Global Hard Tea Market

Market Size in USD Billion

CAGR :

%

USD

1.28 Billion

USD

14.31 Billion

2024

2032

USD

1.28 Billion

USD

14.31 Billion

2024

2032

| 2025 –2032 | |

| USD 1.28 Billion | |

| USD 14.31 Billion | |

|

|

|

|

Hard Tea Market Size

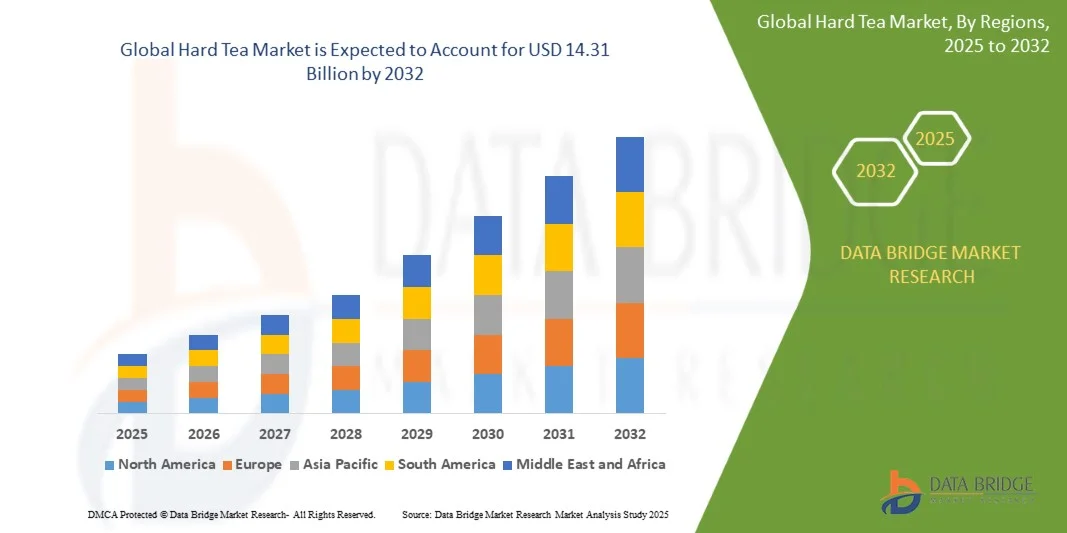

- The Hard Tea Market size was valued at USD 1.28 billion in 2024 and is expected to reach USD 14.31 billion by 2032, growing at a CAGR of 35.10% during the forecast period.

- The market growth is primarily driven by increasing consumer preference for ready-to-drink alcoholic beverages, coupled with the rising popularity of flavored and craft hard tea variants across various regions.

- Additionally, growing health consciousness among consumers and innovations in natural and organic ingredients are boosting demand, while expanding distribution channels and marketing initiatives are further propelling the market’s expansion globally.

Hard Tea Market Analysis

- Hard tea, a ready-to-drink alcoholic beverage combining tea and spirits, is gaining traction in both retail and hospitality sectors due to its refreshing taste and growing consumer interest in low-calorie, flavored alcoholic options.

- The rising demand for innovative flavors, natural ingredients, and craft alcoholic beverages is driving growth, alongside increased marketing efforts and expanding distribution through e-commerce and retail outlets.

- North America Dominated the Hard Tea Market with the largest revenue share of 35.5% in 2024, supported by high consumer awareness, a mature alcoholic beverage market, and strong presence of major brands introducing new product lines to cater to evolving tastes.

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, fueled by increasing urbanization, rising disposable incomes, and a growing youth population exploring alternative alcoholic drinks.

- The 2.0%–5.0% ABV segment dominated the market with the largest market revenue share of 62.4% in 2024, driven by rising demand for light, sessionable alcoholic beverages.

Report Scope and Hard Tea Market Segmentation

|

Attributes |

Hard Tea Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hard Tea Market Trends

“Flavor Innovation and Premium Positioning in Hard Tea Segment”

- A significant and accelerating trend in the Hard Tea Market is the growing emphasis on flavor innovation and premium product positioning, catering to evolving consumer tastes and the demand for elevated drinking experiences. Brands are increasingly developing unique flavor blends that combine traditional tea bases with exotic fruits, botanicals, and natural sweeteners to stand out in a crowded alcoholic beverage landscape.

- For Instance, brands such as Loverboy and Owl’s Brew are launching hard teas with ingredients such as hibiscus, ginger, lavender, and white tea, offering health-conscious, gluten-free, and organic options that appeal to millennials and Gen Z consumers. Similarly, larger beverage companies are expanding their hard tea portfolios with limited-edition flavors and seasonal offerings to keep the product line fresh and relevant.

- Premiumization is another driving force, with many hard tea products now being marketed in sleek cans or glass bottles with sophisticated branding that appeals to consumers seeking lifestyle-oriented alcoholic beverages. Craft breweries and smaller brands are also capitalizing on this trend by offering small-batch hard teas that emphasize artisanal quality and ingredient transparency.

- The blending of traditional tea culture with alcohol is also being explored, as companies experiment with regional tea varieties such as matcha, oolong, and rooibos to create differentiated products with cultural resonance and unique flavor profiles.

- This trend towards creative flavor development and premium branding is reshaping consumer expectations in the hard tea category, driving demand for beverages that offer not just refreshment but a curated, experience-driven appeal. Consequently, companies are investing in R&D and market testing to craft hard teas that balance taste, quality, and wellness-oriented positioning.

- As consumers continue to seek out flavorful, low-calorie alternatives to beer and sugary cocktails, the hard tea market is expected to see sustained growth through innovative product offerings that align with broader lifestyle and consumption trends.

Hard Tea Market Dynamics

Driver

“Growing Demand Driven by Health-Conscious Consumers and Alcohol Innovation”

- The Hard Tea Market is experiencing strong growth due to rising health consciousness among consumers and increased demand for innovative, low-calorie alcoholic beverages that align with modern wellness lifestyles.

- For instance, in March 2024, Anheuser-Busch expanded its product line with a new range of hard teas under its "Better Tomorrow" initiative, focusing on lower sugar content and natural ingredients, appealing to health-focused consumers seeking guilt-free indulgence. Such strategic moves by leading companies are expected to accelerate market expansion.

- As consumers become more selective about what they drink, hard tea presents an appealing alternative to traditional beer and high-sugar cocktails, offering a lighter, refreshing option that fits into active and mindful living.

- Additionally, the fusion of tea — often perceived as a healthy and calming beverage — with alcohol provides a unique value proposition that resonates with younger demographics seeking both novelty and balance in their drinking habits.

- The growing preference for gluten-free, low-carb, and natural ingredient-based drinks is making hard tea a key player in the evolving alcohol landscape. Increased interest in transparent labeling and clean ingredients further fuels this trend, as brands highlight antioxidants, botanical blends, and real brewed tea in their formulations.

- The surge in demand is also supported by broader shifts in drinking culture, including the rise of "sober-curious" lifestyles and moderation trends. These shifts are prompting alcohol brands to rethink their product lines, offering lower-ABV and sessionable drinks like hard teas that fit new consumption patterns.

Restraint/Challenge

“Regulatory Hurdles and Market Fragmentation”

- One of the primary challenges facing the Hard Tea Market is the complex regulatory landscape governing alcoholic beverages, which varies widely across countries and even within regions, creating significant barriers to market entry and expansion.

- For Instance, differences in alcohol classification, labeling requirements, and distribution laws can slow the launch of new products or restrict marketing activities. In some countries, hard tea may fall into ambiguous legal categories, requiring additional certifications or reformulations to comply with local laws.

- Furthermore, fragmented supply chains and the lack of standardized ingredients can result in inconsistent product quality across markets, affecting consumer trust and brand reputation. Smaller brands in particular may struggle to scale production while maintaining the same taste, quality, and compliance.

- Another significant restraint is the relatively limited consumer awareness of hard tea in some regions, particularly in emerging markets where traditional alcoholic beverages dominate and tea is consumed primarily in non-alcoholic forms. Education and marketing are required to shift perceptions and introduce hard tea as a mainstream product.

- Finally, although demand is growing, competition is intensifying, with major beverage companies and craft startups alike entering the space. This saturation increases the pressure on brands to differentiate themselves through flavor innovation, packaging, pricing, and health claims — all while maintaining compliance and consistency across global markets.

- Overcoming these challenges through regulatory alignment, consumer education, and consistent product development will be critical to sustaining long-term growth and expanding hard tea’s footprint worldwide.

Hard Tea Market Scope

The market is segmented on the basis of ABV, flavor, distribution channel.

• By ABV

On the basis of ABV, the Hard Tea Market is segmented into 2%–5% and more than 5.1%. The 2.0%–5.0% ABV segment dominated the market with the largest market revenue share of 62.4% in 2024, driven by rising demand for light, sessionable alcoholic beverages. Consumers, particularly millennials and Gen Z, are increasingly inclined toward drinks that offer moderate alcohol content with refreshing flavors and lower calorie counts. These products align well with wellness-focused lifestyles and are ideal for casual, social consumption.

The more than 5.1% ABV segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by growing interest in premium, full-bodied hard teas that cater to experienced drinkers seeking more pronounced alcohol effects. Craft beverage companies are actively expanding their portfolios to include bold, high-ABV flavors, contributing to the strong growth outlook of this segment in both developed and emerging markets.

• By Flavor

On the basis of flavor, the Hard Tea Market is segmented into Lemon, Raspberry, and Others (including peach, hibiscus, and mixed berries). The lemon flavor segment dominated the market in 2024 with the largest revenue share of 38.7%, supported by its broad appeal, familiarity among consumers, and its association with traditional iced tea flavors. Lemon-flavored hard tea is perceived as refreshing and versatile, making it a top choice across all demographics and occasions.

The raspberry segment is expected to record the fastest growth rate from 2025 to 2032, fueled by shifting consumer preferences toward sweeter, fruit-forward flavor profiles. Raspberry hard teas are particularly popular among younger consumers looking for vibrant, bold-tasting alcoholic beverages. Innovations in fruit-tea combinations and seasonal flavors are further driving the demand for raspberry and other unique blends, as brands expand their flavor portfolios to enhance product differentiation and appeal to evolving palates.

• By Distribution Channel

On the basis of distribution channel, the Hard Tea Market is segmented into Supermarket/Hypermarket, Online, and Others (including convenience stores, liquor shops, and specialty retailers). The supermarket/hypermarket segment held the largest market revenue share of 46.3% in 2024, owing to its widespread accessibility, strong shelf visibility, and consumer preference for in-store purchases of alcoholic beverages. These outlets offer a wide product range and promotional pricing, encouraging impulse buys and bulk purchases.

The online segment is projected to be the fastest-growing distribution channel from 2025 to 2032, driven by increasing internet penetration, improved legal frameworks for alcohol e-commerce, and consumer demand for convenience. Online platforms enable customers to discover niche or craft hard tea brands, compare prices, and read product reviews. The post-pandemic shift in consumer behavior toward digital shopping has further solidified online sales channels as a major growth area for the hard tea industry globally.

Hard Tea Market Regional Analysis

- North America dominated the Hard Tea Market with the largest revenue share of 35.5% in 2024, driven by rising consumer preference for innovative alcoholic beverages and the growing popularity of ready-to-drink (RTD) formats. The region's mature beverage industry and openness to new flavor trends make it a key driver of market growth.

- Consumers in North America are increasingly seeking low-calorie, refreshing alcoholic options that align with health-conscious lifestyles, with hard tea offering a balanced blend of flavor, alcohol, and perceived wellness benefits.

- The strong market presence of established beverage companies, expanding craft beverage startups, and a well-developed retail infrastructure—including supermarkets, liquor stores, and e-commerce platforms—support widespread adoption. Additionally, shifting consumption patterns among younger demographics and a rising trend of premiumization in RTD beverages further boost demand for hard tea across both on-premise and off-premise channels.

U.S. Hard Tea Market Insight

The U.S. hard tea market captured the largest revenue share of 78% in 2024 within North America, driven by shifting consumer preferences toward flavored alcoholic beverages and the growing popularity of ready-to-drink (RTD) options. Younger demographics, especially millennials and Gen Z, are fueling demand for refreshing, low-calorie alcoholic drinks that align with modern wellness trends. The U.S. market benefits from a mature alcohol industry, the presence of key players such as Boston Beer Company and Anheuser-Busch, and widespread availability across supermarkets, liquor stores, and online platforms. Additionally, strong innovation in flavor combinations, functional ingredients, and premium branding are contributing to market expansion across both mainstream and craft segments.

Europe Hard Tea Market Insight

The Europe hard tea market is projected to grow at a substantial CAGR throughout the forecast period, supported by increasing demand for low-alcohol, flavored beverages and the shift toward alternative drink categories. European consumers are embracing RTD options that offer convenience, taste variety, and perceived health benefits over traditional alcohol. The region’s growing preference for organic, vegan, and clean-label alcoholic beverages is encouraging manufacturers to introduce hard teas with natural ingredients and reduced sugar content. Additionally, changing social habits, particularly in countries with rising moderation trends such as Germany and France, are propelling the demand for lighter alcoholic formats like hard tea.

U.K. Hard Tea Market Insight

The U.K. hard tea market is expected to grow at a noteworthy CAGR during the forecast period, driven by evolving drinking habits and increased interest in premium, low-ABV beverages. British consumers, particularly in urban centers, are showing increased openness to innovative alcohol products such as hard tea, especially those with botanical infusions or wellness claims. The popularity of iced teas and cold brew formats further supports adoption. Moreover, the U.K.’s robust retail network and strong online alcohol sales infrastructure are accelerating product visibility and availability, particularly among health-conscious and younger consumers seeking novel drinking experiences.

Germany Hard Tea Market Insight

The Germany hard tea market is poised for significant growth during the forecast period, fueled by increasing consumer demand for functional and flavorful RTD alcoholic beverages. Germany’s growing health and sustainability awareness has led to greater interest in beverages made with natural ingredients, minimal additives, and low sugar. Hard teas are appealing to consumers who want a middle ground between soft drinks and beer, with a lighter profile and a modern image. Additionally, the rise of premiumization trends and the success of craft beer in the country are encouraging similar experimentation within the hard tea segment.

Asia-Pacific Hard Tea Market Insight

The Asia-Pacific hard tea market is projected to grow at the fastest CAGR of 24% during the forecast period (2025–2032), driven by rapid urbanization, rising disposable incomes, and changing lifestyle preferences in countries such as China, Japan, India, and South Korea. Increasing interest in Western-style beverages and the growing presence of international brands in the region are expanding consumer exposure to hard tea. Government initiatives supporting digital retail infrastructure and alcohol e-commerce are also supporting growth. Furthermore, the influence of tea culture in APAC presents a unique advantage, with local producers developing hard tea products that blend traditional tea profiles with modern alcoholic formats.

Japan Hard Tea Market Insight

The Japan hard tea market is gaining momentum due to the country’s deep-rooted tea culture and rising consumer interest in low-alcohol, refreshing beverages. As Japanese consumers increasingly prioritize convenience, taste innovation, and wellness, hard tea is emerging as a trendy alternative to beer and chu-hi. The popularity of bottled and canned tea drinks in the non-alcoholic segment provides a solid foundation for crossover innovation in the alcoholic category. Additionally, the aging population is expected to support demand for moderate-alcohol beverages, while tech-savvy consumers are embracing online platforms for product discovery and purchase.

China Hard Tea Market Insight

The China hard tea market held the largest revenue share in Asia-Pacific in 2024, driven by a rapidly expanding middle class, urban lifestyle trends, and the country’s strong tradition of tea consumption. With a growing number of consumers seeking new and trendy alcoholic options, hard tea is emerging as a preferred choice among younger, social drinkers. China’s vibrant RTD market and the strong presence of domestic beverage giants provide fertile ground for innovation in this category. The development of flavored hard teas tailored to local tastes—such as jasmine or oolong-based variants—is gaining traction, further supported by online retail platforms and influencer-led marketing campaigns.

Hard Tea Market Share

The Hard Tea industry is primarily led by well-established companies, including:

- The Boston Beer Company (U.S.)

- Pabst Brewing Company (U.S.)

- Constellation Brands, Inc. (U.S.)

- Molson Coors Beverage Company (U.S)

- Heineken N.V. (Netherlands)

- Diageo plc (U.K.)

- AB InBev (Belgium)

- Mark Anthony Brands International (Canada)

- Asahi Group Holdings, Ltd. (Japan)

- Suntory Holdings Limited (Japan)

- Carlsberg Group (Denmark)

- Kirin Holdings Company, Limited (Japan)

- Brown-Forman Corporation (U.S.)

- Pernod Ricard (France)

- BrewDog plc (U.K.)

- Red Bull GmbH (Austria)

- PepsiCo, Inc. (U.S.)

- Coca-Cola Company (U.S.)

What are the Recent Developments in Hard Tea Market?

- In April 2023, Pabst Brewing Company expanded its product portfolio with the nationwide release of Pabst Blue Ribbon Hard Tea, a refreshing alcoholic beverage that combines brewed tea with real fruit flavors. Targeting health-conscious millennials and Gen Z consumers, this launch underscores the company's efforts to tap into the growing demand for flavored, lower-ABV alternatives to traditional beers and spirits. By leveraging its iconic branding and market reach, Pabst is positioning itself as a strong contender in the rapidly expanding Hard Tea Market.

- In March 2023, Twisted Tea, a brand under the Boston Beer Company, announced the rollout of new flavor variants, including Peach and Blackberry, to diversify its hard tea lineup. These additions are designed to cater to evolving consumer palates and broaden the brand’s appeal across a wider demographic. The launch highlights Twisted Tea’s continued innovation within the segment, reinforcing its leadership in the Hard Tea Market through product variety and strategic flavor development.

- In March 2023, Anheuser-Busch entered the hard tea category with the debut of Lipton Hard Iced Tea, developed in partnership with PepsiCo. Combining Lipton’s strong legacy in the non-alcoholic tea market with Anheuser-Busch’s alcohol distribution network, the launch leverages brand trust and market synergy. This strategic collaboration signals increasing cross-industry partnerships in the Hard Tea Market, aiming to capture consumer attention in both retail and on-premise channels.

- In February 2023, NÜTRL, a brand under Labatt Breweries of Canada (a subsidiary of AB InBev), introduced its first hard tea product line in the Canadian market, featuring natural ingredients and no added sugar. The move aligns with consumer trends favoring transparency, health-conscious options, and functional beverages. NÜTRL’s entry into the hard tea space underscores the brand’s commitment to innovation and its ambition to diversify within the broader ready-to-drink (RTD) alcohol category.

- In January 2023, Blue Point Brewing Company, a subsidiary of Anheuser-Busch, launched Blue Point Hard Tea, a line of craft-inspired hard teas aimed at younger consumers seeking flavorful, low-ABV alternatives. Launched initially in select U.S. states, the product line blends real brewed tea with subtle fruit infusions. This introduction emphasizes Blue Point’s strategy to tap into niche subcategories within the Hard Tea Market, aligning with shifting consumer preferences and seasonal drinking trends.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hard Tea Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hard Tea Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hard Tea Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.