Global Hardware Acceleration Market

Market Size in USD Billion

CAGR :

%

USD

17.12 Billion

USD

420.56 Billion

2024

2032

USD

17.12 Billion

USD

420.56 Billion

2024

2032

| 2025 –2032 | |

| USD 17.12 Billion | |

| USD 420.56 Billion | |

|

|

|

|

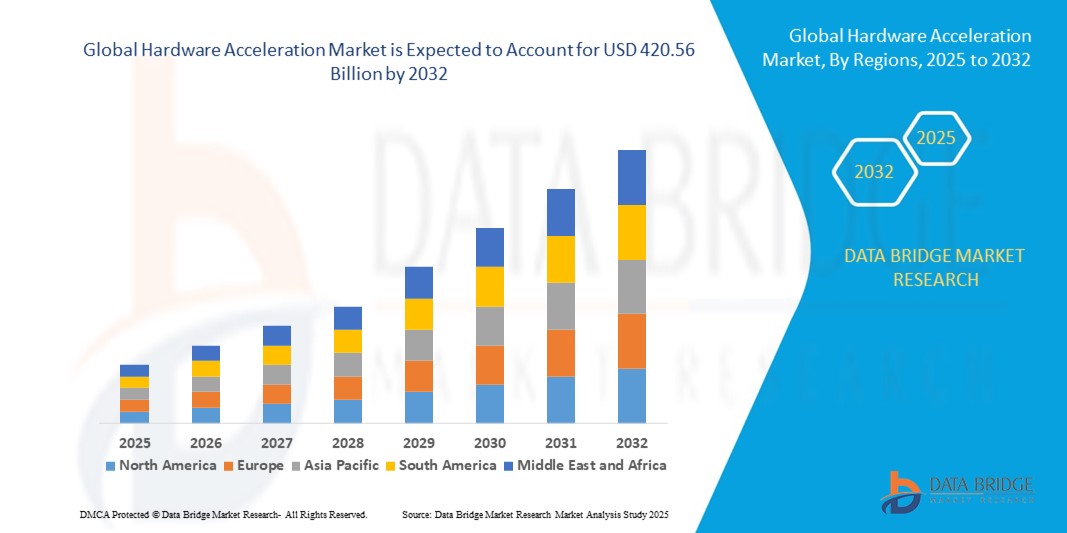

What is the Global Hardware Acceleration Market Size and Growth Rate?

- The global hardware acceleration market size was valued at USD 17.12 billion in 2024 and is expected to reach USD 420.56 billion by 2032, at a CAGR of49.20% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within connected home devices and smart home technology, leading to increased digitalization in both residential and commercial settings

- Furthermore, rising consumer demand for secure, user-friendly, and integrated solutions for their homes and businesses is establishing Hardware Accelerations as the modern access control system of choice. These converging factors are accelerating the uptake of Hardware Acceleration solutions, thereby significantly boosting the industry's growth

What are the Major Takeaways of Hardware Acceleration Market?

- Hardware Accelerations, offering electronic or digital access control for doors and gates, are increasingly vital components of modern home security and automation systems in both residential and commercial settings due to their enhanced convenience, remote access capabilities, and seamless integration with smart home ecosystems

- The escalating demand for hardware accelerations is primarily fueled by the widespread adoption of smart home technologies, growing security concerns among consumers, and a rising preference for the convenience of keyless entry

- North America dominated the hardware acceleration market with the largest revenue share of 45.69% in 2024, driven by strong demand for AI-powered computing, data centers, and high-performance workloads

- The Asia-Pacific hardware acceleration market is projected to grow at the fastest CAGR of 9.14% between 2025 and 2032, driven by rapid digital transformation, expanding 5G networks, and a surge in AI adoption across industries

- The Graphics Processing Unit (GPU) segment dominated the market with the largest revenue share of 46.5% in 2024, driven by its established role in accelerating parallel computations required for AI, gaming, and high-performance computing

Report Scope and Hardware Acceleration Market Segmentation

|

Attributes |

Hardware Acceleration Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Hardware Acceleration Market?

Enhanced Performance Through AI and Machine Learning Integration

- A major and accelerating trend in the global hardware acceleration market is the integration of artificial intelligence (AI) and machine learning (ML) to optimize computational performance and reduce latency in data-intensive workloads. This trend is redefining hardware accelerators’ role across industries including cloud computing, autonomous vehicles, and high-performance computing (HPC)

- For instance, NVIDIA’s GPUs and Google’s Tensor Processing Units (TPUs) are increasingly leveraged to handle AI-driven tasks such as image recognition, predictive analytics, and natural language processing, significantly boosting efficiency compared to general-purpose CPUs

- Hardware accelerators embedded with AI capabilities can dynamically allocate resources, improve inference speeds, and enable energy-efficient computing for large-scale operations

- Integration with AI workloads is also fueling adoption in edge devices, supporting real-time decision-making in IoT, 5G, and robotics

- This shift towards AI-powered, intelligent, and high-speed accelerators is reshaping market expectations, compelling major players such as Intel, NVIDIA, and Qualcomm to innovate and expand AI-focused product lines

- Consequently, demand for AI-integrated hardware accelerators is surging across both enterprise and consumer markets, driving long-term growth

What are the Key Drivers of Hardware Acceleration Market?

- The rising demand for faster and more efficient data processing in applications such as AI, cloud computing, and deep learning is a primary driver for the hardware acceleration market

- For instance, in March 2024, Intel launched its Gaudi 3 AI accelerator designed for large-scale generative AI workloads, showcasing industry-wide focus on specialized, high-performance chips

- Businesses and developers are increasingly shifting from CPU-only infrastructures to GPU, FPGA, and ASIC-based accelerators for tasks requiring parallel processing and real-time insights

- The explosive growth of cloud services and data centers is another key factor, as hyperscalers such as AWS, Microsoft Azure, and Google Cloud continuously deploy accelerators to meet AI-driven customer demands

- In addition, the growing popularity of autonomous driving, AR/VR, and 5G further fuels demand, as these technologies require high-speed, low-latency computation

- The rising need for energy-efficient solutions that minimize operational costs while maximizing throughput is also pushing adoption across industries

- Together, these drivers are establishing hardware acceleration as a cornerstone of modern computing infrastructure

Which Factor is Challenging the Growth of the Hardware Acceleration Market?

- A major challenge facing the hardware acceleration market is the high cost and complexity of deployment, coupled with cybersecurity risks linked to connected accelerators

- Advanced GPUs, FPGAs, and ASICs require significant capital investment, making them less accessible for small enterprises and cost-sensitive markets

- For instance, the NVIDIA H100 GPU, widely adopted for AI training, has been reported to cost tens of thousands of dollars per unit, restricting widespread usage in developing regions

- Alongside cost barriers, concerns over data security and integrity in cloud environments using hardware accelerators raise hesitation among enterprises

- In addition, the rapid pace of innovation often renders existing hardware obsolete within short product cycles, creating challenges for long-term ROI and deployment strategies

- While companies are working to mitigate these concerns by offering cloud-based accelerator services and enhanced encryption, affordability and security remain key hurdles

- Overcoming these barriers through lower-cost solutions, scalable accelerator-as-a-service models, and stronger security frameworks will be crucial for broader adoption in the coming years

How is the Hardware Acceleration Market Segmented?

The market is segmented on the basis of type, application, and end user.

- By Type

On the basis of type, the hardware acceleration market is segmented into Graphics Processing Unit (GPU), Video Processing Unit (VPU), AI Accelerator, Regular Expression Accelerator, Cryptographic Accelerator, and Others. The Graphics Processing Unit (GPU) segment dominated the market with the largest revenue share of 46.5% in 2024, driven by its established role in accelerating parallel computations required for AI, gaming, and high-performance computing. GPUs are extensively used in data centers and cloud platforms, making them indispensable for large-scale AI model training.

The AI Accelerator segment is projected to witness the fastest CAGR of 23.4% from 2025 to 2032, fueled by the rapid adoption of AI across industries such as autonomous driving, healthcare imaging, and robotics. Their efficiency in reducing power consumption while delivering higher throughput makes them increasingly preferred. Growing investment in edge AI further supports the strong growth trajectory of AI accelerators.

- By Application

On the basis of application, the hardware acceleration market is segmented into Deep Learning Training, Public Cloud Inference, Enterprise Inference, and Others. The Deep Learning Training segment captured the largest market revenue share of 44.1% in 2024, as enterprises and research institutions heavily depend on hardware accelerators to process massive datasets and train complex neural networks. The growing number of generative AI applications, including large language models, continues to drive significant demand in this segment.

The Public Cloud Inference segment is expected to expand at the fastest CAGR of 22.8% from 2025 to 2032, supported by the rising integration of AI capabilities within cloud service providers such as AWS, Microsoft Azure, and Google Cloud. Cloud-based inference allows scalable deployment of AI applications across industries, providing cost-effective and flexible access to advanced computing resources, which is particularly appealing for startups and enterprises with limited infrastructure.

- By End User

On the basis of end user, the hardware acceleration market is segmented into Information Technology and Telecommunication, BFSI, Retail, Hospitality, Logistics, Automotive, Healthcare, Energy, and Others. The Information Technology and Telecommunication sector dominated the market with the largest revenue share of 38.6% in 2024, driven by the heavy reliance on hardware accelerators in data centers, 5G infrastructure, and cloud computing platforms. The demand for real-time analytics, secure communications, and large-scale AI workloads further boosts adoption in this sector.

The Healthcare segment is anticipated to witness the fastest CAGR of 21.9% from 2025 to 2032, propelled by the increasing application of AI in medical imaging, drug discovery, genomics, and patient data analysis. Hardware accelerators are essential for processing vast amounts of healthcare data with precision and speed, enabling faster diagnoses and personalized treatment. Growing investments in digital healthcare infrastructure worldwide support the rapid expansion of this segment.

Which Region Holds the Largest Share of the Hardware Acceleration Market?

- North America dominated the hardware acceleration market with the largest revenue share of 45.69% in 2024, driven by strong demand for AI-powered computing, data centers, and high-performance workloads

- Enterprises in the region highly value the scalability, performance optimization, and seamless integration of hardware accelerators such as GPUs, FPGAs, and AI chips with cloud and edge systems

- This dominance is further supported by large-scale investments from technology giants, a robust startup ecosystem, and the growing need for low-latency AI applications across IT, BFSI, healthcare, and automotive industries

U.S. Hardware Acceleration Market Insight

The U.S. hardware acceleration market captured the largest regional share of 81% in 2024, supported by the rapid deployment of AI models, data-intensive computing, and hyperscale cloud services. Growing adoption of AI accelerators in autonomous vehicles, defense, and healthcare analytics continues to drive momentum. Major players such as NVIDIA, Intel, and Qualcomm are actively developing advanced accelerator solutions, further strengthening the U.S. market. The country’s emphasis on AI leadership and federal support for semiconductor manufacturing enhances its competitive advantage.

Europe Hardware Acceleration Market Insight

The Europe hardware acceleration market is projected to grow at a strong CAGR during the forecast period, fueled by stringent data protection regulations and the rising adoption of accelerators for edge AI and enterprise computing. Increasing digitalization across banking, logistics, and manufacturing sectors is fostering demand for advanced compute solutions. European enterprises are also emphasizing energy-efficient and eco-conscious accelerators, aligning with the EU’s sustainability initiatives. Adoption is particularly strong in high-performance computing centers and next-gen automotive applications, driving continuous market expansion.

U.K. Hardware Acceleration Market Insight

The U.K. hardware acceleration market is expected to grow significantly, supported by the expansion of fintech, AI-driven healthcare, and cloud adoption. A surge in data center investments and the push for secure, scalable enterprise AI solutions are driving market penetration. In addition, the U.K.’s growing AI research ecosystem and collaborations between academia and industry are fostering innovation in custom accelerators. The increasing focus on cybersecurity and real-time analytics further strengthens adoption across BFSI and government sectors.

Germany Hardware Acceleration Market Insight

The Germany hardware acceleration market is forecast to expand at a notable CAGR, underpinned by the country’s strong industrial base and leadership in automotive and manufacturing innovation. Hardware accelerators are increasingly integrated into Industry 4.0, robotics, and connected car technologies, where low-latency AI and real-time decision-making are critical. Germany’s push for sovereign cloud infrastructure and secure digital ecosystems further drives adoption. Growing investments in quantum computing and high-performance clusters add to the country’s pivotal role in the European accelerator market.

Which Region is the Fastest Growing in the Hardware Acceleration Market?

The Asia-Pacific hardware acceleration market is projected to grow at the fastest CAGR of 9.14% between 2025 and 2032, driven by rapid digital transformation, expanding 5G networks, and a surge in AI adoption across industries. Countries such as China, Japan, and India are investing heavily in AI research, chip design, and semiconductor production, positioning APAC as both a major consumer and producer of hardware accelerators. The rise of smart cities, autonomous mobility, and affordable edge devices is making accelerators more accessible across the region.

Japan Hardware Acceleration Market Insight

The Japan hardware acceleration market is gaining traction, supported by the country’s leadership in robotics, electronics, and advanced computing. With rapid urbanization and a growing aging population, Japan is deploying AI accelerators for healthcare diagnostics, smart infrastructure, and autonomous systems. Integration with IoT devices, including connected vehicles and factory automation, is driving demand. Strong government backing for digital innovation and next-gen semiconductor development further accelerates the adoption of specialized hardware solutions in Japan.

China Hardware Acceleration Market Insight

The China hardware acceleration market held the largest share in APAC in 2024, supported by its expanding semiconductor ecosystem, vast consumer base, and strong government initiatives to achieve technological self-reliance. China is witnessing robust demand for accelerators in cloud computing, e-commerce, surveillance, and AI-enabled applications. The rise of domestic players such as Huawei and Horizon Robotics, along with government-led programs to build smart cities, is fueling growth. The affordability of locally manufactured accelerators is also expanding access across enterprises and startups asuch as.

Which are the Top Companies in Hardware Acceleration Market?

The hardware acceleration industry is primarily led by well-established companies, including:

- SAMSUNG (South Korea)

- Apple Inc. (U.S.)

- videantis GmbH (Germany)

- Qualcomm Technologies, Inc. (U.S.)

- NVIDIA Corporation (U.S.)

- Premier Farnell Limited (U.K.)

- Micron Technology, Inc. (U.S.)

- Alphabet Inc. (U.S.)

- Veridify Security Inc. (U.S.)

- Microsoft (U.S.)

- Xilinx (U.S.)

- Intel Corporation (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Arm Limited (U.K.)

- MediaTek Inc. (Taiwan)

- IBM Corporation (U.S.)

- Horizon Robotics (China)

- Cisco Systems, Inc. (U.S.)

- Cadence Design Systems, Inc. (U.S.)

- Oracle (U.S.)

What are the Recent Developments in Global Hardware Acceleration Market?

- In October 2024, AMD introduced the Alveo UL3422, an electronic trading accelerator created for ultra-low latency financial applications. This compact card, powered by the AMD Virtex UltraScale+ FPGA, enables trading firms to execute trades in under 3ns latency. Offering a cost-efficient solution for high-frequency trading, it makes advanced performance accessible to organizations of all scales. This launch reinforces AMD’s commitment to delivering cutting-edge acceleration solutions for the financial sector

- In September 2024, Intel unveiled its next-generation AI offerings, including the Xeon 6 processor and Gaudi 3 AI accelerators. The Xeon 6 delivers twice the performance for AI and HPC workloads, while Gaudi 3 boosts throughput by 20% and provides an improved price-to-performance advantage. These innovations are tailored for scalable AI infrastructures in data centers and cloud environments, helping enterprises improve efficiency, performance, and cost optimization. This launch positions Intel as a strong enabler of next-generation AI adoption globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hardware Acceleration Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hardware Acceleration Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hardware Acceleration Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.