Global Handheld Spectrum Analyzer Market

Market Size in USD Million

CAGR :

%

USD

607.15 Million

USD

1,218.69 Million

2024

2032

USD

607.15 Million

USD

1,218.69 Million

2024

2032

| 2025 –2032 | |

| USD 607.15 Million | |

| USD 1,218.69 Million | |

|

|

|

|

Handheld Spectrum Analyzer Market Size

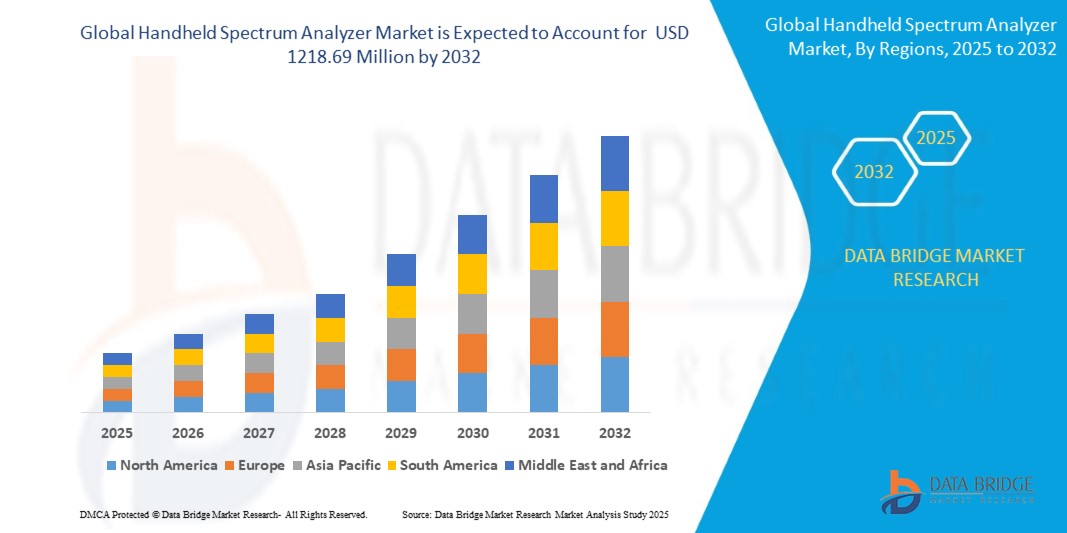

- The global handheld spectrum analyzer market size was valued at USD 607.15 million in 2024 and is expected to reach USD 1218.69 million by 2032, at a CAGR of 9.1% during the forecast period

- The market growth is largely fuelled by the increasing demand for portable and field-ready testing equipment across sectors such as telecommunications, aerospace and defense, and electronics

- Rising adoption of 5G infrastructure, IoT devices, and wireless communication systems is further supporting the need for handheld spectrum analyzers due to their mobility, ease of use, and real-time frequency analysis capabilities

Handheld Spectrum Analyzer Market Analysis

- The growing complexity of wireless environments is creating a need for spectrum monitoring and interference detection, particularly in dense urban and industrial areas

- Advances in spectrum analyzer technology, including enhanced frequency range, battery life, and rugged designs, are increasing adoption among field engineers and technicians

- North America dominated the handheld spectrum analyzer market with the largest revenue share of 36.7% in 2024, driven by increased demand for real-time spectrum monitoring and field-deployable solutions across defense, telecommunications, and aerospace sectors

- The Asia-Pacific region is expected to witness the highest growth rate in the global Handheld Spectrum Analyzer market, driven by rapid industrialization, increased spending in telecommunications and electronics, and the region's emergence as a hub for electronics production and 5G technology adoption

- The product segment dominated the market with the largest revenue share in 2024, driven by rising demand for portable field-testing tools across diverse industries. These devices are essential for detecting interference, troubleshooting networks, and verifying signal integrity in real time. Enhanced portability, rugged design, and improved user interfaces continue to drive adoption across technical and field-based operations

Report Scope and Handheld Spectrum Analyzer Market Segmentation

|

Attributes |

Handheld Spectrum Analyzer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Handheld Spectrum Analyzer Market Trends

“Integration of Advanced Connectivity Features”

- The incorporation of Wi-Fi, Bluetooth, and USB in handheld spectrum analyzers is rising steadily as these interfaces offer seamless data transfer and enable real-time monitoring directly from the field enhancing operational efficiency across industries such as telecommunications and aerospace

- Cloud connectivity is becoming a standard feature as it facilitates centralized data storage, off-site collaboration, and long-term analytics which are essential in remote troubleshooting and ongoing maintenance of network infrastructure

- Remote access capabilities are in high demand as field engineers require instant diagnostics and reporting while minimizing the need to revisit installation sites thereby saving time and reducing operational costs

- For instance, Rohde & Schwarz offers handheld analyzers with advanced wireless interfaces that allow technicians to control and monitor devices remotely through mobile applications increasing flexibility during 5G deployments and RF testing

- This trend reflects a broader shift towards digital transformation in test and measurement tools ensuring greater adaptability in high-speed and mission-critical environments

Handheld Spectrum Analyzer Market Dynamics

Driver

“Expanding 5G Infrastructure Worldwide”

- The global rollout of 5G infrastructure is fueling strong demand for compact and portable spectrum analyzers capable of performing precise signal testing across a wide frequency range ensuring that network components are accurately installed and validated during each stage of deployment to prevent performance degradation

- Telecom operators are prioritizing the use of advanced field-testing equipment to quickly detect and resolve critical issues such as signal interference latency and network congestion since 5G’s reliance on high-frequency millimeter waves demands greater precision and frequent network adjustments

- Handheld analyzers offer quick and effective measurement capabilities in outdoor urban and rural settings making them essential for field engineers working in dynamic environments where reliable spectrum visibility and portability are crucial to sustaining uninterrupted connectivity

- For instance, Anritsu’s MS2090A Field Master Pro delivers top-tier 5G NR spectrum analysis with real-time signal visualization and rugged weather-resistant build making it particularly effective for on-site troubleshooting in dense network zones and outdoor deployment scenarios

- This driver emphasizes the increasing importance of highly reliable portable testing solutions that can support the growing scale and complexity of next-generation wireless networks and align with the rising standards for network performance reliability and agility

Restraint/Challenge

“Limited Frequency Range and Performance Constraints”

- One of the major challenges in handheld spectrum analyzers is limited battery life which restricts extended field usage especially in rural or isolated locations where access to charging may be difficult and continuous monitoring is required over long periods making current battery capacity inadequate for uninterrupted testing tasks

- These devices often have constrained internal memory and lower processing power compared to benchtop analyzers which can slow down data analysis and reduce the ability to capture high-volume spectral data in real time especially during peak traffic or high-frequency surveillance where real-time interpretation is crucial

- As spectrum environments become more complex the need for devices that can perform advanced functions continuously in remote and power-limited settings is rising but current battery technologies remain a bottleneck preventing full-spectrum diagnostics during prolonged operations and limiting multi-functionality in one compact device

- For instance, several compact models on the market offer only 3–4 hours of operating time under full load which proves insufficient for long-duration site inspections or military surveillance missions without auxiliary power making them unsuitable for mission-critical environments requiring continuous uptime and quick adaptability

- This restraint underscores the ongoing need for innovation in energy-efficient hardware and smarter power management solutions to fully unlock the potential of handheld spectrum analysis in critical applications while also encouraging manufacturers to explore low-power processors and solar-compatible modules to extend device utility in off-grid scenarios

Handheld Spectrum Analyzer Market Scope

The market is segmented on the basis of offering, type, frequency type, size, power source, network technology, and end use.

• By Offering

On the basis of offering, the handheld spectrum analyzer market is segmented into product and software. The product segment dominated the market with the largest revenue share in 2024, driven by rising demand for portable field-testing tools across diverse industries. These devices are essential for detecting interference, troubleshooting networks, and verifying signal integrity in real time. Enhanced portability, rugged design, and improved user interfaces continue to drive adoption across technical and field-based operations.

The software segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the growing need for data visualization, remote monitoring, and integration with cloud-based systems. As analyzers become smarter, value-added software capabilities such as post-processing, automation, and spectrum mapping are gaining popularity, especially among telecommunications and military users requiring detailed analytics.

• By Type

On the basis of type, the market is segmented into swept-tuned spectrum analyzer, vector signal spectrum analyzer, and real-time spectrum analyzer. The swept-tuned spectrum analyzer segment held the largest share in 2024, owing to its established utility in traditional radio frequency (RF) measurements and affordability for general-purpose spectrum analysis. These analyzers are widely used in education, manufacturing, and electronics testing due to their user-friendly functionality.

The real-time spectrum analyzer segment is expected to witness the fastest growth rate from 2025 to 2032 due to increasing complexity in wireless networks and demand for real-time signal capture. Their ability to detect transient signals and interference events in dense signal environments makes them ideal for 5G testing, defense communications, and electronic warfare applications.

• By Frequency Type

Based on frequency type, the market is categorized into less than 6 GHz, 6 GHz – 18 GHz, and more than 18 GHz. The less than 6 GHz segment accounted for the largest revenue share in 2024, driven by widespread applications in Wi-Fi, Bluetooth, and lower-band 5G frequency testing. These devices are commonly deployed in telecom, consumer electronics, and IT infrastructure settings.

The 6 GHz – 18 GHz segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to increasing usage in satellite communications, radar systems, and military-grade wireless technologies. The mid-band spectrum is crucial for high-speed data transmission, which is driving the demand for analyzers that can operate efficiently across these frequencies.

• By Size

On the basis of size, the handheld spectrum analyzer market is segmented into less than 1 KG and more than 1 KG. The more than 1 KG segment dominated the market in 2024 due to its ability to integrate advanced features such as larger displays, better battery capacity, and enhanced processing units. These analyzers are often used in applications where extended diagnostics and multiple test capabilities are required.

The less than 1 KG segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by the rising demand for ultra-portable and easy-to-carry devices for quick field checks, particularly in telecom tower installations, field surveys, and remote industrial sites.

• By Power Source

By power source, the market is segmented into battery, line, and others. The battery segment captured the highest market share in 2024, driven by increasing need for untethered mobility and on-site testing. Battery-powered analyzers are widely used in remote locations, allowing technicians to conduct signal measurements without access to a continuous power supply.

The others segment, is expected to witness the fastest growth rate from 2025 to 2032, due to the growing focus on sustainability and extended operational time in energy-constrained environments such as border monitoring and disaster zones.

• By Network Technology

Based on network technology, the market is divided into wired and wireless. The wireless segment held the largest revenue share in 2024, supported by growing adoption of cloud-connected and Bluetooth/Wi-Fi-enabled analyzers. These devices facilitate real-time data access, sharing, and remote control, enabling efficient workflow for field engineers.

The wired segment is expected to witness the fastest growth rate from 2025 to 2032, due to its reliability and faster data transfer rates in high-precision lab environments. Wired connections are still favored in controlled testing conditions such as semiconductor manufacturing, R&D labs, and high-frequency analysis.

• By End Use

By end use, the market is segmented into automotive and transportation, aerospace and defense, IT and telecommunication, medical and healthcare, semiconductors and electronics, industrial and energy, educational institutes, government sector, and others. The IT and telecommunication segment dominated the market in 2024, driven by the global expansion of 5G networks and increasing complexity of wireless communications. Handheld analyzers are critical tools for network verification, interference detection, and regulatory compliance.

The aerospace and defense segment is expected to witness the fastest growth rate from 2025 to 2032, owing to heightened demand for secure communication, radar verification, and signal intelligence in military and space operations. These analyzers play a vital role in ensuring mission-critical communication systems function without disruption in diverse and rugged environments.

Handheld Spectrum Analyzer Market Regional Analysis

- North America dominated the handheld spectrum analyzer market with the largest revenue share of 36.7% in 2024, driven by increased demand for real-time spectrum monitoring and field-deployable solutions across defense, telecommunications, and aerospace sectors

- The region’s established infrastructure for wireless communication, coupled with growing 5G deployments and spectrum regulation enforcement, continues to accelerate adoption of advanced handheld analyzers among service providers and regulatory bodies

- Furthermore, the presence of leading manufacturers, along with rising investment in portable test equipment and government-led spectrum management initiatives, supports North America's strong market position

U.S. Handheld Spectrum Analyzer Market Insight

The U.S. handheld spectrum analyzer market captured the largest revenue share in 2024 within North America, primarily driven by high deployment in military communication, homeland security, and commercial telecom testing. The U.S. government’s increasing investment in defense-grade communication networks and spectrum surveillance tools contributes to demand. In addition, the country’s strong presence of research and test labs along with leading instrument vendors fuels product innovation and deployment for 5G and Wi-Fi 6E applications

Europe Handheld Spectrum Analyzer Market Insight

The Europe handheld spectrum analyzer market is expected to witness the fastest growth rate from 2025 to 2032, led by growing interest in spectrum efficiency, interference analysis, and telecom infrastructure modernization. Regulatory bodies and private firms in countries such as Germany, France, and the U.K. are adopting these devices to ensure clean, interference-free wireless communication. The rise in demand for portable test equipment across industrial and public safety applications is further contributing to market growth in the region

Germany Handheld Spectrum Analyzer Market Insight

The Germany handheld spectrum analyzer market is expected to witness the fastest growth rate from 2025 to 2032, due to increased investments in smart manufacturing, industrial IoT, and energy-efficient wireless networks. German firms prioritize precision and reliability in testing environments, leading to greater demand for high-performance spectrum tools. The country’s advanced automotive, aerospace, and electronics sectors also rely on handheld analyzers for real-time field validation and compliance.

U.K. Handheld Spectrum Analyzer Market Insight

The U.K. handheld spectrum analyzer market is expected to witness the fastest growth rate from 2025 to 2032, supported by rising investments in 5G infrastructure, public safety networks, and interference detection tools. Regulatory agencies and telecom operators in the country are increasingly adopting portable spectrum analyzers to ensure spectrum efficiency and minimize signal disruptions. Moreover, the presence of advanced R&D facilities, coupled with growing deployment of smart city and connected transportation projects, is further boosting market demand for compact, field-ready spectrum testing solutions in the U.K.

Asia-Pacific Handheld Spectrum Analyzer Market Insight

The Asia-Pacific handheld spectrum analyzer market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the region’s accelerating 5G rollout, increasing demand for portable field-testing tools, and strong manufacturing capabilities. Countries such as China, Japan, South Korea, and India are witnessing substantial expansion in wireless infrastructure and telecom testing requirements. Moreover, the affordability of compact analyzers and increasing domestic production are making these tools more accessible for local network operators and service technicians

China Handheld Spectrum Analyzer Market Insight

The China handheld spectrum analyzer market held the largest revenue share in Asia-Pacific in 2024, driven by aggressive 5G network expansion, smart city initiatives, and a growing ecosystem of domestic electronic equipment manufacturers. The Chinese government’s strong focus on digital infrastructure development and spectrum compliance monitoring has spurred widespread adoption of portable analyzers. Local manufacturers are also launching cost-competitive, feature-rich models catering to the needs of field engineers and telecom operators

Japan Handheld Spectrum Analyzer Market Insight

The Japan handheld spectrum analyzer market is expected to witness the fastest growth rate from 2025 to 2032, supported by expanding wireless communication infrastructure and evolving technology needs in spectrum testing. The country’s anticipated shift to a new spectrum auction system—transitioning from government-assigned spectrum to communication service provider-owned licenses—will further drive demand for spectrum diagnostics and planning tools.

Handheld Spectrum Analyzer Market Share

The Handheld Spectrum Analyzer industry is primarily led by well-established companies, including:

- RIGOL TECHNOLOGIES, Co. LTD. (China)

- Keysight Technologies (U.S.)

- Good Will Instrument Co., Ltd. (Taiwan)

- TEKTRONIX, INC. (U.S.)

- ANRITSU CORPORATION (Japan)

- Bird (U.S.)

- Savitri Telecom Services (India)

- HUBER+SUHNER (Switzerland)

- VIAVI Solutions Inc. (U.S.)

- Aaronia AG (Germany)

- B&K Precision Corporation (U.S.)

- Narda Safety Test Solutions GmbH (Germany)

- Aim and Thurlby Thandar Instruments (U.K.)

- BERKELEY NUCLEONICS CORPORATION (U.S.)

- CRFS (U.K.)

- Saluki Technology (Taiwan)

Latest Developments in Global Handheld Spectrum Analyzer Market

- In May 2021, EXFO Inc. introduced a new product, the 5GPro Spectrum Analyzer, designed to enhance field testing in 4G/LTE and 5G NR environments. This field-upgradeable handheld device supports both FR1 and FR2 bands, enabling precise and comprehensive spectrum analysis. It allows technicians to perform real-time validation and troubleshooting, improving efficiency and reducing deployment delays. This launch significantly strengthens EXFO’s position in the 5G testing landscape and supports the growing need for versatile spectrum solutions in next-generation networks

- In March 2021, SAF Tehnika expanded its product portfolio by launching a new model in the Spectrum Compact Series, supporting frequencies from 6 GHz to 20 GHz. This development targets telecom operators, ISPs, and mobile carriers with a compact tool optimized for regulatory testing, drone communication, and satellite signal analysis. The launch enhances operational flexibility and improves compliance capabilities for field engineers. It reinforces SAF Tehnika’s focus on niche frequency testing needs in the growing spectrum management market

- In July 2021, Narda Safety Test Solutions GmbH unveiled a product innovation with the release of its TTK TSCM Travel Kit. This compact toolkit includes the MESA handheld spectrum analyzer, specifically designed for Technical Surveillance Counter-Measures (TSCM) professionals who travel frequently. The solution facilitates rapid deployment and precise spectrum monitoring in sensitive environments. It reflects Narda’s commitment to mobility, convenience, and expanding demand for advanced handheld spectrum analysis in security-focused sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Handheld Spectrum Analyzer Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Handheld Spectrum Analyzer Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Handheld Spectrum Analyzer Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.