Global Haptic Touchscreen Market

Market Size in USD Billion

CAGR :

%

USD

11.15 Billion

USD

24.28 Billion

2024

2032

USD

11.15 Billion

USD

24.28 Billion

2024

2032

| 2025 –2032 | |

| USD 11.15 Billion | |

| USD 24.28 Billion | |

|

|

|

|

Haptic Touchscreen Market Size

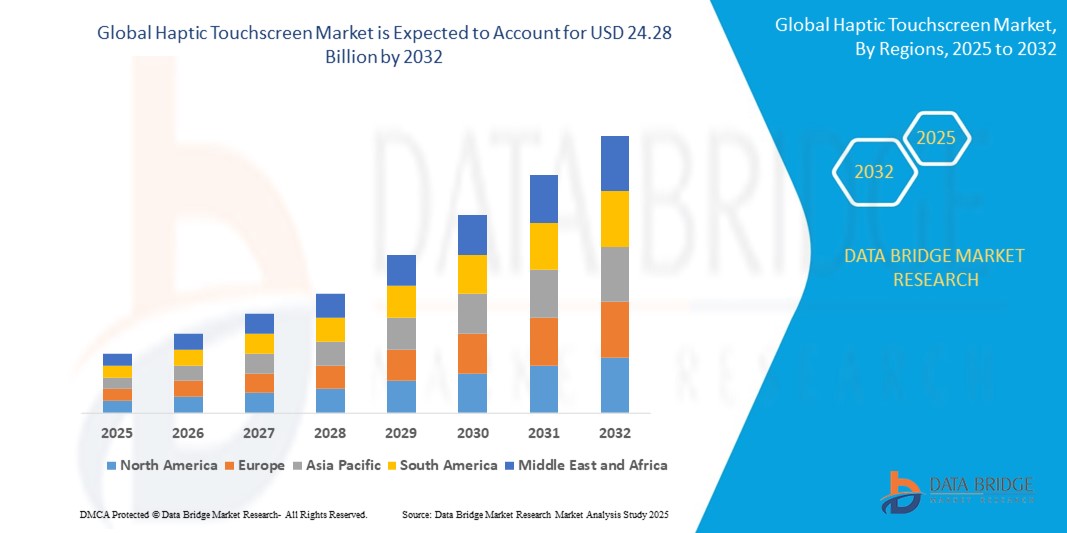

- The global haptic touchscreen market size was valued at USD 11.15 billion in 2024 and is expected to reach USD 24.28 billion by 2032, at a CAGR of 10.21% during the forecast period

- The market growth is primarily driven by the increasing integration of haptic feedback technology in consumer electronics, automotive interfaces, and medical devices, fueled by advancements in tactile feedback systems and growing demand for immersive user experiences

- In addition, rising consumer preference for intuitive, interactive, and user-friendly interfaces in smart devices and vehicles is positioning haptic touchscreens as a preferred solution for modern human-machine interaction, significantly contributing to market expansion

Haptic Touchscreen Market Analysis

- Haptic touchscreens, which provide tactile feedback to enhance user interaction with touch interfaces, are becoming integral to consumer electronics, automotive dashboards, medical equipment, and industrial control systems due to their ability to improve usability, precision, and user engagement

- The growing demand for haptic touchscreens is driven by the proliferation of smart devices, increasing adoption of advanced driver-assistance systems (ADAS) in vehicles, and the need for precise tactile feedback in medical and industrial applications

- Asia-Pacific dominated the haptic touchscreen market with the largest revenue share of 42.5% in 2024, driven by the region’s robust electronics manufacturing ecosystem, high adoption of smartphones and wearables, and the presence of major technology players in countries such as China, Japan, and South Korea

- North America is expected to be the fastest-growing region during the forecast period, propelled by rapid advancements in automotive technology, increasing investment in healthcare innovations, and strong demand for consumer electronics with enhanced user interfaces

- The capacitive technology segment dominated the largest market revenue share of 48.2% in 2024, driven by its widespread adoption in consumer electronics such as smartphones and tablets due to its precise and responsive haptic feedback

Report Scope and Haptic Touchscreen Market Segmentation

|

Attributes |

Haptic Touchscreen Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Haptic Touchscreen Market Trends

“Increasing Integration of AI and Advanced Haptic Feedback Technologies”

- The global haptic touchscreen market is experiencing a notable trend toward the integration of Artificial Intelligence (AI) and advanced haptic feedback technologies

- These technologies enable precise tactile feedback, enhancing user interaction by simulating realistic touch sensations for various applications

- AI-powered haptic systems allow for adaptive feedback, tailoring touch sensations to user preferences or specific tasks, such as gaming or medical simulations

- For instances, companies are developing AI-driven haptic platforms that adjust vibration intensity or texture simulation based on user input or environmental conditions, improving user experience in automotive and consumer electronics

- This trend enhances the appeal of haptic touchscreens, offering immersive and intuitive interfaces for both individual users and industrial applications

- AI algorithms analyze user interactions, such as touch pressure, swipe speed, and gesture patterns, to optimize haptic responses for personalized experiences

Haptic Touchscreen Market Dynamics

Driver

“Rising Demand for Immersive User Interfaces and Enhanced User Experience”

- Increasing consumer demand for interactive and immersive interfaces in devices such as smartphones, automotive infotainment systems, and wearable devices is a key driver for the haptic touchscreen market

- Haptic touchscreens enhance user experience by providing tactile feedback, such as vibrations or texture simulation, making interactions more intuitive and engaging

- Government initiatives promoting advanced automotive technologies, particularly in regions such as Asia-Pacific, are driving the adoption of haptic touchscreens in vehicle dashboards and control systems

- The proliferation of IoT and advancements in 5G technology enable faster data processing and seamless integration of haptic systems, supporting real-time tactile feedback in connected devices

- Manufacturers are increasingly incorporating haptic touchscreens as standard or premium features to meet consumer expectations and differentiate their products in competitive markets

Restraint/Challenge

“High Development Costs and Data Privacy Concerns”

- The significant initial investment required for developing and integrating advanced haptic touchscreen technologies, including hardware and software, poses a barrier to adoption, particularly in cost-sensitive markets

- Integrating haptic systems into existing devices or platforms can be complex and expensive, requiring specialized components such as piezoelectric or electrostatic actuators

- Data privacy and security concerns are a major challenge, as haptic touchscreens collect sensitive user interaction data, raising risks of breaches or misuse, particularly in consumer electronics and automotive applications

- The varied regulatory landscape across countries regarding data collection and user privacy complicates compliance for global manufacturers and service providers

- These factors may deter adoption in regions with high cost sensitivity or stringent data privacy awareness, limiting market growth

Haptic Touchscreen market Scope

The market is segmented on the basis of technology, display type, application, haptic effect, and end-user.

- By Technology

On the basis of technology, the global haptic touchscreen market is segmented into capacitive, piezoelectric, electrostatic, and thermal. The capacitive technology segment dominated the largest market revenue share of 48.2% in 2024, driven by its widespread adoption in consumer electronics such as smartphones and tablets due to its precise and responsive haptic feedback. Capacitive haptics use a grid of electrodes to detect touch-induced changes in capacitance, enabling seamless integration with multi-touch interfaces.

The piezoelectric technology segment is expected to witness the fastest growth rate of 15.8% from 2025 to 2032, fueled by increasing demand in automotive and industrial applications where strong and precise vibrations enhance user interaction. Advancements in piezoelectric actuators are enabling thinner, more efficient haptic solutions for diverse devices.

- By Display Type

On the basis of display type, the global haptic touchscreen market is segmented into integrated, on-cell, in-cell, and suspended. The integrated display type segment is expected to hold the largest market revenue share of 52.7% in 2024, driven by its seamless combination of touchscreen and haptic feedback into a single unit, reducing device size and enhancing user experience. This segment benefits from widespread use in consumer electronics and automotive infotainment systems.

The in-cell display type segment is anticipated to experience the fastest growth rate of 16.3% from 2025 to 2032, propelled by its compact design and cost-effectiveness, making it ideal for smartphones and wearables where space and efficiency are critical.

- By Application

On the basis of application, the global haptic touchscreen market is segmented into consumer electronics, automotive, medical, and industrial. The consumer electronics segment dominated the market with a revenue share of 45.8% in 2024, driven by the high adoption of haptic touchscreens in smartphones, tablets, and gaming devices, where tactile feedback enhances user engagement and immersive experiences.

The automotive segment is expected to witness the fastest growth rate of 17.5% from 2025 to 2032, fueled by increasing integration of haptic feedback in infotainment systems and advanced driver assistance systems (ADAS), improving safety and user interaction by providing tactile cues without diverting driver attention.

- By Haptic Effect

On the basis of haptic effect, the global haptic touchscreen market is segmented into vibration, force feedback, texture simulation, and thermal feedback. The vibration segment held the largest market revenue share of 60.3% in 2024, attributed to its widespread use in consumer electronics for providing tactile feedback through vibration motors in devices such as smartphones and gaming controllers.

The force feedback segment is anticipated to experience the fastest growth rate of 18.1% from 2025 to 2032, driven by its increasing adoption in automotive and gaming applications, where it provides realistic resistance and tactile sensations, enhancing user immersion and interaction.

- By End-User

On the basis of end-user, the global haptic touchscreen market is segmented into OEMs, system integrators, and end consumers. The OEMs segment dominated the market with a revenue share of 47.6% in 2024, driven by their role in integrating haptic touchscreens into devices during manufacturing, particularly in consumer electronics and automotive industries.

The system integrators segment is expected to witness the fastest growth rate of 16.9% from 2025 to 2032, fueled by their increasing role in customizing and deploying haptic solutions across various applications, including medical and industrial sectors, to meet specific user requirements.

Haptic Touchscreen Market Regional Analysis

- Asia-Pacific dominated the haptic touchscreen market with the largest revenue share of 42.5% in 2024, driven by the region’s robust electronics manufacturing ecosystem, high adoption of smartphones and wearables, and the presence of major technology players in countries such as China, Japan, and South Korea

- Consumers prioritize haptic touchscreens for enhanced user interaction, improved tactile feedback, and seamless integration in devices, particularly in regions with high smartphone penetration and technological advancements

- Growth is supported by innovations in haptic technologies, such as capacitive and piezoelectric solutions, alongside rising demand in OEM and aftermarket segments across consumer electronics, automotive, and industrial applications

Japan Haptic Touchscreen Market Insight

Japan’s haptic touchscreen market is expected to witness strong growth due to consumer preference for high-quality, technologically advanced haptic solutions that enhance user interaction and device safety. The presence of major consumer electronics and automotive manufacturers accelerates market penetration, with significant integration in OEM devices. Rising interest in aftermarket customization and advanced haptic effects such as vibration and texture simulation also contributes to growth.

China Haptic Touchscreen Market Insight

China holds the largest share of the Asia-Pacific haptic touchscreen market, propelled by rapid urbanization, rising device ownership, and increasing demand for tactile feedback solutions in consumer electronics and automotive applications. The country’s growing middle class and focus on smart technology support the adoption of advanced haptic touchscreens. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

North America Haptic Touchscreen Market Insight

North America is the fastest-growing region in the global haptic touchscreen market, driven by rapid advancements in consumer electronics, automotive, and medical sectors. The U.S. leads with significant investments in haptic technologies such as capacitive and thermal Christensen, focusing on tactile feedback and user experience enhancements. Increasing adoption in smart vehicles, wearables, and industrial applications, coupled with innovations in display types such as in-cell and on-cell, fuels market expansion.

U.S. Haptic Touchscreen Market Insight

The U.S. haptic touchscreen market is expected to witness significant growth, fueled by strong demand in consumer electronics and automotive sectors. Growing consumer preference for immersive user experiences and advancements in force feedback and texture simulation technologies drive market expansion. The trend toward smart vehicle interfaces and regulatory focus on driver safety further boost adoption in both OEM and aftermarket segments.

Europe Haptic Touchscreen Market Insight

The Europe haptic touchscreen market is expected to witness robust growth, driven by increasing demand for enhanced user interfaces in automotive and medical applications. Consumers seek haptic solutions that improve interaction precision and tactile feedback while ensuring energy efficiency. Growth is prominent in countries such as Germany and France, supported by advancements in integrated and on-cell display technologies and stringent regulations promoting user safety.

U.K. Haptic Touchscreen Market Insight

The U.K. market for haptic touchscreens is expected to witness significant growth, driven by demand for improved user experience in consumer electronics and automotive applications. Increased focus on device aesthetics and tactile feedback for enhanced usability encourages adoption. Evolving regulations emphasizing safety and user interaction standards further influence consumer preferences, balancing advanced haptic effects with compliance.

Germany Haptic Touchscreen Market Insight

Germany is expected to witness strong growth in the haptic touchscreen market, attributed to its advanced automotive and industrial sectors and high consumer focus on interactive and energy-efficient technologies. German consumers prefer cutting-edge haptic solutions, such as piezoelectric and electrostatic technologies, that enhance device functionality and contribute to lower energy consumption. Integration in premium vehicles and industrial systems supports sustained market growth.

Haptic Touchscreen Market Share

The haptic touchscreen industry is primarily led by well-established companies, including:

- Texas Instruments Incorporated (U.S.)

- Johnson Electric Holdings Limited (China)

- AAC Technologies (China)

- TDK Corporation (Japan)

- Microchip Technology Inc. (U.S.)

- Immersion (U.S.)

- Semiconductor Components Industries, LLC (U.S.)

- Precision Microdrives (U.K.)

- Synaptics Incorporated (U.S.)

- ultraleap (U.K.)

- Cypress Semiconductor (U.S.)

- Novasentis (U.S.)

- Fujitsu (Japan)

- HaptX (U.S.)

- ON Semiconductor (U.S.)

What are the Recent Developments in Global Haptic Touchscreen Market?

- In September 2024, Samsung introduced an advanced haptic feedback system tailored for its foldable smartphones, enhancing touch responsiveness and user interaction across flexible displays. This innovation addresses the unique mechanical and sensory challenges posed by foldable form factors, aiming to deliver more immersive tactile experiences that align with the dynamic nature of folding screens. By refining vibration precision and integrating adaptive feedback mechanisms, Samsung’s system improves usability in both folded and unfolded modes—especially for gaming, typing, and gesture-based controls.

- In June 2024, Italian tech firm Weart S.r.l. launched the TouchDIVER Pro, a cutting-edge haptic glove designed to elevate immersion in virtual and augmented reality. The glove features six actuation points across all fingers and the palm, delivering multimodal haptic feedback through three distinct sensations: Force Feedback for pressure simulation, Texture Rendering to mimic surface feel, and Thermal Cues that replicate temperature changes from 18°C to 42°C. With precise hand tracking, low-latency connectivity, and an intuitive SDK, TouchDIVER Pro supports XR training, prototyping, teleoperations, and immersive marketing

- In April 2024, Immersion Corporation, a pioneer in haptic feedback technology, partnered with a major gaming console manufacturer to integrate next-generation vibration systems into future gaming devices. This collaboration aims to deliver more immersive and realistic tactile experiences, synchronized with high-definition graphics and audio. The new TouchSense® technology offers a broader range of vibration effects—crisper, more nuanced, and responsive to in-game actions—without increasing power consumption or hardware footprint. It also supports motion control compatibility, wireless transmission, and developer-friendly authoring tools, setting a new benchmark for interactive gaming realism

- In February 2024, Apple secured a patent for an innovative haptic feedback system aimed at elevating tactile interactions in augmented and virtual reality (AR/VR) environments. The technology focuses on delivering precise, responsive vibrations that simulate real-world touch sensations, enhancing immersion and user engagement across Apple’s mixed-reality devices. This development underscores Apple’s strategic push to refine spatial computing experiences, particularly within its Vision Pro ecosystem. By integrating advanced haptics, Apple aims to create more intuitive and emotionally resonant digital interactions, reinforcing its leadership in the rapidly expanding AR/VR market

- In January 2023, OnePlus partnered with AAC Technologies to introduce a biometric haptic actuator in its flagship smartphones, notably the OnePlus 11. This advanced actuator merges acoustic, optical, and haptic technologies, delivering stronger, more refined vibrations that elevate the sensory experience for users. The system enhances feedback precision during interactions such as typing, gaming, and biometric authentication, offering a more immersive and tactile interface. This innovation reflects OnePlus’s commitment to pushing the boundaries of smartphone ergonomics and user engagement

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Haptic Touchscreen Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Haptic Touchscreen Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Haptic Touchscreen Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.