emicizumab has transformed disease management. In addition, strategic collaborations between biotech firms and healthcare providers are accelerating access to novel therapies. The emphasis on personalized treatment, increased awareness, and robust clinical trial activity further support continued market dominance.

Europe Haemophilia Market Insight

The Europe hemophilia market is projected to expand at a substantial CAGR throughout the forecast period, fueled by increasing diagnosis rates, supportive government healthcare programs, and access to innovative treatment options. A growing preference for extended half-life factor therapies and preventive care is improving patient outcomes. European nations are also witnessing enhanced investment in hemophilia research, and advocacy organizations are playing a crucial role in raising awareness. Comprehensive hemophilia care centers across the region further bolster treatment accessibility.

U.K. Haemophilia Market Insight

The U.K. hemophilia market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by well-established national health services and early incorporation of gene therapy into treatment protocols. Patient-focused initiatives and registries enable better disease management and data tracking. The government’s funding of rare disease research and structured hemophilia care pathways enhance the adoption of advanced therapies. In addition, increasing demand for home-based treatment and self-administration products is driving market growth.

Germany Haemophilia Market Insight

The Germany hemophilia market is expected to expand at a considerable CAGR during the forecast period, owing to the country’s advanced biotechnology sector and strong emphasis on research and innovation. The presence of specialized hemophilia centers, coupled with favorable reimbursement policies, ensures timely access to cutting-edge therapies. Germany’s patient-centric approach, involving individualized prophylaxis and telehealth integration, is improving long-term disease outcomes. Local collaborations with global pharma players further contribute to a dynamic market landscape.

Asia-Pacific Haemophilia Market Insight

The Asia-Pacific hemophilia market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising awareness, improving healthcare infrastructure, and increasing diagnosis rates. Countries such as China, Japan, and India are investing in rare disease programs and expanding access to clotting factor concentrates. With growing government support and foreign investment in local biopharma manufacturing, affordability and access are improving across both urban and rural populations. Public-private partnerships are also emerging to bridge treatment gaps.

Japan Haemophilia Market Insight

The Japan hemophilia market is gaining traction owing to its robust healthcare system, early adoption of recombinant products, and cutting-edge R&D capabilities. The country's proactive regulatory framework has facilitated the approval and use of advanced therapies, including gene therapy and bispecific monoclonal antibodies. Integration of hemophilia care with telemedicine and digital health platforms enhances treatment monitoring. An aging patient population and strong government backing for rare diseases continue to drive long-term growth.

India Haemophilia Market Insight

The India hemophilia market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to improved diagnosis capabilities, increased government funding, and growing NGO-led awareness campaigns. India has witnessed a rapid rise in patient registrations and access to factor replacement therapies via national and state health schemes. The expansion of hemophilia treatment centers and increased collaboration with international health organizations are supporting market penetration. Local manufacturing of clotting factors is also helping reduce treatment costs.

Haemophilia Market Share

The haemophilia industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- GSK plc (U.K.)

- Novartis AG (Switzerland)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sanofi (France)

- AstraZeneca (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Baxter (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- Grifols, S.A. (Spain)

- CSL (U.S.)

- BioMarin (U.S.)

- Spark Therapeutics, Inc. (U.S.)

- Chugai Pharmaceutical Co. Ltd. (Japan)

- Octapharma AG (Switzerland)

- Novo Nordisk A/S (Denmark)

- Biogen (U.S.)

- Genentech Inc. (U.S.)

- Bayer AG (Germany)

- Ferring B.V. (Switzerland)

What are the Recent Developments in Global Haemophilia Market?

- In April 2023, CSL Behring announced positive topline results from its Phase III AFFINITY study evaluating efanesoctocog alfa, a novel recombinant factor VIII therapy for hemophilia A. The trial demonstrated extended half-life and superior bleed protection compared to existing factor VIII products. This advancement underscores CSL’s commitment to innovating long-acting therapies that enhance patient quality of life and treatment adherence while reducing infusion frequency

- In March 2023, BioMarin Pharmaceutical Inc. received European Commission approval for Roctavian (valoctocogene roxaparvovec), the first gene therapy for severe hemophilia A. The single-dose therapy offers long-term bleeding control by enabling patients to produce factor VIII endogenously. This historic approval marks a major milestone in hemophilia care and positions BioMarin as a leader in curative gene-based solutions

- In February 2023, Pfizer Inc. and Sangamo Therapeutics reported updated results from their Phase I/II Alta study of giroctocogene fitelparvovec, an investigational gene therapy for hemophilia A. The data indicated sustained therapeutic levels of factor VIII and a significant reduction in bleeding episodes over a multi-year follow-up. This collaboration reflects the growing momentum behind gene therapy as a transformative treatment pathway for hemophilia

- In January 2023, Roche’s Hemlibra (emicizumab) was included in China’s National Reimbursement Drug List (NRDL), significantly increasing its accessibility to hemophilia A patients with and without inhibitors. This development represents a critical step toward equitable treatment in emerging markets and reinforces Roche’s strategic focus on global expansion of its innovative bispecific antibody therapy

- In January 2023, Sanofi and Sobi announced a joint initiative to expand access to Alprolix and Eloctate, their extended half-life factor IX and factor VIII therapies, in underserved regions through a partnership with the World Federation of Hemophilia (WFH). This initiative aims to close treatment gaps by enhancing global distribution, education, and support infrastructure—reinforcing the companies’ commitment to equitable healthcare delivery for hemophilia patients worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.