Global Hammer Mill Market

Market Size in USD Billion

CAGR :

%

USD

3.40 Billion

USD

5.22 Billion

2024

2032

USD

3.40 Billion

USD

5.22 Billion

2024

2032

| 2025 –2032 | |

| USD 3.40 Billion | |

| USD 5.22 Billion | |

|

|

|

|

Hammer Mill Market Size

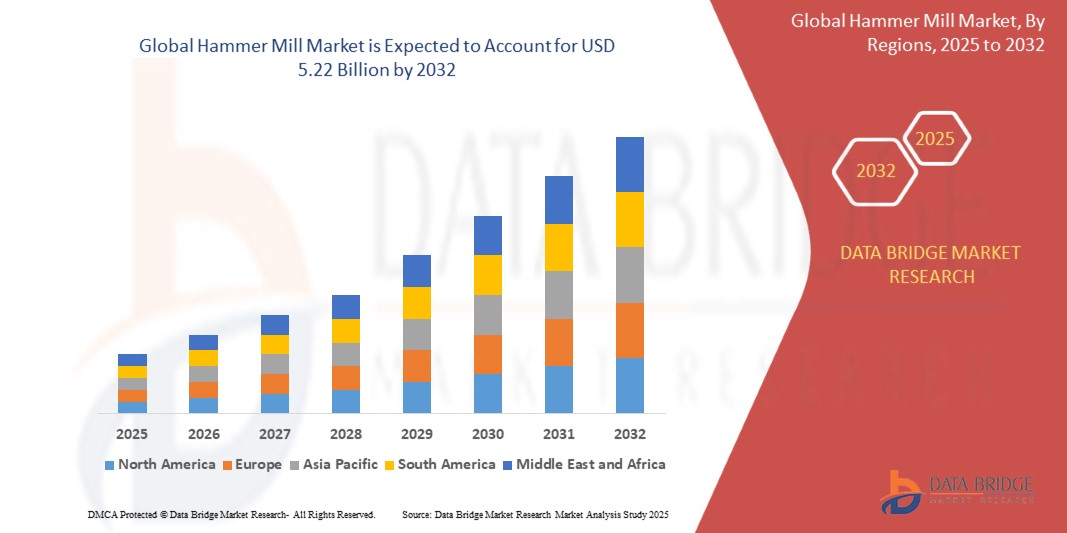

- The global hammer mill market size was valued at USD 3.40 billion in 2024 and is expected to reach USD 5.22 billion by 2032, at a CAGR of 5.5% during the forecast period

- The market growth is largely fueled by the increasing demand for efficient size reduction equipment across industries such as food & feed, agriculture, mining, and recycling, supported by advancements in hammer mill designs that enhance productivity and reduce energy consumption

- Furthermore, rising adoption of automated and high-capacity hammer mills in large-scale processing plants is driving significant growth, as industries seek reliable, flexible, and cost-effective solutions for grinding, powder production, and recycling applications

Hammer Mill Market Analysis

- Hammer mills are mechanical size reduction machines that crush and grind materials using high-speed rotating hammers, making them vital in industries such as energy, agriculture, mining, pharmaceuticals, food, and recycling

- The escalating demand for hammer mills is primarily driven by their versatility, ability to handle diverse materials, and growing integration of modular, automated designs that enhance efficiency, safety, and sustainability across industrial applications

- North America dominated the hammer mill market in 2024, due to strong demand from the metals & mining, food & feed, and recycling industries

- Asia-Pacific is expected to be the fastest growing region in the hammer mill market during the forecast period due to rapid industrialization, growing demand in agriculture and feed processing, and expansion of mining activities

- Heavy duty hammer mills segment dominated the market with a market share of 42.6% in 2024, due to their ability to process bulk quantities of materials at high throughput levels. These mills are widely deployed in mining, metal processing, and large-scale recycling facilities where robust construction and long service life are critical. Their efficiency in reducing hard and abrasive materials ensures consistent performance, making them indispensable in industrial-scale operations

Report Scope and Hammer Mill Market Segmentation

|

Attributes |

Hammer Mill Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hammer Mill Market Trends

Rising Demand for Agricultural Products

- The increasing demand for processed agricultural products across both developed and emerging economies is significantly driving the adoption of hammer mills. As these machines are extensively used for grinding grains, crushing crop residues, and preparing feed, the growth of agricultural production directly supports market expansion

- For instance, Bühler Group, a leading provider of processing equipment, has introduced advanced hammer mills equipped with improved energy efficiency and precision grinding technology to cater to the growing agricultural processing needs. Their solutions are widely used in feed mills and grain processing facilities

- The accelerating trend of mechanization in agriculture is further boosting hammer mill adoption. Farmers and processing companies are increasingly investing in modern machinery to enhance efficiency, lower labor dependence, and increase output quality, leading to greater reliance on equipment such as hammer mills

- The rising popularity of multifunctional hammer mills that allow flexibility in handling diverse raw materials such as soybeans, maize, grains, and biomass is reshaping the industry. These adaptable machines are becoming critical to meeting the varied demands of agricultural producers and feed manufacturers

- In addition, the growing focus on sustainable biomass energy is creating new opportunities for hammer mills in the processing of woody biomass, crop residues, and organic waste into usable fuels or raw material for energy production. This is expanding the market beyond traditional agricultural processing

- Technological advancements in hammer mill design, such as the integration of automated controls, dust management systems, and noise reduction features, are enhancing user adoption. These innovations are improving product efficiency and are also aligning with regulatory standards on safety and environmental sustainability

Hammer Mill Market Dynamics

Driver

Expansion of the Livestock and Poultry Industry

- The growth of global livestock and poultry production is creating a strong demand for animal feed, and hammer mills are at the center of feed processing due to their effectiveness in grinding grains and producing uniform feed particles. This sectoral growth directly translates into higher sales for hammer mills

- For instance, Andritz AG has strengthened its feed and biofuel segment by offering high-capacity hammer mills catered specifically to the production of livestock and poultry feed. Their solutions enhance feed quality while improving cost-efficiency, making them valuable to large-scale feed producers

- The increasing demand for protein-rich diets is pushing the global consumption of meat, poultry, and dairy products, which requires efficient feed production. Hammer mills are gaining importance in this space as their role in feed milling ensures consistent nutritional value across rations for livestock and poultry

- In addition, the rising trend of industrial-scale poultry and cattle farming is shaping investments in high-capacity feed plants where hammer mills establish themselves as indispensable machinery for large volumes of material processing

- Manufacturers providing customized hammer mills that can optimize feed formulations according to different nutritional requirements are also contributing to market growth, as this flexibility allows feed producers to adapt to regional or species-specific demands

Restraint/Challenge

High Initial Investment

- One of the key restraints hindering the widespread adoption of hammer mills is the relatively high cost of acquisition, especially for small and mid-sized enterprises or farms. The initial expenditure for high-capacity or technologically advanced hammer mills often remains a barrier to entry

- For instance, smaller agricultural operations find it challenging to invest in advanced hammer mills offered by global suppliers such as Bühler or Andritz, as the upfront costs tend to limit feasibility despite the machines’ long-term efficiency benefits

- The cost challenge is further intensified by additional expenses linked to installation, maintenance, and regular operational upkeep, which discourages smaller agribusinesses from opting for modern hammer mills over less sophisticated alternatives

- In addition, the limited access to financing in several developing regions reduces the investment capability of small-scale farmers and feed processors. This poses a hurdle to the modernization of equipment and results in slower adoption rates in such markets

- The risk perception associated with high-cost machinery also plays a role, as farmers and smaller processors remain reluctant to invest in hammer mills unless there is guaranteed consistency in demand and profitability, thereby slowing down overall market growth

Hammer Mill Market Scope

The market is segmented on the basis of type, capacity, speed, application, and end-user.

• By Type

On the basis of type, the hammer mill market is segmented into reversible hammer mills, non-reversible hammer mills, up running hammer mills, down running hammer mills, and automatic hammer mills. The reversible hammer mills segment dominated the largest market share in 2024, as they offer extended lifespan of hammers by allowing rotation of rotor direction. Their efficiency in handling abrasive materials and cost-effectiveness in terms of maintenance make them highly preferred in industries such as mining and recycling. The ability to achieve consistent particle size reduction further strengthens their adoption across heavy-duty industrial applications.

The automatic hammer mills segment is expected to witness the fastest growth from 2025 to 2032, driven by rising demand for automation in material processing industries. With features such as digital control, programmable settings, and reduced labor dependency, automatic hammer mills are gaining traction across food, feed, and pharmaceutical sectors. Their precision, energy efficiency, and reduced operational downtime position them as the preferred choice in modern production facilities focusing on high output and quality consistency.

• By Capacity

On the basis of capacity, the hammer mill market is categorized into light duty hammer mills, medium duty hammer mills, and heavy duty hammer mills. The heavy duty hammer mills segment held the largest share of 42.6% in 2024, owing to their ability to process bulk quantities of materials at high throughput levels. These mills are widely deployed in mining, metal processing, and large-scale recycling facilities where robust construction and long service life are critical. Their efficiency in reducing hard and abrasive materials ensures consistent performance, making them indispensable in industrial-scale operations.

The medium duty hammer mills segment is anticipated to register the fastest growth during 2025–2032, supported by their versatility and affordability for mid-sized processing facilities. They are increasingly being used in agriculture, chemicals, and food processing industries where medium-scale output is sufficient. Their balance between cost, performance, and flexibility makes them appealing for emerging markets and SMEs looking for efficient material handling solutions without heavy capital investment.

• By Speed

On the basis of speed, the hammer mill market is segmented into upto 1 ton/hr, 1 to 3 ton/hr, 3 to 6 ton/hr, 6 to 10 ton/hr, 10 to 50 tons/hr, 50 to 150 tons/hr, 150 to 300 tons/hr, and above 300 tons/hr. The 10 to 50 tons/hr segment dominated the market in 2024, as it represents the most widely used range across large industrial applications. This capacity suits diverse sectors such as mining, agriculture, and energy, where moderate-to-large scale material processing is required with efficiency. The segment’s ability to handle bulk loads while maintaining output consistency has established it as a preferred choice in high-demand environments.

The above 300 tons/hr segment is projected to experience the fastest CAGR between 2025 and 2032, as demand rises for large-scale production in mining, energy, and heavy-duty recycling industries. Growing industrialization, particularly in emerging economies, is driving the adoption of high-capacity hammer mills to reduce material processing time. Their ability to meet large-volume requirements with lower operational costs per unit makes them increasingly attractive for enterprises aiming for economies of scale.

• By Application

On the basis of application, the hammer mill market is segmented into powder production, material size reduction, grinding, scrapping & recycling process, mixing, and others. The material size reduction segment accounted for the largest market share in 2024, as it serves as the core application of hammer mills across industries. Its critical role in producing uniform particle sizes for downstream processing in food, feed, chemicals, and pharmaceuticals underpins its dominance. Industries value hammer mills for their versatility, efficiency, and reliability in converting raw materials into desired forms for further use.

The scrapping & recycling process segment is expected to register the highest growth during 2025–2032, driven by increasing global emphasis on sustainability and resource recovery. Hammer mills are widely employed in metal recycling, e-waste management, and scrap processing for their ability to break down complex materials into reusable components. Rising adoption of circular economy principles and stricter waste management regulations are accelerating the demand for hammer mills in this application area.

• By End-user

On the basis of end-user, the hammer mill market is segmented into energy & power, agriculture, chemicals, scrap recycling, pharmaceuticals, metals & mining, food & feed, and others. The metals & mining segment held the dominant share in 2024, owing to the extensive use of hammer mills in crushing ores, minerals, and rocks. Their capacity to handle tough, abrasive materials with high efficiency makes them indispensable in mineral processing plants. The growing global demand for metals and minerals for construction, manufacturing, and energy industries reinforces the segment’s dominance.

The scrap recycling segment is projected to grow at the fastest rate between 2025 and 2032, as industries increasingly adopt recycling to reduce environmental impact and raw material costs. Hammer mills are particularly effective in processing scrap metals, electronic waste, and industrial residues, supporting recovery of valuable resources. Government initiatives promoting recycling, combined with advancements in hammer mill technology for high-efficiency scrap processing, are propelling growth in this segment.

Hammer Mill Market Regional Analysis

- North America dominated the hammer mill market with the largest revenue share in 2024, driven by strong demand from the metals & mining, food & feed, and recycling industries

- The region benefits from a mature industrial base, advanced processing technologies, and widespread adoption of heavy-duty machinery

- High focus on efficient material size reduction, combined with increasing investments in recycling infrastructure, continues to fuel hammer mill deployment. In addition, growing demand for feed processing equipment in the livestock sector further supports market expansion

U.S. Hammer Mill Market Insight

The U.S. hammer mill market captured the largest revenue share in 2024 within North America, supported by large-scale mining operations, well-established agriculture and feed industries, and advanced waste recycling initiatives. Rising demand for high-capacity hammer mills in mineral processing plants and increased investments in biofuel production drive market growth. Moreover, technological advancements in automated hammer mills and strong adoption across pharmaceuticals and food processing industries further strengthen the U.S. market.

Europe Hammer Mill Market Insight

The Europe hammer mill market is projected to grow at a significant CAGR during the forecast period, largely driven by stringent environmental regulations and a strong emphasis on recycling and sustainable manufacturing. Growing adoption of hammer mills in waste management, metal recycling, and feed processing industries underpins the region’s expansion. Increasing modernization of agricultural practices and rising demand for efficient grinding and size reduction solutions across chemicals and pharmaceuticals also fuel growth.

U.K. Hammer Mill Market Insight

The U.K. hammer mill market is anticipated to expand at a notable CAGR during the forecast period, primarily due to growing investments in recycling infrastructure and the agricultural feed industry. Rising concerns over waste management and sustainability are encouraging industries to adopt hammer mills for scrap processing and resource recovery. In addition, technological upgrades in milling equipment and the country’s push towards eco-friendly solutions further accelerate adoption.

Germany Hammer Mill Market Insight

The Germany hammer mill market is expected to witness substantial growth, fueled by the nation’s robust industrial base and strong emphasis on technological innovation. With a well-developed mining and metal processing sector, demand for heavy-duty hammer mills remains high. Germany’s strict recycling policies and sustainability goals are also driving adoption in waste management and energy recovery applications. Furthermore, increasing automation and integration of hammer mills in advanced manufacturing setups contribute to market growth

Asia-Pacific Hammer Mill Market Insight

The Asia-Pacific hammer mill market is poised to record the fastest CAGR from 2025 to 2032, driven by rapid industrialization, growing demand in agriculture and feed processing, and expansion of mining activities. Countries such as China, India, and Japan are witnessing rising adoption of hammer mills due to their broad application in food processing, recycling, and material size reduction. The region’s role as a global manufacturing hub, coupled with supportive government initiatives in infrastructure and industrial expansion, accelerates market penetration.

Japan Hammer Mill Market Insight

The Japan hammer mill market is experiencing steady growth, supported by technological advancements, urbanization, and rising demand for eco-friendly processing equipment. Japan’s strong focus on efficiency, sustainability, and automation is driving adoption across food, feed, and recycling industries. In addition, the pharmaceutical sector is increasingly deploying precision hammer mills for particle size control, while the country’s advanced engineering capabilities ensure continuous innovation.

China Hammer Mill Market Insight

The China hammer mill market accounted for the largest revenue share in Asia-Pacific in 2024, owing to its vast mining operations, expanding agriculture and feed industries, and strong domestic manufacturing base. The country’s rapid urbanization and infrastructure development have boosted demand for high-capacity hammer mills in construction, energy, and recycling sectors. China’s push towards circular economy practices, along with availability of cost-effective equipment from local manufacturers, continues to strengthen its leadership in the regional market.

Hammer Mill Market Share

The hammer mill industry is primarily led by well-established companies, including:

- Hosokawa Micron Powder Systems (U.S.)

- Andritz (Austria)

- Bühler Group (Switzerland)

- Schenck Process Holding GmbH (Germany)

- Hosokawa Micron Corp (Japan)

- L.B. Bohle Maschinen & Verfahren GmbH (Germany)

- NSK Lessine (France)

- Filtra Vibración, S.L. (Spain)

- NETZSCH Group (Germany)

- Palamatic Process (France)

- POITTEMILL FORPLEX (France)

- Prater Industries, Inc. (U.S.)

Latest Developments in Global Hammer Mill Market

- In March 2025, ReThink Milling Inc. received a USD 1 million award for its Conjugate Anvil Hammer Mill (CAHM) and MonoRoll technologies, recognized for delivering superior milling efficiency, significantly reduced energy use, and lower greenhouse gas emissions—especially in mining operations. This recognition underscores the industry's shift toward sustainable, eco-friendly milling solutions, aligning with growing demand from mining and heavy industries for greener processing technologies

- In 2025, the 100–500 kg/h capacity segment emerged as the largest contributor to the global hammer mill market, capturing an estimated 35% share, while gravity discharge hammer mills dominated the product type category with around 40% market share. These insights reflect heightened demand for versatile mid-sized mills, offering SME-friendly throughput and operational efficiency, and the continued preference for gravity discharge models known for simplicity, low maintenance, and cost-effectiveness across industries such as agriculture, recycling, and biomass

- In May 2024, Schenck Process Food and Performance Materials (FPM) was officially rebranded as Coperion, following its acquisition by Hillenbrand, Inc. in September 2023. This name transition unified the business under a globally recognized brand, enabling integrated offerings and expanded technological capabilities in grinding and processing solutions. This strategic integration is expected to strengthen market positioning, enhance R&D synergies, and deliver a more comprehensive hammer mill portfolio to customers across industries

- In October 2023, CPM (California Pellet Mill) introduced a new HM Series Hammer Mill constructed from carbon steel and high-density framing, designed for continuous 24-hour operation in demanding environments. Tailored for processing animal feed, fish feed, ethanol, and grains, this durable model delivers energy-efficient performance with minimized noise and vibration. This launch addresses industrial needs for robust, low-maintenance milling solutions in high-demand feed and biofuel production facilities

- In November 2022, Bühler launched the Granulex 5 series, a next-generation hammer mill featuring a groundbreaking modular design that delivers 10–30% energy reduction per ton, a 10% capacity increase, and 50% faster screen changeovers—all while maintaining top-tier product quality and safety. The innovation enhances operational efficiency, cuts energy and maintenance costs, and offers digital connectivity, boosting adoption among food, feed, and pharmaceutical processors seeking flexible, high-throughput grinding solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hammer Mill Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hammer Mill Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hammer Mill Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.