Global Hair Oil Market

Market Size in USD Billion

CAGR :

%

USD

4.86 Billion

USD

6.75 Billion

2025

2033

USD

4.86 Billion

USD

6.75 Billion

2025

2033

| 2026 –2033 | |

| USD 4.86 Billion | |

| USD 6.75 Billion | |

|

|

|

|

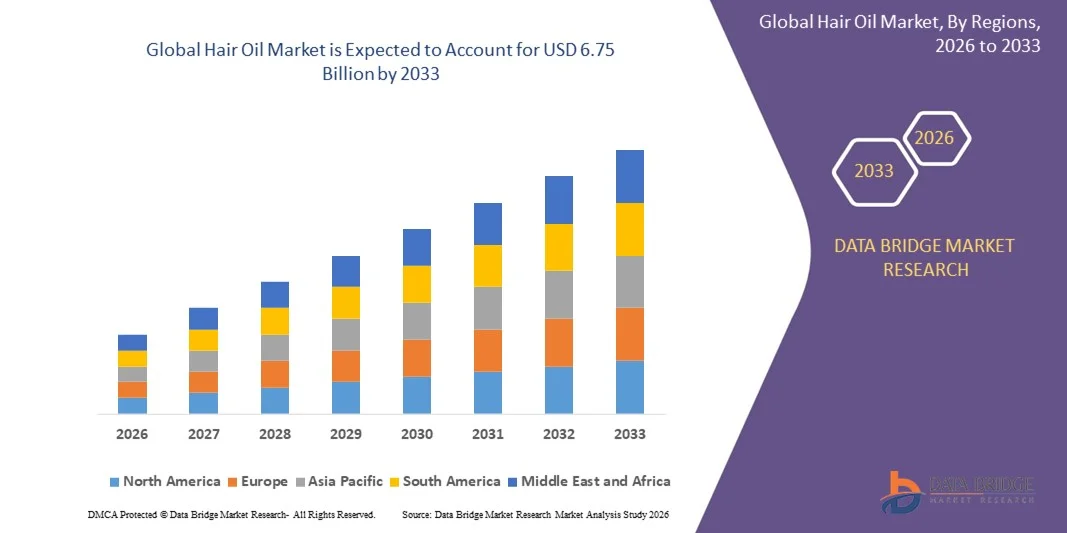

What is the Global Hair Oil Market Size and Growth Rate?

- The global hair oil market size was valued at USD 4.86 billion in 2025 and is expected to reach USD 6.75 billion by 2033, at a CAGR of4.20% during the forecast period

- Major factors that are expected to boost the growth of the hair oil market in the forecast period are the rise in the need for quick and easy hair care solutions to address specific hair issues

- Furthermore, the growing disposable income and increase in the middle class population are further anticipated to propel the growth of the hair oil market

What are the Major Takeaways of Hair Oil Market?

- The rise in the popularity of colour treated hair which need specialty hair oils that can protect the colour treatment and nourish the hair such as traditional oils at the same time is further estimated to cushion the growth of the hair oil market

- On the other hand, the ease of obtainability of non-oil hair care products is further projected to impede the growth of the hair oil market in the timeline period. In addition, the rise in the inclination for easy to handle hair oil formats will further provide potential opportunities for the growth of the hair oil market in the coming years

- Asia-Pacific dominated the hair oil market with an estimated 46.8% revenue share in 2025, driven by deep-rooted cultural usage of hair oils, large population base, and high frequency of application across countries such as India, China, Indonesia, and Thailand

- North America is projected to register the fastest CAGR of 10.69% from 2026 to 2033, driven by rising demand for premium, organic, and specialty hair oils. Growing awareness of scalp health, increasing hair damage concerns due to chemical treatments, and influence of multicultural hair care routines support market growth

- The Coconut Oil segment dominated the market with an estimated 41.6% share in 2025, owing to its deep-rooted cultural acceptance, affordability, and proven benefits for scalp nourishment, hair strengthening, and moisture retention

Report Scope and Hair Oil Market Segmentation

|

Attributes |

Hair Oil Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Hair Oil Market?

Increasing Shift Toward Natural, Ayurvedic, and Problem-Solution-Based Hair Oils

- The hair oil market is witnessing a strong shift toward natural, herbal, and ayurvedic formulations, driven by rising concerns over chemical-based products and long-term scalp health

- Manufacturers are introducing lightweight, non-sticky, and fast-absorbing oils enriched with ingredients such as onion, coconut, argan, amla, bhringraj, and castor oil to address hair fall, dandruff, and hair thinning

- Growing consumer preference for targeted hair oils focused on scalp nourishment, damage repair, and stress-related hair loss is expanding product differentiation

- For instance, companies such as Dabur, Marico, Emami, Himalaya, and Patanjali have expanded their portfolios with ayurvedic, onion-based, and herbal hair oil variants across mass and premium segments

- Increasing demand for clean-label, sulfate-free, and paraben-free hair oils is accelerating innovation in formulation and packaging

- As consumers increasingly prioritize preventive hair care and natural wellness, hair oils are evolving from traditional grooming products into specialized scalp treatment solution

What are the Key Drivers of Hair Oil Market?

- Rising prevalence of hair fall, dandruff, premature greying, and scalp dryness, driven by stress, pollution, poor diet, and lifestyle changes

- For instance, in 2024–2025, leading brands such as Marico, Dabur, and Bajaj Consumer Care launched enhanced formulations focusing on hair fall control, onion extracts, and cooling scalp oils

- Growing awareness of ayurvedic and herbal hair care across India, Southeast Asia, and the Middle East is boosting demand for traditional oil-based solutions

- Expansion of e-commerce platforms, D2C brands, and influencer-driven marketing is improving product accessibility and consumer engagement

- Rising disposable incomes and premiumization trends are driving demand for argan oil, Moroccan oil, and specialty therapeutic hair oils

- Supported by strong brand loyalty, cultural relevance, and continuous product innovation, the hair oil market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Hair Oil Market?

- High competition and price sensitivity in mass-market segments limit margin expansion for manufacturers

- For instance, during 2024–2025, fluctuations in raw material prices such as coconut oil, castor oil, and essential oils increased production costs for several players

- Consumer skepticism regarding exaggerated hair growth and hair fall claims reduces trust and repeat purchases

- Availability of alternative hair care products such as serums, leave-in conditioners, and scalp treatments is shifting consumption patterns, particularly among younger consumers

- Regulatory scrutiny over ingredient transparency, labeling, and ayurvedic claims creates compliance challenges for brands

- To overcome these challenges, companies are focusing on clinical validation, transparent communication, sustainable sourcing, and product differentiation to strengthen market positioning

How is the Hair Oil Market Segmented?

The market is segmented on the basis of type, material, category, application, and distribution channel.

- By Type

On the basis of type, the hair oil market is segmented into Coconut Oil, Almond Oil, Argan Oil, and Others. The Coconut Oil segment dominated the market with an estimated 41.6% share in 2025, owing to its deep-rooted cultural acceptance, affordability, and proven benefits for scalp nourishment, hair strengthening, and moisture retention. Coconut oil is widely used across mass and rural markets due to its versatility, long shelf life, and suitability for all hair types. Major FMCG brands continue to expand coconut oil variants with added herbs and cooling properties.

The Argan Oil segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising premiumization, increasing urban adoption, and growing demand for Moroccan oil-based formulations. Higher awareness of anti-frizz, shine-enhancing, and damage-repair benefits is accelerating argan oil usage, particularly among younger consumers and professional salons.

- By Material

On the basis of material, the hair oil market is segmented into Light Hair Oil, Heavy Hair Oil, Cooling Hair Oil, and Others. The Light Hair Oil segment accounted for the largest share of 38.9% in 2025, driven by increasing preference for non-sticky, fast-absorbing oils suitable for daily use. Urban consumers favor lightweight formulations that provide nourishment without greasy residue, making them ideal for office-going individuals and warm climatic regions. Manufacturers are innovating with silicone-free and herbal blends to enhance texture and absorption.

The Cooling Hair Oil segment is projected to witness the fastest growth during 2026–2033, supported by rising temperatures, stress-related scalp issues, and growing demand for menthol- and ayurveda-based cooling formulations. These oils are increasingly marketed for headache relief, stress reduction, and scalp soothing, especially across India and Southeast Asia.

- By Category

On the basis of category, the market is segmented into Non-Medicated and Medicated Hair Oils. The Non-Medicated segment dominated the market with a 64.2% share in 2025, supported by widespread everyday usage, easy availability, and strong brand penetration across mass retail channels. These oils are primarily used for nourishment, shine, and routine hair care, making them suitable for all age groups. High-volume consumption and competitive pricing continue to sustain dominance.

The Medicated Hair Oil segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing incidence of hair fall, dandruff, scalp infections, and stress-induced hair problems. Rising trust in ayurvedic, herbal, and dermatologically tested formulations is accelerating adoption, particularly among urban and health-conscious consumers seeking problem-specific solutions.

- By Application

On the basis of application, the hair oil market is segmented into Individual, Commercial, and Others. The Individual segment held the largest share of 71.5% in 2025, driven by daily household consumption, cultural grooming habits, and increasing awareness of preventive hair care. Strong penetration in rural and urban households, coupled with affordable product availability, continues to support dominance.

The Commercial segment is anticipated to grow at the fastest CAGR during 2026–2033, supported by expansion of salons, spas, grooming centers, and professional hair care services. Rising demand for premium oils, scalp treatments, and massage therapies in commercial establishments is boosting bulk consumption. Increased focus on professional-grade products and branded salon partnerships is further accelerating growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Specialty Stores, Drug Stores or Pharmacies, Supermarkets, Hypermarkets, Convenience Stores, and Others. The Supermarkets and Hypermarkets segment dominated the market with a combined share of 35.8% in 2025, supported by strong shelf visibility, promotional discounts, and wide brand assortments. These outlets serve as key purchase points for mass-market and premium hair oils.

The Specialty Stores and Online-Enabled ‘Others’ segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising D2C brands, ayurvedic retailers, and e-commerce platforms. Personalized recommendations, influencer-driven marketing, and subscription-based sales models are improving consumer engagement and accelerating channel growth.

Which Region Holds the Largest Share of the Hair Oil Market?

- Asia-Pacific dominated the hair oil market with an estimated 46.8% revenue share in 2025, driven by deep-rooted cultural usage of hair oils, large population base, and high frequency of application across countries such as India, China, Indonesia, and Thailand. Traditional grooming practices, strong preference for coconut, almond, and herbal oils, and widespread availability through mass retail channels support sustained consumption

- Regional manufacturers are actively launching ayurvedic, herbal, and problem-solution-based hair oils, targeting hair fall, dandruff, and scalp nourishment. Competitive pricing and localized formulations further strengthen market penetration

- Rising disposable incomes, expanding middle-class population, and growing awareness of preventive hair care reinforce Asia-Pacific’s leadership position in the global hair oil market

India Hair Oil Market Insight

India is the largest contributor within Asia-Pacific, supported by strong cultural reliance on hair oiling, extensive rural and urban consumption, and dominance of coconut and ayurvedic oils. Leading brands such as Dabur, Marico, Emami, Bajaj Consumer Care, and Patanjali drive market growth through continuous product innovation. Rising awareness of herbal and medicated hair oils for hair fall control and scalp health further accelerates demand.

China Hair Oil Market Insight

China contributes significantly due to increasing focus on personal grooming, rising urbanization, and growing adoption of premium and herbal hair oils. Expanding e-commerce penetration and growing demand for lightweight, non-greasy formulations are supporting steady market expansion.

North America Hair Oil Market

North America is projected to register the fastest CAGR of 10.69% from 2026 to 2033, driven by rising demand for premium, organic, and specialty hair oils. Growing awareness of scalp health, increasing hair damage concerns due to chemical treatments, and influence of multicultural hair care routines support market growth. Leading brands are introducing argan oil, Moroccan oil, and therapeutic scalp oils, catering to diverse hair types and ethnic consumer groups. Strong presence of professional salons, high purchasing power, and expanding e-commerce channels further accelerate regional market growth.

U.S. Hair Oil Market Insight

The U.S. leads North America due to increasing adoption of premium and clean-label hair oils across both retail and salon channels. Growing preference for sulfate-free, vegan, and dermatologist-tested formulations drives demand. Influence of beauty influencers and D2C brands further strengthens market expansion.

Canada Hair Oil Market Insight

Canada shows steady growth supported by rising awareness of natural personal care products and increasing demand for moisturizing oils suited to cold climatic conditions. Growing preference for argan, coconut, and herbal blends supports consistent market adoption.

Which are the Top Companies in Hair Oil Market?

The hair oil industry is primarily led by well-established companies, including:

- Dabur India Ltd. (India)

- Marico (India)

- Bajaj Consumer Care Ltd. (India)

- Emami Group (India)

- L'Oréal S.A. (France)

- Unilever (U.K.)

- Henkel AG (Germany)

- BioVeda Action Research Company (U.S.)

- Moroccanoil (Israel)

- Patanjali Ayurved (India)

- Khadi Natural (India)

- Coty Inc. (U.S.)

- Procter & Gamble (U.S.)

- CavinCare Group (India)

- Johnson & Johnson (U.S.)

- Himalaya Drug Company (India)

- Amway (U.S.)

- Conair Corporation (U.S.)

- AVEDA Corp. (U.S.)

What are the Recent Developments in Global Hair Oil Market?

- In July 2025, Diffar’s Tokyo Balance Hair Oil debuted as a luxury, perfume-infused hair treatment formulated with premium Japanese botanicals and positioned for frizz control and enhanced shine, following a successful Brooklyn pop-up and subsequent online availability, marking the brand’s strategic entry into upscale and niche haircare segments by appealing to fragrance lovers and beauty-indie consumers, thereby strengthening premium positioning in the luxury hair oil space

- In May 2025, NovaTrio LLC officially launched D'Cherlane Goodness Hair Oil, a premium botanical formulation infused with 17 natural oils and developed to deeply nourish the scalp and support healthy hair care routines, with availability across Amazon and TikTok Shop U.S. ahead of Mother’s Day, reinforcing the company’s focus on digital-first distribution and premium gifting-oriented hair oil offerings

- In April 2025, at In-Cosmetics Global 2025, BASF introduced three eco-conscious hair care ingredients including a corn-based natural styling polymer Verdessence Maize, a wax-based opacifier, and a Rainforest Alliance-certified coconut oil-derived betaine surfactant, aimed at delivering high performance with reduced environmental impact, highlighting the growing emphasis on sustainability-driven innovation in hair care formulations

- In February 2022, Dabur India Ltd announced the launch of Virgin Coconut Oil to strengthen its portfolio in the coconut oil segment and cater to rising consumer preference for pure and natural hair nourishment solutions, supporting the brand’s leadership in traditional and health-focused hair oil categories

- In February 2022, L’Oréal Paris launched the Extraordinary Oil Smooth product range comprising shampoo, conditioner, hair serum, and steam mask to deliver enhanced smoothness and nourishment benefits, demonstrating the company’s strategy to build integrated, oil-infused hair care ecosystems across multiple product formats

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.