Global Halal Empty Capsules Market

Market Size in USD Billion

CAGR :

%

USD

1.01 Billion

USD

1.52 Billion

2024

2032

USD

1.01 Billion

USD

1.52 Billion

2024

2032

| 2025 –2032 | |

| USD 1.01 Billion | |

| USD 1.52 Billion | |

|

|

|

|

Halal Empty Capsules Market Size

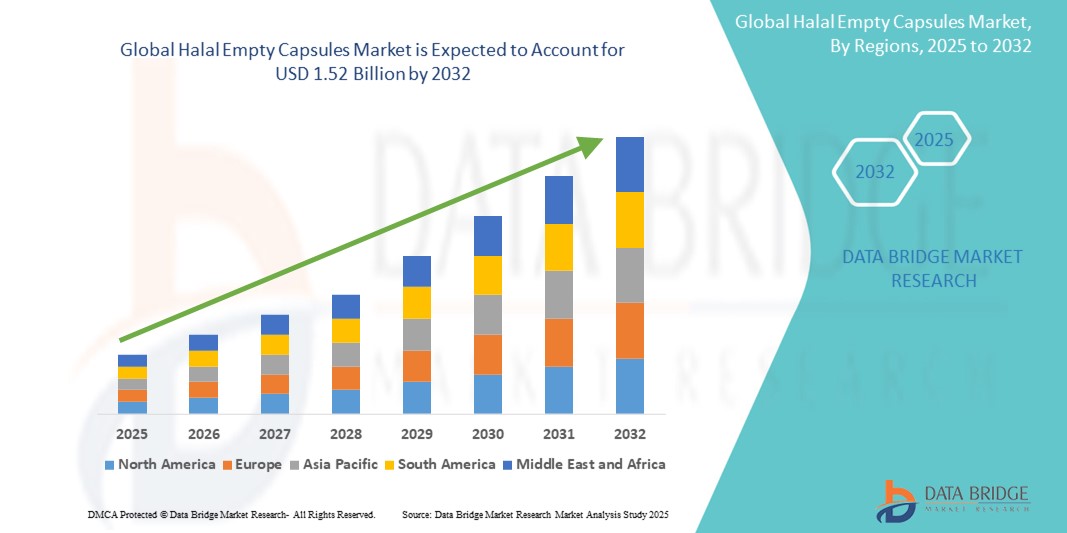

- The global Halal empty capsule market size was valued at USD 1.01 billion in 2024 and is expected to reach USD 1.52 billion by 2032, at a CAGR of 5.28% during the forecast period

- This growth is driven by factors such as increasing demand for halal-certified products, health and wellness trends, and rising muslim population

Halal Empty Capsules Analysis

- Halal empty capsules are essential in the pharmaceutical, nutraceutical, and dietary supplement industries for encapsulating various products while adhering to Islamic dietary laws. These capsules are typically made from vegetarian sources or other permissible materials, ensuring compliance with halal standards

- The demand for halal empty capsules is significantly driven by the increasing global Muslim population, rising health consciousness, and growing awareness about halal-certified health products. As more consumers seek ethical and health-conscious products, halal capsules have become a preferred choice, especially in Muslim-majority regions

- North America is expected to hold a significant share approximately 38.40% of the Halal empty capsules market, driven by advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and a strong presence of key market players

- Asia-Pacific is projected to register the highest growth rate with a share of 26.3% in the halal empty capsules market during the forecast period, driven by the large Muslim population, expanding healthcare infrastructure, and growing awareness about halal certifications. The rising preference for halal dietary supplements and pharmaceuticals in countries such as Indonesia, Malaysia, and India further accelerates market expansion

- Gelatin segment is expected to dominate the market with a market share of 60.5% due to their affordability, widespread use, and ease of production. As the preferred choice in the pharmaceutical industry, their superior dissolving properties and enhanced bioavailability contribute to their continued dominance

Report Scope and Halal Empty Capsules Segmentation

|

Attributes |

Halal Empty Capsules Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Halal Empty Capsules Trends

“Advancements in Plant-based and Ethical Capsule Solutions”

- One prominent trend in the halal empty capsules market is the increasing demand for plant-based and vegan capsules, which align with the growing consumer shift towards ethical, health-conscious, and sustainable products. These capsules are made from vegetarian sources such as Hydroxypropyl Methylcellulose (HPMC) or Pullulan, making them suitable for both halal and non-halal consumers who prefer alternatives to gelatin-based capsules

- Another key trend is the integration of advanced manufacturing technologies, including improved production processes and quality control. These innovations help enhance the consistency, durability, and integrity of halal capsules, ensuring they meet the strict halal certification standards. The use of clean-label ingredients and sustainable sourcing is also becoming increasingly important in maintaining transparency and meeting the expectations of health-conscious consumers

- In addition, increased collaboration between pharmaceutical companies and halal certification bodies is another growing trend. This collaboration ensures the widespread availability of halal-certified products across various regions, meeting the needs of a larger, more diverse consumer base. With the rising popularity of halal-certified pharmaceuticals and nutraceuticals, more companies are seeking certification for their products to access both Muslim and non-Muslim markets

- These trends are driving market growth by aligning with the increasing demand for health-conscious, ethically produced products, and supporting the adoption of halal empty capsules in various industries, including pharmaceuticals, nutraceuticals, and dietary supplements

Halal Empty Capsules Dynamics

Driver

“Rising Demand for Halal-Certified Products in Pharmaceutical and Nutraceutical Industries”

- The increasing global Muslim population and rising consumer awareness about halal dietary laws are significantly driving the demand for halal-certified products in the pharmaceutical and nutraceutical sectors

- As consumers become more conscious of the ingredients used in medications and supplements, there's a growing shift toward products that align with religious and ethical values, particularly in Muslim-majority countries

- Pharmaceutical and nutraceutical companies are actively working to reformulate products using halal-compliant ingredients, leading to increased adoption of halal empty capsules, particularly gelatin alternatives such as HPMC and pullulan

For instance,

- In 2022, Qualicaps Europe S.A.U. announced the launch of halal-certified capsules manufactured with bovine gelatin that meets the requirements of both halal and pharmaceutical-grade standards, aimed specifically at markets in Southeast Asia and the Middle East

- As a result of this consumer-driven demand and regulatory backing, there is a significant increase in the production and global distribution of halal empty capsules

Opportunity

“Rising Popularity of Plant-Based and Clean-Label Products”

- Halal empty capsules made from non-animal sources such as HPMC and pullulan align with the growing demand for clean-label, plant-based, and vegetarian-friendly products, expanding their appeal beyond religious consumers

- These capsules are also non-GMO, gluten-free, and allergen-free, making them attractive in broader health-conscious markets, especially in North America and Europe

- Manufacturers are focusing on improving the mechanical strength, stability, and bioavailability of plant-based halal capsules to match or exceed the performance of traditional gelatin capsules

For instance,

- In February 2023, ACG announced the expansion of its HPMC capsule production facility to meet the rising demand for plant-based halal-certified capsules, especially in Asia and the Middle East, where dietary regulations are more stringent

- The expanding use of plant-based halal capsules in both over-the-counter and prescription formulations offers a key growth opportunity for capsule manufacturers worldwide

Restraint/Challenge

“Limited Availability and High Cost of Halal-Certified Raw Materials”

- One of the primary challenges facing the halal empty capsules market is the limited availability of halal-certified raw materials, especially gelatin derived from animals slaughtered according to Islamic law

- The stringent sourcing and certification process increases production costs, leading to higher prices for halal capsules compared to conventional ones

- This cost differential can deter smaller pharmaceutical and supplement companies from entering or expanding in the halal market segment

For instance,

- In November 2024, according to Halal Times, the complexities and inconsistencies in halal certification across different regions make it challenging for manufacturers to achieve global halal compliance, thus affecting their ability to scale and maintain affordability

- Consequently, these challenges can limit market penetration, particularly in price-sensitive regions, and slow the growth of the halal empty capsules industry despite strong demand

Halal Empty Capsules Scope

The market is segmented on the basis of type and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

In 2025, the gelatin is projected to dominate the market with a largest share in type segment

The gelatin segment is expected to dominate the market with the largest share of approximately 60.5% in 2025 due to their affordability, widespread use, and ease of production. As the preferred choice in the pharmaceutical industry, their superior dissolving properties and enhanced bioavailability contribute to their continued dominance. The demand for effective drug delivery systems further drives market growth, with gelatin capsules being highly valued for their efficiency in this regard.

The pharmaceutical industry is expected to account for the largest share during the forecast period in application market

In 2025, the pharmaceutical industry is expected to dominate the halal empty capsules market with the largest market share of around 30.4%. This growth is driven by the increasing demand for halal-certified medications, particularly in regions with large Muslim populations, such as Asia and the Middle East. The growing preference for halal-certified products in the pharmaceutical sector is contributing to the significant market share held by this segment.

Halal Empty Capsules Regional Analysis

“North America Holds the Largest Share in the Halal Empty Capsules Market”

- North America is expected to hold a significant share approximately 38.40% of the halal empty capsules market, driven by advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and a strong presence of key market players

- U.S. dominates within North America with a share of 46.5% due to the growing demand for halal-certified medications across various sectors, especially in pharmaceuticals, and the increasing consumer preference for health-conscious products

- The availability of well-established halal certification systems and strong regulations that ensure product quality further strengthen the market

- In addition, the rising demand for nutraceuticals and pharmaceuticals that meet halal standards is fueling the market’s growth, especially in regions with large Muslim populations

“Asia-Pacific is Projected to Register the Highest CAGR in the Halal Empty Capsules Market”

- Asia-Pacific is projected to register the highest growth rate with a share of 26.3% in the halal empty capsules market during the forecast period, driven by the large Muslim population, expanding healthcare infrastructure, and growing awareness about halal certifications. The rising preference for halal dietary supplements and pharmaceuticals in countries such as Indonesia, Malaysia, and India further accelerate market expansion

- This strong growth is primarily driven by the large and rapidly expanding Muslim population in countries such as Indonesia, Malaysia, India, and Pakistan, where demand for halal-compliant pharmaceutical and nutraceutical products is rising sharply. Additionally, increasing health awareness, a growing middle-class population, and improving healthcare infrastructure are contributing factors. Governments and regulatory authorities across Asia-Pacific are also promoting halal certification, boosting consumer confidence in halal products

- India is projected to register the highest CAGR, because of its rapidly developing healthcare sector is increasing the demand for pharmaceutical and nutraceutical products, including halal-certified capsules

Halal Empty Capsules Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Qualicaps (U.S.)

- ACG (India)

- SUHEUNG (South Korea)

- Erawat Pharma Limited (India)

- Lonza (Switzerland)

- Vitasweet (China)

- Jiangsu Pharmaceutical Co., Ltd. (China)

- CapsCanada (Canada)

- Healthcaps India Ltd. (India)

- Changzhou Sunli Pharmaceutical Co., Ltd. (China)

- Gelita AG (Germany)

- BASF (Germany)

- Shandong Weigao Group (China)

- Hunan Er-Kang Pharmaceutical Co., Ltd. (China)

- PipingRock Health Products, Inc. (U.S.)

Latest Developments in Global Halal Empty Capsules Market

- In February 2023, ACG, announced the expansion of its vegetarian capsule facility to scale up production of HPMC (Hydroxypropyl Methylcellulose) capsules. This move aims to meet the rising global demand for halal-certified, plant-based capsules, particularly in the nutraceutical and pharmaceutical sectors. The expansion enhances ACG’s capacity to deliver halal-compliant solutions while maintaining high standards of quality and scalability

- In September 2024, Aizon, in collaboration with Euroapi, launched "Aizon Execute," an advanced electronic batch record (eBR) software solution that incorporates artificial intelligence to streamline pharmaceutical manufacturing. This innovation improves production efficiency and ensures strict compliance with halal standards, particularly in the manufacturing of halal-certified empty capsules

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.