Global Health And Fitness Club Market

Market Size in USD Billion

CAGR :

%

USD

130.45 Billion

USD

234.39 Billion

2025

2033

USD

130.45 Billion

USD

234.39 Billion

2025

2033

| 2026 –2033 | |

| USD 130.45 Billion | |

| USD 234.39 Billion | |

|

|

|

|

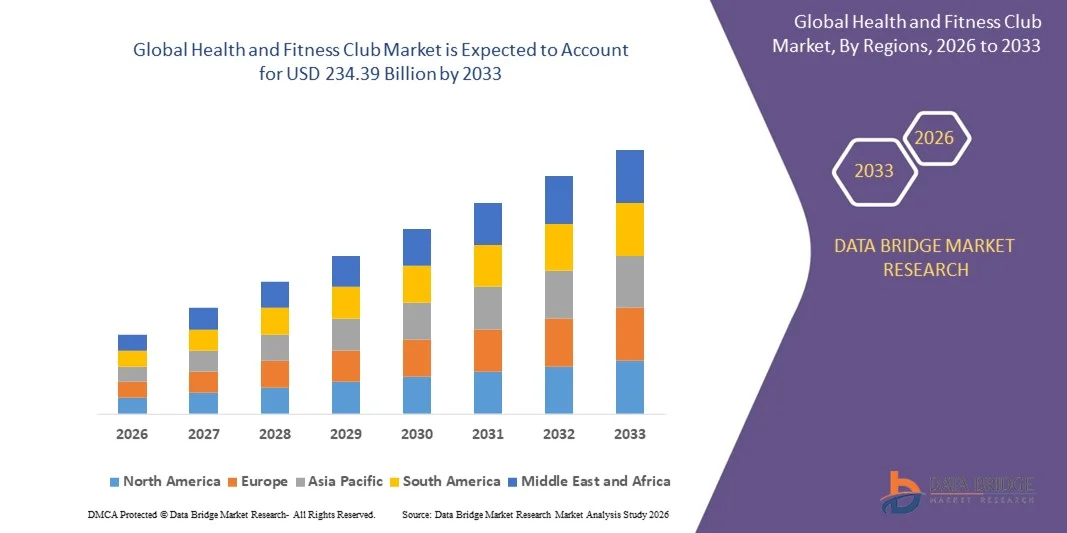

What is the Global Health and Fitness Club Market Size and Growth Rate?

- The global health and fitness club market size was valued at USD 130.45 billion in 2025 and is expected to reach USD 234.39 billion by 2033, at a CAGR of7.62% during the forecast period

- The consumers are ready to spend higher on health and fitness clubs which is one of the major factors anticipated to drive the health and fitness club market growth rate

- Moreover, the rise in disposable income and increase in the number of health clubs and gyms with personal training are also expected to fuel the growth of the health and fitness club market

What are the Major Takeaways of Health and Fitness Club Market?

- The easy availability of latest fitness equipment and presence of equipment and facility spaces in fitness clubs such as high altitude training rooms, metabolic testing equipment, hot yoga studios, medical exercise areas and day spas are also expected to highly impact the growth of the health and fitness club market

- While, the rise in the health awareness and increase in the obesity among consumers are also amongst the major factors expected to fuel the growth of the health and fitness club market

- North America dominated the health and fitness club market with a 34.26% revenue share in 2025, driven by high consumer health awareness, strong disposable incomes, and rapid adoption of fitness memberships across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 6.9% from 2026 to 2033, driven by rising urbanization, growing middle-class population, and increasing health and fitness awareness across China, Japan, India, South Korea, and Southeast Asia

- The Profit segment dominated the market with a 62.5% share in 2025, driven by strong expansion of premium gyms, branded chains, and corporate wellness facilities across North America, Europe, and Asia-Pacific

Report Scope and Health and Fitness Club Market Segmentation

|

Attributes |

Health and Fitness Club Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Health and Fitness Club Market?

Increasing Focus on Technology-Driven, Premium, and Personalized Fitness Solutions

- The health and fitness club market is witnessing strong adoption of connected fitness equipment, wearable integration, and digital performance tracking, designed to enhance user engagement and training efficiency

- Operators are introducing smart gyms, AI-driven coaching, and app-based workout management systems that offer personalized training plans, progress tracking, and nutrition guidance

- Growing demand for cost-efficient, flexible, and hybrid fitness solutions is driving usage across urban centers, residential communities, and corporate wellness programs

- For instance, companies such as Equinox, Life Time, 24 Hour Fitness, Planet Fitness, and Gold’s Gym have upgraded their offerings with mobile apps, virtual classes, and connected equipment, enhancing member experience and retention

- Increasing need for data-driven fitness solutions, virtual coaching, and multi-device compatibility is accelerating adoption of hybrid and technology-enabled health clubs

- As consumer preference shifts toward personalized, convenient, and immersive fitness experiences, health and fitness clubs remain essential for achieving holistic health goals

What are the Key Drivers of Health and Fitness Club Market?

- Rising demand for personalized workout programs, group fitness classes, and integrated wellness solutions is fueling market growth

- For instance, in 2025, leading operators such as Equinox, Life Time, Planet Fitness, Gold’s Gym, and 24 Hour Fitness invested in connected gym equipment, wearable integration, and hybrid fitness platforms to improve member engagement and retention

- Growing adoption of smart wearables, fitness apps, and remote training solutions across North America, Europe, and Asia-Pacific is boosting demand for high-tech fitness clubs

- Advancements in IoT-enabled equipment, AI coaching, virtual fitness platforms, and hybrid membership models have strengthened performance, convenience, and member satisfaction

- Rising health awareness, corporate wellness initiatives, and demand for functional and strength-based training are driving expansion across urban and suburban regions

- Supported by investments in premium facilities, smart equipment, and digital content platforms, the Health and Fitness Club market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Health and Fitness Club Market?

- High costs associated with premium equipment, technology integration, and facility maintenance restrict adoption among smaller gyms and local operators

- For instance, during 2024–2025, fluctuations in equipment supply, real estate rental costs, and labor shortages increased operational costs for several global operators

- Complexity in managing digital platforms, hybrid membership models, and personalized training programs increases the need for skilled staff and continuous training

- Limited awareness and affordability constraints in emerging markets slow adoption of high-tech, premium fitness solutions

- Competition from home fitness equipment, boutique studios, online classes, and low-cost gyms creates pricing pressure and reduces differentiation

- To address these issues, companies are focusing on flexible membership plans, hybrid offerings, technology-enabled training, and digital wellness platforms to increase global adoption of Health and Fitness Clubs

How is the Health and Fitness Club Market Segmented?

The market is segmented on the basis of product type, service type, and application.

- By Product Type

On the basis of product type, the health and fitness club market is segmented into Profit and Non-profit clubs. The Profit segment dominated the market with a 62.5% share in 2025, driven by strong expansion of premium gyms, branded chains, and corporate wellness facilities across North America, Europe, and Asia-Pacific. Profit clubs offer state-of-the-art equipment, technologically integrated workout platforms, and personalized training programs, which attract high-value memberships and drive revenue. Non-profit clubs, including community and municipal gyms, are growing steadily but face limitations in budget, equipment upgrades, and technology integration.

The Non-profit segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing government and community initiatives, partnerships with local organizations, and rising health awareness among low- and middle-income populations. Expanding public fitness programs and hybrid membership models support the adoption of non-profit clubs globally.

- By Service Type

On the basis of service type, the market is segmented into Membership Fees, Total Admission Fees, Personal Training, and Instruction Services. The Membership Fees segment dominated the market with a 55.7% share in 2025, supported by recurring revenue from monthly or annual subscriptions, bundled wellness services, and loyalty programs. Clubs offering comprehensive memberships with access to equipment, group classes, and digital fitness platforms attract consistent participation.

The Personal Training segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for individualized coaching, AI-enabled performance tracking, and fitness guidance for specialized training programs. Premium gyms, boutique studios, and hybrid digital solutions are increasingly offering personal training sessions, nutrition consultation, and performance analytics, which enhance member retention and revenue per user.

- By Application

On the basis of application, the market is segmented into Aged 55 and Older and Aged 35 to 54. The Aged 35 to 54 segment dominated the market with a 58.3% share in 2025, driven by high disposable income, health awareness, and interest in strength, functional, and endurance training. This demographic actively invests in memberships, wellness programs, and digital fitness solutions.

The Aged 55 and Older segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing focus on active aging, preventive healthcare, rehabilitation programs, and senior-friendly fitness services. Health clubs and community centers are expanding offerings such as low-impact training, balance and flexibility classes, and wellness consultations to meet the rising demand from the older population, promoting longevity and quality of life.

Which Region Holds the Largest Share of the Health and Fitness Club Market?

- North America dominated the health and fitness club market with a 34.26% revenue share in 2025, driven by high consumer health awareness, strong disposable incomes, and rapid adoption of fitness memberships across the U.S. and Canada. Growth in urban populations, corporate wellness programs, and premium gym chains continues to fuel demand for health and fitness clubs across major metropolitan areas.

- Leading operators in North America are expanding offerings with digital fitness platforms, AI-driven personal training, hybrid memberships, and wellness services, reinforcing the region’s market leadership. Continuous investment in advanced gym infrastructure, boutique fitness studios, and wellness tech solutions drives long-term regional growth.

- Strong infrastructure, high health-conscious population, and established fitness ecosystems further consolidate North America’s dominance in the health and fitness club market.

U.S. Health and Fitness Club Market Insight

The U.S. is the largest contributor in North America, supported by premium fitness chains, boutique studios, and expanding corporate wellness programs. High adoption of wearable devices, digital training apps, and personalized fitness solutions intensifies demand for technologically integrated Health and Fitness Clubs. Rising health awareness, lifestyle diseases, and strong fitness culture further drive market growth.

Canada Health and Fitness Club Market Insight

Canada contributes significantly to regional growth, driven by government-supported wellness initiatives, rising disposable incomes, and increasing popularity of gym memberships. Health clubs offering hybrid models, personal training, and community wellness programs strengthen adoption. Expansion of urban centers and corporate fitness schemes supports steady market penetration.

Asia-Pacific Health and Fitness Club Market

Asia-Pacific is projected to register the fastest CAGR of 6.9% from 2026 to 2033, driven by rising urbanization, growing middle-class population, and increasing health and fitness awareness across China, Japan, India, South Korea, and Southeast Asia. Demand for gyms, boutique fitness studios, and wellness centers is accelerating, supported by government health initiatives and lifestyle transformation trends. High adoption of digital fitness apps, AI-enabled personal coaching, and hybrid memberships in major cities is boosting market expansion. Growth in disposable income, health-conscious millennials, and fitness-driven communities further accelerates market penetration.

China Health and Fitness Club Market Insight

China is the largest contributor to Asia-Pacific due to rapidly expanding urban populations, rising corporate wellness adoption, and government initiatives promoting active lifestyles. Premium gym chains and boutique studios are increasingly integrating technology-based fitness solutions, supporting both domestic and international expansion.

Japan Health and Fitness Club Market Insight

Japan shows steady growth due to a strong focus on elderly fitness programs, preventive healthcare, and technology-enhanced training facilities. Fitness clubs targeting seniors and urban professionals contribute to sustained market expansion.

India Health and Fitness Club Market Insight

India is emerging as a key growth hub, supported by rising disposable incomes, fitness awareness, and expanding gym and boutique studio networks. Increasing adoption of digital fitness platforms, personal training, and wellness programs is driving rapid growth.

South Korea Health and Fitness Club Market Insight

South Korea contributes significantly due to high demand for technologically integrated fitness clubs, smart gym equipment, and wellness services. Rising urbanization, lifestyle-focused population, and increasing health-consciousness support strong market adoption.

Which are the Top Companies in Health and Fitness Club Market?

The health and fitness club industry is primarily led by well-established companies, including:

- 24 Hour Fitness USA, LLC (U.S.)

- Gold's Gym International, Inc. (U.S.)

- Equinox (U.S.)

- Life Time, Inc. (U.S.)

- Planet Fitness Franchising, LLC (U.S.)

- CrossFit, LLC (U.S.)

- Fitness First India Pvt Ltd. (India)

- CRUNCH FITNESS (U.S.)

- The Bay Club Company (U.S.)

- LA Fitness International LLC (U.S.)

- Self Esteem Brands, LLC (U.S.)

What are the Recent Developments in Global Health and Fitness Club Market?

- In May 2023, Virtuagym, an Amsterdam-based digital health and fitness company, partnered with Hidden Profits Marketing, an Amsterdam-based advertising agency, to launch a product integration solution aimed at helping fitness studios and clubs enhance their lead management processes, strengthening the company’s position in digital fitness solutions

- In May 2023, Planet Fitness, a U.S.-based fitness center operator, launched a high school summer pass program providing free mental and physical health services to students aged 14 to 19, reinforcing its commitment to community wellness and youth fitness initiatives

- In October 2022, 24 Hour Fitness, a U.S.-based fitness chain, collaborated with Headspace Health, a U.S.-based online mental health company, to offer Headspace subscriptions to club members, launched on World Mental Health Day to promote mental wellness and enhance member experience

- In April 2022, Anytime Fitness, a Netherlands-based fitness chain, introduced AF SmartCoaching technology, allowing members to access personalized coaching through the AF app, supporting the company’s strategy to provide fitness guidance both inside and outside the club environment

- In February 2020, Plus Fitness, an Australia-based fitness brand, inaugurated a new club in Mumbai, India, and announced plans to expand additional facilities nationwide, marking the brand’s entry into the Indian fitness market and expanding its global footprint

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.