Global Hdpe Wax Market

Market Size in USD Million

CAGR :

%

USD

469.69 Million

USD

632.98 Million

2024

2032

USD

469.69 Million

USD

632.98 Million

2024

2032

| 2025 –2032 | |

| USD 469.69 Million | |

| USD 632.98 Million | |

|

|

|

|

High-Density Polyethylene (HDPE) Wax Market Size

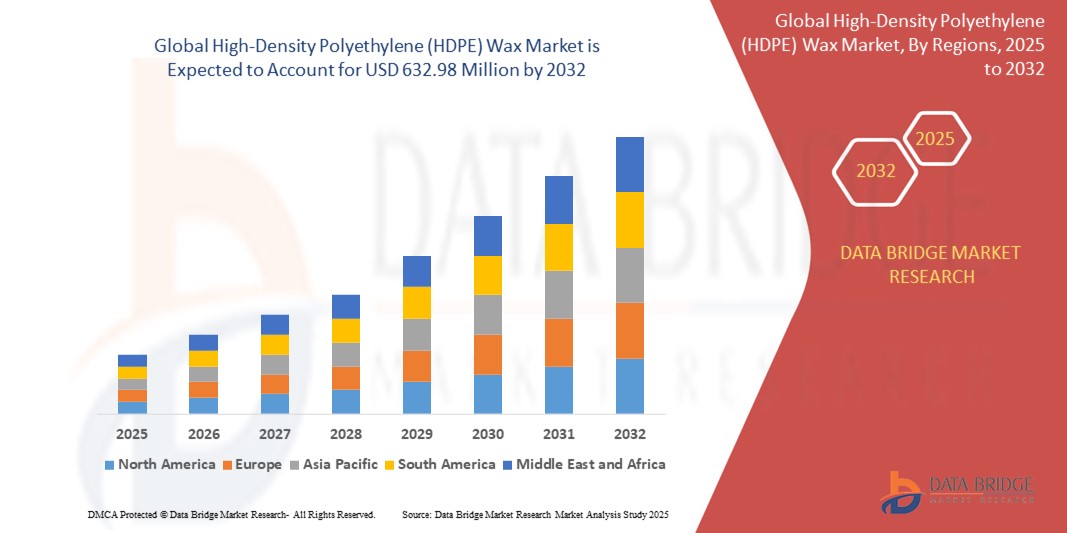

- The global high-density polyethylene (HDPE) wax market size was valued at USD 469.69 million in 2024 and is expected to reach USD 632.98 million by 2032, at a CAGR of 3.80% during the forecast period

- The market growth is primarily driven by the increased use of HDPE wax as a processing aid and dispersing agent in plastics, rubber, and coatings industries, owing to its superior lubricity and thermal stability

- In addition, the growing demand for PVC processing and masterbatch production, especially in developing economies, is fueling the consumption of HDPE wax across industrial applications

High-Density Polyethylene (HDPE) Wax Market Analysis

- HDPE wax is increasingly vital across various industries, particularly in plastic processing, rubber compounding, hot-melt adhesives, and inks/coatings, due to its excellent thermal stability, lubricity, and low viscosity

- The rising use of HDPE wax in PVC processing, color masterbatches, and hot-melt adhesives is a primary driver of market growth, supported by expanding demand in packaging, construction, and automotive sectors globally

- Asia-Pacific dominates the HDPE wax market with the largest revenue share of 41.7% in 2025, owing to robust industrial output, particularly in China and India, where large-scale plastics and packaging production drives consumption. Major manufacturers in the region are expanding capacity and investing in cost-efficient wax solutions to meet growing domestic and export demand

- North America is expected to be the fastest-growing region in the HDPE wax market during the forecast period, driven by rising demand in sustainable packaging, the recovery of the manufacturing sector, and increasing application in industrial lubricants and coatings. The U.S. leads with technological advancements in polymer processing and strong R&D investments from players such as Honeywell and Innospec

- The plastic segment is projected to dominate the market with a market share of 39.5% in 2025, as HDPE wax is extensively used to improve the dispersion of fillers and pigments, enhance surface quality, and reduce processing friction in polyolefin compounds and PVC formulations.

Report Scope and High-Density Polyethylene (HDPE) Wax Market Segmentation

|

Attributes |

High-Density Polyethylene (HDPE) Wax Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

High-Density Polyethylene (HDPE) Wax Market Trends

“Strategic Technological Advancements and Supply Chain Integration”

- A key and accelerating trend in the global HDPE wax market is the adoption of advanced polymer processing technologies, such as automated extrusion systems, reactive extrusion, and continuous blending processes, which enhance dispersion efficiency, reduce energy consumption, and improve product consistency across applications such as masterbatches, adhesives, and coatings

- For instance, in July 2023, Clariant implemented a next-generation polymer processing line at its additives facility in Germany, featuring real-time monitoring and automated quality control for wax dispersions—enhancing throughput and reducing waste in HDPE wax-based applications

- Leading chemical and plastic additive companies are engaging in vertical integration across the wax value chain, including upstream polyethylene sourcing and downstream application formulation. In March 2024, Mitsui Chemicals expanded its in-house HDPE resin capabilities to streamline supply for wax production, ensuring cost control and stable product quality for global clients

- The use of specialty HDPE waxes in sustainable formulations—such as bio-based packaging, recyclable plastics, and solvent-free coatings—is growing in response to tightening global regulations on VOC emissions and non-biodegradable materials. For example, in February 2024, Michelman Inc. launched a new line of high-performance HDPE wax emulsions for water-based coatings to comply with European REACH and U.S. EPA standards

- Digitalization and automation across supply chains are gaining momentum. In September 2023, Honeywell International Inc. introduced a blockchain-enabled supply tracking platform for its specialty chemicals division, allowing real-time tracking and traceability of HDPE wax shipments across international markets to address transparency and logistical bottlenecks

- The expansion of circular economy initiatives, including waste polyethylene recycling into wax derivatives, is emerging as a strategic sustainability pathway. In 2024, Westlake Corporation began pilot testing a pyrolysis-based HDPE wax recovery system from post-consumer plastic waste streams, targeting industrial lubricant and adhesive applications

- These developments reflect a broader transformation of the HDPE wax market, where technological modernization, regulatory alignment, and end-to-end value chain control are shaping competitiveness and innovation. Market players are increasingly investing in intelligent production systems, green formulations, and closed-loop supply models to secure long-term growth

High-Density Polyethylene (HDPE) Wax Market Dynamics

Driver

“Growing Demand from Polymer Processing and Sustainable Packaging Sectors”

- The rising global consumption of plastic products and polymer compounds across industries such as packaging, automotive, construction, and consumer goods is a key driver fueling the demand for HDPE wax, which serves as a critical processing aid and dispersing agent

- For instance, in January 2024, SCG Chemicals announced the expansion of its HDPE wax production line in Thailand to meet increasing regional demand from the masterbatch and hot-melt adhesive sectors, especially for high-performance packaging solutions

- The global shift toward sustainable packaging, especially recyclable and lightweight plastics, has elevated the use of HDPE wax in low-VOC, solvent-free coatings and water-based ink systems. These applications benefit from HDPE wax’s abrasion resistance, gloss enhancement, and anti-blocking properties

- As PVC processing and color masterbatch manufacturing gain momentum in fast-developing regions such as Southeast Asia, Africa, and Latin America, the use of HDPE wax to optimize mixing efficiency, pigment dispersion, and melt flow is increasing sharply

- In addition, technological advancements in extrusion and compounding are enhancing the utility of HDPE wax across a wider range of polymer matrices, with companies such as Innospec and BASF offering engineered waxes tailored to modern polymer blending systems

- Overall, the sustained growth of the plastics and coatings industries, paired with rising emphasis on environmentally compliant formulations, continues to drive demand for HDPE wax globally

Restraint/Challenge

“Volatility in Raw Material Prices and Limited Recycling Integration”

- One of the major challenges in the HDPE wax market is the fluctuating price of feedstock polyethylene resins, which are derived from petrochemicals. Price volatility in ethylene and crude oil significantly affects HDPE wax production economics

- For Instances, the 2022–2024 crude oil price swings, triggered by geopolitical tensions and OPEC+ production decisions, directly impacted polymer raw material costs, leading to unstable HDPE wax pricing and margin pressures on manufacturers

- Another restraint is the low integration of post-consumer polyethylene recycling into wax production. While circular economy initiatives are growing, only a small portion of waste HDPE is currently upgraded into high-purity waxes due to technical barriers in separation and purification

- The energy-intensive nature of HDPE wax production, particularly in oxidized or micronized forms, contributes to operational costs and environmental concerns, especially in regions with high power tariffs or carbon taxes

- In addition, regulatory pressure on synthetic waxes containing residual solvents or non-biodegradable components is rising in regions such as the European Union, where REACH and Green Deal policies are tightening requirements on product safety and sustainability

- The capital investment required for modern wax manufacturing units with precise temperature and molecular weight control systems remains high, creating entry barriers for small and medium-sized players in emerging economies

- Addressing these challenges will require innovations in feedstock flexibility, advanced recycling technologies, and the adoption of energy-efficient production methods to ensure sustainable market growth.

High-Density Polyethylene (HDPE) Wax Market Scope

The market is segmented on the basis of type, process, and application.

• By Type

On the basis of type, the High-Density Polyethylene (HDPE) Wax market is segmented into oxidation type HDPE wax, non-oxidation type HDPE wax, oxidized PE wax, and micronized PE wax. The Oxidation Type HDPE Wax segment dominates the largest market revenue share in 2025, driven by its superior lubricity, dispersing properties, and thermal stability, which make it suitable for applications in PVC processing, inks, and coatings. Manufacturers often prioritize oxidation type HDPE wax for its excellent surface protection and matting effects across diverse industrial formulations. The market also witnesses strong demand for oxidation type waxes due to their enhanced adhesion and scratch resistance benefits in packaging and decorative coatings

The Micronized PE Wax segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its increasing adoption in high-performance inks and coatings, where ultra-fine particle size enables superior smoothness, gloss control, and rub resistance. Micronized wax also finds growing usage in powder coatings and wood finishes, offering formulation flexibility and environmental compliance benefits

• By Process

On the basis of process, the High-Density Polyethylene (HDPE) Wax market is segmented into polymerization, modification, micronization, and thermal cracking. The Polymerization segment held the largest market revenue share in 2025, driven by the ability to produce consistent molecular weight distributions and low-melt viscosity HDPE waxes ideal for masterbatches, cable compounds, and plastic processing. Polymerization enables precise control over wax structure and functionality, making it a preferred method for premium-grade industrial applications

The Micronization process segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand for finely milled waxes in printing inks, coil coatings, and specialty adhesives. Micronization enhances the dispersion and surface activity of HDPE wax particles, offering high-end performance characteristics in low-VOC and water-based systems

• By Application

On the basis of application, the High-Density Polyethylene (HDPE) Wax market is segmented into inks and coatings, adhesives, masterbatches, plastics, rubber, hot-melt adhesive, and others. Masterbatches segment held the largest market revenue share in 2025, driven by the widespread use of HDPE wax as a processing aid to improve pigment dispersion, reduce melt viscosity, and enhance flow characteristics during compounding. HDPE wax supports color uniformity and extrusion efficiency in various thermoplastics, contributing to its dominant position in this application area

The Hot-Melt Adhesive segment is expected to witness the fastest CAGR from 2025 to 2032, favored for its growing role in pressure-sensitive adhesives, packaging, and hygiene products. HDPE wax enhances thermal resistance, tack control, and open time properties in hot-melt formulations, enabling performance optimization in both industrial and consumer use cases

High-Density Polyethylene (HDPE) Wax Market Regional Analysis

- Asia-Pacific dominates the global High-Density Polyethylene (HDPE) Wax market, accounting for the largest revenue share of 41.7% in 2025, driven by the rapid expansion of the plastics and packaging industries in countries such as China, India, and Japan. The region benefits from large-scale industrial production, availability of low-cost labor, and increasing domestic consumption of plastic-based products and additives

- In addition, significant investments in polymer processing technologies and rising exports of HDPE-based masterbatches and adhesives are boosting regional market growth. Key players such as Mitsui Chemicals and SCG Chemicals are expanding their production capacities and strengthening supply chains to meet growing demand across diverse sectors including automotive, construction, and textiles

- The regional market also benefits from supportive government initiatives promoting industrial growth and chemical manufacturing self-sufficiency. Ongoing advancements in plastic recycling and sustainable wax alternatives, particularly in China and South Korea, further enhance market prospects by aligning with circular economy goals and environmental compliance mandates

Japan High-Density Polyethylene (HDPE) Wax Market Insight

The Japan HDPE wax market is driven by the country’s advanced polymer processing sector, precision manufacturing standards, and demand for high-performance additives in electronics, automotive, and printing applications. Japanese companies are emphasizing innovation in wax modification and micronization to cater to niche applications such as coatings, adhesives, and toner formulations. In addition, Japan’s increasing focus on eco-friendly manufacturing and circular plastics economy is pushing demand for synthetic waxes with improved compatibility and performance

China High-Density Polyethylene (HDPE) Wax Market Insight

The China HDPE wax market is expected to dominate the Asia-Pacific region, driven by the country’s massive plastic production capacity, strong infrastructure for polymer blending, and the widespread use of HDPE wax in masterbatches, PVC processing, and rubber industries. China’s growing exports of color masterbatches and engineered plastics are further boosting local consumption. Key domestic manufacturers are investing in automated processing and upgrading production lines to meet rising demand for high-quality, low-emission waxes across domestic and international markets

North America High-Density Polyethylene (HDPE) Wax Market Insight

The North America HDPE wax market is witnessing robust growth due to rising demand from the construction, packaging, and automotive sectors. Increasing usage of HDPE wax in hot-melt adhesives, wood plastic composites, and protective coatings is fueling market expansion. Additionally, technological advancements in wax micronization and the presence of major players such as Honeywell and Westlake Corporation are enhancing production efficiency and expanding product portfolios to cater to diversified industrial applications

U.S. High-Density Polyethylene (HDPE) Wax Market Insight

The U.S. HDPE wax market holds the largest share in North America in 2025, fueled by the country's mature chemical manufacturing infrastructure, strong presence of end-use industries, and rising adoption of HDPE wax in plastics and printing inks. Increasing demand for environmentally compliant additives and efficient lubricants is encouraging the development of high-performance oxidized and micronized wax grades. Ongoing investments in polymer modification and additive blending are further strengthening domestic supply chains and export capabilities

Europe High-Density Polyethylene (HDPE) Wax Market Insight

The Europe HDPE wax market is projected to expand steadily, driven by increasing regulatory pressure for low-VOC and sustainable chemical solutions, and rising adoption of HDPE waxes in coatings, adhesives, and sealants. Countries such as Germany, France, and the Netherlands are at the forefront of deploying HDPE wax in industrial and consumer applications, supported by innovation in polymer formulations and strategic collaborations between chemical companies and compounders. The shift toward recyclable and lightweight packaging also contributes to regional demand growth

U.K. High-Density Polyethylene (HDPE) Wax Market Insight

The U.K. HDPE wax market is gaining momentum owing to growing demand from the printing, paints, and construction chemicals sectors. Manufacturers are increasingly adopting HDPE wax for its slip, anti-block, and dispersing properties in high-performance coatings and sealants. Government sustainability mandates and industry-led initiatives on green chemistry are also propelling the use of low-emission waxes, especially oxidized and micronized variants, in industrial applications

Germany High-Density Polyethylene (HDPE) Wax Market Insight

The Germany HDPE wax market is expanding significantly, driven by the country’s strong plastics and automotive industries, which utilize HDPE waxes in polymer processing, compounding, and metal protection solutions. German companies are focusing on high-purity, tailored wax solutions to meet stringent EU regulations and advanced application needs. The rise in demand for specialty waxes in technical textiles, inks, and precision adhesives is further supporting market growth, along with growing investments in sustainable product development

High-Density Polyethylene (HDPE) Wax Market Share

The high-density polyethylene (HDPE) wax industry is primarily led by well-established companies, including:

- Honeywell International Inc. (U.S.)

- Mitsui Chemicals, Inc. (Japan)

- CLARIANT (Switzerland)

- TRECORA RESOURCES (U.S.)

- BASF SE (Germany)

- SCG Chemicals Co., Ltd (Thailand)

- Innospec (U.S.)

- The Lubrizol Corporation (U.S.)

- Westlake Corporation (U.S.)

- Baker Hughes Company (U.S.)

- Zellag. (Spain)

- Michelman, Inc. (U.S.)

- Synergy Poly Additives Pvt. Ltd. (India)

- WIWAX (Germany)

- Messe Düsseldorf GmbH (Germany)

- Paramelt RMC B.V. (Netherlands)

Latest Developments in Global High-Density Polyethylene (HDPE) Wax Market

- In May 2025, Clariant continued to expand its HDPE wax solutions, strengthening its product portfolio and geographical reach. As a leading provider of wax additives and performance polymers, Clariant offers biobased rice bran waxes, polyolefin waxes, and specialty blends to industries such as plastics, coatings, and adhesives. This strategic expansion reinforces Clariant’s commitment to sustainable innovation and global market leadership

- In May 2025, Sasol Limited expanded its HDPE wax portfolio, reinforcing its commitment to sustainable practices and high-performance solutions. Through strategic partnerships and investment in R&D, Sasol continues to drive innovation in the competitive market landscape. The company’s focus on energy-efficient formulations and eco-friendly production strengthens its position as a global leader in wax solutions

- In April 2025, Honeywell and Dow Chemical advanced their efforts in bio-based polyethylene waxes, emphasizing sustainable alternatives to traditional formulations. Their innovations aim to enhance performance, cost efficiency, and environmental impact, shaping future market competition and growth trajectories. Honeywell’s expertise in high-performance additives and Dow’s commitment to eco-friendly solutions reinforce their leadership in

- In May 2024, Clariant introduced AddWorks PPA, a PFAS-free polymer processing aid for polyolefin film extrusion, unveiled at NPE 2024. This innovation enhances processability, ensuring smooth film aesthetics while eliminating sharkskin and die build-up effects. The additive maintains high thermal stability, low migration, and cost efficiency, aligning with tightening PFAS regulations

- In November 2024, BASF launched Easiplas™, a new HDPE brand, alongside achieving key construction milestones at its Zhanjiang Verbund site in China. Easiplas™ integrates ease of use, ethylene, and plastics, reinforcing BASF’s backward integration into the C2 value chain. The new HDPE plant, with an annual capacity of 500,000 metric tons, is set to come online by the end of 2025

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hdpe Wax Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hdpe Wax Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hdpe Wax Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.