Global Haptic Interface Market

Market Size in USD Billion

CAGR :

%

USD

3.89 Billion

USD

34.21 Billion

2024

2032

USD

3.89 Billion

USD

34.21 Billion

2024

2032

| 2025 –2032 | |

| USD 3.89 Billion | |

| USD 34.21 Billion | |

|

|

|

|

Haptic Interface Market Size

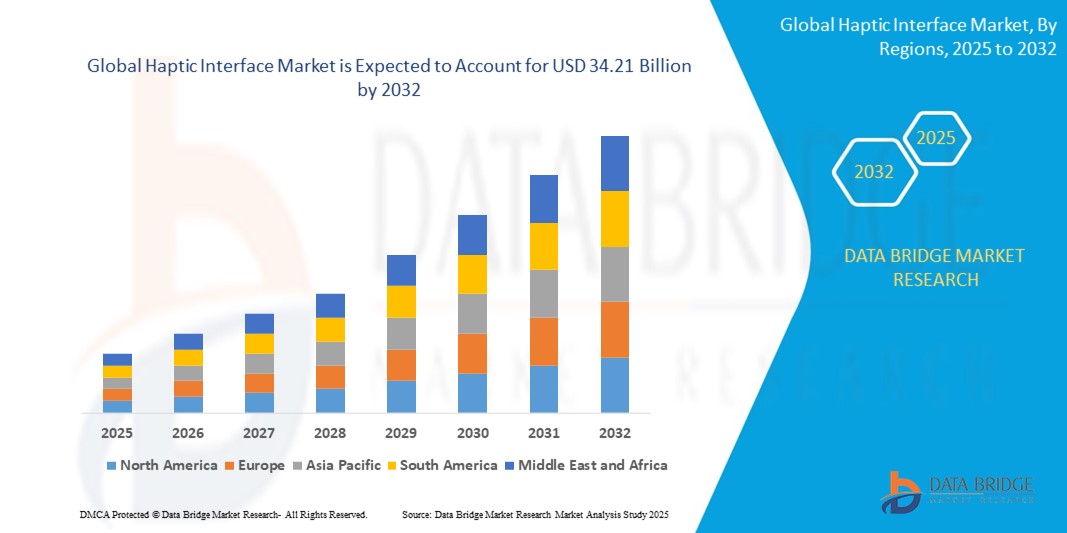

- The global haptic interface market size was valued at USD 3.89 billion in 2024 and is expected to reach USD 34.21 billion by 2032, at a CAGR of 31.20% during the forecast period

- The market growth is largely fueled by the increasing integration of haptic technology in consumer electronics, gaming, automotive systems, and healthcare devices, driven by rising demand for immersive and interactive user experiences across both personal and professional environments

- Furthermore, advancements in virtual reality (VR), augmented reality (AR), and robotics are accelerating the adoption of haptic interfaces, as industries seek precise tactile feedback for simulation, training, and real-time control. These converging factors are significantly enhancing the utility and appeal of haptic systems, thereby driving substantial growth in the market

Haptic Interface Market Analysis

- Haptic interfaces are systems that allow users to interact with digital environments through touch-based feedback using actuators, sensors, and controllers that simulate the sensation of physical interaction. These solutions enhance user engagement and precision in applications ranging from VR gaming and mobile devices to surgical training and remote machinery control

- The surging adoption of haptic technologies is primarily driven by the growing popularity of immersive digital environments, increasing deployment of haptics in smart devices and wearables, and the rising need for realistic interaction in training, automotive, and medical applications

- North America dominated the haptic interface market with a share of 36.5% in 2024, due to the widespread adoption of advanced technologies across automotive, healthcare, and gaming industries

- Asia-Pacific is expected to be the fastest growing region in the haptic interface market during the forecast period due to rapid digital transformation, booming consumer electronics adoption, and a strong manufacturing base

- Windows segment dominated the market with a market share of 66.6% in 2024, due to the dominance of Windows-based systems in professional environments including automotive design, military simulation, and desktop-based gaming platforms. The high compatibility of Windows with advanced haptic toolkits and peripheral support makes it a preferred OS for research, industrial design, and training applications requiring detailed control and feedback

Report Scope and Haptic Interface Market Segmentation

|

Attributes |

Haptic Interface Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Haptic Interface Market Trends

Adoption in Industrial Robotics and Automation

- The Haptic Interface Market is experiencing significant growth driven by increasing adoption of tactile feedback technologies in industrial robotics and automation systems to improve precision, safety, and remote operation capabilities

- For instance, companies such as Ultraleap and HaptX are developing advanced haptic gloves and exoskeletons that provide operators with realistic touch and force feedback, enhancing control in complex manufacturing and remote robotic tasks

- Demand for haptic systems in automation is supported by rising investment in Industry 4.0 initiatives, where integration with AI and IoT enables enhanced human-machine collaboration and predictive maintenance via tactile sensing

- The use of haptics in teleoperation for hazardous environments such as nuclear plants, underwater exploration, and medical robotics is expanding, allowing safe, intuitive remote manipulation with superior sensory feedback

- Increasing incorporation of haptic interfaces in robotic training simulators helps improve operator skill levels, reduce errors, and lower training costs across automotive, aerospace, and defense sectors

- Advancements in miniaturization and sensor technology are making haptic devices more compact, responsive, and affordable, facilitating broader adoption in industrial automation systems across emerging and developed markets

Haptic Interface Market Dynamics

Driver

Increased Demand for Wearable Devices

- The surge in wearable technologies across healthcare, consumer electronics, and virtual reality sectors is significantly propelling demand for sophisticated haptic interfaces that offer tactile feedback to enhance user experience and functionality

- For instance, companies such as Immersion Corporation and Tanvas are innovating in haptic touch feedback for wearables such as smartwatches, fitness trackers, and VR gloves, enabling applications ranging from notification alerts to realistic virtual object manipulation

- Growing awareness of the benefits of haptic wearables for physical therapy, gesture recognition, and immersive gaming intensifies market growth by blending health and entertainment use cases

- The rise of AR/VR devices with integrated haptics fosters immersive applications in education, training, and remote collaboration, extending the market scope for wearable haptic technologies

- Increased consumer preference for interactive, multi-sensory experiences in personal electronics and gaming fuels continued investment and R&D focused on lightweight, low-power, and high-resolution haptic solutions for wearables

Restraint/Challenge

High Cost of Haptic Technology

- The relatively high cost of designing, manufacturing, and integrating advanced haptic systems remains a major barrier to widespread adoption, particularly in cost-sensitive industrial and consumer applications

- For instance, established players such as HaptX and Ultraleap face challenges in reducing system costs while maintaining performance, limiting deployment of haptic devices primarily to premium and specialized product segments

- Expensive components such as high-fidelity actuators, sensors, and real-time feedback processing units contribute to elevated production costs and longer development cycles

- Integration complexity with existing hardware and software platforms demands significant customization and engineering effort, further increasing upfront investment and system costs

- Price sensitivity among end-users and OEMs, especially in emerging markets, slows market penetration of haptic interfaces despite growing interest, restricting growth to niche applications where premium quality tactile feedback is essential

Haptic Interface Market Scope

The market is segmented on the basis of component, technology, operating system, and application.

- By Component

On the basis of component, the haptic interface market is segmented into hardware and software. The hardware segment dominated the largest market revenue share in 2024, primarily due to the critical role of actuators, sensors, and controllers in delivering real-time tactile feedback. As haptic systems become integral to automotive dashboards, robotic surgical tools, and immersive gaming peripherals, the demand for sophisticated and high-performance hardware has surged. Manufacturers are investing in miniaturized and energy-efficient hardware components that enhance responsiveness and realism, further solidifying hardware's market dominance.

The software segment is projected to witness the fastest growth rate from 2025 to 2032, driven by increasing focus on user experience design, simulation algorithms, and cross-platform integration. Haptic software enables customization and fine-tuning of feedback patterns, essential for creating more immersive and context-aware interactions across industries such as training, gaming, and healthcare. The growth of virtual environments and extended reality platforms continues to fuel the demand for software-driven adaptive haptic experiences.

- By Technology

On the basis of technology, the haptic interface market is segmented into tactile feedback and force feedback. The tactile feedback segment held the largest revenue share in 2024, owing to its widespread use in consumer electronics, especially smartphones, tablets, wearables, and touchscreens. The technology is favored for its cost-effectiveness, compact integration, and ability to provide intuitive responses through vibrations, clicks, or taps, enhancing user engagement across everyday devices.

The force feedback segment is anticipated to register the highest CAGR from 2025 to 2032, driven by its increasing adoption in high-precision applications such as surgical simulators, robotic control systems, and advanced flight training modules. Force feedback technology offers users a mechanical resistance sensation, delivering a realistic sense of pressure and motion. As industries place greater emphasis on lifelike simulations and remote operation accuracy, demand for sophisticated force feedback solutions is rapidly accelerating.

- By Operating System

On the basis of operating system, the haptic interface market is segmented into Windows and Mobile OS. The Windows segment led the market with a share of 66.6% in 2024, largely due to the dominance of Windows-based systems in professional environments including automotive design, military simulation, and desktop-based gaming platforms. The high compatibility of Windows with advanced haptic toolkits and peripheral support makes it a preferred OS for research, industrial design, and training applications requiring detailed control and feedback.

The Mobile OS segment is projected to experience the fastest growth through 2032, fueled by the exponential adoption of smartphones, tablets, and wearable devices. As mobile applications evolve to include immersive gaming, augmented reality, and assistive technologies, developers are increasingly incorporating haptic APIs within Android and iOS platforms. The push for enriched user interaction in compact, on-the-go formats is significantly contributing to the expansion of mobile-based haptic systems.

- By Application

On the basis of application, the haptic interface market is segmented into education and training, gaming console, automotive industry, military and defense. The gaming console segment accounted for the largest market share in 2024, propelled by the gaming industry’s focus on realism and immersive player experiences. Haptic-enabled controllers, VR headsets, and wearable suits are increasingly being adopted to simulate environmental cues such as recoil, impact, and motion, driving strong growth in consumer and competitive gaming ecosystems.

The military and defense segment is anticipated to grow at the fastest rate from 2025 to 2032, driven by the critical need for high-fidelity simulation and remote control systems. Haptic feedback in defense applications enhances training accuracy, improves decision-making in mission rehearsals, and provides precision control for drones and robotic platforms. Government investments in virtual training and tactical simulations are expected to continue propelling the adoption of advanced haptic systems in the sector.

Haptic Interface Market Regional Analysis

- North America dominated the haptic interface market with the largest revenue share of 36.5% in 2024, driven by the widespread adoption of advanced technologies across automotive, healthcare, and gaming industries

- The region benefits from strong R&D capabilities, high consumer spending on immersive technologies, and early integration of haptic solutions in simulation and training platforms

- The presence of leading tech companies and a mature digital infrastructure further accelerate the adoption of haptic devices across both consumer electronics and enterprise applications

U.S. Haptic Interface Market Insight

The U.S. accounted for the largest revenue share in 2024 within the North American haptic interface market, driven by increasing demand for immersive experiences in virtual reality, simulation training, and medical robotics. The country leads in R&D and innovation, with significant funding directed toward defense, healthcare, and education technology that utilizes haptics for realism and engagement. Consumer adoption is also strong in the gaming industry, where advanced haptic controllers and feedback systems are enhancing user interactivity. The availability of cutting-edge infrastructure and integration with smart systems such as AR/VR platforms further bolsters market growth in the U.S.

Europe Haptic Interface Market Insight

The haptic interface market in Europe is projected to grow at a substantial CAGR during the forecast period, driven by increasing investments in virtual simulation, automotive HMI (Human-Machine Interface), and digital education platforms. Countries across the region are adopting haptic solutions for professional training, particularly in medical and military applications where tactile realism is critical. The market also benefits from rising consumer interest in high-fidelity gaming and touch-sensitive consumer electronics. Europe's focus on ergonomic design, sustainable innovation, and regulatory support for safe and efficient technologies creates a favorable environment for haptic interface adoption across industries.

U.K. Haptic Interface Market Insight

The U.K. haptic interface market is anticipated to grow at a notable CAGR, supported by rising deployment of tactile technologies in digital healthcare, immersive learning environments, and retail simulation experiences. The country’s proactive stance on digital transformation and innovation in assistive technology is encouraging broader use of haptic feedback in medical training, rehabilitation, and e-learning applications. In addition, the presence of technology incubators and partnerships between universities and private firms is driving the development of next-generation haptic systems aimed at improving accessibility, usability, and human-machine interaction.

Germany Haptic Interface Market Insight

Germany’s haptic interface market is poised for significant expansion, underpinned by its world-renowned engineering capabilities and strong industrial base. The automotive sector is a major contributor, with increased integration of haptic feedback in touch-based controls, infotainment systems, and safety features. Germany’s leadership in Industry 4.0 and commitment to smart manufacturing is also driving demand for haptic-enabled interfaces in training simulators and collaborative robotics. The country’s emphasis on precision, energy efficiency, and privacy aligns well with the evolving features of advanced haptic systems, making it a growing hub for both innovation and application.

Asia-Pacific Haptic Interface Market Insight

Asia-Pacific is expected to register the fastest CAGR from 2025 to 2032 in the global haptic interface market, supported by rapid digital transformation, booming consumer electronics adoption, and a strong manufacturing base. Countries such as China, Japan, and South Korea are leading the region’s growth, fueled by increasing investments in smart devices, automotive technologies, and e-learning platforms. The rise in disposable income, growing demand for realistic gaming experiences, and favorable government initiatives supporting tech innovation contribute significantly to regional market expansion. Asia-Pacific is also a key exporter of haptic hardware components, which strengthens local availability and cost efficiency.

Japan Haptic Interface Market Insight

Japan’s haptic interface market is experiencing strong momentum, driven by the nation’s high-tech culture, advanced robotics sector, and a rising need for user-friendly solutions in an aging society. Haptic technologies are increasingly being used in healthcare simulators, robotic surgery, and personal care robotics to deliver realistic tactile experiences. Japan’s leadership in precision electronics and human-machine interface development makes it a crucial market for high-end haptic applications. The integration of haptic feedback into smart home systems, infotainment panels, and AR/VR-based gaming is further broadening the scope of adoption across both consumer and enterprise segments.

China Haptic Interface Market Insight

China held the largest revenue share in the Asia-Pacific haptic interface market in 2024, propelled by robust growth in its consumer electronics industry and large-scale adoption of connected devices. The country is a major production hub for haptic components, which drives affordability and rapid market penetration. With the expansion of smart education, e-commerce, and entertainment sectors, demand for interactive and tactile feedback systems is rising across both public and private domains. China’s emphasis on smart city development and AI integration is also pushing the incorporation of haptic interfaces into a wider range of applications, from automotive systems to smart healthcare devices.

Haptic Interface Market Share

The haptic interface industry is primarily led by well-established companies, including:

- Apple Inc. (U.S.)

- HAPTION (U.S.)

- Immersion (U.S.)

- 3D Systems, Inc. (U.S.)

- NOVASENTIS, INC. (U.S.)

- Ultraleap Limited (U.K.)

- Qualcomm Technologies Inc. (U.S.)

- ALPS ALPINE CO., LTD. (Japan)

- NIDEC CORPORATION (Japan)

- Johnson Electric Holdings Limited (China)

- Jinlong Machinery & Electronics Co. Ltd. (China)

- Precision Microdrives Limited (U.K.)

Latest Developments in Global Haptic Interface Market

- In April 2024, Samsung introduced its latest Neo QLED 8K and 4K OLED TVs, powered by the Samsung Tizen OS, integrating advanced smart features that significantly elevate the role of haptics in the home entertainment ecosystem. By enabling smartphones to function as gaming devices with a customized user interface (UI) and embedded haptic feedback, Samsung is expanding the accessibility of immersive gaming experiences. This move reinforces the adoption of haptic technologies in consumer electronics, especially in the smart TV and mobile gaming segments, and reflects a growing emphasis on multisensory engagement in mainstream devices

- In May 2023, Ultraleap launched the second generation of its Leap Motion Controller—Leap Motion Controller 2—offering enhanced hand-tracking capabilities for PCs, VR/AR/MR headsets, and holographic displays. This launch marks a significant advancement in contactless haptic interaction, enabling users to naturally engage with digital content through gesture-based inputs. The innovation strengthens the use of mid-air haptics in immersive environments, boosting the demand for non-contact haptic interfaces in gaming, virtual training, and enterprise simulations

- In January 2023, Peratech unveiled its FusionPad Haptic Force-Enhanced Trackpad at CES in Las Vegas, bringing an advanced tactile solution to notebook interfaces. By supporting multiple click inputs and delivering precise force-based haptic feedback, the FusionPad transforms the conventional laptop touchpad into a more interactive and intuitive control surface. This advancement underscores the growing trend of integrating haptic feedback into computing peripherals, enhancing usability and precision in productivity and creative tasks, and thereby widening the commercial scope of the haptic interface market

- In June 2022, Apple Inc. announced the development of its ultrasonic haptic sound wave technology, a patented solution designed to deliver highly immersive tactile sensations within virtual environments. Intended for use in Apple’s upcoming mixed-reality headsets, this technology aims to replicate real-world tactile experiences via ultrasonic waves, bridging the sensory gap in VR applications. This innovation positions Apple as a key player in shaping the next generation of XR interfaces and accelerates the integration of sophisticated haptic feedback in extended reality devices

- In January 2022, Synaptics Incorporated launched its S9A0H ASIC Haptic TouchPad, designed for compatibility with Google Chromebook and Microsoft Windows devices. This launch addressed the growing need for responsive and tactile input solutions in the hybrid work era, supporting remote productivity with enhanced user interaction. As demand for intuitive and portable computing solutions rises, Synaptics’ innovation plays a pivotal role in embedding haptic feedback into mainstream PC hardware, thereby broadening the adoption of touch-based haptic interfaces across work and education environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Haptic Interface Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Haptic Interface Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Haptic Interface Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.