Global Hand Dryers Market

Market Size in USD Billion

CAGR :

%

USD

1.28 Billion

USD

2.46 Billion

2024

2032

USD

1.28 Billion

USD

2.46 Billion

2024

2032

| 2025 –2032 | |

| USD 1.28 Billion | |

| USD 2.46 Billion | |

|

|

|

|

Hand Dryers Market Size

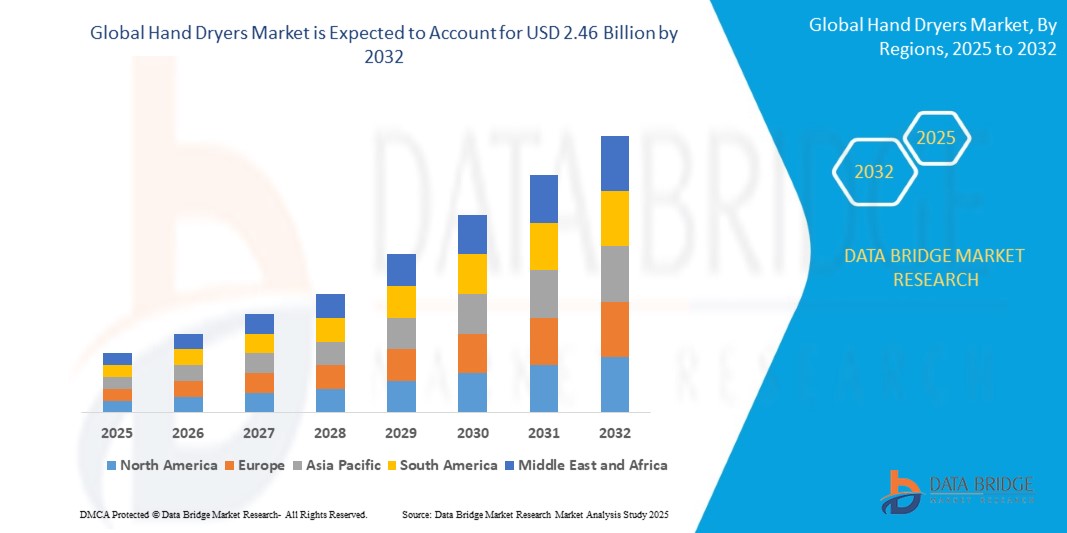

- The global Hand Dryers market size was valued at USD 1.28 billion in 2024 and is expected to reach USD 2.46 billion by 2032, at a CAGR of 8.50% during the forecast period

- This growth is driven by increasing emphasis on hygiene and sustainability in public and commercial facilities, coupled with rising awareness of energy-efficient and eco-friendly solutions in response to global environmental concerns. The growing adoption of touchless hand dryers, particularly in high-traffic areas like airports, malls, and hospitals, is a key factor propelling market expansion.

- Advancements in hand dryer technologies, such as high-speed jet air systems, noise reduction features, and IoT-enabled maintenance capabilities, are further fueling demand, especially in smart buildings and green infrastructure projects across developed and emerging markets.

Hand Dryers Market Analysis

- Hand dryers are electric devices designed to dry hands quickly and hygienically by blowing warm or high-speed air, commonly used in public restrooms to replace paper towels, reduce waste, and improve hygiene. These devices are critical in commercial, institutional, and industrial settings, with growing adoption in residential applications due to sustainability trends.

- The market is propelled by the global push for sustainable practices, with hand dryers reducing paper towel usage by up to 90% in commercial facilities, aligning with environmental regulations like the EU’s Circular Economy Action Plan. The global commercial real estate market, valued at USD 1.1 trillion in 2023, drives demand for energy-efficient hand dryers in new and retrofitted buildings.

- The integration of advanced technologies, such as touchless sensors, HEPA filters, and IoT-enabled diagnostics, is transforming the market by offering faster drying times, improved hygiene, and predictive maintenance capabilities. These innovations are particularly relevant in healthcare and hospitality sectors, where hygiene standards are paramount.

- Europe led the global hand dryers market with a commanding revenue share of 35.2% in 2024, driven by stringent hygiene regulations, high adoption in commercial and public facilities, and strong sustainability initiatives in countries like Germany, the U.K., and France. The United Kingdom, in particular, dominates due to its focus on green building certifications like BREEAM.

- The Asia-Pacific region is anticipated to witness the fastest growth rate, with a projected CAGR of 9.8% from 2025 to 2032, fueled by rapid urbanization, increasing investments in commercial infrastructure, and government-led initiatives to promote hygiene in public spaces in countries like China, India, and Japan.

- Among product types, the jet air hand dryer segment held the largest market share of 40.3% in 2024, valued at USD 0.48 billion, attributed to its high-speed drying capabilities, energy efficiency, and widespread use in high-traffic environments like airports and shopping malls.

Report Scope and Hand Dryers Market Segmentation

|

Attributes |

Hand Dryers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hand Dryers Market Trends

“Advancements in Touchless Technology and Sustainable Design”

- A prominent trend in the global hand dryers market is the widespread adoption of touchless, sensor-based hand dryers, which accounted for 45% of new product launches in 2023 and 2024. These systems enhance hygiene by eliminating physical contact, making them ideal for hospitals, airports, and restaurants.

- The integration of high-efficiency particulate air (HEPA) filters in hand dryers, improving air quality by removing up to 99.97% of airborne particles, is gaining traction, with over 30% of new models in 2024 featuring this technology.

- Sustainability is reshaping the market, with over 25% of manufacturers using eco-friendly materials, such as recyclable plastics, and energy-efficient designs to comply with regulations like the EU’s Ecodesign Directive, reducing energy consumption by up to 20% compared to traditional models.

- The rise of IoT-enabled hand dryers, which offer real-time performance monitoring and predictive maintenance, is transforming facility management, with adoption rates increasing by 15% in commercial buildings like offices and malls.

- Noise reduction technologies are becoming critical, particularly in hospitality and residential applications, with over 20% of new hand dryers in 2024 featuring low-decibel operation for improved user comfort.

- The growth of e-commerce platforms has revolutionized market accessibility, with online sales of hand dryers increasing by 18% annually, driven by competitive pricing and the convenience of bulk purchasing for facility managers.

Hand Dryers Market Dynamics

Driver

““Rising Hygiene Awareness, Sustainability Goals, and Commercial Infrastructure Growth”

- Heightened awareness of hygiene, particularly following the COVID-19 pandemic, has driven demand for touchless hand dryers, with over 60% of commercial facilities in developed markets adopting sensor-based models to minimize germ transmission.

- The global push for sustainability, with initiatives like the EU’s Circular Economy Action Plan and the U.S. Green Building Council’s LEED certification, is boosting demand for energy-efficient hand dryers that reduce paper towel waste and energy consumption.

- Rapid growth in commercial infrastructure, with global investments in commercial real estate reaching USD 1.1 trillion in 2023, is driving the installation of hand dryers in new and retrofitted buildings, particularly in airports, malls, and offices.

- Increasing adoption of smart building technologies, valued at USD 96 billion in 2023 and projected to reach USD 200 billion by 2030, is fueling demand for IoT-enabled hand dryers that integrate with building management systems for optimized performance.

- Government regulations promoting energy efficiency and waste reduction, such as the EU’s Ecodesign Directive and India’s Swachh Bharat Mission, are encouraging the replacement of paper towels with hand dryers in public and institutional facilities.

- The rise of e-commerce and facility management outsourcing is increasing access to hand dryers, with online platforms accounting for 25% of sales in 2024, driven by competitive pricing and bulk purchasing options.

Restraint/Challenge

“High Initial Costs, Maintenance Complexities, and Consumer Preferences”

- The high initial cost of advanced hand dryers, particularly those with touchless sensors, HEPA filters, and IoT capabilities, poses a challenge to adoption in cost-sensitive markets, where facility managers and small businesses prefer cheaper alternatives like paper towels.

- Supply chain disruptions, including shortages of semiconductors and specialized components, have impacted production, leading to delays and increased costs. The COVID-19 pandemic caused a temporary decline in demand due to reduced foot traffic in commercial facilities.

- Maintenance complexities, such as the need for regular cleaning of HEPA filters and calibration of IoT-enabled systems, increase operational costs and require skilled technicians, limiting adoption in regions with limited technical expertise.

- Consumer preference for paper towels in certain markets, particularly in North America and parts of Asia-Pacific, where paper towels are perceived as more hygienic, poses a challenge to hand dryer adoption, with 30% of facilities still using paper-based systems.

- Stringent certification requirements, such as UL standards in the U.S. and CE markings in Europe, increase production costs and compliance burdens for manufacturers, particularly in regulated markets.

- Noise concerns associated with high-speed jet air hand dryers, which can reach up to 90 decibels, deter adoption in noise-sensitive environments like hospitals and residential buildings, despite advancements in noise reduction technologies.

Hand Dryers Market Scope

The global hand dryers market is segmented on the basis of product type, component, application, technology, end-user, and sales channel.

- By Product Type

On the basis of product type, the market is segmented into jet air hand dryers, hot air hand dryers, blade hand dryers, and others. The jet air hand dryer segment dominated the market with a commanding revenue share of 40.3% in 2024, valued at USD 0.48 billion, driven by its high-speed drying capabilities, energy efficiency, and widespread use in high-traffic commercial environments.

The blade hand dryer segment is anticipated to witness the fastest CAGR of 10.2% from 2025 to 2032, fueled by its sleek design and ability to dry hands in under 10 seconds.

- By Component

On the basis of component, the market is segmented into hardware, software, and services. The hardware segment held the largest market revenue share of 68.7% in 2024, driven by the widespread demand for physical hand dryer units in commercial and institutional applications.

The software segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by the growing adoption of IoT-enabled software for real-time monitoring and maintenance in smart buildings.

- By Application

On the basis of application, the market is segmented into commercial (hotels, restaurants, airports, shopping malls, offices), institutional (hospitals, educational institutions, government facilities), industrial, residential, and others. The commercial segment accounted for the largest market revenue share of 55.4% in 2024, driven by high foot traffic and hygiene requirements in public spaces.

The institutional segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing investments in healthcare and educational infrastructure.

- By Sales Channel

On the basis of sales channel, the market is segmented into online and offline (retail stores, distributors). The offline segment held the largest share of 60.2% in 2024, driven by bulk purchases by facility managers through distributors.

The online segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by the rise of e-commerce platforms and consumer convenience.

- By Technology

On the basis of technology, the market is segmented into touchless (sensor-based), manual (push-button), and others. The touchless segment dominated with a 62.1% share in 2024, driven by its hygienic benefits and widespread adoption in post-COVID-19 public facilities.

This segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by increasing demand for contactless solutions.

- By End-User

On the basis of end-user, the market is segmented into commercial enterprises, public sector, industrial facilities, households, and others. The commercial enterprises segment dominated with a 50.8% revenue share in 2024, driven by high demand in hotels, malls, and offices.

The household segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by rising consumer awareness of sustainability and hygiene in residential settings.

Hand Dryers Market Regional Analysis

North America

North America held a significant share of the global market in 2024, driven by high adoption in commercial and institutional facilities, particularly in the U.S., which accounted for 82.6% of the regional market. The focus on hygiene post-COVID-19 and the presence of key players like Excel Dryer and American Dryer support market growth.

U.S. Hand Dryers Market Insight

The United States is expected to dominate the North American market, driven by its robust commercial infrastructure, stringent hygiene standards, and high consumer awareness. The adoption of energy-efficient hand dryers in LEED-certified buildings and the rise of e-commerce sales are key growth factors.

Europe Hand Dryers Market Insight

Europe dominated the global hand dryers market with a revenue share of 35.2% in 2024, driven by stringent hygiene and environmental regulations, high adoption in commercial and public facilities, and a strong focus on sustainability. The commercial segment accounted for the largest application share of 58.6% in 2024, driven by the proliferation of green-certified buildings. The institutional segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by investments in healthcare and educational infrastructure.

U.K. Hand Dryers Market Insight

The United Kingdom captured the largest revenue share of 28.4% within Europe in 2024, driven by its leadership in sustainable building practices, with over 50% of new commercial buildings adhering to BREEAM standards. The adoption of touchless hand dryers in public restrooms, particularly in airports and shopping malls, is fueled by hygiene awareness and government initiatives like the Net Zero Strategy.

Germany Hand Dryers Market Insight

Germany’s market is expected to expand at a considerable CAGR during the forecast period, fueled by its leadership in green building technologies and stringent hygiene regulations. The adoption of jet air and blade hand dryers in commercial and industrial facilities is driven by Germany’s focus on energy efficiency and sustainability, supported by the presence of key players like Stiebel Eltron.

Asia-Pacific Hand Dryers Market Insight

The Asia-Pacific region is poised to grow at the fastest CAGR of approximately 9.8% during the forecast period of 2025 to 2032, driven by rapid urbanization, increasing commercial infrastructure, and government-led hygiene initiatives in countries like China, India, and Japan. The market was valued at USD 0.4 billion in 2024 and is expected to reach USD 0.9 billion by 2032. Initiatives like India’s Swachh Bharat Mission and China’s smart city projects are driving demand for touchless hand dryers.

Japan Hand Dryers Market Insight

Japan’s market is gaining momentum due to its advanced manufacturing sector and focus on hygiene in public spaces. The integration of touchless and IoT-enabled hand dryers in commercial facilities, coupled with the presence of manufacturers like TOTO Ltd. and Mitsubishi Electric, supports market growth.

China Hand Dryers Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, driven by its massive commercial construction sector, rapid urbanization, and government policies promoting hygiene and sustainability. The adoption of touchless hand dryers in public facilities and the growth of e-commerce platforms, with online sales growing by 20% annually, are key growth drivers.

Hand Dryers Market Share

- The Hand Dryers industry is primarily led by well-established companies, including:

- Dyson Ltd. (U.K.)

- Excel Dryer, Inc. (U.S.)

- TOTO Ltd. (Japan)

- World Dryer Corporation (U.S.)

- Mitsubishi Electric Corporation (Japan)

- American Dryer, LLC (U.S.)

- Hokwang Industries Co., Ltd. (Taiwan)

- Bobrick Washroom Equipment, Inc. (U.S.)

- Palmer Fixture Company (U.S.)

- Bradley Corporation (U.S.)

- Mediclinics S.A. (Spain)

- JVD SAS (France)

- Stiebel Eltron GmbH & Co. KG (Germany)

- Taishan Jieda Electrical Co., Ltd. (China)

- Panasonic Corporation (Japan)

- ASI Group (U.S.)

Latest Developments in Global Hand Dryers Market

- In February 2023, Dyson Ltd. launched the Dyson Airblade 9kJ, a high-speed, energy-efficient hand dryer with a HEPA filter, designed for high-traffic commercial environments, reducing drying time to 10 seconds and energy consumption by 25% compared to previous models.

- In March 2024, Excel Dryer, Inc. introduced the XLERATORsync, an IoT-enabled hand dryer with real-time monitoring and predictive maintenance capabilities, adopted by over 200 commercial facilities in North America, reducing maintenance costs by 15%.

- In January 2024, TOTO Ltd. unveiled a new line of touchless blade hand dryers with noise reduction technology, tailored for hospitality and healthcare applications in Japan and Southeast Asia, offering a 20% reduction in decibel levels.

- In April 2024, Mitsubishi Electric Corporation launched a smart hand dryer integrated with IoT diagnostics and HEPA filters, designed for smart buildings, with adoption in over 150 commercial projects in Asia-Pacific, improving hygiene and operational efficiency.

- In June 2023, Hokwang Industries Co., Ltd. introduced an eco-friendly hand dryer series using recyclable materials, aligning with global sustainability goals and gaining traction in Europe and North America, with a 30% increase in export sales.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hand Dryers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hand Dryers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hand Dryers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.