Global Halal Logistics Market

Market Size in USD Billion

CAGR :

%

USD

4.28 Billion

USD

8.05 Billion

2025

2033

USD

4.28 Billion

USD

8.05 Billion

2025

2033

| 2026 –2033 | |

| USD 4.28 Billion | |

| USD 8.05 Billion | |

|

|

|

|

Halal Logistics Market Size

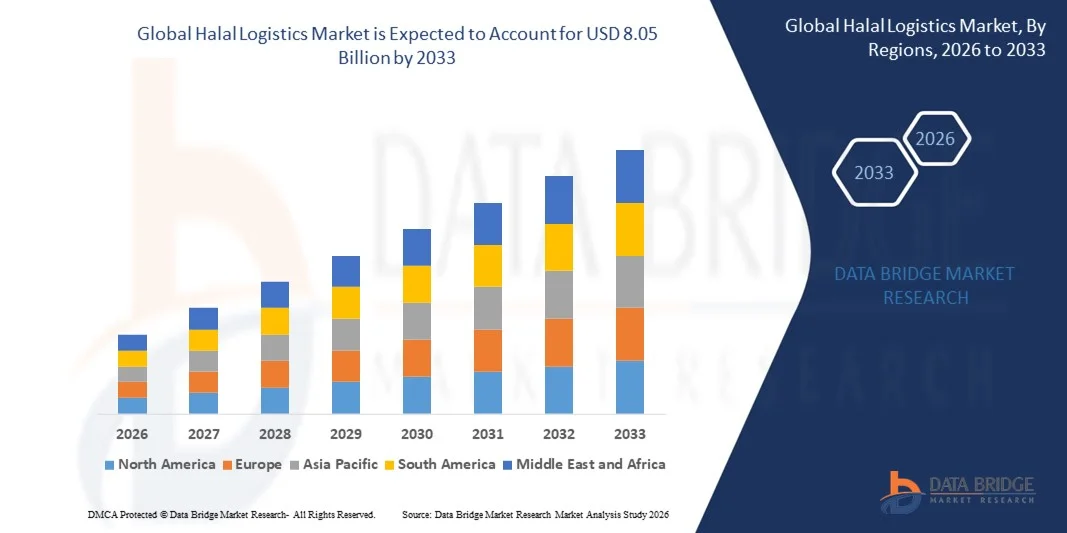

- The global halal logistics market size was valued at USD 4.28 billion in 2025 and is expected to reach USD 8.05 billion by 2033, at a CAGR of 8.20% during the forecast period

- The market growth is largely fuelled by the increasing global demand for halal-certified food and pharmaceutical products, along with the need for specialized storage, transportation, and handling solutions that comply with Islamic regulations

- Expansion of e-commerce and cross-border trade for halal products is driving the adoption of dedicated halal logistics services

Halal Logistics Market Analysis

- The market is witnessing robust growth due to the rising demand for halal-compliant transportation and warehousing services across food, pharmaceutical, and cosmetic sectors

- Increasing government regulations, certifications, and standards for halal logistics are enhancing consumer confidence and driving adoption across key global markets

- North America dominated the halal logistics market with the largest revenue share in 2025, driven by the growing demand for halal-certified food, pharmaceuticals, and cosmetics, as well as the increasing adoption of specialized supply chain solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global halal logistics market, driven by expanding halal product demand, government initiatives promoting halal certification, improvements in cold chain infrastructure, and increasing adoption of technology-enabled tracking and monitoring systems

- The storage segment held the largest market revenue share in 2025, driven by the increasing need for temperature-controlled and segregated warehouses that maintain halal compliance for food, pharmaceuticals, and cosmetics. These storage solutions ensure product integrity, reduce contamination risks, and support global export standards

Report Scope and Halal Logistics Market Segmentation

|

Attributes |

Halal Logistics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Halal Logistics Market Trends

Rise of Specialized Halal-Compliant Supply Chain Solutions

- The growing emphasis on halal-compliant supply chains is transforming the logistics landscape by ensuring that food, pharmaceutical, and cosmetic products are handled, stored, and transported according to Islamic regulations. This ensures product integrity, improves consumer trust, and reduces the risk of cross-contamination or non-compliance. Businesses are increasingly investing in certified processes, labeling systems, and monitoring tools to meet global halal standards

- Increasing demand for halal-certified products in international markets is accelerating the adoption of dedicated storage facilities, temperature-controlled transportation, and segregated handling processes. Governments and industry bodies are also supporting certification programs to maintain compliance and traceability. The integration of IoT and real-time tracking technologies is further enhancing operational efficiency and transparency across the supply chain

- The affordability and scalability of modern halal logistics services are making them attractive for small and medium enterprises, enabling wider market participation. Businesses benefit from streamlined distribution without incurring excessive costs, improving overall supply chain efficiency. In addition, flexible service models allow providers to cater to both domestic and international halal product shipments

- For instance, in 2023, several halal food manufacturers in the Middle East reported improved export compliance and reduced spoilage after partnering with specialized halal logistics providers. These services facilitated certified storage and transport while maintaining product quality and shelf life. Companies also reported increased customer satisfaction due to consistent adherence to halal standards

- While halal logistics solutions are enhancing compliance and operational efficiency, their effectiveness depends on continuous innovation, training of personnel, and adherence to certification standards. Providers must focus on localized service offerings and technology-enabled tracking to fully capitalize on growing demand. Collaboration with regulatory bodies and investment in staff education are critical for sustaining market credibility

Halal Logistics Market Dynamics

Driver

Rising Global Demand for Halal-Certified Products

- The growing consumer preference for halal-certified food, pharmaceuticals, and cosmetics is pushing manufacturers and logistics providers to prioritize compliant supply chains. This has accelerated investment in dedicated storage, transportation, and distribution networks. Companies are also leveraging automation and digital solutions to ensure traceability and compliance across every stage of the supply chain

- Businesses are increasingly aware of the economic and reputational risks associated with non-compliance, including product recalls, loss of export opportunities, and reduced consumer trust. This awareness is driving the adoption of halal-certified logistics solutions across key markets. Firms are also implementing standardized operating procedures to ensure uniform compliance across multiple regions

- Government regulations, certification frameworks, and industry standards are strengthening trust in halal-compliant logistics, encouraging wider adoption among exporters, distributors, and retailers. Supportive frameworks include inspection programs, labeling requirements, and facility audits. Continuous updates to certification guidelines also motivate logistics providers to upgrade their infrastructure and processes

- For instance, in 2022, several Southeast Asian countries introduced stricter halal logistics certification guidelines, boosting demand for compliant warehousing and transportation services among domestic and international producers. These initiatives promoted greater market transparency and enhanced cross-border trade efficiency for halal products

- While rising demand and regulatory support are driving market growth, there is still a need to expand last-mile delivery infrastructure, improve cost efficiency, and integrate technology for traceability to ensure sustained adoption. Developing partnerships with local distributors and investing in cold chain solutions are also critical to meet growing consumer expectations

Restraint/Challenge

High Cost of Compliance and Limited Infrastructure in Emerging Markets

- The high cost of establishing and maintaining halal-compliant storage, transportation, and handling systems limits adoption among small and mid-sized logistics providers. Investments in certified facilities, specialized vehicles, and monitoring equipment remain significant barriers. This financial burden often discourages new entrants from offering fully compliant services in developing regions

- In many emerging markets, there is a lack of trained personnel capable of ensuring strict adherence to halal standards. Limited infrastructure, inconsistent certification enforcement, and logistical hurdles reduce the accessibility and reliability of compliant services. Continuous training programs and capacity-building initiatives are required to bridge the knowledge gap

- Market penetration is further constrained by fragmented supply chains, limited cold storage facilities, and challenges in coordinating cross-border halal compliance. These issues can lead to delays, contamination risks, and increased operational costs. In addition, the absence of standardized technology platforms across regions complicates monitoring and reporting efforts

- For instance, in 2023, logistics agencies in Sub-Saharan Africa reported that over 60% of halal product shipments faced compliance challenges due to inadequate infrastructure and insufficient trained staff. These limitations impacted export efficiency and market expansion opportunities for local halal producers

- While technology and service innovation are expanding capabilities, addressing cost, infrastructure gaps, and personnel training remains essential to unlocking the full potential of the halal logistics market. Investment in digital solutions, scalable cold chain systems, and regulatory alignment will be key to supporting long-term growth and ensuring global competitiveness

Halal Logistics Market Scope

The market is segmented on the basis of component, transport, and end-user.

- By Component

On the basis of component, the halal logistics market is segmented into storage, transportation, monitoring components, software, and services. The storage segment held the largest market revenue share in 2025, driven by the increasing need for temperature-controlled and segregated warehouses that maintain halal compliance for food, pharmaceuticals, and cosmetics. These storage solutions ensure product integrity, reduce contamination risks, and support global export standards.

The monitoring components segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the rising adoption of IoT-enabled tracking systems, real-time sensors, and automated monitoring devices. These solutions help ensure compliance, improve traceability, and provide transparency throughout the halal supply chain.

- By Transport

On the basis of transport, the market is segmented into railways, roadways, airways, and waterways. The roadways segment accounted for the largest revenue share in 2025 due to the flexibility, cost-efficiency, and wide coverage offered by trucks and vans for transporting halal-certified products. Road transport is particularly preferred for domestic distribution and last-mile delivery.

The airways segment is projected to grow at the fastest rate during 2026–2033, driven by the increasing demand for rapid international shipments of halal food and pharmaceuticals. Air transport ensures faster delivery, minimal spoilage, and adherence to strict temperature and handling requirements.

- By End-User

On the basis of end-user, the market is segmented into healthcare, manufacturing, trade & transportation, telecommunication, government & public utilities, banking & financial services, retail, media and entertainment, and information technology. The retail segment held the largest market share in 2025, supported by the rising demand for halal-certified products in supermarkets, hypermarkets, and online platforms. Retailers increasingly rely on specialized logistics to maintain compliance and quality across their supply chains.

The healthcare segment is expected to witness the fastest growth from 2026 to 2033 due to the increasing need for halal-compliant pharmaceuticals, vaccines, and medical products. Hospitals, clinics, and pharmaceutical distributors are adopting dedicated logistics solutions to ensure safe, traceable, and certified supply chains.

Halal Logistics Market Regional Analysis

- North America dominated the halal logistics market with the largest revenue share in 2025, driven by the growing demand for halal-certified food, pharmaceuticals, and cosmetics, as well as the increasing adoption of specialized supply chain solutions

- Businesses and consumers in the region highly value certified storage, transportation, and monitoring services that ensure compliance with halal standards while maintaining product quality and traceability

- This widespread adoption is further supported by well-established infrastructure, high consumer awareness, and government-backed certification programs, establishing halal logistics as a preferred solution for both domestic and international supply chains

U.S. Halal Logistics Market Insight

The U.S. halal logistics market captured the largest revenue share in 2025 within North America, fueled by rising consumer demand for halal products and the growing presence of international halal food and pharmaceutical companies. Businesses are increasingly investing in compliant warehouses, temperature-controlled transport, and digital monitoring systems. Furthermore, regulatory guidelines and industry certification frameworks are strengthening trust in halal logistics solutions, contributing to steady market growth.

Europe Halal Logistics Market Insight

The Europe halal logistics market is expected to witness the fastest growth rate from 2026 to 2033, driven by strict food safety and halal compliance regulations, as well as rising demand for imported halal products. Increasing urbanization, trade expansion, and consumer preference for certified goods are fostering the adoption of specialized storage and transport services. The region is also seeing growth in cross-border halal trade, boosting the need for advanced logistics solutions.

U.K. Halal Logistics Market Insight

The U.K. halal logistics market is expected to witness the fastest growth rate from 2026 to 2033, supported by the growing Muslim population and the increasing demand for certified halal food, beverages, and pharmaceuticals. Businesses are prioritizing compliance with international halal standards, integrating advanced monitoring and tracking solutions, and expanding certified transport networks. The country’s strong e-commerce sector is also accelerating demand for last-mile halal logistics services.

Germany Halal Logistics Market Insight

The Germany halal logistics market is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising consumer awareness of halal certification and the growing import of halal products. Germany’s well-developed infrastructure, emphasis on sustainability, and focus on food and pharmaceutical safety promote the adoption of certified storage, transportation, and monitoring systems. Integration with digital traceability platforms is also increasing to ensure compliance and improve supply chain efficiency.

Asia-Pacific Halal Logistics Market Insight

The Asia-Pacific halal logistics market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, increasing disposable incomes, and government initiatives promoting halal certification in countries such as China, India, and Malaysia. Rising demand for halal-certified food and pharmaceuticals in domestic and export markets is fueling the adoption of dedicated logistics services. In addition, the region’s strong manufacturing base and investment in cold chain infrastructure are enhancing accessibility and affordability of halal logistics solutions.

Japan Halal Logistics Market Insight

The Japan halal logistics market is expected to witness the fastest growth rate from 2026 to 2033 due to the increasing focus on high-quality halal-certified products and the country’s aging population requiring convenient and safe supply chains. Adoption of specialized storage, transport, and monitoring systems is growing among food manufacturers and pharmaceutical companies. Integration with digital tracking and IoT-based monitoring further ensures compliance and product integrity.

China Halal Logistics Market Insight

The China halal logistics market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to rapid urbanization, expanding middle-class consumer base, and increasing domestic and international trade of halal-certified products. Strong government support, increasing awareness of halal standards, and investments in dedicated warehouses and transport infrastructure are key factors propelling the market. Moreover, the presence of local halal-certified logistics providers is enhancing market reach and service efficiency.

Halal Logistics Market Share

The Halal Logistics industry is primarily led by well-established companies, including:

- Nippon Express (Japan)

- TIBA (Egypt)

- YUSEN LOGISTICS CO., LTD (Japan)

- TASCO Berhad (Malaysia)

- Kontena Nasional Berhad (Malaysia)

- MASkargo (Malaysia)

- SEJUNG SHIPPING CO., LTD. (South Korea)

- DB Schenker (Germany)

- Al Furqan Shipping & Logistics LLC (U.A.E.)

- Northport (Malaysia)

- Hala SCS Solutions (U.K.)

- Freight Management Holdings Bhd (Malaysia)

- HAVI (U.S.)

Latest Developments in Global Halal Logistics Market

- In September 2024, Malaysia announced a major investment of approximately USD 888 million from China in the halal industry. This investment aims to support key sectors including herbal medicine, food and beverages, vaccines, cosmetics, and pharmaceuticals. The announcement followed discussions at the Malaysia-China Halal Business Forum, where Malaysia's Deputy Prime Minister and a delegation engaged with Chinese halal industry leaders. The capital influx is expected to enhance cross-border trade, strengthen halal infrastructure, and boost market growth in both countries

- In May 2024, Nippon Express Holdings Co., Ltd. obtained halal logistics certification from the Nippon Asia Halal Association for its Fukuoka Chuo Logistics Center. This development enables the company to meet the rising global demand for halal products, particularly Japanese food exports, ensuring compliance, product integrity, and improved customer confidence. The certification is likely to strengthen Nippon Express’s position in the halal logistics market and drive further adoption of certified supply chain services

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.