Global Halitosis Treatment Market

Market Size in USD Billion

CAGR :

%

USD

14.94 Billion

USD

34.43 Billion

2024

2032

USD

14.94 Billion

USD

34.43 Billion

2024

2032

| 2025 –2032 | |

| USD 14.94 Billion | |

| USD 34.43 Billion | |

|

|

|

|

Halitosis Treatment Market Size

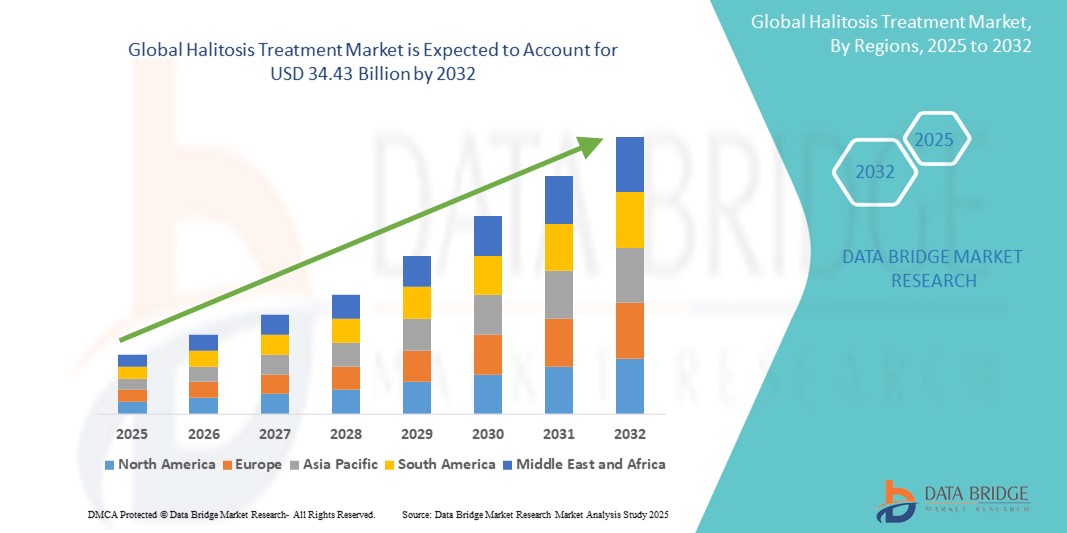

- The global halitosis treatment market size was valued at USD 14.94 billion in 2024 and is expected to reach USD 34.43 billion by 2032, at a CAGR of 11.00% during the forecast period

- The market growth is largely fueled by the increasing global awareness about oral hygiene and the rising prevalence of halitosis, which has become a major concern for both aesthetic and health-related reasons

- Furthermore, rising consumer demand for fast-acting, non-invasive, and over-the-counter solutions is establishing halitosis treatments—such as mouthwashes, toothpaste, and breath fresheners—as a vital component of daily oral care routines. These converging factors are accelerating the uptake of Halitosis Treatment solutions, thereby significantly boosting the industry's growth

Halitosis Treatment Market Analysis

- Halitosis treatments, including therapeutic mouthwashes, antiseptic rinses, and antimicrobial toothpaste, are increasingly vital components of modern oral healthcare due to their effectiveness in addressing both temporary and chronic bad breath in residential and clinical settings

- The escalating demand for halitosis treatments is primarily fueled by rising awareness of oral hygiene, increasing incidences of periodontal diseases, and a growing preference for non-invasive solutions to improve social and professional interactions

- North America dominated the halitosis treatment market with the largest revenue share of 43.2% in 2024, characterized by early adoption of advanced oral care solutions, high disposable incomes, and a strong presence of key industry players. The U.S. experienced substantial growth in halitosis treatment adoption across pharmacies and dental clinics, driven by increased awareness campaigns and innovations in formulation by established and emerging brands

- Asia-Pacific is expected to be the fastest growing region in the halitosis treatment market during the forecast period, with a projected CAGR of 24.3%, due to increasing urbanization, rising disposable incomes, and growing awareness of oral health in countries such as China, India, and Japan

- The halimeter segment dominated the halitosis treatment market under the diagnostic tests category with a market share of 36.7% in 2024, driven by its accuracy in detecting volatile sulfur compounds (VSCs), which are key indicators of bad breath

Report Scope and Halitosis Treatment Market Segmentation

|

Attributes |

Halitosis Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Halitosis Treatment Market Trends

“Enhanced Convenience Through AI and Personalized Digital Health Integration”

- A significant and accelerating trend in the global halitosis treatment market is the increasing integration of artificial intelligence (AI) and digital health platforms, offering patients more personalized and efficient treatment options. These innovations are enabling smarter diagnostics, targeted therapies, and improved monitoring of treatment outcomes, greatly enhancing patient convenience and compliance

- For instance, AI-powered oral health apps are now capable of analyzing breath composition and identifying volatile sulfur compounds (VSCs), which are the primary cause of halitosis. These tools provide users with real-time feedback and recommendations for customized treatment, including tailored oral hygiene routines and product suggestions.

- Integration with wearable and mobile technologies allows for remote monitoring of oral hygiene habits and breath quality. Smart toothbrushes, for instances, can track brushing duration, pressure, and coverage, sending data to companion apps that analyze trends and suggest improvements, contributing to more effective halitosis management

- Furthermore, digital assistants and telehealth platforms are making it easier for individuals to consult with dental professionals, receive automated reminders for oral care routines, and schedule in-person or virtual visits. This supports better treatment adherence and reduces the burden on traditional healthcare systems

- The seamless integration of AI-driven halitosis solutions into broader wellness ecosystems is transforming the way oral health is managed. Through unified interfaces, users can monitor their breath health alongside other vital parameters such as hydration, nutrition, and gastrointestinal health, offering a comprehensive view of personal well-being

- This trend toward intelligent, intuitive, and digitally connected halitosis treatments is setting new standards in patient care. Consequently, companies such as Rowpar Pharmaceuticals and Colgate-Palmolive are investing in smart oral care technologies that combine AI diagnostics, user-friendly interfaces, and evidence-based formulations for enhanced efficacy and user satisfaction

- The demand for halitosis treatments that integrate seamlessly with AI and personalized digital health platforms is growing rapidly across both consumer and clinical segments, as individuals increasingly prioritize convenience, transparency, and real-time insight in managing their oral health

Halitosis Treatment Market Dynamics

Driver

“Growing Need Due to Rising Awareness and Demand for Oral Hygiene Solutions”

- The increasing prevalence of halitosis (bad breath) among global populations, particularly due to poor oral hygiene, dietary habits, and underlying medical conditions, is a significant driver for the heightened demand for effective halitosis treatments

- For instance, in April 2024, Rowpar Pharmaceuticals, known for its CloSYS brand, announced advancements in chloride dioxide-based formulations, enhancing long-lasting freshness and antibacterial action. Such innovations by key companies are expected to drive the Halitosis Treatment industry growth during the forecast period

- As consumers become more conscious of the social and psychological impact of halitosis, they are actively seeking reliable, safe, and fast-acting treatment solutions—including therapeutic mouthwashes, sugar-free chewing gums, antimicrobial lozenges, and tongue scrapers

- Furthermore, the growing popularity of oral health and wellness products, particularly through e-commerce and online health platforms, is making halitosis treatments more accessible and appealing. Increasing adoption of personalized oral care regimens, often guided by AI-driven apps and dental consultation tools, supports long-term oral freshness and hygiene

- The convenience of over-the-counter availability, clinically validated formulations, and inclusion in daily self-care routines are key factors propelling the uptake of halitosis treatments across both urban and semi-urban consumer segments. The trend towards natural and herbal products, along with innovations in packaging and on-the-go formats, further contributes to market growth

Restraint/Challenge

“Limited Consumer Awareness and Product Misconceptions”

- Limited awareness about the root causes of halitosis and the distinction between temporary bad breath and chronic halitosis can hinder early diagnosis and treatment. Many consumers often misattribute symptoms to poor diet or digestion, delaying effective oral care intervention

- For instance, despite the availability of clinically proven treatments, a significant portion of the population still relies on temporary solutions such as mints or chewing gums, which do not address the underlying bacterial causes of bad breath

- Overcoming this challenge requires sustained consumer education through dental health campaigns, pharmacist guidance, and digital content. Dental professionals play a crucial role in recommending evidence-based halitosis treatments as part of comprehensive oral hygiene routines

- Moreover, in some regions, high-quality halitosis treatment products remain relatively expensive or limited in distribution, particularly in rural or underserved markets. Premium therapeutic formulations, such as those with stabilized chlorine dioxide or zinc compounds, may be perceived as luxury oral care items

- Affordability and accessibility challenges can restrict widespread adoption, especially among cost-conscious consumers. To counter this, companies are increasingly investing in smaller pack sizes, localized branding, and partnerships with dental clinics and pharmacies

- Building trust through clinical validation, accessible pricing, and clearer product labeling—combined with greater consumer education—will be essential for addressing misconceptions and expanding the reach of effective halitosis treatments worldwide

Halitosis Treatment Market Scope

The market is segmented on the basis of diagnostic tests, treatment type, halitosis type, end-users, and distribution channel.

• By Diagnostic Tests

On the basis of diagnostic tests, the halitosis treatment market is segmented into halimeter, gas chromatography, BANA Test, β-Galactosidase activity assay, and others. The halimeter segment accounted for the largest market revenue share of 36.7% in 2024, driven by its widespread use in dental clinics for measuring volatile sulfur compounds (VSCs), the main cause of halitosis. Its portability, ease of use, and non-invasive testing make it the most preferred choice among clinicians.

The gas chromatography segment is expected to witness the fastest CAGR of 7.9% from 2025 to 2032, owing to its high accuracy in detecting multiple VSCs. Though expensive, technological advancements are making this method more accessible for high-end diagnostic labs and research centers.

• By Treatment Type

On the basis of treatment type, the halitosis treatment market is segmented into antiseptics, antacids, ranitidine, cimetidine, and others. The antiseptics segment dominated the market with a revenue share of 41.3% in 2024, attributed to their efficacy in reducing oral bacteria and providing immediate relief from bad breath. Products such as chlorhexidine mouthwashes are commonly prescribed for both temporary and chronic halitosis.

The antacids segment is projected to witness the fastest growth rate of 8.5% from 2025 to 2032, especially among patients with GERD-related halitosis. Rising awareness about gastrointestinal causes of bad breath is boosting demand in this category.

• By Halitosis Type

On the basis of halitosis type, the halitosis treatment market is segmented into pathological halitosis and physiological halitosis. Pathological halitosis held the largest share of 63.8% in 2024, driven by its association with chronic oral conditions such as periodontitis, tonsillitis, and systemic diseases. The growing incidence of these conditions is fueling the demand for targeted treatments and diagnostics.

Physiological halitosis is expected to register the highest CAGR of 6.9% during the forecast period, mainly driven by lifestyle factors such as smoking, fasting, and consumption of specific foods. OTC solutions and awareness campaigns are driving this growth.

• By End-Users

On the basis of end-users, the halitosis treatment market is segmented into hospitals, homecare, specialty centers, and others. Hospitals accounted for the largest revenue share of 39.6% in 2024, due to the availability of advanced diagnostics and professional treatment options. Their role in managing halitosis associated with systemic diseases such as diabetes and liver disorders strengthens their dominance.

The homecare segment is expected to witness the fastest CAGR of 8.1% from 2025 to 2032, supported by the increasing popularity of at-home oral care products and growing demand for non-prescription treatments.

• By Distribution Channel

On the basis of distribution channel, the halitosis treatment market is segmented into hospital pharmacy, online pharmacy, and retail pharmacy. Retail pharmacy dominated with a revenue share of 46.9% in 2024, benefiting from consumer convenience, accessibility, and availability of both OTC and prescription products for bad breath treatment.

The online pharmacy segment is expected to register the fastest CAGR of 9.2% from 2025 to 2032, driven by growing e-commerce adoption, discounts, and the convenience of home delivery, especially in urban areas.

Halitosis Treatment Market Regional Analysis

- North America dominated the halitosis treatment market with the largest revenue share of 43.2% in 2024, driven by rising awareness about oral hygiene, high healthcare expenditure, and the presence of leading pharmaceutical and oral care companies

- Increasing consumer inclination towards over-the-counter (OTC) treatments and diagnostic services for bad breath, along with the growing prevalence of periodontal diseases, supports market expansion in this region

- The region also benefits from strong R&D investments and frequent product launches by key players, including advanced diagnostic tools such as Halimeters and enzymatic assays, which enhance early detection and effective management of halitosis

U.S. Halitosis Treatment Market Insight

The U.S. halitosis treatment market captured the largest revenue share of 79% within North America in 2024, primarily due to the widespread prevalence of lifestyle-related causes of halitosis such as GERD, poor dental hygiene, and smoking. A strong presence of dental care providers, along with growing adoption of advanced diagnostic devices such as Halimeters and β-Galactosidase assays, continues to fuel market growth.

Europe Halitosis Treatment Market Insight

The Europe halitosis treatment market accounted for a revenue share of 28.4% in the global halitosis treatment market in 2024, supported by increasing oral health awareness campaigns, robust healthcare infrastructure, and high adoption of non-invasive treatments. Regulatory initiatives for oral health, aging populations, and growing consumer inclination towards dental aesthetics and hygiene are encouraging higher adoption of both OTC and prescription treatments.

U.K. Halitosis Treatment Market Insight

The U.K. halitosis treatment market is projected to grow at a CAGR of 6.5% from 2025 to 2032, driven by increased healthcare access, rising use of mouthwashes and antiseptics, and a growing number of dental check-ups. The country’s National Health Service (NHS) initiatives promoting dental hygiene, coupled with growing awareness around halitosis as a symptom of systemic illness, are also contributing to market growth.

Germany Halitosis Treatment Market Insight

The Germany halitosis treatment market is expected to register a CAGR of 6.8% during the forecast period, with growing awareness of halitosis linked to gastrointestinal and metabolic disorders. Germany’s emphasis on sustainable and advanced pharmaceutical products, along with a high prevalence of chronic conditions such as diabetes and liver disease, is expected to drive demand for systemic halitosis treatments.

Asia-Pacific Halitosis Treatment Market Insight

The Asia-Pacific halitosis treatment market is expected to grow at the fastest CAGR of 24.3% from 2025 to 2032, attributed to the increasing urbanization, growing dental awareness, and rising disposable incomes in countries such as China, India, and Japan. The presence of a large patient population suffering from poor oral hygiene, rising demand for affordable OTC products, and governmental initiatives promoting oral health are boosting the regional market.

Japan Halitosis Treatment Market Insight

The Japan halitosis treatment market is expanding rapidly, supported by high levels of oral care awareness and a technology-savvy healthcare system. A culturally rooted concern with hygiene and personal care, combined with an aging population that requires frequent oral health evaluations, is encouraging the adoption of both preventive and therapeutic halitosis treatments.

China Halitosis Treatment Market Insight

The China halitosis treatment market captured the largest revenue share in the Asia-Pacific halitosis treatment market in 2024, due to increasing dental service utilization, a growing middle-class population, and a shift in consumer focus toward personal hygiene. The expansion of public health infrastructure, along with strong local manufacturing of oral care products, is expected to further accelerate market growth in the coming years.

Halitosis Treatment Market Share

The halitosis treatment industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Merck & Co., Inc. (U.S.)

- Cipla (U.S.)

- Abbott (U.S.)

- AbbVie Inc. (U.S.)

- Lupin (India)

- Hikma Pharmaceuticals PLC (U.K.)

- Colgate-Palmolive Company (U.S.)

- Rowpar Pharmaceuticals Inc. (U.S.)

- Reckitt Benckiser Group PLC (U.K.)

- Nissha Co., Ltd. (Japan)

- Foramen (Spain)

- Himalaya Wellness Company (India)

Latest Developments in Global Halitosis Treatment Market

- In April 2024, Colgate-Palmolive Company announced the launch of its next-generation Colgate Total Advanced Fresh Gel in North America and Europe. This product is designed specifically to combat halitosis by targeting the volatile sulfur compounds (VSCs) responsible for bad breath. Featuring dual-zinc plus arginine technology, the new formulation provides long-lasting breath protection while promoting gum health. This launch reinforces Colgate’s commitment to innovation in the oral care segment and expands its presence in the global halitosis treatment market

- In March 2024, Rowpar Pharmaceuticals Inc., the maker of TheraBreath, introduced a new line of probiotic oral rinses formulated to support healthy oral flora and reduce the recurrence of halitosis. These products are aimed at consumers seeking holistic and preventive care solutions. This move aligns with the growing consumer preference for natural, microbiome-friendly formulations and enhances Rowpar’s product portfolio in the premium halitosis treatment category

- In February 2024, Reckitt Benckiser Group PLC expanded its Listerine Smart Rinse portfolio in the Asia-Pacific region, integrating advanced enzymatic neutralizers and anti-microbial agents targeted at individuals with chronic halitosis. The expansion leverages increasing demand for specialized oral care products in emerging markets, particularly India and Southeast Asia, and highlights Reckitt's strategy to localize product innovation based on regional oral health needs

- In January 2024, F. Hoffmann-La Roche Ltd. launched a pilot program in collaboration with dental clinics across Germany to integrate its Halimeter X500 device into routine oral check-ups. The device offers real-time analysis of VSC levels, enabling accurate halitosis diagnosis and customized treatment plans. This initiative is expected to significantly advance diagnostic capabilities in the clinical halitosis segment and promote Roche's position as a diagnostic leader

- In December 2023, Abbott introduced a novel enzymatic rinse under its Sensodent brand line, combining antacids and antibacterial compounds to target halitosis originating from gastrointestinal issues. The product is tailored for patients whose bad breath stems from acid reflux and other digestive conditions. With this launch, Abbott addresses the growing need for cross-disciplinary treatments that bridge gastroenterology and dental health

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.