Global Hard Coffee Market

Market Size in USD Million

CAGR :

%

USD

127.45 Million

USD

769.46 Million

2024

2032

USD

127.45 Million

USD

769.46 Million

2024

2032

| 2025 –2032 | |

| USD 127.45 Million | |

| USD 769.46 Million | |

|

|

|

|

Hard Coffee Market Size

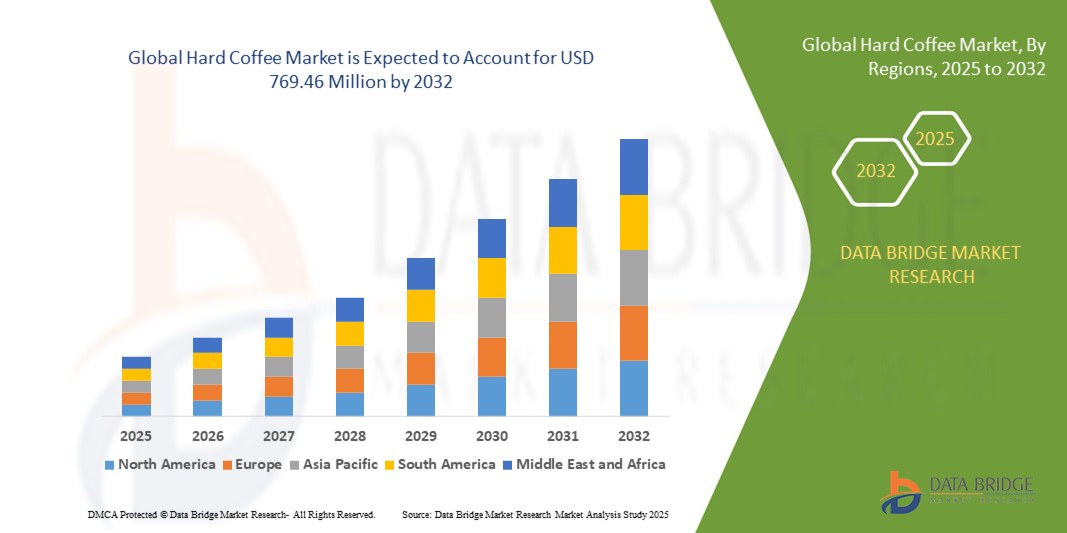

- The global hard coffee market size was valued at USD 127.45 million in 2024 and is expected to reach USD 769.46 million by 2032, at a CAGR of 25.20% during the forecast period

- The market growth is largely fueled by the rising consumer preference for ready-to-drink alcoholic beverages that combine convenience with unique flavor experiences, meeting the demands of busy lifestyles and on-the-go consumption

- Furthermore, increasing interest in innovative flavor profiles and product formats, along with expanding distribution channels such as e-commerce and specialty stores, is driving the popularity of hard coffee globally. These factors are accelerating market adoption, thereby significantly boosting industry growth

Hard Coffee Market Analysis

- Hard coffee is a ready-to-drink alcoholic beverage that blends coffee flavors with spirits, offering consumers a convenient and flavorful alternative to traditional alcoholic drinks. These products are available in various forms, including canned RTDs, mixers, and nitro cold brews, catering to diverse consumer preferences

- The escalating demand for hard coffee is primarily driven by changing consumer lifestyles, increased experimentation with alcoholic beverages, and the growing influence of millennial and Gen Z consumers who seek premium, innovative, and convenient drink options. Additionally, the expansion of distribution channels and marketing efforts focused on lifestyle branding are contributing to market growth

- North America dominated the hard coffee market with a share of 32.5% in 2024, due to rising consumer preference for ready-to-drink alcoholic beverages and the growing popularity of hard coffee products among millennials and Gen Z

- Asia-Pacific is expected to be the fastest growing region in the hard coffee market during the forecast period due to rapid urbanization, increasing disposable incomes, and rising demand for innovative ready-to-drink alcoholic beverages

- Classic coffee segment dominated the market with a market share of 62.2% in 2024, due to consumers’ preference for the authentic and robust coffee taste combined with alcohol. This segment benefits from its familiarity and trust among traditional coffee drinkers who are venturing into hard coffee products. Classic flavors are often perceived as safe and reliable, making them a staple in the market. The segment is supported by strong brand loyalty and extensive product availability across channels, ensuring widespread consumer reach

Report Scope and Hard Coffee Market Segmentation

|

Attributes |

Hard Coffee Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hard Coffee Market Trends

Rising Demand for Flavored and Premium Hard Coffee Variants

- The hard coffee market is experiencing significant growth driven by consumer interest in innovative flavored options and premium products that combine coffee taste with alcoholic content, catering to evolving tastes and lifestyle preferences

- For instance, brands such as White Claw, Truly, and High Noon are expanding their flavor portfolios with offerings like mocha, vanilla, caramel, and seasonal blends, using premium ingredients and craft brewing techniques to attract millennials and Gen Z consumers seeking novel ready-to-drink alcoholic beverages

- Increasing consumer willingness to experiment with hybrid beverages and premium ready-to-drink (RTD) formats is supporting product diversification and premiumization trends

- Growing emphasis on clean labels, natural ingredients, and lower sugar content aligns with health-conscious consumer segments, accelerating introduction of premium hard coffee variants with transparent ingredient sourcing

- E-commerce and off-premise retail channels are expanding accessibility, enabling quicker market adoption of premium and limited-edition hard coffee products globally

- Regional popularity surges, notably in North America, drive innovation and competition among brands to meet rising demand for high-quality, distinctively flavored hard coffee offerings

Hard Coffee Market Dynamics

Driver

Rise in Premiumization and Craft Trends

- The growing consumer preference for premium and craft alcoholic beverages is a key driver, pushing hard coffee producers to focus on quality ingredients, artisanal methods, and innovative flavor profiles that offer enhanced sensory experiences

- For instance, craft beverage makers and established breweries are launching small-batch, barrel-aged, or single-origin hard coffee beverages targeting discerning consumers who value uniqueness and premium craftsmanship

- Premiumization supports higher price points and margins, encouraging brands to invest in sophisticated marketing and packaging that differentiate their hard coffee products on retail shelves

- The trend aligns with broader consumer movements toward experiential drinking and lifestyle branding, supporting stronger brand loyalty and repeat purchases

- Expansion of cocktail culture and home mixology further stimulates demand for premium hard coffee products that can be consumed neat or in mixed drinks. Increasing distribution in on-premise venues such as bars and restaurants also promotes premium hard coffee trial and repeat consumption

Restraint/Challenge

Disruption in Supply Chain

- The hard coffee market faces supply chain disruptions that impact ingredient sourcing, packaging materials, and production timelines, creating challenges in meeting consumer demand and maintaining product quality and availability

- For instance, volatility in coffee bean prices and limited availability of certain flavoring agents due to global logistic constraints has led to cost fluctuations and occasional shortages affecting manufacturing schedules

- Disruptions in glass, aluminum, and plastic packaging supply chains further constrain production volumes and increase operational costs for hard coffee producers

- Dependency on international suppliers and raw material imports exposes manufacturers to geopolitical risks, shipping delays, and tariff impacts that complicate supply planning. Fluctuations in energy costs and labor shortages in production facilities contribute to operational inefficiencies and pricing challenges

- To mitigate risks, manufacturers are exploring supply chain diversification, local sourcing, and inventory optimization strategies, although these adjustments may increase short-term capital expenditure

Hard Coffee Market Scope

The market is segmented on the basis of product type, flavor, distribution channel, packaging types, and alcohol content.

- By Product Type

On the basis of product type, the hard coffee market is segmented into Hard Coffee RTDs (Ready-to-Drink), Hard Coffee Mixers, and Hard Nitro Cold Brew. The Hard Coffee RTDs segment dominated the largest market revenue share in 2024, owing to its unmatched convenience and ready-to-consume nature that caters to busy lifestyles. Consumers favor RTDs for their consistent quality, ease of purchase, and portability, making them ideal for on-the-go consumption. The strong retail presence and increasing availability across convenience stores and online platforms further support this segment. Additionally, RTDs benefit from brand innovations in flavor and packaging that appeal to a wide demographic. The segment’s accessibility and appeal among millennials and Gen Z significantly drive its dominance in the market.

The Hard Coffee Mixers segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by rising consumer experimentation and demand for customizable alcoholic beverages. Mixers offer versatility, allowing consumers to blend hard coffee with other spirits or flavors, catering to social and party occasions. Growth in bar culture and mixology trends enhances demand for these products. Innovations in flavor profiles and packaging also contribute to the expanding appeal. This segment is gaining momentum in both on-trade and off-trade channels, capturing interest from younger, adventurous consumers seeking new drinking experiences.

- By Flavor

On the basis of flavor, the hard coffee market is segmented into Classic Coffee and Flavored varieties. The Classic Coffee segment held the largest revenue share of 62.2% in 2024, driven by consumers’ preference for the authentic and robust coffee taste combined with alcohol. This segment benefits from its familiarity and trust among traditional coffee drinkers who are venturing into hard coffee products. Classic flavors are often perceived as safe and reliable, making them a staple in the market. The segment is supported by strong brand loyalty and extensive product availability across channels, ensuring widespread consumer reach.

The Flavored segment is projected to witness the fastest CAGR from 2025 to 2032, as consumer demand shifts toward unique and experimental taste profiles. Innovations such as vanilla, caramel, mocha, and seasonal fruit infusions appeal especially to younger demographics and those seeking variety beyond standard coffee flavors. Flavor extensions increase the occasion-based consumption of hard coffee, encouraging trial and repeat purchases. Marketing efforts highlighting exotic and gourmet flavors further drive consumer curiosity and expand market penetration.

- By Distribution Channel

On the basis of distribution channels, the hard coffee market is segmented into Online and Offline sales. Offline channels, including supermarkets, liquor stores, and convenience stores, dominated the largest market share in 2024 due to their established physical presence and consumer preference for immediate purchase. The wide availability of products and in-store promotions make offline retail a key driver of sales, particularly for traditional buyers and casual consumers. Additionally, the ability to browse and purchase multiple brands in one location supports offline dominance.

The Online segment is expected to witness the fastest growth rate from 2025 to 2032, boosted by increasing e-commerce penetration and changing consumer habits favoring home delivery and contactless shopping. Online platforms provide consumers with access to a broader range of products, including niche and premium brands that might be less available offline. Subscription models, digital promotions, and targeted advertising enhance customer retention and engagement. The COVID-19 pandemic accelerated the shift to online purchasing, a trend that is expected to continue growing steadily.

- By Packaging Types

The packaging types segment divides the hard coffee market into Cans, Bottles, and Draft or Kegs. The Cans segment held the largest market share in 2024, driven by their convenience, portability, and sustainability advantages. Consumers prefer cans for outdoor activities, events, and casual consumption, as they are lightweight, recyclable, and easy to carry. The growing environmental awareness and regulations favoring recyclable packaging further support this segment’s leadership. Cans also enable attractive branding and innovation in portion sizes that appeal to on-the-go lifestyles.

The Bottles segment is forecasted to register the fastest growth from 2025 to 2032, largely due to its premium positioning and aesthetic appeal. Bottled hard coffee products are often associated with higher quality and giftability, appealing to consumers looking for a refined drinking experience. The segment benefits from craft and artisanal brands emphasizing packaging design and limited editions. Increasing consumer preference for collectibles and reusable packaging also fuels growth. Bottles find strong demand in specialty stores, bars, and restaurants, expanding their market reach.

- By Alcohol Content

On the basis of alcohol content, the hard coffee market is segmented into Low Alcohol Content and High Alcohol Content categories. Low Alcohol Content hard coffee dominated the largest market share in 2024, as consumers increasingly seek moderation in alcohol intake without sacrificing taste. This segment appeals particularly to health-conscious drinkers and those looking for beverages suitable for daytime or casual social occasions. Regulatory trends favoring lower alcohol content in ready-to-drink products also support this segment’s growth. The availability of flavorful, low-alcohol options enhances its accessibility among a broader audience.

The High Alcohol Content segment is projected to witness the fastest CAGR from 2025 to 2032, driven by consumers seeking bolder flavors and a stronger alcohol experience. This segment attracts more experienced drinkers and those who prefer beverages with higher potency for evening or party consumption. Premium brands are innovating with craft production techniques and stronger formulations to cater to this demand. The growth is supported by increased acceptance of stronger alcoholic products in certain markets and expanding on-trade consumption channels.

Hard Coffee Market Regional Analysis

- North America dominated the hard coffee market with the largest revenue share of 32.5% in 2024, driven by rising consumer preference for ready-to-drink alcoholic beverages and the growing popularity of hard coffee products among millennials and Gen Z

- The region benefits from a well-established distribution network and high disposable incomes, which support premiumization and product innovation. Consumers highly value the convenience, flavor variety, and portability that hard coffee offers, fueling consistent demand across both urban and suburban markets

- The expanding craft beverage culture and increasing acceptance of alternative alcoholic beverages also contribute to market growth. Moreover, extensive marketing campaigns and collaborations with lifestyle brands are enhancing brand visibility and consumer engagement in North America

U.S. Hard Coffee Market Insight

The U.S. hard coffee market captured the largest revenue share in North America in 2024, propelled by the rapid adoption of ready-to-drink alcohol beverages and evolving consumer lifestyles favoring on-the-go consumption. The U.S. market sees robust innovation in flavors and packaging, appealing to younger consumers and health-conscious drinkers alike. Increasing penetration of hard coffee in both retail and on-premise channels, including bars and restaurants, drives growth. Additionally, expanding e-commerce platforms and promotional strategies targeting social media-savvy consumers bolster market expansion. The growing trend toward premiumization and the rising influence of craft beverage movements also support the sustained growth of hard coffee in the U.S.

Europe Hard Coffee Market Insight

The Europe hard coffee market is projected to grow steadily throughout the forecast period, driven by rising urbanization, increasing consumer inclination toward flavored alcoholic beverages, and a growing café culture. Countries such as the U.K., Germany, and France are witnessing increased demand for novel alcoholic beverages that combine coffee and alcohol. The preference for premium and artisanal products, coupled with heightened health awareness, is encouraging manufacturers to innovate with organic and low-alcohol variants. Additionally, Europe's well-developed retail infrastructure and flourishing hospitality sector contribute to the widespread availability of hard coffee products. Regulatory frameworks in the region, which support responsible drinking, further shape market dynamics.

U.K. Hard Coffee Market Insight

The U.K. hard coffee market is expected to experience considerable growth, driven by consumers’ increasing interest in craft and ready-to-drink alcoholic beverages. The country’s vibrant pub and nightlife culture, combined with growing awareness of innovative alcohol categories, supports the adoption of hard coffee. Additionally, the U.K.’s strong e-commerce presence and the rising demand for convenience products accelerate market penetration. Health-conscious trends are also encouraging the introduction of low-alcohol and flavored hard coffee variants. Increasing collaborations between beverage brands and lifestyle influencers further fuel consumer engagement in the region.

Germany Hard Coffee Market Insight

The Germany hard coffee market is anticipated to expand at a notable CAGR, supported by a growing preference for high-quality and innovative alcoholic beverages among German consumers. Emphasis on sustainability and organic product offerings enhances appeal, as consumers increasingly seek eco-conscious brands. Germany’s robust retail and hospitality sectors provide ample opportunities for hard coffee products to gain traction, particularly in urban areas. The country’s inclination towards premium and artisanal alcoholic beverages, along with increasing health awareness, stimulates demand for diverse product offerings, including low-alcohol and flavored variants.

Asia-Pacific Hard Coffee Market Insight

The Asia-Pacific hard coffee market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid urbanization, increasing disposable incomes, and rising demand for innovative ready-to-drink alcoholic beverages in countries such as China, Japan, and India. The expanding middle-class population and shifting consumer preferences toward premium and convenient beverage options further accelerate market growth. Government initiatives promoting digitalization and e-commerce adoption facilitate wider product accessibility. Moreover, the region’s growing café and nightlife culture boosts demand for unique and flavored hard coffee products. The rise of domestic manufacturers and international brand entries contribute to market expansion.

Japan Hard Coffee Market Insight

The Japan hard coffee market is gaining momentum due to consumers’ affinity for high-quality, innovative beverages and a strong culture of convenience. The country’s aging population and busy urban lifestyles create demand for easy-to-consume alcoholic drinks that combine traditional coffee flavors with alcohol. Integration of hard coffee in convenience stores, vending machines, and retail outlets supports its popularity. Additionally, Japan’s focus on product aesthetics and packaging innovation enhances consumer appeal. The increasing number of collaborations between beverage companies and lifestyle brands is further driving growth.

China Hard Coffee Market Insight

The China hard coffee market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, a burgeoning middle class, and rising disposable incomes. The growing popularity of ready-to-drink alcoholic beverages, combined with expanding café culture and social drinking trends, drives adoption. Affordable product options and aggressive marketing campaigns by domestic and international brands further boost market penetration. Government support for digital commerce and improved logistics enhance accessibility across urban and semi-urban areas. The increasing trend toward premiumization and flavored variants also fuels growth in China’s hard coffee market.

Hard Coffee Market Share

The hard coffee industry is primarily led by well-established companies, including:

- Pabst Brewing Company (U.S.)

- Hornitos Tequila (Beam Suntory) (U.S.)

- Blackeye Roasting Co. (U.S.)

- Archer Roose (U.S.)

- Cuvee Coffee (U.S.)

- La Colombe Coffee Roasters (U.S.)

- Baileys Irish Cream (Diageo) (U.K.)

- Left Hand Brewing Company (U.S.)

- Hard Frescos (U.S.)

Latest Developments in Global Hard Coffee Market

- In April 2025, Starbucks announced plans to increase barista hiring and scale back automation efforts following unexpected financial results and a 1% global sales decline. This strategic pivot, led by CEO Brian Niccol, aims to restore customer loyalty in its largest market, the U.S., by enhancing personalized service and in-store experience. The move is expected to strengthen Starbucks’ competitive positioning amid growing consumer demand for human interaction and premium coffee experiences, potentially reversing the recent sales downturn and bolstering its market share

- In April 2025, Nestlé expanded its Nescafé Ready-to-Drink cold coffee portfolio to key emerging markets, including India, the MENA region, and Brazil. This expansion targets young, fast-paced consumers, particularly Gen Z and Millennials, who are driving double-digit growth in cold coffee consumption. By broadening its geographic footprint, Nestlé is positioning itself to capitalize on shifting consumer preferences toward convenient and flavorful cold beverages, strengthening its global presence and accelerating growth in high-potential markets

- In March 2025, UCC Ueshima Coffee Co. in Japan commenced large-scale production of coffee roasted using green hydrogen technology. This significant innovation, involving an investment of approximately 1 billion yen, aims to reduce carbon dioxide emissions while enhancing coffee flavor profiles. By targeting upscale sales channels such as luxury hotels and airlines, UCC is aligning itself with rising consumer demand for sustainable and premium coffee options, setting new standards in eco-friendly coffee production and potentially influencing industry practices

- In November 2024, Nestlé launched a new range of Nescafé Classic soluble coffee in Central and Eastern Europe, featuring caramel and hazelnut flavors. This product innovation, which dissolves efficiently in both hot and cold water, caters to younger consumers’ growing preference for cold and flavored coffee beverages. The launch is expected to drive increased adoption of soluble coffee products in the region, broadening Nestlé’s consumer base and responding to evolving taste trends, thus strengthening its competitive edge in the instant coffee segment

- In August 2022, Twelve5’s Rebel Hard Beverages re-released limited-edition seasonal flavors including Pumpkin Spice Hard Latte, Peppermint Mocha Hard Latte, and Winter Wonderland Hard Latte Variety Pack. This move leverages seasonal consumer interest and flavor innovation to boost brand visibility and sales momentum. The re-release taps into the growing hard coffee segment’s demand for unique and festive offerings, enhancing consumer engagement and positioning Rebel Hard Beverages as a dynamic player in the evolving alcoholic coffee market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hard Coffee Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hard Coffee Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hard Coffee Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.