Global Hams Market

Market Size in USD Billion

CAGR :

%

USD

26.26 Billion

USD

39.84 Billion

2025

2033

USD

26.26 Billion

USD

39.84 Billion

2025

2033

| 2026 –2033 | |

| USD 26.26 Billion | |

| USD 39.84 Billion | |

|

|

|

|

Global Hams Market Size

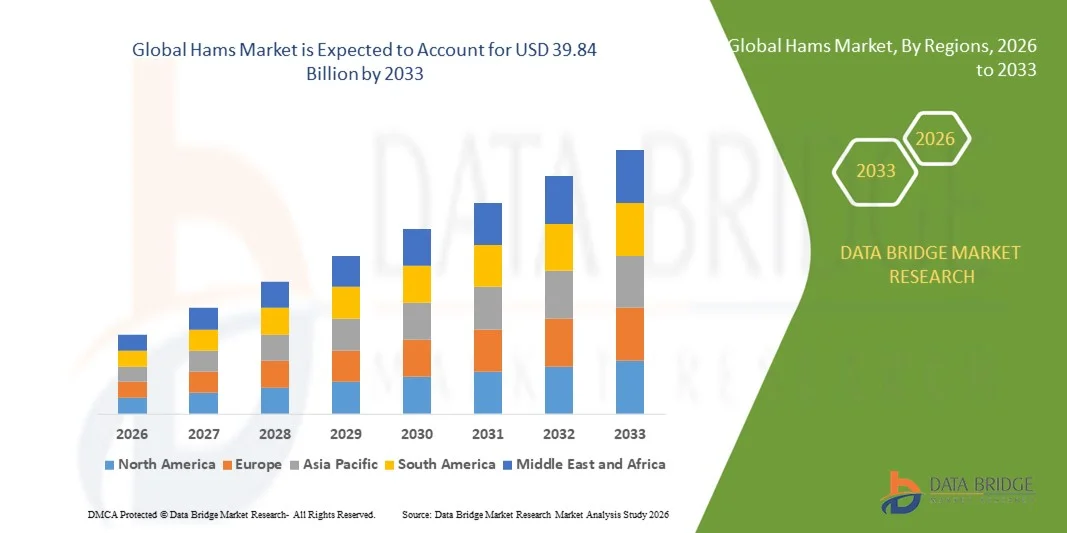

- The global Hams Market size was valued at USD 26.26 billion in 2025 and is projected to reach USD 39.84 billion by 2033, growing at a CAGR of 5.35% during the forecast period.

- The market expansion is primarily driven by increasing consumer demand for premium, ready-to-eat meat products, coupled with rising disposable incomes and changing dietary preferences across emerging economies.

- Additionally, growing popularity of processed and convenience foods, advancements in meat preservation and packaging technologies, and rising adoption of high-protein diets are fostering substantial growth in the global hams industry.

Global Hams Market Analysis

- Hams, offering premium cured and processed meat products, are becoming increasingly popular in both residential and commercial food sectors due to their rich flavor, long shelf life, and versatility across a wide range of culinary applications in global cuisines.

- The growing demand for hams is primarily fueled by the rising consumption of ready-to-eat and convenience foods, increasing disposable incomes, and shifting consumer preferences toward high-protein, gourmet, and value-added meat products.

- North America dominated the Global Hams Market with the largest revenue share of 35.5% in 2025, supported by strong consumer demand for premium meat products, established cold chain infrastructure, and the presence of key industry players focusing on innovative flavor profiles and sustainable sourcing.

- Asia-Pacific is expected to be the fastest-growing region in the Global Hams Market during the forecast period, driven by rapid urbanization, rising middle-class populations, and increasing adoption of Western food trends across countries such as China, Japan, and South Korea.

- The air-dried cured hams segment dominated the market with the largest revenue share of 56.4% in 2025, attributed to their premium positioning, artisanal processing methods, and rich flavor profiles.

Report Scope and Global Hams Market Segmentation

|

Attributes |

Hams Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Hams Market Trends

Premiumization and Product Innovation in Processed Meats

- A significant and accelerating trend in the Global Hams Market is the growing focus on premiumization and continuous product innovation, driven by evolving consumer preferences for high-quality, flavorful, and convenient meat products. Manufacturers are increasingly investing in advanced curing, smoking, and flavor-enhancement techniques to create distinctive offerings that appeal to gourmet and health-conscious consumers.

- For instance, leading brands such as Smithfield Foods and Danish Crown have introduced premium dry-cured and organic ham varieties that emphasize natural ingredients, reduced sodium content, and sustainable sourcing. Similarly, Hormel Foods and Campofrío are expanding their portfolios with ready-to-eat and portion-controlled ham products tailored for busy lifestyles.

- Innovation in processing technologies, including vacuum packaging and cold-chain logistics, ensures longer shelf life and superior freshness, while new flavor infusions such as herb-seasoned, honey-glazed, and truffle-infused hams are gaining traction among consumers seeking unique taste experiences.

- The increasing popularity of artisan and region-specific hams, such as Spanish Jamón Ibérico and Italian Prosciutto di Parma, further reflects a shift toward authenticity and premium culinary experiences. These products are often marketed as luxury delicacies, appealing to both domestic and international gourmet markets.

- This ongoing emphasis on product differentiation, quality assurance, and sustainability is reshaping the competitive landscape of the global hams industry. Companies are leveraging innovation not only to enhance taste and texture but also to align with clean-label and ethical consumption trends.

- The demand for premium, value-added ham products is expected to grow rapidly across both retail and foodservice channels, as consumers increasingly associate high-quality processed meats with indulgence, convenience, and superior nutrition.

Global Hams Market Dynamics

Driver

Growing Demand Driven by Changing Lifestyles and Rising Protein Consumption

- The increasing shift toward convenient, protein-rich, and ready-to-eat food options, along with changing dietary habits and busy modern lifestyles, is a key driver fueling the growth of the Global Hams Market. Consumers are seeking nutritious yet convenient meal solutions, and ham products—being versatile, flavorful, and rich in protein—are meeting this growing demand.

- For instance, in March 2025, Hormel Foods Corporation expanded its product line with a new range of low-sodium, nitrate-free hams, targeting health-conscious consumers looking for balanced nutrition without compromising on taste. Such strategic product innovations by key players are expected to drive the industry’s expansion during the forecast period.

- As consumers increasingly prioritize high-quality, clean-label, and sustainably sourced meat products, manufacturers are enhancing their offerings with organic certifications, reduced preservatives, and transparent ingredient labeling. These efforts resonate strongly with global consumers who value health and authenticity in their food choices.

- Furthermore, the growing popularity of Western-style cuisines and increased adoption of ready-to-cook and deli meat products in emerging markets are accelerating market penetration. Hams are also becoming a staple in quick-service restaurants (QSRs) and foodservice chains, contributing significantly to global consumption growth.

- The convenience of pre-sliced and packaged ham, coupled with innovations in vacuum-sealing and refrigeration technologies, allows consumers to enjoy fresh, high-quality meat products with extended shelf life. These advancements, along with broader retail availability, continue to strengthen market accessibility across regions.

Restraint/Challenge

Health Concerns and Price Sensitivity in Developing Markets

- Health-related concerns surrounding high sodium content, preservatives, and processed meat consumption present notable challenges to the broader growth of the hams industry. Increasing consumer awareness of links between excessive processed meat intake and potential health risks has prompted many to seek alternative protein sources such as poultry, seafood, or plant-based products.

- For instance, reports from health organizations have influenced some consumers—particularly in developed regions—to moderate their consumption of cured and processed meats, impacting short-term demand for traditional ham products.

- Addressing these challenges requires producers to focus on health-oriented innovations, including low-sodium, nitrite-free, and organic ham varieties, as well as clear labeling and responsible marketing to rebuild consumer trust. Leading brands such as Danish Crown and Smithfield Foods are already investing in healthier product formulations to align with evolving consumer expectations.

- Additionally, the premium pricing of high-quality ham products, due to rising production and raw material costs, can limit affordability and market penetration in developing regions. Price-sensitive consumers often opt for lower-cost meat alternatives, constraining overall market expansion.

- Overcoming these barriers through cost-efficient production methods, wider product diversification, and consumer education on the nutritional value of ham will be essential to sustaining long-term market growth and competitiveness.

Global Hams Market Scope

Hams market is segmented on the basis of product type, applications and distribution channel.

- By Product Type

On the basis of product type, the Global Hams Market is segmented into air-dried cured hams and smoked hams. The air-dried cured hams segment dominated the market with the largest revenue share of 56.4% in 2025, attributed to their premium positioning, artisanal processing methods, and rich flavor profiles. Products such as Jamón Ibérico and Prosciutto di Parma are gaining popularity among consumers seeking authentic, gourmet meat experiences. Their longer shelf life and strong demand in foodservice and luxury retail sectors further strengthen their dominance.

The smoked hams segment is expected to witness the fastest CAGR from 2026 to 2033, driven by growing global preference for convenient, ready-to-eat protein products and the increasing use of smoked hams in sandwiches, salads, and quick-service meals. The segment’s versatility, affordability, and appeal across diverse cuisines make it a key growth driver in both developed and emerging markets.

- By Applications

On the basis of application, the Global Hams Market is segmented into supermarkets and hypermarkets, independent retailers, convenience stores, specialist retailers, and online retailers. The supermarkets and hypermarkets segment dominated the market with a revenue share of 47.8% in 2025, owing to their extensive product variety, frequent promotional activities, and established cold storage infrastructure that supports the sale of fresh and packaged hams. These large retail outlets serve as the primary distribution point for branded and premium ham products.

The online retailers segment is projected to record the fastest CAGR from 2026 to 2033, fueled by the rapid expansion of e-commerce platforms, growing consumer preference for home delivery, and digital marketing strategies adopted by leading meat brands. Enhanced packaging for temperature-controlled deliveries and subscription-based meat boxes are further accelerating online sales growth globally.

- By Distribution Channel

On the basis of distribution channel, the Global Hams Market is bifurcated into online and offline channels. The offline segment dominated the market with the largest revenue share of 68.9% in 2025, supported by the strong presence of physical retail stores, delis, and butcher shops that provide personalized customer service and immediate product availability. Consumers often prefer offline purchases for fresh and premium hams, benefiting from in-store promotions and tasting experiences.

The online segment is expected to witness the fastest growth from 2026 to 2033, driven by the increasing adoption of digital retail platforms, improved cold-chain logistics, and the convenience of doorstep delivery. The proliferation of online grocery services and partnerships between meat producers and e-commerce platforms are reshaping the distribution landscape, offering consumers broader access to specialty and imported ham products worldwide.

Global Hams Market Regional Analysis

- North America dominated the Global Hams Market with the largest revenue share of 35.5% in 2025, driven by a strong consumer preference for high-quality processed meats, rising consumption of ready-to-eat and convenience food products, and the presence of well-established food processing companies.

- Consumers in the region highly value the premium quality, authentic flavor, and nutritional benefits of ham products, with growing demand for organic, low-sodium, and nitrite-free varieties reflecting increased health awareness.

- This strong market presence is further supported by high disposable incomes, a mature retail infrastructure, and a thriving foodservice industry, which includes restaurants, delis, and quick-service chains. Together, these factors make North America a leading market for both traditional and premium ham products, establishing the region as a key hub for innovation and consumption within the global hams industry.

U.S. Hams Market Insight

The U.S. hams market captured the largest revenue share of 81% in 2025 within North America, driven by the country’s strong meat consumption culture and increasing demand for premium, ready-to-eat, and high-protein products. Consumers are increasingly favoring organic, low-sodium, and nitrate-free hams, reflecting heightened health awareness. The rapid expansion of quick-service restaurants (QSRs), deli chains, and packaged food retailing continues to support the market. Moreover, innovation in flavor profiles, packaging, and sustainable sourcing is further propelling the growth of the U.S. hams industry.

Europe Hams Market Insight

The Europe hams market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the region’s rich culinary tradition and strong preference for artisanal and cured meat products. Strict food quality regulations and a growing appetite for premium, region-specific hams such as Prosciutto di Parma and Jamón Ibérico are fueling demand. Rising urbanization, increasing demand for convenience foods, and the integration of hams in gourmet and fine dining establishments are further strengthening the market across both Western and Eastern Europe.

U.K. Hams Market Insight

The U.K. hams market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by changing consumer lifestyles, increasing demand for ready-to-eat and packaged protein foods, and growing interest in premium imported hams. Rising health awareness has prompted consumers to opt for leaner and reduced-sodium options, while festive seasons and culinary traditions sustain high seasonal demand. The expansion of supermarkets, online retailing, and foodservice outlets continues to stimulate market growth.

Germany Hams Market Insight

The Germany hams market is expected to expand at a considerable CAGR during the forecast period, fueled by strong domestic production of cured and smoked hams such as Black Forest ham and rising consumer interest in traditional, high-quality meat products. Germany’s emphasis on sustainability, food safety, and clean-label formulations supports demand for locally sourced and minimally processed options. Additionally, technological innovations in meat processing and packaging are enhancing product shelf life and flavor retention, contributing to steady market expansion.

Asia-Pacific Hams Market Insight

The Asia-Pacific hams market is poised to grow at the fastest CAGR of 24% during 2026–2033, driven by rising disposable incomes, rapid urbanization, and increasing Western dietary influence in countries such as China, Japan, and South Korea. The growing popularity of convenience foods, breakfast meats, and imported premium hams is boosting demand across both retail and foodservice channels. Additionally, advancements in cold chain logistics and expanding e-commerce grocery platforms are making hams more accessible to consumers in emerging economies.

Japan Hams Market Insight

The Japan hams market is gaining momentum due to the country’s affinity for premium, high-quality, and packaged meat products. The demand for hams is being driven by the rise of Western-style dining, a growing preference for ready-to-eat meals, and an emphasis on taste and texture innovation. Japan’s aging population also contributes to the demand for convenient, easy-to-consume protein options. Additionally, strong domestic brands and collaborations with European producers are enhancing product variety and market growth.

China Hams Market Insight

The China hams market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s rapid urbanization, expanding middle class, and evolving dietary preferences. China has a long-standing tradition of producing regional specialties such as Jinhua ham, while imported European hams are also gaining traction among affluent consumers. The growing demand for ready-to-eat meat snacks, coupled with strong domestic manufacturing and expanding cold storage infrastructure, is propelling market growth. Government support for food processing modernization and export-oriented meat production further enhances China’s leadership in the Asia-Pacific hams market.

Global Hams Market Share

The Hams industry is primarily led by well-established companies, including:

• Smithfield Foods, Inc. (U.S.)

• Hormel Foods Corporation (U.S.)

• JBS S.A. (Brazil)

• Danish Crown A/S (Denmark)

• Campofrío Food Group (Spain)

• BRF S.A. (Brazil)

• Mangalica Co. (Hungary)

• Nature’s Reserve (U.K.)

• Frigorífico Concepción (Chile)

• MG Foods (U.S.)

• Marfrig Global Foods (Brazil)

• Herta (Germany)

• Melita Foods (Italy)

• Santa Catarina Alimentos (Brazil)

• Puratos Group (Belgium)

• Alba Group (Italy)

• Pursey Foods (U.S.)

• Acorn Foods (U.K.)

• San Rafael Foods (Argentina)

• Traditions of Spain (Spain)

What are the Recent Developments in Global Hams Market?

- In April 2024, Smithfield Foods, Inc., a global leader in pork production and processing, announced a strategic investment in sustainable ham production facilities in Spain, aimed at reducing carbon emissions and enhancing supply chain efficiency. This initiative reflects Smithfield’s commitment to environmental stewardship and responsible sourcing while meeting the rising global demand for premium cured meats. By leveraging advanced curing technologies and sustainable practices, the company continues to reinforce its leadership position in the rapidly expanding Global Hams Market.

- In March 2024, Danish Crown A/S, one of Europe’s largest meat processing companies, launched its “Pure Taste” line of nitrate-free and organic hams, targeting health-conscious consumers seeking cleaner label options. The new product range emphasizes natural ingredients, reduced sodium content, and traceable sourcing, aligning with global wellness trends. This launch underlines Danish Crown’s strategy to innovate within the premium ham category while maintaining its reputation for quality and craftsmanship.

- In March 2024, Hormel Foods Corporation unveiled a state-of-the-art research and innovation center in Minnesota, dedicated to developing new protein-rich and ready-to-eat ham products. The facility focuses on exploring advanced curing techniques, flavor innovation, and sustainable packaging solutions to cater to evolving consumer preferences. This development highlights Hormel’s continuous investment in product innovation and its focus on strengthening its premium processed meat portfolio.

- In February 2024, Campofrío Food Group announced a strategic partnership with Carrefour to launch a new range of gourmet hams under the “Selecta” label, exclusively available across Carrefour’s European stores. The collaboration aims to enhance accessibility to authentic Spanish hams and expand Campofrío’s retail footprint. This partnership underscores the brand’s commitment to delivering premium-quality, traditionally crafted ham products to a broader consumer base.

- In January 2024, JBS S.A., one of the world’s largest food companies, introduced its “Swift Premium Smoked Ham Series” at the International Food Expo 2024 in Chicago. This innovative product line offers ready-to-eat, naturally smoked hams made with minimal preservatives and advanced flavor-retention techniques. The launch showcases JBS’s dedication to combining modern food processing technologies with traditional culinary excellence, catering to both retail and foodservice segments seeking high-quality, convenient meat solutions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hams Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hams Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hams Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.